- Home

- »

- Medical Devices

- »

-

Air Ambulance Services Market Size & Share Report, 2030GVR Report cover

![Air Ambulance Services Market Size, Share & Trends Report]()

Air Ambulance Services Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Rotary-wing, Fixed-wing), By Service Model (Hospital-based, Community-based), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-715-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Air Ambulance Services Market Summary

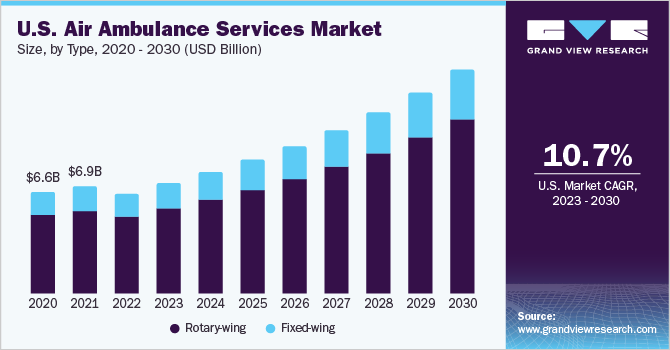

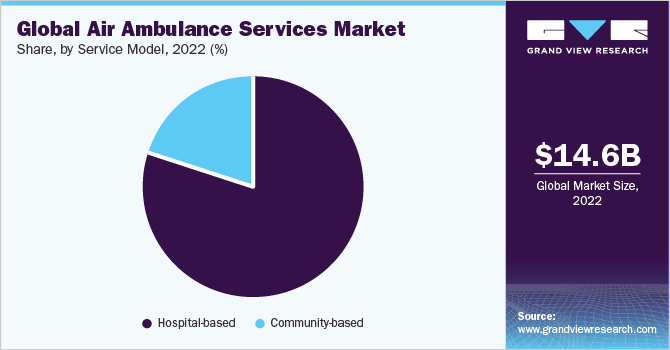

The global air ambulance services market size was estimated at USD 14.6 billion in 2022 and is projected to reach USD 32.9 billion by 2030, growing at a CAGR of 10.7% from 2023 to 2030. According to the World Health Organization (WHO), chronic diseases are the leading cause of death worldwide and represent over 60% of total deaths.

Key Market Trends & Insights

- North America led the market with a revenue share of 49.5% in 2022.

- By type, the rotary-wing segment led the market, with a revenue share of 76.7% in 2022.

- By service, the hospital-based service segment led the market, with a revenue share of 79.9% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 14.6 Billion

- 2030 Projected Market Size: USD 32.9 Billion

- CAGR (2023-2030): 10.7%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Nearly 80% of the deaths caused by chronic diseases occur in middle- and low-income countries. It is estimated that over 49% of the U.S. population will be affected by chronic diseases by 2025. As per the Centers for Disease Control and Prevention, more than 877,500 U.S. population die of stroke, heart disease, and cardiovascular disorders every year.

In addition, cardiovascular diseases are the leading cause of death globally. Stroke is the second most common cause of death worldwide. According to the WHO, it is estimated that by 2022, chronic diseases will account for 3/4th of the total deaths globally, out of which 71% will be caused by ischemic heart diseases and 75% of deaths will be caused by stroke.

India and China exhibit a high prevalence of cardiac diseases. Chronic diseases, such as cardiac diseases and stroke, usually require an emergency medical response. Air ambulance services provide rapid response in case of such emergency medical situations. Air ambulances are equipped with advanced and innovative medical care for cardiac, stroke, chronic obstructive pulmonary disorders, and trauma patients.

There has been a drastic increase in global health expenditure since 1980. In 2012, the total global healthcare expenditure was USD 6.5 trillion annually. The global healthcare expenditure is expected to reach USD 18.28 trillion by 2040. According to a WHO report (2012), the U.S. had the highest per capita healthcare expenditure (USD 8,362), and Eritrea had the lowest per capita healthcare expenditure. The Luxembourg government spent the highest amount per person annually on health (USD 6,906) and the Myanmar government spent the lowest amount per person annually on health.

It is projected that over 9% of the global GDP will be spent on health by 2040. The per capita expenditure on health in high-income countries is projected to be USD 9,019. On the other hand, upper-middle-income countries are expected to spend USD 1,935.0 per capita on health. The lower-middle-income countries are projected to spend USD 507.0 per capita on health, whereas the low-income countries are expected to spend USD 164.0 per capita on health.

An increase in per capita healthcare expenditure is expected to have a positive effect on the salaries of medical professionals, treatment facilities, & hospital administration and help reduce the cost of medical procedures & pharmaceutical products. An increase in per capita healthcare expenditure can aid in overcoming the problem of a shortage of medical professionals and facilities. An increase in the availability of these resources is expected to contribute to the growth of the air ambulance services industry.

