- Home

- »

- Advanced Interior Materials

- »

-

Aerospace Parts Manufacturing Market Size Report, 2030GVR Report cover

![Aerospace Parts Manufacturing Market Size, Share & Trends Report]()

Aerospace Parts Manufacturing Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Engines, Aircraft Manufacturing, Cabin Interiors, Equipment, System, & Support, Avionics), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-678-3

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aerospace Parts Manufacturing Market Summary

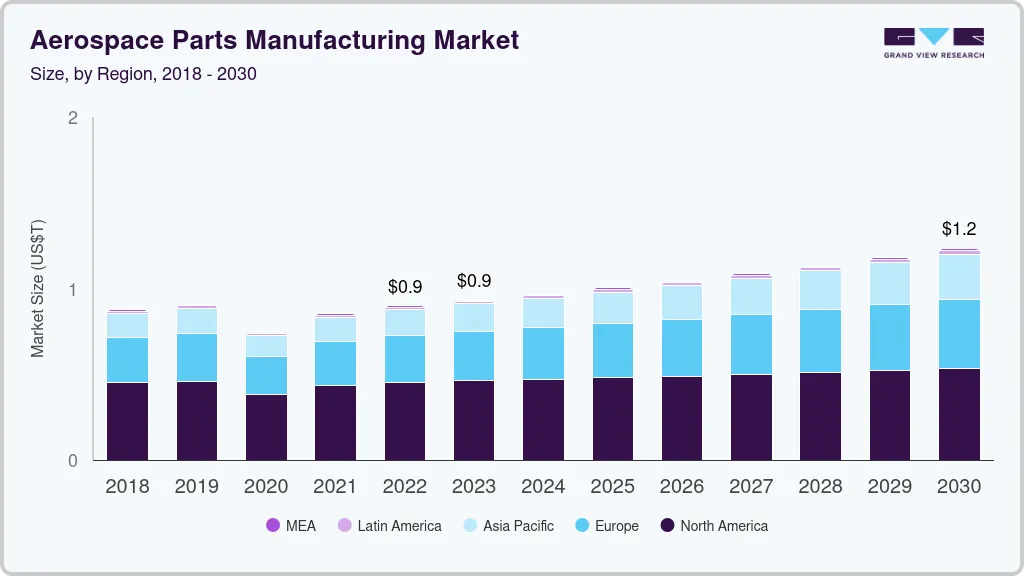

The global aerospace parts manufacturing market size was estimated at USD 913.13 billion in 2023 and is expected to reach USD 1,233.24 billion in 2030, growing at a CAGR of 4.2% from 2024 to 2030. The market is growing on account of the rising passenger traffic, especially in Asia Pacific and Middle East & Africa, and is expected to drive the demand and production of aerospace parts, over the coming years.

Key Market Trends & Insights

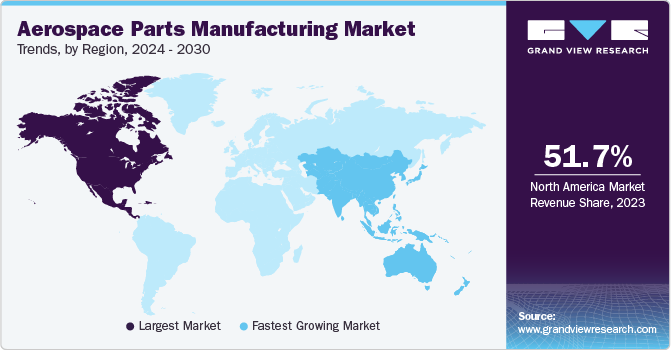

- North America industry for aerospace parts manufacturing dominated the regional market with largest revenue share of 51.7% in 2023.

- Asia Pacific accounted for a significant share in 2023.

- Based on product, aircraft manufacturing segment accounted for the largest revenue share of over 51% in 2023.

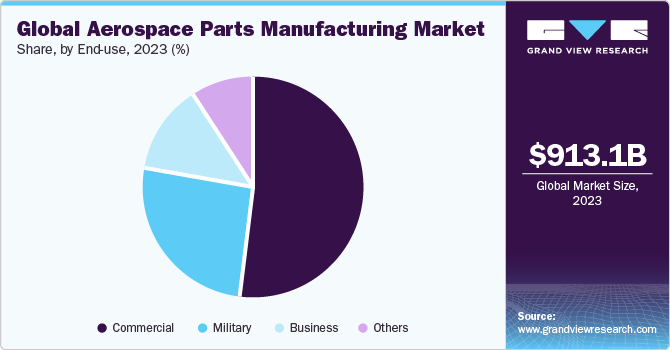

- Based on end-use, commercial segment dominated the market with highest revenue share in 2023 in manufacturing of aerospace parts.

