- Home

- »

- Next Generation Technologies

- »

-

Microwave Oven Market Size, Share & Growth Report, 2030GVR Report cover

![Microwave Oven Market Size, Share & Trends Report]()

Microwave Oven Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Application (Commercial, Household), By Structure, By Control Feature, By Price Point, By Wattage, By Capacity, By Distribution Channel, By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-654-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Microwave Oven Market Summary

The global microwave oven market size was estimated at USD 12,974.9 million in 2023 and it is projected to expand at a CAGR of 3.4% from 2024 to 2030. A major market driver is the fast-evolving lifestyle of consumers globally.

Key Market Trends & Insights

- North America held a significant revenue share of around 29% in 2022.

- By product, the convection segment dominated the global market with a revenue share of around 39% in 2022.

- By application, the medium-duty commercial ovens segment dominated the global market in 2022 with a revenue share of more than 44%.

- By price point, the USD 2000 - USD 6000 commercial ovens segment dominated the market in 2022 with a revenue share of more than 34%.

Market Size & Forecast

- 2023 Market Size: USD 12,974.9 Million

- 2030 Projected Market Size: USD 16,413.0 Million

- CAGR (2024-2030): 3.4%

- North America: Largest market in 2022

These appliances significantly reduce the cooking time, when compared to conventional methods, making them an essential tool for busy households. Additionally, the growing number of single-person households as well as dual-income families has steadily driven the demand for appliances that can ensure convenient meal preparation without compromising on its quality.

The market has been shaped by a series of technological advancements that have revolutionized the way people cook and prepare food. The foundational technologies that underpin the market are magnetrons. This crucial component generates the microwave energy that heats the food. Over the years, there have been significant improvements in magnetron technology. The integration of smart technology has been a major driving force in the market. Smart features in the ovens offer a range of benefits, from remote control and monitoring to recipe suggestions and automatic cooking programs. These features are made possible through the incorporation of sensors, connectivity modulus, and sophisticated software. For instance, some modern microwaves can be controlled through smartphone apps, allowing users to start or stop cooking remotely. In February 2022, GE Appliances (GEA) launched its new lineup GE profile for laundry and kitchen innovations, with advanced technology that provides solutions for modern lifestyles. These forward-thinking, problem-solving advances simplify the lives of consumers through voice, AI, and smart upgrades.

Another notable technology trend in the market is the advancement in cooking sensors and precision cooking technologies. Cooking sensors are specialized components that are deployed for monitoring factors such as temperature, humidity, and weight during the cooking process. These sensors offer real-time feedback to the microwave oven, enabling it to accordingly adjust cooking parameters. For example, a humidity sensor helps detect the moisture level in a food item and adjusts cooking power levels and time to avoid overcooking or undercooking. This technology ensures that food is cooked consistently and to its desired level. Furthermore, precision cooking technologies, such as inverter technology, have become increasingly prominent. Traditional microwaves operate on a fixed power level, cycling between full and no power to achieve lower settings.

A rise in the disposable income of the people is expected to provide a higher potential to the market. Consumers are spending more on smart appliances to make their lives convenient, which increases the demand for convection microwave ovens. The market undergoes changing consumer preferences coupled with socio-economic factors such as rising population, consequent increase in disposable income, etc., growing urbanization globally is expected to increase the adoption of ovens in the market, as consumers are willing to spend on gadgets that help in doing their daily household tasks easily.

Product Insights

The convection segment dominated the global market with a revenue share of around 39% in 2022. Convection microwaves use a fan to circulate hot air around the food, resulting in faster and more even cooking. The aforementioned technology has steadily increased in popularity due to its convenience and versatility, helping users to bake, roast, and grill, while also performing traditional microwave functions. With the growing popularity of healthy eating practices, convection microwaves have seen a growth in their appeal, as they offer a healthier alternative to deep-frying and other high-fat cooking techniques. Moreover, the compactness of these appliances has made them a very viable alternative for smaller kitchens and households. As more consumers prioritize space-saving and multi-functional appliances, the growth in demand for convection ovens is anticipated to continue.

