- Home

- »

- Homecare & Decor

- »

-

Agritourism Market Size, Share And Growth Report, 2030GVR Report cover

![Agritourism Market Size, Share & Trends Report]()

Agritourism Market (2025 - 2030) Size, Share & Trends Analysis Report By Activity (On-farm Sales, Outdoor Recreation, Entertainment, Educational Tourism, Accommodations), By Booking Mode, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-971-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Agritourism Market Summary

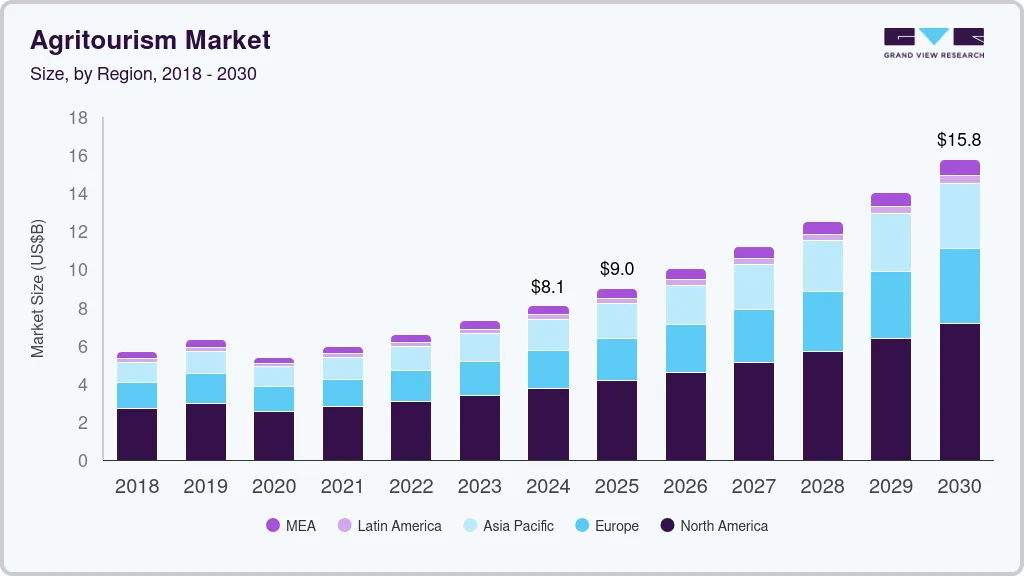

The global agritourism market size was estimated at USD 8.10 billion in 2024 and is projected to reach USD 15.78 billion by 2030, growing at a CAGR of 11.9% from 2025 to 2030. Agritourism has experienced significant growth in recent years, driven by a convergence of factors that appeal to both domestic and international travelers seeking authentic rural experiences.

Key Market Trends & Insights

- North America agritourism market held the largest revenue share of 46.26% in 2024.

- The U.S. agritourism market is expected to grow at a CAGR of 11.3% from 2025 to 2030.

- On the basis of activity, the farm-based outdoor recreation activities captured a market share of 34.26% in 2024.

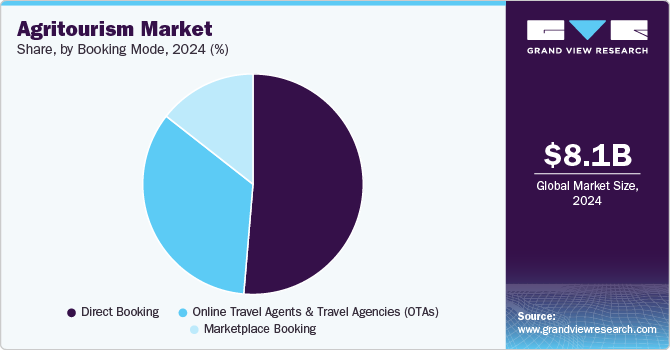

- On the basis of booking mode, in 2024, direct booking of agritours accounted for a market share of 51.34%.

Market Size & Forecast

- 2024 Market Size: USD 8.10 Billion

- 2030 Projected Market Size: USD 15.78 Billion

- CAGR (2025-2030): 11.9%

- North America: Largest market in 2024

This market expansion is underpinned by rising consumer interest in sustainable and immersive travel experiences that connect them with agricultural activities and rural lifestyles. Moreover, heightened awareness and appreciation for local food systems have spurred demand for farm-to-table experiences, where visitors can directly engage in activities such as harvesting produce, participating in cooking classes with farm-fresh ingredients and learning about traditional farming practices from local experts.

