- Home

- »

- Healthcare IT

- »

-

AI In Pathology Market Size, Share, Industry Report, 2033GVR Report cover

![AI In Pathology Market Size, Share & Trends Report]()

AI In Pathology Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Software, Hardware), By Technology (Machine Learning, Computer Vision-based Image Analysis), By Application (Disease Diagnosis & Classification), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-758-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AI In Pathology Market Summary

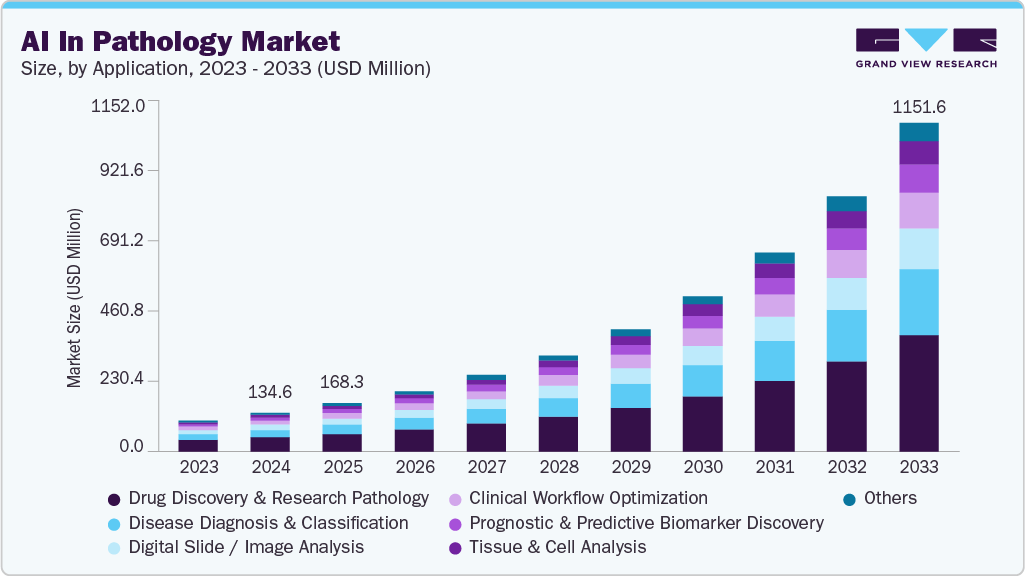

The global AI in pathology market size was estimated at USD 134.57 million in 2024 and is projected to reach USD 1,151.55 million by 2033, growing at a CAGR of 27.18% from 2025 to 2033. Growing demand for precision medicine, rising prevalence of chronic diseases, technological advancements are significant factors contributing to market growth.

Key Market Trends & Insights

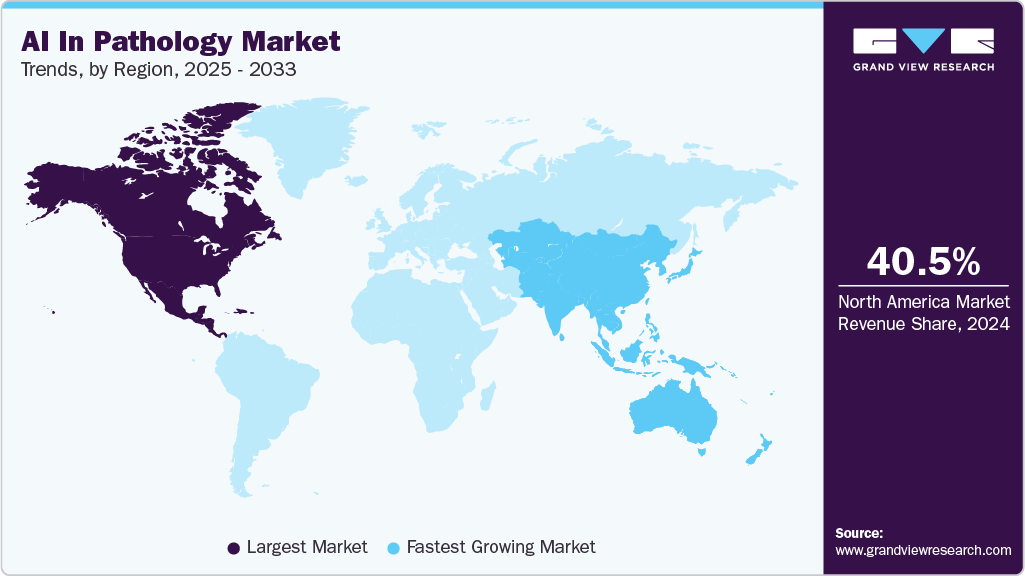

- North America AI in pathology market accounted for the largest revenue share of 40.47% in 2024.

