- Home

- »

- Next Generation Technologies

- »

-

Greenhouse Market Size And Share, Industry Report, 2033GVR Report cover

![Greenhouse Market Size, Share & Trends Report]()

Greenhouse Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Type (Glass, Plastic), By Crop Category, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-024-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Greenhouse Market Summary

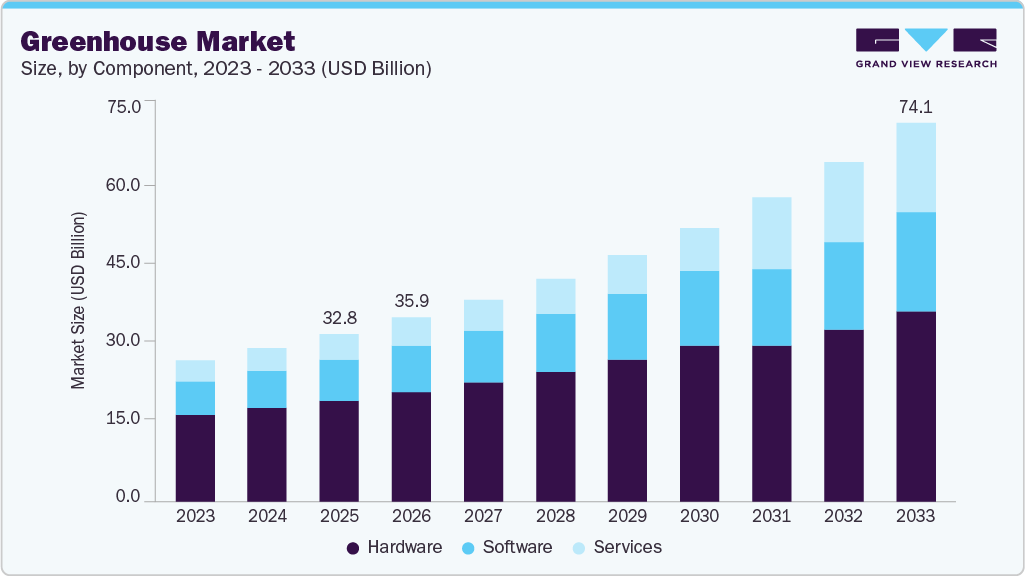

The global greenhouse market size was estimated at USD 32.84 billion in 2025 and is projected to reach USD 74.10 billion by 2033, growing at a CAGR of 10.9% from 2026 to 2033. Increasing demand for sustainable and controlled agricultural practices is driving market growth.

