- Home

- »

- Plastics, Polymers & Resins

- »

-

Aerospace Plastics Market Size, Share, Growth Report, 2030GVR Report cover

![Aerospace Plastics Market Size, Share & Trends Report]()

Aerospace Plastics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (PEEK, PPSU, PC, PEI, PMMA, PA, PPS), By Process (Injection Molding, CNC Machining), By Application (Cabin Interiors, Structural Components), By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-189-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aerospace Plastics Market Summary

The global aerospace plastics market size was estimated at USD 8.15 billion in 2024 and is expected to reach USD 13.88 billion by 2030, growing at a CAGR of 9.6% from 2025 to 2030. The increasing demand for plastics in several aerospace applications including cabin interiors, structural components, electrical electronics & control panels, windows, windshields, and canopies is expected to drive the growth of the market for aerospace plastics in the forthcoming years.

Key Market Trends & Insights

- North America was the leading region in the demand for aerospace plastics and accounted for 56.90% market share in terms of revenue in 2024.

- By product, polyetheretherketone (PEEK) segment led the market with 61.62% revenue share in 2024.

- By process, the injection molding segment dominated the market with the largest revenue share of 36.95% in 2024.

- By application, the structural components segment dominated the market with the largest revenue share of 29.70% in 2024.

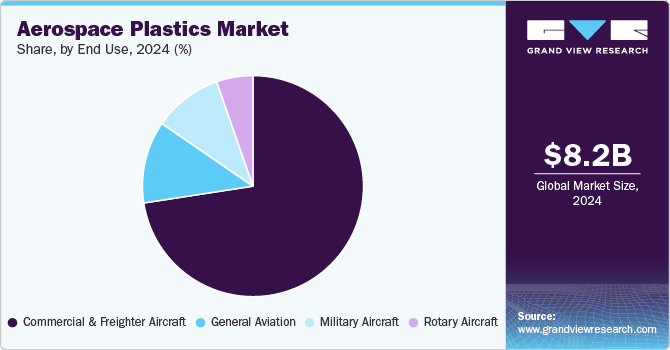

- By end-use, the commercial & freighter aircraft segment dominated the market with the largest revenue share of 72.56% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.15 Billion

- 2030 Projected Market Size: USD 13.88 Billion

- CAGR (2025-2030): 9.6%

- North America: Largest market in 2024

Reduction in overall airplane weight directly impacts performance and efficiency. In addition, with reduction of 1 kilogram (kg) weight is estimated to nullify lifetime operating costs associated with fuel, for a commercial airplane. Plastics being lightweight and highly durable, they are used as an alternative to aluminum and steel components, increasing their share in the overall structure of an airplane.

According to the International Trade Administration, U.S. Department of Commerce, the U.S. is considered as the leading country in the global aerospace market. The country hosts a number of aircraft manufacturers such as Boeing, Lockheed Martin Corporation, Gulfstream Aerospace Corporation, and Airbus Helicopters, Inc. among others, which has contributed to the growth of the aerospace sector in the country. The Continuous Lower Energy, Emissions and Noise (CLEEN) Program which was launched in 2010, has designated the Federal Aviation Administration to introduce steps for reducing noise, aviation emissions, and improve fuel efficiency by 20%. Such initiatives have driven the demand for substitute materials such as plastics, thus significantly impacting the U.S. market for aerospace plastics.

Drivers, Opportunities & Restraints

The growing demand for fuel-efficient and environmentally sustainable aircraft is driving the market growth. Airlines are under increasing pressure to comply with stringent environmental regulations and reduce operational costs by improving fuel efficiency. By using lightweight plastics, aircraft manufacturers can lower the weight of aircraft components, leading to reduced fuel consumption and lower carbon emissions. The rising focus on sustainability, coupled with increasing passenger traffic, is driving demand for aircraft that are both efficient and environmentally friendly, thus boosting the use of plastics in aerospace manufacturing.

An emerging opportunity in the market lies in the rise of 3D printing technology. Additive manufacturing allows for the creation of complex, lightweight plastic parts with high precision and minimal waste. This technology is revolutionizing the production of aerospace components, enabling faster prototyping, customization, and more efficient production processes. Companies in the aerospace industry are investing in 3D printing to reduce lead times and production costs while maintaining the strength and reliability of components. This presents a lucrative growth opportunity for plastic material suppliers who can cater to the increasing demand for 3D-printed aerospace parts.

