- Home

- »

- Next Generation Technologies

- »

-

AI And Machine Learning Operationalization Software Market Report, 2033GVR Report cover

![AI And Machine Learning Operationalization Software Market Size, Share & Trends Report]()

AI And Machine Learning Operationalization Software Market (2025 - 2033) Size, Share & Trends Analysis Report By Deployment, By Functionality, By Application, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-620-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI and Machine Learning Operationalization Software Market Summary

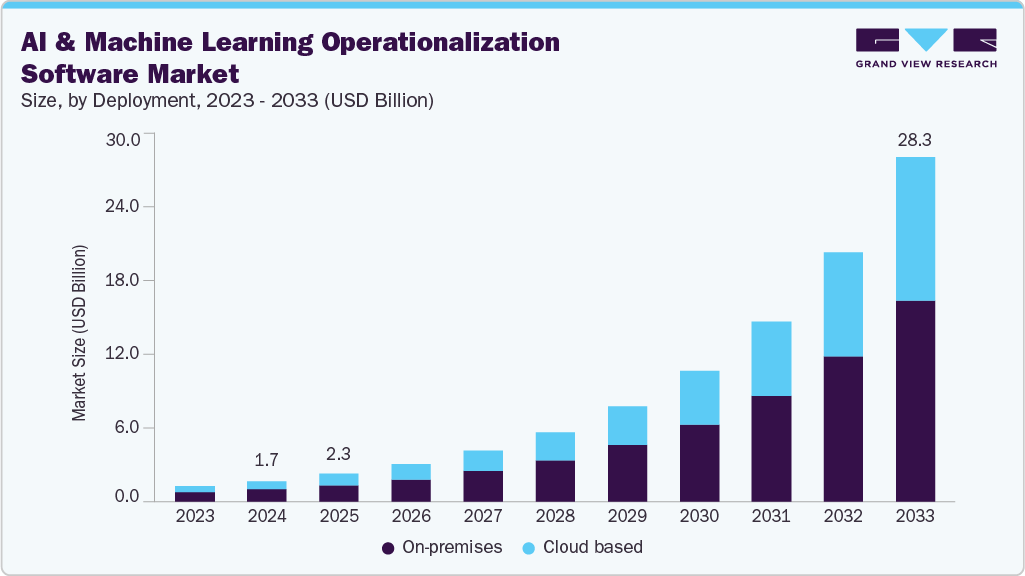

The global AI and machine learning operationalization software market size was estimated at USD 1,668.4 million in 2024, and is projected to reach USD 28,286.4 million by 2033, growing at a CAGR of 37.2% from 2025 to 2033. The AI and machine learning operationalization software market is growing rapidly, because it has become essential in enabling businesses to streamline their processes and fully capitalize on the potential of AI-powered solutions.

