- Home

- »

- Sensors & Controls

- »

-

Bearing Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Bearings Market Size, Share & Trends Report]()

Bearings Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Application (Automotive, Agriculture, Electrical, Mining & Construction, Railway & Aerospace, Automotive Aftermarket), By Region, And Segment Forecasts

- Report ID: 978-1-68038-373-7

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bearing Market Summary

The global bearing market size was estimated at USD 120.98 billion in 2023 and is projected to reach USD 226.60 billion by 2030, growing at a CAGR of 9.5% from 2024 to 2030. Bearings are virtually used in every kind of equipment or machinery, ranging from automobile parts, farm equipment, and household appliances to defense and aerospace equipment.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for a revenue share of 40.0% in 2023.

- The bearing market in China accounted for a revenue share of 53.75% in the Asia Pacific market.

- Based on product, the roller bearings segment accounted for the largest revenue share of more than 45% in 2023.

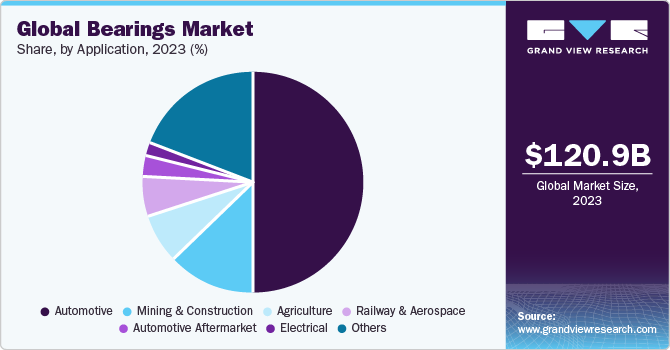

- Based on application, the automotive segment dominated the market and accounted for 49.0% of the market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 120.98 Billion

- 2030 Projected Market Size: USD 226.60 Billion

- CAGR (2024-2030): 9.5%

- Asia Pacific: Largest market in 2023

- Europe: Fastest growing market

This factor is projected to drive the market in the near future. There has been a rising demand for bearings with lower maintenance requirements, higher efficiency, and longer service life. Moreover, a rise in demand for specialized bearing solutions that meet different industry-specific requirements and challenges is projected to boost the market. For instance, the rising application of high-capacity products in wind turbines is expected to catapult the demand. Wind turbines utilize these products to enhance turbine performance and reliability, increase energy production, and reduce lubricant consumption.

Manufacturers constantly work on improving product designs to increase performance and energy efficiency. They use a special material for raceways, cages, and rolling elements as well as redesigned raceway profiles. Furthermore, technological advancements in seal and lubrication technologies and the use of lightweight materials in high-performance products are generating huge prospects for manufacturers. Integration of electro-mechanical features directly into the bearings helps in performance improvement and reductions in size and cost.

Rising demand for high-performance bearings has resulted in manufacturers integrating advanced sensor units in their products. The sensor units assist in the digital monitoring of axial movement, deceleration, acceleration, rotation speed, and load-carrying capacity of the product. Additionally, the advent of the Agricultural Internet of Things (IoT) has encouraged the adoption and constant monitoring of connected equipment and machinery. This trend has also influenced the market positively.

A few key suppliers have started providing smart bearings, whose conditions can be constantly monitored to predict faults before they occur. The adoption of these products is still in the nascent stage. Several other major manufacturers are likely to offer in their portfolios in the near future. As it is easy to predict the faults in smart bearings before they occur, they add considerable value by reducing the cost of unexpected downtime, which is projected to surge the espousal of these products during the forecast period.

The coronavirus pandemic has had a significant impact on the market, with many manufacturing companies facing adverse effects of lockdown situations in major economies such as China and Japan, among several others. The automotive industry, which is the largest consumer of bearing among all the other industries, witnessed a substantial reduction in vehicle production, primarily owing to supply chain disruptions and restrictions on the movement of people. However, the conditions improved in the later quarters of 2020 with gradual upliftment of restrictions and subsequent increases in production activities. Moreover, the rollout of the coronavirus vaccine across the globe is further anticipated to strengthen the market growth over the forecast period.

Market Concentration & Characteristics

The bearing market manifests characteristics indicative of fragmentation, with a diverse array of players catering to its demands across various industries, including automotive, aerospace, industrial machinery, and renewable energy. Unlike a concentrated market, this landscape is marked by the presence of numerous entities, each contributing to a fragmented competitive environment. This scenario results in intensified competition and a proliferation of niche offerings as companies seek to carve out their market niches.

