- Home

- »

- Water & Sludge Treatment

- »

-

Africa Water Treatment Chemicals Market Size Report,2030GVR Report cover

![Africa Water Treatment Chemicals Market Size, Share & Trends Report]()

Africa Water Treatment Chemicals Market Size, Share & Trends Analysis Report By Application (Raw Water Treatment, RO, UF & NF Membrane Treatment), By End Use, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-975-5

- Number of Report Pages: 500

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

Report Overview

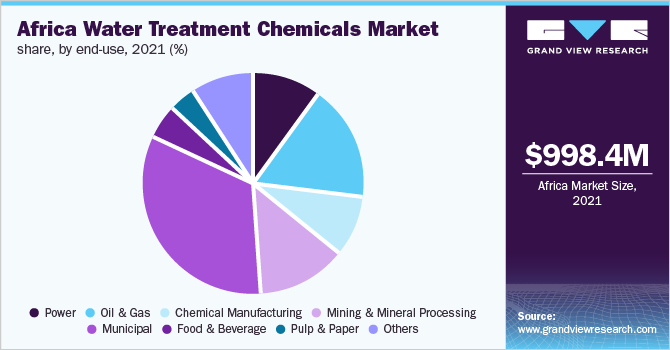

The Africa water treatment chemicals market size was estimated at USD 998.4 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.0% from 2022 to 2030. This is attributed to the growing need for water treatment in the sugar, food & beverages, power, chemical manufacturing, and oil & gas industries, specifically in emerging economies of Africa. Africa is a region with significant growth opportunities. A strong manufacturing sector is one of the drivers for development in Africa. Manufacturing sectors including food & beverages, chemical manufacturing, textile, and other existing industries in Africa are developing and expanding. These manufacturers will directly reflect growth in the demand for the products to address the environmental concerns arising from several manufacturing industries and effluents.

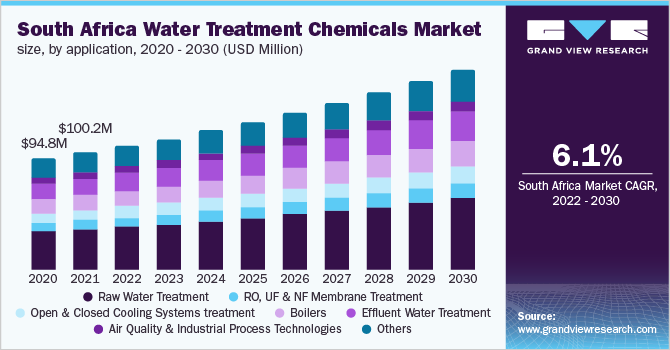

South Africa is the largest market for African water chemicals treatment in the African region. It is considered to be one of the prominent consumers of the product. A large number of environmental contaminants in countries of Africa are generated by industrial operations. These contaminants can reach both, underground and surface resources by the emission of liquid, solid, and gaseous materials into the environment from several industries. The supply of improperly treated water has been a major concern in South Africa.

The demand for the products, which are employed particularly in the mining and mineral processing, petrochemical manufacturing, fertilizer, and refining sectors, is predicted to increase due to the limited supply of water for many industrial applications. These industries together make for a significant revenue share of the African market for the products.

Application Insights

The raw water treatment segment dominated with 34.9% of the revenue share in 2021. The growth of this segment can be attributed to improving process performance and product efficiency for a particular application. This process may vary from one another as they are designed according to specific treatment needs. Before being utilized as makeup water in the majority of utility procedures, raw water must be treated or clarified. Clarification helps avoid scaling, corrosion, and fouling by removing dissolved and suspended solids, bacteria, and other types of impurities.

Other products used in this treatment application are viscosity reducers, decoloring agents, granulation aids, phosphates, strengthening agents, anti-caking agents, wetting agents, solvents, and demulsifiers, among others. Solvents are formulated in a manner that makes them highly efficient in dissolving particles suspended in water. They make the process smooth and efficient.

Following this segment is the effluent water treatment and others. Water systems employ a variety of processes, including chemical and biological processing, which require the use of various chemicals to sanitize and maintain a stable pH level. The major chemicals utilized in effluent treatment are pH controllers, defoamers, coagulants, disinfectants, and others.

Other chemicals that can be used for more specialized applications that are part of effluent treatment processes include certain products containing bacteria for the efficacy of the effluent, these are used in biological treatments.

