- Home

- »

- Advanced Interior Materials

- »

-

Advanced Composites Market Size And Share Report, 2030GVR Report cover

![Advanced Composites Market Size, Share & Trends Report]()

Advanced Composites Market Size, Share & Trends Analysis Report By Product (Aramid, Carbon, Glass), By Resin Type, By Application (Aerospace & Defense, Automotive, Wind Energy), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-268-6

- Number of Pages: 118

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Advanced Materials

Advanced Composites Market Size & Trends

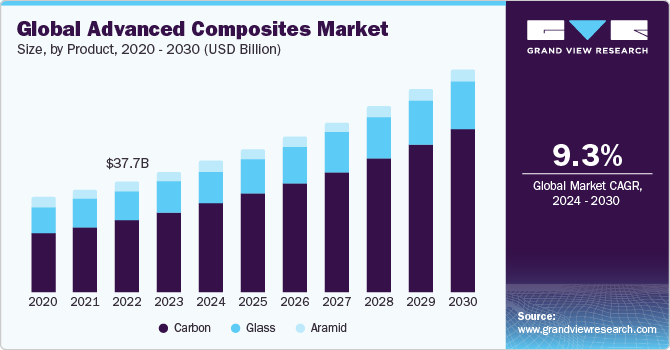

The global advanced composites market size was estimated at USD 37.69 billion in 2023 and is projected to grow at a CAGR of 9.3% from 2024 to 2030. The demand for advanced composites in the aerospace & defense industry and manufacturing of wind turbines is expected to grow significantly over the forecast period, due to the increasing air passenger traffic and installations of wind energy plants across the globe respectively.

The need for lightweight components, particularly turbines to increase the conversion efficiency of wind farms is expected to have a positive impact on the demand for composites. Composites-based turbines offer low resistance to wind and rotate easily to produce a high amount of electricity, which is likely to aid market growth over the forecast.

Key market players are involved in notable R&D efforts in a bid to build their product portfolio and increase revenues. Major players focus on delivering customized solutions to the clients which leads to a high switching cost for the consumer companies. In addition, the companies in the market are involved in notable collaborations with technology-based firms and research institutions to build advanced high-strength solutions.

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The market is fragmented in nature and is therefore marked by an extensive presence of large manufacturers. Key players in the global market include Koninklijke TenCate NV, Toray International, Inc., Hexcel Corporation, Teijin Limited, SGL Group, and Cytec Solvay Group among others. Key manufacturers operating in the market place extensive focus on the production and development of advanced composite materials in a bid to increase product traction.

The market is characterized by the presence of a large number of regulations. The production process of composite materials is heavily regulated on account of critical nature of their usage. In addition, the usage of such materials is also subject to various regulations related to the strength and required performance characteristics, which affect the overall market growth.

The threat of substitutes is expected to remain low over the forecast period, owing to the presence of various substitutes, such as metal. In addition, high prices of composites and inexpensive metal prices are anticipated to increase the substitution threat. However superior product properties coupled with declining prices are expected to keep the substitution threat at a low level.

Product Insights

The carbon fiber segment led the market with the largest revenue share of 66.23% in 2023 and is expected to grow at the fastest CAGR over the forecast period. Advanced carbon composites are widely utilized in the aerospace industry. The lightweight of the material coupled with high impact resistance are expected to drive market growth over the forecast period. In addition, the demand for advanced carbon composites is growing significantly in automotive, sporting goods and pipes & tanks industry. The resistance to heat and impact is one of the key reasons for the product growth in manufacturing of pipes & tanks. The need for lightweight material in sporting goods is expected to aid market growth for carbon fibers in the industry.

The demand for advanced glass composites is expected to gain share due to the enhanced characteristics of the material including dimensional stability, moisture resistance, high strength, fire resistance, chemical resistance, electrical resistance and thermal conductivity. The diversified characteristics offered by the composites render their application in electrical insulation, manufacturing industry, marine industry and others. Glass composites contain glass fibers within the polymer matrix and are popular for several reasons; for instance, they can be easily drawn into high-strength fibers from molten state and economically fabricated using different composite manufacturing techniques. In addition, glass fiber possesses chemical inertness, which, coupled with the inertness of plastics, is useful in a variety of corrosive environments.