- The U.S. AI in pathology market held the largest market share in 2024.

- Based on component, software segment held the largest market share of 51.27% in 2024.

- Based on technology, the machine learning segment accounted for the largest revenue share of 35.75% in 2024.

- Based on application, the image analysis segment accounted for the largest revenue share of 36.44% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 134.57 Million

- 2033 Projected Market Size: USD 1,151.55 Million

- CAGR (2025-2033): 27.18%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, the growing digitization of pathological infrastructure, supportive regulatory progress, and industry partnerships are strengthening the market environment. The growing demand for precision medicine is one of the significant drivers of AI in pathology market. AI facilitates tailored treatments by integrating histopathological image analysis with genomic data to provide more precise disease subtyping and prognosis. For instance, in July 2025, LG AI Research unveiled its upgraded pathology AI model, EXAONE Path 2.0, to enhance cancer diagnosis and drug development. The system combines analysis of both entire slide images and smaller patches to avoid feature collapse and preserve contextual information. Trained on multi-omics data, including DNA, RNA, and whole slide pathology images, the model analyzes genetic mutations, gene expression, and subtle tissue changes with 78.4% prediction accuracy.

In addition, growing funding for AI research and healthcare digital transformation programs, alongside rising adoption of telepathology, support the deployment of AI tools on a large scale. For instance, in March 2025, Proscia secured USD 50 million in funding to accelerate the adoption of its AI-powered Concentriq platform, an AI-driven pathology solution, to integrate more AI capabilities and leverage partnerships with OEMs like Agilent Technologies and Siemens Healthineers.

Workflow optimization and operational efficiency in laboratories also significantly fuel the adoption of AI pathology solutions. AI-driven automation of routine tasks such as tissue segmentation, cell counting, and measurement reduces manual labor and human error, allowing pathologists to devote more time to complex cases. For instance, in January 2025, Owkin unveiled new insights into digital pathology and AI solutions, highlighting challenges such as rising pathologist burnout due to workload and diagnostic complexity. Their AI diagnostics support quick interpretation of whole slide images, biomarker screening, and patient outcome predictions to enable precision oncology.

Furthermore, industry partnerships are strengthening the market environment. Pharmaceutical companies are collaborating with AI developers to incorporate digital pathology into clinical trials and drug development. For instance, in April 2025, Precision for Medicine and PathAI announced a strategic collaboration to develop novel AI technologies and integrate PathAI’s advanced digital pathology capabilities into Precision for Medicine’s clinical trial and biospecimen operations. Precision for Medicine is expected to leverage PathAI’s AISight image management system and AI algorithms to enhance biospecimen analysis workflows with quality control steps, improving data consistency and reliability.

Recent Developments in the AI In Pathology Market

Company/Institute

Year and Month

Initiative

Techcyte

August 2025

Techcyte partnered with Modella AI to integrate Modella’s research-use-only AI co-pilot, PathChat, into Techcyte’s cloud-based digital pathology platform, Techcyte Fusion. The collaboration aims to improve workflow efficiency in pathology research by combining Modella’s AI innovation with Techcyte’s unified pathology platform and expanding access to AI-powered tools.

FUJIFILM Healthcare

June 2025

FUJIFILM Healthcare Europe partnered with Ibex Medical Analytics to integrate Ibex’s AI platform with Fujifilm’s SYNAPSE Pathology solution, improving cancer diagnosis efficiency and accuracy.

Techcyte

March 2025

Techcyte launched Fusion, a unified anatomic and clinical digital pathology platform that integrates pathology teams, IT systems, and AI tools into a single cloud-native SaaS solution. Fusion aims to eliminate workflow silos, enhance diagnostic accuracy, and improve interoperability by uniting patient data, whole slide imaging, laboratory information systems (LIS), communication tools, and AI diagnostics. The platform supports seamless integration with LIS, EHR, scanners, and third-party AI algorithms using standards like DICOM, FHIR, HL7, and DICOMWeb.

