- Home

- »

- Medical Devices

- »

-

Actigraphy Device Market Size, Share, Industry Report, 2030GVR Report cover

![Actigraphy Device Market Size, Share & Trends Report]()

Actigraphy Device Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Sleep Disorders, Physical Activity Monitoring, Chronic Disease Management), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-515-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Actigraphy Device Market Summary

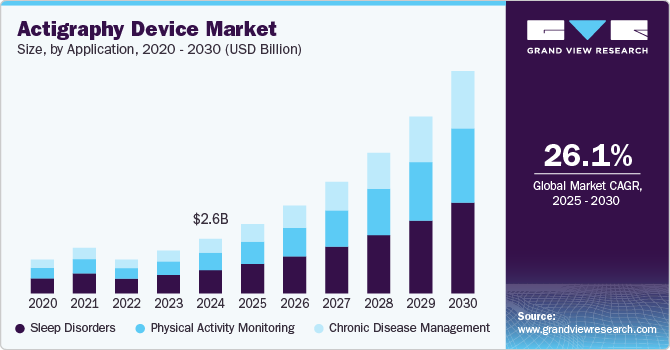

The global actigraphy device market size was estimated at USD 2.64 billion in 2024 and is anticipated to reach USD 10.67 billion by 2030, growing at a CAGR of 26.09% from 2025 to 2030. The market growth is driven by the rising prevalence of sleep disorders such as insomnia, sleep apnea, and restless legs syndrome.

Key Market Trends & Insights

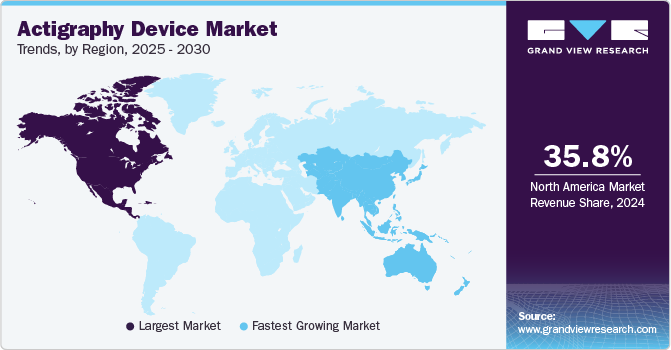

- North America actigraphy device industry dominated with a share of 35.76% in 2024.

- The U.S. held a significant share of the market in 2024.

- By application, the sleep disorders segment dominated the market in 2024.

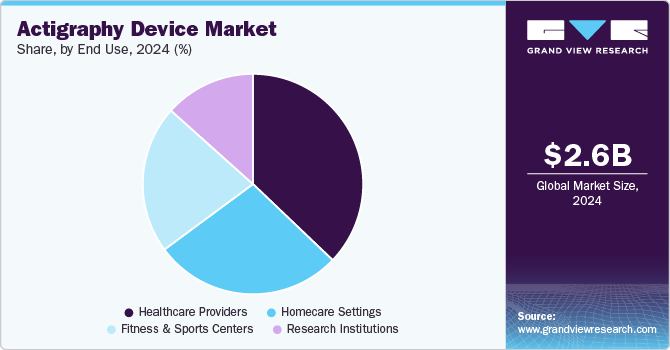

- By end-use, the healthcare providers segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.64 Billion

- 2030 Projected Market Size: USD 10.67 Billion

- CAGR (2025-2030): 26.09%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The aging population, with its increased susceptibility to sleep disturbances, further fuels market growth. Technological advancements, such as the development of more accurate and user-friendly devices with improved data analysis capabilities, are also significantly driving market expansion.The increasing prevalence of sleep disorders like insomnia, sleep apnea, and restless legs syndrome is significantly driving the growth of the actigraphy device industry. For instance, as per a report by The State Of Sleep Health In America in 2023, sleep disorders affect a significant portion of the American population, impacting an estimated 50 to 70 million individuals. Furthermore, a substantial number of adults-approximately 84 million, or 1 in 3-experience insufficient uninterrupted sleep, falling short of the recommended levels necessary for maintaining good health.

