- Home

- »

- Next Generation Technologies

- »

-

Air Quality Monitoring System Market Size Report, 2030GVR Report cover

![Air Quality Monitoring System Market Size, Share & Trends Report]()

Air Quality Monitoring System Market Size, Share & Trends Analysis Report By Product Type (Indoor, Outdoor), By Pollutant (Physical, Chemical), By Component, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-039-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Air Quality Monitoring System Market Trends

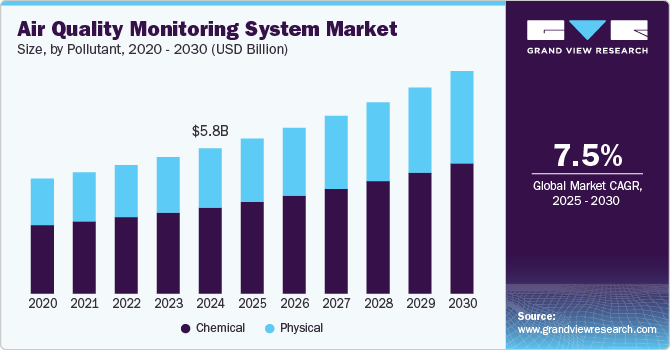

The global air quality monitoring system market size was estimated at USD 5.80 billion in 2024 and is expected to grow at a CAGR of 7.5% from 2025 to 2030. Technological advancements, such as IoT and sensor technology, are revolutionizing how data on air quality is collected, analyzed, and utilized, fostering a more initiative-taking and informed approach to managing air pollution and its impacts on public health and the environment. IoT technology enables the interconnection of physical devices, such as air quality sensors, through the internet, allowing them to communicate and exchange data with each other and with centralized systems. This connectivity transforms traditional air quality monitoring systems into dynamic, interconnected networks that can provide comprehensive and granular insights into air pollution patterns in real-time.

IoT connectivity facilitates the development of smart, connected air quality monitoring solutions that are integral to smart city initiatives. These solutions can be integrated with other smart infrastructures, such as traffic control and public health systems, to create synergistic responses to air quality issues. For instance, real-time air quality data can trigger adaptive traffic management systems to reduce vehicle emissions during periods of high pollution. In addition, the widespread adoption of Internet of Things (IoT) technology in air quality monitoring is driving innovation in sensor design and functionality. Sensors are becoming more compact, energy-efficient, and capable of detecting a broader range of pollutants at lower concentrations. This not only expands the potential for deploying sensors in diverse environments but also enhances the granularity and reliability of air quality assessments.

Mobile monitoring platforms have made air quality monitoring more accessible to the public, providing a dynamic tool for environmental researchers and policymakers to gather and analyze air quality data on a granular level. The essence of mobile monitoring platforms lies in their ability to integrate sophisticated air quality sensors with smartphones and other portable devices. These platforms can measure a variety of pollutants, such as particulate matter, nitrogen dioxide, and volatile organic compounds, in real time. Users can access this information directly on their mobile devices, enabling them to make informed decisions about their daily exposure to air pollution.

Multi-pollutant monitoring systems are designed to detect and quantify multiple pollutants simultaneously, offering a complete picture of air quality and its potential effects on human health and the environment. Traditionally, air quality monitoring focused on measuring individual pollutants, often because of regulatory requirements or limitations in sensor technology. However, this single-pollutant approach does not account for the combined effects of multiple pollutants, which can interact with each other in the atmosphere and exacerbate health risks. Multi-pollutant monitoring addresses this gap by employing advanced sensors and analytical techniques capable of tracking a wide array of pollutants, including particulate matter (PM2.5 and PM10), nitrogen dioxide (NO2), sulfur dioxide (SO2), carbon monoxide (CO), volatile organic compounds (VOCs), and ozone (O3), among others. The advancement of sensor technology plays a crucial role in enabling multi-pollutant monitoring.

Various countries are implementing air quality monitoring systems in major cities with the help of system integrators. The service segment has grown significantly due to an increase in the number of organizations that perform systems integrations. Apart from system integration, these organizations also provide consultancy and maintenance services through long-term contracts. Furthermore, various Original Equipment Manufacturers (OEMs) are establishing partnerships with system integrators and governments are offering long-term contracts to system integrators.