Key Market Trends & Insights

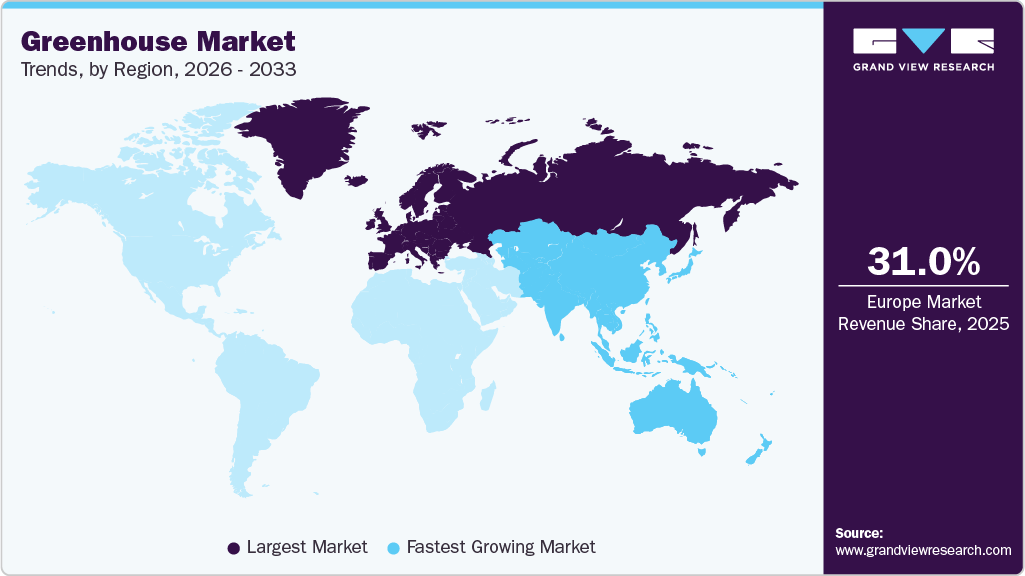

- Europe greenhouse industry held the major share of over 31.0% of the global market in 2025.

- The greenhouse industry in the UK is expected to grow at a CAGR of 8.0% during the forecast period.

- By component, the hardware segment accounted for the largest market share of over 60.0% in 2025.

- By type, the plastic segment dominated the market with a highest a revenue share in 2025.

- By crop category, the fruits, vegetables & herbs segment dominated the market with a highest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 32.84 Billion

- 2033 Projected Market Size: USD 74.10 Billion

- CAGR (2026-2033): 10.9%

- Europe: Largest market in 2025

- Asia Pacific: Fastest growing market

As the global population rises and arable land becomes increasingly limited due to urbanization, climate change, and soil degradation, greenhouse farming offers an efficient alternative to traditional open-field agriculture. Greenhouses enable year-round cultivation, protect crops from extreme weather conditions, and allow for better control over factors such as temperature, humidity, and light. This controlled environment leads to higher crop yields, reduced water usage, and more predictable harvests, making greenhouse solutions particularly appealing to commercial growers and governments investing in food security.

The surging demand for high-quality, locally grown produce, particularly in urban and developed markets, is driving the market growth. Consumers are increasingly concerned about the origin, freshness, and safety of their food, which is pushing retailers and restaurants to source produce closer to consumption points. Greenhouses, especially those integrated into urban environments or near cities, enable local food production with reduced transportation time and costs. This is contributing to the expansion of greenhouse operations in regions such as North America and Europe, where consumers value organic and pesticide-free produce, and where regulatory frameworks support sustainable agriculture.

Moreover, the rising demand for specialty crops, including herbs, flowers, and high-value fruits and vegetables, is driving greenhouse cultivation. These crops often require specific environmental conditions that are difficult to maintain in open fields but easily achievable within a greenhouse. The ability to cultivate niche, high-margin crops year-round enhances profitability for growers and encourages investment in greenhouse structures. As consumer preferences evolve and global markets become more interconnected, greenhouse farming is positioned as a vital component of the future of agriculture.

The growth of vertical farming and urban agriculture is also closely tied to the market’s expansion. With urban populations booming and land availability within cities becoming scarce, integrating greenhouses into vertical farming systems offers a space-efficient solution for fresh food production. These high-tech greenhouses often use hydroponics, aeroponics, and advanced lighting systems to maximize yield in small spaces. As smart city initiatives and urban sustainability goals gain momentum, municipal governments and private investors are funding greenhouse projects within city limits to reduce reliance on long-distance food supply chains.

In addition, the expansion of export-oriented agriculture is fueling greenhouse investments. Many countries are leveraging greenhouses to produce export-grade vegetables, flowers, and fruits that meet stringent international standards. Controlled environments allow growers to achieve consistent quality and reduce contamination risks, which are critical for penetrating high-value markets such as the EU, Japan, and North America. For example, nations such as Kenya, the Netherlands, and Mexico have heavily invested in greenhouse infrastructure to boost their agricultural export competitiveness.

Component Insights

The hardware segment accounted for the largest market share of over 60.0% in 2025. The rising adoption of automated irrigation and fertigation systems is another significant driver of the hardware segment. These systems allow for precise water and nutrient delivery based on plant requirements, which minimizes resource wastage and improves plant health. In areas facing water scarcity, automated drip and mist irrigation systems are especially valuable. As concerns around sustainability and resource optimization grow, demand for advanced irrigation hardware that conserves water while maintaining high yields is surging.

