- Home

- »

- Petrochemicals

- »

-

Activated Carbon Market Size & Share, Industry Report 2033GVR Report cover

![Activated Carbon Market Size, Share & Trends Report]()

Activated Carbon Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Powdered, Granular, Other), By Form (Liquid Phase, Gas Phase), By End Use (Water Treatment, Air Purification, Other End Use), By Region, And Segment Forecasts

- Report ID: 978-1-68038-073-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Activated Carbon Market Summary

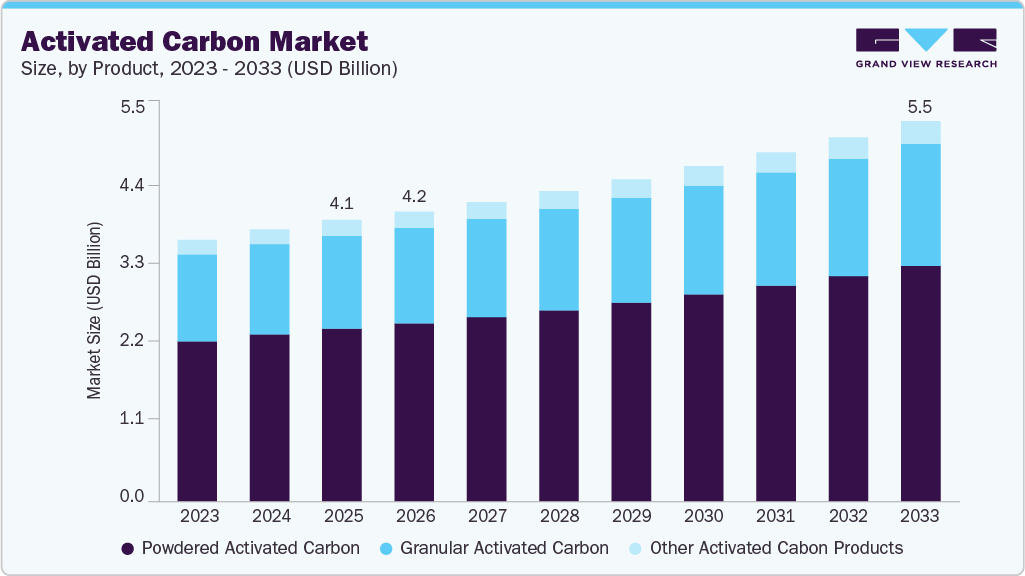

The global activated carbon market size was estimated at USD 4,068.8 million in 2025 and is projected to reach USD 5,497.3 million by 2033, growing at a CAGR of 4.0% from 2026 to 2033. The market is expanding steadily as industries prioritize advanced purification technologies to meet rising environmental and regulatory demands.

Key Market Trends & Insights

- Asia Pacific dominated the market with the largest revenue share of 48.9% in 2025.

- The market in China is expected to grow at a significant CAGR of 4.0% from 2026 to 2033.

- The powdered segment held the largest revenue share of 61.4% in 2025.

- By form, the gas phase segment held the largest revenue share of 54.1% in 2025 in terms of revenue.

- By end use, the water treatment segment held the largest revenue share of 42.5% in 2025 in terms of value.

Market Size & Forecast

- 2025 Market Size: USD 4,068.8 Million

- 2033 Projected Market Size: USD 5,497.3 Million

- CAGR (2026-2033): 4.0%

- Asia Pacific: Largest market in 2025

- Middle East & Africa: Fastest growing market

Growth is supported by increasing applications across water treatment, air purification, and industrial processes. Diverse product categories and emerging regional markets contribute to a dynamic industry landscape that continues to evolve as sustainability and public health concerns intensify worldwide. Product diversification plays a central role in the market’s development, with each category serving distinct performance needs. The honeycomb activated carbon market is growing due to its efficiency in VOC removal for industrial air purification. The activated carbon fiber market expands as its rapid adsorption and lightweight properties benefit electronics, protective gear, and chemical processing. The pelletized activated carbon market is also advancing, supported by its strength and low dust generation in gas-phase filtration. Traditional segments like the wood-activated carbon market and coal-based activated carbon market remain essential because of their availability and adaptability across multiple purification applications today.Regional dynamics significantly influence the expansion of the activated carbon industry, with developing economies assuming an increasingly important role. The India activated carbon market is experiencing rapid growth fueled by expanding water treatment capacity, rising industrial activity, and a strong base of coconut-shell raw materials. Likewise, the Gulf Cooperation Council's activated carbon market is benefiting from heavy investment in desalination plants, pollution control technologies, and stricter regulatory standards. These regions illustrate how local environmental challenges, resource availability, and industrial development influence demand patterns, ultimately strengthening the global supply chain and facilitating the wider adoption of activated carbon solutions across essential applications worldwide today.

