Aerospace Floor Panels Market Trends

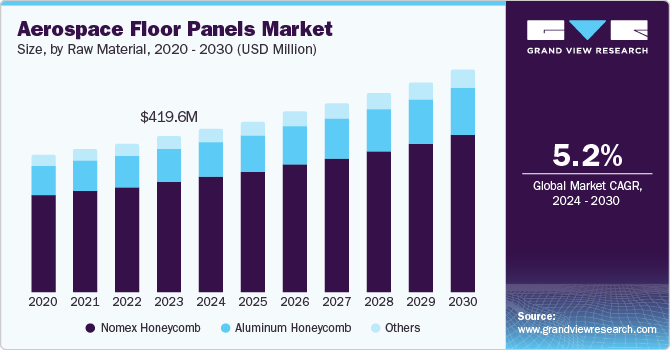

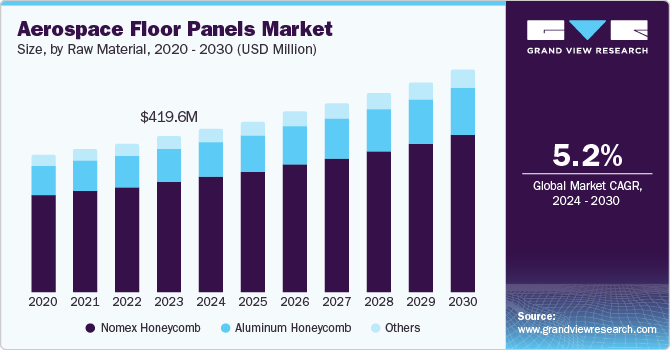

The global aerospace floor panels market size was valued at USD 419.6 Million in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2030. The rise in military expenditures across major economies worldwide and the robust growth of the aerospace industry drive demand for aerospace floor panels over the forecast period. Technological advancements in the aviation industry are poised to generate opportunities for growth and development.

In addition, the expanding global aviation market increases the demand for aerospace floor panels. The increasing number of passengers also increases the demand for new aircraft. Economic growth in emerging markets has also increased investment in aviation infrastructure, further driving the need for advanced floor panel solutions.

Manufacturers innovate floor panel designs that meet industry standards. In addition, the growing passenger experience focuses on interior aesthetics and comfort. It includes high-quality, visually appealing floor panels. Customization options such as color, texture, and design are poised to augment demand to cater to specific branding and comfort needs. Most airline companies invest in interior upgrades to offer a more pleasant travel experience. This includes advanced flooring solutions that deliver robust aesthetics and travel functionalities.

Raw Material Insights

Nomex honeycomb accounted for a leading market share of 69.6% in 2023 owing to its fire-resistant properties and safety essentials, the demand for these materials drives the segment growth. This material can hold high temperatures and provides excellent thermal and acoustic insulation. The superior dimensional stability and resistance of the material to moisture and chemicals further contribute to its widespread adoption in the aerospace industry.

Aluminum honeycomb is expected to register the fastest CAGR of 5.1% during the forecast period due to the importance of the material used in weight reduction in aircraft design. It is lighter than regular materials used in floor panels, such as steel and metals. This optimizes the aircraft’s internal performance and saves fuel costs. The increasing adoption of advanced manufacturing techniques, such as additive manufacturing, has simplified the production of complex, customized aluminum honeycomb structures, further driving its adoption in the aerospace floor panel market.