Koninklijke Philips N.V.

March 2025

Philips and Ibex Medical Analytics expanded their partnership to accelerate the adoption of AI-enabled digital pathology. The collaboration integrates Ibex's AI platform with Philips IntelliSite Pathology Solution (PIPS), offering enhanced interoperability and a new release of PIPS 6.0 with improved workflows and AI capabilities.

Pramana, Inc.

March 2025

Pramana and ARUP Laboratories partnered to digitize pathology slides and develop AI-powered algorithms for hematopathology diagnostics. Using Pramana’s SpectralHT edge AI-enabled whole-slide imaging scanners, the collaboration aims to improve bone marrow biopsy assessments by enhancing diagnostic accuracy and efficiency.

Microsoft

May 2024

In collaboration with the University of Washington and Providence Health Network, Microsoft developed Prov-GigaPath, one of the largest AI models for real-world whole-slide digital pathology analysis. Trained on 1.3 billion pathology images from over 171,000 slides of 30,000+ patients covering 31 tissue types, the model addresses challenges like data scarcity, whole-slide modeling, and accessibility.

Market Concentration & Characteristics

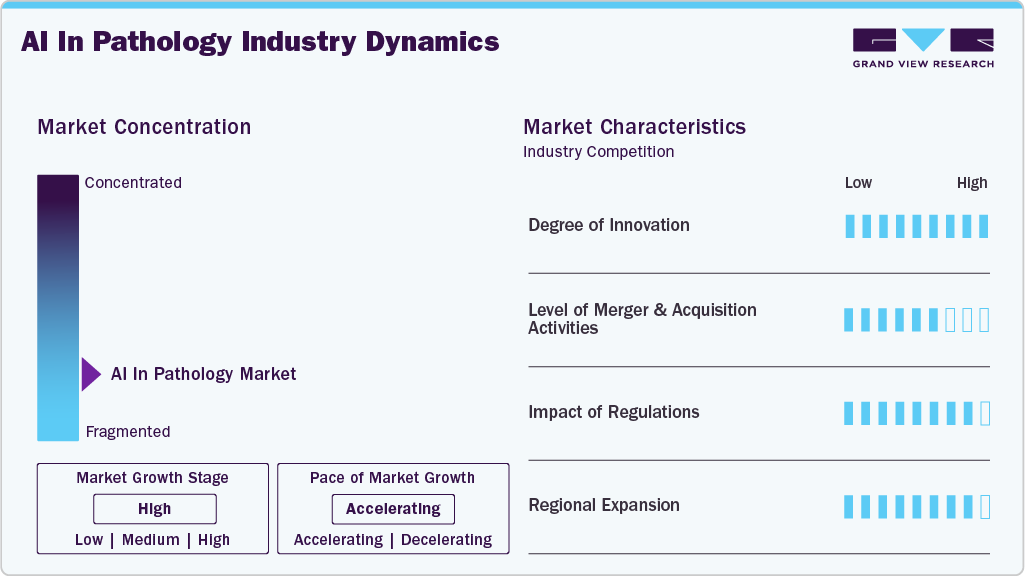

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaboration activities, degree of innovation, impact of regulations, and regional expansion. The AI in pathology market is fragmented, with several emerging players entering the market. The degree of innovation is high. The level of merger & acquisition activities is moderate. Moreover, the impact of regulations and the regional expansion of industry is high.

AI in pathology market is characterized by constant innovation, with a strong focus on launching new platforms and devices to leverage administrative tasks, improve diagnostic accuracy, and enhance care delivery. Prominent players are integrating their existing systems with advanced technologies such as cloud-computing. For instance, in September 2025, Proscia, a pathology AI company, integrated its Concentriq platform with AWS HealthImaging to manage growing digital pathology data and standardize siloed data. This cloud-native integration offers sub-second image retrieval, enterprise-scale interoperability using DICOM standards, and a seamless AI data foundation.

The industry is experiencing a moderate level of merger and acquisition activities undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market. For instance, in August 2025, Tempus AI acquired Paige, a digital pathology AI company, for USD 81.25 million. The acquisition expands Tempus’ dataset, technical team, and footprint in digital pathology, aiming to build the largest oncology foundation model and advance precision medicine.

