- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Alginate Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Alginate Market Size, Share & Trends Report]()

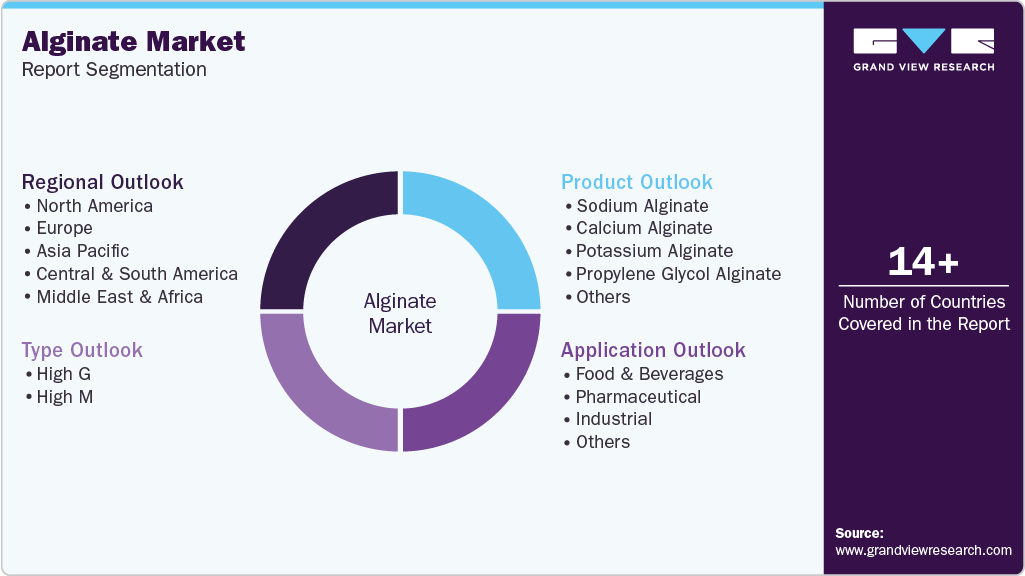

Alginate Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Sodium Alginate, Calcium Alginate, Potassium Alginate, Propylene Glycol Alginate), By Type (High M, High G), By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-244-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Alginate Market Summary

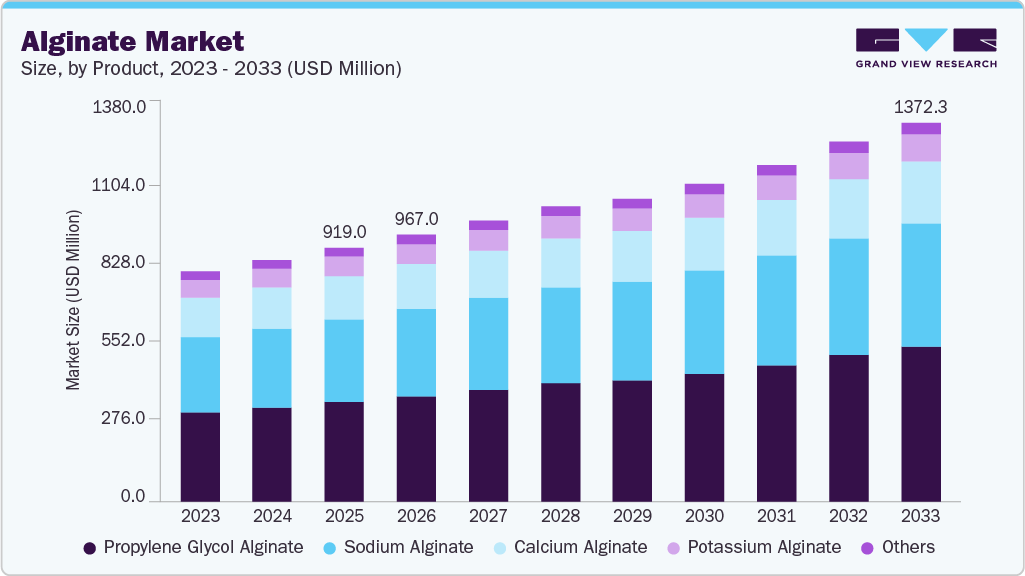

The global alginate market size was valued at 919.0 million in 2025 and is expected to reach USD 1,372.3 million by 2033, expanding at a CAGR of 5.1% from 2026 to 2033. The global industry is experiencing steady growth due to its expanding application base across pharmaceuticals, food and beverages, biomedical engineering, and industrial manufacturing.