Application Insights

The medium-duty commercial ovens segment dominated the global market in 2022 with a revenue share of more than 44%. These appliances offer fast and efficient cooking solutions for businesses such as cafes, restaurants, and hotels. Commercial microwaves also are packed with several advanced features such as multiple power levels, programmable settings, and premium build quality. This allows for precise cooking and temperature control, ensuring an easier preparation for a wide variety of dishes with consistent results, even during peak operations.

Price Point Insights

The USD 2000 - USD 6000 commercial ovens segment dominated the market in 2022 with a revenue share of more than 34%. This growth is owing to various factors, including the rising demand for efficient and quick food preparation in commercial kitchens. Commercial microwave ovens provide an easy solution for busy chefs and kitchen staff, helping them to rapidly heat and cook food without compromising on its quality. Besides their efficiency and speed, commercial microwave ovens have also become more advanced regarding their features and capabilities. This has created a high demand for them in a wide range of commercial kitchens, from cafes to restaurants and catering companies.

Wattage Insights

The <1200W household ovens segment is anticipated to register a significant CAGR of over 3.0% over the forecast period. These microwaves are generally utilized for defrosting, reheating, and basic food preparation, instead of high-volume cooking applications. Despite the strong appeal of other cooking appliances such as air fryers and slow cookers, the simplicity and convenience of microwave ovens continue to be popular among several households. Moreover, developments in technology have resulted in improved energy efficiency & functionality of residential microwaves, making them an appealing option for consumers aiming to save time and energy in the kitchen. Overall, while the demand for residential microwave ovens may not be witnessing significant growth, it remains a staple appliance in many households.

Capacity Insights

The >50L capacity commercial ovens segment dominated the market with a revenue share of more than 33% in 2022. These ovens are suitable for commercial kitchens, restaurants, as well as other food-related settings that need an efficient food preparation setup. The increase in popularity of these ovens is due to several factors. One reason is that they are extremely fast and efficient, preparing food in a fraction of the time required by a conventional oven. This allows businesses to boost their output and serve more customers. The growth in popularity of these ovens is because of their ease of use. Most models are built with pre-set cooking programs, meaning that even inexperienced staff can use them easily.

The 20L to 30L residential ovens segment is estimated to expand at a significant CAGR of over 3.0% over the forecast period. Such ovens are perfect for small apartments, homes, and dorm rooms. They help cook food quickly and efficiently without the need for a conventional oven or stove. The primary factor driving the growth in popularity of these ovens is their affordability. They are a cost-effective option for consumers needing a reliable cooking appliance without spending too much money. Moreover, they are easy to use, with most models having built-in cooking programs that make them user-friendly.

Control Feature Insights

The digital control feature segment dominated the global market with a revenue share of more than 53% in 2022. The market is witnessing strong growth due to the rising demand for digital control features. An increasing number of consumers prefer microwaves that house advanced controls and settings to help them cook their meals easily and quickly. This trend is projected to continue in the coming years, as technology keeps advancing and consumers become accustomed to utilizing digital devices in their daily lives. Microwave manufacturers are addressing this demand by developing new models with advanced digital control features to make food preparation easier than ever.

Distribution Channel Insights

The eCommerce segment led the global market with a revenue share of over 62% in 2022 and is expected to advance at the fastest CAGR of over 3.0% during the projection period. Consumers prefer the convenience of being able to shop from home and compare product features and prices across various websites. While brick-and-mortar stores provide a tactile shopping experience, online sales still account for a significant share of the market. Manufacturers and retailers are aiming to maintain a strong presence in both online and physical channels to reach the maximum customer base possible and remain competitive.

