- Home

- »

- Advanced Interior Materials

- »

-

Aerospace Fasteners Market Size, Industry Report, 2033GVR Report cover

![Aerospace Fasteners Market Size, Share & Trends Report]()

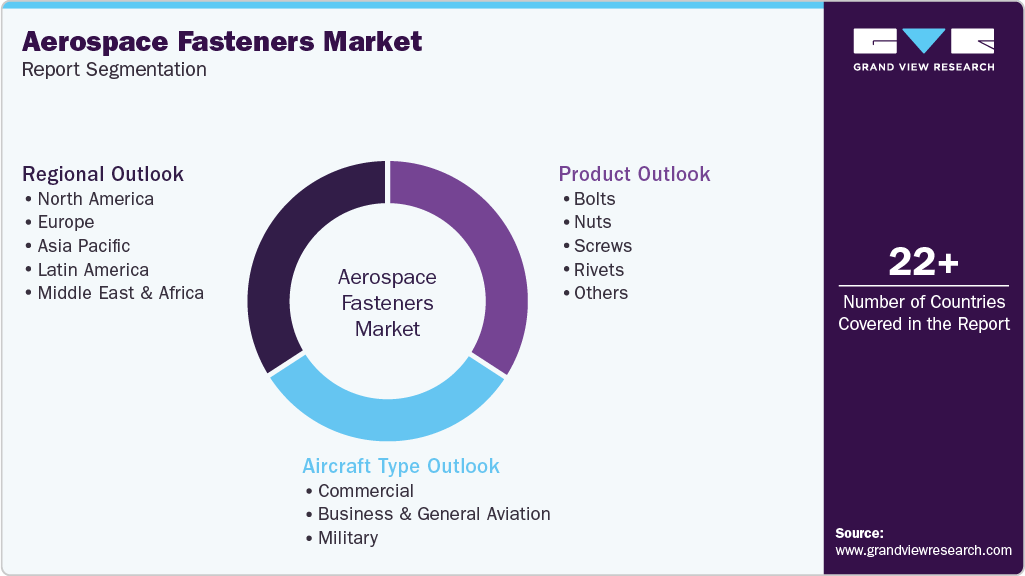

Aerospace Fasteners Market (2025 - 2033) Size, Share & Trends Analysis Report By Aircraft Type (Commercial, Business & General Aviation, Military), By Product (Bolts, Nuts, Screws, Rivets), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-657-6

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aerospace Fasteners Market Summary