Key Market Trends & Insights

- By region, Europe dominated the global alginate market in 2025 with a revenue share of 35.8%.

- By product, propylene glyco alginate accounted for a market share of 39.3% in 2025.

- By type, high G accounted for a market share of 52.8% in 2025.

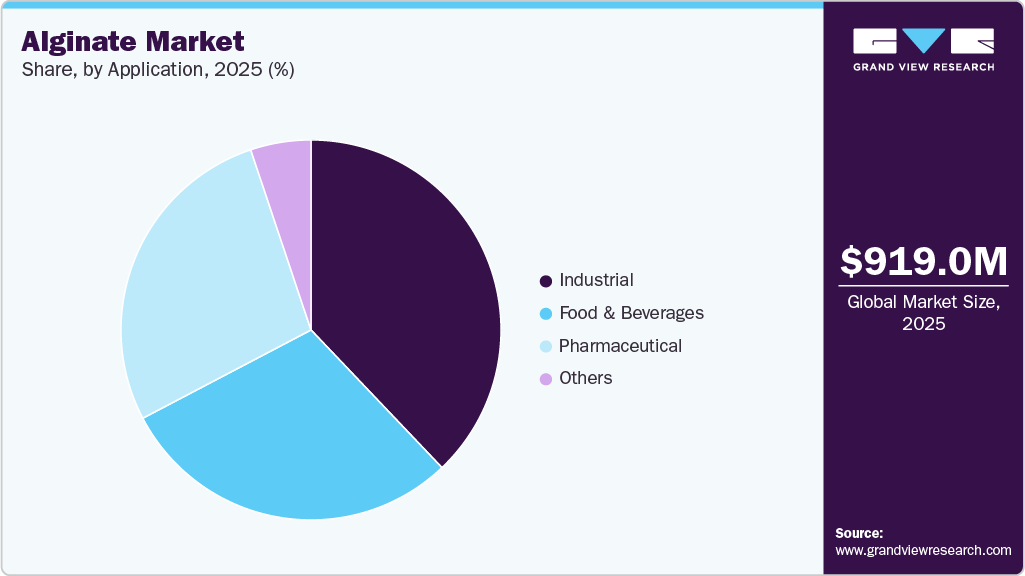

- By application, the industrial sector accounted for a market share of 37.9% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 919.0 Million

- 2033 Projected Market Size: USD 1,372.3 Million

- CAGR (2026-2033): 5.1%

Alginate’s unique properties, including biocompatibility, gel-forming capability, non-toxicity, and versatility, have positioned it as an essential biomaterial in both established and emerging industries. Its natural origin and sustainability advantages also make it increasingly preferred over synthetic polymers, particularly as companies worldwide shift toward eco-friendly and plant-derived ingredients. As a result, alginate has transitioned from a niche additive to a strategic raw material serving multiple high-growth sectors.

Demand for alginate is rising significantly in medical and pharmaceutical applications. Alginate is widely used in wound dressings, controlled drug delivery, tissue engineering scaffolds, and cell encapsulation, driven by its biocompatibility and ability to form hydrogels. The growth in chronic wounds, diabetic ulcers, and post-operative care needs is fueling the demand for alginate-based dressings. In addition, research in regenerative medicine is accelerating the use of alginate in 3D bioprinting and cell therapy, further supporting market expansion.

Alginate’s role as a thickener, stabilizer, emulsifier, and gelling agent is driving demand in the food and beverage sector. The rise of convenience foods, plant-based products, dairy alternatives, and clean-label formulations is encouraging manufacturers to incorporate natural hydrocolloids like alginate. Its stability under heat and acidity makes it suitable for ice creams, sauces, beverages, bakery products, and encapsulated flavorings. As global consumers shift toward natural and minimally processed ingredients, alginate is benefiting from being seen as a safer, label-friendly additive.

