- Home

- »

- Electronic & Electrical

- »

-

Air Fryer Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Air Fryer Market Size, Share & Trends Report]()

Air Fryer Market (2024 - 2030) Size, Share & Trends Analysis Report By Device, By Capacity, By Application (Residential, Commercial), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-673-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Air Fryer Market Summary

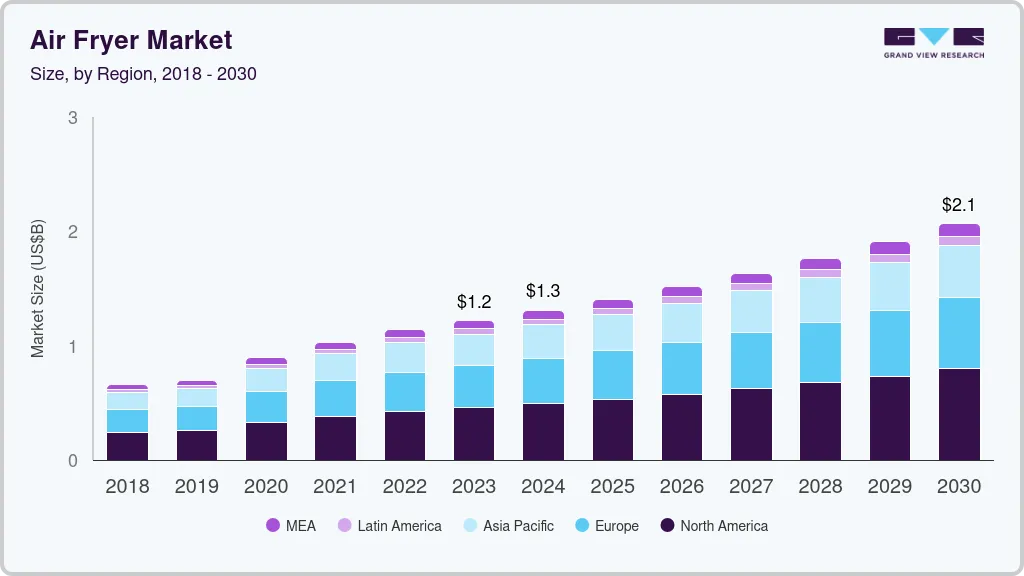

The global air fryer market size was estimated at USD 1.28 billion in 2023 and is projected to reach USD 2.07 billion by 2030, growing at a CAGR of 7.9% from 2024 to 2030. The driving factors for the market include consumer awareness about health, introduction of new products, flexibility and easy accessibility of air fryers, and social media and celebrity influence.

Key Market Trends & Insights

- North America air fryer market dominated the global air fryer market with a revenue share of 37.6% in 2023.

- By device, the automatic device segment dominated the market with a revenue share of 58.4% in 2023.

- By capacity, the up-to-4-lit capacity segment dominated the market with a revenue share of 48.4% in 2023.

- By application, the residential application segment dominated the market with a revenue share of 67.2% in 2023.

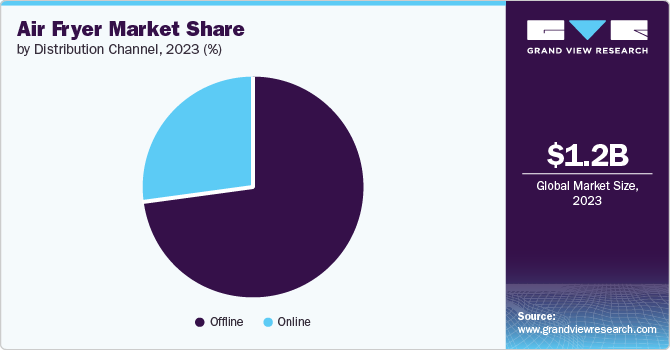

- By distribution channel, the offline distribution channel segment dominated the market with a revenue share of 73.1% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.28 Billion

- 2030 Projected Market Size: USD 2.07 Billion

- CAGR (2024-2030): 7.9%

- North America: Largest market in 2023

- Europe: Fastest growing market

The increasing offers and better design of air fryers in both automatic and manual devices are further expected to drive market growth. For health considerations, consumers avoid extra oil and use air fryers to manage their weight better and prevent diseases. Rising concern over healthy products and items used in restaurants, hotels, hospitals, and other places drives the market. A study published by the National Library of Medicine in April 2022 found that the use optimal air frying process used for frying potato strips can reduce the formation of Maillard hazards and cause the starch digestibility change without leading to a sudden spike in blood sugar. This makes air frying a healthier and more preferred option for frying potato strips, which is healthier and more preferred by customers.