Resin Type Insights

Based on resin type, the advanced thermosetting accounted for the largest revenue share in 2023, due to their lightweight nature coupled with high strength, which makes them particularly desirable for industries prioritizing weight reduction like aerospace and automotive sectors. In addition, their durability and resistance to chemicals make them well-suited for applications in harsh environments such as marine structures. Moreover, their ability to be molded into complex shapes allows for greater design flexibility, catering to industries seeking intricate designs and customization. Ongoing advancements in manufacturing techniques are also contributing to their cost-effectiveness and broader accessibility, further fueling the anticipated increase in demand for advanced thermosetting composites.

Application Insights

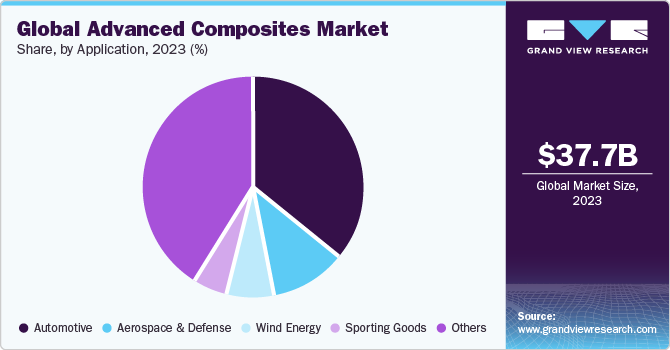

Based on application, the automotive segment led the market with the largest revenue share of 14.75% in 2023, and it is expected to grow at the fastest CAGR over the forecast period. The rising demand for durable, lightweight, and conductive raw materials in the automotive industry is expected to boost market growth over the forecast period. In addition, the global automotive industry is growing at a constant rate, owing to steady technological advancement, the need for emission reduction, and high volatility in some emerging countries, such as India and Brazil. These factors are predicted to fuel the demand for advanced composites in automotive applications.

The growing demand for air travel amongst passengers and the ability to spend is expected to be the driving factor for the aerospace industry over the forecast period, which in turn is expected to impact the advanced composites industry positively. Moreover, the increasing investment in the defense sector is expected to increase demand for aramid composites. The growing global political friction is expected to further increase the funding in the defense sector, which is expected to have a positive effect on the demand for the product in the coming years.

Regional Insights

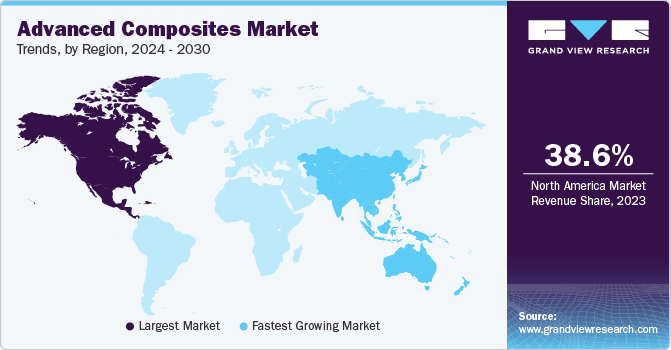

North America dominated the advanced composites market with a revenue share of 38.64% in 2023. The automotive sector in North America is one of the biggest in the world with the U.S. being one of the largest producers of automobiles. High market size and significant disposable income of consumers along with the ability of mass production and high product variation have boosted industry growth in the country, which is further likely to increase the consumption of advanced composites in automotive applications in the region.

U.S. Advanced Composites Market Trends

The advanced composites market in U.S. is expected to grow at the fastest CAGR of 8.0% over the forecast period. The increasing utilization of the product in the industry coupled with presence of the biggest airplane manufacturer in the country. In addition, the rising penetration of advanced composites in the wind turbine manufacturing industry owing to the need for lightweight materials is anticipated to boost the demand for the product.

Europe Advanced Composites Market Trends

The advanced composites market in Europe is anticipated to grow at a significant CAGR over the forecast period. Rapid growth of the wind energy production industry in Germany and Spain is expected to drive the demand for composites over the forecast period. High aerospace & defense industry growth in the region is expected to have a positive impact on the industry.