The software segment is anticipated to grow at the fastest CAGR during the forecast period. The emergence of cloud-based and mobile-friendly greenhouse management systems is driving segment growth. These platforms provide scalability, ease of access, and integration with a wide variety of hardware. Cloud-based software allows users to analyze historical and real-time data, generate actionable insights, and receive alerts and recommendations based on predictive analytics. This is especially beneficial for commercial greenhouses operating across multiple locations, where centralized monitoring and coordination are crucial. The convenience of accessing greenhouse data from smartphones and tablets also empowers field workers and managers to make timely decisions from virtually anywhere.

Type Insights

The plastic segment dominated the market and accounted for a revenue share of over 57.0% in 2025. The increased focus on controlled-environment agriculture (CEA) is driving market growth. Plastic coverings, especially UV-stabilized films, help maintain a consistent microclimate by trapping heat and humidity, thus enabling off-season cultivation and better crop yields. These properties are particularly advantageous in arid and semi-arid regions, where maintaining adequate growing conditions can be challenging. In addition, multi-layered plastic films can be engineered to provide benefits such as anti-drip, anti-dust, and infrared-reflective properties, further enhancing their efficiency.

The glass segment is expected to register a significant CAGR from 2026 to 2033. The expansion of commercial horticulture and floriculture industries is another factor supporting the glass greenhouse segment. High-end commercial growers often prefer glass for its aesthetic value, structural integrity, and capability to provide optimal growing environments for premium products. Glass greenhouses are increasingly being utilized in urban farming projects, botanical gardens, and research institutions, where visual appeal and long-term utility are important considerations.

Crop Category Insights

The fruits, vegetables & herbs segment dominated the market and accounted for a revenue share of over 57.0% in 2025. The rise of urban agriculture and local farming initiatives is fueling this segment. As cities seek to become more self-sufficient and sustainable, greenhouses are being integrated into urban landscapes on rooftops, in community spaces, and even within vertical farming systems. These setups often focus on growing fast-yielding and high-demand crops such as leafy greens, herbs, and fruiting vegetables, making them ideal candidates for greenhouse environments. This urban farming trend supports local food systems, reduces reliance on imported produce, and minimizes carbon emissions associated with long-distance transportation.

The flowers & ornamentals segment is expected to register a significant CAGR from 2026 to 2033. The growth of e-commerce and online floral delivery services drives greenhouse floriculture segment adoption. Online platforms now allow consumers to purchase flowers and ornamental plants from the comfort of their homes, with delivery often promised within 24 to 48 hours. This rapid fulfillment requires a reliable, quality-controlled supply chain, which greenhouse cultivation supports by enabling uniform growth conditions and reducing pest or weather-related spoilage. E-commerce giants and dedicated floral platforms are increasingly partnering with greenhouse growers to maintain inventory levels that can respond flexibly to surges in demand during holidays and promotional events.