Application Insights

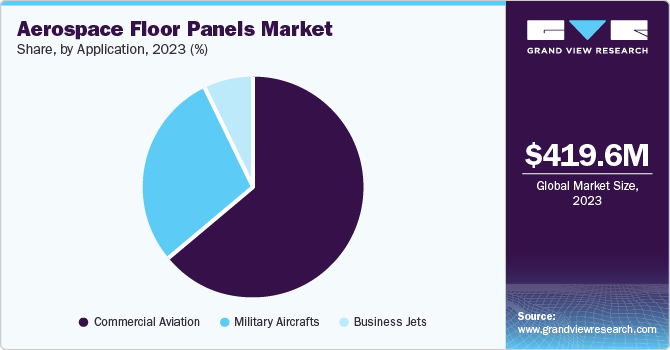

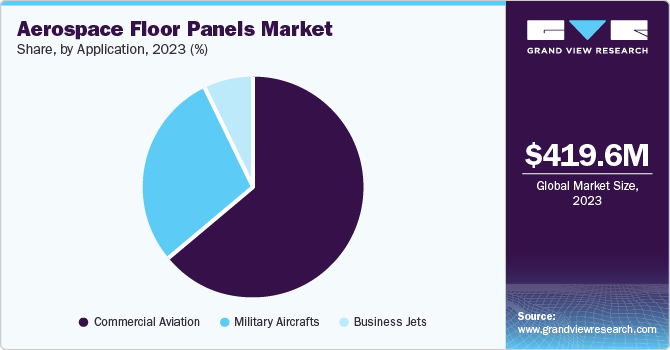

Commercial aviation accounted for the largest market share of 63.8% in 2023 pertaining to the increasing air passenger traffic, expanding airline fleets, and the demand for fleet modernization. Commercial aircraft need larger floor panel areas over other aviation applications, such as military or general aviation, further contributing to the segment growth. The commercial airlines' focus on passengers' comfort, safety, and operational efficiency further contributes to the segment growth. In addition, commercial aviation manufacturers majorly invest in high-quality, durable aerospace floor panels.

Military aircraft are expected to register a significant CAGR of 5.3% during the forecast period. The rise in global tensions, geopolitical instability, and emerging economies' spending on modernizing defense aircraft is expected to fuel the need for floor panels. The allotment of significant budgets on training and simulation positively impacts the upgrade policies adopted by the defense sector.

Regional Insights

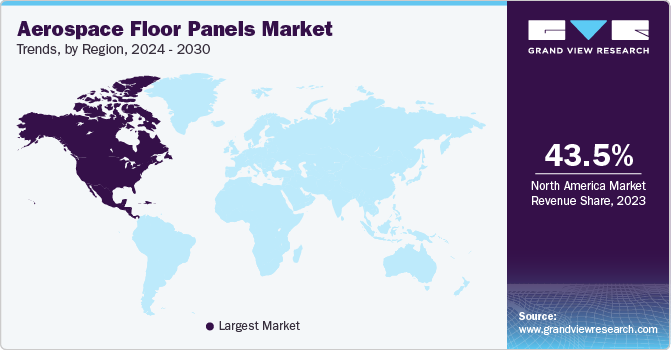

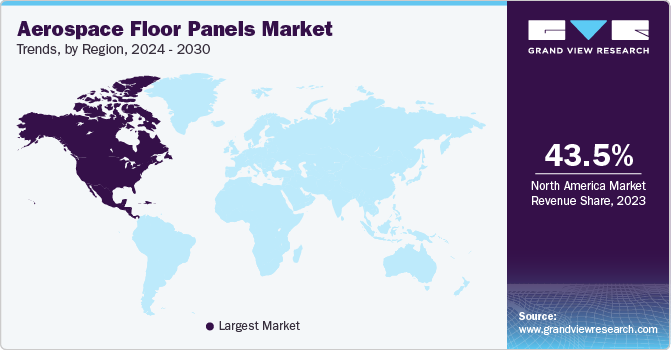

North America aerospace floor panels dominated with a market share of 43.5% in 2023. The region has positioned itself as the largest economy along with robust defense policies. Aviation spending has increased in the past two decades highlighting the significance of aerospace floor panels. The increasing importance of research and development and the availability of advanced manufacturing capabilities increases market demand. In addition, government investments and support for the aerospace industry boost the market demand.

U.S. Aerospace Floor Panels Market Trends

The U.S. aerospace floor panels market dominated North America with a share of 87.4% in 2023 due to the increasing focus on weight reduction in aircraft design that drives demand for lightweight and high-performance floor panel materials, such as advanced composites and honeycomb structures. The growing importance of passenger comfort and safety has contributed to market growth.

Europe Aerospace Floor Panels Market Trends

Europe aerospace floor panels market was identified as a lucrative region owing to the presence of major aircraft manufacturers, which is expected to fuel the market size. The focus on environmental sustainability and developing more fuel-efficient aircraft has driven the adoption of lightweight and advanced composite materials in producing aerospace floor panels. The region's investments in research and development are poised to encourage industry development in the near future.

Asia Pacific Aerospace Floor Panels Market Trends

Asia Pacific aerospace floor panels market is anticipated to witness significant growth in the aerospace floor panels market. The rapid expansion of the aviation industry in the region is attributed to the growth of regional markets. The region’s focus on modernizing and upgrading aircraft fleets further contributes to industry developments. Moreover, the presence of skilled labor and improving transportation infrastructure is a contributing factor.

Japan aerospace floor panels market is expected to grow more in the coming years due to the well-established and technologically advanced aerospace industry. Japan’s state-of-the-art technology in the aviation industry has significantly contributed to the global economy. Therefore, regional market growth is reflected in Japan’s technological dominance in aviation.