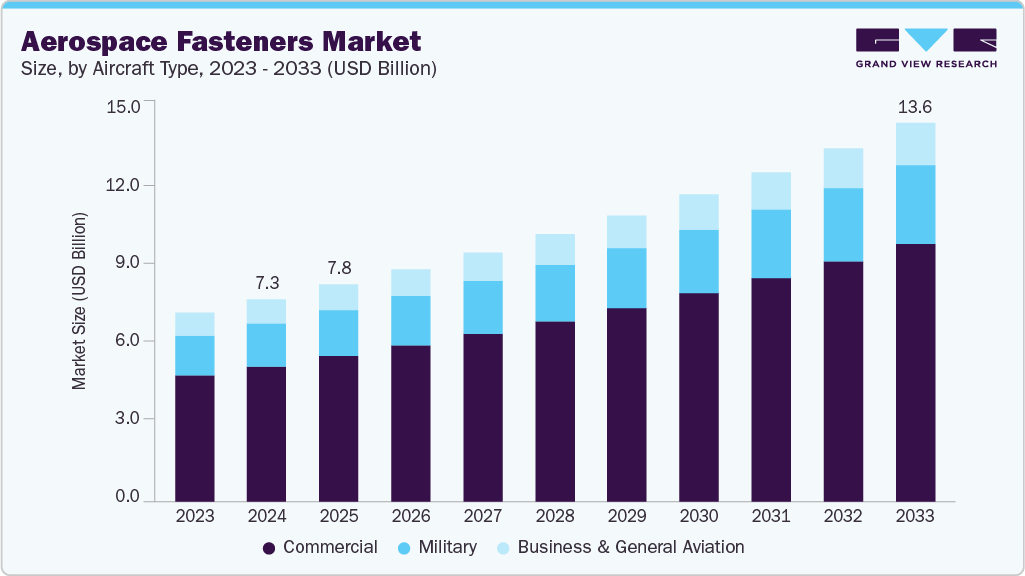

The global aerospace fasteners market size was estimated at USD 7.28 billion in 2024 and is projected to reach USD 13.61 billion by 2033, growing at a CAGR of 7.2% from 2025 to 2033. The market is witnessing significant growth due to the steady rise in commercial air travel, defense modernization programs, and the expansion of space exploration initiatives.

Key Market Trends & Insights

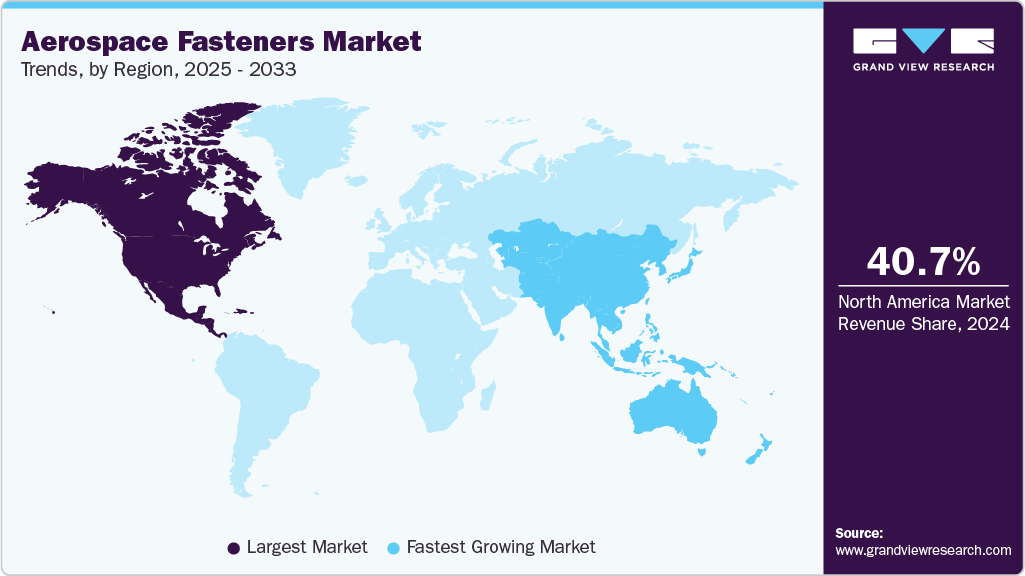

- North America dominated the aerospace fasteners market with the largest revenue share of 40.7% in 2024.

- By aircraft type, the commercial segment is expected to grow at the fastest CAGR of 7.4% over the forecast period.

- By product, the rivets segment is expected to grow at the fastest CAGR of 7.7% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 7.28 Billion

- 2033 Projected Market Size: USD 13.61 Billion

- CAGR (2025-2033): 7.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

With increasing global passenger traffic and cargo movement, aircraft manufacturers are ramping up production to meet rising demand. This, in turn, is fueling the need for advanced, reliable, and lightweight fasteners that can withstand extreme environmental and mechanical stress in both commercial and military aircraft.Key drivers of the market include a surge in aircraft fleet expansion, heightened demand for fuel-efficient aircraft, and the increasing use of composite materials in airframes and interiors. Fasteners are crucial for joining components in lightweight composite structures, which are replacing traditional metal counterparts to reduce overall aircraft weight and enhance fuel efficiency. Moreover, the growing demand for maintenance, repair, and overhaul (MRO) services globally is also boosting fastener replacement cycles, further driving market growth.

Innovations and trends shaping the aerospace fasteners market include the adoption of titanium and other advanced alloy fasteners for weight reduction and corrosion resistance, as well as the development of smart fasteners with embedded sensors for structural health monitoring. Additive manufacturing (3D printing) is also gaining traction for prototyping and low-volume production of customized fasteners. Additionally, automation in assembly lines, environmental regulations pushing for sustainable manufacturing practices, and the increasing use of digital supply chain systems are transforming the production and application of aerospace fasteners.