The agritourism sector has benefited from strategic collaborations between farms, local governments, and tourism organizations aiming to promote rural development and economic diversification. These partnerships often involve initiatives to enhance infrastructure, promote agritourism routes, and provide tailored marketing efforts that highlight the cultural and environmental richness of rural areas. In June 2024, the Ohio Ecological Food and Farm Association (OEFFA), along with its partners, hosted its annual Farm Tour and Workshop Series. The program featured 24 events, including tours of organic and ecological farms in Ohio and Michigan, and educational workshops. Participants had the opportunity to explore farm fields, gardens, and pastures during 10 OEFFA-led farm tours. Additionally, 14 workshops covered topics such as organic certification, farmland access, and farm employment law, offering valuable insights into sustainable agriculture and local food systems. Additionally, advancements in digital platforms and social media have amplified the visibility of agritourism destinations, allowing farms to reach a broader audience of travelers seeking unique and memorable experiences off the beaten path.

The growth trajectory of agritourism also reflects evolving consumer preferences towards experiential travel, where tourists seek meaningful connections with local communities and environments. This trend has prompted farms worldwide to innovate by offering a range of activities beyond traditional farm tours, including vineyard stays, agricultural festivals, and wildlife safaris integrated with agricultural landscapes. Moreover, the appeal of agritourism extends beyond leisure travelers to include educational institutions and corporate groups seeking team-building activities and sustainable tourism practices.

According to data released by the U.S. Census of Agriculture in 2022, a total of 28,617 farms provided agritourism and recreational services. This substantial number highlights the growing integration of tourism within the agricultural sector, contributing to the overall expansion of the agritourism market. As more farms diversify their operations to include visitor services, the sector is poised for continued growth, driven by increased consumer demand for experiential travel and sustainable tourism offerings. This trend not only enhances farm revenue streams but also strengthens rural economies by attracting both domestic and international tourists seeking authentic agricultural experiences.

In the coming years, the travel industry will witness a sustained shift toward experiential tourism, with travelers increasingly seeking authentic, immersive experiences. Agritourism offers a distinctive platform for visitors to engage with local communities and experience their way of life firsthand. Farm stays, which allow guests to reside on active farms and participate in daily agricultural activities, are gaining significant popularity. Additionally, the rise of culinary tourism, centered on experiencing regional food and beverages, is becoming a key driver within the agritourism sector. Farmers markets, food festivals, and farm-to-table dining experiences offer travelers a unique opportunity to engage deeply with local food culture while supporting sustainable, farm-based economies.

The market is experiencing rapid expansion, supported by strong initiatives from tourism ministries in various countries, which are expected to further fuel market growth. Key drivers such as digital innovation, evolving consumer spending patterns, and increasing urbanization are collectively propelling the demand for agritourism experiences. Farm tourism, offering visitors the chance to immerse themselves in the tranquil rural environment, engage in farm activities, and experience a lifestyle distinct from urban areas, is poised for significant growth. As individuals increasingly seek innovative forms of entertainment and relaxation, the demand for alternative travel experiences in village settings is accelerating, further contributing to the expansion of the farm tourism industry.

For the farming community, agritourism presents a vital opportunity for supplementary income while enhancing global sustainability efforts. This sector holds immense potential for providing profitable business ventures to farmers, alongside creating affordable, family-friendly recreational experiences. As a result, the growing integration of tourism within agricultural practices is driving significant market growth. However, the agritourism industry does face challenges, particularly in the form of unpredictable climate changes and environmental degradation, which present potential risks to its future sustainability.

Activity Insights

The farm-based outdoor recreation activities captured a market share of 34.26% in 2024. The growth of this segment is primarily driven by increasing tourist interest in outdoor sports activities such as hiking, horseback riding, fishing, and hunting. These activities, characterized by relatively low risk, have gained widespread popularity, particularly among children and millennials, contributing to the anticipated market expansion in the coming years. Moreover, the rising demand for adventure-based experiences is further fueling market growth. An increasing preference for agritourism, especially among older age groups seeking immersive rural experiences, is also expected to serve as a key driver in the sector’s continued development during the forecast period.

