- Home

- »

- Homecare & Decor

- »

-

Africa Safari Tourism Market Size, Industry Report, 2030GVR Report cover

![Africa Safari Tourism Market Size, Share & Trends Report]()

Africa Safari Tourism Market Size, Share & Trends Analysis Report By Type (Adventure Safari, Private Safari), By Accommodation Type (Safari Resorts & Lodges, Safari Camps), By Group, By Booking Mode, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-219-9

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Africa Safari Tourism Market Size & Trends

The Africa safari tourism market size was estimated at USD 16.90 billion in 2023 and it is expected to grow at CAGR of 6.2% from 2024 to 2030. Increase in disposable income and social media driven trends are two key reason behind projected growth of this market. The industry is most likely to generate greater demands owing to factors such as stimulating market trends heavily influenced by social media platforms, growing desire to engage in unique travel experiences, rising awareness about significance of wildlife, trending travel ideas to explore different landscapes across the world, and presence of companies and businesses which provide assistance in planning tours around the world.

The Africa safari tourism market accounted for 48.8% of global safari tourism market revenue in market in 2023. Many tourists and wildlife admirers are drawn to this experience owing to numerous reasons such as Unique Wildlife sightings, Adventure and Thrill offered by it, escape and relaxation it provides. Those days are long gone when tourist would just visit places, capture moments in camera and leave. The young travellers now prefer immersive experiences. This aspect plays vital role in generating growth for Africa safari tourism market. Increasing influence of social media platforms, influencers and celebrities, peer-pressure and few other factors assist the trends in this market.

Government authorities in the region have been promoting the safari tourism experience across the globe. Tourism brings in innumerable tourists in the region, which in turn helps the economies of different countries and contributes to growing inbound foreign currency. In addition, the demand for immersive experience through safari travels in wildlife sanctuaries, marine parks, natural habitats of rarely seen animal such as elephants, tigers, etc., has been growing like never before after pandemic period, the times of strict lockdowns and restrictions of movements.

In addition, governments and travel industry participants have been collaborating to promote safari tourism as it results in enhanced job creation, increased revenue, cultural exchange, and more. These initiatives have been working like an effective marketing technique to generate greater demand for safari tourism in the region. Collaborated effort and partnerships among key countries and companies have been attracting many tourists in the region.

Owing to increased penetration of social media, other aspects associated with travel and tourism such as photography, video contents, blogs and arts have been creating unprecedented stimulus for the potential customers of this industry. Young and mid-age tourists who spend several hours of the day consuming such contents through internet primarily drive this market.

Market Concentration & Characteristics

The Africa safari tourism market is growing at accelerating pace and the growth stage is identified as medium. This market is characterised with companies that have been in the business since a very long time as well as new market entrants who have been attracting new customers from the different parts of the world. This industry is expected to gain pace in terms of growth in upcoming years. Tour advisors and organisers have been using expertise of local guides, personnel and assistance provided by government authorities to reach enhanced service quality and reduce associated risks.

Degree of innovation is at low level, as the experience does not really involve technology aspect in it. Use of vehicles, gadgets used to track and predict the movement of wild animals, safety features, preventive measures, inclusion of connectivity are some of the areas where innovation has helped this industry to enhance their operations. However, the product itself, experience of safari tourism has not been upgraded or changed entirely with help of innovation.

Level of M&A (mergers & acquisitions) is identified as moderate. The key companies operating at global scale tend to acquire companies, which are operating in particular region or segment only, at a smaller or medium scale. In addition, this industry is characterised by numerous collaborations and partnerships, which are developed with an intent of effective operations and collective effort to tackle problems in efficient implementation of planned tours.

This industry is highly impacted by the regulations established by the government bodies and basic wildlife related etiquette. To safeguard the public health, to protect wildlife, to adhere with compliance and government regulations, to promote responsible tourism are some of the functions which companies have to take care of. The key regulations, which have an impact on this industry, are wildlife protection laws, conservation and environmental regulations, licensing and permitting, safety and welfare standards, international agreements and conventions, community engagement and indigenous rights.

Compliance with regulatory framework is crucial in this business, as every operator needs to ensure legal operations, work without harming environmental sustainability, and consciously uphold the ethical standards while organising and operating through safaris. Often these safaris are organised in preserved natural habitats of wild animals, which makes it necessary of the participants to obtain required permits and stay informed about relevant regulations related to the safaris.

Type Insights

The adventure safari market in Africa held revenue share of 50.43% in 2023. This is one of the most commonly chosen type of safaris by tourists across the world. Thrilling activities that offers experiences beyond conventional wildlife sightings are part of these adventure safaris. The allure of Africa coupled with close encounters with wildlife, night safaris, rides in deepest part of the African forests and more. Adventure safaris are often opted by young customers, who prefer seeking adventures across the globe while they travel with their friends.