End-use Insights

The municipal segment dominated the Africa water treatment chemicals market with 28% of the revenue share in 2021. Owing to the strict regulations imposed on effluents pollutants concentration and the increasing volume of urban wastewater, municipal wastewater treatment has become one of the significant environmental issues. It requires post-treatment before membrane-treated water is sent to the distribution.

The treatment of municipal sewage mainly includes chemical coagulants such as iron-based chemicals or aluminum that help in the removal of organic compounds, fluoride, pathogens, and other contaminants. Additionally, sludge conditioners, bio cultures, lime, alum, polyaluminium chloride, several flocculants and coagulants, and other chemicals are included in the treatment of municipal sewage.

Closely following behind is the mining & mineral processing and power segment. A solid, favorable legal and policy framework has been established for mining & mineral processing industry. The power segment includes chemicals such as sodium hypochlorite, antiscalants, coagulants, flocculants, ultrafiltration membranes, corrosion inhibitors, dispersants, sulfuric acid, biocides, algaecides, sodium bisulfate, and others are used to treat power plant’s cooling system.

Power plants, whether powered by nuclear energy or fossil fuels are covered under this segment. In the power industry these products are used in wet cooling towers, decarbonization ion exchange, decarbonization with lime alkali reacting sludge, piping and steam generator, and others.

Country Insights

South Africa dominated the market in 2021 with a revenue share of 10.0%. This is attributed to the large consumption of water for industrial sectors such as mining, oil & gas, sugar processing, and petrochemical manufacturing among others. Major countries including South Africa, Ethiopia, Angola, and other Sub-Saharan African countries are significantly developing their treatment infrastructure to address ongoing water crises in the African region, which is anticipated to drive the demand for the products in the region.

According to the National Development Plan 2030, the Government of South Africa has initiated a program to ensure that all its citizens have access to clean running water in their houses by 2030. This has led the government of the country to set up treatment facilities for proper removal of contaminants before distributing them to the masses, as well as cleaning the effluent in treatment plants before discharging it into water bodies. Such initiatives by governments of different countries in Africa are expected to act as growth opportunities in the region.

Several large- and medium-scale manufacturing industries in Ethiopia have primary-level treatment plants. These plants are not operational on regular basis and are only developed in different industrial facilities to avoid penalties levied against them during inspections conducted by Environment Protection Authority. Very few industries in the country recycle their process water that is severely polluted by toxic chemicals. The surging requirement for establishing effective treatment facilities in the country with recommended guidelines is anticipated to fuel the demand for the product in Ethiopia.

Key Companies & Market Share Insights

The market is very competitive and consolidated with the presence of numerous players. It has the presence of multiple players that are involved in regional expansion, premeditated mergers & acquisitions, and product developments and inventions to increase profits, strengthen their position, and at the same time find innovative and sustainable solutions.

It is established with major applications in food, beverages, mining & mineral processing, chemical manufacturing, municipal, oil & gas, pulp & paper, and power. The manufacturing of chemicals is highly dependent on the adequate availability of several raw materials such as sodium hydroxide, chlorine dioxide, ozone, aluminum, iron, and others at favorable costs.

The market is highly fragmented owing to the presence of a large number of manufacturers of the product. Several manufacturers are also involved in the forward and backward integration. As such, they produce raw materials for manufacturing water treatment chemicals and distribute these chemicals, thereby increasing their profit margins. Some prominent players in the Africa water treatment chemicals market include:

-

SUEZ

-

ACURO ORGANICS LIMITED

-

ALM INTERNATIONAL Group

-

Baker Hughes Company

-

Baroid Industrial Drilling Products

-

BASF SE

-

Buckman

-

BWT Holding GmbH

-

Clariant

-

Cortec Corporation

-

Ecolab Inc.

-

Halliburton

-

Kemira

-

Nouryon

-

Schlumberger Limited

-

SNF

-

Solenis LLC

-

Solvay

-

Dow

-

Veolia

-

Thermax Limited

-

Kurita Water Industries Ltd.