Product Type Insights

The outdoor air quality monitoring segment led the market, accounted for over 65% of the global revenue in 2024. The market growth can be attributed to rising individual spending, increasing urbanization, and industrialization, along with the growing adoption of innovative technologies. The adoption of innovative technologies is helping develop enhanced monitoring systems, making them more efficient and dependable. Moreover, governments worldwide are investing in measures to combat air pollution, reflecting a growing commitment to environmental health. Notable examples include the U.S. EPA's establishment of National Ambient Air Quality Standards and the Indian government's launch of Swachh Vayu Diwas under the National Clean Air Program (NCAP). Such initiatives are likely to drive the demand for a variety of outdoor air quality monitoring solutions across the world.

The indoor air quality monitoring segment is predicted to foresee the highest CAGR from 2025 to 2030. Owing to the growing concerns regarding the range of health issues linked to poor indoor air quality, respiratory conditions, and more severe health issues, both commercial and residential end users are heavily investing in technology for monitoring and improving the air quality within their premises. The increasing use of smart home technology is making it easier to integrate IAQ monitoring systems seamlessly into everyday life, which offers real-time data and actionable insights. Advancements in sensor technology make AQMS devices more accurate and cost-effective, enabling individuals and organizations to prioritize health and well-being through improved air quality.

Pollutant Insights

The chemical segment accounted for the largest market revenue share in 2024. The segment’s growth can be attributed to the increasing demand for systems capable of detecting and measuring the concentration of various harmful chemicals in the air. These pollutants, including volatile organic compounds, sulfur oxides, nitrogen dioxide, and particulate matter, pose serious health issues. Government and environmental agencies are implementing strict regulations to monitor and control air quality. This regulatory pressure, combined with growing public awareness about the health implications of air pollution, is pushing both public and private sectors to invest in advanced air quality monitoring systems designed for detecting chemical pollutants.

The physical segment is predicted to foresee the highest CAGR from 2025 to 2030. Physical pollutants, primarily Particulate Matter (PM), including PM2.5 and PM10, are tiny particles or droplets in the air that can be inhaled and cause serious health issues, such as respiratory infections, heart disease, and lung cancer. The rise in urbanization and industrial activities has led to an increase in the levels of these pollutants, particularly in densely populated cities. Consequently, there is a heightened demand for air quality monitoring systems capable of detecting and quantifying the presence of these physical particles.

Components Insights

The hardware segment accounted for the largest revenue share in 2024. This can be attributed to the increasing number of system integrators in the market. Some of the multi-national businesses perform the work of system integration and, therefore, purchase hardware such as sensors and displays from component manufacturers. The major factor contributing to the growth of the hardware segment is the increasing deployment of advanced air quality monitoring systems. Furthermore, the growing popularity of smart homes in economies such as China, the U.S., and Germany is also expected to drive the demand for the hardware segment soon.

The software segment is predicted to foresee the highest CAGR from 2025 to 2030. The growth can be attributed to the increasing demand for sophisticated air quality monitoring solutions from smart city authorities. Various smart city authorities are demanding centralized software for monitoring air quality monitoring systems deployed across a city. In addition, the adoption of web-based monitoring software is increasing among residential end users. Various software companies are emphasizing the development of air quality index software that provides location-specific, real-time air quality information from the data collected through air quality sensors, which is driving segment growth.

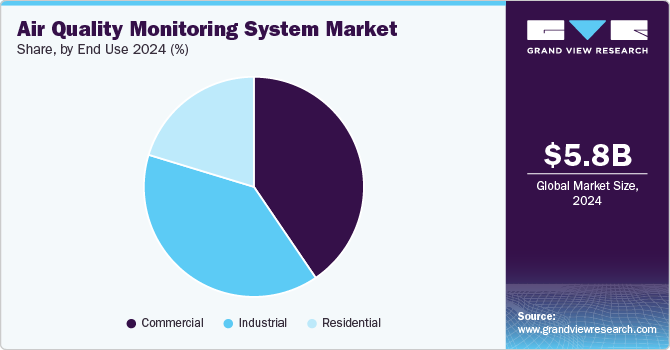

End Use Insights

The commercial segment accounted for the largest revenue share in 2024. The integration of IoT in air quality monitoring allows commercial buildings to capture and analyze data continuously, thus improving air management efficiency. Smart buildings equipped with IoT-linked sensors can adjust ventilation systems based on real-time pollution levels, helping to save energy while maintaining a healthy indoor environment. This trend is especially relevant as energy efficiency and environmental sustainability become essential in commercial real estate. By linking air quality systems with Building Management Systems (BMS), companies can gain insight into pollutant sources and act proactively, optimizing costs and creating healthier spaces. The demand for IoT-enabled monitors is likely to increase as more companies seek comprehensive solutions that deliver both environmental and economic benefits.