End-use applications continue to drive significant advancements within the activated carbon sector, particularly in highly regulated industries. The automotive activated carbon canister market is expanding as manufacturers adopt improved vapor recovery systems to reduce hydrocarbon emissions. Meanwhile, the activated carbon mercury control market grows with stricter limits on mercury emissions from power generation and metal processing. The activated carbon filter market remains one of the most versatile segments, serving residential, commercial, and industrial purification needs. Together, these applications highlight activated carbon’s critical role in supporting environmental compliance, operational efficiency, and public health across global markets today in a rapidly evolving industry.

Market Concentration & Characteristics

The market is moderately fragmented, with a few global players, such as Boyce Carbon, Cabot Corporation, and Kuraray Co., are some of the prominent companies that dominate the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

Leading players in the industry are adopting a combination of strategic expansions, mergers & acquisitions, and product innovation to strengthen their market position and enhance global reach. Companies are increasingly investing in capacity expansions and the development of sustainable, bio-based activated carbon products to meet the growing demand for eco-friendly solutions across water and air purification applications. Strategic collaborations with municipal bodies and industrial clients are enabling long-term supply agreements, securing revenue stability.

Product Insights

The powdered activated carbon segment held the largest revenue share of 61.4% in 2025, primarily due to its widespread applicability, high adsorption efficiency, and cost-effectiveness across key industries such as municipal water treatment, food & beverage processing, and pharmaceuticals. Its fine particle size offers a significantly larger surface area compared to other forms, enabling faster and more effective removal of contaminants such as organic compounds, chlorine, and micropollutants. This advantage has made PAC the preferred choice for batch treatment processes, emergency spill responses, and seasonal water quality management. The flexibility in dosing and ease of handling have further driven its adoption in both centralized and decentralized treatment systems, especially in regions with limited infrastructure.

Granular activated carbon is expected to grow at a CAGR of 3.6% from 2026 to 2033, supported by increasing demand across water treatment, air purification, and industrial filtration applications. Its high adsorption efficiency makes it essential for removing contaminants from municipal water systems, industrial effluents, and volatile organic compounds in air streams. Stricter environmental regulations and the global push for cleaner processes are further accelerating its adoption. Industries such as food and beverage, chemicals, and pharmaceuticals continue to expand their usage of granular due to its reliability and sustainability. Ongoing technological advancements and rising infrastructure investments will help sustain this steady market growth.

Form Insights

The gas phase segment accounted for the largest revenue share of 54.1% in 2025, driven by the rising global emphasis on air quality management, industrial emission control, and regulatory compliance. Activated carbon’s effectiveness in adsorbing volatile organic compounds (VOCs), sulfur compounds, and other hazardous air pollutants has positioned it as a critical component in flue gas treatment, solvent recovery systems, and automotive emission control technologies. With stringent regulations such as the U.S. Clean Air Act, Euro 6 standards, and China’s Air Pollution Prevention and Control Action Plan coming into force, industries across manufacturing, power generation, and chemicals have been compelled to adopt activated carbon-based gas purification solutions. This shift has significantly contributed to the segment’s revenue dominance.

In addition to industrial uses, growing adoption of activated carbon in consumer-level air purification systems, HVAC filters, and automotive cabin air filters has further supported demand across residential and commercial sectors. Rising concerns over indoor air pollution, especially in densely populated urban centers, have spurred the deployment of advanced filtration systems that rely on granular and impregnated activated carbon for effective odor, allergen, and toxin removal. The expanding application of gas-phase activated carbon in emerging areas such as EV battery off-gas filtration, cleanroom environments, and electronics manufacturing has also created new revenue streams.

End Use Insights

The water treatment segment held the largest revenue share of 42.5% in 2025, primarily driven by escalating global concerns over access to clean and safe drinking water, alongside increasingly stringent water quality regulations. Activated carbon plays a pivotal role in the removal of organic contaminants, chlorine, pesticides, pharmaceutical residues, PFAS, and heavy metals from water sources, making it indispensable in municipal and industrial water treatment systems. Governments and regulatory bodies across developed and developing nations have introduced stricter discharge and potable water standards, thereby accelerating the deployment of activated carbon technologies in municipal utilities, wastewater treatment facilities, and industrial effluent treatment plants.