Key Aerospace Floor Panels Company Insights

Some of the key companies in the aerospace floor panels market include Collins Aerospace,Hexcel Corporation,HUTCHINSON, Euro-Composites and Singapore Technologies Engineering Ltd. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers & acquisitions and partnerships with other major companies.

Key Aerospace Floor Panels Companies:

The following are the leading companies in the anti-reflective coatings market. These companies collectively hold the largest market share and dictate industry trends.

- Collins Aerospace

- Hexcel Corporation

- HUTCHINSON

- Euro-Composites

- Singapore Technologies Engineering Ltd.

- AIM Altitude

- The Gill Corporation

- The NORDAM Group LLC

- Triumph Group

- Aeropair Ltd.

Recent Developments

-

In July 2024, Singapore Technologies Engineering Ltd. expanded its support for Safran Aircraft Engines by providing enhanced services for the LEAP engine, which includes comprehensive maintenance and repair solutions. The collaboration improves engine performance and reliability, leveraging ST Engineering’s expertise in aerospace support. The partnership reflects a commitment to advancing engine technology and optimizing operational efficiency for Safran's LEAP engines.

-

In June 2022, AVIC Cabin Systems UK acquired AIM Altitude's cabin programs, enhancing its portfolio in aircraft interior solutions. This acquisition allows AVIC Cabin Systems to expand its capabilities and offerings in designing and manufacturing cabin components. Integrating AIM Altitude's expertise and technologies strengthens AVIC's position in the aerospace industry.

-

In November 2023, The Gill Corporation France contracted with Sonaca to supply honeycomb parts for Airbus programs. Under this agreement, Gill Corporation offers advanced honeycomb core materials, critical for Airbus aircraft's lightweight and structural integrity. The contract reinforces Gill Corporation's position as a key supplier in the aerospace industry, supporting the ongoing demands of Airbus's aircraft production.

Aerospace Floor Panels Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 439.9 million

|

|

Revenue forecast in 2030

|

USD 596.3 million

|

|

Growth Rate

|

CAGR of 5.2% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Report updated

|

December 2024

|

|

Quantitative units

|

Revenue in USD Million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Raw material, application, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; MEA

|

|

Country scope

|

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Brazil; Argentina; Saudi Arabia; South Africa

|

|

Key companies profiled

|

Collins Aerospace; Hexcel Corporation; Composite Industrie S.A.; Euro-Composites; Singapore Technologies Engineering Ltd.; AIM Altitude; The Gill Corporation; The NORDAM Group LLC; Triumph Group; Aeropair Ltd.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Aerospace Floor Panels Market Report Segmentation

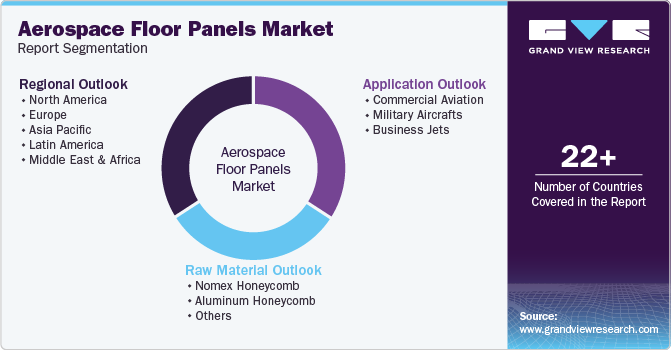

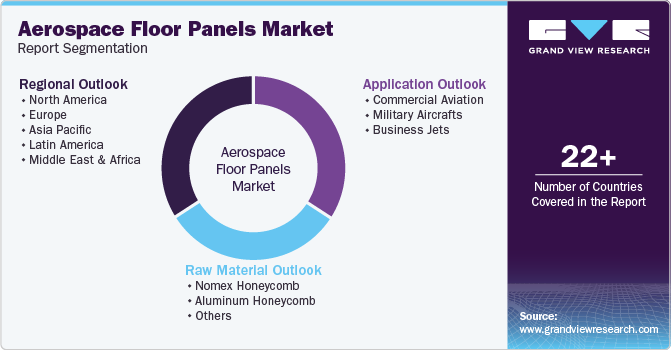

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aerospace floor panels market report based on raw material, application, and region.

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Nomex Honeycomb

-

Aluminum Honeycomb

-

Others

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial Aviation

-

Military Aircrafts

-

Business Jets

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)