“Paige is a leader in digital pathology and has amassed one of the most comprehensive digital pathology datasets in the world through its relationship with Memorial Sloan Kettering Cancer Center. We believe both the Paige team, with their deep generative AI experience, and the dataset they have built, will be catalytic across all of our AI efforts.”

-Eric Lefkofsky, Founder and CEO of Tempus.

Regulations, such as the HIPAA in the U.S. and the GDPR in Europe, establish standards for safeguarding patient data privacy and security. Compliance with these regulations is crucial for AI applications in healthcare to ensure the safe and secure handling of patient information, reducing the risk of data breaches and unauthorized access.

The industry is witnessing high geographical expansion. Companies within the AI in pathology industry seek geographic expansion strategies to maintain their foothold in emerging markets and attract customers from these regions. For instance, in November 2023, Dedalus Group and Ibex Medical Analytics launched a fully integrated end-to-end AI-powered digital pathology solution for cancer diagnosis in major European markets. The solution integrates Ibex’s Galen AI platform into Dedalus’ comprehensive Digital Pathology system, enabling complete digitization of anatomic pathology labs.

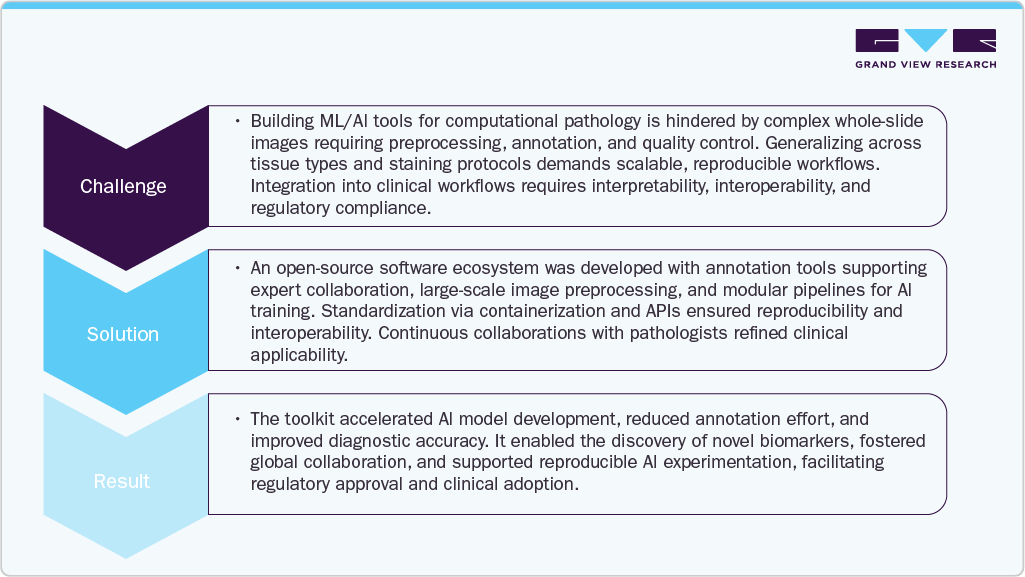

Case Study Insights: Building tools for machine learning and artificial intelligence in computational pathology

Computational pathology is transforming cancer diagnostics by leveraging machine learning (ML) and artificial intelligence (AI) to transform the analysis of digital pathology images. The article "Building Tools for Machine Learning and Artificial Intelligence in Computational Pathology," published in February 2022, highlights the challenges and technological innovations in developing scalable, accurate, and interoperable AI tools that support pathologists in clinical decision-making. The following case study outlines the key challenges faced in deploying AI in pathology, solutions implemented through software development and data annotation tools, and the resulting improvements in research and diagnostic workflows.

Component Insights

Based on component, software segment held the largest market share of 51.27% in 2024. In addition, this segment is expected to grow at the fastest CAGR during the forecast period. The software segment encompasses the algorithms and platforms that analyze digital slides and deliver diagnostic insights. These solutions enable automated detection of abnormalities, quantification of biomarkers, and predictive modeling for treatment response.

Moreover, image analysis & pattern recognition is a critical component of AI in pathology, enabling automated evaluation of digital histopathology slides. These solutions use advanced deep learning and computer vision techniques to detect, classify, and quantify cellular and tissue-level features. Applications include tumor grading, biomarker quantification, immune cell profiling, and detection of disease-specific tissue alterations. For instance, in January 2025, NEC Corporation and Biomy, Inc. signed a MoU to jointly develop and expand AI/deep learning-based analytical platforms in digital pathology. Their partnership focuses on enhancing Biomy’s cloud-based DeepPathFinder platform, automatically analyzing digital pathology images to classify cell and tissue types, including immune cells like lymphocytes and plasma cells from H&E-stained slides.

