- Home

- »

- Next Generation Technologies

- »

-

AI In Warehousing Market Size, Share, Industry Report, 2030GVR Report cover

![AI In Warehousing Market Size, Share & Trends Report]()

AI In Warehousing Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Application, By Deployment, By Organization Size, By Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-558-9

- Number of Report Pages: 118

- Format: PDF

- Historical Range: 2017 -2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI In Warehousing Market Summary

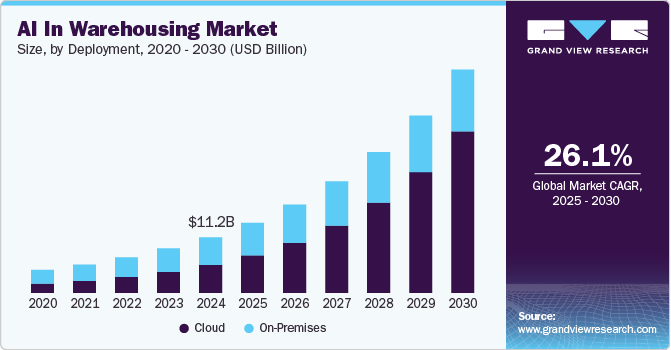

The global AI in warehousing market size was estimated at USD 11.22 billion in 2024 and is expected to reach USD 45.12 billion by 2030, growing at a CAGR of 26.1% from 2025 to 2030. This can be attributed to the surge in e-commerce, which demands faster and more accurate order fulfillment.

Key Market Trends & Insights

- North America dominated the AI in warehousing industry in 2024, accounting for a revenue share of over 32%.

- By component, hardware segment led the industry in 2024, accounting for over 59% of global revenue.

- By application, the inventory management segment led the AI in warehousing market in 2024.

- By deployment, the cloud segment led the market in 2024.

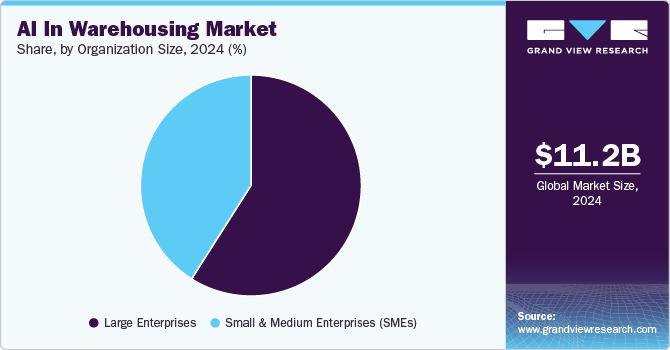

- By organization size, the large enterprises segment led the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11.22 Billion

- 2030 Projected Market Size: USD 45.12 Billion

- CAGR (2025-2030): 26.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Warehouses are under pressure to handle larger volumes and more complex inventories, leading to the adoption of AI-driven automation, robotics, and advanced analytics. These technologies streamline workflows, reduce manual errors, and improve inventory management, while also addressing labor shortages and rising operational costs. The integration of AI enables real-time decision-making and enhances productivity, making warehouses more efficient and competitive. For instance, Ocado operates highly advanced AI-driven warehouses where robotic systems, coordinated by artificial intelligence (AI), manage automated storage, retrieval, and packing with remarkable efficiency and precision.

Continuous advancements in robotics, machine learning, and big data analytics are making AI solutions increasingly accessible and scalable for warehouses of all sizes. The integration of AI with IoT devices allows for real-time tracking and management of inventory and assets, improving visibility and decision-making across the supply chain. Companies are also investing in research and development to introduce innovative solutions that optimize warehouse workflows, automate routine tasks, and support predictive maintenance. AI-powered computer vision and robotic systems further enhance operational accuracy by automatically identifying misplaced or damaged goods, reducing human error, and streamlining inventory processes.

Furthermore, sustainability and the need for cost-effective operations are also influencing the adoption of AI in warehousing. AI technologies help optimize energy use, reduce waste, and improve resource allocation, aligning with corporate sustainability goals. As businesses seek to enhance performance metrics and meet evolving customer expectations, the use of AI in warehousing continues to expand, transforming traditional logistics into data-driven, efficient, and agile operations.

Component Insights

Hardware led the AI in warehousing industry in 2024, accounting for over 59% of global revenue. This dominance is due to the widespread adoption of AI-enabled hardware such as cameras, sensors, and robotics that automate key warehouse functions and enhance operational efficiency. Hardware solutions are critical for real-time data collection, automated material handling, and monitoring, making them essential for modern warehouses. Companies are investing in advanced hardware to meet the growing demand for automation and to support seamless integration with AI-driven software.

The services segment is anticipated to grow at the fastest CAGR during the forecast period. As warehouses adopt more AI technologies, there is a rising need for implementation, maintenance, consulting, and support services to ensure smooth operation and integration. Service providers help organizations optimize AI deployment, manage system upgrades, and provide ongoing technical support, which is crucial for maximizing return on investment. This trend is driven by the complexity of AI systems and the need for specialized expertise to maintain and scale these solutions.

