- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Aerosol Paints Market Size, Share & Growth Report, 2030GVR Report cover

![Aerosol Paints Market Size, Share & Trends Report]()

Aerosol Paints Market (2023 - 2030) Size, Share & Trends Analysis By Product (Water-based, Solvent-based), By Application (Do-it-Yourself, Construction, Automotive, Wooden Furniture, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-183-5

- Number of Report Pages: 122

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aerosol Paints Market Summary

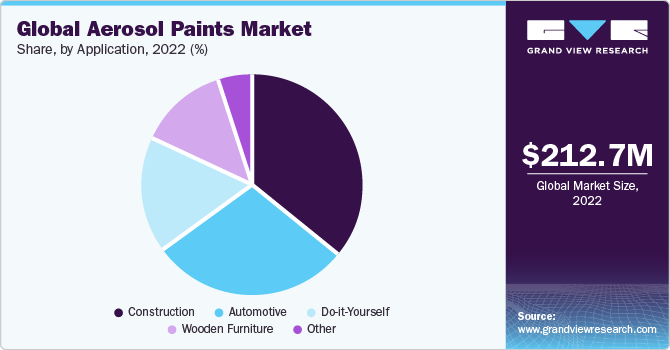

The global aerosol paints market size was valued at USD 212.7 million in 2022 and is projected to reach USD 331.7 million by 2030, growing at a CAGR of 5.8% from 2023 to 2030. Aerosol paints are widely utilized to increase the shelf life of wood, metal, and plastic components.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for the largest revenue share of 34.0% in 2022.

- By application, the construction segment dominated the market and held the largest revenue share of 36.2% in 2022.

- By product, the solvent based segment accounted for the largest revenue share of 54.5% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 212.7 Million

- 2030 Projected Market Size: USD 331.7 Million

- CAGR (2023-2030): 5.8%

- Asia Pacific: Largest market in 2022

The rising product application in the automotive and construction industries for protection and aesthetic purposes is projected to drive market growth over the forecast period. Moreover, technological innovations in the product also contribute to this growth. In April 2023, Rust-Oleum introduced Custom Spray 5-in-1, the latest advancement in spray paint. This cutting-edge advancement in spray paint technology empowers craftsmen to effortlessly switch between various spray patterns with a simple click of a dial.

The market in North America and the U.S. is anticipated to be driven by the presence of several prominent manufacturers, such as Rust-Oleum, RPM International, Inc., and Kelly-Moore Paints. Heavy investments in infrastructure development, with an emphasis on the regional construction sectors in Asia Pacific, North America, and Europe, are also expected to boost the product demand over the coming years.

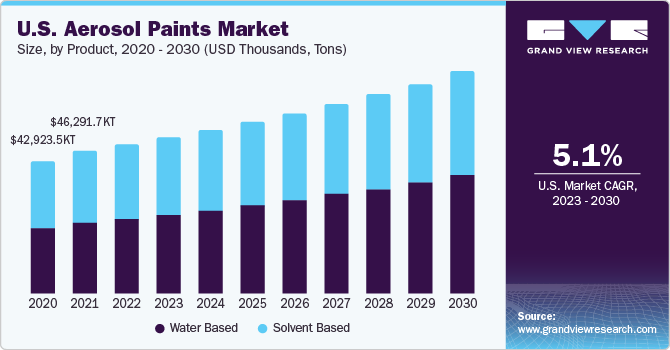

The product manufacturers use two types of production techniques, which are water-based and solvent-based technologies. Water-based products are anticipated to register high demand over the forecast period as these paints are safer to handle in comparison with their solvent-based counterparts. Moreover, green building initiatives across various regions, especially in Europe, are anticipated to propel the demand for water-based paints in the coming years. However, the demand for solvent-based products has witnessed a drop in the developed regions, particularly in Europe and North America, due to the presence of stringent environmental norms and acts about hazardous chemicals.