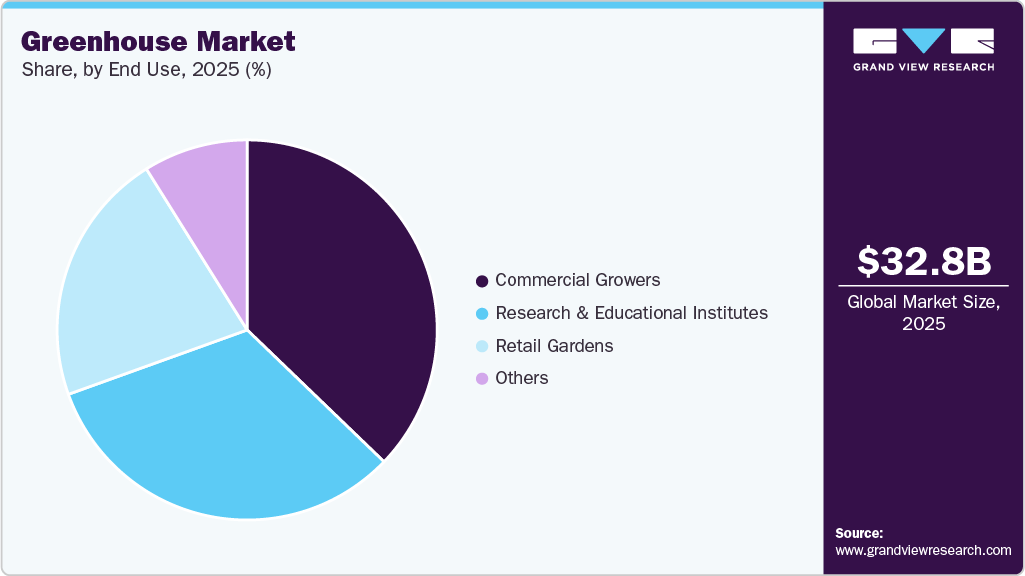

End Use Insights

The commercial growers segment accounted for the largest market share of over 37.0% in 2025. The expansion of the foodservice industry and institutional demand is driving the commercial market growth. Restaurants, hotels, catering services, and institutional kitchens require a steady supply of fresh, high-quality produce to meet customer expectations. Greenhouses enable commercial growers to supply specialty crops, herbs, and out-of-season vegetables that cater specifically to these sectors. The ability to customize crop varieties and ensure reliable delivery schedules makes greenhouses an optimal investment for commercial producers targeting the foodservice market. This rising institutional demand is fueling the expansion and modernization of commercial greenhouse facilities worldwide.

The research and educational institutes segment is anticipated to register the fastest CAGR around 10.0% during the forecast period. The increasing trend toward digital agriculture and precision farming also fuels growth in this segment. Educational and research institutions are adopting greenhouses integrated with IoT (Internet of Things) sensors, automated controls, and data analytics platforms to gather detailed information on plant health, soil moisture, light intensity, and other critical factors. These smart greenhouse setups enable advanced research on optimizing resource use and improving crop quality. The need for sophisticated experimental facilities to develop and test these digital technologies encourages further investment in modern greenhouse infrastructure within academic and research organizations.

Regional Insights

Europe greenhouse industry held the major share of over 31.0% of the global market in 2025. The rising trend of local and seasonal food consumption within Europe is also a key driver. Many European countries promote the farm-to-table concept, encouraging the consumption of locally produced food to reduce carbon footprints associated with long-distance transportation. Greenhouses enable year-round production of various fruits, vegetables, and herbs close to urban centers, meeting the demand for fresh, locally grown food regardless of season. This trend encourages farmers and agribusinesses to invest in greenhouse infrastructure to supply local markets efficiently.

UK Greenhouse Market Trends

The greenhouse industry in the UK is expected to grow during the forecast period. The growing emphasis on food traceability and biosecurity in the UK is accelerating greenhouse adoption. In controlled environments, it's easier to monitor crop inputs, reduce the use of harmful chemicals, and prevent contamination from pests and disease factors critical for meeting regulatory standards and consumer expectations. As food safety becomes a growing priority for both domestic and export markets, greenhouses provide the level of control and documentation required to maintain trust and compliance in the supply chain.

Asia Pacific Greenhouse Market Trends

The greenhouse industry in Asia Pacific is expected to grow at a CAGR of 12.3% from 2026 to 2033. The Asia Pacific region has a strong export-oriented horticulture sector driving market growth. Countries like China and Thailand export significant volumes of vegetables, flowers, and herbs to global markets. The need to meet international quality standards for consistency, pesticide usage, and freshness is prompting growers to shift from open-field to greenhouse cultivation. These structures offer better control over growing conditions and enable year-round production, ensuring a steady supply that aligns with the demands of global buyers and enhances the region’s agricultural export competitiveness.

