- Home

- »

- Next Generation Technologies

- »

-

AI Video Analytics Market Size & Share, Industry Report 2033GVR Report cover

![AI Video Analytics Market Size, Share & Trends Report]()

AI Video Analytics Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Analytics Type, By Deployment, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-752-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI Video Analytics Market Summary

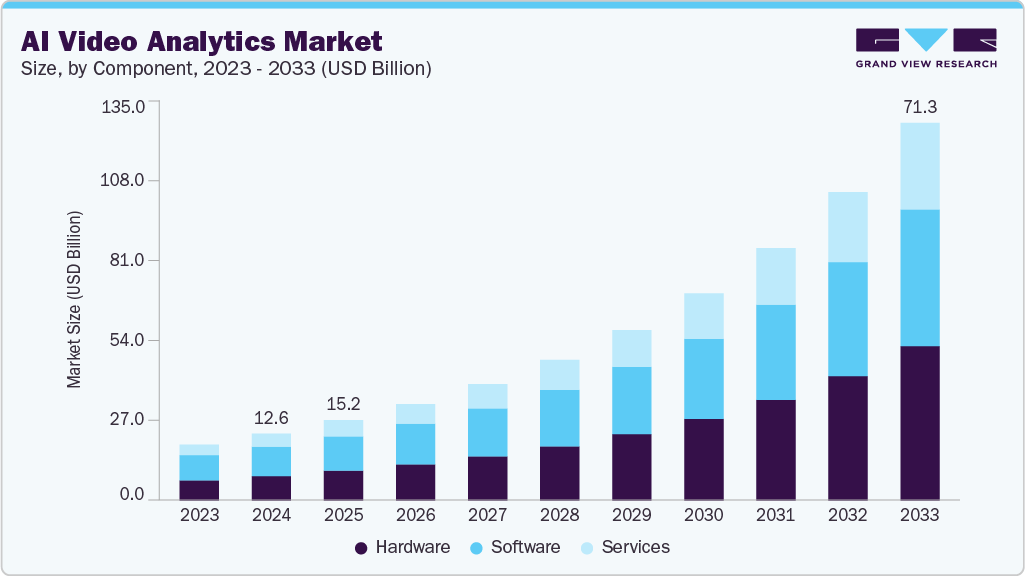

The global AI video analytics market size was valued at USD 12,630.2 million in 2024 and is projected to reach USD 71,302.0 million by 2033, growing at a CAGR of 21.4% from 2025 to 2033. The industry is driven by its ability to deliver data-driven insights that enhance operational planning and decision-making across sectors by analyzing patterns such as traffic flow, customer behavior, and peak usage times.

Key Market Trends & Insights

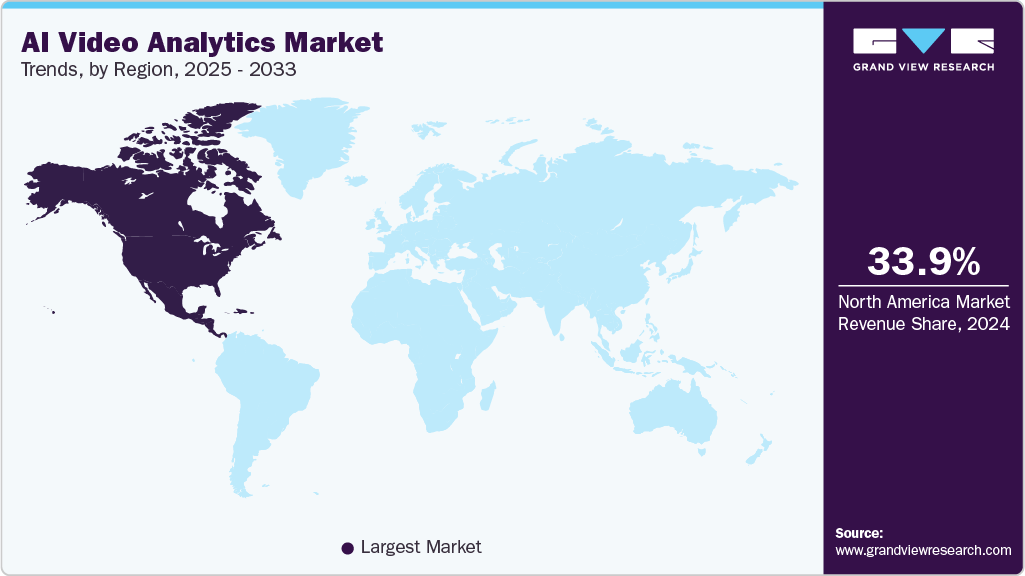

- North America dominated the global AI video analytics market with the largest revenue share of 33.9% in 2024.