Thus, major manufacturers are directing their attention towards sustainable product development technologies as a means to bolster their footprint in the global market. Swift construction endeavors and the notable rise in disposable income, particularly in emerging economies like China and India, stand as pivotal factors propelling the construction application segment and subsequently fueling the demand for these paints.

Application Insights

The construction segment dominated the market and held the largest revenue share of 36.2% in 2022. The global construction chemicals market is expected to witness considerable growth on account of rising construction projects of residential & commercial buildings, landfills, and tunnels, and other infrastructure activities. Furthermore, rapid urbanization in developing regions is anticipated to boost the market over the forecast period. However, the usage of these paints in the construction industry is limited to certain functional applications, owing to their high costs, such as to touch-up small areas or to give a smooth finish to a previously painted area.

Automotive is the second-largest application segment. In the automotive sector, aerosol paints are used during manufacturing, as well as after-sales refinishing of vehicles. These paints are an ideal solution for touch-ups and reconditioning & repairs of different parts of vehicles. Growing sales of consumer automotive, such as trucks, buses, and other forms of passenger transport, are expected to drive the product demand in this segment over the forecast period. The demand for DIY products has also increased over the recent past, majorly owing to the advent of the internet and social media. These are used for basic household applications, such as wall painting, refinishing or customization of vehicles, graffiti, household exterior & interior refurbishing, and hobby artwork.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 34.0% in 2022. Industries, such as automotive, construction, and electrical & electronics, are witnessing significant growth in developing countries like China, India, Malaysia, Vietnam, and Southeast Asia. Thus, the rapid expansion of end-use industries along with a significant rise in per capita disposable income is expected to boost the product consumption, especially in the developing economies of the region, over the forecast period.

The market in North America is also anticipated to witness considerable growth from 2023 to 2030 mainly due to the presence of major manufacturers and the popular trend of Do-It-Yourself (DIY) activities for household and vehicle refurbishing activities. There is an ascending demand for customized vehicles in the region that involves the use of these paints to provide the desired aesthetic look. This is expected to propel the product demand in the regional automotive segment. The North American market was led by the U.S. in 2019 and this trend is anticipated to continue over the forecast period due to the increasing affordability for end-users.

Product Insights

The solvent based segment accounted for the largest revenue share of 54.5% in 2022. Solvent-based aerosol paints are characterized by the different mineral spirits used during their manufacturing process. The demand for these products has changed majorly in the developed regions of the world, particularly in Europe and North America, owing to stringent environmental norms and acts regarding hazardous chemicals.

Solvent-based paints emit toxic compounds during their application and drying, leading to a strong smell. These paints are highly flammable and have harmful effects on the environment and human health. Water-based products are highly efficient and safer to use, thus they are anticipated to have a strong demand over the forecast period. These paints comprise latex resins in a dispersed phase. Moreover, water-based paints have sustainable production methods, which is also anticipated to drive their demand.

Key Companies & Market Share Insights

Companies operating in the global aerosol paints market lay high emphasis on expanding their global footprint to increase their revenue and market share. Companies are expanding their services in North America, Asia Pacific, and Europe to cater to the rising demand from the emerging economies. Countries, such as India, China, the U.S., and the Netherlands, where the construction industry is growing significantly owing to population expansion, increase in disposable income, and rising purchasing power, are expected to provide new growth opportunities for the market players over the forecast period. The global market is found to be significantly fragmented owing to the presence of a large number of manufacturers.

Key Aerosol Paints Companies:

- Nippon Paint Holdings Co., Ltd.

- Masco Corp.

- Dupli-Color Products Company

- LA-CO Industries, Inc.

- Krylon Products Group

- Montana Colors S.L.

- Southfield Paints Ltd.