The greenhouse industry in India is projected to grow during the forecast period. The rise of agritech startups and private sector investments in precision farming tools is facilitating the adoption of greenhouse technology. These companies offer turnkey solutions, including climate control systems, IoT-based monitoring, and AI-driven analytics, making greenhouse operations more accessible and manageable even for first-time users. This integration of technology is attracting a younger generation of entrepreneurs into agriculture, thereby broadening the market base.

North America Greenhouse Market Trends

The greenhouse industry in North America is expected to grow at a significant CAGR during the forecast period. The legalization of cannabis in several U.S. states and across Canada has also significantly boosted greenhouse investments. The cannabis industry relies heavily on greenhouse facilities to meet quality standards and control the growing environment. The demand for high yields, consistency, and energy-efficient operations has prompted cannabis growers to adopt advanced greenhouse systems. This has resulted in a surge of infrastructure development, retrofitting older greenhouses, and building new, purpose-designed facilities across the region.

The U.S. greenhouse industry is projected to grow during the forecast period. Government support and agricultural policies are encouraging the expansion of greenhouse farming. Various federal and state-level programs provide funding, tax credits, and technical assistance to promote sustainable agriculture and food security. The USDA and local agencies are actively supporting controlled-environment agriculture through research grants and pilot programs, helping farmers transition from traditional to protected cultivation methods.

Key Greenhouse Company Insights

Some of the key companies operating in the market include Sotrafa S.A. and NETAFIM, among others.

-

Sotrafa S.A. is a Spanish manufacturing company specializing in the production of polyethylene films for agricultural and environmental end uses. Sotrafa's product portfolio encompasses a wide range of plastic films designed to meet the specific needs of greenhouse cultivation. Their offerings include thermal and non-thermal greenhouse covers, mulching films, hydroponic liners, and silage bags. The company's greenhouse films are engineered to provide optimal light transmission, thermal insulation, and resistance to environmental stressors.

-

Netafim is a global company specializing in precision irrigation and greenhouse solutions. The company specializes in drip and micro-irrigation technologies, offering a range of products including drippers, sprinklers, and crop management software. Netafim offers comprehensive, turnkey solutions designed to create optimal growing conditions year-round. Their climate-controlled greenhouses incorporate advanced systems for heating, cooling, irrigation, and fertigation, tailored to specific crops and regional climates.

The Glasshouse Company Pty Ltd, and Stuppy Greenhouse are some of the emerging market participants in the market.

-

The Glasshouse Company Pty Ltd is a prominent Australian manufacturer specializing in horticultural structures and equipment. The company's product range encompasses a variety of greenhouse solutions, from large-scale commercial installations to smaller domestic units. Their offerings include multi-span greenhouses, poly houses, shade houses, and custom-designed structures tailored to specific client needs. Constructed using high-grade galvanized steel frameworks and advanced materials, these structures are designed for strength, durability, and functionality.

-

Stuppy Greenhouse is a greenhouse manufacturer in North America. Stuppy Greenhouse specializes in designing and constructing customized greenhouse structures for commercial growers, educational institutions, and research facilities. Their product offerings include commercial greenhouses, educational greenhouses, aquaponic systems, and advanced heating solutions like the Heat2O Hydronic Heat system. These products are engineered in-house and manufactured in the U.S., ensuring quality and reliability.

Key Greenhouse Companies:

The following are the leading companies in the greenhouse market. These companies collectively hold the largest market share and dictate industry trends.

- Sotrafa S.A.

- Berry Global

- NETAFIM

- Certhon

- Richel Group SA

- Stuppy Greenhouse

- Logiqs B.V.

- Argus Control Systems Ltd.

- Poly-Tex, Inc.

- The Glasshouse Company Pty Ltd

- Luiten Greenhouses BV

- Agra Tech, Inc.