- The AI video analytics market in the U.S. led the North America Market and held the largest revenue share in 2024.

- By component, software led the market and held the largest revenue share of 43.8% in 2024.

- By analytics type, the gesture/action recognition segment held the dominant position in the market and accounted for the leading revenue share of 27.0% in 2024.

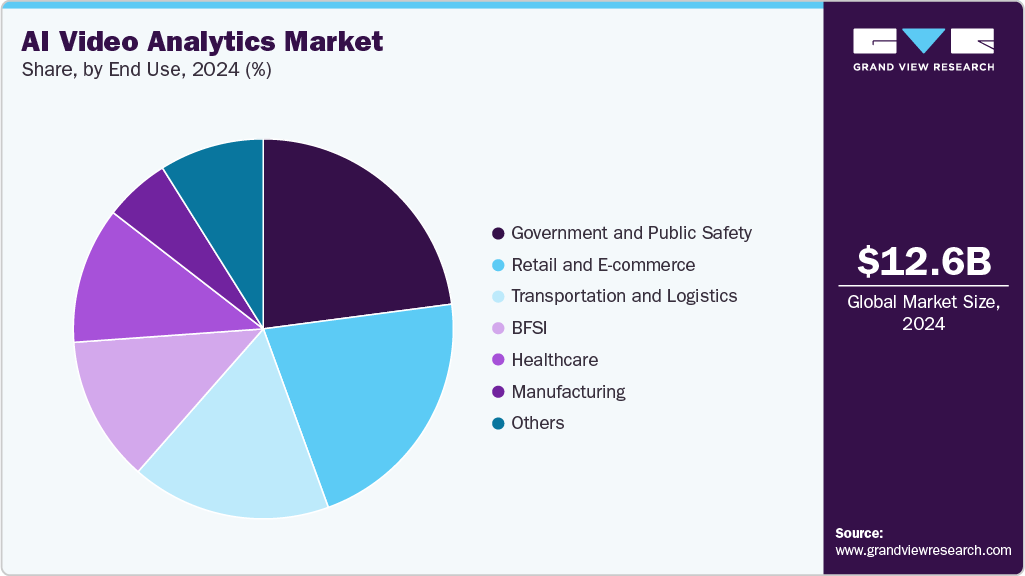

- By end use, the retail and e-commerce segment is expected to grow at the fastest CAGR of 24.2% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 12,630.2 Million

- 2033 Projected Market Size: USD 71,302.0 Million

- CAGR (2025-2033): 21.4%

- North America: Largest Market in 2024

Organizations can replace assumptions with objective data. This capability supports urban planning, retail layout optimization, and public transportation efficiency. Security remains a primary driver for AI video analytics adoption, as the technology enables automated, real-time monitoring that reduces dependence on human observation. Advanced features such as facial recognition, object tracking, and license plate reading assist in detecting unauthorized activities, preventing crime, and managing access control with higher precision. In addition, video analytics accelerates forensic investigations by quickly searching through recorded footage based on specific criteria, thereby improving response times and situational awareness. Scalability and integration capabilities enable organizations to extend security coverage across multiple sites and operational environments effectively.Operational efficiency improvements also contribute significantly to the demand for AI video analytics in industrial, retail, and logistics settings. Video analytics facilitates the identification of operational inefficiencies, compliance with safety protocols, and the correct use of equipment, leading to higher productivity and fewer accidents. Inventory management benefits from automated tracking of goods movement and quantities, which helps reduce theft. Optimal stock levels and quality control processes are enhanced by automated inspection of products, decreasing waste and manual inspection requirements. The automation of monitoring and analysis tasks reduces labor costs and operational losses related to inefficiencies and downtime.

Furthermore, advances in AI technologies such as machine learning, deep learning, and big data processing underpin the increasing adoption of video analytics. These technologies improve the accuracy and capabilities of visual data interpretation, enabling complex functions such as anomaly detection, crowd analytics, and behavioral analysis. The ability to process video data both in cloud environments and at the edge with minimal latency supports diverse use cases, including real-time threat detection and offline forensic analysis. As video data volumes grow, organizations leverage these AI capabilities to extract actionable intelligence that enhances security, planning, and operational outcomes across multiple industries.