The farm educational tours are anticipated to grow with a CAGR of 13.6% from 2025 to 2030. Farm-based education tourism is witnessing notable growth as travelers increasingly seek educational and immersive experiences that offer practical insights into sustainable agriculture, environmental stewardship, and rural life. This niche segment, which includes activities such as guided farm tours, workshops on organic farming practices, and hands-on learning about food production, is becoming an attractive option for schools, families, and eco-conscious travelers. The rise of interest in food security, environmental sustainability, and the benefits of locally sourced agriculture has further accelerated demand for farm-based educational programs. These experiences not only support learning but also foster a deeper connection to the land and agricultural heritage, contributing to the overall growth of agritourism. Additionally, collaborations between educational institutions and farms are expanding, allowing this sector to diversify and reach broader audiences, ultimately strengthening its market presence.

Booking Mode Insights

In 2024, direct booking of agritours accounted for a market share of 51.34%. The growing trend of direct bookings for agritours is a reflection of travelers’ desire for personalized and authentic experiences. Many farms and agritourism operators are investing in enhancing their digital presence through user-friendly websites, social media engagement, and direct communication channels. This shift enables them to provide a more tailored experience to customers, ensuring greater flexibility and customization of the tours. Direct bookings not only allow agritourism providers to retain higher profit margins by bypassing intermediary fees but also help foster stronger relationships with guests. By offering bespoke packages, loyalty incentives, and personalized customer service, farms are increasingly able to meet the specific demands of their visitors, further driving the growth of direct bookings in the agritourism market.

The bookings through online travel agents and agencies are anticipated to grow at a CAGR of 12.8% from 2024 to 2030. The increasing reliance on online travel agencies (OTAs) for agritourism bookings is also a significant driver of market growth. OTAs provide a convenient, accessible platform for consumers to compare, review, and book a variety of agritours globally, boosting visibility and market reach for agritourism operators. The partnership with OTAs enables smaller, local farms to tap into a larger, international customer base that would otherwise be difficult to reach. Additionally, the seamless user experience, advanced search functionalities, and competitive pricing options offered by OTAs make them an attractive choice for travelers seeking convenience. As a result, the growing presence of agritours on OTAs is contributing to the broader expansion of the agritourism sector by making it easier for diverse travelers to discover and book unique farm-based experiences.

Regional Insights

North America agritourism market held the largest revenue share of 46.26% in 2024. Agritourism across North America, including Canada and Mexico, is expanding as travelers seek immersive, nature-based experiences. In Canada, provinces like Ontario and British Columbia are leading the market with popular offerings such as wine tours, organic farm visits, and maple syrup production tours. Provincial governments, through programs like Ontario's Agritourism Strategy, are investing in infrastructure and marketing efforts to support farm-based tourism. In Mexico, agritourism is growing, particularly in rural regions known for coffee plantations, tequila farms, and sustainable agriculture projects. These experiences provide international tourists with an authentic connection to the country’s agricultural heritage, further enhancing North America's overall market presence.

U.S. Agritourism Market Trends

The U.S. agritourism market is expected to grow at a CAGR of 11.3% from 2025 to 2030. Agritourism in the U.S. has seen substantial growth, driven by a strong interest in sustainable travel and local food systems. Farmers across the country have increasingly embraced agritourism as a way to diversify revenue streams, offering experiences such as farm stays, vineyard tours, and U-pick operations. Key regions like California’s wine country and the Midwest’s dairy farms have become popular agritourism destinations. Government initiatives, such as the USDA’s support for rural development programs, have played a critical role in promoting agritourism by offering grants and resources to farmers looking to expand their tourism offerings. Additionally, associations such as the North American Farm Direct Marketing Association (NAFDMA) have helped raise awareness and facilitate best practices within the sector, contributing to its continued growth.

Asia Pacific Agritourism Market Trends

Asia Pacific accounted for a revenue share of around 20.15% in 2024. The agritourism market in Asia Pacific is rapidly evolving, with countries like Japan, India, and Australia leading the way. Japan's growing interest in rural revitalization has made farm-based tourism a key part of its tourism strategy, with initiatives like the Japanese Agriculture Ministry's support for "green tourism" driving growth. In India, agritourism is emerging as a significant sector, particularly in Maharashtra and Kerala, where farm stays and spice plantation tours are gaining popularity among both domestic and international travelers. Meanwhile, Australia’s diverse landscapes, from vineyard tours in South Australia to sheep shearing experiences in New South Wales, are increasingly attracting tourists looking for authentic farm-based experiences. Governments in the region are recognizing the potential of agritourism to boost rural economies and are implementing policies to support its expansion across Asia Pacific.