-

Kimleigh Chemicals SA (Pty) Ltd (PTY) LTD

-

Ultra Water (Pty) Ltd

-

Green Water Treatment Solutions

-

TUSCHEMY

Africa Water Treatment Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.05 billion

Revenue forecast in 2030

USD 1.54 billion

Growth rate

CAGR of 5% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million, Volume in Kilotons, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, country

Regional scope

Africa

Country scope

Angola; Botswana; Burkina Faso; Burundi; Cameroon; Congo Brazzaville; Eritrea; Ethiopia; Gabon; Ivory Coast; Kenya; Malawi; Mali; Mauritania; Mozambique; Namibia; Nigeria; Rwanda; Senegal; South Africa; South Sudan; Tanzania; Uganda; Zimbabwe

Key companies profiled

SUEZ; ACURO ORGANICS LIMITED; ALM INTERNATIONAL; Baker Hughes Company; Baroid Industrial Drilling Products; BASF SE; Buckman; BWT Holding GmbH; Clariant; Cortec Corporation; Ecolab; Halliburton; Kemira; Nouryon; Schlumberger Limited; SNF; Solenis LLC; Solvay; Dow; Thermax Limited; Veolia; Kurita Water Industries Ltd.; Kimleigh Chemicals SA (Pty) Ltd (PTY) LTD; Ultra Water (Pty) Ltd; Green Water Treatment Solutions; TUSCHEMY

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Africa Water Treatment Chemicals Market Segmentation

This report forecasts the volume and revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Africa water treatment chemicals market report based on application, end-use, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Raw Water Treatment

-

Pretreatment

-

Antiscalants, Pipeline Cleaning & Passivation Chemicals

-

Biocides (Disinfectants)

-

Coagulants & Flocculants

-

Heavy Metals Removal

-

Dewatering Aids

-

Defoamer & Foam Control Agents

-

pH Control

-

Bio-augmentation products

-

Others

-

-

RO, UF and NF Membrane Treatment

-

Pretreatment

-

Antiscalants, Pipeline Cleaning & Passivation Chemicals

-

Biocides (Disinfectants)

-

Chlorine Removal

-

Dispersants

-

CIP Chemistries

-

Post Treatment

-

pH Control

-

Others

-

-

Open & Closed Cooling Systems treatment

-

Feedwater Pretreatment

-

Antiscalants, Pipeline Cleaning & Passivation Chemicals

-

Biocides (Disinfectants)

-

Fouling Control

-

Corrosion Inhibitors

-

Defoamer & Foam Control Agents

-

pH Control

-

Others

-

-

Boilers

-

Feedwater Pretreatment

-

Internal treatment (Antiscalants & Deposit control)

-

Corrosion Inhibitors for Condensate Treatment

-

Fireside Treatment

-

pH Control

-

Oxygen Scavengers

-

Others

-

-

Effluent Water Treatment

-

Pretreatment

-

Antiscalants, Pipeline Cleaning & Passivation Chemicals

-

Biocides (Disinfectants)

-

Coagulants & Flocculants

-

Heavy Metals Removal

-

Dewatering Aids

-

Defoamer & Foam Control Agents

-

pH Control

-

Bio-augmentation Products

-

Others

-

-

Air Quality & Industrial Process Technologies

-

Dust Control

-

Odor Control

-

Heavy Fuel Oil Combustion Emissions

-

Legionella Control

-

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Power

-

Oil & Gas

-

Chemical Manufacturing

-

Mining & Mineral Processing

-

Municipal

-

Food & Beverage

-

Pulp & Paper

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Africa

-

Angola

-

Botswana

-

Burkina Faso

-

Burundi

-

Cameroon

-

Congo Brazzaville

-

Eritrea

-

Ethiopia

-

Gabon

-

Ivory Coast

-

Kenya

-

Malawi

-

Mali

-

Mauritania

-

Mozambique

-

Namibia

-

Nigeria

-

Rwanda

-

Senegal

-

South Africa

-

South Sudan

-

Tanzania

-

Uganda

-

Zimbabwe

-

Rest of Africa

-

-

Frequently Asked Questions About This Report

b. The global Africa water treatment chemicals market is projected to grow from USD 998.43 million in 2021 to USD 1.05 billion by 2022.

b. The global Africa water treatment chemicals market is projected to grow at a CAGR of 5.0% from 2022 to 2030 to reach USD 1.54 billion by 2030.

b. Raw water treatment emerged as the dominating application segment in 2021. The growth of this segment can be attributed to improve process performance and product efficiency for a particular application.

b. Some key players operating in the Africa water treatment chemicals market include BASF SE, Ecolab Inc., SUEZ, Solenis LLC, Nouryon, Solvay, and Cortec Corporation are the key players having a prominent share in Africa water treatment chemicals market.

b. Increasing demand for Africa water treatment chemicals for usage in food, beverages, Oil & gas, Sugar, and other applications expected to drive the growth of the market during the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."