The consumer is more inclined toward cost-efficient and energy-precise products which in turn is driving this market. Some of the features such as touch screen panel, and temperature control features of the digital fryer that are presented in the market alongside many others such factors enhance the customer demand for air fryers around the globe.

Moreover, e-commerce is also a major factor in driving the air fryer market growth. Effective marketing and competitive pricing influence consumers buying the product. Rise in the disposable income and changing lifestyles have a great impact on the air fryer market as consumers are shifting towards lavish lifestyles and need products such as air fryers.

Device Insights

The automatic device segment dominated the air fryer market with a revenue share of 58.4% in 2023. Automatic air fryers display the data on the screen, making it easier to control the temperature and time of frying. Numerous pre-sets and smart features such as shake reminder, warm-up, and connection through Wi-Fi/Bluetooth allow faster and more effective frying. In addition, the development of smart features in the newer models of automatic air fryers with features such as app control and voice assistance continue to drive the growth of the global air fryer market. For instance, in August 2022, Xiaomi expanded its portfolio of IoT devices with the launch of Smart Air Fryer 3.5L in India.

The manual device segment is expected to grow significantly over the forecast period. Manual air fryers are cheaper than automatic air fryers, making them easily accessible to many people. In addition, most manual air fryers are simple to use, and the control knobs are easily distinguishable by users who are familiar with conventional kitchen appliances, which drives their demand in the market growth.

Capacity Insights

The up-to-4-lit capacity segment dominated the air fryer market with a revenue share of 48.4% in 2023. Air fryers that are of a smaller capacity, that are up to 4 lit are more appropriate for home use. The small size of the air fryers as compared to the large ones also ensures that they consume less energy, and hence, they can contribute to the conservation of the environment. In addition, the increasing innovation and technological developments in air fryers are further expected to drive market growth. For instance, in April 2024, Sharp launched an air fryer with a 2 x 4-litre cooking space and a drawer Air Fryer. The launch of such advanced products is further expected to drive segment growth.

The 4 to 6-lit capacity segment is expected to register the fastest CAGR over the forecast period. The larger models, air fryers with 4 to 6 liters, are perfect for preparing large volumes of food. This size range also enables the users to prepare meals for many people at a given instance hence efficient use of time in the kitchen. In addition, capacities ranging from 4 to 6 liters are adjustable regarding various forms of food products, be it snacks or full meals can be easily cooked at a time using an air fryer without the need to overcrowd the cooking basket. In June 2024, Xiaomi introduced Xiaomi Air Fryer 6L in India with a 1500W Power Capacity. The increasing launch of such new and advanced products is further likely to add to the market growth over the forecast period.

Application Insights

The residential application segment dominated the air fryer market with a revenue share of 67.2% in 2023. The residential segments have started using air fryers since it is more efficient in preparing healthier food than deep frying. In addition, the growth in the modular kitchens segment and the launch of advanced air fryers for home use across the globe have also driven the use of air fryers in the residential segment. For instance, in February 2024, Ninja announced its plans to launch a DoubleStack air fryer that is more suitable for a family and fits in small kitchens.

The commercial segment is expected to grow at the fastest CAGR over the forecast period. This can be attributed to the rising usage of air fryers among restaurants and cafe establishments. The increasing awareness regarding the consumption of healthy food and the emphasize of food establishments such as restaurants and food trucks on serving healthier food to respond to the growing demand for healthy food items is driving the market growth.

Distribution Channel Insights

The offline distribution channel segment dominated the air fryer market with a revenue share of 73.1% in 2023. Since air fryers are not cheap and many families make a big investment in buying them, customers appreciate the ability to personally get an idea of how they work. Moreover, while adopting the offline store technique, consumers can get the assurance of trustworthiness that may sometimes be missing with the online channels. These benefits of the offline distribution channels are driving the segment growth.

The online distribution channel segment is expected to register the fastest CAGR over the forecast period. Most online channels, such as Amazon.com, Inc., post low-price promotions and other offers on air fryers, which appeal to price-sensitive consumers. These offers can affect the amount of sales volume and customer retention in the air fryer market. In addition, social media advertisement, collaborations with social media influencers, and the use of online advertisements to market the air fryer drive consumer preferences, hence driving the market growth.

Regional Insights

North America air fryer market dominated the global air fryer market with a revenue share of 37.6% in 2023. The increasing consumer preference for healthy ways of cooking food in the North American market and the ability of air flyers to meet this need by cooking food with less oil is driving regional growth. Moreover, the increased technological advancements in the air fryer, such as AI, make it even more convenient to consumers, driving the air fryer market in North America. For instance, Chef AI, a start-up in the U.S., is developing an AI-based automatic air fryer that can use deep learning models and sensors to help determine the food's size, shape, weight, and thickness. The development of such products is likely to drive market growth in the region.

