- Home

- »

- Communication Services

- »

-

Africa Roaming Tariff Market Size, Industry Report, 2030GVR Report cover

![Africa Roaming Tariff Market Size, Share & Trends Report]()

Africa Roaming Tariff Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (National, International), By Distribution Channel (Retail Roaming, Wholesale Roaming), By Service (Voice, SMS, Data), By Country, And Segment Forecasts

- Report ID: GVR-4-68038-195-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Africa Roaming Tariff Market Size & Trends

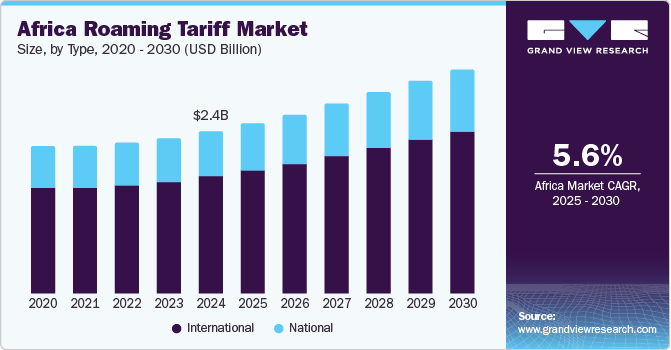

The Africa roaming tariff market size was estimated at USD 2.36 billion in 2024 and is projected to grow at a CAGR of 5.6% from 2024 to 2030. The increasing number of international travelers for business and leisure has significantly boosted the demand for roaming services. As more people travel across borders, seamless mobile connectivity becomes paramount. Furthermore, the rapid adoption of smartphones and the internet across the continent has led to a surge in mobile data usage, further driving the demand for affordable roaming tariffs. These factors are expected to drive market growth over the forecast period.

Expanding mobile networks into remote areas has improved connectivity, encouraging more people to travel and stay connected. Regulatory initiatives to reduce roaming charges and enhance consumer protection have also played a crucial role in market growth. Furthermore, partnerships between local and international telecom operators have facilitated the provision of competitive roaming plans, making it easier for users to access mobile services while traveling.

The market for roaming tariffs in Africa is expected to witness significant growth over the forecast period owing to an increasing mobile subscriber base and rising internet penetration. The number of smartphone users in Africa is growing at a substantial rate.

Sub-Saharan Africa is expected to have a major contribution to the market growth owing to increasing mobile subscriptions in this country. According to the GSMA Association, by 2025, 50.0% of the total population is projected to subscribe to mobile services. Countries such as Nigeria, Ethiopia, the Democratic Republic of the Congo (DRC), Tanzania, and Kenya, will contribute to the growing penetration rate of the mobile subscriber base. GSMA also states that subscriber penetration of the Economic Community of West African States (ECOWAS) and the Southern African Development Community (SADC) will increase from 48.0%, and 44% in 2018 to 54%, and 50% respectively by 2025.

Type Insights

The international segment dominated the market with the largest revenue share of 72.1% in 2023. The increasing number of international travelers for business and leisure has significantly boosted the demand for international roaming services. With globalization, more people travel across borders, necessitating reliable and affordable mobile connectivity. Furthermore, the proliferation of smartphones and the internet has led to a surge in mobile data usage, particularly among international travelers who rely on their devices for navigation, communication, and accessing information. Additionally, expanding mobile networks and adopting advanced technologies such as 4G and 5G have improved connectivity and service quality, making international roaming more attractive. Regulatory initiatives to reduce roaming charges and enhance consumer protection have also been crucial in driving market growth.

The national segment is expected to grow at a significant CAGR of 5.4% over the forecast period. This growth is driven by the increasing internal mobility within African countries, fueled by urbanization and economic development and boosts the demand for national roaming services. As people move between cities and countries for work, education, and other purposes, seamless mobile connectivity becomes essential. Moreover, expanding mobile network infrastructure into rural and underserved areas enhances connectivity, making national roaming services more accessible to a larger population. Additionally, the growing adoption of smartphones and mobile internet services drives higher data usage, further propelling the demand for national roaming. Regulatory efforts to standardize and reduce national roaming charges are crucial in encouraging market growth. Lastly, telecom operators are increasingly offering attractive national roaming plans and packages to cater to the diverse needs of domestic travelers, ensuring they stay connected without incurring high costs.

Service Insights

Data service dominated the market with the largest revenue share in 2024. The widespread adoption of smartphones and mobile internet has led to a significant increase in data consumption among travelers. As more people rely on their devices for navigation, communication, and accessing information while abroad, the demand for data services has surged. Furthermore, expanding 4G and 5G networks across the continent has improved the quality and speed of mobile internet, making data services more attractive to users. Additionally, the increasing number of international travelers for business and leisure has further driven the need for reliable and affordable data roaming services. Regulatory initiatives to reduce data roaming charges and enhance consumer protection have also played a crucial role in market growth.

The voice service segment is expected to witness a significant CAGR over the forecast period. The increasing number of international and domestic travelers who prefer traditional voice calls for communication, especially in areas with limited internet connectivity, is boosting the demand for voice services. The expansion of mobile network infrastructure, including the deployment of advanced technologies such as VoLTE (Voice over LTE), enhances the quality and reliability of voice calls, making them more appealing to users. Additionally, regulatory efforts to reduce voice roaming charges and improve consumer protection encourage more people to use voice services while traveling. Furthermore, telecom operators offer attractive voice roaming packages and plans, ensuring travelers can stay connected with their contacts without incurring high costs.