End-use Insights

The household segment dominated the global market with a revenue share of more than 51% in 2022. Continuous innovation in the market has played a significant role in the growth, as manufacturers have introduced features like smart technology, inverter technology, advanced cooking modes, and precision sensors. These innovations have enhanced the functionality and convenience of microwaves for household use. Busy lifestyles and an increasing number of dual-income households have led to a higher demand for convenient cooking solutions. Microwave ovens provide a quick and efficient way to prepare meals, aligning with the fast-paced lifestyle of many households.

The commercial segment is estimated to grow at the fastest CAGR of over 3.0% over the forecast period. The food industry has evolved to meet the changing consumer demands for speed and convenience, and the demand for high-powered, specialized ovens designed for commercial use has increased. Manufacturers have been responding by developing models tailored to meet the specific needs of these businesses. The commercial usage of microwaves in restaurants, cafes, food service provider units, and other businesses in the food sector relies heavily on commercial-grade microwaves for their operations. These ovens enable them to quickly reheat and cook a wide range of food items, ensuring prompt service to customers.

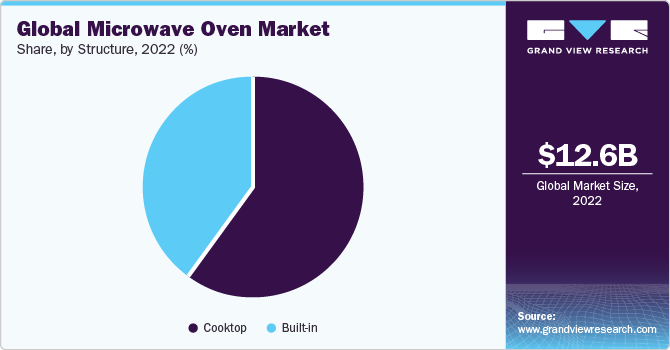

Structure Insights

The built-in segment is poised to progress at a substantial CAGR of over 2.0% during the projection period. Built-in ovens are designed to seamlessly fit into kitchen cabinets, bringing a sleek and stylish look to the setup. Moreover, they are very convenient to use, as they free up counter space and can be operated at the simple push of a button. Built-in microwaves are also more energy-efficient than countertop variants, as they are designed to be integrated into the electrical system of the kitchen.

The growth in demand for built-in microwaves can be ascribed to the rapid rise of smart homes. With the emergence of Internet of Things (IoT) technology, consumers are increasingly choosing appliances that can be controlled remotely or via voice commands. Built-in microwaves belong to this category, as they can be connected to a smart home system and controlled using a mobile application or virtual assistant.

Regional Insights

North America held a significant revenue share of around 29% in 2022. The integration of advanced technologies, such as smart features, inverter technology, and cooking sensors, has enhanced the functionality and versatility of the ovens. These technological advancements have made ovens more appealing to consumers. Environmental consciousness is an increasingly significant factor in consumer purchasing decisions. Manufacturers in the region are responding by producing microwaves with energy-efficient features and materials.

The Asia Pacific is expected to witness a growth rate of over 4.0% over the forecast period. The region is undergoing a period of rapid urbanization, leading to smaller living spaces and kitchens. These trends increase the demand for compact and space-saving appliances like ovens, which are essential for quick and convenient meal preparation. The region’s economic growth, particularly in countries like China and India has been led by rising disposable income. As more households gain the financial capacity to invest in modern kitchen appliances, the demand for microwave ovens is expected to surge.

Key Companies & Market Share Insights

Original Equipment Manufacturers (OEMs) aim for strategic partnerships, as well as mergers & acquisitions (M&A), to leverage the latest technologies and increase their geographical footprint. Established companies have a strong foothold with a large customer base, giving them an edge over their competitors in the global industry. Moreover, companies are investing extensively in marketing campaigns to boost their visibility in the arena. Major players are shifting their focus toward energy-efficient appliances integrated with IoT platforms to enable customers to operate their appliances remotely.

In August 2023, Miele launched the Miele Steam Oven with the HydroClean feature. The self-cleaning function allows for the removal of stubborn food residue by pouring liquid cleaner into the strainer at the oven’s base, which is then automatically mixed with fresh water and dispersed throughout the interior of the appliance.