Key Market Trends & Insights

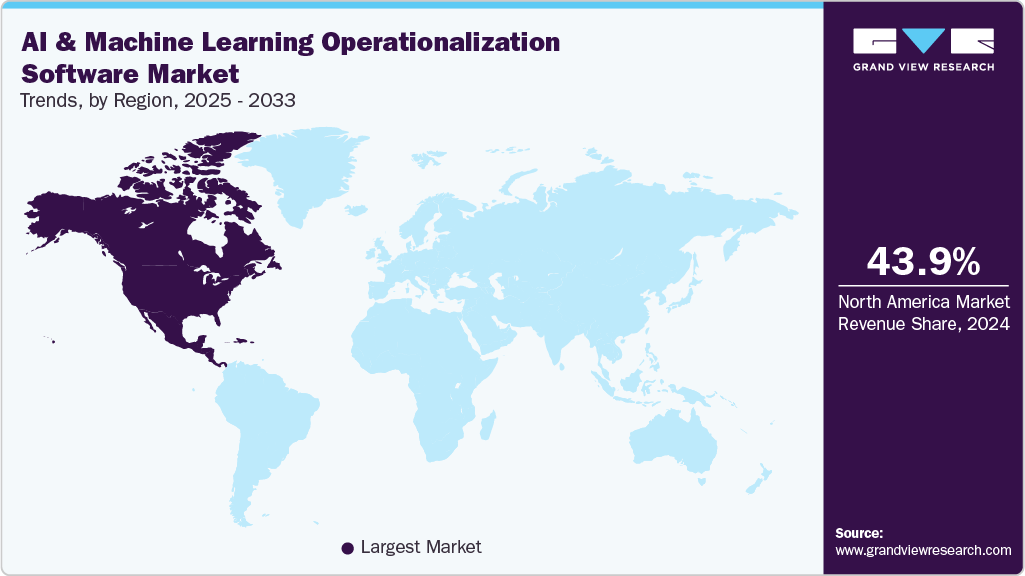

- North America dominated the global AI and machine learning operationalization software market with the largest revenue share of 43.9% in 2024.

- The AI and machine learning operationalization software market in the U.S. led the North America Market and held the largest revenue share in 2024.

- By deployment, on-premises led the market and held the largest revenue share of 60.5% in 2024.

- By end use, banking, financial services, and insurance (BFSI) segment held the dominant position in the market and accounted for the leading revenue share of 30.2% in 2024.

- By end use, healthcare and life sciences segment is expected to grow at the fastest CAGR of 39.7% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 1,668.4 million

- 2033 Projected Market Size: USD 28,286.4 million

- CAGR (2025-2033): 37.2%

- North America: Largest Market in 2024

The AI and machine learning operationalization (MLOps) software market is gaining momentum as organizations seek to streamline the end-to-end lifecycle of machine learning models. MLOps tools automate key processes such as model deployment, performance monitoring, and compliance governance, enabling smoother transitions from development to production environments. This automation enhances reliability, scalability, and consistency, helping businesses accelerate time-to-value while reducing operational overhead. By simplifying complex workflows, MLOps solutions enable companies to fully harness AI and machine learning for high impact use cases such as fraud detection, predictive maintenance, and personalized customer experiences. These platforms support faster innovation cycles and greater operational efficiency, ultimately delivering measurable business outcomes and a competitive edge in data-driven decision-making.

The growing dependency on artificial intelligence (AI) and machine learning (ML) across diverse industries is fueling the demand for MLOps software, as organizations increasingly apply these technologies for automation, smarter decision-making, and process optimization. Managing the complexity of developing, deploying, and maintaining ML models requires streamlined workflows for which MLOps platforms are designed to deliver. By automating critical tasks like deployment, monitoring, and governance, MLOps solutions help reduce errors, enhance operational efficiency, and accelerate the delivery of AI-driven outcomes, making them essential tools for scaling AI initiatives effectively.

As regulatory oversight of AI and ML applications grows, there is an increasing focus on model governance and ability to ensure transparency and compliance. MLOps software addresses these concerns by offering strong tools for tracking, auditing, and interpreting model behavior, which not only meets regulatory requirements but also builds trust in AI systems. In addition, the fast adoption of cloud computing presents significant opportunities for MLOps vendors. Cloud-based platforms offer scalable, flexible, and cost-effective solutions, making them ideal for organizations looking to manage AI operations efficiently. This shift to the cloud is a key driver behind the expanding MLOps software market.

Deployment Insights

The on-premises segment led the market and accounted for 60.5% of the global revenue in 2024. On-premises dominate the AI and machine learning operationalization software market due to the rising demand from sectors with strong data privacy and regulatory requirements, such as finance, healthcare, and government. These solutions provide complete control over data and infrastructure, enhancing security and minimizing the risks linked to data transmission. On-premises Deployment are ideal for organizations managing sensitive or highly regulated data that must remain within internal systems. For instance, solutions such as IBM Watson Machine Learning and H2O.ai’s Driverless AI support on-premises implementation, enabling secure model development and deployment in private environments.