A large population pool over 60 years, which typically has a lower immunity level and is prone to cardiac problems, neurological diseases, spinal injuries, and cancer is expected to be a high impact-rendering driver for the market growth during the forecast period. As per the WHO, globally, the number of people aged 65 or older is anticipated to grow from an estimated 524 million in 2010 to nearly 1.5 billion in 2050.

The geriatric population is highly susceptible to diseases such as arthritis, heart attacks, stroke, osteoporosis, and obesity. Patients suffering from such diseases may require an emergency as well as a non-emergency ambulance service model. Hence, the increasing geriatric population is likely to result in the growth of the air ambulance services demand.

The COVID-19 pandemic had a positive impact on the air ambulance market. This can be accredited to the increase in demand for air ambulances during the pandemic. For instance, the International Critical Care Air Transfer Team (ICATT), a Bengaluru-based air ambulance service firm, witnessed a 500% increase in demand during the pandemic period. Before the pandemic, ICATT used to transfer 15 to 20 critically ill patients in a month, which surged to around 300 patients a month.

A similar rise in demand was seen globally. Moreover, to deal with the rising demand, many market players underwent several strategic changes. For instance, Air Ambulance Kent Surrey Sussex formed a designated critical care transfer team. Furthermore, it was one of the first civilian air ambulances in the UK to move ventilated & critical COVID-19 patients via air.

The European Air Ambulance (EAA), one of the largest air ambulance providers in Europe, created an ‘Infectious Disease Unit’ for the safe transport of COVID-19 patients. Additionally, the EAA invested in Challenger-605, an aircraft that is large and can fly for long ranges.

Furthermore, in October 2020, the company introduced transport procedures for COVID-19 patients, to curb the spread of coronavirus. The company also adopted the use of the IsoPod, known as the infectious disease unit, which provides the patient room to roam around, permits less-intensive treatment, and keeps them completely segregated from a non-infected environment.

Type Insights

Based on products, the global air ambulance services market is further categorized into rotary-wing and fixed-wing. The term rotary-wing is generally used for a helicopter. Rotary-wing led the product segment in 2022 and accounted for 76.7% of the overall share. The key advantages of helicopter-based air ambulance services are their cost-effectiveness, quick response time, and versatility. Helicopters serve patients in emergencies, especially when a quick response time is expected. Helicopters are a good substitute for ground ambulances as they can land almost anywhere, including roads, parks, fields, cramped urban areas, and paved areas. However, due to low fuel capacity, they have a short operating range.

The helicopter-based air ambulances can be used in a wide range of situations mainly dealing with emergency response. Hospitals use rotary-wing air ambulance services to transport the medical team to a patient’s location and then escort them back to the hospital. Commonly used helicopters for air ambulance services are Bell 206, 429, & 407; Eurocopter AS350, EC135, BK117, EC145, & EC130; Sikorsky S-76; and Augusta Westland 139, 149 & 109. Some of the key players operating in this market segment are REVA Inc., PHI, AirMed International, Scandinavian Air Ambulance, and Native American Air Ambulance.

The fixed-wing segment is expected to grow at the fastest rate of 11.0% during the forecast period. Fixed-wing air ambulances can travel long distances as they have better fuel capacity compared to rotary-wing aircraft. Aircraft with propellers are mostly used for short distances. Some propeller-driven aircraft are also known as turboprops and are sometimes used for long-distance and/or outstation travel.

Moreover, fixed-wing aircraft can operate in unpleasant weather conditions with faster speed and longer range without compromising patients’ comfort and quality of care. The ability to operate in adverse weather conditions, a rise in the number of intensely critical patients, and a rise in medical tourism are three main reasons that can be attributed to the increase in demand for fixed-wing air ambulance services.

The use of a turboprop or a jet is based on the parameters of transport. Some commonly used fixed-wing air ambulances are Learjet 31, 35, 36, 40 & 60; King Air 350, 200, 90; Pilatus PC-12; Beechcraft King Air C90GT; Cessna Citation II, III, X; and Piper Cheyenne. Air Methods Corporation; REVA Inc.; PHI Air Medical; AirMed International; Scandinavian Air Ambulance; and Native American Air Ambulance are some of the key players operating in this market segment.

Service Model Insights

Based on services, the global air ambulance market is further categorized into hospital and community-based. Hospital-based led the services segment in 2022 and accounted for 79.9% of the overall share. It is anticipated to witness a considerable growth rate during the forecast period. In a hospital-based service model, a hospital generally provides the medical team and partners with an aviation service provider for aircraft, pilots, and mechanics.

An aviation service provider is required to have a Federal Aviation Administration (FAA) certificate and is paid by the hospital for the service model offered. Hospital-based service model holds the largest share of the air ambulance market. The first hospital-based helicopter service for civilians started in 1972, and currently around half a million rotary- and fixed-wing aircraft operate annually. The lack of specialty care and medical physicists in some regions has led to an increase in the use of air ambulance services to rapidly transfer patients to specialty hospitals.

