- Home

- »

- Homecare & Decor

- »

-

Air Mattress Market Size, Share And Growth Report, 2030GVR Report cover

![Air Mattress Market Size, Share & Trends Report]()

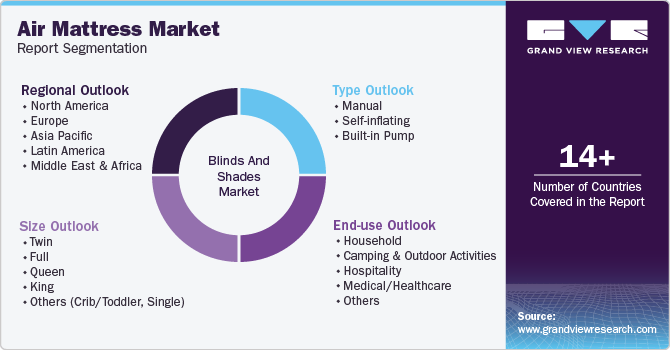

Air Mattress Market (2024 - 2030) Size, Share & Trends Analysis Report By Size (Twin, Full, Queen, King, Others), By Type (Manual, Self-inflating, Built-In Pump), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-493-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Air Mattress Market Summary

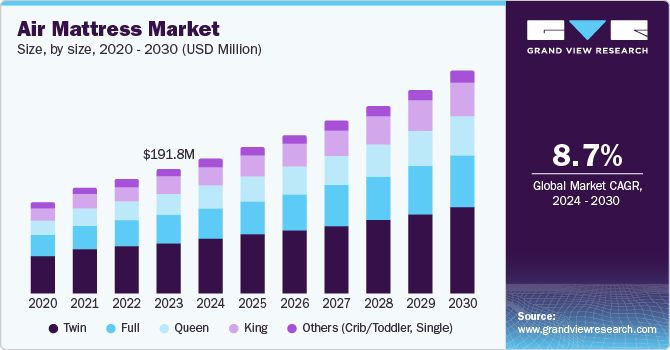

The global air mattress market size was estimated at USD 191.8 million in 2023 and is projected to reach USD 342.6 million by 2030, growing at a CAGR of 8.7% from 2024 to 2030. The rising popularity of outdoor activities, such as camping and hiking, drives the market growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- The U.S. air mattress market dominated the regional market with the largest market revenue share in 2023.

- By size, the twin segment held the largest market revenue share of 41.1% in 2023.

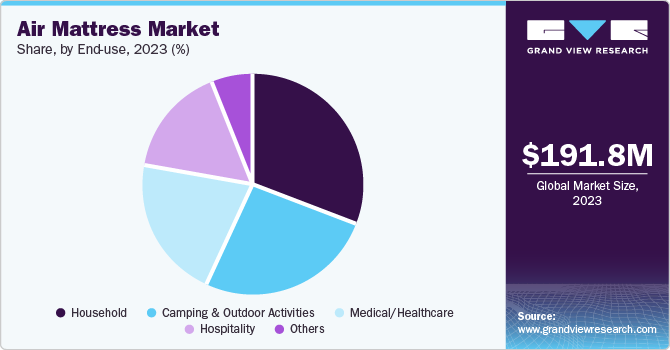

- By end use, the household segment held the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 191.8 Million

- 2030 Projected Market Size: USD 342.6 Million

- CAGR (2024-2030): 8.7%

- North America: Largest market in 2023

As more people embrace outdoor adventures, the need for portable, comfortable, and lightweight bedding solutions has surged. Air mattresses provide a convenient option for campers, offering comfort similar to traditional beds while being easy to transport and set up in various environments. This trend is particularly strong among millennials and younger generations, who prioritize experiences and are more likely to engage in recreational activities that require portable bedding solutions.

The growing trend of temporary and shared living arrangements also contributes to the increased demand for air mattresses. In many urban areas, where space is limited and housing costs are high, individuals often opt for flexible living arrangements such as renting rooms, co-living spaces, or staying with friends and family. Air mattresses offer an affordable and practical solution for accommodating guests or creating additional sleeping space. Their ease of storage and quick setup make them a popular choice for people living in small apartments or those who frequently host visitors.

Furthermore, the air mattress design and technological innovation have significantly enhanced their appeal. Modern air mattresses have features like built-in pumps, adjustable firmness settings, and durable, puncture-resistant materials. These advancements have improved the overall user experience, making air mattresses a viable alternative to traditional beds for both temporary and long-term use. Customizing firmness levels to suit individual preferences has also made air mattresses more attractive to a broader audience, including those with specific health needs or comfort preferences.