The cloud based segment is predicted to foresee significant growth in the forecast period due to its scalability, flexibility, and cost-efficiency. These solutions enable organizations to quickly deploy and manage machine learning models without heavy investment in local infrastructure. Platforms such as Amazon Web Services (AWS) with SageMaker or EC2 instances, Microsoft Azure Machine Learning services, and Google cloud AI platform or vertex AI provide strong cloud-based tools for model development, and monitoring, making it easier for businesses to scale and integrate ML models into their operations. Moreover, the fast growth of big data and the increasing adoption of hybrid and multi-cloud strategies are driving the demand for cloud-native AI operationalization solutions. These tools enable effective model management, real-time monitoring, and regulatory compliance within complex and evolving business environments.

Functionality Insights

The model deployment & management segment accounted for the largest market revenue share in 2024. The model deployment & management segment holds the largest market revenue share due to the increasing demand for quicker and more dependable deployment of ML models into production, supporting both real-time and batch inference to enhance user experience and operational performance. The implementation of MLOps methodologies such as continuous integration and continuous deployment (CI/CD) automates and optimizes deployment processes, ensuring consistent quality and faster release cycles. Furthermore, the need for scalable, adaptable, and closely monitored deployment solutions that seamlessly integrate with existing IT systems and accommodate various deployment methods (such as embedded or runtime configurations) is fueling innovation in this area.

The model monitoring & performance evaluation segment is predicted to foresee significant growth in the forecast period. The model monitoring & performance evaluation segment is growing rapidly due to the essential need to continuously measure model performance using key metrics such as accuracy, precision, recall, and F1 score to ensure reliable outcomes in production settings. Real-time detection of data drift and irregularities further supports early identification of performance issues, allowing organizations to take corrective actions promptly. These capabilities are vital for enabling timely retraining or fine-tuning, ensuring models remain effective and compliant with regulatory standards in ever-changing data environments.

Application Insights

The predictive analytics segment accounted for the largest market revenue share in 2024. The expansion of the predictive analytics application segment in the AI and Machine Learning Operationalization Software Market is fueled by multiple factors. AI integration significantly boosts predictive analytics by automating data processing, increasing model precision, and enabling real-time forecasting, helping organizations make quicker, data-informed decisions. Moreover, the operationalization of machine learning streamlines the deployment of predictive models, shortening time to market and embedding insights directly into business workflows. Together, these developments help industries forecast trends, enhance operational efficiency, and strengthen their competitive advantage.

The customer experience management segment is predicted to foresee significant growth in the forecast period. The customer experience management segment in the market is growing due to the rising use of AI-driven tools to deliver personalized interactions and boost service efficiency. Businesses utilize MLOps platforms to automate the deployment and monitoring of models, enabling real-time, data-backed insights that enhance customer satisfaction and retention. Furthermore, the increasing demand for scalable, cloud-based AI solutions supports the seamless integration and ongoing optimization of customer experience models, driving further expansion in this area.

Enterprise Size Insights

The large enterprises segment accounted for the largest market revenue share in 2024. Large enterprises are a key force behind the growth of the AI and machine learning operationalization software market, driven by their need for scalable, automated workflows to manage the deployment, monitoring, and governance of multiple ML models. By adopting MLOps solutions, these organizations aim to boost efficiency, minimize human errors, and accelerate innovation through continuous integration and delivery of AI models. Companies in industries such as finance, healthcare, manufacturing, and retail are increasingly using these tools to support data-driven decisions, enhance customer experiences, and maintain regulatory compliance, contributing substantially to market expansion.

The small & medium size segment is predicted to foresee significant growth in the forecast period. This segment is experiencing the growth in the AI and machine learning operationalization software market because more of the SMEs adopt AI and ML to boost efficiency and cut operational costs. These businesses are using such tools to streamline model deployment, monitoring, and governance, which supports quicker innovation and better decision-making. The increasing availability of flexible, cloud-based solutions is also making advanced AI capabilities more affordable and accessible to SMEs, further driving their adoption and market expansion.