The presence of numerous players also fosters innovation, with companies vying to distinguish themselves through specialized products and tailored solutions. Despite the fragmentation, strategic collaborations and mergers are not uncommon as participants seek synergies to enhance their market position. The impact of globalization on competition remains significant, prompting market participants to navigate complex international dynamics.

Technological advancements, particularly the integration of intelligent features for condition monitoring, underscore the adaptability of fragmented players to embrace innovation. Regulatory compliance and stringent adherence to quality standards persist as paramount considerations, given the pivotal role of bearings in ensuring safety and optimal machinery performance within this diverse and dynamic market.

The bearing industry exhibits a moderate degree of innovation, primarily driven by advancements in materials and manufacturing processes. Integration of smart technologies, such as sensor-equipped bearings for condition monitoring, has also contributed to incremental innovation.Ongoing product development focuses on enhancing bearing performance, durability, and efficiency. Manufacturers are investing in R&D to introduce bearings tailored for specific applications, such as high-speed machinery or extreme environmental conditions, aligning with market demands for specialized solutions.

The bearing industry is subject to global quality standards and regulatory requirements, ensuring compliance with specifications related to safety, durability, and environmental impact. Adherence to these regulations is integral for market access and maintaining a competitive edge.While there are limited direct substitutes for bearings in many applications, the rise of predictive maintenance services and condition monitoring technologies poses a potential alternative approach for ensuring equipment reliability, impacting the traditional aftermarket bearing replacement market.

The bearing market exhibits a diverse end-user concentration, with significant demand stemming from sectors like automotive, industrial machinery, and aerospace. Manufacturers often tailor their offerings to meet the specific requirements and performance standards of key end-user industries, contributing to market segmentation strategies.

Product Insights

Based on product, the bearings market is segmented into ball, roller, plain bearing, and others. The roller bearings segment accounted for the largest revenue share of more than 45% in 2023. The segment is also estimated to continue its supremacy and emerge as the fastest-growing segment in the coming years. These products reduce rotational friction, support radial and axial loads, and can sustain limited axial loads and heavy radial loads more efficiently than their counterparts. The widespread espousal of roller bearings by several industries, such as capital equipment, automobiles, home appliances, and aerospace, is estimated to positively impact product demand.

The report also covers the ball and other bearings. Ball bearings have a smaller surface contact and, therefore, help to reduce friction to a great extent. They can also be used with thrust and radial loadings, ascribed to which, these products are increasingly being used in both four and two-wheeled automobiles. Hence the segment is anticipated to witness healthy growth over the forecast period.

Plain bearings, also known as sleeve bearings, are the most preliminary type of bearings with no rolling components. They are used for sliding, oscillating, rotating, and reciprocating motions. In sliding applications, they are used as bearing strips, slide bearings, and wear plates. Due to greater contact area and conformability, plain bearings offer greater resistance to high shock loads and load capacity as compared to roller bearings. Such benefits offered over their counterparts make plain bearing a preferred option in applications where greater resistance to damage from oscillatory movements is requisite. The demand for plain bearings is expected to register a steady growth rate over the forecast period.

Application Insights

In 2023, the automotive segment dominated the market and accounted for 49.0% of the market share. The high share of this segment can be attributed to high automotive production, globally. Also, the demand for vehicles with technologically advanced solutions is escalating, thus leading to a rise in vehicle manufacturing that necessitates instrumented products. The growth in demand for highly advanced vehicles and the subsequent increase in the capabilities of the vehicles has escalated the demand for bearing in the automotive industry. Additionally, the automotive aftermarket segment is also anticipated to boost at a subsequently higher CAGR over the forecast period, thereby further bolstering the demand for bearings.

The railway and aerospace segment is anticipated to emerge as the fastest-growing segment by 2030. This growth can be attributed to growing interest in travel activities, the growing need to renew aging fleets owing to stringent environmental legislation, and fuel price pressure coupled with the availability of improved ways to assist global and local transportation systems. Demand from the railway segment is also anticipated to rise on account of accelerated railway construction in developing countries. Further, surging demand for small single-aisle aircraft and helicopters from emerging economies is anticipated to further drive the growth of the segment.