In August 2023, LG Electronics launched a home appliances lineup offering A-grade energy efficiency in the ‘Net-Zero House’. The devices are designed for a more sustainable life, and the company’s latest kitchen, laundry, and living solutions respond to the growing need to reduce power consumption, running costs, and environmental impact.

Key Microwave Oven Companies:

- Alto-Shaam Inc.

- Amazonbasics (Amazon.Com)

- Brandt

- Breville

- Bsh Home Appliances Group

- Dongbu Daewoo Electronics

- Electrolux AB

- Farberware Cookware

- Galanz (Guangdong Galanz Enterprises Co. Ltd.)

- GE Appliances

- Itw Food Equipment Group

- LG Electronics

- Midea Group

- Miele

- Moulinex (Group SeB)

- Panasonic Corporation

- Samsung Electronics

- Sharp Corporation

- Smeg S.P.A

- Toshiba Corporation

- Whirlpool Corporation

Microwave Oven Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13,352.1 million

Revenue forecast in 2030

USD 16,413.0 million

Growth rate

CAGR of 3.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, consumer behavior analysis, leading regional games, competitive landscape, growth factors, and trends

Segments covered

Product, application, price point, wattage, capacity, structure, control feature, distribution channel, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France;, Italy; Spain; Poland; BENELUX; Nordics; China; Japan; India; South Korea; Australia; Indonesia; Thailand; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Alto-Shaam Inc.; Amazonbasics (Amazon.Com); Brandt; Breville; Bsh Home Appliances Group; Dongbu Daewoo Electronics; Electrolux Ab; Farberware Cookware; Galanz (Guangdong Galanz Enterprises Co. Ltd.); GE Appliances; Itw Food Equipment Group; LG Electronics; Midea Group; Miele; Moulinex (Group Seb); Panasonic Corporation; Samsung Electronics; Sharp Corporation; Smeg S.P.A; Toshiba Corporation; Whirlpool Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Microwave Oven Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global microwave oven market report based on product, application, price point, wattage, capacity, structure, control feature, distribution channel, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Convection

-

Grill

-

Solo

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Light Duty

-

Medium Duty

-

Heavy Duty

-

-

Household

-

-

Price Point Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Below USD 2000

-

USD 2000 - USD 6000

-

Above USD 6000

-

-

Household

-

Below USD 400

-

USD 400 - USD 1000

-

Above USD 1000

-

-

-

Wattage Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

<3000W

-

3000W - 5000W

-

>5000W

-

-

Household

-

<1200W

-

1200W - 2000W

-

>2000W

-

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

<30L

-

30L - 50L

-

>50L

-

-

Household

-

<20L

-

20L - 30L

-

>30L

-

-

-

Structure Outlook (Revenue, USD Million, 2018 - 2030)

-

Built-in

-

Cooktop

-

-

Control Feature Outlook (Revenue, USD Million, 2018 - 2030)

-

Digital

-

Analog

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

eCommerce

-

Brick & Mortar

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Food Service Industry

-

Food Industry

-

-

Household

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Poland

-

BENELUX

-

NORDIC

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global microwave oven market size was estimated at USD 12.63 billion in 2022 and is expected to reach USD 12.97 billion in 2023.

b. The global microwave oven market is expected to grow at a compound annual growth rate of 3.4% from 2023 to 2030 to reach USD 16.41 billion by 2030

b. Convection dominated the global market revenue, with a market share of around 39% in 2022. This technology has become increasingly popular due to its versatility and convenience, allowing users to roast, bake, and grill in addition to traditional microwave functions.

b. Some key players operating in the microwave oven market include Whirlpool Corporation, Toshiba Corporation, Panasonic Corporation, Samsung Electronics, LG Electronics, GE Appliances, Electrolux AB, and ITW Food Equipment Group.

b. The factor contributing to the growth of the market is the evolving lifestyle of consumers. They significantly reduce the cooking time compared to conventional methods, making them an indispensable tool for busy households.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.