The industrial segment is expected to exhibit a significant CAGR from 2025 to 2030. Industrial companies are prioritizing air quality monitoring to improve workplace safety and reduce the health risks associated with air pollution exposure. In sectors like mining, chemical manufacturing, and construction, air quality monitoring systems help manage risks related to particulate matter, VOCs, and toxic gases. Enhanced air quality contributes to safer environments, reducing workplace accidents and long-term health issues among employees. Furthermore, with heightened awareness of occupational health standards, companies are recognizing the benefits of providing cleaner air, which aligns with workplace safety regulations and industry best practices. This trend also fosters goodwill and strengthens employer branding, appealing to workers who value healthy and safe workplaces.

Regional Insights

North America air quality monitoring system market dominated the global market with a revenue share of over 36% in 2024. This can be attributed to the rising levels of acid rain in North America, which has resulted in most of the region's lakes becoming acidic. In response, governments have mandated strict measures for monitoring air quality, which is expected to drive market growth for air quality monitoring systems. Moreover, in April 2023, NASA launched the Tropospheric Emissions: Monitoring of Pollution (TEMPO) satellite mission from the Kennedy Space Center in Florida. This satellite offers high-resolution hourly air quality data across North America, aiding in effective regional planning.

U.S. Air Quality Monitoring System Market Trends

The air quality monitoring system market in the U.S. is expected to grow at a CAGR from 2025 to 2030. Stringent environmental regulations and the growing awareness of health issues related to air pollution are the key drivers for the air quality monitoring system market. In addition, technological advancements in monitoring systems and increased funding for air quality management are propelling market growth.

Europe Air Quality Monitoring System Market Trends

The air quality monitoring system market in the Europe region is expected to witness significant growth over the forecast period. The market growth can be attributed to rising government regulations aimed at controlling air pollution levels. Moreover, the growing public awareness about the health impacts of air pollution has created a need for more comprehensive monitoring solutions. The rise in industrial activities and urbanization across European countries is also driving the demand for effective air quality control measures. Technological advancements in monitoring systems have made them more efficient and accessible, contributing to their high demand in the region.

Asia Pacific Air Quality Monitoring System Market Trends

The Asia Pacific air quality monitoring system market is anticipated to register the highest CAGR over the forecast period. This growth is attributed to the rising incidence of respiratory and cardiovascular diseases due to air pollution in numerous cities across the region. In 2022, 24 out of 30 cities with the worst Air Quality Index (AQI) worldwide were from Asia Pacific. In addition, supportive government policies are expected to drive market growth in the region. For instance, the Government of India requires manufacturing companies to provide real-time air quality data to the Central Pollution Control Board (CPCB).

Key Air Quality Monitoring System Company Insights

Leading companies in the market, including General Electric, Aeroqual, Emerson Electric Co., Siemens, Merck KGaA, and Teledyne Technologies Incorporated, are actively implementing strategies to broaden their reach and strengthen their market position. These companies are advancing their offerings through partnerships, mergers, acquisitions, and collaborations, and developing innovative products and technologies that incorporate AI to enhance contract management solutions. This approach enables them to keep pace with the increasing demands for security and operational transparency within the industry. By proactively evolving their technological capabilities, they aim to meet shifting market needs and reinforce their competitive advantage.

-

General Electric focuses on providing advanced air quality monitoring solutions that utilize IoT and analytics to capture real-time environmental data. Their solutions are often used in industries where emissions management is crucial, such as manufacturing and power generation, to help clients comply with environmental regulations. By integrating AI, GE’s systems not only monitor but also analyze pollution levels, providing actionable insights for industries to optimize processes and reduce emissions. This approach not only improves air quality but also enhances operational efficiency, helping companies meet both regulatory standards and sustainability goals.