Component Insights

The software segment led the market and accounted for 43.8% of the global revenue in 2024. The segment experiences growth driven by advancements in machine learning, computer vision, and deep learning technologies, which enhance capabilities such as behavior analysis, facial recognition, and predictive analytics. The rising deployment of AI in smart cities, retail optimization, healthcare, and public safety sectors increases demand for sophisticated software solutions that enable real-time video interpretation and decision-making. Additionally, integration with IoT sensors and cloud-edge hybrid deployments supports scalability and flexibility, meeting diverse operational requirements.

The segment benefits from increased investments in automation and the need to reduce manual surveillance efforts, improving accuracy, efficiency, and actionable insights from video data. For instance, in December 2024, Fujitsu launched the video analytics AI agent to enhance safety, security, and efficiency in frontline workplaces. This AI agent integrates spatial video and image data with written documentation to accurately analyze long-duration video content using a multimodal large language model (LLM). The technology employs selective attention mechanisms to efficiently process important visual details, enabling precise assessments of workplace spatial relationships and task status.

The services segment is predicted to foresee significant growth in the forecast period, driven by the demand for implementation, integration, customization, and maintenance of AI video analytics systems across various industries. As organizations adopt complex AI solutions, professional services ensure seamless deployment, system tuning, and ongoing support to maximize performance and reliability. Training, consulting, and managed services are gaining importance to help users extract maximum value from analytics, especially in sectors like security, transportation, and retail. Moreover, after-sales support and software updates facilitate adaptation to evolving AI models and regulatory requirements, highlighting the critical role of services in sustaining system effectiveness and operational continuity in dynamic environments.

Analytics Type Insights

The gesture/action recognition segment accounted for the largest market revenue share in 2024. This segment is driven by its ability to interpret human movements and gestures from video data with high accuracy, enabling enhanced human-computer interaction in various applications. Advanced deep learning models and multimodal sensor integration improve the precision of gesture detection and classification, which is critical for use cases in virtual and augmented reality, healthcare monitoring, and security surveillance. These systems facilitate touchless control interfaces and real-time behavior analysis, expanding the range of automated, context-aware responses. The ongoing evolution of neural network architecture supports handling the complexity of dynamic and subtle gestures, overcoming challenges such as occlusions and individual variability.

The facial recognition segment is predicted to foresee significant growth in the forecast period. The Facial Recognition analytics segment in AI video analytics is driven by its capability to enhance security through rapid, accurate identification of individuals, which aids in crime prevention and public safety management. The technology supports real-time surveillance and access control, efficiently distinguishing authorized personnel from intruders in sensitive environments. It also accelerates investigations by enabling swift review and correlation of footage across multiple cameras. Beyond security, facial recognition improves operational productivity and customer experience by enabling personalized services and effective resource management. These systems integrate advanced AI algorithms that manage large volumes of video data to deliver actionable intelligence across various industries. For instance, in January 2024, BriefCam announced the release of its 2024 M1 version, which enhanced its comprehensive Video Analytics Platform with new capabilities such as vehicle make and model recognition, integrated intelligence for investigations, and enterprise-wide business insights for multi-site organizations.

Deployment Insights

The on-premises segment accounted for the largest revenue share in 2024, driven by its ability to provide real-time processing with minimal latency, which is critical for mission-critical security applications. Maintaining data privacy by keeping sensitive information on-site supports compliance with stringent regulatory frameworks across industries. The customizable nature of AI models in on-premises environments allows organizations to tailor analytics to their specific security needs without exposing data externally. Utilizing flexible open platform video management software enables centralized control of extensive camera networks and rapid adaptation to emerging threats. Additionally, on-prem solutions address scalability by maintaining local control of critical data while using cloud resources for storage and advanced analytics, balancing performance with operational flexibility.