Additionally, alginate’s renewable marine origin (derived from brown seaweed) supports global sustainability goals. Industries seeking biodegradable materials for packaging, bioplastics, and textile applications are increasingly adopting alginate as an eco-friendly alternative to synthetic polymers. Regulatory pressure to reduce plastic waste has also accelerated research and high Mization of alginate-based biodegradable films and fibers.

Product Insights

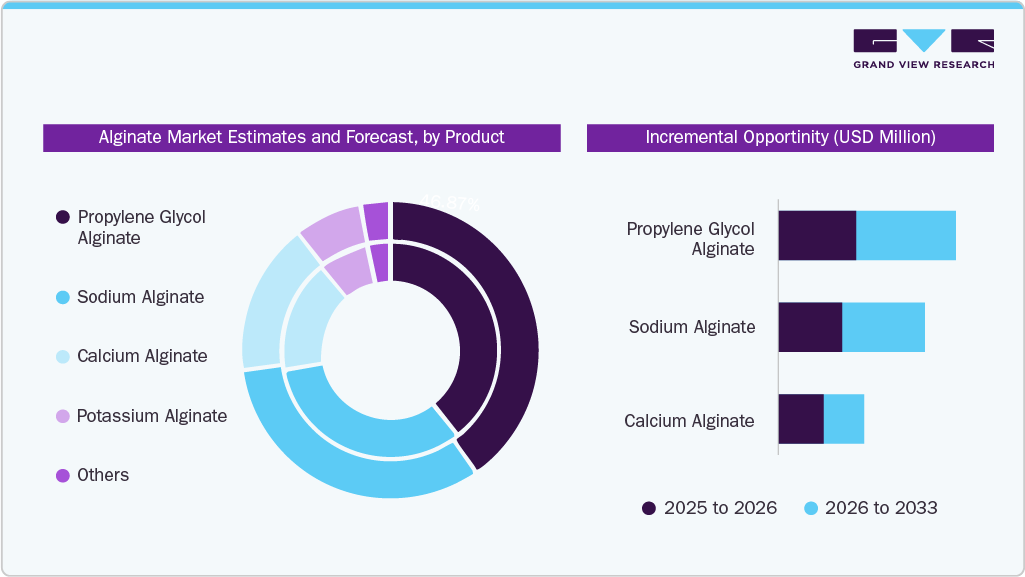

The propylene glycol alginate accounted for a market share of 39.3% of the global revenues in 2025. The demand for propylene glycol alginate (PGA) is rising as manufacturers across food, beverages, pharmaceuticals, and cosmetics shift toward high-performance, clean-label stabilizers that offer both natural origin and superior functional properties. PGA provides better acid stability, emulsification, and heat resistance than many traditional hydrocolloids, making it ideal for acidic drinks, salad dressings, dairy alternatives, flavored syrups, and pharmaceutical suspensions. Its ability to improve mouthfeel, extend shelf life, and maintain product consistency has become especially valuable as brands reformulate for healthier, low-additive, and plant-based products.

Additionally, the expansion of RTD beverages, functional drinks, and premium personal-care products is further accelerating PGA adoption due to its versatility and compatibility with modern clean-label formulations.

The sodium alginate segment is projected to grow at a CAGR of 5.1% from 2026 to 2033. Demand for sodium alginate is rising as companies across food, pharma, and cosmetics shift toward natural, clean-label, and plant-derived ingredients. It offers strong functional benefits, thickening, gelling, stabilizing, moisture retention, and film-forming while being vegan, biodegradable, and safe. Its versatility makes it valuable for plant-based foods, dairy alternatives, bakery fillings, beverages, and edible coatings. At the same time, pharmaceutical and personal-care manufacturers increasingly prefer sodium alginate for controlled-release formulations, wound-care gels, reflux treatments, and clean beauty products.

Type Insights

High G alginates accounted for a share of 52.8% of the global revenues in 2025. Demand for high-G alginate is increasing because industries now require stronger, more stable gels that can withstand heat, mechanical stress, and processing without breaking down. High-G alginates, which contain a higher proportion of guluronic acid blocks, create firmer, more elastic, and highly heat-resistant gels-making them ideal for modern applications such as plant-based meats, structured dairy alternatives, encapsulated nutrients, confectionery, pharmaceutical controlled-release systems, and medical wound dressings.