Thus, as digital pathology adoption grows globally, demand for robust image analysis and pattern recognition software continues to rise, positioning image analysis & pattern recognition as a major driver of innovation and market growth.

Technology Insights

Based on technology, the machine learning segment accounted for the largest revenue share of 35.75% in 2024. Machine learning enables automated classification, segmentation, and quantification of tissue structures by training models on annotated whole-slide images. This capability supports pathologists in detecting patterns and anomalies with greater consistency and speed. In addition, machine learning is increasingly applied to predictive and prognostic modeling in pathology. Advanced methods, including deep learning and transfer learning, allow models to perform effectively even with limited training data. Integrating these models into digital pathology workflows enhances efficiency and accuracy across clinical laboratories. As the demand for precision medicine grows, machine learning remains a foundational technology driving innovation in AI-powered pathology solutions.

The computer vision-based image analysis segment is anticipated to register fastest growth from 2025 to 2033. This segment enables automated interpretation of histopathology slides. These solutions leverage advanced image recognition techniques to identify, segment, and quantify complex tissue structures accurately. Computer vision-based image analysis is widely applied in cancer detection, grading, and biomarker analysis, where accurate image interpretation is critical. This segment is increasingly integrated into digital pathology platforms, supporting faster and more reliable diagnostic outcomes.

Application Insights

Based on application, the image analysis segment accounted for the largest revenue share of 36.44% in 2024. AI platforms process vast volumes of pathology images, enabling high-throughput analysis for evaluating drug efficacy, toxicity, and mechanism of action. In addition, AI-enabled pathology enhances biomarker discovery and patient stratification. Integrating multi-omics data further strengthens drug response modeling and improves translational research outcomes. For instance, in January 2025, Nvidia partnered with Mayo Clinic to transform digital pathology and drug discovery using AI. The partnership aims to create human digital twins for simulating patient outcomes, support generative AI tools for personalized medicine, and enable new drug discovery, thus advancing precision health and patient care with scalable AI infrastructure and next-generation diagnostic tools.

The disease diagnosis & classification segment is projected to grow at the fastest CAGR during the forecast period. AI enhances disease classification by stratifying patients based on histological and molecular characteristics. This allows better alignment with personalized treatment protocols and targeted therapies. AI capabilities offer precision and efficiency in identifying complex disease states. For instance, in March 2025, Paige launched the Paige GI Suite, an AI-assisted diagnostic tool for the entire gastrointestinal tract, detecting and grading over 40 GI-related conditions, including cancers and inflammatory diseases. Available on the Paige Alba platform, this system-wide solution represents a significant advance in AI-powered pathology for comprehensive GI diagnosis and precision medicine.