U.S. Air Fryer Market Trends

The U.S. air fryer market accounted for a significant share of the North American air fryer market in 2023. Rise in disposable income, changing lifestyles, and the development and availability of advanced air fryer options have led to market growth in the U.S. Moreover, e-commerce platforms play a crucial role in driving the market in the U.S. as they give consumers an easy way to buy products.

Europe Air Fryer Market Trends

Europe air fryer market is expected to grow at the fastest CAGR over the forecast period. The rapid urbanization and changing lifestyle have increased the demand for time-saving cooking appliances such as air fryers. The presence of key players in the region and launch of new products is expected to boost market growth. For instance, in April 2024, Ninja introduced the new Double Stack Air Fryer in the UK and European market.

The UK air fryer market is expected to grow rapidly in the coming years due to the changing lifestyles, increasing awareness about healthy diets, and increasing energy costs in the country. In September 2023, eBay collaborated with a chef to launch the first air fryer restaurant in the UK. Such developments are likely to increase awareness regarding the benefits of air fryers and drive market growth in the country.

Asia Pacific Air Fryer Market Trends

Asia Pacific air fryer market is anticipated to witness significant growth in the global air fryer market. Increasing awareness regarding healthy food consumption, a rise in the consumer’s disposable income, and a consequent increase in purchasing power have driven the demand for air fryers in the region. The growing demand has also created opportunities for market players to launch new and advanced products, further driving market growth.

China air fryer market is expected to grow rapidly over the forecast period due to cost-effective manufacturing and subsequently efficient supply chains. The launch of new products in this category is further expected to drive market growth. For instance, in August 2023, Xiaomi introduced the Mijia 5.5L Visual Air Fryer in China for USD 50. Such launches are expected to encourage families to use air fryers, further driving market growth.

Air fryer market in India is held a substantial market share in 2023 owing to rising awareness about healthy diets. In addition, the presence of global and local players in the market and their development strategies are further adding to the market growth. For instance, Usha International, an India-based brand, expanded its business into kitchen appliances in October 2023 with the launch of its iChef range, which also included the iChef Smart Air Fryer - Digital 5L.

Key Air Fryer Company Insights

Some key companies in the air fryer market include Koninklijke Philips N.V.; SharkNinja Operating LLC; Cuisinart.; the BLACK + DECKER; and Dash; Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

SharkNinja Operating LLC is a worldwide product design and technology enterprise that makes a specialty of a vast range of family products. The company's product portfolio includes a diverse variety of products such as vacuum cleaners, steam mops, air purifiers, blenders, food processors, air fryers, coffee systems, and more.

-

Havells India Limited is a Fast-Moving Electrical Goods (FMEG) Company with a worldwide presence. The organization designs, produces, distributes, and sells an extensive variety of commercial and consumer electrical products. Havells offers products that include switches, home equipment, lighting solutions, water heaters, and more.

Key Air Fryer Companies:

The following are the leading companies in the air fryer market. These companies collectively hold the largest market share and dictate industry trends.

- Koninklijke Philips N.V.

- SharkNinja Operating LLC

- Cuisinart.

- the BLACK + DECKER

- Dash

- Breville Site.

- Havells India Ltd.

- TTK Prestige Ltd.

- Corelle Brands LLC.

- Tefal

Recent Developments

-

In June 2024, TTK Prestige Ltd. launched the Prestige 4.5-liter Nutrifry air fryer. This product uses smart airflow 360-diploma warm air circulation for frying, resulting in a crisp texture.

-

In April 2024, Koninklijke Philips N.V. introduced the newest air fryer in the signature series addition to its lineup of air fryers. The appliance is built with seven-layer fast air technology and has cooking ability of as much as 7.3 liters.

-

In September 2022, INALSA introduced its Air Fryer with Dual Baskets India.

Air Fryer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.31 billion

Revenue forecast in 2030

USD 2.07 billion

Growth Rate

CAGR of 7.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device, capacity, application, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia & New Zealand, Brazil, South Arabia

Key companies profiled

Koninklijke Philips N.V.; SharkNinja Operating LLC; Cuisinart.; the BLACK + DECKER; Dash; Breville Site.; Havells India Ltd.; TTK Prestige Ltd.; Corelle Brands LLC.; Tefal

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Air Fryer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global air fryer market report based on, device, capacity, application, distribution channel, and region.

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Automatic

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 4 Liters

-

4 Liters to 6 Liters

-

6 Liters to 8 Liters

-

Above 8 Liters

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.