- Home

- »

- Homecare & Decor

- »

-

Safari Tourism Market Size, Share & Trends Report, 2030GVR Report cover

![Safari Tourism Market Size, Share & Trends Report]()

Safari Tourism Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Adventure Safari, Private Safari), By Accommodation Type, By Group (Friends, Family, Couples, Solo), By Booking Mode, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-954-4

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Safari Tourism Market Summary

The Global Safari Tourism Market size was estimated at USD 34,628.9 Million in 2023 and is projected to reach USD 51,460.3 Million by 2030, growing at a CAGR of 5.8% from 2024 to 2030.The increasing interest of bloggers and influencers in safari travel is the key factor fueling the market growth.

Key Market Trends & Insights

- In terms of region, MEA was the largest revenue generating market in 2023.

- Country-wise, Saudi Arabia is expected to register the highest CAGR from 2024 to 2030.

- Based on type, adventure safari dominated the market with the largest revenue share of over 50% in 2023.

- Based on groups, the couples segment dominated the global market with the largest revenue share in 2023.

- Based on booking mode, direct booking mode dominated the global market with the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 34,628.9 Million

- 2030 Projected Market Size: USD 51,460.3 Million

- CAGR (2024-2030): 5.8%

- MEA: Largest market in 2023

There are many travel bloggers and influencers on social networking sites, with a large follower base. These people post their travel content on social media platforms. The increasing preference of people for unique as well as exotic holiday experiences, growth in middle and upper-middle-class expenditure, and the growing impact of social media on the travel industry are the major factors that drive the market growth.

Safari tourism has grown at an augmented pace over the years. One of the significant drivers propelling the growth of the market is the abundant wildlife and diverse natural habitats found in safari destinations. These destinations offer a unique and awe-inspiring opportunity for travelers to experience the beauty of nature and observe a wide range of wildlife species in their natural habitats. The allure of encountering iconic wild animals creates a sense of excitement and adventure for tourists. This has significantly impacted the global safari tourism market resulting in an ever-growing number of travelers looking for a safari tourism experience.

According to a United Nations World Tourism Organization (UNWTO) report titled 'Towards Measuring the Economic Value of Wildlife Watching Tourism in Africa,' wildlife tourism constitutes 7% of global tourism and experiences an annual growth rate of approximately 3%. The report further highlights that 14 African countries collectively generate around USD 142 million through entrance fees for protected sites and areas. This number is expected to grow in the coming years as more travelers, especially millennials, seek tourism activities that allow them to immerse themselves in pristine natural environments and witness wildlife in their natural habitats.

The growing consumer inclination toward sustainable tourism is expected to help hospitality and tourism professionals with an opportunity to recover from the pandemic’s impact and prepare for a more resilient and sustainable future. According to the ‘2023 Sustainable Travel Report’ published by World Economic Forum, around 76% of travelers prefer to travel sustainably and look for sustainable options for travelling. This is expected to offer safari tour operators an opportunity to transform their business models and strategies and set realistic and reasonable parameters around food, flights, accommodation, and transport in their travel policies. With a clear understanding of consumer willingness to spend on their safari tours, tour operators in the market are managing their pricing portfolio to tap into price-sensitive markets.

Market Concentration & Characteristics

The degree of innovation in the safari tourism market is driven by advancements in technology, sustainability, and personalized experiences. Innovations include the integration of eco-friendly practices, such as solar-powered lodges and conservation-focused itineraries, which appeal to environmentally conscious travelers. Technological advancements have enhanced safari experience through the use of high-quality optics for wildlife viewing, GPS tracking for locating animals, and drones for aerial photography. Additionally, there is a growing trend toward bespoke safari experiences that cater to individual preferences, including tailored itineraries, private guides, and luxury amenities. These innovations collectively enhance the appeal and accessibility of safari tourism, making it a dynamic and evolving market.

Regulations have a significant impact on the market by ensuring sustainable practices, protecting wildlife, and preserving natural habitats. Strict regulations help to limit the number of tourists and vehicles in sensitive areas, reducing environmental degradation and disturbance to animals. These regulations often mandate eco-friendly practices for tour operators, such as waste management and energy-efficient lodging, promoting conservation efforts. Additionally, regulations can enhance the safety and quality of the tourist experience by enforcing standards for guides and infrastructure. While compliance with regulations may increase operational costs for safari businesses, it ultimately benefits the industry by promoting long-term sustainability and attracting environmentally conscious travelers.