Application Insights

The inventory management segment led the AI in warehousing market in 2024. AI-powered systems enable real-time tracking, demand forecasting, and automated stock replenishment, resulting in improved inventory accuracy and reduced stockouts or overstocking. These solutions help warehouses maintain optimal inventory levels and respond quickly to market changes, which is vital for efficient supply chain management. The integration of AI in inventory management directly addresses the challenges of manual tracking and human error.

The warehouse optimization segment is anticipated to grow at the fastest CAGR during the forecast period. AI technologies are increasingly being used to optimize warehouse layouts, streamline picking and packing processes, and allocate resources efficiently. By analyzing large volumes of operational data, AI identifies bottlenecks and suggests improvements, leading to higher throughput and reduced operational costs. This focus on continuous improvement and efficiency is driving the rapid adoption of AI for warehouse optimization.

Deployment Insights

The cloud segment led the market in 2024, reflecting a preference for cloud-based AI solutions in warehousing. Cloud platforms offer scalability, flexibility, and cost savings by eliminating the need for on-premises IT infrastructure. They enable real-time data access, seamless integration with other digital tools, and easier system updates, which are essential for dynamic warehouse environments. The ability to manage fluctuating product volumes and integrate with multiple technologies makes cloud solutions highly attractive for warehouse operators.

The on-premises segment is expected to grow at a significant CAGR during the forecast period as some organizations prioritize data security, regulatory compliance, and control over their IT infrastructure. Industries with sensitive data or strict operational requirements often choose on-premises solutions to maintain direct oversight of their systems. These deployments also allow for customization to meet specific operational needs, which is important for certain large-scale or specialized warehouses. As a result, on-premises AI solutions continue to see strong demand in select sectors.

Organization Size Insights

The large enterprises segment led the market in 2024, as their resources and scale enable the deployment and integration of advanced AI technologies. These organizations often manage complex, high-volume operations that benefit significantly from automation, predictive analytics, and real-time decision-making. Large enterprises are also more likely to invest in comprehensive AI strategies, integrating hardware, software, and services across multiple sites. Their focus on efficiency, cost reduction, and customer satisfaction drives substantial adoption of AI in warehousing.

The small & medium (SMEs) segment is expected to grow at the fastest CAGR during the forecast period. As AI solutions become more accessible and affordable, SMEs are increasingly leveraging these technologies to compete with larger players. Cloud-based platforms and modular AI tools lower the barriers to entry, enabling SMEs to automate processes, improve inventory management, and enhance operational efficiency. This democratization of AI technology supports rapid growth among smaller organizations in the sector.

Industry Insights

The logistics & transportation segment held the largest revenue share in 2024, reflecting the critical role of AI in optimizing supply chain operations. AI-driven solutions enhance route planning, shipment tracking, and fleet management, resulting in faster and more reliable deliveries. Logistics companies are adopting AI to improve resource utilization, reduce costs, and meet the demands of e-commerce and global trade. The integration of AI in logistics supports end-to-end visibility and efficiency across the supply chain.

The retail & e-commerce segment is estimated to grow at the fastest CAGR during the forecast period, driven by the surge in online shopping and changing consumer expectations. AI enables retailers and e-commerce companies to automate order fulfillment, personalize customer experiences, and manage inventory more effectively. As competition intensifies, these businesses are turning to AI to improve delivery speed, accuracy, and customer satisfaction. For instance, Amazon.com, Inc. has transformed its fulfillment centers by deploying AI-powered robots that autonomously pick, sort, and transport products, optimizing warehouse efficiency and reducing operational costs. These AI systems also enable real-time inventory tracking and predictive demand analysis, allowing Amazon.com, Inc. to accelerate delivery times and maintain high levels of accuracy across its logistics network.

Regional Insights

North America dominated the AI in warehousing industry in 2024, accounting for a revenue share of over 32%. This can be attributed to early adoption of advanced technologies, a strong presence of leading AI vendors, and significant investments in automation. North American companies prioritize operational efficiency and customer service, driving widespread implementation of AI in warehousing. The mature logistics infrastructure and focus on innovation further strengthen the region’s market position.

U.S. AI in Warehousing Market Trends

The U.S. AI in warehousing industry is anticipated to exhibit a significant CAGR over the forecast period, supported by ongoing investments in digital transformation and automation. American companies are leveraging AI to address labor shortages, improve accuracy, and enhance supply chain resilience. The country's large-scale retail, e-commerce, and logistics sectors provide fertile ground for AI adoption. Regulatory support and a culture of innovation also contribute to the expansion of AI in U.S. warehousing.

Europe AI In Warehousing Market Trends

The Europe AI in warehousing industry is expected to witness significant growth over the forecast period. As companies in the region increasingly embrace digital transformation. European businesses are focusing on sustainability, efficiency, and compliance, prompting the adoption of AI-driven solutions for warehouse management. The presence of established logistics networks and a growing e-commerce market further supports AI integration. Collaboration between technology providers and logistics companies accelerates the deployment of AI across European warehouses.