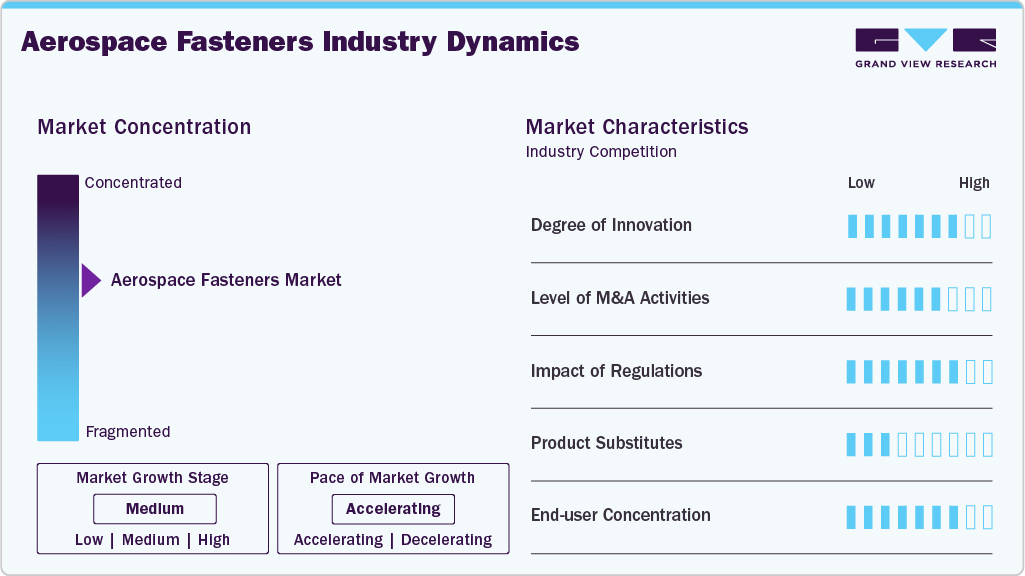

Market Concentration & Characteristics

The aerospace fasteners market exhibits a moderately concentrated structure, with a few key global players dominating due to their technological capabilities, long-term contracts with aircraft manufacturers, and adherence to stringent aerospace quality standards. Major companies such as Howmet Aerospace, LISI Aerospace, Precision Castparts Corp., and Stanley Black & Decker hold significant market shares. These players benefit from high entry barriers, including certification requirements, capital-intensive manufacturing processes, and established supplier relationships with OEMs such as Boeing and Airbus. However, regional manufacturers and specialized suppliers are gaining ground by focusing on niche applications, rapid lead times, and customized solutions.

Aircraft Type substitutes for aerospace fasteners are limited due to the critical safety and performance requirements in aircraft assembly. However, innovations in adhesive bonding technologies and composite joining techniques are emerging as partial substitutes, especially in non-structural components. While adhesives can reduce weight and streamline production, they lack the mechanical reliability and inspectability of traditional fasteners in high-stress areas. In specific applications, welding and riveting techniques may also serve as alternatives, but they often come with design limitations and are less favored in modular aerospace designs. As a result, mechanical fasteners continue to remain the preferred solution for most aerospace applications.

Aircraft Type Insights

Commercial segment held the largest market share of 67.0% in 2024. This dominance is primarily driven by the high production volumes of commercial aircraft from manufacturers like Boeing and Airbus, coupled with the growing global air travel demand and the need for fleet expansion and modernization. Each commercial aircraft requires millions of fasteners for both structural and interior components, making this segment a significant consumer. Moreover, the robust aftermarket for maintenance, repair, and overhaul (MRO) in the commercial sector further contributes to consistent fastener demand, especially for replacement and upgrade purposes.