The increasing prevalence of sleep disorders like insomnia, sleep apnea, and restless legs syndrome is significantly driving the growth of the actigraphy device industry. For instance, as per a report by The State Of Sleep Health In America in 2023, sleep disorders affect a significant portion of the American population, impacting an estimated 50 to 70 million individuals. Furthermore, a substantial number of adults-approximately 84 million, or 1 in 3-experience insufficient uninterrupted sleep, falling short of the recommended levels necessary for maintaining good health.

As more individuals seek effective ways to monitor and manage their sleep patterns, actigraphy devices, which track and analyze sleep behavior, have gained popularity among both healthcare professionals and consumers. These disorders often require consistent and precise monitoring, and actigraphy devices offer a non-invasive, cost-effective solution for tracking sleep cycles and disturbances. As awareness of sleep health continues to rise and the demand for personalized healthcare tools increases, the market for actigraphy devices is expected to expand, offering improved outcomes for individuals suffering from sleep disorders.

Public awareness of the importance of sleep for overall health and well-being is growing. This increased awareness is driving demand for sleep monitoring tools, including actigraphy devices, as individuals seek to better understand and manage their sleep patterns. For instance, The American Academy of Sleep Medicine (AASM) has launched the "Act on Actigraphy" campaign to promote the use of actigraphy testing in diagnosing and managing sleep disorders. The campaign emphasizes the value of actigraphy as an evidence-based tool for patient-centered sleep care and advocates for insurance coverage of this essential medical service to ensure patient access.

The rising geriatric population is significantly contributing to the market growth. For instance, according to UN population projections, the global population aged 65 and over is rapidly aging. Between 1974 and 2024, this demographic doubled, rising from 5.5% to 10.3% of the global population. By 2074, this figure is projected to double again, reaching 20.7%. As individuals age, they often experience sleep-related issues such as insomnia, fragmented sleep, and other disorders that can impact their overall health and quality of life.

Actigraphy devices, which provide a convenient, non-invasive way to monitor sleep patterns, are becoming increasingly valuable in managing these sleep disturbances among older adults. Healthcare providers are leveraging these devices to better assess sleep conditions, tailor treatments, and monitor the effectiveness of interventions in elderly patients. With the global aging population on the rise, the demand for solutions to improve sleep quality and manage related health issues is expected to fuel continued growth in the actigraphy device market.

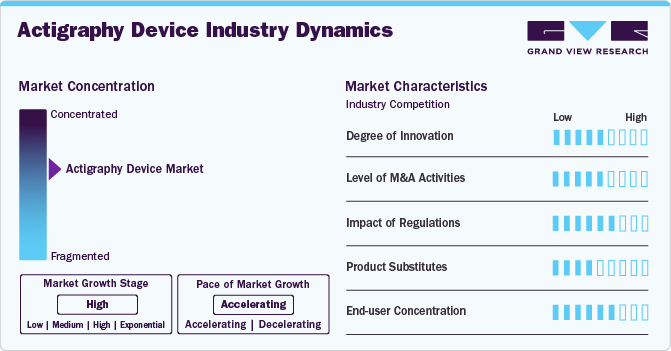

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The market is characterized by the rising prevalence of sleep disorders, the aging population, growing emphasis on personalized medicine, and the increasing awareness of sleep health.

The actigraphy device industry exhibits a moderate degree of innovation. While advancements in sensor technology, data analytics, and integration with other health metrics are ongoing, truly novel biomaterials or fundamental shifts in the core technology are less frequent. However, the increasing prevalence of neurological conditions and the rise in surgeries are expected to drive further innovation in actigraphy device over the forecast period.

Regulatory bodies play a significant role in shaping the market. Compliance with standards set by agencies like the FDA and EMA is crucial for product approval and market access. These regulations, while ensuring safety and efficacy, can present challenges due to the need for rigorous testing and documentation, potentially impacting the speed of innovation and time to market.

The level of M&A activity in the market is moderate. Companies pursue mergers and acquisitions to expand market presence, diversify product portfolios, achieve regional expansion, and gain access to new technologies or research capabilities. This consolidation trend is expected to continue as companies seek competitive advantages in this growing market.