Recent Developments

-

In March 2025, Orbia Advance Corporation’s S.A.B. de C.V. Precision Agriculture business, Netafim, partnered with Virridy to expand its carbon credit initiatives. This collaboration builds on the success of Netafim’s pioneering carbon program for drip-irrigated rice, launched in 2022, which significantly reduced methane emissions, nearly eliminating them, while also conserving water, energy, and fertilizers. Through this new partnership, Netafim is extending its carbon credit efforts to alfalfa, sugar beet, and corn farms in Turkey by implementing precision irrigation. The adoption of this technology will contribute to lowering greenhouse gas emissions, enhancing water efficiency, and boosting crop yields.

-

In November 2024, Orbia’s Precision Agriculture business, Netafim, partnered with Bayer to enhance data-driven farming. This collaboration focuses on simplifying the collection of primary data and leveraging it to generate customized recommendations, helping growers boost crop yields while optimizing resource use and reducing environmental impact. In addition, Orbia Netafim has integrated irrigation insights into the HortiView platform, offering personalized irrigation guidance tailored to each grower based on their specific data. The partnership also plans to expand connectivity with GrowSphere, Netafim’s comprehensive irrigation management system, which supports advanced irrigation, crop protection, and fertigation strategies.

-

In October 2024, NETAFIM partnered with Phytech Ltd to enhance in-field irrigation through real-time data and actionable insights. This collaboration will capitalize on NETAFIM’s robust distribution and service network, delivering improved operational feedback and data-driven recommendations to shared customers. As part of the partnership, Phytech’s advanced technology will be integrated into GrowSphere, NETAFIM’s comprehensive irrigation operating system. This integration will offer users enhanced visibility into their irrigation environment, enabling faster, more accurate monitoring and decision-making.

Greenhouse Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 35.95 billion

Revenue forecast in 2033

USD 74.10 billion

Growth rate

CAGR of 10.9% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, type, crop category, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Sotrafa S.A.; Berry Global; NETAFIM; Certhon; Richel Group SA; Stuppy Greenhouse; Logiqs B.V.; Argus Control Systems Ltd.; Poly-Tex, Inc.; The Glasshouse Company Pty Ltd; Luiten Greenhouses BV; Agra Tech, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Greenhouse Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global greenhouse market report based on component, type, crop category, end use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Climate Control Systems

-

Lighting Systems

-

Sensors

-

Irrigation Systems

-

Others

-

-

Software

-

Web-Based

-

Cloud-Based

-

-

Services

-

System Integration & Consulting

-

Managed Services

-

Assisted Professional Services

-

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Glass

-

Horticulture Glass

-

Others

-

-

Plastic

-

Polyethylene

-

Polycarbonate

-

Polymethyl-methacrylate

-

-

-

Crop Category Outlook (Revenue, USD Million, 2021 - 2033)

-

Fruits, Vegetables, & Herbs

-

Tomato

-

Lettuce

-

Bell & Chili Peppers

-

Strawberry

-

Cucumber

-

Leafy Greens

-

Herbs

-

Others

-

-

Flowers & Ornamentals

-

Perennials

-

Annuals

-

Ornamentals

-

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial Growers

-

Research & Educational Institutes

-

Retail Gardens

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global greenhouse market size was estimated at USD 32.84 billion in 2025 and is expected to reach USD 35.95 billion in 2026.

b. The global greenhouse market is expected to grow at a compound annual growth rate of 10.9% from 2026 to 2033 to reach USD 74.10 billion by 2033.

b. The hardware segment accounted for the largest market share of over 60.3% in 2025 in the greenhouse market. The rising adoption of automated irrigation and fertigation systems is another significant driver of the hardware segment.

b. Major players operating in the target market include Sotrafa S.A., Berry Global, NETAFIM, Certhon, Richel Group SA, Stuppy Greenhouse, Logiqs B.V., Argus Control Systems Ltd., Poly-Tex, Inc., The Glasshouse Company Pty Ltd, Luiten Greenhouses BV, Agra Tech, Inc.

b. Factors such the increasing demand for sustainable and controlled agricultural practices, the surging demand for high-quality, locally grown produce, particularly in urban and developed markets and the rising demand for specialty crops, including herbs, flowers, and high-value fruits and vegetables are anticipated to accelerate the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.