The impact of the global pandemic has played a role in boosting demand for air mattresses. As more people work from home and travel restrictions limit traditional vacations, there has been an increased focus on creating comfortable living spaces and exploring local destinations. Air mattresses are a versatile addition to home furnishings, offering an easy solution for accommodating guests or enhancing comfort during staycations. This shift in consumer behavior, combined with the ongoing trends of outdoor activities and flexible living arrangements, continues to drive the global demand for air mattresses.

Air mattress is a cost-effective option for the regular mattress and is designed for everyday use like any other mattress. The increasing popularity of air mattresses attributed to durability, flexibility, portability, handling convenience, and odor-free nature is one of the major factors that has impacted the growth in the air mattress market. Rising awareness about the health-related benefits of air mattresses is further contributing to growth in their demand globally. Rising wellness tourism and never-ending holiday trips or outings have further generated increased opportunities for air mattress manufacturers.

Size Insights

Twin segment held the largest market revenue share of 41.1% in 2023. Twin-sized air mattresses are preferred due to their versatility and space efficiency, making them suitable for a range of uses, including guest beds, camping trips, and temporary sleeping arrangements in small spaces. As urban living spaces become more compact, consumers seek practical solutions that maximize space without compromising comfort. Additionally, twin air mattresses are generally more affordable and accessible to store and transport, appealing to budget-conscious consumers and those who frequently travel. The rise in outdoor recreational activities and the growing popularity of minimalist living further contribute to the heightened demand for twin-sized air mattresses.

The King size segment is expected to grow at the fastest CAGR of 10.4% over the forecast period. As more consumers prioritize comfort and space in their sleeping arrangements, king-size air mattresses are becoming increasingly popular. This trend is especially noticeable among families and couples who require more sleeping space for better rest. The rising trend of camping and outdoor activities has also boosted the demand for larger air mattresses that can comfortably accommodate multiple people. The versatility and portability of king-size air mattresses make them a preferred choice for guests and temporary bedding solutions. With the growing emphasis on convenience, comfort, and multipurpose use, the king-size segment is experiencing a significant surge in demand in the air mattress market.

Type Insights

The built-in pump segment held the largest market revenue share in 2023. Built-in pumps simplify the setup and removal process, making air mattresses more user-friendly. This convenience benefits consumers who seek hassle-free solutions for temporary bedding. These mattresses can be easily deflated and packed away, making them suitable for people with limited space, frequent travelers, and campers. The popularity of camping, road trips, and outdoor activities drives demand for portable and comfortable sleeping solutions like air mattresses with built-in pumps.

Self-Inflating segment is expected to witness a significant growth in the forecast period. Self-inflated air mattresses offer significant convenience compared to traditional air mattresses. They eliminate the need for external pumps or manual inflation, making them user-friendly and quick to set up. The travel and hospitality industry has seen an increased use of portable bedding solutions to accommodate guests in various settings, including vacation rentals and temporary accommodation. Self-inflated air mattresses are mostly used in these scenarios due to their portability and ease of setup.

End-use Insights

The household segment held the largest market revenue share in 2023. Households increasingly use air mattresses as a flexible solution for accommodating guests, particularly in smaller living spaces where a permanent guest bed may not be practical. Additionally, advancements in air mattress technology, such as improved comfort, durability, and ease of inflation and deflation, have made them more user-friendly for everyday use. The growing trend of minimalistic and space-saving living also drives households to choose air mattresses as an alternative to traditional bedding options. Furthermore, the affordability of air mattresses compared to conventional beds makes them an attractive option for budget-conscious consumers, further fueling demand in the household segment.

The medical/healthcare segment is expected to grow at the fastest CAGR over the forecasted period. The increasing demand for air mattresses in the medical and healthcare segment is primarily driven by the growing awareness of the importance of patient comfort and the prevention of pressure ulcers, particularly in long-term care and hospital settings. Air mattresses are designed to provide superior pressure redistribution, which is critical for patients who are bedridden or have limited mobility. As the global population ages, there is a corresponding rise in elderly individuals requiring prolonged hospital stays or home care, further fueling the demand for specialized air mattresses. Additionally, advancements in air mattress technology, such as the integration of adjustable firmness and automatic pressure adjustments, make these products more attractive for healthcare providers, aiming to improve patient outcomes and reduce the incidence of bedsores.

Regional Insights

North America air mattress market dominated the market with a revenue share of 38.5% in 2023. The rising popularity of outdoor recreational activities such as camping drives the market growth. The growing trend of hosting guests at home has led to more households investing in air mattresses as a convenient and space-saving solution for temporary sleeping arrangements. The emphasis on convenience and ease of storage also plays a role, as consumers seek flexible options for accommodating visitors without compromising comfort. Moreover, advancements in air mattress technology, including built-in pumps and improved durability, have enhanced their appeal to a wider range of consumers.