Regional Insights

Asia Pacific dominated the market and accounted for a revenue share of 40.0% in 2023. The region is also anticipated to witness the fastest growth in terms of revenue, accounting for over USD 98.20 billion by 2030. China is one of the major markets, and sale in the country is expected to catapult over the foreseeable years stimulated by the rapid expansion of machinery and motor vehicle production coupled with a strong aftermarket for industrial equipment and motor vehicle repair. Moreover, the robust construction and mining equipment market in India is estimated to facilitate market growth through 2030.

In Europe, the market is anticipated to witness favorable growth during the forecast period, owing to sustainable economic growth and increased investment. Furthermore, in the mature markets of the U.S., Western Europe, and Japan, the demand is driven by the rebounding production of motor vehicles and a healthy fixed investment environment. Increased sales of high-value bearings, such as large-diameter, custom-built used in heavy machinery and wind turbines, are also expected to drive the market in North America. In the Middle East and Africa, the rapid development of city infrastructures is positively influencing overall growth.

U.K. bearing market

Bearing Market in the UK accounted for a revenue share of 9.93% in the Western European market. One reason for the upward trajectory of the bearing market in the U.K. could be increased industrial activity and infrastructure development projects, leading to higher demand for bearings.

France bearing Market

The bearing Market in France accounted for a revenue share of 18.40% in the Western European market. The revenue share can be attributed to the enhanced focus on renewable energy projects and advancements in automotive manufacturing, driving demand for bearings in wind turbines, electric vehicles, and machinery.

Germany bearing market

The bearing Market in Germany accounted for a revenue share of 29.89% in the Western European market. The revenue share can be attributed to the strong growth in the machinery and automotive industries, fueled by technological innovation and export demand, resulting in increased demand for bearings as key components in machinery and vehicles.

China bearing market

The bearing market in China accounted for a revenue share of 53.75% in the Asia Pacific market. The revenue share can be attributed to the rapid urbanization, industrialization, and infrastructure development initiatives, leading to robust demand for bearings in construction machinery, automotive manufacturing, and industrial equipment.

India bearing market

The bearing market in India accounted for a revenue share of 9.39% in the Asia Pacific market. The revenue share can be attributed to the growth in manufacturing, construction, and infrastructure sectors, propelled by government initiatives such as "Make in India" and investments in transportation and renewable energy projects, boosting demand for bearings.

Japan bearing market

The bearing market in Japan accounted for a revenue share of 19.74% in the Asia Pacific market. The revenue share can be attributed to technological innovation and automation in the manufacturing processes, coupled with growth in automotive and electronics industries, driving demand for high-precision bearings for robotics, machinery, and precision equipment.

Brazil bearing market

The bearing market in Brazil accounted for a revenue share of 54.99% in the Latin America market. The revenue share can be attributed to the recovery in the automotive and industrial sectors, supported by economic reforms and investments in infrastructure, leading to increased demand for bearings in vehicle production and industrial machinery.

Kingdom of Saudi Arabia (KSA) bearing market

The growth of the bearing market in KSA can be attributed to the diversification efforts beyond oil-dependent industries, with investments in sectors such as manufacturing, construction, and transportation stimulating demand for bearings in machinery, automotive, and infrastructure projects

Key Companies & Market Share Insights

Some of the key players operating in the market include JTEKT Corporation and SKF, among others.

-

JTEKT Corporation operates as a manufacturer and distributor of various products, including home accessory equipment, bearings, driveline components, electronic control devices, machine tools, and steering systems. The company was formed through the merger of Toyoda Machine Works, specializing in machine tools, and Koyo Seiko Co., a provider of bearings, steering systems, home accessory equipment, driveline components, and electronic control devices. Bearing products are marketed under the Koyo brand, which originated from Koyo Seiko Co., Ltd.

-

SKF provides products and solutions such as bearings and units, mechatronics systems, seals, services, as well as lubrication systems. The company conducts its business activities through two segments, namely Automotive and Industrial. Through the Automotive segment, the company manufactures cars, light and heavy trucks, buses, trailers, and two-wheelers with customized seals, bearings, and other related products.

-

Schaeffler AG, and The Timken Company. are some of the emerging market participants in the target market.