Market Size & Forecast

- 2023 Market Size: USD 913.13 Billion

- 2030 Projected Market Size: USD 1,233.24 Billion

- CAGR (2024-2030): 4.2%

- North America: Largest market in 2023

Moreover, increasing demand for lightweight and fuel-efficient aircraft to reduce greenhouse gas (GHG) emissions is positively influencing the industry demand. Expansion in air passenger and air freight volume worldwide against the backdrop of economic growth in emerging countries and considerable developments in commercial aerospace are expected to drive industry growth. An increase in air travel and transport is presumed to propel the demand for manufacturing of aerospace parts that are used in aircraft. This growing demand for transportation is expected to stimulate aircraft production, which, in turn, is expected to result in an extension of contracts between aerospace parts suppliers and aircraft manufacturing companies. In addition, increased defense spending to reduce operational costs and improve the efficiency of aircraft is anticipated to create opportunities for innovation, which is expected to boost technological advancements in the industry.

Aircraft are durable assets and typically remain in service for two or three decades. As the cost to retain and operate the aircraft exceeds the profits generated, they must be replaced. New-generation aircraft and aerospace parts provide improved range and payload capability, thus enabling better fuel efficiency, significant cost savings, and profit margins compared to older aircraft. The annual replacement rate in the airline industry is approximately 3%. Fleet replacement provides a strong base for long-term demand for the manufacturing of new aerospace parts since it is much needed for fleet expansion, which contributes to market development.

The U.S. market dominates the global industry owing to the presence of established companies, such as Boeing, United Technologies, and Lockheed Martin. An increased passenger transportation is expected to drive the manufacturing of aerospace parts in the U.S. Moreover, rising demand for aerospace parts sourced from the U.S. including wings, fasteners, and fuselages on account of assurance of airworthiness strong legacy, and technological ability to produce high-quality products, is expected to drive market growth over the forecast period.

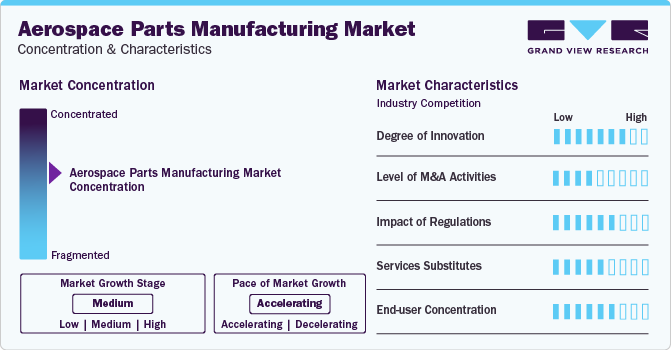

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The market exhibits low competition owing to the presence of limited players operating in the aerospace parts manufacturing market. An increased competition among the aerospace parts manufacturing companies aiming to establish secure contracts with aircraft manufacturers is being observed in the industry. Players in global aerospace parts manufacturing market compete based on differentiation in technology, design, product performance, and conformity to customer specifications. Additional factors, such as timely delivery of the product, industry goodwill, superior customer service & support, and price also affect market competition.

The aerospace & defense industry is opting for lightweight materials in an attempt to improve the cost-efficiency and environmental performance of the aircraft. Hence, high-strength, lightweight, and fiber-reinforced composite materials are vital for the aircraft manufacturing industry. Replacing traditional materials with lightweight materials is an effective path toward achieving the aim of producing lightweight aircraft to enhance fuel efficiency, decrease emissions, and reduce material usage. Incorporating lightweight materials for the production of aircraft enables manufacturers to reduce the weight while allowing the innovations and installation of new functions.

There are a limited number of manufacturers that cater to customized product requirements, with products being order-specific, the market faces almost no threat of substitution. However, use of emerging technologies such as additive manufacturing, also known as 3D printing for manufacturing of low-cost, sustainable aircraft parts is increasing at a significant rate. This technology may replace the traditional manufacturing process for aircraft components in future.

Product Insights

Based on product, aircraft manufacturing accounted for the largest revenue share of over 51% in 2023. This segment includes manufacturing and assembly of a complete aircraft, including the aerostructure. Aero-structure mainly comprises fuselage, door pairings, wings, and airframe. This segment also includes developing and making aircraft prototypes; aircraft conversion that includes significant modifications to aircraft, and complete aircraft overhaul and rebuilding. Aircraft manufacturing consists of the building and assembly of civil aircraft, such as large commercial aircraft, business jets, and regional aircraft.

This segment is led by Boeing, which also manufactures freighters for logistic air supply. Equipment, safety, and support segment is expected to register the fastest CAGR from 2024 to 2030. The equipment, system, and support segment comprises various parts including landing gear, opening and closing doors, air management system, actuation & control system, and others. The overall weight of an aircraft is a crucial factor in determining the efficiency and design of the equipment, system, and other support systems. The reduced weight has a significant impact on the overall performance of an aircraft.