The threat of product substitutes in the market is moderate. While traditional methods like polysomnography (PSG) remain the gold standard for sleep diagnosis, they are often more expensive, time-consuming, and require a clinical setting. Actigraphy offers a more accessible and convenient alternative, particularly for long-term monitoring and at-home use, mitigating the threat from PSG to some extent. However, other wearable health trackers that include some sleep tracking features represent a moderate substitute threat, though typically with less precision than dedicated actigraphy devices.

The actigraphy device market is characterized by a moderate level of end-user concentration. Key end users include hospitals, sleep clinics, research institutions, and increasingly, individual consumers for personal health tracking. While hospitals and clinics represent a significant segment, the growing direct-to-consumer market is diversifying the user base and influencing product development.

Application Insights

The sleep disorders segment dominated the market in 2024 owing to the critical role these devices play in the diagnosis and management of various sleep-related conditions. Actigraphy offers a convenient, cost-effective, and objective method for monitoring sleep patterns over extended periods, aiding in the identification of issues like insomnia, sleep apnea, and circadian rhythm disorders. The increasing prevalence of these disorders, coupled with the growing awareness of sleep health, fuels the demand for actigraphy devices as both healthcare professionals and individuals seek reliable tools for assessment and intervention. This widespread use in sleep medicine solidifies the sleep disorders segment's dominance.

The chronic disease management segment is expected to witness the fastest growth during the forecast period, due to the increasing recognition of the interconnectedness between sleep, activity, and chronic conditions. Actigraphy devices provide valuable data on patients' sleep and activity, empowering healthcare providers to remotely monitor and manage individuals with conditions such as diabetes, cardiovascular disease, and obesity. Tracking these key metrics allows for personalized treatment plans, assessment of intervention effectiveness, and early identification of potential complications. The growing adoption of remote patient monitoring and telehealth, combined with the rising prevalence of chronic diseases, fuels this segment's expansion as healthcare systems prioritize proactive, personalized care.

End Use Insights

The healthcare providers segment dominated the market in 2024 owing to their central role in patient care and diagnosis. These institutions utilize actigraphy for a variety of purposes, including sleep disorder diagnosis, pre-and post-surgical patient monitoring, and research. The high volume of patients requiring sleep and activity assessments within these settings, coupled with the established integration of actigraphy into clinical workflows, makes Healthcare Providers the largest end-user segment. Moreover, the growing integration of telehealth and remote patient monitoring within healthcare systems further solidifies the dominance of the segment.

The homecare settings segment is expected to witness the fastest growth over the forecast period, due to A growing preference for remote patient monitoring, coupled with the rising prevalence of chronic conditions requiring long-term care, is fueling rapid expansion in the homecare settings segment. These devices enable convenient, continuous sleep and activity monitoring at home, facilitating early detection of health issues and personalized interventions. Focus on cost-effective healthcare delivery further drive demand. This shift toward home-based care is projected to sustain the segment's rapid growth over the forecast period.

Regional Insights

North America actigraphy device industry dominated with a share of 35.76% in 2024. This can be attributed to the combination of factors including the high prevalence of sleep disorders, an aging population, and well-established healthcare infrastructure. The region's strong emphasis on technological advancements and personalized medicine further fuels market growth. The presence of key market players and easy access to advanced actigraphy devices contribute to the market's maturity in this region.

U.S. Actigraphy Device Market Trends

The actigraphy device industry in the U.S. held a significant share of the market in 2024 owing to the high healthcare expenditure, a large geriatric population, and a growing preference for home-based healthcare solutions. The increasing adoption of telehealth and remote patient monitoring further strengthens the market.

Canada actigraphy device market is experiencing steady growth fueled by an aging population, rising awareness of sleep disorders, and increasing adoption of advanced healthcare technologies. In recent years, Canada has experienced a rise in sleep disorders, such as insomnia, sleep apnea, and restless legs syndrome. For instance, according to the report by Elsevier B.V. in December 2024, Insomnia disorder affected an estimated 16.3% of the population of Canada, with women experiencing higher rates.

Europe Actigraphy Device Market Trends

The Europe actigraphy device industry is experiencing significant growth, driven by factors such as the growing prevalence of sleep disorders, the aging population, and an increasing focus on health and wellness. Europe has one of the fastest-growing elderly populations. According to Eurostat, the percentage of people aged 65 and older in the European Union (EU) is projected to reach over 20% by 2030. Aging individuals are more likely to experience sleep disorders due to factors like chronic health conditions, medications, and changes in sleep architecture.