The Germany advanced composites market accounted for the largest revenue share of 33.4% in 2023. Germany is one of the leading manufacturing countries with respect to vehicles, particularly cars. The growing manufacturing of vehicles in industry and growing demand across the globe for cars is expected to drive market growth over the forecast period. The rising need for fuel-efficient vehicles is expected to aid market growth over the forecast period.

The advanced composites market in the UK is anticipated to grow at the fastest CAGR of 9.1% over the forecast period. The positive trend in demand for carbon composites in several industries including aerospace, marine, pipes & tanks and others is expected to aid market growth over the forecast period. High consumer demand for air travel is expected to augment demand for airplanes which in turn is expected to drive carbon composites industry.

Asia Pacific Advanced Composites Market Trends

The advanced composites market in Asia Pacific region is expected to grow at the fastest CAGR over the forecast period. The growing demand for product in aerospace & defense and automotive industry is expected to drive demand in Asia Pacific.

The growing automotive industry in Japan and India coupled with high aerospace & defense industry growth in China is expected to augment demand for advanced composites industry in region.

The China advanced composites market accounted for the largest revenue share of 41.4% in Asia Pacific in 2023. Inexpensive labor and low cost of raw materials are expected to attract manufacturers in the country which in turn is expected to drive the demand for composites in construction and other industries. China is the leading producer of several products that it exports across the globe, which is expected to have a positive impact on the market growth.

The advanced composites market in India is expected to grow at the fastest CAGR of 11.6% over the forecast period. India is expected to be one of most promising markets for composites over forecast period. The rapidly growing economy coupled with growing manufacturing sector is expected to have a positive impact on the demand for advanced composites in country. Growing automotive, pipes & tanks and wind turbine manufacturing industry is expected to drive market growth over forecast period.

Central & South America Advanced Composites Market Trends

The advanced composites market in the Central & South America region is expected to grow at a significant CAGR over the forecast period. Safety & protection, electrical insulation, filtration, frictional materials, optical fiber cables, rubber and tire reinforcements are among current applications in which aramid fibers have been mostly utilized owing to which demand for product is expected to rise in the region.

The advanced composites market in Brazil is expected to grow at the fastest CAGR of 8.0% over the forecast period. Glass fiber is expected to gain a share in the country owing to the utilization in manufacturing of luxury cars and components of cars. The growing consumer per capita income has led to demand for luxury vehicles in country which in turn is expected to drive market growth.

Middle East & Africa Advanced Composites Market Trends

The advanced composites market in the Middle East & Africa region is anticipated to grow at a significant CAGR over the forecast period. The growing demand for aramid in defense sector coupled with increasing government funding in the sector is expected to drive market growth over the forecast period.

The advanced composites market in Saudi Arabia accounted for the largest revenue share of 22.4% in Middle East & Africa in 2023. The increasing application of composites in manufacturing of airplanes and defense equipment is expected to be the driving factor for advanced composites in the industry. Light weight of the product coupled with high strength & stiffness is likely to have a positive impact on the demand for the product in the industry.

Key Advanced Composites Company Insights

Some of the key players operating in industry include Toray Industries, Inc., Owens Corning, and Huntsman Corporation.

-

Toray Industries, Inc. operates through the following business segments: Fibers and Textiles, Functional Chemicals, Carbon Fiber Composite Materials, Environment & Engineering, Life Science, and others

-

Owens Corning provides its products through three segments, namely roofing, insulations, and composite. It offers services to various industries such as building & construction, transportation, consumer goods & electronics, industry, and energy generation. The company has over 30 manufacturing facilities and 5 R&D centers across Europe, North America, and Asia

AGY Holdings Corp. and Strata Manufacturing are some of the emerging participants in global market.

-

AGY Holdings Corp is U.S. based company which is engaged in manufacturing, designing and distribution of composite materials namely glass fibers. It caters to a wide range of industries including aerospace, defense, electronics, automotive, construction and industries

-

Strata Manufacturing, established in 2009 is headquartered in UAE. The company is engaged in manufacturing and distribution of aero- structures manufactured using advanced composite materials

Key Advanced Composites Companies:

The following are the leading companies in the advanced composites market. These companies collectively hold the largest market share and dictate industry trends.