Europe Agritourism Market Trends

The Europe agritourism market is projected to grow at a CAGR of 12.2% from 2025 to 2030. In Europe, agritourism has long been a popular segment, particularly in countries such as Italy, France, and Spain, where centuries-old agricultural traditions are intertwined with rich cultural heritage. Tuscany’s farm stays and vineyard tours, Provence’s lavender fields, and Spain’s olive farms have become iconic destinations for agritourism enthusiasts. The European Union’s Common Agricultural Policy (CAP) supports agritourism by funding rural development programs, which encourage farmers to diversify into tourism. Additionally, European agritourism benefits from government regulations that promote sustainable tourism practices and protect rural landscapes. These policies, coupled with strong demand for farm-based activities and culinary tourism, are driving significant growth in the region.

Key Agritourism Company Insights

The competitive landscape of the agritourism market is characterized by a diverse mix of small-scale local farms, mid-sized agribusinesses, and large-scale operators, all competing to attract a growing base of experiential travelers. Many smaller, family-owned farms differentiate themselves through personalized and authentic experiences, such as organic farm tours, sustainable farming workshops, and unique accommodations like farm stays or glamping options. These operators often rely on direct marketing through websites and social media to engage with niche customer segments, offering tailored packages that cater to eco-conscious consumers and those seeking intimate, hands-on interactions with agricultural life.

In contrast, mid-sized and larger players, including agricultural cooperatives and corporate-backed operations, leverage their scale to offer a wider range of services, including culinary tourism, adventure-based farm activities, and large event hosting, such as weddings and corporate retreats.

Key Agritourism Companies:

The following are the leading companies in the agritourism market. These companies collectively hold the largest market share and dictate industry trends.

- Farm to Farm Tours

- Bay Farm Tours

- Tourism Prince George

- Star Destinations

- Expedia, Inc.

- Greenmount Travel

- Blackberry Farm, LLC

- Ruppier Tours

- Hermitage Farm

- Select Holidays

Recent Developments

-

In June 2024, Tourism Prince George launched a new self-guided outing titled Farm Tour, aimed at enthusiasts of local growers and sustainable food practices. The tour spans 15 distinct locations, featuring six farms situated within a one-hour radius of the city, in addition to markets, restaurants, and local establishments that prioritize sourcing from regional growers.

-

In September 2024, the Great Canadian Farm Tour reemerges for its fourth season, uniquely positioned in the fall to highlight the diverse aspects of Canadian agriculture during this distinct season. From October through December, Agriculture in the Classroom Canada (AITC-C) and its ten provincial affiliates invite students nationwide to engage with the harvest experience and gain insights into fall operations within the agricultural and food sectors.

Agritourism Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.01 billion

Revenue forecast in 2030

USD 15.78 billion

Growth rate

CAGR of 11.9% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Activity, booking mode, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Farm to Farm Tours; Bay Farm Tours; Tourism Prince George; Star Destinations; Expedia, Inc.; Greenmount Travel; Blackberry Farm, LLC; Ruppier Tours; Hermitage Farm; Select Holidays

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Agritourism Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the agritourism market report based on activity, booking mode, and region:

-

Activity Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-farm Sales

-

Outdoor Recreation

-

Entertainment

-

Educational Tourism

-

Accommodations

-

Others

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct Booking

-

Online Travel Agents and Travel Agencies (OTAs)

-

Marketplace Booking

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global agritourism market was estimated at USD 8.10 billion in 2024 and is expected to reach USD 9.01 billion in 2025.

b. The global agritourism market is expected to grow at a compound annual growth rate of 11.9% from 2025 to 2030, reaching USD 15.78 billion by 2030.

b. North America dominated the agritourism market with a share of 46.26% in 2024. Agritourism across North America is expanding significantly as travelers seek immersive, nature-based experiences. In Canada, provinces like Ontario and British Columbia are leading the agritourism market with popular offerings such as wine tours, organic farm visits, and maple syrup production tours.

b. Some of the key players operating in the agritourism market include Farm to Farm Tours, Bay Farm Tours, Tourism Prince George, Star Destinations, Expedia, Inc., Greenmount Travel, Blackberry Farm, LLC, Ruppier Tours, Hermitage Farm, and Select Holidays.

b. The growth of the global agritourism market is majorly driven by rising consumer interest in sustainable and immersive travel experiences that connect them with agricultural activities and rural lifestyles and heightened awareness and appreciation for local food systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.