The community-based segment is expected to grow at the fastest CAGR of 10.8% during the forecast period. In a community-based service model, independent operators set up bases in communities and serve various localities via different service models. The operator has an FAA certificate and employs its own medical and flight crew. An increase in the need for access to healthcare in rural areas has led to the growth of community-based air ambulance services.

In the community-based model, the income is obtained entirely from patient transfers instead of fixed agreements with hospitals. These service models are based on public donations and/or are donated by businesses. Service models are provided through contracts with private operators and community healthcare organizations. Air Evac Lifeteam is one of the biggest community-based operators.

Regional Insights

North America dominated the market with a share of 49.5% in 2022 and is expected to witness a considerable growth rate of 10.8% during the forecast period owing to the presence of various air ambulance service providers, and favorable infrastructure for air medical transportation. In addition, favorable reimbursement policies are one of the major drivers for regional growth.

Asia Pacific is expected to grow at the fastest CAGR of 11.5% during the forecast period. The presence of economies such as India, China, and Japan is expected to boost market growth. In addition, the rapidly growing medical tourism industry in these countries along with government initiatives such as ‘Heal in India’ by the Indian government to promote medical tourism can also be attributed to the increase in demand for air ambulance services in this region.

For instance, as per data in Financial Express, between 2017 and 2019, India experienced over 40.0% growth in FTAs, with the number of tourists increasing from 495,056 in 2017 to 697,000 in 2019. According to the Associated Chambers of Commerce and Industry of India (ASSOCHAM), India is set to become a top medical tourism destination by 2025.

Key Companies & Market Share Insights

Key players are involved in adopting strategies such as mergers & acquisitions, partnerships, and launching new services to strengthen their foothold in the market. For instance, in January 2023, Air Methods, an American air medical services provider, launched a new critical care transport service.

The new service will provide air ambulance transportation for patients who require critical care, such as ventilator support or ECMO. Furthermore, in March 2023, the company announced the acquisition of Guardian Flight, a regional air ambulance provider based in Alaska. The acquisition will expand Air Methods' reach in Alaska and provide it with additional resources to meet the growing demand for air ambulance services in the region.

In February 2023 Air Methods and UnitedHealthcare announced their partnership to provide air ambulance services to UnitedHealthcare members. The partnership will allow UnitedHealthcare members to access Air Methods' air ambulance services at no additional cost.

In February 2020, Bombardier announced the sale of 2 Learjet 75 Liberty aircraft to Fargo Jet Center (FJC). These aircraft were to be delivered to Lotnicze Pogotowie Ratunkowe (LPR), Poland-based air ambulance service provider. Similarly, in April 2021, Babcock Norway was awarded a contract to jet air ambulance service to the rescEU scheme. Babcock would offer a fast jet air ambulance capability in the EU including maintenance of the aircraft and the provision & training of personnel. Some prominent players in the global air ambulance services market:

-

Air Methods

-

AMR

-

PHI Air Medical

-

Babcock Scandinavian Air Ambulance

-

Express Air Medical Transport

-

REVA, Inc.

-

Lifeguard Ambulance Service LLC.

-

Acadian Ambulance

-

IAS Medical, Ltd.

-

American Air Ambulance

-

Global Medical Response

-

AirMed International

-

Guardian Air (Pty) Ltd

-

AirLink Ambulance USMX

-

Life Flight Network

Air Ambulance Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 16.1 billion

Revenue forecast in 2030

USD 32.9 billion

Growth rate

CAGR of 10.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, service model, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Thailand; Australia; South Korea; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Air Methods; AMR; PHI Air Medical; Babcock Scandinavian Air Ambulance; Express Air Medical Transport; REVA, Inc.; Lifeguard Ambulance Service LLC.; Acadian Ambulance; IAS Medical, Ltd.; American Air Ambulance; Global Medical Response; AirMed International; Guardian Air (Pty) Ltd; AirLink Ambulance USMX; Life Flight Network

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Air Ambulance Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global air ambulance services market report based on type, service model, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Rotary-wing

-

Fixed-wing

-

-

Service Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital-based

-

Community-based

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global air ambulance services market size was estimated at USD 14.6 billion in 2022 and is expected to reach USD 16.1 billion in 2023.

b. The global air ambulance services market is expected to grow at a compound annual growth rate of 10.7% from 2023 to 2030 to reach USD 32.9 billion by 2030.

b. The hospital-based segment dominated the market for air ambulance services and held the largest revenue share of 79.8% in 2022, and is anticipated to witness a considerable growth rate over the forecast period.

b. North America dominated the air ambulance services market and accounted for the largest revenue share of 49.5% in 2022. The region is expected to witness a considerable growth rate of 10.8% over the forecast period.

b. The rotary-wing segment dominated the market for air ambulance services and held the largest revenue share of 76.7% in 2022.

b. Key factors that are driving the air ambulance services market growth include favorable reimbursement policies, the entrance of new ambulance service providers globally, rising medical tourism, increasing number of road accidents and CVD cases, and increasing geriatric population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.