-

.Schaeffler AG develops, manufactures, and supplies components and systems for automotive and industrial applications. The company operates through three business divisions: Automotive O.E.M., Automotive Aftermarket, and Industrial. The Automotive O.E.M. business division is further classified into: Engine Systems, E-Mobility, Chassis Systems, and Transmission Systems. The Chassis Systems sub-division develops systems and components such as wheel bearings.

-

The Timken Company designs and manages a portfolio of engineered bearings and power transmission products and services. The company operates through two reportable segments: Mobile Industries and Process Industries. The company offers a portfolio of under-engineered bearing products, including tapered, spherical, cylindrical roller bearings, thrust, and ball bearings. The company caters to sectors including industrial distribution, general industrial, mining, construction, agriculture, rail, aerospace and defense, automotive, heavy truck, metals, and energy

Key Bearing Companies:

The following are the leading companies in the bearing market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these bearing companies are analyzed to map the supply network.

- Brammer PLC

- Harbin Bearing Manufacturing Co., Ltd.

- HKT Bearings Ltd.

- JTEKT Corporation

- NBI Bearings Europe

- NSK Global

- NTN Corporation

- RBC Bearings Inc.

- Rexnord Corporation

- RHP Bearings

- Schaeffler Group

- SKF

- The Timken Company

Recent Developments

-

In September 2023, Schaeffler AG strategically diversified its product portfolio by introducing new offerings in rotary table bearings, torque motors, and linear motors. This expansion includes the introduction of various sizes for rotary table and rotary axis bearings, complemented by the incorporation of bearing-integrated angular measuring systems. The standardization of torque motors within the RKIB series, now available up to size 690, further strengthens the company's capability to offer a comprehensive range of top-tier solutions.

-

In November 2023, The Timken Company successfully concluded the acquisition of Engineered Solutions Group, also recognized as Innovative Mechanical Solutions or iMECH. Specializing in the production of, radial bearings, specialty coatings, thrust bearings and other components primarily tailored for the energy industry, iMECH operates with a workforce of around 70 professionals. The business foresees generating revenue of approximately USD 30 million for the calendar year 2023. This strategic acquisition is instrumental in enhancing the company’s standing as a provider of comprehensive solutions within the industrial motion and engineered bearings sector.

Bearings Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 120.98 billion

Revenue forecast in 2030

USD 226.60 billion

Growth rate

CAGR of 9.5% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Historical Data

2017 - 2022

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country scope

U.S.; Canada; Western Europe (UK; Germany; France; Italy) Eastern Europe (Russia); China; India; Japan; Brazil; Mexico, KSA, UAE, and South Africa

Key companies profiled

Rubix, Harbin Bearing Manufacturing Co., Ltd., HKT Bearings Ltd., JTEKT Corporation, NBI Group, NSK Ltd, NTN Corporation, RBC Bearings Incorporated., Regal Rexnord Corporation, Schaeffler AG, SKF, The Timken Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bearing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global bearing market report based on product, application, and region:

-

Product Outlook (Revenue, USD Billion; 2017 - 2030)

-

Ball Bearings

-

Deep Groove Bearings

-

Others

-

-

Roller Bearings

-

Split

-

Tapered

-

Others

-

-

Plain Bearings

-

Journal Plain Bearings

-

Linear Plain Bearings

-

Thrust Plain Bearings

-

Others

-

-

Others

-

-

Application Outlook (Revenue, USD Billion; 2017 - 2030)

-

Automotive

-

Agriculture

-

Electrical

-

Mining & Construction

-

Railway & Aerospace

-

Automotive Aftermarket

-

Others

-

-

Regional Outlook (Revenue, USD Billion; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Western Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Eastern Europe

-

Russia

-

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bearing market size was estimated at USD 111.59 billion in 2022 and is expected to reach USD 120.98 billion in 2023.

b. The global bearing market is expected to advance at a compound annual growth rate of 10.6% from 2023 to 2030 to reach USD 226.6 billion by 2030.

b. The roller bearings segment dominated the global market and accounted for the largest revenue share of more than 47.37% in 2022. Further, this segment is also anticipated to continue its dominance and emerge as the fastest-growing segment by 2030.

b. The automotive segment dominated the bearing market and held the largest revenue share of approximately 49.72% in 2022. The substantial share of this segment can be attributed to high automotive production globally.

b. The Asia Pacific dominated the bearing market and accounted for the largest revenue share of 40.42% in 2022. The region is projected to observe the fastest growth in terms of revenue, accounting for over USD 98.68 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.