- Home

- »

- Advanced Interior Materials

- »

-

Aerospace & Defense C-Class Parts Market Size Report, 2030GVR Report cover

![Aerospace & Defense C-Class Parts Market Size, Share & Trends Report]()

Aerospace & Defense C-Class Parts Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Bearings, Electrical Components, Machined Components), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-590-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aerospace & Defense C-Class Parts Market Summary

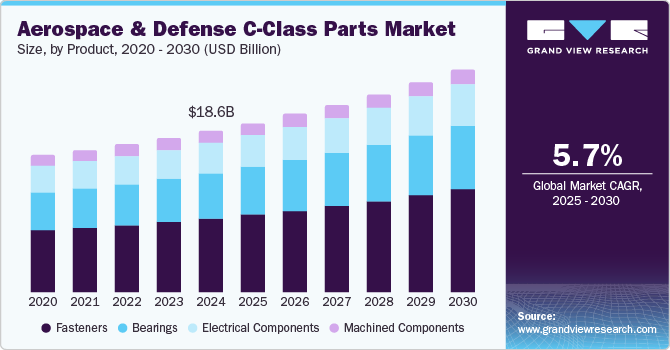

The global aerospace & defense C-class parts market size was estimated at USD 18.6 billion in 2024 and is projected to reach USD 25.65 billion by 2030, growing at a CAGR of 5.7% from 2025 to 2030. A primary factor influencing this market is the substantial increase in defense budgets among nations worldwide.

Key Market Trends & Insights

- North America aerospace & defense C-class parts market dominated the global market with a revenue share of 37.6% in 2024.

- The aerospace & defense C-class parts market in the U.S. dominated the North America market with a revenue share of 92.2% in 2024.

- Based on product, fasteners dominated the market and accounted for a share of 45.5% in 2024.

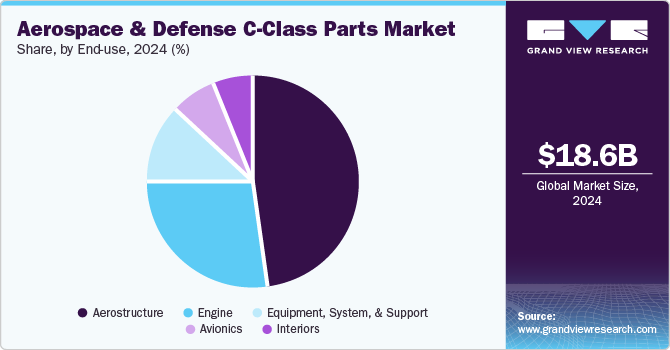

- Based on the application, aerostructure dominated the market and accounted for a share of 47.9% in 2024.

- Based on end-use, the commercial segment dominated the market and accounted for a share of 60.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 18.6 Billion

- 2030 Projected Market Size: USD 25.65 Billion

- CAGR (2025-2030): 5.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In response to escalating geopolitical tensions, governments are prioritizing military modernization, which necessitates the procurement of essential components, including C-Class parts. These parts play a critical role in the assembly and maintenance of various military platforms such as aircraft and naval vessels, driving the demand for advanced components that enhance operational effectiveness.In parallel with the military sector’s expansion, the commercial aviation industry is witnessing remarkable growth, fueled by rising passenger traffic and aggressive fleet expansion initiatives from airlines. This demand surge directly correlates with higher production rates for both commercial and military aircraft, leading to an increased requirement for C-Class parts such as fasteners, connectors, and bearings. Moreover, the ongoing trend of fleet modernization is compelling airlines to replace outdated components with innovative C-Class parts, ensuring compliance with stringent aviation standards and enhancing overall performance.

Furthermore, advancements in manufacturing technologies are playing a transformative role within the Aerospace & Defense C-Class Parts Market. The emergence of Industry 4.0 technologies, such as IoT, automation, and data analytics, is revolutionizing traditional manufacturing practices. By integrating these cutting-edge solutions, manufacturers can significantly improve production efficiency, quality control, and supply chain resilience. The ability to produce high-quality parts that meet rigorous specifications positions companies to cater effectively to the rising demand within the market.

Regional dynamics are also influential in shaping the trajectory of the C-Class parts market. Rapid growth in aerospace sectors, particularly in the Asia-Pacific region, is being driven by increased defense budgets and initiatives aimed at local manufacturing capabilities. Countries such as China and India are developing indigenous aircraft programs that substantially elevate the demand for C-Class parts. In addition, investments in airport infrastructure across various regions are facilitating increased air traffic

Product Insights

Fasteners dominated the market and accounted for a share of 45.5% in 2024 due to their essential function in aircraft assembly. Manufacturers are increasingly prioritizing lightweight and corrosion-resistant fasteners, fostering enhanced aircraft safety and performance, and consequently driving consumption across a diverse range of applications within the industry.

Machined components are expected to grow rapidly over the forecast period, stemming from their critical importance in precision engineering and custom applications. Their capacity to fulfill stringent specifications and performance standards makes them indispensable for both military and commercial aerospace projects, thereby ensuring maximum reliability and safety in operations.

Application Insights

Aerostructure dominated the market and accounted for a share of 47.9% in 2024 as it includes the main structural elements of an aircraft, such as wings and fuselage. Rising production rates in both commercial aviation and military modernization programs create a pressing need for robust aerostructure supplies.