Avionics segment is expected to register a significant CAGR from 2024 to 2030. Advanced avionics are generally used to incorporate screens allowing pictures of the flight routes as well as necessary flight instrument data. Avionics are designed to increase the safety and utility of aircraft and aerospace parts. It encompasses electronic aircraft systems, such as fly-by-wire or fly-by-light flight controls, system monitoring, anti-collision systems, and pilot interface systems including communication, flight management systems, navigation, and weather forecast. Avionics demand generally follows the overall aerospace manufacturing industry and is expected to grow in line with increasing demand for aircraft.

End-use Insights

Based on end-use, commercial segment dominated the market with highest revenue share in 2023 in manufacturing of aerospace parts. Commercial aircraft segment is also expected to remain the fastest growing segment from 2024 to 2030. This is on account of rise in passenger and freight traffic around worldwide. With improved trade relations globally, there is a surge in demand for cargo services, which is expected to contribute to growth of the commercial aircraft parts market.

Commercial aircraft market is characterized by presence of a limited number of manufacturing companies owing to the associated financial risks and technological requirements. Manufacturing engines for commercial aircraft entail highest risk, thereby constricting number of manufacturing companies competing in the market. Boeing and Airbus are significant commercial aircraft manufacturing companies, together accounts for majority of the overall revenue share.

Business and general aviation aircraft comprises light planes that are used for private leisure flying, personal transportation, corporate travel, and short-haul commercial transportation, such as air taxis and commuter airliners, with low takeoff weights. Growing demand for business aircraft can be attributed to its benefits such as increased mobility, enhanced productivity, and improved efficiency. Business aircraft is anticipated to boost productivity, as air travel requires less time compared to other modes of travel. This is expected to drive the demand for business aircraft along with market for aerospace parts over the forecast period.

Military aircrafts are used to move troops and materials such as tanks, automotive vehicles, and helicopters. With modifications, they also serve as tankers for in-flight refueling. Military transporters have special features compared to commercial freight aircraft, which includes short-takeoff-and-landing capability, loading ramps, airdrop capability, and paratroop doors.

Regional Insights

North America industry for aerospace parts manufacturing dominated the regional market with largest revenue share of 51.7% in 2023. North American economy is extremely favorable for aircraft manufacturing owing to increased number of aging fleets in the region. Replacement of this aging aircraft is contributed to the lower operating efficiency and revenue requirements for the operating airlines. Moreover, increase in per capita income is expected to boost the number of airway passengers, thereby boosting regional demand for aircraft and its parts.

Asia Pacific accounted for a significant share in 2023. This is due to growing development in aviation industry in Asia Pacific driven by economic growth of Japan, China and other countries. There is a rapid rise in international air travel along with growing demand for international cargo which is expected to trigger regional demand for MRO activities, thereby boosting demand for aerospace parts.

Growth of the European aerospace and defense industry is expected to surpass that of aerospace industry in the U.S. over the forecast period, owing to a slight increase in defense spending by some European countries, such as Russia, Italy. The industry has experienced improved performance against the backdrop of economic slowdown and uncertainties in recent years. However, European industry is highly concentrated in nature on account of the major players accounting for a significant revenue share.

Key Companies & Market Share Insights

The global aerospace parts manufacturing market exhibits an increasingly competitive environment, owing to the rising demand from aircraft manufacturing industry. Aerospace parts market has observed a trend of major companies collaborating to start a joint venture for product development, due to the risks and increased costs associated with development and manufacturing of new aerospace parts.

-

In August 2022, Safran Data Systems, a Safran Electronics & Defense division, has just purchased Captronic Systems, a local Indian firm. As a result, Safran Data Systems is expanding its product portfolio and strengthening its international operations in this strategic country as a leading player in the space industry, supplying instrumentation for testing, telemetry, and communications with satellites, launch vehicles, and all types of remote platforms.

-

In May 2022, JAMCO Corporation has announced the signing of a Supporter Agreement with SkyDrive Inc., a company that is developing flying cars. JAMCO will begin the collaboration by lending SkyDrive its Aircraft Interiors development professionals.

Key Aerospace Parts Manufacturing Companies:

- JAMCO Corporation

- Intrex Aerospace

- Rolls Royce plc

- CAMAR Aircraft Parts Company

- Safran Group

- Woodward, Inc.

- Engineered Propulsion System

- Eaton Corporation plc

- Aequs

- Aero Engineering & Manufacturing Co.

- GE Aviation

- Lycoming Engines

- Pratt & Whitney

- Superior Air Parts Inc.

- MTU Aero Engines AG

- Honeywell International, Inc.