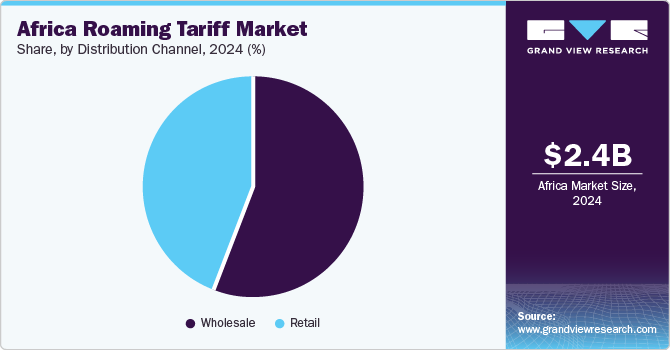

Distribution Channel

Wholesale roaming dominated the market with the largest revenue share in 2024. The increasing collaboration between local and international telecom operators has facilitated wholesale roaming services, allowing operators to offer competitive rates and extensive coverage. This has made it easier for smaller operators to provide roaming services without investing heavily in infrastructure. Moreover, the growing number of international travelers has boosted the demand for wholesale roaming agreements as operators seek to ensure seamless connectivity for their customers across borders. Regulatory initiatives to reduce wholesale roaming charges and promote fair competition have also played a crucial role in market growth.

Retail roaming is expected to grow at the fastest CAGR over the forecast period. The increasing number of individual travelers, both for business and leisure, is boosting the demand for retail roaming services. As more people travel across borders, the need for affordable and reliable mobile connectivity becomes essential. The proliferation of smartphones and mobile internet has led to a surge in data usage among travelers, further driving the demand for retail roaming plans. Additionally, the expansion of mobile networks and the adoption of advanced technologies such as 4G and 5G have improved connectivity and service quality, making retail roaming more attractive to users. Regulatory initiatives to reduce retail roaming charges and enhance consumer protection have also played a crucial role in encouraging market growth.

Country Insights

South Africa's roaming tariff dominated the African market with the largest revenue share of 28.1% in 2023. South Africa’s major business and tourism hub position attracts many international travelers, increasing the demand for roaming services. The country’s advanced mobile network infrastructure, including widespread 4G and emerging 5G services, ensures high-quality connectivity, making it a preferred destination for travelers requiring reliable mobile services. Additionally, South Africa’s regulatory environment, which promotes competitive pricing and consumer protection, has made roaming tariffs more attractive. The presence of major telecom operators offering a variety of roaming packages also plays a crucial role in capturing a large market share. Moreover, the strategic partnerships between South African telecom operators and international counterparts facilitate seamless roaming experiences, further driving the market’s growth.

Kenya Roaming Tariff Market Trends

Kenya roaming tariff market is projected to grow steadily over the forecast period. With the continued expansion of mobile network coverage and increased smartphone penetration in Kenya, the number of mobile subscribers traveling abroad is growing.

Key Africa Roaming Tariff Company Insights

Some of the key players operating in the market include America Movil, AT&T Inc., Bharti Airtel Ltd, China Mobile Ltd, and others. The market for roaming tariffs in Africa is moderately consolidated due to abundant growth opportunities in the country. As a result, all established players strive to maintain their market positions. These players introduce new service lines at competitive prices and engage in mergers, acquisitions, and strategic partnerships.

-

America Movil is a major telecommunications company that offers many services, including fixed-line, mobile phone, broadband, digital television, and IPTV. The company is known for its extensive reach, serving millions of customers across various countries. It operates under several brand names, such as Claro, Telcel, and Tracfone. The company is also notable for its sustainability efforts and corporate governance practices.

Key Africa Roaming Tariff Companies:

- America Movil

- AT&T Inc.

- Bharti Airtel Ltd

- Deutsche Telekom AG

- Digicel Group

- China Mobile Ltd

- Sprint Corporation

- Telefonica SA

- Verizon Communications Inc.

- Vodafone Grp plc

Recent Developments

-

In June 2022, Bharti Airtel Ltd. acquired spectrum to expand its 4G network in the Democratic Republic of Congo, Africa. It is stated to be a 58-megahertz (MHz) spectrum that will spread across 900, 1800, 2100, and 2600 MHz bands.

-

In June 2022, The Posts and Telecommunications Regulatory Authority of Zimbabwe (POTRAZ) announced plans to monitor telecommunications traffic. This examination is said to be done for revenue assurance purposes.

Africa Roaming Tariff Market Scope

Report Attribute

Details

Market size value in 2025

USD 2.48 billion

Revenue forecast in 2030

USD 3.26 billion

Growth rate

CAGR of 5.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Type, distribution channel, service

Country scope

Africa

Key companies profiled

America Movil; AT&T Inc.; Bharti Airtel Ltd.; China Mobile Ltd; Deutsche Telekom AG; Digicel Group; Sprint Corporation; Telefonica SA; Verizon Communications Inc.; Vodafone Grp plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Africa Roaming Tariff Market Report Segmentation

The report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Africa roaming tariff market report based on type, distribution channel, and service:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

National

-

International

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

Wholesale

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Voice

-

SMS

-

Data

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

South Africa

-

Nigeria

-

Kenya

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.