- Home

- »

- Homecare & Decor

- »

-

Air Sports Equipment Market Size And Share Report, 2030GVR Report cover

![Air Sports Equipment Market Size, Share & Trends Report]()

Air Sports Equipment Market Size, Share & Trends Analysis Report By Product (Container/Harness, Protective Gear), By Application (Parachuting, Paragliding, Hang Gliding, Base Jumping), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-483-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Air Sports Equipment Market Size & Trends

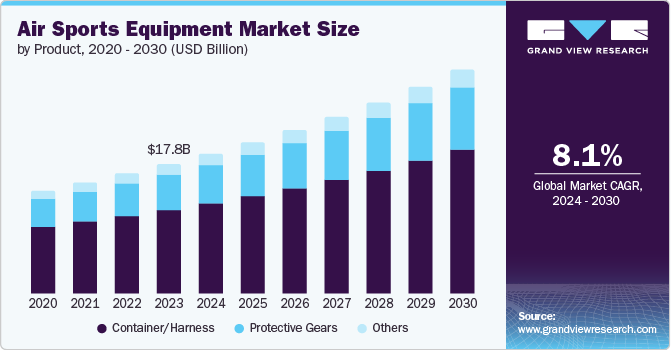

The global air sports equipment market size was valued at USD 17.8 billion in 2023 and is projected to grow at a CAGR of 8.1% from 2024 to 2030. This growth is attributed to the rise in the popularity of extreme adventure sports, which has increased the number of participants. In recent years, air sports activities such as paragliding, skydiving, bungee jumping, Base jumping, jet skiing, and wakeboarding have gained traction as recreational pursuits. In addition, engaging in these sports can offer various long-term mental and physical advantages due to the high level of physical activity involved, further boosting the market growth.

The shifts in demographics, increasing disposable incomes, and aspirational lifestyles positively impact extreme sports. As a result, these factors are anticipated to propel the expansion of the global air sports equipment market in the upcoming years. Furthermore, the increase in technological advancements aimed at improving product innovation and the growing availability of training programs and courses for various air sports is another factor contributing to the expansion of the market worldwide. These training facilities are staffed with skilled and experienced instructors and pilots who provide instruction to sports enthusiasts and provide air sports equipment at minimum prices, thereby contributing to the increased popularity of air sports. Moreover, the expansion of air sports training programs raises public awareness and increases the number of air sports professionals.

Product Insights

The container dominated the market and accounted for the largest market share of 64.6% in 2023. Containers and harnesses are crucial components in equipment, safeguarding the parachutes by addition and deployment, which drives the segment growth in the market. Furthermore, innovations in building and designing materials have led to more comfortable, durable, strong, and lightweight harnesses, enhancing the overall experience for individuals.

Protective gear is expected to grow at a CAGR of 8.4% over the projected years. This growth is driven by increased demand for protective equipment, such as helmets, goggles, and specialized attire. It is becoming a rapidly expanding sector in the worldwide air sports equipment industry. As safety and risk minimization becomes more prominent, individuals engaging in paragliding, skydiving, and hang gliding acknowledge the significance of top-notch protective gear. Furthermore, the development of impact-resistant materials and cutting-edge designs is contributing to the expansion of this sector.

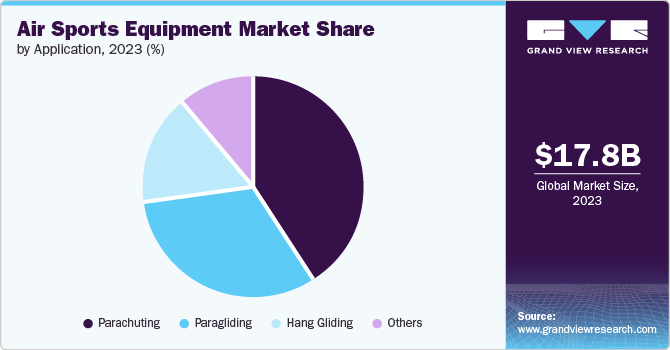

Application Insights

The parachuting application segment dominated the market with a revenue share of 41.5% in 2023. It is a widely sought-after experience to engage in this activity at least once in a lifetime, as it is a highly favored sport that promotes overall well-being. It helps alleviate stress and rejuvenates both the body and mind. In addition, as technology advances, skydiving equipment becomes more modernized, and research and development efforts increase, resulting in the segment growth. Furthermore, government administrations are allocating more funds towards expanding parachuting facilities to keep up with the rising interest in air sports adventure activities.

Paragliding witnessed is expected to grow at a significant CAGR of 8.6% over the forecast years. Paragliding festivals are becoming substantial events in global tourism, attracting tourists to local and international destinations to capture and enjoy thriller life experiences. In addition, paragliding provides a chance to glide through exceptional and breathtaking locations that are often unreachable through traditional methods. Furthermore, compared to skydiving or other extreme-level sports, pasragliding is relatively affordable, making it reachable for adventure enthusiasts, which drives the segment's growth.