The industry exhibits significant end-user concentration, with a strong focus on affluent travelers and couples seeking unique and luxurious travel experiences. This segment includes high-income individuals and families, often from developed countries, who prioritize adventure, exclusivity, and premium services in their travel choices. Additionally, there is a notable presence of honeymooners and couples celebrating special occasions, drawn to the romantic and intimate settings that safari destinations offer. The market also caters to niche groups such as wildlife enthusiasts, photographers, and eco-tourists who are willing to invest in high-quality, immersive experiences in the natural world.

Type Insights

Based on type, adventure safari dominated the market with the largest revenue share of over 50% in 2023. Adventure safari offers travelers the opportunity to engage in thrilling activities that go beyond traditional wildlife viewing. Adventure safaris may include activities like walking safaris and hot air balloon rides, which are preferred by adventure-seeking travelers. This is expected to propel the market growth over the forecast period. In addition, social media platforms have started to play a significant role in travel decisions, including adventure safaris.

The demand for private safari is expected to grow at a CAGR of 6.1% over the forecast period. A private safari provides more freedom and security, and the comfort of a personal vehicle and guide. Individuals can choose from luxurious or simple private safaris based on their preferences and budget. According to a survey conducted by SafariBookings, Africa’s safari industry was significantly impacted by the pandemic. However, according to the most recent survey conducted in May 2022, most safari tour operators experienced a significant recovery.

Group Insights

Based on groups, the couples segment dominated the global market with the largest revenue share in 2023. Safari trips provide couples an opportunity to explore breathtaking landscapes and observe exotic wildlife in their natural habitats, creating memorable and shared experiences that strengthen their bond. Additionally, many safari packages include luxury accommodations, such as secluded lodges and tented camps, which offer privacy and high-end amenities. The combination of adventure, romance, and exclusivity makes safari tourism particularly appealing to couples seeking a distinctive and enriching travel experience.

Safari tourism for friends is anticipated to grow at a CAGR of about 6.4% from 2024 to 2030.Group travel, including trips with friends, is a popular choice among travelers, particularly for adventure safari tourism. Millennials, in particular, show a strong interest in group travel experiences. According to the Centre for the Promotion of Imports from developing countries, part of the Ministry of Foreign Affairs of the Netherlands, in 2021, 37% of millennials in Europe preferred to travel with friends. This trend is expected to boost the growth of the segment over the forecast period.

Booking Mode Insights

Based on booking mode, direct booking mode dominated the global market with the largest revenue share in 2023. Direct bookings give travelers better control over their safari experience. They can research and select accommodations, activities, and services that align with their preferences and priorities. For instance, according to the 2022 Adventure Travel Industry Snapshot by the Adventure Travel Trade Association (ATTA), globally, roughly 62% of bookings are directly made with the service provider.

Marketplace booking is anticipated to grow at a CAGR of about 7.7% from 2024 to 2030. Safari tourism through marketplace booking modes, such as online travel agencies (OTAs) or booking platforms, has gained popularity in recent years. Marketplace booking modes provide travelers a convenient and accessible platform to search, compare, and book safari experiences. For example, SafariBookings, the largest and most reliable source for organizing an African safari, allows individuals to compare safari offerings from top-rated travel operators using its online marketplace.