-

Aeroqual specializes in designing and manufacturing air quality monitoring devices that range from portable monitors to large-scale integrated systems for both indoor and outdoor environments. Their monitors are known for high precision and user-friendly design, catering to diverse applications, from research and environmental assessment to industrial compliance monitoring. Aeroqual is also proactive in developing AI-driven technologies that improve data accuracy and offer predictive analytics, allowing businesses and governments to anticipate and respond to air quality issues more effectively. With a strong focus on accuracy and innovation, Aeroqual supports real-time air quality data monitoring and contributes to effective decision-making across sectors.

Key Air Quality Monitoring System Companies:

The following are the leading companies in the air quality monitoring system market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- General Electric

- HORIBA Scientific

- Aeroqual

- Emerson Electric Co.

- Siemens

- Merck KGaA

- Teledyne Technologies Incorporated.

- Testo SE & Co. KGaA

- Thermo Fisher Scientific Inc.

View a comprehensive list of companies in the Air Quality Monitoring System Market

Recent Developments

-

In February 2024, Merck Group announced plans to open a new distribution center in Brazil in Cajamar, São Paulo, to better serve its Life Science customers in the region. The new facility spanning 13,000 square meters, almost double the size of the previous location in the municipality of Cotia, called for investments worth USD 21.6 million (EUR 20 million). Plans envisaged the new space being operational by late February 2024.

-

In February 2024, Honeywell International Inc. was designated the Official Sustainable Building Technology Partner for the Atlanta Hawks and the State Farm Arena. Through this multi-year partnership, Honeywell International Inc. will introduce a range of advanced upgrades to the building operations systems at State Farm Arena. These enhancements aim to reduce energy use and emissions while improving the management and monitoring of the indoor environment.

-

In January 2024, HORIBA Ltd. launched the AP-380 series of analyzers, featuring five models, each designed for specific trace gas monitoring needs. The comprehensive lineup included the APMA-380 for carbon monoxide, the APOA-380 for ozone, the APSA-380 for sulfur dioxide, the APHA-380 for hydrocarbon trace gas, and the APNA-380 for nitrogen oxides.

Air Quality Monitoring System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.19 billion

Revenue forecast in 2030

USD 8.89 billion

Growth rate

CAGR of 7.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, pollutant, component, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

3M; HORIBA Scientific; General Electric; Aeroqual; Emerson Electric Co.; Siemens; Merck KGaA; Teledyne Technologies Incorporated.; Testo SE & Co. KGaA; Thermo Fisher Scientific Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Air Quality Monitoring System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global air quality monitoring system market based on product type, pollutant, component, end use, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor Air Quality Monitoring Systems

-

Fixed Indoor Systems

-

Portable Indoor Systems

-

-

Outdoor Air Quality Monitoring Systems

-

Fixed Outdoor Systems

-

Portable Outdoor Systems

-

-

-

Pollutant Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical

-

Nitrogen Oxides

-

Sulfur Oxides

-

Carbon Oxides

-

Volatile Organic Compounds

-

Others

-

-

Physical

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Sensors

-

Processors

-

Output Devices

-

-

Software

-

Services

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Oil & Gas

-

Manufacturing

-

Food & Beverages

-

Pharmaceuticals

-

Healthcare

-

Others

-

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global air quality monitoring system market size was estimated at USD 5.80 billion in 2024 and is expected to reach USD 6.19 billion in 2024.

b. The global air quality monitoring system market is expected to grow at a compound annual growth rate of 7.5% from 2025 to 2030 to reach USD 8.89 billion by 2030.

b. North America dominated the air quality monitoring system market with a share of 36% in 2024. This can be attributed to the rising levels of acid rain in North America, which has resulted in most of the region's lakes becoming acidic.

b. Some key players operating in the air quality monitoring system market include Emerson Electric Co., Thermo Fisher Scientific Inc., Siemens AG, 3M, Aeroqual Limited, and Testo SE & Co. KGaA, among others

b. Air quality monitoring systems, which measure the levels of pollutants such as particulate matter, nitrogen dioxide, sulfur dioxide, carbon monoxide, and volatile organic compounds, are crucial for assessing the cleanliness of the air and formulating strategies to mitigate pollution.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."