End Use Insights

The banking, financial services, and insurance (BFSI) segment accounted for the largest market revenue share in 2024, as it increasingly adopts AI to boost efficiency, ensure regulatory compliance, and enhance customer experiences. By leveraging AI, BFSI organizations can analyze vast amounts of structured and unstructured data to make smarter decisions in areas such as lending, fraud detection, and risk management, while also enabling secure, real-time digital transactions and personalized financial services. Moreover, the growing trend toward digital transformation and the rising demand for AI-powered tools such as chatbots, predictive analytics, and robotic process automation are further accelerating market growth in this segment.

The healthcare and life sciences segment is projected to grow significantly over the forecast period due to the increasing integration of AI technologies in vehicles. The Healthcare and Life Sciences segment is driving demand due to the pressing need to enhance efficiency and cut costs in areas such as drug discovery and clinical trials. AI supports these efforts by improving patient recruitment, site selection, and trial oversight. It also plays an important role in advancing personalized medicine through the analysis of genetic, clinical, and environmental data, while automating regulatory tasks to speed up approvals and ensure compliance. In addition, AI adoption is rising as it boosts diagnostic accuracy, optimizes supply chain management, and facilitates predictive maintenance of medical equipment ultimately leading to improved patient outcomes and greater operational effectiveness.

Regional Insights

North America dominated the market and accounted for 43.9% share in 2024. The AI and machine learning operationalization software market in North America is driven by its strong technological infrastructure, high demand for personalized, data-driven AI solutions, and favorable government initiatives supporting AI integration across various sectors. The region also benefits from the presence of major Functionality companies and substantial investments in AI research and development, which drive advancements in scalable and automated model deployment and management. Together, these elements contribute to North America's leadership in the market, particularly in industries such as healthcare, finance, and retail.

U.S. AI and Machine Learning Operationalization Software Market Trends

The AI and machine learning operationalization software market in the U.S. is being driven by the widespread adoption of AI and ML across sectors such as finance, healthcare, retail, and manufacturing, all of which require effective model deployment, monitoring, and management to boost efficiency and cut costs. The increase in data volume and complexity, along with the need for regulatory compliance and streamlined operations, is increasing demand for scalable, automated MLOps solutions that enable continuous integration and delivery of AI models. Growth is further supported by the expansion of cloud infrastructure, alignment with DevOps practices, and rising investments in AI research and development.

Europe AI and Machine Learning Operationalization Software Market Trends

Europe Market is being driven by growing demand for automation and data-driven insights across sectors where scalable and efficient AI model deployment is essential. Government initiatives such as the EU’s AI Act, along with significant investments in AI research, are encouraging innovation and widespread adoption. In addition, the focus is on compliance and ethical AI use is further accelerating market growth. As managing numerous ML models becomes increasingly complex, organizations are turning to operationalization tools to automate workflows, improve model performance, and seamlessly integrate AI into their business operations.

Asia Pacific AI and Machine Learning Operationalization Software Market Trends

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The Asia Pacific region is experiencing swift growth in the AI and machine learning operationalization software market, due to the accelerating digital transformation in sectors such as BFSI, healthcare, and e-commerce. A strong ecosystem of vendors creating advanced machine learning solutions, along with growing demand for scalable and automated AI model deployment, is driving this expansion. Furthermore, supportive government policies, the rollout of 5G networks, and the increasing necessity for efficient data-driven decision-making are further boosting the adoption of operationalization software across the region.

Key AI And Machine Learning Operationalization Software Market Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their Market share. The companies have used various techniques to enhance Market penetration and boost their position in the competitive industry. For instance, in February 2025, DataRobot has acquired Agnostiq, the developer of the open-source distributed computing platform Covalent, to boost the development of agentic AI applications. This strategic acquisition will enhance DataRobot’s capabilities in compute orchestration and optimization, making it easier to deploy AI across various infrastructures. The integration is designed to provide organizations with increased flexibility, lower operational costs, and improved scalability for creating and managing advanced AI solutions.

Key AI And Machine Learning Operationalization Software Companies:

The following are the leading companies that collectively hold the largest AI and machine learning operationalization software market share and dictate industry trends.