- Toray Industries, Inc.

- Koninklijke Ten Cate NV

- Teijin Limited

- Hexcel Corporation

- SGL Group

- Cytec Solvay Group

- Owens Corning

- E. I. Dupont De Nemours and Company

- Huntsman Corporation

- Momentive Performance Materials Inc.

- WS Atkins plc

- AGY Holdings Corp.

- Formosa Plastics Corporation

- Plasan Carbon Composites

- Strata Manufacturing

Recent Developments

-

In February 2022, Teijin Automotive Technologies, the primary entity for the Teijin Group's automotive composites sector, declared that a new facility for the production of composites has started up for business in Changzhou, Jiangsu province, China's Wujin National Hi-Tech Industrial Zone. There are 39,000 square meters of workspace in the new building. The company also revealed that it is building a third facility in China, which is expected to have 13,000 square meters of workspace and is anticipated to be completed in the summer of 2023

-

In June 2022, Hexcel Corporation announced that Sikorsky, a Lockheed Martin Company, has provided a long-term contract, in order to deliver innovative composite structures for the CH-53K King Stallion heavy lift helicopter program

-

In March 2022, Hexcel Corporation announced the expansion of its current engineered core manufacturing operation in Morocco. In order to address the rising demand for lightweight advanced composites from aerospace clients

Advanced Composites Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 41.14 billion

Revenue forecast in 2030

USD 70.18 billion

Growth rate

CAGR of 9.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, resin type, application, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; Japan; India; South Korea; Brazil; Saudi Arabia

Key companies profiled

Toray Industries, Inc.; Koninklijke Ten Cate NV; Teijin Limited; Hexcel Corporation; SGL Group; Cytec Solvay Group; Owens Corning; E. I. Dupont De Nemours and Company; Huntsman Corporation; Momentive Performance Materials Inc.; WS Atkins plc; AGY Holdings Corp.; Formosa Plastics Corporation; Plasan Carbon Composites; Strata Manufacturing

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Advanced Composites Market Report Segmentation

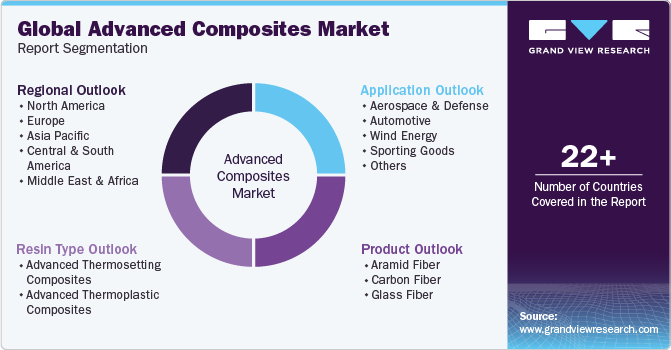

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the advanced composites market report based on product, resin type, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Aramid Fiber

-

Carbon Fiber

-

Glass Fiber

-

-

Resin Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Advanced Thermosetting Composites

-

Advanced Thermoplastic Composites

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Aerospace & Defense

-

Automotive

-

Wind Energy

-

Sporting Goods

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global advanced composites market size was estimated at USD 37.69 billion in 2023 and is expected to reach USD 41.14 billion in 2024.

b. The global advanced composites market is expected to grow at a compound annual growth rate of 9.3% from 2024 to 2030 to reach USD 70.18 billion by 2030.

b. The automotive application segment led the market and accounted for over 44.4% share of the revenue in 2023. The rising demand for durable, lightweight, and conductive raw materials in the automotive industry is expected to boost the advanced composites market over the forecast period.

b. Some of the key players operating in the advanced composites market include Toray Industries, Inc., Koninklijke Ten Cate NV, Teijin Limited, Hexcel Corporation, SGL Group, Cytec Solvay Group, Owens Corning, E. I. Dupont De Nemours and Company, Huntsman Corporation, Momentive Performance Materials Inc., WS Atkins plc, AGY Holdings Corp., Formosa Plastics Corporation, Plasan Carbon Composites, Strata Manufacturing.

b. The key factors that are driving the global advanced composites market include the growing demand for the product in the aerospace and defense industry and sporting goods.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."