- Collins Aerospace

- Composite Technology Research Malaysia Sdn. Bhd.

- Mitsubishi Heavy Industries Ltd.

- Kawasaki Heavy Industries Ltd.

- Subaru Corporation

- IHI Corporation

- Lufthansa Technik AG

- Diel Aviation Holding GmbH

- Elektro-Metall Export GmbH

- Liebherr International AG

- Hexcel Corporation

- DuCommun Incorporated

- Rockwell Collins

- Spirit Aerosystems, Inc.

- Panasonic Avionics Corporation

- Zodiac Aerospace

- Thales S.A.

- Dassault Systems SE

- Parker-Hannifin Corporation

- Chemetall GmbH

- Premium AEROTECH GmbH

- Daher Group

- FACC AG

- Triumph Group

- Curtiss-Wright Corporation

- Stelia Aerospace

- Magellan Aerospace

- Bridgestone Corporation

Aerospace Parts Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 966.05 billion

Revenue forecast in 2030

USD 1,233.24 billion

Growth Rate

CAGR of 4.2% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America, Europe, Asia Pacific, Middle East & Africa, Central & South America

Country scope

U.S., Canada, Mexico, Germany, France, Italy, U.K., Netherlands, Poland, China, Japan, Australia, Indonesia, Malaysia, Philippines, Brazil

Key companies profiled

JAMCO Corporation, Intrex Aerospace, Rolls Royce plc, CAMAR Aircraft Parts Company, Safran Group, Woodward, Inc., Engineered Propulsion System, Eaton Corporation plc, Aequs, Aero Engineering & Manufacturing Co., GE Aviation, Lycoming Engines, Pratt & Whitney, Superior Air Parts Inc., MTU Aero Engines AG, Honeywell International, Inc., Collins Aerospace, Composite Technology Research Malaysia Sdn. Bhd., Mitsubishi Heavy Industries Ltd., Kawasaki Heavy Industries Ltd., Subaru Corporation, IHI Corporation, Lufthansa Technik AG, Diel Aviation Holding GmbH, Elektro-Metall Export GmbH, Liebherr International AG, Hexcel Corporation, DuCommun Incorporated, Rockwell Collins, Spirit Aerosystems, Inc., Panasonic Avionics Corporation, Zodiac Aerospace, Thales S.A., Dassault Systems SE, Parker-Hannifin Corporation, Chemetall GmbH, Premium AEROTECH GmbH, Daher Group, FACC AG, Triumph Group, Curtiss-Wright Corporation, Stelia Aerospace, Magellan Aerospace, Bridgestone Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

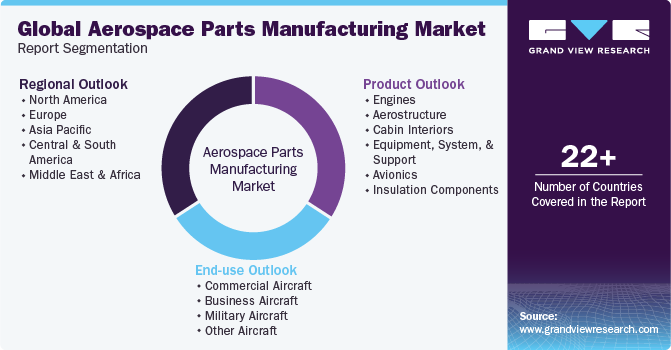

Global Aerospace Parts Manufacturing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global aerospace parts manufacturing market report on the basis of product, end use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Engines

-

Aerostructure

-

Cabin Interiors

-

Equipment, System, and Support

-

Avionics

-

Insulation Components

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial Aircraft

-

Business Aircraft

-

Military Aircraft

-

Other Aircraft

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

The Netherlands

-

-

Asia Pacific

-

Indonesia

-

Malaysia

-

Philippines

-

China

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Some key players operating in the aerospace parts manufacturing market include JAMCO Corporation, Intrex Aerospace, Rolls Royce plc, CAMAR Aircraft Parts Company, Safran Group, Woodward, Inc., Engineered Propulsion System, Eaton Corporation plc, Aequs, Aero Engineering & Manufacturing Co., and GE Aviation

b. The global aerospace parts manufacturing market size was estimated at USD 931.49 billion in 2023 and is expected to reach USD 966.05 billion in 2024.

b. The global aerospace parts manufacturing market is expected to grow at a compound annual growth rate a CAGR of 4.2% from 2024 to 2030 to reach USD 1,233.24 billion by 2030.

b. The U.S aerospace parts manufacturing market accounted for the largest revenue share in 2023 and this is due to the increasing air traffic and higher defense budgets in the country.

b. The expansion in air passenger and air freight volume across the globe against the backdrop of economic growth in emerging countries and considerable developments in commercial aviation is driving the market for aerospace parts manufacturing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.