Asia Pacific AI In Warehousing Market Trends

The Asia Pacific AI in warehousing industry is anticipated to register the highest CAGR over the forecast period, driven by rapid industrialization, urbanization, and the expansion of e-commerce. Countries in the region are investing heavily in automation and digital infrastructure to meet rising consumer demand and improve supply chain efficiency. The adoption of AI in warehousing supports faster order processing, better inventory control, and enhanced operational agility. Government initiatives and increasing technology adoption among businesses fuel the market growth in Asia Pacific.

Key AI In Warehousing Company Insights

Some key companies in the AI in warehousing market are ABB, Google LLC, Honeywell International, Inc., and IBM Corporation.

-

ABB specializes in electrification, automation, and robotics, with a focus on integrating AI into warehouse operations. The company’s AI-powered solutions enhance warehouse efficiency through intelligent robotics, automated material handling, and advanced process optimization. ABB leverages machine learning and data analytics to improve inventory management, optimize picking and sorting, and enable predictive maintenance, supporting seamless and scalable warehouse automation.

-

Honeywell International Inc. offers advanced automation, robotics, and data-driven solutions tailored for modern distribution centers. Through its Honeywell Robotics center and collaborations with partners such as Google Cloud, Honeywell International Inc. develops AI and machine learning applications that streamline warehouse workflows, automate repetitive tasks, and provide real-time operational insights.

Key AI In Warehousing Companies:

The following are the leading companies in the AI in warehousing market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Amazon Web Services, Inc.

- Google LLC

- Honeywell International, Inc.

- IBM Corporation

- Microsoft

- Oracle

- SAP SE

- Siemens AG

- Zebra Technologies Corporation

Recent Developments

-

In March 2025, Powerfleet, a provider of AIoT technology and fleet telematics, launched its Unity in-warehouse solutions through a partnership with TELUS to enhance safety, workforce retention, and operational efficiency in Canada and the United States. This collaboration leverages TELUS’s extensive communications network and expertise in digital transformation to expand the reach and impact of Powerfleet’s AI-driven platform. Unity integrates advanced AI to unify operational data, providing actionable insights that address key challenges such as fragmented systems and safety risks in warehouse environments.

-

In January 2025, Gather AI launched its Partner Program to enable vetted supply chain optimization experts to deliver AI-powered inventory monitoring solutions. The program leverages advanced computer vision and autonomous drones to help partners increase revenue and enhance customer satisfaction by significantly reducing inventory errors by up to 70% and boosting clients’ return on investment by three to five times.

-

In January 2025, KION GROUP AG began collaborating with Accenture to optimize supply chains using NVIDIA’s advanced AI and simulation technologies. By leveraging NVIDIA’s Omniverse and Mega platforms, KION is able to create digital replicas of warehouse environments, enabling real-time testing and optimization of layouts, automation equipment, and workforce allocation without disrupting operations. The initiative aims to deliver more efficient, resilient, and adaptable supply chain solutions for global customers.

AI In Warehousing Market Report Scope

Report Attribute

Details

Market size in 2025

USD 14.13 billion

Revenue forecast in 2030

USD 45.12 billion

Growth rate

CAGR of 26.1% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, deployment, organization size, industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

ABB; Amazon Web Services, Inc.; Google LLC; Honeywell International, Inc.; IBM Corporation; Microsoft; Oracle; SAP SE; Siemens AG; Zebra Technologies Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI In Warehousing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global AI in warehousing market report based on component, application, deployment, organization size, industry, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Inventory Management

-

Order Picking & Sorting

-

Warehouse Optimization

-

Predictive Maintenance

-

Supply Chain Visibility

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small & Medium Enterprises (SMEs)

-

Large Enterprises

-

-

Industry Outlook (Revenue, USD Million, 2017 - 2030)

-

Logistics & Transportation

-

Retail & E-commerce

-

Healthcare

-

Manufacturing

-

Food & Beverage

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global AI in warehousing market size was estimated at USD 11.22 billion in 2024 and is expected to reach USD 14.13 billion in 2025.

b. The global AI in warehousing market is expected to grow at a compound annual growth rate of 26.1% from 2025 to 2030 to reach USD 45.12 billion by 2030.

b. North America dominated the AI in warehousing market with a share of 33.8% in 2024, This can be attributed to the early adoption of advanced technologies, a strong presence of leading AI vendors, and significant investments in automation.

b. Some key players operating in the AI in warehousing market include ABB; Amazon Web Services, Inc.; Google LLC; Honeywell International, Inc.; IBM Corporation; Microsoft; Oracle; SAP SE; Siemens AG; Zebra Technologies Corporation

b. Key factors driving the AI in warehousing market's growth include increasing demand for fast and accurate order fulfillment and need for enhanced operational efficiency and cost reduction

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.