- Kobra Paint

- Rust-Oleum

- Aeroaids Corp

Recent Developments

-

In April 2023, Diamond Vogel acquired N92 Menomonee Falls, LLC, a subsidiary of The Sherwin-Williams Company. Through this acquisition, Diamond Vogel will gain access to the products facility and the expertise of the N92 Menomonee Falls, LLC, team in aerosol manufacturing. This strategic move aims to expand the Diamond Vogel product portfolio and enhance its global reach.

-

In April 2022, Akzo Nobel N.V. launched the Dulux Simply Refresh spray paint collection for the Do-It-Yourself (DIY) paints category. Utilizing the unique low splatter and low drip technology embedded in this ready-to-use interior washable paint, consumers can now complete their DIY projects more efficiently, with a cleaner process, and reduced waste.

-

In November 2022, BRIOLF GROUP acquired aerosol manufacturer ARECO ITALIA S.P.A. The aim behind the acquisition is to expand its presence in the international market.

-

In June 2022, BEHR Process Corporation launched its new product, BEHR PREMIUM Spray Paint. This product is offered in 51 shades, including new metallic and textured finishes. These aerosol spray paints feature an improved composition that combines primer and paint capabilities within a single can. This innovation results in a high-quality, long-lasting finish, allowing for the revitalization of furniture and décor items both indoors and outdoors.

-

In June 2021, Krylon Products Group introduced a new range of aerosol craft sprays. These aerosol sprays are ideal for rejuvenating furniture and decorative items within the home, offering a variety of the latest brilliant and pale tones. They dry quickly and are suitable for use on craft foam, both indoors and outdoors. The product is available in over 30 shades, including options like satin matcha green, gloss olive oil, satin velvet pine, and satin buttered hazelnut.

-

In July 2021, Nippon Paint Holdings Co., Ltd. introduced PROTECTON BARRIERX SPRAY, utilizing visible light-responsive photocatalyst technology. This solution contains a significant amount of alcohol, which acts rapidly to eliminate viruses and bacteria on surfaces. The photocatalysts within this product respond to visible light, even in the presence of dim indoor lighting. These photocatalysts offer a combined effect of antibacterial and antiviral performance, even in low light conditions, in addition to the actions of metallic ions also present in the product.

Aerosol Paints Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 223.9 million

Revenue forecast in 2030

USD 331.7 million

Growth rate

CAGR of 5.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD thousands, Volume in Tons and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Belgium; Russia; China; Japan; India; South Korea; Southeast Asia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Nippon Paint Holdings Co., Ltd.; Masco Corp.; Dupli-Color Products Company; LA-CO Industries, Inc.; Krylon Products Group; Montana Colors S.L.; Southfield Paints Ltd.; Kobra Paint; Rust-Oleum; Aeroaids Corp.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerosol Paints Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aerosol paints market based on product, application, and region:

-

Product Outlook (Revenue, USD Thousands, Volume, Tons, 2018 - 2030)

-

Water Based

-

Solvent Based

-

-

Application Outlook (Revenue, USD Thousands, Volume, Tons, 2018 - 2030)

-

Do-it-Yourself

-

Construction

-

Automotive

-

Wooden Furniture

-

Other

-

-

Regional Outlook (Revenue, USD Thousands, Volume, Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Belgium

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Southeast Asia

-

South Korea

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global aerosol paints market size was estimated at USD 212.7 million in 2022 and is expected to reach USD 223.9 million in 2023.

b. The global aerosol paints market is expected to grow at a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 331.7 million by 2030.

b. Asia Pacific dominated the aerosol paints market with a share of 34.0% in 2022. This is attributable to increasing product demand from various end-use industries along with a significant rise in per capita disposable income especially in the developing economies of Asia Pacific.

b. Some of the key players operating in the global aerosol paints market Masco Corporation, Dupli-Color Products Company, LA-CO Industries, Inc., Krylon Products Group, Montana Colors S.L.

b. Key factors driving the aerosol paints market growth include an increase in automobile refinishing activities and growing demand from end-use industry growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.