- Amazon Web Services, Inc.

- Google Inc.

- IBM Corporation

- Intel Corporation

- Oracle

- Microsoft Corporation

- DataRobot, Inc

- Databricks

- NVIDIA Corporation

- SAS Institute Inc.

Recent Developments

-

In May 2025, Databricks has introduced Data Intelligence for Market ing, a unified data and AI platform designed to consolidate customer and campaign data, giving marketers real-time insights and the ability to deliver more personalized, efficient campaigns. The platform includes built-in integrations with top market ing tools, allowing teams to independently access analytics and enhance market ing performance at scale. It supports improved audience segmentation, personalization, and campaign impact. This launch represents a major advancement in making sophisticated AI tools accessible to marketers of all technical levels.

-

In March 2025, DataRobot has introduced new AI application suites focused for finance and supply chain operations, designed to integrate smoothly with SAP systems. These ready-to-use, customizable solutions enable businesses to quickly implement AI-powered insights to improve forecasting, manage risks, and boost operational efficiency. Through this strengthened partnership, SAP users can fast-track AI adoption and scale digital transformation efforts. Leveraging SAP’s comprehensive business data, DataRobot’s AI apps provide real-time analytics and actionable insights directly within existing workflows.

-

In March 2025, NVIDIA has introduced the Llama Nemotron series of open reasoning AI models, designed to help developers and businesses create sophisticated agentic AI systems. Engineered for tasks like multistep math, coding, and complex decision-making, these models offer greater accuracy and five times faster inference. Companies including Microsoft, SAP, and ServiceNow are already leveraging these models to boost productivity and drive innovation. Available through NVIDIA’s AI Enterprise platform, the Llama Nemotron models and their supporting microservices are ready for both development and production deployment.

AI And Machine Learning Operationalization Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,258.4 million

Revenue forecast in 2033

USD 28,286.4 million

Growth rate

CAGR of 37.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, functionality, application, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Europe ; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Amazon Web Services, Inc.; Google Inc.; IBM Corporation; Intel Corporation; Oracle; DataRobot, Inc.; Microsoft Corporation; NVIDIA Corporation; Databricks; SAS Institute Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI And Machine Learning Operationalization Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI and machine learning operationalization software market report based on deployment, functionality, application, enterprise size, and end use:

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

On-premises

-

Cloud based

-

-

Functionality Outlook (Revenue, USD Million, 2021 - 2033)

-

Model Deployment & Management

-

Data Preprocessing & Feature Engineering

-

Model Monitoring & Performance Evaluation

-

Integration with Existing Systems

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Predictive analytics

-

Fraud detection and risk management

-

Customer experience management

-

Natural language processing (NLP) and text analytics

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Small & Medium size

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Banking, financial services, and insurance (BFSI)

-

Healthcare and life sciences

-

Retail and e-commerce

-

IT and telecommunications

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Europe

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI and machine learning operationalization software market size was estimated at USD 1,668.4 million in 2024 and is expected to reach USD 2,258.4 million in 2025.

b. The global AI and machine learning operationalization software market is expected to grow at a compound annual growth rate of of 37.2% from 2025 to 2033 to reach USD 28,286.4 million by 2033.

b. North America dominated the AI and ML operationalization software market with a share of 43.9% in 2024. This is attributable to its strong technological infrastructure, high demand for personalized, data-driven AI solutions, and favorable government initiatives supporting AI integration across various sectors. The region also benefits from the presence of major Functionality companies and substantial investments in AI research and development.

b. Some key players operating in the AI and ML operationalization software market include Amazon Web Services, Inc., Google Inc., IBM Corporation, Intel Corporation, Oracle, DataRobot, Inc., Microsoft Corporation, NVIDIA Corporation, Databricks, SAS Institute Inc.

b. Key factors that are driving the market growth include growing dependency on artificial intelligence (AI) and machine learning (ML) across diverse industries and necessity for enabling businesses to streamline their processes and fully capitalize on the potential of AI-powered solutions

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.