The cloud segment is predicted to foresee significant growth in the forecast period. The market is driven by its scalability and flexibility, allowing organizations to easily adjust processing capacity needs without additional hardware investments. Cloud environments support advanced analytics with powerful computing resources, facilitating the use of complex machine learning models for behavior assessment, threat detection, and pattern recognition across extensive camera networks. Furthermore, rapid deployment and minimal on-site infrastructure requirements reduce lead times and overall operational burdens. For instance, in June 2025, Hexagon’s Safety, Infrastructure & Geospatial division introduced HxGN dC3 Video, a cloud-based, AI-powered video analytics solution to enhance flexibility and resilience in surveillance operations. The system is compatible with a broad range of IP cameras from different vendors and enables remote viewing, management, and control of video streams. By integrating generative AI, it speeds up investigations with advanced functions such as object tracking and behavior analysis, while offering natural language interaction for easier monitoring and search. It also features end-to-end encryption, detailed access controls, and adherence to global compliance standards, making it suitable for security needs in sectors such as healthcare, finance, retail, and public safety.

End Use Insights

The government and public safety segment accounted for the largest revenue share in 2024. Drivers include advanced capabilities such as intrusion detection, anomaly recognition, and crowd management allow for proactive monitoring of restricted areas, detection of suspicious behaviors, and prevention of incidents without expanded human surveillance efforts. Additionally, AI-powered analytics optimize resource deployment during large gatherings and critical events through accurate crowd density and flow analysis. The integration of edge computing and machine learning further reduces latency, ensuring timely alerts and efficient handling of emergencies in public environments. Ethical and privacy-conscious AI adoption is also emphasized as agencies balance security with civil liberties while advancing smart city initiatives for safer, more resilient urban environments.

The retail and e-commerce segment is projected to grow significantly over the forecast period. The retail and e-commerce segment is driven by the need for enhanced loss prevention and theft detection across multiple store locations. AI-powered systems analyze customer behavior patterns and suspicious activities in real-time, enabling timely alerts that reduce shrinkage and prevent repeat offenses. These solutions streamline security operations by automating surveillance and minimizing manual monitoring, thus improving response times and operational efficiency. Additionally, video analytics supports customer behavior insights through footfall analysis and heat mapping, which optimize store layouts and marketing strategies. The technology also aids workforce management by allocating staff based on real-time store activity, thereby improving service quality and operational productivity.

Regional Insights

North America AI video analytics market dominated and accounted for 33.9% share in 2024. The market is driven by the investment in advanced surveillance infrastructure and the wide-scale deployment of AI-powered video analytics. The region benefits from substantial adoption in critical infrastructure, retail, and public safety sectors, driven by federal and state-level security initiatives. Additionally, advancements in edge computing and 5G connectivity enhance real-time video processing capabilities. The presence of leading technology companies fueling innovation and integration of video analytics with broader smart city projects further supports this region’s prominence.

U.S. AI Video Analytics Market Trends

The AI video analytics market in the U.S. is driven by extensive federal funding for national security and law enforcement applications, integrating AI video analytics with homeland security systems. The high penetration of CCTV and surveillance networks across public and private sectors fuels ongoing adoption. The country also leads in innovations involving real-time edge analytics in critical venues such as schools, airports, and logistics centers. Additionally, sustained R&D investments by technology giants foster cutting-edge advancements, making the U.S. a hub for AI video analytics innovation and deployment.

Europe AI Video Analytics Market Trends

The AI video analytics market in Europe is growing, driven by tough regulatory frameworks governing data privacy and ethical AI usage, including adherence to GDPR and emerging AI regulations. Public-private partnerships accelerate smart urban infrastructure projects, focusing on transportation, healthcare, and law enforcement modernization. Cross-border collaboration for security and disaster response leverages AI video analytics to enhance operational efficiency. A growing focus on transparency and algorithmic accountability shapes market adoption and technology development within the region.

Asia Pacific AI Video Analytics Market Trends

The AI video analytics market in Asia Pacific is anticipated to register the fastest CAGR over the forecast period. Asia Pacific's market is driven by rapid urbanization, and increasing governmental investments in smart city initiatives are expanding the AI video analytics market. Countries in this region focus on large-scale deployment for traffic management, public safety, and retail intelligence, often integrating AI with IoT networks. Rising awareness and demand for AI-enabled solutions in emerging economies such as China and India are escalating adoption rates. The development of cost-effective hardware and software tailored to diverse infrastructure conditions further supports growth across both developed and developing markets.

Key AI Video Analytics Company Insights

Key players operating in the AI video analytics market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key AI Video Analytics Companies:

The following are the leading companies in the AI video analytics market. These companies collectively hold the largest market share and dictate industry trends.

- AllGoVision Technologies Pvt. Ltd

- Axis Communications AB.

- Bosch Sicherheitssysteme GmbH

- Clarifai, Inc.