The actigraphy device market in the UK is expected to grow significantly over the forecast period. The UK market benefits from a well-developed healthcare system and a rising prevalence of sleep disorders. The increasing adoption of digital health solutions further supports market growth.

The Germany actigraphy device market is witnessing significant growth driven by the country’s developed healthcare infrastructure and growing focus on medical research. Additionally, the country's high adoption rate of advanced medical technologies contributes to market growth.

Asia Pacific Actigraphy Device Market Trends

Asia Pacific actigraphy device industry is anticipated to grow at the fastest CAGR over the forecast period. Several factors such as large and growing population, increasing awareness of sleep disorders, and improving healthcare infrastructure. In recent years, countries such as Japan, China, and India have seen a growing demand for actigraphy device, driven by an aging population. Moreover rising disposable incomes and increasing access to healthcare drives the region’s growth.

The actigraphy device market in China is expected to witness significant growth over the forecast period. China's market is experiencing rapid growth due to increasing healthcare expenditure, a large geriatric population, and rising awareness of sleep health. The expanding healthcare infrastructure and increasing adoption of advanced medical technologies are further driving market growth.

Latin America Actigraphy Device Market Trends

The Latin America market is experiencing steady growth driven by increasing healthcare expenditure and improving access to healthcare services. The rising prevalence of chronic diseases and growing awareness of sleep disorders are also contributing factors.

Middle East and Africa Actigraphy Device Market Trends

The actigraphy device industry in MEA is experiencing growth driven by the increasing investments in healthcare infrastructure, rising healthcare expenditure, and growing awareness of sleep health. The increasing prevalence of chronic diseases and the rising adoption of advanced medical technologies are also driving market growth.

Key Actigraphy Device Company Insights

Key market players are adopting various strategies such as product launches, approvals and others to increase their market presence and get competitive advantage over other market players. These advancements in actigraphy device industry are anticipated to boost market growth over the forecast period.

Key Actigraphy Device Companies:

The following are the leading companies in the actigraphy device market. These companies collectively hold the largest market share and dictate industry trends.

- ActiGraph, LLC.

- Fibion Inc.

- Koninklijke Philips N.V.,

- CamNtech Ltd

- Empatica Inc.

- ActivInsights Ltd

- neurocare group AG

Recent Developments

-

In October 2024, ActiGraph, a company specializing in wearable technology and scientific services for clinical drug development and academic research, has partnered with Indivi, a TechBio company that uses smartphones to advance precision medicine in neuroscience R&D.

Actigraphy Device Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.35 billion

Revenue forecast in 2030

USD 10.67 billion

Growth rate

CAGR of 26.09% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Report coverage

Revenue, competitive landscape, growth factors, and trends

Segments covered

Application, end use, region

Key companies profiled

ActiGraph, LLC.; Fibion Inc.; Koninklijke Philips N.V.; CamNtech Ltd; Empatica Inc.; ActivInsights Ltd; neurocare group AG.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Actigraphy Device Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global actigraphy device market report based on application, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Sleep Disorders

-

Physical Activity Monitoring

-

Chronic Disease Management

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare Providers

-

Research Institutions

-

Homecare Settings

-

Fitness and Sports Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. North America dominated the actigraphy device market with a share of 35.76% in 2024. North America has a significant population suffering from various sleep disorders like insomnia, sleep apnea, and restless legs syndrome. This drives the demand for diagnostic tools like actigraphy devices.

b. Some key players operating in the actigraphy device market include ActiGraph, LLC.; Fibion Inc.; Koninklijke Philips N.V.; CamNtech Ltd; Empatica Inc.; ActivInsights Ltd; neurocare group AG.

b. Key factors that are driving the market growth include growing prevalence of sleep disorders, rising health consciousness, and advancements in wearable technology.

b. The global actigraphy device market size was estimated at USD 2.64 billion in 2024 and is expected to reach USD 3.35 billion in 2025

b. The global actigraphy device market is expected to grow at a compound annual growth rate of 26.09% from 2025 to 2030 to reach USD 10.67 billion by 2030

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.