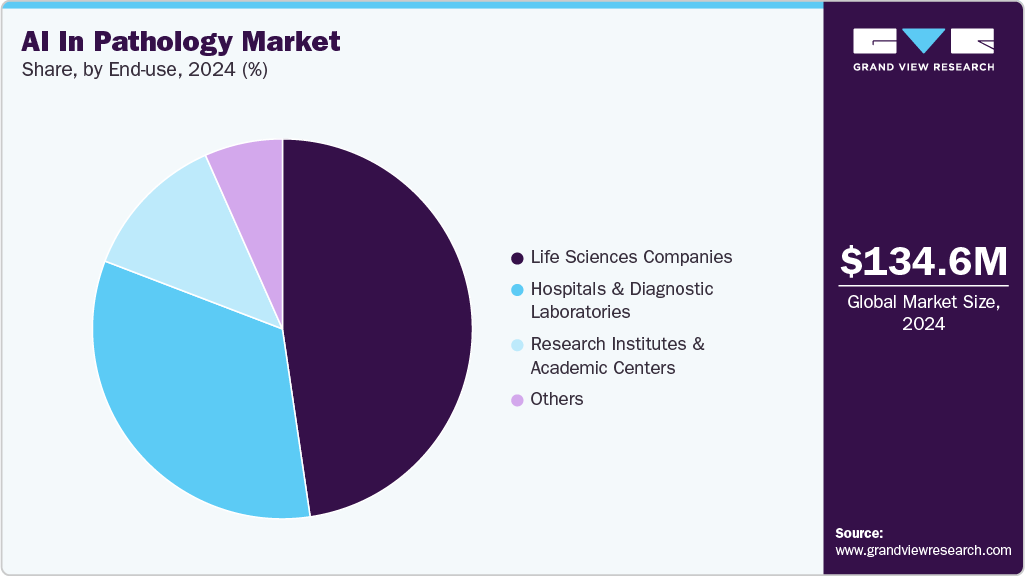

End Use Insights

Based on end use, the life science companies’ segment held the largest market share of 47.67%. Life science companies are increasingly adopting AI in pathology to accelerate drug discovery, biomarker identification, and translational research. By leveraging AI-driven image analysis, these organizations are able to process large volumes of pathology data efficiently, identifying novel disease mechanisms and therapeutic targets. In addition, life science companies utilize AI-powered pathology platforms for companion diagnostics and personalized medicine initiatives.

The hospitals and diagnostic laboratories segment is anticipated to grow at the fastest CAGR from 2025 to 2033. These institutes are key adopters of computational pathology, leveraging AI-driven image analysis, digital slide management, and automated reporting to improve diagnostic speed and accuracy. The demand for AI-enabled pathology in hospitals and clinics is driven by increasing case complexity and the shortage of skilled pathologists. For instance, in February 2025, Ruijin Hospital, affiliated with Shanghai Jiao Tong University School of Medicine, and Huawei Technologies unveiled RuiPath, a clinical-grade multimodal AI pathology model.

Regional Insights

North America AI in pathology market accounted for the largest revenue share of 40.47% in 2024. The market is driven by the integration of AI-based diagnostics, strong digital infrastructure, and high investment in clinical research. For instance, major U.S. cancer centers are deploying deep learning models for tumor classification and biomarker quantification, improving diagnostic accuracy and enabling personalized treatment strategies. Partnerships between AI developers, diagnostic labs, and pharmaceutical companies are expanding applications in clinical trials and drug development. For instance, in October 2022, GE Healthcare partnered with Tribun Health to integrate AI-powered digital pathology into its enterprise imaging solutions for oncology. The collaboration aims to unify patient data, streamline diagnostics, and enhance collaboration between clinicians.

U.S. AI in Pathology Market Trends

The U.S. AI in pathology market held the largest market share in 2024. The market is expanding due to the growth of high-throughput slide scanning, adoption of cloud-based pathology platforms, and rising use of multi-omics data integration in diagnostics. In March 2025, Aiforia partnered with PathPresenter to accelerate adoption of digital pathology and AI in the U.S., integrating Aiforia’s AI-powered image analysis with PathPresenter’s workflow platform. This collaboration enables pathologists to access advanced AI models for breast, lung, and prostate cancers, improving diagnostic speed and accuracy.

"This partnership with PathPresenter is a significant step in expanding the reach of Aiforia's AI solutions in the United States. PathPresenter's widely used platform connects pathologists globally and provides access to valuable expertise and best-in-class tools. By integrating our technologies, we will enable pathologists to seamlessly access and utilize Aiforia's AI solutions for image analysis, aiming to improve the speed and accuracy of the diagnostic workflows.”

-Jukka Tapaninen, CEO of Aiforia.

Europe AI in Pathology Market Trends

Europe AI in pathology market is expected to witness significant growth during the forecast period. This is attributed to the widespread adoption of AI technologies in healthcare and growing need for rapid disease diagnosis. The region also benefits from strong investment in healthcare digitization and supportive regulatory frameworks that encourage digital diagnostics innovation and integration. Moreover, leading companies such as Leica Biosystems (Danaher), F. Hoffmann-La Roche Ltd., Visiopharm A/S, and Proscia Inc. maintain a robust presence in Europe, actively pursuing strategic initiatives to expand their market share.

The UK AI in pathology market is expected to grow over the forecast period, owing to the robust healthcare infrastructure and increasing investments in AI technologies to enhance medical diagnosis and patient care. Advancements in machine learning and image analysis technologies are further enabling scalable and cost-effective pathology workflows throughout the UK.