Africa private safari market is expected to grow at CAGR of 6.2% from 2024 to 2030. This projected growth can be attributed to increasing disposable income levels, shifting preferences towards private travels instead with larger groups, offers related to customised tours and enhanced experiences delivered through such safaris. Those who want to engage in specialised experiences and original raw essence of the wildlife by paying premium prices primarily pick this alternative. These safaris are planned and tailored according to customers’ requirements and expectations.

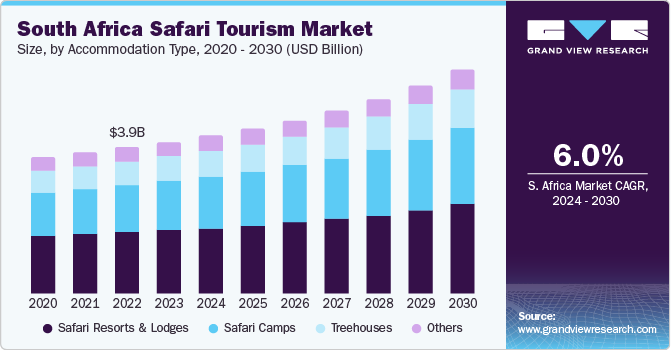

Accommodation Type Insights

The safari resorts & lodges market in Africa held revenue share of 41.37% in 2023. This is mainly because of the additional safety feature this accommodation type offers. Those who are willing to engage in wilder experience of the safaris and adventure often prefer camps and treehouses. Solo travellers tend to choose such alternatives. However, tourists travelling with families, friends, spouses generally choose safer option while maintaining the essence of the travel, that is, safari tourism. These safari resorts are surrounded by abundance of nature and they offer other amenities such as temperature control, internet connections, spa facilities, kitchen with cuisines across the world, phone charging facilities, uninterrupted energy supply and more. The lavish infra and locations closer to civilisation adds extra value.

Safari camps market in Africa is expected to grow at CAGR of 6.9% from 2024 to 2030. This growth can be attributed to factors such as camps located right next to natural landscapes, water bodies, and forests, easier accessibility to the key spots such as big migration hotspots along the Mara River and increased possibility of wildlife sightings and closure encounters through seasonal movements of wildlife.

Group Insights

The participation of couples in Africa safari tourism market held revenue share of 44.58% in 2023. Safari tourism is widely preferred by couples as one of the most exciting adventure gateway. Younger and mid-age couples from across the globe tend to prefer unique experiences such as opportunity to explore natural beauty of landscapes, thrilling encounters with wild animals, memorable sights and more. These couple often choose their safari tours, which are characterised by combination of luxurious accommodations and higher possibilities of wildlife sightings. Camps and resorts that offer wellness amenities coupled with adventurous experience are preferred by these couples.

The participation group of friends in the Africa safari tourism market is expected to grow at CAGR of 6.4% from 2024 to 2030. This is one of most popular choices that drives the growth for safari markets across the globe. Group of young friends tend to choose adventure safaris and thrill-based experiences. According to Adventure Travel Trade Association (ATTA), approximately 23% of adventure travellers chose to travel with their friends in year 2021.

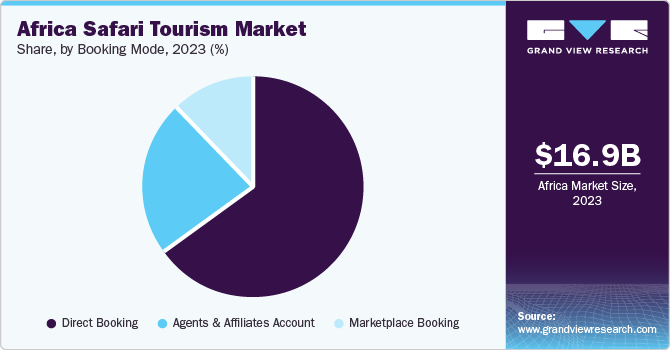

Booking Mode Insight

Africa safari tourism market through direct booking held revenue share of 65.12% in 2023. The direct booking was not even imagined by many tourists a few years back. However, the emergence of internet, increased awareness about the world tourism, easier accessibility to information regarding safari tours and their nature, presence of booking platforms, and advantages attained through direct bookings have been encouraging the customers to choose direct bookings instead of involving agents or third-party organisers.

Marketplace bookings in the Africa safari tourism markets are on rise and are expected to grow at CAGR of 7.5% from 2024 to 2030. Online travel agencies (OTAs) and platforms have been providing a service where customers get to choose their tours, search for alternatives, compare factors such as prices, offerings, experiences and organise own customised safaris as well. These platforms also offer customer support services where tourists get answer to each of their questions before paying or during the travel.