A significant restraint in the aerospace plastics market is the high cost of advanced polymers used in critical applications. While these plastics offer superior strength, heat resistance, and durability compared to traditional materials, they are often more expensive to produce. This high cost can be a barrier for widespread adoption, particularly for smaller aerospace manufacturers and suppliers who may find it challenging to justify the cost in comparison to traditional metals or less expensive materials. Additionally, the stringent regulatory approvals required for new materials in the aerospace industry can delay the integration of these plastics into aircraft designs, further slowing market growth.

Product Insights

Polyetheretherketone (PEEK) emerged as the leading plastic under-product segment and accounted for 61.62% revenue share in 2024. This is attributed to its inherent flame retardancy, excellent stress cracking resistance, outstanding mechanical strength, excellent resistance to rain erosion, and low smoke & toxic gas emissions. Aircraft parts manufactured from PEEK are chemically resistant to hydraulic fluid, water, salt, steam, and jet fuel. Furthermore, the incredible strength and stiffness offered by PEEK plastic make it a suitable alternative to metals such as steel and aluminum.

Polyphenyl sulfone (PPSU) is also used in aircraft components due to its high-temperature resistance (180 °C), good electrical insulation, high impact strength, good chemical compatibility, and favorable dielectric characteristics. Its versatility and compliance with FAA regulations have allowed it to be used in decorative & structural interior components of aircraft. For instance, the Radel brand PPSU from Solvay is used as an alternative to aluminum in the manufacturing of aircraft catering trolleys in the cabin interior. Also, Radel PPSU foam offers better resistance to Skydrol aircraft hydraulic fluid and cleaning agents compared to PEI foam, driving its consumption in the cabin interiors.

Process Insights

The injection molding segment dominated the market with the largest revenue share of 36.95% in 2024, driven by the growing need for precision and efficiency in manufacturing complex aerospace components. Injection molding offers the ability to produce high-quality plastic parts with tight tolerances and repeatability, which is critical for aerospace applications where performance and reliability are non-negotiable. This process allows for mass production of lightweight yet durable components, such as interior panels, brackets, and housings, at a lower cost and faster turnaround compared to traditional manufacturing methods.

The CNC machining process is expected to witness a substantial growth over the forecast period. Computer Numerical Control (CNC) machining provides unmatched precision and consistency, which is crucial for aerospace applications where even the smallest deviation can impact performance or safety. This process is especially valuable for creating parts from high-performance plastics like PEEK, PPS, and Ultem, which are used in critical applications such as engine components, electrical systems, and structural elements. The flexibility of CNC machining allows for rapid prototyping and production of low- to medium-volume runs without the need for costly molds, making it ideal for custom or specialized parts in both commercial and defense sectors. Additionally, advancements in CNC technology, such as multi-axis machining and automation, enable faster production with higher quality control, further driving its use in aerospace plastics manufacturing.

Application Insights

The structural components segment dominated the market with the largest revenue share of 29.70% in 2024. Structural components consist of aircraft propulsion system components, wingtips, engine parts, rotor, landing gear, fuselage, and other hardware components. Aircraft frame contains the maximum amount of carbon fiber reinforced plastic and composites reducing the weight by 20%. The extended use of composites and plastics in the high-tension loaded environment of the fuselage reduces the maintenance primarily due to fatigue.

The cabin interiors segment is growing significantly. Cabin interiors include seats & seating components, galleys, cabin divider, overhead storage compartment, over-molded aircraft cabin bracket, and other cabin interior components. Earlier aircraft seats consisted of metal composite materials which comply with strict FAA flammability regulations, such as smoke density, vertical burn tests, and heat release tests for aircraft interiors. However, the properties exhibited by the plastics such as lightweight, flame retardancy, cushioning, and other beneficial properties complying with FAA flammability regulations and cost effectiveness have resulted in the inclusion of plastic & plastic composites in seats & seating components. Safran, a global aircraft cabin interior manufacturer uses PEEK polymer and carbon-fibre-LMPAEK composite developed by Victrex plc to manufacture overmoulded aircraft cabin bracket.