Military segment is expected to grow at a significant CAGR of 6.9% over the forecast period, fueled by increased global defense spending, modernization of air fleets, and the development of advanced fighter jets and transport aircraft. Military aircraft often require high-performance, corrosion-resistant fasteners made from specialized alloys, which command premium pricing. Additionally, rising geopolitical tensions and renewed investments in defense capabilities across major economies are accelerating the procurement of new aircraft and upgrades to existing ones, driving rapid growth in the military fasteners segment. While it contributes a smaller share compared to commercial aviation, its growth trajectory is outpacing other segments.

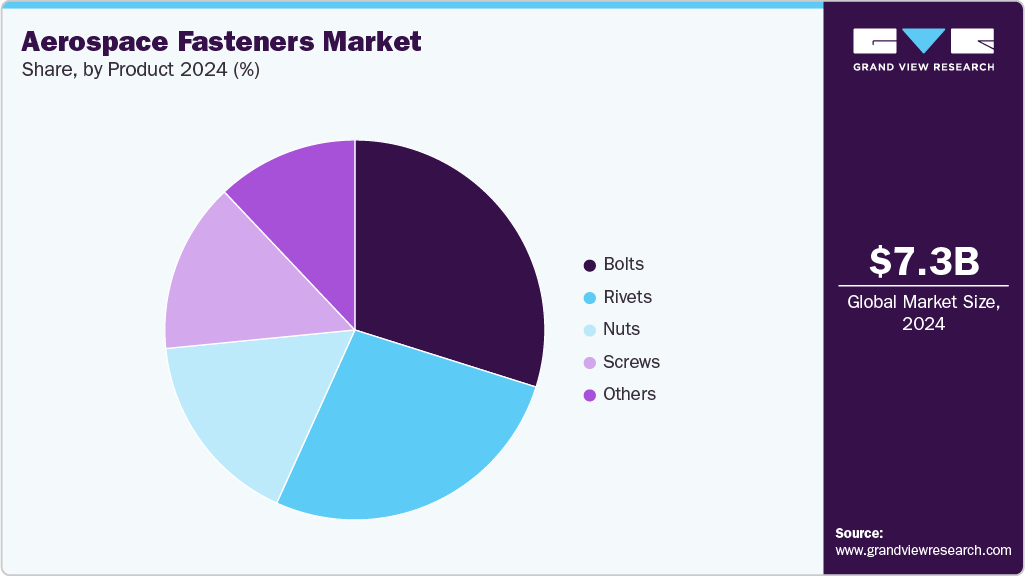

Product Insights

Bolts segment held the largest revenue market share of 29.9% in 2024. This growth is fueled by the increasing use of high-performance materials, demand for detachable joints in modern aircraft designs, and a shift toward modular assembly practices. Bolts, such as engines, landing gear, and interior components, are preferred in areas where maintenance access and reassembly are required. Innovations in bolt materials and coatings for enhanced strength, corrosion resistance, and weight reduction further accelerate their adoption, especially in next-generation aircraft platforms.

Rivets segment is expected to grow at the fastest CAGR of 7.7% over the forecast period, primarily due to their extensive use in aircraft assembly, particularly in joining sheet metal components in fuselage, wings, and control surfaces. Rivets create lightweight, permanent joints that resist vibration, ensuring structural integrity for both commercial and military aircraft. Their widespread application in both original equipment manufacturing (OEM) and maintenance, repair, and overhaul (MRO) activities ensures steady demand and high-volume consumption, making them the leading revenue contributor among all fastener types.

Regional Insights

North America aerospace fasteners market dominated the market and accounted for the largest revenue share of about 40.7% in 2024. It benefits from the presence of leading OEMs such as Boeing, Lockheed Martin, and Bombardier, along with a highly advanced manufacturing and R&D ecosystem. The region has robust demand from both commercial and military aviation, including modernization programs and new aircraft deliveries. Strong government support, advanced technology integration, and strict regulatory compliance standards shape the market’s quality and innovation. Additionally, the U.S. aerospace and defense export capabilities ensure a steady global demand. North America’s position is reinforced by a mature supply chain and strategic partnerships across the aerospace sector.