Forms of activated carbon in air purification are growing the fastest within the market, with a projected CAGR of 4.1%. This strong growth is driven by rising concerns over indoor and outdoor air quality, increasing industrial emissions, and stricter environmental regulations worldwide. Activated carbon’s ability to effectively remove volatile organic compounds, hazardous gases, and odors makes it essential for industrial air treatment, automotive cabin filters, and residential purification systems. Expanding manufacturing activity and the global shift toward cleaner, healthier environments continue to accelerate adoption. Additionally, technological improvements in filtration systems are further boosting demand for activated carbon in air purification applications.

Regional Insights

The Asia Pacific dominated the industry with a commanding 48.9% share in 2025, driven by rapid industrialization, increasing environmental concerns, and growing investments in water and air purification infrastructure. The region’s leadership is anchored by strong demand from municipal water treatment, pharmaceuticals, food processing, and automotive sectors, particularly in countries like China, India, Japan, and South Korea. Government-led initiatives to curb pollution, improve public health, and expand access to potable water have driven the adoption of activated carbon technologies across both urban and rural areas.

China Activated Carbon Market Trends

China hold 49.4% market share of Asia Pacific activated carbon market.china remained the single largest contributor within Asia Pacific, owing to its extensive industrial base, severe air and water pollution challenges, and aggressive regulatory measures under the government’s environmental protection agenda. The country has implemented stricter emission control norms under the Blue Sky Protection Campaign, boosting the use of activated carbon in gas-phase applications across power plants, manufacturing, and automotive industries. Additionally, large-scale investments in municipal water treatment infrastructure and industrial wastewater reuse have sustained robust demand.

North America Activated Carbon Market Trends

North America accounted for 25.7% of the global market in 2025, driven by a strong regulatory framework, advanced water and air treatment infrastructure, and rising demand for high-purity applications. The U.S. Environmental Protection Agency (EPA) regulations targeting contaminants like PFAS, VOCs, and mercury have significantly influenced industrial adoption of activated carbon across water utilities, chemical manufacturing, and energy generation sectors. The market is further bolstered by consumer demand for indoor air purification systems, automotive filtration, and pharmaceutical-grade purification processes.

The U.S. activated carbon market represented the core of North America’s activated carbon market, backed by rigorous environmental compliance standards, a mature water treatment network, and a strong presence of global manufacturers. High demand stems from regulatory actions such as the PFAS Action Plan and Clean Water Act, which have prompted municipal utilities and industrial players to adopt advanced filtration technologies. The country is also witnessing an increasing uptake of activated carbon in point-of-use water systems, HVAC filtration, and pharmaceutical applications.

Europe Activated Carbon Market Trends

Europe activated carbon market is shaped by rising demand for advanced water and air purification solutions, driven by stringent EU environmental regulations. Industries such as pharmaceuticals, food and beverage, and chemicals increasingly rely on activated carbon for high-purity processing and emission control. Growing awareness of air quality and the adoption of sustainable filtration technologies are boosting usage across residential and industrial sectors. Additionally, the shift toward renewable, bio-based raw materials is influencing production trends and supporting long-term market growth.

The Germany activated carbon market stood out as a key market within Europe due to its advanced environmental standards, strong industrial base, and leadership in sustainable technologies. Activated carbon is widely used in flue gas cleaning, air filtration, and water purification, driven by strict compliance with EU emission directives. The country’s emphasis on green manufacturing and renewable energy transition has also spurred adoption in chemical, automotive, and utility sectors.

Latin America Activated Carbon Market Trends

Latin America activated carbon market is experiencing steady growth driven by increasing demand for water treatment, mining, and industrial purification applications. Expanding urbanization and rising concerns over water quality are pushing municipalities to adopt more advanced filtration systems. The region’s strong gold mining industry also boosts consumption of granular activated carbon for metal recovery. Additionally, growing industrial activity and stricter environmental regulations are encouraging wider use of activated carbon in air purification and chemical processing, supporting long-term market expansion.

Middle East & Africa Activated Carbon Market Trends

Middle East & Africa activated carbon market is projected to grow at the fastest CAGR of 4.6% from 2026 to 2033, driven by rising investments in water treatment infrastructure and increasing demand for clean drinking water in rapidly expanding urban areas. Industrial growth in oil & gas, petrochemicals, and mining is further boosting the need for advanced purification and emission-control solutions. Additionally, tightening environmental regulations and growing awareness of air quality are accelerating the adoption of activated carbon across both municipal and industrial applications.