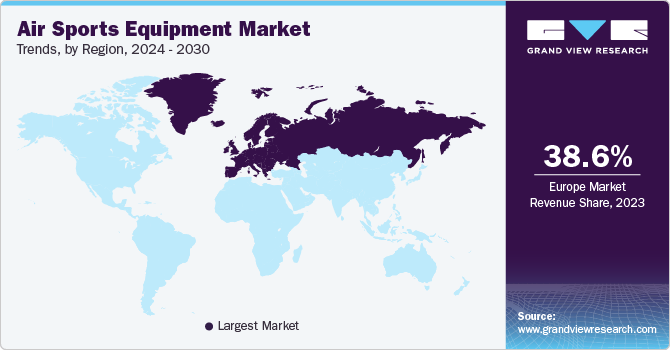

Regional Insights

The North America air sports equipment market accounted for a revenue share of 28.4% in 2023. This growth is attributed to the increasing popularity of activities such as paragliding, skydiving, or hang gliding, which deliver thrill & adventure enthusiasts with the opportunity to experience the skies with these excitement and adrenaline rush. In addition, manufacturers are focusing on creating products that can be altered to specific conditions and demands of participants, which is expected to drive the market growth. Furthermore, leading companies are implementing various marketing strategies, such as introducing new products, expanding their research and development efforts, and establishing partnerships with key distributors to expand their customer reach.

U. S. Air Sports Equipment Market Trends

The air sports equipment market in the U.S.is expected to grow substantially over the projected years owing to the rising culture of adventure and real-time experience tourism. Sport enthusiasts seek places with diverse and vivid landscapes and suitable weather conditions for air sports. Furthermore, governments and local communities are increasingly recognizing this niche economic potential of the market and investing in infrastructure and promotional campaigns to attract tourists.

Europe Air Sports Equipment Market Trends

The Europe air sports equipment market dominated the global market and accounted for the largest market share of 38.6% in 2023. This growth is attributed to the collaboration between governments and industries, which led to the formation of designated air sports regions and the implementation of safety standards. Furthermore, financial incentives for air sports events and competitions further contributed to the market growth in the region.

The UK air sports equipment market is expected to grow significantly over the projected years owing to the increasing demand for adventure sports and outdoor activities. As individuals worldwide are expected to seek distinctive and exhilarating experiences, air sports allow enthusiasts to step away from traditional leisure activities, further driving the growth of the market growth.

The air sports equipment market in France held a substantial revenue share in 2023. Adventure tourism is a significant factor in the travel industry, with many tourists seeking out destinations known for air sports offerings.Furthermore, government backing and efforts to boost tourism and adventure sports contribute to the growth of the market. Acknowledging the economic benefits of adventure tourism, numerous governments allocate resources towards enhancing infrastructure, implementing safety measures, and launching promotional activities to appeal to a wide range of domestic and international adventurers.

Asia Pacific Air Sports Equipment Market Trends

The air sports equipment market in Asia Pacificis expected to grow at a CAGR of 9.0% over the forecast period. Aspirational lifestyles consistently drive the demand for air sports equipment. Social media platforms such as Instagram and YouTube, where influencers share their airborne experiences, boost the visibility of adventure sports. The desire to share thriller experiences on social media increases the market growth.

The growth of the China air sports equipment market is driven by growing disposable incomes, rising interest in adventure tourism, and government efforts to promote air sports. In addition, technological advancements in air sports equipment propel market growth by introducing the latest products and enhancing operational effectiveness. Maintaining a lead in embracing new technologies can offer a competitive edge, shape market dynamics, and unlock potential business prospects.

The air sports equipment market in India is expected to experience significant growth over the forecast year owing to increasing technological advancements leading to more efficient designs, increased popularity among thrill-experiencing enthusiasts due to affordability, and advanced projects by government administrations directed at encouraging skydiving and related activities.

Key Air Sports Equipment Company Insights

Some of the key companies in the air sports equipment market include Velocity Sports Equipment Sdn Bhd., Parachute Industry Association, Ozone Paragliders LTD., SUP’AIR, and Peregrine Manufacturing, Inc. in the market are focusing on development & to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

Velocity Sports Equipment Sdn Bhd manufactures aluminum-based sports equipment, including Track and field, Indoor and outdoor Surface, and Artificial Grass equipment for sports enthusiasts.

-

Sun Path Products Inc. mainly serves customers in the U.S. and provides custom harness and container systems. They also offer javelin rigs, Odyssey, Accuracy, Aurora, and other products.

Key Air Sports Equipment Companies:

The following are the leading companies in the air sports equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Velocity Sports Equipment Sdn Bhd.

- Parachute Industry Association

- Ozone Paragliders LTD.

- SUP’AIR

- Peregrine Manufacturing, Inc.

- AdrenalinBASE

- Sun Path Products, Inc.

- Mirage Systems

- Apco Aviation Ltd.

- Flyneo

Air Sports Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 19.2 billion

Revenue forecast in 2030

USD 30.7 billion

Growth Rate

CAGR of 8.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Velocity Sports Equipment Sdn Bhd.; Parachute Industry Association,; Ozone Paragliders LTD.; SUP’AIR; Peregrine Manufacturing, Inc.; AdrenalinBASE; Sun Path Products, Inc.; Mirage Systems; Apco Aviation Ltd.; Flyneo.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Air Sports Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global air sports equipment market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Container/Harness

-

Protective Gears

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Parachuting

-

Paragliding

-

Hang Gliding

-

Base Jumping

-

Bungee Jumping

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."