U.S. Aerospace Fasteners Market Trends

The U.S. aerospace fasteners market is a global leader, driven by continuous aircraft production, defense projects, and MRO activities. The presence of major OEMs and defense contractors ensures high and stable demand for fasteners across all aircraft classes. Innovations in lightweight materials, additive manufacturing, and digital supply chains are being actively adopted in fastener production. The U.S. government’s support for reshoring critical manufacturing and enhancing aerospace competitiveness further strengthens the sector. Regulatory bodies like the FAA ensure product standardization and safety, promoting trusted, certified suppliers. The U.S. also serves as a major exporter, supplying aerospace fasteners to key regions around the world.

Asia Pacific Aerospace Fasteners Market Trends

Asia Pacific is expected to grow at the fastest CAGR of 7.5% in the forecast period, due to rapid growth in commercial aviation, increasing defense budgets, and expanding manufacturing capabilities. Countries such as China, India, and Japan are investing heavily in both domestic aircraft production and aerospace infrastructure. The rise of low-cost carriers, regional connectivity schemes, and rising air passenger traffic further fuel demand for aircraft and related components. The region also benefits from a strong supply chain for raw materials and cost-effective labor, attracting global OEMs and Tier 1 suppliers. Government initiatives to boost aerospace exports are adding to the region’s momentum. As a result, Asia Pacific continues to be the most dynamic and revenue-attractive region in the global market.

China aerospace fasteners market is growing rapidly alongside its expanding civil and military aviation sectors. The country's indigenous aircraft programs, like COMAC’s C919 and ARJ21, are increasing domestic demand for high-quality fasteners. China is also heavily investing in aerospace R&D, quality control systems, and certifications to meet international standards. Local manufacturers are scaling up production and forming joint ventures with global suppliers to gain technological expertise. Moreover, government backing through policies and subsidies is boosting the domestic aerospace supply chain. China's strategic aim to become a self-reliant aerospace hub is significantly shaping the fasteners market landscape.

Europe Aerospace Fasteners Market Trends

Aerospace fasteners market in Europe is marked by high regulatory standards, a well-established MRO network, and strong industrial capabilities. Countries like France, Germany, and the UK play a central role due to Airbus’ operations and a dense network of aerospace suppliers. The region emphasizes precision engineering and innovation in materials and coatings used in fasteners. Environmental regulations and sustainability goals are encouraging the use of eco-friendly production techniques. Moreover, collaboration between governments, industry associations, and R&D institutions supports continual development. Europe's market is stable and diversified, catering to both commercial and defense aviation across various subregions.

Germany aerospace fasteners market stands out as a leading aerospace hub in Europe, with a strong focus on engineering excellence and innovation. Its aerospace fasteners market benefits from advanced manufacturing infrastructure, skilled labor, and a strategic location within the EU. German companies are investing in smart manufacturing and sustainability-focused production, including recyclable materials and energy-efficient processes. The country is also home to several Tier 1 and Tier 2 suppliers that serve global aircraft manufacturers. Government support for aerospace research and digitization initiatives further boosts the industry. M&A activities and partnerships with international firms are helping German companies expand their technological capabilities in fastener production.

Central & South America Aerospace Fasteners Market Trends

Central & South America’s aerospace fasteners market is emerging steadily, supported by growing aircraft manufacturing and MRO operations in countries like Mexico and Brazil. Mexico, in particular, has become a regional aerospace manufacturing hub due to favorable trade agreements and skilled labor availability. While commercial aviation drives most of the demand, increasing defense investments are also contributing. Regional airlines are expanding their fleets, creating demand for both OEM and aftermarket fasteners. Governments are encouraging foreign direct investment and partnerships with international aerospace firms. Though still developing compared to other regions, Central & South America holds significant long-term growth potential in this sector.

Middle East & Africa Aerospace Fasteners Market Trends

The Middle East & Africa region is witnessing moderate growth in the aerospace fasteners market, primarily fueled by rising investments in aviation infrastructure and defense procurement. The UAE, Saudi Arabia, and South Africa are key contributors, with growing airline fleets and regional MRO facilities. Fastener demand is also supported by ambitious aviation expansion projects like airport developments and national carrier upgrades. The defense sector is seeing increased procurement of advanced aircraft, driving demand for specialized fasteners. Although the manufacturing base is limited, strategic partnerships with global aerospace firms are helping build local capabilities. The region's long-term outlook is positive as it invests more in aerospace and defense autonomy.