End Use Insights

The commercial & freighter aircraft segment dominated the market with the largest revenue share of 72.56% in 2024. As airlines and cargo operators seek to optimize performance and lower fuel consumption, lightweight materials like advanced plastics are increasingly being used in place of traditional metals. These plastics offer high strength-to-weight ratios, corrosion resistance, and durability, which contribute to significant weight reductions across various aircraft components, such as interiors, panels, and cargo doors. Lighter aircraft consume less fuel, which not only reduces emissions to meet stricter environmental regulations but also lowers overall operational expenses. In the freighter segment, where payload capacity and fuel efficiency are paramount, the adoption of aerospace plastics is particularly impactful, helping to maximize cargo load while minimizing fuel usage. This shift toward lightweighting in both commercial and freighter aircraft is driving greater demand for advanced plastic materials in the aerospace market.

Manufacturers of military aircraft have been using plastics to reduce the overall weight and improve fuel efficiency. Military aircraft are often treated as the testing grounds for innovative aerospace structures, and the advancements in the application of plastics are often witnessed in military aircraft where demand for polymers is high. Aerospace plastics provide a high degree of freedom in the designing of complicated components of an aircraft. As a result, the percentage of aerospace plastics utilized in manufacturing commercial and military airplane has increased significantly over the past couple of decades.

Regional Insights

North America was the leading region in the demand for aerospace plastics and accounted for 56.90% market share in terms of revenue in 2024. The region is expected to witness a growing demand for fuel-efficient aircraft over the forecast period on account of the rising fuel prices. High replacement rate mainly for regional aircraft is driving the growth in the matured North America aerospace plastics market. The urge to modify/replace the existing inefficient aircraft with a fuel-efficient airplane is expected to augment market growth.

U.S. Aerospace Plastics Market Trends

In the U.S., a major driver for the aerospace plastics market is the rapid expansion of the defense and space sectors. The U.S. government’s increased investment in military aircraft, drones, and space exploration initiatives, such as NASA’s Artemis program, is fueling demand for lightweight, durable materials like aerospace-grade plastics. These plastics are critical for manufacturing components that must withstand extreme conditions while improving fuel efficiency and reducing maintenance costs. The growing number of commercial space ventures, led by companies like SpaceX and Blue Origin, is also boosting the need for advanced aerospace plastics to develop next-generation spacecraft and launch systems.

Western Europe Aerospace Plastics Market Trends

The Western European market witnessed significant growth in 2024 and is expected to continue its growth on account of the availability of skilled engineers and the glut of investments seen in research and development. The presence of aircraft manufacturing companies in France including European consortiums along with French participants (ATR, EADS, etc.), has bolstered the Western European aerospace polymers market.

Eastern Europe Aerospace Plastics Market Trends

In Eastern Europe, the growing local aerospace manufacturing sector, along with increased collaboration with Western European aerospace firms, is driving the demand for aerospace plastics. Countries like Poland, the Czech Republic, and Hungary are emerging as important hubs for aerospace production and component manufacturing due to lower labor costs and expanding industrial capabilities. Aerospace plastics are increasingly being used in the region to produce parts for both commercial and military aircraft, helping local manufacturers meet global quality standards while keeping production costs competitive. This growth in Eastern Europe’s aerospace sector is pushing the demand for high-performance plastic materials.

Asia Pacific Aerospace Plastics Market Trends

Constant change in the economic environment of Asia Pacific has significantly impacted the airline industry during past five years. However, emerging economies in Asia including China, India, and Japan are largely fueling the aerospace polymers market owing to the emergence airplane manufacturing industry in the region. The region has witnessed major global aircraft manufacturing companies entering into collaboration with regional aircraft manufacturers to further penetrate the aerospace market in Asia Pacific.

The China aerospace plastics market’s growth is driven by the country’s aggressive push to become a global leader in aviation and aerospace technology. China’s state-backed initiatives, such as the development of the COMAC C919, a domestic commercial aircraft, and its growing space exploration programs, are creating significant demand for advanced aerospace materials. Plastics are being used to reduce aircraft weight and improve fuel efficiency in line with global standards, while also supporting the country’s ambition to build a strong, self-sufficient aerospace industry. Additionally, China’s increasing investment in military aviation and satellite technology is further boosting the demand for aerospace-grade plastics in various applications.