Key Activated Carbon Company Insights

Key players, such as Boyce Carbon, Cabot Corporation, Kuraray Co., CarboTech AC GmbH, are dominating the market.

-

Boyce Carbon is a prominent player in the global activated carbon market, known for its vertically integrated operations and diverse product portfolio catering to applications such as water treatment, air purification, gold recovery, food & beverage processing, and pharmaceuticals. The company leverages its strategic manufacturing facilities across India, Sri Lanka, and other Southeast Asian regions, enabling cost-efficient production of both powdered and granular activated carbon derived from coconut shells and other sustainable raw materials. Boyce Carbon has positioned itself as a key supplier in high-growth markets, particularly in Asia Pacific, Middle East, and Africa, by offering tailored solutions, technical support, and a strong export network. Its focuses on quality certifications, innovation in impregnated carbon, and expansion of reactivation capabilities continue to strengthen its competitive edge in both industrial and environmental segments of the activated carbon industry.

Key Activated Carbon Companies:

The following are the leading companies in the activated carbon market. These companies collectively hold the largest market share and dictate industry trends.

- CarbPure Technologies

- Boyce Carbon

- Cabot Corporation

- Kuraray Co.

- CarboTech AC GmbH

- Donau Chemie AG

- Haycarb (Pvt) Ltd.

- Jacobi Carbons Group

- Kureha Corporation

- Osaka Gas Chemical Co.; Ltd.

- Evoqua Water Technologies LLC.

- Carbon Activated Corporation

- Hangzhou Nature Technology Co., Ltd.

- CarbUSA

- Sorbent JSC

Recent Developments

-

In 2024, Germany-based chemical manufacturer Nordmann acquired Italy-based SD Chemicals S.r.l., a distributor of raw materials catering to the cosmetics industry catering to skin care, hair care and makeup applications. This acquisition will enable Nordmann to expand its presence and enhance customer reach.

-

In January 2023, Ningbo Juhua Chemical & Science Co., Ltd. awarded a contract to Technip Energies for a Activated Carbon plant with an annual capacity of 72 kilo tons in Ningbo, Zhejiang, China. This is part of the company’s initiative to expand its petrochemical new material business.

Activated Carbon Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 4,189.0 million

Revenue forecast in 2033

USD 5,497.3 million

Growth rate

CAGR of 4.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million, Volume in Kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, end use, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia; South Korea; Saudi Arabia; South Africa; Brazil; Argentina

Key companies profiled

CarbPure Technologies; Boyce Carbon; Cabot Corporation; Kuraray Co.; CarboTech AC GmbH; Donau Chemie AG; Haycarb (Pvt) Ltd.; Jacobi Carbons Group; Kureha Corporation; Osaka Gas Chemical Co., Ltd.; Evoqua Water Technologies LLC.; Carbon Activated Corporation; Hangzhou Nature Technology Co., Ltd.; CarbUSA; Sorbent JSC

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Activated Carbon Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global activated carbon market report based on product, form, end use, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2033)

-

Powdered

-

Granular

-

Other Products

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2033)

-

Liquid Phase

-

Gas Phase

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2033)

-

Water Treatment

-

Food & Beverage Processing

-

Pharmaceutical & Medical

-

Automotive

-

Air Purification

-

Other End Use

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global activated carbon market size was estimated at USD 4,068.8 million in 2025 and is expected to reach USD 4,189.0 million in 2026.

b. The global activated carbon market is expected to grow at a compound annual growth rate of 4.0% from 2026 to 2033 to reach USD 5,497.3 million by 2033.

b. The powdered activated carbon (PAC) segment held the largest revenue share in 2024 due to its high adsorption efficiency, cost-effectiveness, and widespread use in water treatment, food processing, and pharmaceutical purification. Its flexibility in dosing and rapid contaminant removal capabilities made it the preferred choice across both municipal and industrial applications.

b. Some of the key players operating in the activated carbon market include CarbPure Technologies, Boyce Carbon, Cabot Corporation, Kuraray Co., CarboTech AC GmbH, Donau Chemie AG, Haycarb (Pvt) Ltd., Jacobi Carbons Group, Kureha Corporation, Osaka Gas Chemical Co.; Ltd., Evoqua Water Technologies LLC., Carbon Activated Corporation, Hangzhou Nature Technology Co., Ltd., CarbUSA, and Sorbent JSC.

b. The market is driven by stringent environmental regulations and the growing need for efficient water and air purification solutions across industrial, municipal, and residential sectors. Rising concerns over contaminant removal, public health, and sustainability are further accelerating adoption globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.