High M alginates are projected to grow at a CAGR of 4.9% from 2026 to 2033. High-M grades offer softer, more elastic gels ideal for applications like meat analogues, plant-based seafood, dairy alternatives, wound-care gels, and pharmaceutical controlled-release formulations. As clean-label reformulation accelerates across food, pharma, and cosmetics, manufacturers prefer high-M alginate for its flexibility in texture modification, better freeze-thaw stability, and enhanced performance in emulsions and moisture retention. This combination of natural origin, functionality, and versatility is driving strong adoption across multiple high-growth industries.

Application Insights

Use of alginate in industrial applications accounted for a share of 37.9% of the global revenues in 2025. As a natural, biodegradable polymer derived from seaweed, alginates provide strong thickening, gelling, stabilizing, and film-forming properties, making them ideal replacements for synthetic chemicals in food processing, pharmaceuticals, cosmetics, textiles, and even new-age areas like 3D bioprinting and biodegradable packaging. Industries are actively adopting alginates to meet clean-label, eco-friendly, and regulatory-compliant formulation needs while improving product stability, texture, and controlled-release capabilities. This shift toward natural, multifunctional ingredients is accelerating alginate usage in manufacturing, specialty chemicals, and advanced material applications.

Use of alginate in pharmaceuticals is anticipated to grow at a CAGR of 5.8% from 2026 to 2033. Pharma companies are increasingly replacing synthetic polymers with alginates to meet clean-label and regulatory expectations while improving patient safety. Alginates enable sustained drug delivery, stabilize sensitive APIs, and form protective gels used in popular reflux medications (e.g., alginate-based antacids). They are also widely used in wound dressings, tissue engineering, and biomedical scaffolds due to their ability to promote moisture retention and controlled absorption.

Regional Insights

North America alginate market accounted for a share of 24.0% of the global revenue in 2025. Consumers prefer natural thickeners and stabilizers over synthetic additives, driving reformulation across dairy alternatives, beverages, sauces, and processed foods. At the same time, pharmaceutical and biomedical companies in the U.S. and Canada are using more alginates for wound-care products, controlled-release drug formulations, and biocompatible medical gels. The clean beauty movement is also pushing cosmetic brands to adopt seaweed-derived polymers for safer, natural textures. Combined with strong growth in seaweed cultivation partnerships and rising R&D investment in bio-based materials, these trends are accelerating alginate adoption across North America.

U.S. Alginate Market Trends

The alginate market in the U.S. is projected to grow at a CAGR of 4.1% from 2026 to 2033. Consumers in the U.S. are actively avoiding synthetic stabilizers, creating strong interest in seaweed-derived hydrocolloids that offer safety, transparency, and high functionality. At the same time, the rise of vegan and plant-based foods, growth in functional beverages and gut-health products, and ongoing demand for natural texturizers in clean beauty formulations are driving broader adoption. U.S. pharmaceutical companies are also using alginates more frequently in controlled-release drugs and reflux formulations.

Europe Alginate Market Trends

The alginate market in Europe accounted for a share of 35.8% of the global revenue in 2025. European food, beverage, pharmaceutical, and cosmetics companies are actively replacing synthetic stabilizers with plant-derived hydrocolloids, and alginates sourced from seaweed fit well with the region’s strong sustainability, vegan, and eco-friendly preferences. The rapid growth of plant-based foods, functional beverages, and clean beauty products is driving higher usage of alginates for texture, stability, and gel formation. At the same time, Europe's strict regulatory environment encourages the use of safe, natural additives, while expanding seaweed cultivation in Norway, France, and the U.K. ensures a stable supply.

Asia Pacific Alginate Market Trends

The alginate market in Asia Pacific is projected to grow at a CAGR of 6.7% from 2026 to 2033. Demand for alginates is rising quickly in the Asia Pacific due to the region’s strong shift toward natural, clean-label, and plant-based ingredients, supported by expanding processed food, dairy alternative, and functional beverage industries. Large-scale seaweed cultivation in China, Indonesia, South Korea, and the Philippines provides abundant raw material, making alginates cost-efficient and widely available for manufacturers. In addition, pharmaceutical and personal-care companies in APAC are increasingly adopting alginates for controlled-release formulations, wound care products, gels, and clean-beauty skincare.