- Gorilla Technology Group

- Honeywell International Inc.

- IntelliVision

- Motorola Solutions, Inc.

- PureTech Systems

- Videonetics Technology Pvt. Ltd.

Recent Developments

-

In June 2025, Honeywell launched its first locally designed and produced 50 Series CCTV camera portfolio in India, developed at its global development center in Bengaluru in collaboration with VVDN Technologies. The cameras, available in 3MP and 5MP resolutions and dome and bullet formats, feature intelligent video analytics for proactive threat detection, gyro sensor-based image stabilization, enhanced imaging, and robust cybersecurity. This launch supports India’s Atmanirbhar Bharat initiative and caters to security needs across government, healthcare, education, transport, commercial, and real estate sectors.

-

In April 2025, Axis Communications AB introduced the AXIS Camera Station S1228 Rack AI Optimized Server, a high-performance recording solution built to advance video surveillance with AI-driven analytics such as free text search. Engineered to handle high-activity environments with multiple moving objects, it delivers up to ten times more detections than conventional servers. It provides free text search results up to 1000 times faster. The system comes with an NVIDIA GPU, dual SSDs, a powerful processor, 12 TB of storage, and 28 AXIS Camera Station Pro licenses. It also ensures strong cybersecurity compliance with TPM certification, NDAA adherence, and offers a 5-year warranty, including next business day onsite replacement.

-

In November 2024, PureTech Systems released PureActiv Version 16, featuring advanced geospatial AI-boosted video analytics designed for autonomous perimeter intrusion detection and critical infrastructure protection. This version includes enhanced machine learning models that improve classification accuracy to distinguish real access events from false alarms, supported by intelligent PTZ camera tracking for real-time situational awareness. The update integrates ground and air intrusion detection, including counter-drone capabilities, into a unified operating picture for comprehensive security coverage across land, maritime, and air domains.

-

In July 2024, Bosch Building Technologies launched a localized assembly line in India for its FLEXIDOME IP Starlight 5000i cameras, underscoring its commitment to the Indian market and 'Make in India' initiative. These cameras feature edge-based AIoT solutions with AI capabilities and video analytics, designed for both indoor and outdoor environments. They incorporate advanced technologies such as intelligent streaming, low-light performance, efficient H.265 compression, and cybersecurity features including embedded firewall and Trusted Platform Model functionality.

AI Video Analytics Market Report Scope

Report Attribute

Details

Market size in 2025

USD 15,151.2 million

Revenue forecast in 2033

USD 71,302.0 million

Growth rate

CAGR of 21.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Component, analytics type, deployment, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

AllGoVision Technologies Pvt. Ltd; Axis Communications AB.; Bosch Sicherheitssysteme GmbH; Clarifai, Inc.; Gorilla Technology Group; Honeywell International Inc.; IntelliVision; Motorola Solutions, Inc.; PureTech Systems; Videonetics Technology Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI Video Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI video analytics market report based on component, analytics type, deployment, end use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Analytics Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Video Content Analytics

-

Facial Recognition

-

Crowd and Behavior Detection

-

Automatic Number-Plate Recognition

-

Gesture / Action Recognition

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud

-

On-premises

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Government and Public Safety

-

Retail and E-commerce

-

Transportation and Logistics

-

Manufacturing

-

BFSI

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI video analytics market size was estimated at USD 12,630.2 million in 2024 and is expected to reach USD 15,151.2 million in 2025.

b. The global AI video analytics market is expected to grow at a compound annual growth rate of 21.4% from 2025 to 2033 to reach USD 71,302.0 million by 2033.

b. North America dominated the AI video analytics market with a share of 33.9% in 2024. North America’s AI video analytics market is driven by the investment in advanced surveillance infrastructure and wide-scale deployment of AI-powered video analytics support market growth in North America.

b. Some key players operating in the AI video analytics market include AllGoVision Technologies Pvt. Ltd; Axis Communications AB.; Bosch Sicherheitssysteme GmbH; Clarifai, Inc.; Gorilla Technology Group; Honeywell International Inc.; IntelliVision; Motorola Solutions, Inc.; PureTech Systems; Videonetics Technology Pvt. Ltd.

b. Key factors that are driving the market growth include its ability to deliver data-driven insights that enhance operational planning and decision-making across sectors by analyzing patterns such as traffic flow, customer behavior, and peak usage times, organizations can replace assumptions with objective data.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.