Country Insights

South Africa Safari Tourism Market Trends

South Africa safari tourism market held 23.92% of the African market revenue in 2023. This country has presence of key safari spots such as Kruger National Park, Madikwe Game Reserve, Addo Elephant National Park, Hluhluwe-Imfolozi Game Reserve, Karoo National Park, Kgalagadi Transfrontier Park and more. Popular safari experiences such as Pafuri Walking Safaris, Samara Karoo, Royal Malewane, Camp Figtree, etc. have been attracting tourists from several countries. This has been contributing significantly to growth of the market.

Tanzania Safari Tourism Market Trends

Safari tourism market in Tanzania is expected to grow at CAGR of 6.5% from 2024 to 2030. This market has been experiencing overwhelming response from a few years owing to presence of locations such as Northern Safari Circuit, which consists safaris through areas such as Lake Manyara, Serengeti, Ngorongoro, Tarangire and Kilimanjaro.

Key Africa Safari Tourism Company Insights

The industry is characterized by the presence of major domestic and regional companies and emerging players. Major players of the industry emphasize product innovation & differentiation and unique designs aligned with the changing consumer trends. These players have extensive distribution networks worldwide, which enable them to reach a wide customer base and expand into emerging markets. Emerging companies, on the other hand, are focused on niche markets, specialized product portfolios, and fresh designs to improve their visibility in the market.

-

African Wildlife Safaris was founded in 1985. The company offers diverse portfolio of safaris, which include elite accommodation and cultural experiences. It is one of the well-known family-owned tour company.

-

Wilderness, established in 1983, is one of the prominent tourism companies, which operates across numerous African countries such as Botswana, Namibia, Zambia, Zimbabwe, Kenya, Rwanda, and Seychelles. The company caters to different consumer groups such as families, solo travellers, and couples as well.

-

Thomas cook is global travel and tourism company, which operates in Africa Safari Market as well. It is privately held company and offers safaris in different countries including Kenya, South Africa, and Tanzania.

Key Africa Safari Tourism Companies:

- Acacia Adventure Holidays

- Absolute Africa

- Global Journeys

- Wilderness

- Thomas Cook

- Scott Dunn Ltd.

- Rothschild Safaris

- Gamewatchers Safaris

- Backroads

- G Adventures

Recent Developments

-

In February 2024, international and dynamic hotel group, with ten distinguished brands and more than one thousand hotels across the world, Radisson Hotel Group, announced inauguration of their first safari hotel in South Africa, named Radisson Safari Hotel Hoedspruit.

-

In September 2023, Ximuwu Lodge announced that they would be commencing with their latest safari offering featuring wheelchair-accessible safari in South Africa. The aim behind this was expressed as to ensure that watching wildlife is a privilege which can be enjoyed by anyone and everyone. This includes sightings of animals such as hyenas, leopards, lions, rhinos, giraffes and more.

Africa Safari Tourism Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.60 billion

Revenue Forecast in 2030

USD 25.17 billion

Growth Rate

CAGR of 6.2% from 2024 to 2030

Actual data

2018 - 2023

Forecasts period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast; company ranking; competitive landscape; growth factors; and trends

Segments Covered

Type, accommodation type, group, booking mode, country

Regional scope

South Africa; Kenya; Tanzania; Botswana; Namibia

Key companies profiled

Acacia Adventure Holidays; Absolute Africa; Global Journeys; Wilderness; Thomas Cook; Scott Dunn Ltd.; Rothschild Safaris; Gamewatchers Safaris; Backroads; G Adventures

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Africa Safari Tourism Market Report Segmentation

This report forecasts growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Africa safari tourism market report based on type, accommodation type, group, booking mode and country:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Adventure Safari

-

Private Safari

-

Others

-

-

Accommodation Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Safari Resorts & Lodges

-

Safari Camps

-

Treehouses

-

Others

-

-

Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

Friends

-

Families

-

Couples

-

Solos

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct Booking

-

Agents and Affiliates Account

-

Marketplace Booking

-

-

Country Outlook

-

South Africa

-

Kenya

-

Tanzania

-

Botswana

-

Namibia

-

Frequently Asked Questions About This Report

b. The Africa safari tourism market was estimated at USD 16.90 billion in 2023 and is expected to reach USD 17.60 billion in 2024.

b. The Africa safari tourism market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030 to reach USD 25.17 billion by 2030.

b. South Africa dominated the Africa safari tourism market with a share of around 23.9% in 2023. Popular safari experiences such as Pafuri Walking Safaris, Samara Karoo, Royal Malewane, Camp Figtree, etc. have been attracting tourists from several countries. This has been contributing significantly to growth of the market.

b. Some of the key players operating in the Africa safari tourism market include Acacia Adventure Holidays; Absolute Africa; Global Journeys; Wilderness; Thomas Cook; Scott Dunn Ltd.; Rothschild Safaris; Gamewatchers Safaris; Backroads; G Adventures

b. Increase in disposable income and social media driven trends are two key reason behind projected growth of this market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."