Key Alginate Companies Insights

Established and emerging players in the global alginate market operate in a highly competitive landscape, driven by continuous innovation in formulation efficiency, purity grades, and multi-industry application performance. Companies are increasingly investing in advanced extraction technologies, sustainable seaweed sourcing, and high-value specialty grades to meet growing demand from food, pharmaceutical, personal care, and biomedical sectors. In addition, leading manufacturers are expanding their global supply chains, strengthening partnerships with seaweed cultivators, and leveraging clean-label positioning and functional advantages to appeal to brands seeking natural, safe, and versatile hydrocolloid solutions. As industries shift toward plant-based, eco-friendly, and high-performance ingredients, market players are differentiating themselves through quality consistency, application-specific innovation, and robust technical support across diverse end-use categories.

Key Alginate Companies:

The following are the leading companies in the alginate market. These companies collectively hold the largest market share and dictate industry trends.

- Algaia

- Marine Biopolymers Limited

- DuPont de Nemours, Inc.

- Ingredients Solutions, Inc.

- KIMICA

- Ceamsa

- Algea

- Cargill

- FMC Corporation

- Shandong Jiejing Group Corporation

Recent Developments

-

In January 2025, Klaria Pharma signed a license agreement with CNX Therapeutics, granting CNX rights to market Klaria’s Sumatriptan Alginate Film for migraine in the European Economic Area, the UK, and Switzerland. The launch is planned for Germany, Spain, and Italy in the second half of 2025, followed by further expansion next year.

-

In May 2024,IFF unveiled new alginate technologies designed for regenerative medicine and 3D cell culture at major biomedical conferences in 2024. The company introduced a self-gelling alginate hydrogel system for minimally invasive therapeutic delivery at the World Biomaterials Congress. It showcased innovative macro-porous alginate foam scaffolds for advanced 3D cell culture at the TERMIS World Congress. These developments, part of IFF’s NovaMatrix ultrapure alginate portfolio, enable customized biomedical solutions without relying on animal-based materials, supporting tissue engineering and biotherapeutic research.

Alginate Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 967.0 million

Revenue forecast in 2033

USD 1,372.3 million

Growth rate

CAGR of 5.1% from 2026 to 2033

Actuals

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Volume in tons; revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; South Africa; Brazil

Key companies profiled

Algaia; Marine Biopolymers Ltd.; DuPont de Nemours, Inc.; Ingredients Solutions, Inc.; KIMICA; Ceamsa; Algea; Shandong Jiejing Group Corp.; Cargill; FMC Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alginate Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global alginate market report on the basis of product, type, application, and region.

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Sodium Alginate

-

Calcium Alginate

-

Potassium Alginate

-

Propylene Glycol Alginate

-

Others

-

-

Type Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

High G

-

High M

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Bakery

-

Confectionery

-

Meat Products

-

Dairy Products

-

Sauces & Dressings

-

Beverages

-

Others

-

-

Pharmaceutical

-

Industrial

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global alginate market was estimated at USD 728.4 million in 2020 and is expected to reach USD 759.8 million in 2021.

b. The global alginate market is expected to grow at a compound annual growth rate of 5% from 2021 to 2028 to reach USD 1,074.4 million by 2028.

b. The Asia Pacific emerged as a dominating region with a volume share of 37.05% in the year 2020 owing to the presence of several alginates manufactures, higher raw material availability, and a higher consumer base in the countries like India and China.

b. The key player in the global alginate market includes Algaia, Marine Biopolymers Limited, DuPont de Nemours, Inc, Ingredients Solutions, Inc., KIMICA, Ceamsa, Algae, SNAP Natural & Alginate Products Pvt. Ltd, Shandong Jiejing Group Corporation, IRO Alginate Industry Co., Ltd.

b. Increasing demand for natural ingredients from the food and beverage industry as well as the pharmaceutical industry owing to higher consumer awareness is expected to drive the alginate market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.