Key Aerospace Plastics Company Insights

The market is highly competitive, with several key players dominating the landscape. It is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Aerospace Plastics Companies:

The following are the leading companies in the aerospace plastics market. These companies collectively hold the largest market share and dictate industry trends.

- Victrex plc

- Ensinger

- SABIC

- Solvay

- BASF SE

- Evonik Industries AG

- Toray Advanced Composites

- Saint Gobain Aerospace

- DuPont

- Celanese Corporation

- Sumitomo Chemical Co., Ltd.

- Covestro AG

- the Mitsubishi Chemical Group of companies

- PPG Industries, Inc.

- Röchling

Recent Developments

-

In August 2024, Pexco acquired Precise Aerospace Manufacturing, a move aimed at enhancing its capabilities in the aerospace sector. This acquisition allows Pexco to expand its product offerings and improve its service to customers in the aerospace industry. The deal is expected to strengthen Pexco's position in the market by leveraging Precise Aerospace's expertise and resources.

-

In August 2024, Trelleborg Group acquired Magee Plastics, a U.S. company specializing in high-performance thermoplastic and composite materials for the aerospace industry. This move enhances Trelleborg's Sealing Solutions business unit and strengthens its presence in the aerospace sector.

Aerospace Plastics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.79 billion

Revenue forecast in 2030

USD 13.88 billion

Growth rate

CAGR of 9.6% from 2024 to 2030

Historical data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion, volume in tons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors and trends

Segments covered

Product, process, application, end use, region

Regional scope

North America; Western Europe; Eastern Europe; China; Asia; Southeast Asia; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; China; India; Japan; Indonesia; Brazil; Saudi Arabia; United Arab Emirates

Key companies profiled

Victrex plc; Ensinger; SABIC; Solvay; BASF SE; Evonik Industries AG; Toray Advanced Composites; Saint Gobain Aerospace; DuPont; Celanese Corporation; Sumitomo Chemical Co., Ltd.; Covestro AG; the Mitsubishi Chemical Group of companies; PPG Industries, Inc.; Röchling

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerospace Plastics Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented global aerospace plastics market report based on product, process application, end use, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Polyetheretherketone (PEEK)

-

Polyphenylsulfone (PPSU)

-

Polycarbonate (PC)

-

Polyetherimide (PEI)

-

Polymethyl Methacrylate (PMMA)

-

Polyamide (PA)

-

PolyPhenyleneSulfide (PPS)

-

Polyamide-imide (PAI)

-

Polyphenylene ether (PPE)

-

Polyurethane (PU)

-

Others

-

-

Process Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Injection Molding

-

CNC Machining

-

Thermoforming

-

Extrusion

-

3D Printing

-

Others(Blow and Roto Molding)

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Cabin Interiors

-

Structural Components

-

Electrical, Electronics, and Control Panel

-

Window & Windshields, Doors, and Canopies

-

Flooring & Wall Panels

-

-

End Use Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Commercial & Freighter Aircraft

-

General Aviation

-

Military Aircraft

-

Rotary Aircraft

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Western Europe

-

Germany

-

UK

-

France

-

-

Eastern Europe

-

China

-

Asia

-

India

-

Japan

-

-

Southeast Asia

-

Indonesia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates

-

-

Frequently Asked Questions About This Report

b. The global aerospace plastics market size was estimated at USD 8.15 billion in 2024 and is expected to reach USD 8.79 billion in 2025.

b. The global aerospace plastics market is expected to witness a compound annual growth rate of 9.6% from 2025 to 2030 to reach USD 13.89 billion by 2030.

b. Polyetheretherketone (PEEK) in the product segment accounted for the largest share of more than 61.6% in 2024 in terms of revenue. This is attributed to the inherent flame retardancy, excellent stress cracking resistance, outstanding mechanical strength, excellent resistance to rain erosion, and low smoke & toxic gas emissions properties of PEEK.

b. SABIC, BASF SE, Solvay, Victrex plc, Evonik Industries AG, Röchling, DuPont, Toray Advanced Composites, and Sumitomo Chemical Company are some of the key players operating in the aerospace plastics market.

b. Key factors that are driving the market growth include due to their durability, high strength, light weight, and high corrosion and chemical resistance and their increasing use for assembling heads-up-displays, night vision systems, firearms, and other military and aerospace applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.