Germany AI in pathology is expected to grow significantly over the forecast period. This growth is attributed to increasing investments in healthcare technology and robust healthcare infrastructure. In addition, advanced research in digital diagnostics and strong technological innovation further contribute to market growth. Funding from the Federal Ministry of Health and incentives under the Digital Healthcare Act (DVG) accelerate adoption. Public-private partnerships and clinical validation trials support early use of next-gen solutions featuring deep learning, cloud-based data sharing, and EMR interoperability.

Asia Pacific AI in Pathology Market Trends

Asia Pacific AI in pathology market is expected to grow at the fastest CAGR in the coming years. This growth is attributed to the rising healthcare expenditure, increasing adoption of AI in healthcare, and growing prevalence of chronic diseases. In addition, growing focus on rapid diagnostics and precision medicine propel market growth further. Moreover, collaborations between key market players expedite market growth. For instance, in November 2024, Lunit announced a strategic collaboration with AstraZeneca to develop an AI-powered digital pathology tool, Lunit SCOPE Genotype Predictor, aimed at rapidly predicting NSCLC driver mutations from H&E slides.

“This collaboration with Lunit underscores our commitment to advancing precision medicine in oncology. Tools like this will help to address unmet needs by optimizing diagnostic workflows for NSCLC patients and, ultimately, improve their outcomes.”

-Kristina Rodnikova, Head of Global Oncology Diagnostics, Oncology Business Unit at AstraZeneca.

India AI in pathology marketis expanding rapidly, driven by the high prevalence of hypertension, government health initiatives, and technological innovation. Moreover, the shortage of trained pathologists and the need for faster, more accurate diagnoses increase adoption of AI-powered digital pathology solutions. The growing burden of cancer and infectious diseases creates demand for scalable platforms capable of handling large volumes of complex histopathological data.

AI in pathology market in Japan is expected to grow rapidly over the forecast period. Strong government support and significant investments in healthcare innovation drive extensive research and development in this field. Japan’s aging population increases the demand for efficient diagnostics, fueling growth in computational pathology adoption across hospitals and research centers. In March 2022, Proscia and Japan-based Hamamatsu Photonics announced a collaboration to accelerate enterprise-scale adoption of digital pathology. Their unified solution combines Proscia’s AI-enabled Concentriq platform with Hamamatsu’s NanoZoomer whole slide scanners. This partnership aims to enhance interoperability and streamline pathology workflows for improved clinical and operational outcomes.

Latin America AI in Pathology Market Trends

Latin America AI in pathology market is anticipated to grow at a significant CAGR over the forecast period. Rising prevalence of cancer and chronic diseases fuels demand for faster, precise diagnostics, while government initiatives and funding support digital healthcare infrastructure. Collaborations between hospitals, research institutes, and technology providers accelerate development of AI-based pathology platforms. Investments in R&D and growing clinician awareness of AI-assisted diagnostics are expanding market adoption.

Middle East and Africa AI in Pathology Market Trends

Middle East and Africa AI in pathology market is expected to grow at a significant CAGR over the forecast period. The market is characterized by a dynamic landscape driven by the increasing adoption of AI in healthcare, rising healthcare expenditures and supportive government policies. Countries such as Saudi Arabia and the UAE are integrating AI into healthcare infrastructure under strategic visions such as Saudi Vision 2033 and the UAE National Strategy for Artificial Intelligence 2031.

Key AI In Pathology Company Insights

Key players operating in the AI in pathology market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as new product launches and partnerships play a key role in propelling market growth.

Key AI In Pathology Companies:

The following are the leading companies in the AI in pathology market. These companies collectively hold the largest market share and dictate industry trends.

- Leica Biosystems Nussloch GmbH (subsidiary of Danaher)

- Koninklijke Philips N.V.

- F. Hoffmann-La Roche Ltd.

- PathAI

- Proscia Inc.

- Aiforia/ Aiforia Technologies PLC

- Ibex Medical Analytics

- Mindpeak GmbH

- Owkin, Inc.

- Tempus AI

- Indica Labs, LLC.

- Qritive

Recent Developments

-

In August 2025, PathAI and Moffitt Cancer Center announced a multi-year strategic collaboration to deploy PathAI's AISight Dx digital pathology platform across Moffitt's pathology programs. AISight Dx is a cloud-native digital pathology image management system combining enterprise-scale slide management, viewing, and collaboration with seamless AI integration to enhance speed, accuracy, and operational efficiency. The partnership supports joint research programs, real-world multimodal data collation, clinical trials, biopharma collaborations, and co-development of next-generation AI diagnostics to advance precision medicine.