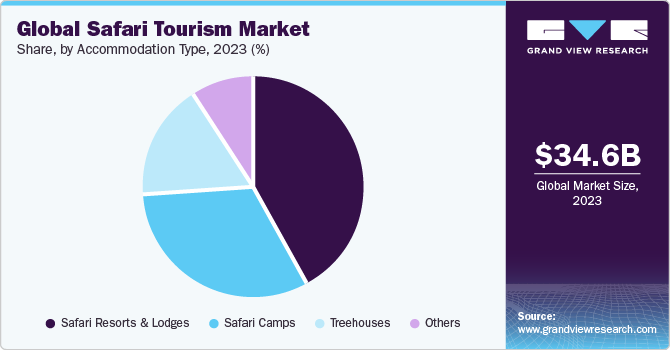

Accommodation Type Insights

Based on accommodation type, safari resorts & lodges dominated the market with the largest revenue share in 2023. With contemporary amenities like climate control, internet & phone connections, and reasonably simple access, safari lodges are typically more lavish and situated slightly closer to civilization, likely favor its preference among consumers. Moreover, due to increased demand for safari tourism, major companies are expanding their accommodation portfolios. For example, Marriott International, Inc. and Baraka Lodges LTD. announced a deal in March 2022 for Marriott to enter the African safari market. The JW Marriott Masai Mara Lodge was scheduled to open in the Mara National Reserve in 2023 and welcome visitors. Visitors will have the chance to view the "Big Five" that call Masai Mara home-lions, leopards, buffalos, rhinoceroses, and elephants.

The demand for safari camps is expected to grow at a CAGR of 6.9% over the forecast period. Tented safaris, known as "safari camps", are typically found next to magnificent natural settings where wildlife can graze in abundance. These can also be found next to water bodies, where animals gather during the day. These are an excellent chance to get up close and personal with the wild game without going too far into the woods. Growing demand among consumers toward experiencing the close encounter with animals is likely to favor the demand for safari camps.

Regional Insights

Africa Safari Tourism Market Trends

The safari tourism market in Africa held a global revenue share of about 50% in 2023. High spending power and growing consumer preference for family vacations have propelled the demand for safari tourism in the region. In addition, Africa is gradually becoming a favored destination for international travelers seeking sunny beaches, national parks, ecotourism products, and exotic culture and food. As per the United Nations World Tourism Organization, Africa recovered around 96% of pre-pandemic visitors in 2023. Moreover, South Africa experienced around 1.8 million tourist arrivals between January and March 2024, from to rest of the African continent, showing a significant increase of 74.5% of all arrivals compared to the same period in 2023.

Tanzania safari tourism market is expected to grow at a CAGR of 7.1% from 2024 to 2030. Tanzania is home to iconic destinations such as the Serengeti National Park and Mount Kilimanjaro, which attract adventure seekers and wildlife enthusiasts from around the world. Tanzania also has a well-developed tourism infrastructure, with numerous safari lodges, camps, and experienced guides.

Middle East Safari Tourism Market Trends

The safari tourism market in the Middle East is expected to grow at a CAGR of about 7.1% from 2024 to 2030. Tourists are attracted to the region by the safari parks' conservation efforts and other influencing factors. During the May 2023 Arabian Travel Market (ATM), the sustainable trends of green airlines, sustainable attractions, eco-hospitality, locally produced goods, and government initiatives were focal points. In addition, the Sand Sherpa in Dubai, for instance, offers eco-adventures including animal safaris in protected regions and eco-friendly camping. Market players in the Middle East are seamlessly blending culture and nature to curate retreats in remote locations, creating a harmonious synergy that mirrors the essence of safari tourism, where travelers can immerse themselves in both the rich cultural heritage and diverse natural landscapes of the destinations.

Key Safari Tourism Company Insights

The industry is characterized by the presence of global companies and emerging players. The major players of the industry emphasize product innovation & differentiation and unique designs aligned with the changing consumer trends. These players have extensive distribution networks worldwide, which enable them to reach a wide customer base and expand into emerging markets. The emerging companies, on the other hand, are focused on niche markets, specialized product portfolios, and fresh designs to improve their visibility in the market.

TUI Group is one of the largest players with a complete portfolio in the safari market. The company's operations are divided into several categories, including markets and airlines, holiday experiences, and other business sectors. The company has 1,600 travel agencies, 6 airlines with around 150 aircraft, 18 cruise liners, and 380 hotels & resorts. Its integrated offerings provide 27 million customers with an unmatched holiday experience in 180 countries.

Key Safari Tourism Companies:

The following are the leading companies in the safari tourism market. These companies collectively hold the largest market share and dictate industry trends.

- Wilderness

- Thomas Cook Group

- Singita

- Scott Dunn Ltd.