U.S. Mattress Market Trends

The U.S. air mattress market dominated the regional market with the largest market revenue share in 2023. The rise of short-term rental platforms such as Airbnb has led to an increased need for flexible sleeping arrangements, where air mattresses are a convenient option for accommodating additional guests. Furthermore, the ongoing trend of smaller living spaces, particularly in urban areas, has driven the demand for multi-functional and space-saving furniture. Air mattresses are a practical choice for those seeking temporary bedding solutions.

Europe Air Mattress Market Trends

Europe air mattress market was identified as a lucrative region in this industry. The demand for air mattresses in Europe is increasing due to increased outdoor recreational activities, such as camping and festivals, which are particularly popular in countries such as Germany and France. Europeans increasingly embrace the "staycation" trend, where people prefer to travel locally rather than abroad, boosting the need for portable and comfortable sleeping solutions like air mattresses. Furthermore, the growing trend of renting smaller apartments, especially in densely populated cities such as London, Paris, and Berlin, has driven demand for space-saving furniture.

The UK air mattress Market is projected to grow rapidly in the forecasted period. The growing trend of staycations drives the demand for air mattresses in the country. This trend, coupled with the rise in outdoor activities such as camping, has led to higher demand for portable and comfortable sleeping solutions like air mattresses. Additionally, the UK has seen a surge in home renovations and a focus on flexible living spaces, including the need for temporary sleeping arrangements during home improvement projects or accommodating guests.

Asia Pacific Air Mattress Market Trends

The Asia Pacific air mattress market is expected to grow at the fastest CAGR over the forecast period. Rapid urbanization and the increasing trend of compact living spaces in countries such as China, India, and Japan have boosted the demand for air mattresses as they offer a space-saving alternative to traditional beds. Furthermore, the growing awareness of the health benefits of air mattresses, particularly for people with back pain, has contributed to their increasing adoption across the region. The expanding e-commerce sector in Asia-Pacific also plays a crucial role by making air mattresses more accessible to a broader audience, further fueling demand.

India air mattress market is expected to grow significantly over the forecast period. The rapid urbanization in cities such as Mumbai, Delhi, and Bangalore has led to smaller living spaces, where air mattresses offer a convenient and space-saving solution for accommodating guests. With increased purchasing power and exposure to global lifestyles, the growing middle class in India is more inclined to buy quality air mattresses for comfort and convenience. The widespread availability of these products on e-commerce platforms, with discounts and easy delivery options, has further accelerated their adoption nationwide.

Key Air Mattress Company Insights

Some of the key companies include Intex Corporation; The SoundAsleep Company; Serta; Aerobed; Bestway Inflatables & Material Corp; Simmons Beautyrest; and others.

-

Intex Corporation offers a diverse range of air mattresses designed to cater to various needs and preferences. Their product lines include the Dura-Beam Standard Series for basic comfort and durability, the Dura-Beam Plus Series for enhanced support, and the Dura-Beam Deluxe Series for luxury features. For those seeking top-tier comfort, the PremAire Series stands out with its innovative design.

-

King Koil offers a range of high-quality air mattresses designed for comfort and support. Their airbeds feature enhanced coil technology and durable construction, ensuring proper spinal alignment and even weight distribution. Popular models include the King Koil Luxury Air Mattress with a built-in pump for easy inflation and deflation. Available in various sizes such as Twin, Queen, and California King, these air mattresses are suitable for guests, camping, or as a temporary bedding solution.

Key Air Mattress Companies:

The following are the leading companies in the air mattress market. These companies collectively hold the largest market share and dictate industry trends.

- Intex Corporation

- The SoundAsleep Company

- Serta

- Aerobed

- Bestway Inflatables & Material Corp.

- King Koil Airbeds

- idoo

- The Coleman Company, Inc.

- Lazery Sleep

- Simmons Bedding Company, LLC

Recent Developments

-

In May 2024, Serta announced the launch of its new Beauty Sleep Collection and Serta Classic Collection. Beauty Sleep provides consistent supportive sleep and Classic provides comfort zones designed for essential lower back care and classic comfort.

Air Mattress Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 207.5 million

Revenue forecast in 2030

USD 342.6 million

Growth rate

CAGR of 8.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Size, type, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, South Africa

Key companies profiled

Intex Corporation; The SoundAsleep Company; SertaAerobed; Bestway Inflatables & Material Corp.; King Koil Airbeds; idoo; The Coleman Company, Inc.; Lazery Sleep; Simmons Bedding Company, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Air Mattress Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global air mattress market report based on size, type, end-use, and region:

-

Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Twin

-

Full

-

Queen

-

King

-

Others (Crib/Toddler, Single)

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Self-Inflating

-

Built-in Pump

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Household

-

Camping & Outdoor Activities

-

Hospitality

-

Medical/Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.