The engine segment is expected to register significant growth over the forecast period. As manufacturers strive to improve fuel efficiency and minimize emissions, there is a significant uptick in the demand for advanced engine components, including C-Class parts, across both commercial and military sectors.

End Use Insights

The commercial segment dominated the market and accounted for a share of 60.7% in 2024. Airlines are making substantial investments in new aircraft to meet the increasing number of passengers, thereby amplifying the necessity for various C-Class parts essential for both assembly and maintenance functions.

The military segment is projected to grow lucratively over the forecast period, propelled by increased defense budgets and modernization initiatives. Governments are channeling resources into advanced military aircraft and systems, necessitating a continuous supply of C-Class parts to maintain operational readiness and foster technological advancements within the defense sector.

Regional Insights

North America aerospace & defense C-class parts market dominated the global market with a revenue share of 37.6% in 2024, driven by its well-established aerospace manufacturing ecosystem, substantial defense spending, and robust supply chain. Major aircraft manufacturers and MRO facilities in the region ensure a consistent demand for C-Class parts catering to both commercial and military applications.

U.S. Aerospace & Defense C-Class Parts Market Trends

The aerospace & defense C-class parts market in the U.S. dominated the North America market with a revenue share of 92.2% in 2024, fueled by its leadership in aerospace manufacturing, significant defense budgets, and advanced technological capabilities. The presence of prominent OEMs and a comprehensive network of suppliers enhances market growth potential, promoting innovation and efficiency in production processes.

Europe Aerospace & Defense C-Class Parts Market Trends

Europe aerospace & defense C-class parts market held substantial market share in 2024. Increasing investments in defense modernization and a growing commercial aviation sector are driving market growth in the region. The region’s emphasis on sustainability and innovation in aircraft design drives demand for C-Class parts, as manufacturers seek lightweight and efficient components to meet regulatory standards.

The aerospace & defense C-class parts market in the UK is expected to grow in the forecast period, driven by its strong aerospace industry and commitment to advanced manufacturing techniques. Strategic investments in defense capabilities and collaborations with international partners enhance the UK’s market position, driving demand for high-quality C-Class parts essential for aircraft performance.

Asia Pacific Aerospace & Defense C-Class Parts Market Trends

Asia Pacific aerospace & defense C-class parts market is expected to register the fastest CAGR of 7.7% in the forecast period. Countries in this region are investing heavily in indigenous aircraft production and expanding their defense capabilities, significantly boosting the need for various C-Class parts across multiple applications.

The aerospace & defense C-class parts market in China is expected to register the fastest CAGR of 9.9% over the forecast period in the Asia Pacific market. The country has seen substantial investments in military aircraft development and modernization initiatives. The country’s growing defense budget and focus on self-sufficiency in aerospace manufacturing drive demand for C-Class parts.

Key Aerospace & Defense C-Class Parts Company Insights

Some key companies operating in the market include Stanley Black & Decker, Inc.; Amphenol Corporation; LiSi Group; among others. Key industry players drive innovation and quality through strategic initiatives, including investments in research and development, partnerships in advanced manufacturing technologies, and a focus on lightweight materials.

-

Amphenol Corporation specializes in high-performance interconnect systems and components tailored for the aerospace and defense sectors. Their connectors and cable assemblies are essential for dependable communication and power distribution across various aircraft and defense applications, supporting commercial and military operations efficiently.

-

LiSi Group is dedicated to manufacturing high-quality aerospace components, particularly fasteners and machined parts. They meet the needs of both commercial and military aerospace industries by providing innovative solutions that enhance aircraft performance, safety, and reliability, while utilizing lightweight materials

Key Aerospace & Defense C-Class Parts Companies:

The following are the leading companies in the aerospace & defense C-class parts market. These companies collectively hold the largest market share and dictate industry trends.

- Stanley Black & Decker, Inc.

- Amphenol Corporation

- LiSi Group

- Precision Castparts Corp.

- Safran SA

- Arconic

- Triumph Group

- Eaton

Aerospace & Defense C-Class Parts Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.48 billion

Revenue forecast in 2030

USD 25.65 billion

Growth rate

CAGR of 5.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil

Key companies profiled

Stanley Black & Decker, Inc.; Amphenol Corporation; LiSi Group; Precision Castparts Corp.; Safran SA; Arconic; Triumph Group; Eaton

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerospace & Defense C-Class Parts Market Report Segmentation

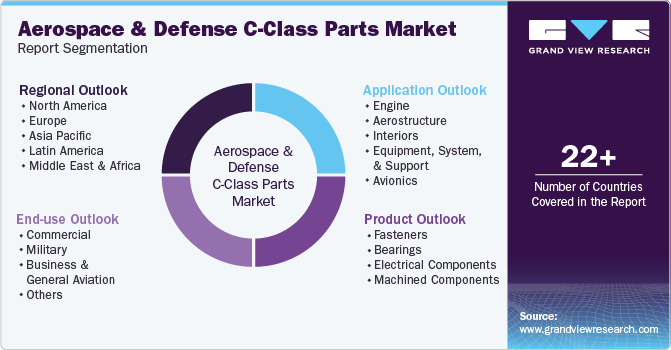

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aerospace & defense C-class parts market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fasteners

-

Bearings

-

Electrical Components

-

Machined Components

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Engine

-

Aerostructure

-

Interiors

-

Equipment, System, and Support

-

Avionics

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Military

-

Business & General Aviation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.