- Rothschild Safaris

- &Beyond

- Abercrombie & Kent USA, LLC

- Gamewatchers Safaris Ltd.

- Backroads

- TUI Group

- Angama

- One&Only

- Wellworth Hospitality Collection

- Marriott International, Inc.

Recent Developments

-

In June 2023, the Marriott International, Inc. partnered with Delaware Investment Limited to establish the first JW Marriott luxury safari lodge in the Serengeti National Park of Tanzania. The resort, which is scheduled to open in 2026, will be in the national park that is home to some of the world's greatest herds, limitless grasslands, and the Great Migration. The resort, which is nestled between the Mbalageti and Grumeti rivers, will offer views of the plains beyond as well as the abundance of wildlife that frequents the rivers to the north and south.

-

In May 2023, & Beyond announced the rebuilding of its Phinda Forest Lodge, situated in &Beyond Phinda Private Game Reserve, KwaZulu Natal, South Africa. To ensure minimal disruption to the delicate habitat, the lodge refurbishment will leverage the existing lodge and room structures instead of a complete rebuild. This approach allows for preserving the lodge's original 'Zulu-zen' concept while incorporating updated architectural elements.

-

In April 2023, Singita unveiled its latest wellness concept, "Wholeness," which emphasizes customized spa experiences for the upcoming summer. The new offerings incorporated locally sourced products, such as riverbank sand for a rejuvenating foot scrub ritual at Singita Sabi Sand. In addition, guests can look forward to an expanded selection of plant-based dishes at the lodges and camps. Furthermore, the Mara River Tented Camp will undergo a summer relaunch, featuring an updated design.

Safari Tourism Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 36.07 billion

Revenue forecast in 2030

USD 51.46 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Report updated

June 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type; accommodation type, group, booking mode, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East, and Africa

Country scope

U.S.; Canada; France; Germany; UK; Spain: Italy; China; India; Bhutan; Nepal; Brazil; Saudi Arabia; South Africa; Kenya; Tanzania; Botswana; Namibia

Key companies profiled

Wilderness; Thomas Cook Group; Singita; Scott Dunn Ltd.; Rothschild Safaris; &Beyond; Abercrombie & Kent USA, LLC; Gamewatchers Safaris Ltd.; Backroads; TUI Group; Angama; One&Only; Wellworth Hospitality Collection; Marriott International, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Safari Tourism Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global safari tourism market report based on type, accommodation type, group, booking mode, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Adventure Safari

-

Private Safari

-

Others

-

-

Accommodation Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Safari Resorts & Lodges

-

Safari Camps

-

Treehouses

-

Others

-

-

Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Friends

-

Families

-

Couples

-

Solos

-

-

Booking Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct Booking

-

Agents And Affiliates Account

-

Marketplace Booking

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Bhutan

-

Nepal

-

-

Central & South America

-

Brazil

-

-

Middle East

-

Saudi Arabia

-

-

Africa

-

South Africa

-

Kenya

-

Tanzania

-

Botswana

-

Namibia

-

-

Frequently Asked Questions About This Report

b. The global safari tourism market was estimated at USD 34.62 billion in 2023 and is expected to reach USD 36.07 billion in 2024.

b. The global safari tourism is expected to grow at a compound annual growth rate of 6.1% from 2024 to 2030 to reach USD 51.46 billion by 2030.

b. Africa dominated the market with a share of around 49% in 2023. This can be attributed to the regional government's development of various safari parks, which are surrounded by other tourist attractions in addition to hotels and restaurants.

b. Some of the key players operating in the safari tourism market include Wilderness,Thomas Cook Group, Singita, Scott Dunn Ltd., Rothschild Safaris, &Beyond, Abercrombie & Kent USA, LLC, Gamewatchers Safaris Ltd., Backroads, TUI Group, Angama, One&Only, Wellworth Hospitality Collection, and Marriott International, Inc.

b. Key factors that are driving the safari tourism market growth include the increasing interest of bloggers and influencers. Rising demand for increased travel memories, swelling in micro trips, and developing tourism all over the globe is anticipated to drive the safari tourism market.

b. The South Africa safari tourism market size was estimated at USD 4.04 billion in 2023 and is expected to reach USD 4.20 billion in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.