-

In July 2025, PathAI launched the Precision Pathology Network (PPN), a network of digital anatomic pathology labs powered by the AISight Image Management System (IMS). The network offers advanced AI capabilities like MET-Predict for identifying MET-amplified tumors, access to Explore biomarker discovery, and the PLUTO foundation model for research collaboration and custom model development.

-

In March 2025, Philips and Ibex Medical Analytics expanded their partnership to enhance AI-enabled digital pathology workflows with the new Philips IntelliSite Pathology Solution (PIPS) 6.0. This integration offers deeper interoperability, improving diagnostic workflows and driving productivity gains of up to 37%.

-

In January 2025, Mayo Clinic launched Mayo Clinic Digital Pathology to modernize pathology and accelerate medical breakthroughs. Leveraging its extensive archive of 20 million digital slide images linked to 10 million patient records, the platform integrates de-identified clinical data, advanced imaging, and AI technologies.

-

In January 2025, Leica Biosystems and Indica Labs announced a strategic partnership to create a digital pathology platform combining Leica’s Aperio scanners with Indica’s HALO AI software. The platform, cleared under CE-IVDR for Europe, the UK, and Switzerland, aims to enhance AI-powered cancer diagnostics and streamline pathology workflows, supporting both onsite and remote diagnosis with comprehensive AI integration.

"We are delighted to team up with Leica Biosystems under this exciting arrangement. As two leading players in digital pathology, with complementary capabilities, this initiative will combine Leica Biosystems’ expertise and footprint in instrumentation with Indica’s expertise and footprint in enterprise software and AI. This collaboration between two companies dedicated to open pathology offers the potential to break down some of the barriers that prevent patients from receiving fast, reliable diagnoses and effective therapies.”

-Indica Labs CEO Steven Hashagen

-

In June 2024, Quest Diagnostics acquired select assets of PathAI Diagnostics, including its advanced digitized pathology lab. The acquisition aims to integrate AI for more accurate diagnosis and treatment.

“This transaction will enable Quest to dramatically ramp our capabilities in AI and digital pathology, building on our leadership in oncology and subspecialized pathology services.”

-Kristie Dolan, Senior Vice President, Oncology, Quest Diagnostics.-

In May 2024, Paige launched its Foundation Models, including the world’s largest multi-modal AI model for pathology and oncology, enabling life sciences and computational pathology developers to accelerate AI innovation.

AI In Pathology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 168.25 million

Revenue forecast in 2033

USD 1,151.55 million

Growth rate

CAGR of 27.18% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Leica Biosystems Nussloch GmbH (subsidiary of Danaher); Koninklijke Philips N.V.; F. Hoffmann-La Roche Ltd.; PathAI; Proscia Inc.; Aiforia/ Aiforia Technologies PLC; Ibex Medical Analytics; Mindpeak GmbH; Owkin, Inc.; Tempus AI; Indica Labs, LLC.; Qritive

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI In Pathology Market Report Segmentation

This report forecasts, revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented global AI in pathology market report based on component, technology, application, end use, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Image Analysis & Pattern Recognition

-

Predictive Analytics Tools

-

Workflow Automation Software

-

Diagnostic Decision Support

-

-

Hardware

-

Whole Slide Imaging (WSI) Scanners

-

Digital Pathology Systems

-

AI-Enabled Microscopes

-

-

Service

-

Implementation & Integration

-

Consulting & Training

-

Managed AI Services

-

Maintenance & Support

-

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Machine Learning (ML)

-

Deep Learning

-

Convolutional Neural Networks (CNNS)

-

Generative Adversarial Networks (GANS)

-

Recurrent Neural Networks (RNNS)

-

Other Neural Networks

-

-

-

Natural Language Processing (NLP)

-

Computer Vision-based Image Analysis

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Disease Diagnosis & Classification

-

Prognostic & Predictive Biomarker Discovery

-

Digital Slide Image Analysis

-

Clinical Workflow Optimization

-

Drug Discovery & Research Pathology

-

Tissue & Cell Analysis

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Diagnostic Laboratories

-

Life Sciences Companies

-

Research Institutes & Academic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.