Key Aerospace Fasteners Company Insights

Some of the key players operating in the market include SFS Group, Boeing

-

SFS Group is a key global supplier of high-performance fastening systems, serving both civil and military aerospace sectors. The company focuses on precision-engineered fasteners and lightweight solutions tailored to meet stringent aerospace standards.

-

Boeing offers a wide range of aerospace fasteners used in its commercial and defense aircraft through its distribution services division. It supports global supply chains by providing certified fastener components and MRO solutions.

-

Precision Castparts Corp. and Howmet Aerospace are some of the emerging market participants in the aerospace fasteners market.

-

PCC is a leading manufacturer of complex metal components and high-strength aerospace fasteners. Known for its vertically integrated operations, the company supplies critical fastener systems for jet engines, airframes, and defense applications.

-

Howmet Aerospace is a major producer of engineered fastening solutions, supplying titanium and nickel-alloy fasteners for commercial and military aircraft. The company focuses on innovation adopting advanced materials, coatings, and automated production to meet rising demand and evolving aerospace standards.

Key Aerospace Fasteners Companies:

The following are the leading companies in the aerospace fasteners market. These companies collectively hold the largest market share and dictate industry trends.

- SFS Group

- LISI Aerospace

- Precision Castparts Corp.

- Howmet Aerospace

- MinebeaMitsumi Aerospace

- 3V Fasteners

- Boeing

- TriMas Corporation

- National Aerospace Fasteners Corporation (NAFCO)

- B&B Specialties Inc.

Recent Developments

-

In February 2025, TriMas completed the acquisition of GMT Aerospace, expanding its aerospace fastener platform and enhancing its portfolio across multiple fastener categories

-

In October 2024, Bossard Group acquired Germany's Ferdinand Gross Group a leading fastening technology distributor with locations in Germany, Hungary, and Poland bolstering its aerospace segment in Europe.

-

In May 2024, AFC Industries acquired Meg Technologies Inc., a Southern California-based distributor of military-standard aerospace fasteners, enhancing its distributor portfolio and customer base.

Aerospace Fasteners Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.80 billion

Revenue forecast in 2033

USD 13.61 billion

Growth rate

CAGR of 7.2% from 2025 to 2033

Base year for estimation

2024

Actual estimates/Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Aircraft type, product, region

Regional scope

Global

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; Japan; India; South Korea

Key companies profiled

SFS Group; LISI Aerospace; Precision Castparts Corp.; Howmet Aerospace; MinebeaMitsumi Aerospace; 3V Fasteners; Boeing; TriMas Corporation; National Aerospace Fasteners Corporation (NAFCO); B&B Specialties Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerospace Fasteners Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the aerospace fasteners market on the basis of aircraft type, product, and region:

-

Aircraft Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Business & General Aviation

-

Military

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Bolts

-

Nuts

-

Screws

-

Rivets

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global aerospace fasteners market size was estimated at USD 7.28 billion in 2024 and is expected to reach USD 7.80 billion in 2025.

b. The global aerospace fasteners market is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2033 to reach USD 13.61 billion by 2033.

b. The commercial segment of the market accounted for the largest revenue share of 67.0% in 2024, driven by the high production volumes of commercial aircraft from manufacturers like Boeing, coupled with the growing global air travel demand and the need for fleet expansion and modernization.

b. Some of the key players operating in the aerospace fasteners market include SFS Group, LISI Aerospace, Precision Castparts Corp., Howmet Aerospace, MinebeaMitsumi Aerospace, 3V Fasteners, Boeing, TriMas Corporation, National Aerospace Fasteners Corporation (NAFCO), and B&B Specialties Inc.

b. Key factors driving the aerospace fasteners market include rising aircraft production, growing MRO demand, lightweight material adoption, and increased defense spending.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.