- Home

- »

- Medical Devices

- »

-

Wound Care Market Size & Share, Industry Report, 2033GVR Report cover

![Wound Care Market Size, Share & Trends Report]()

Wound Care Market (2026 - 2033) Size, Share & Trends Analysis By Product (Advanced Wound Dressing, Surgical Wound Care), By Application (Chronic, Acute), By End Use (Hospitals), By Mode Of Purchase, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-300-3

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wound Care Market Summary

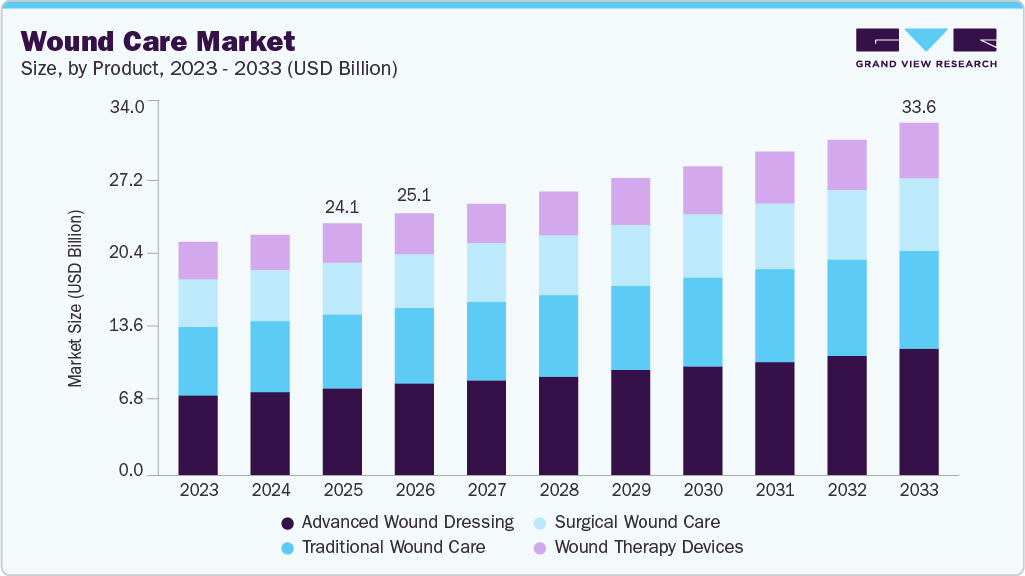

The global wound care market size was estimated at USD 24.08 billion in 2025 and is projected to reach USD 33.62 billion by 2033, growing at a CAGR of 4.28% from 2026 to 2033. The demand for wound care products is rising owing to the growing number of surgical cases and the increasing prevalence of chronic disorders across the globe.

Key Market Trends & Insights

- North America dominated the wound care market with the largest share of 46.88% in 2025.

- The U.S. wound care industry led North America, accounting for the largest revenue share of 82.32% in 2025.

- By product, the advanced wound dressing segment held the largest revenue share of 35.09% in 2025.

- By end use, the hospitals segment held the largest revenue share of 36.41% in 2025.

- By application, the chronic wounds segment led the wound care industry, accounting for the largest revenue share of 59.81% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 24.08 Billion

- 2033 Projected Market Size: USD 33.62 Billion

- CAGR (2026-2033): 4.28%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

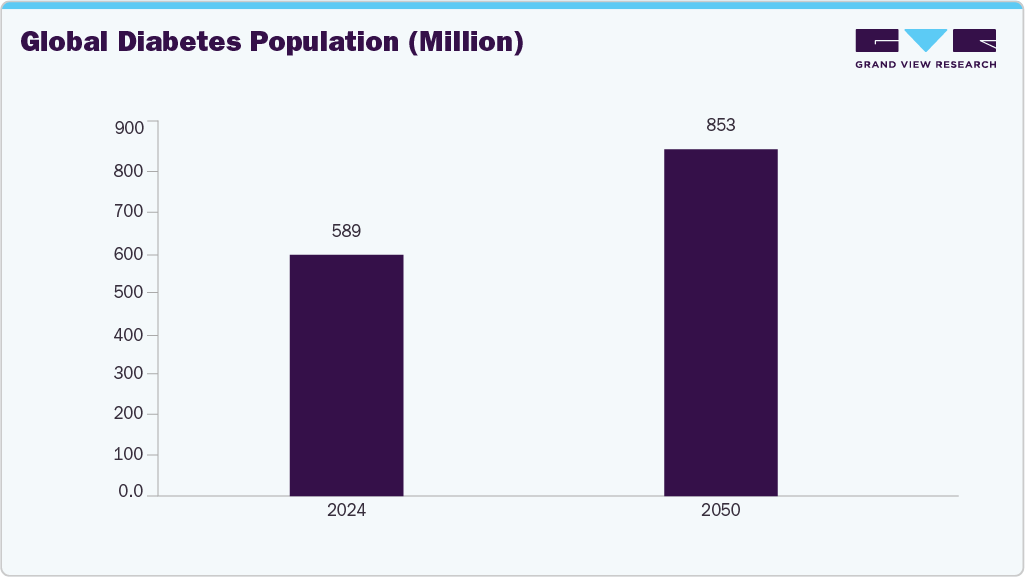

The global diabetes burden is a significant driver of demand for wound care solutions. According to the IDF Diabetes Atlas 2025, about 589 million adults (20-79 years)-roughly 1 in 9-live with diabetes worldwide, and over 40% of them are undiagnosed. Prevalence is projected to rise to ~853 million by 2050, driven by aging, urbanization, lifestyle changes, obesity, and physical inactivity. Diabetes significantly increases chronic wound risk, especially diabetic foot ulcers and slow-healing sores, which require advanced wound management and long-term care. As diabetes prevalence climbs, health systems will face larger patient populations needing wound care products, protocols, and specialist services. The expanding global diabetes population directly boosts wound care market growth by increasing the incidence of chronic and complex wounds, raising utilization of dressings, regenerative therapies, and clinician-directed interventions year-over-year.

The increasing prevalence of chronic wounds-driven by aging populations, diabetes, and longer life expectancy-is a key structural factor contributing to the growth of the wound care industry. According to a 2025 peer-reviewed review published in a Mary Ann Liebert journal, chronic wounds represent a substantial public-health burden, affecting approximately 1 in 6 U.S. Medicare beneficiaries (~10 million people) and driving billions in healthcare costs annually. The review highlights persistent non-healing and recurrence as major challenges and points to emerging personalized, technology-enabled wound care approaches, such as bioengineered skin substitutes, biomarker-guided treatment, and telehealth, as key to improving outcomes and reducing amputations. The rising prevalence of chronic wounds directly expands patient volumes, accelerates the adoption of advanced therapies, and sustains long-term growth in the market.

Technological innovation is structurally reshaping the wound care market by improving clinical efficiency, standardizing care pathways, and expanding treatment beyond acute settings. Advances in therapeutic devices, digital platforms, and data-enabled tools are transforming the assessment, treatment, and monitoring of wounds across hospitals, outpatient clinics, and home care settings. One of the most established innovations is Negative Pressure Wound Therapy (NPWT), which applies controlled sub-atmospheric pressure to wounds to remove exudate and stimulate granulation, thereby improving healing rates and reducing the length of stay compared with standard care. A 2025 randomized study in The Lancet reported that NPWT significantly shortened time to wound healing compared with usual wound management in complex surgical wounds, demonstrating real-world clinical benefit.

Beyond NPWT, digital health and telemedicine are increasingly integrated into wound care delivery. A 2025 peer-reviewed study published in JMIR Nursing reported that digitally enabled wound care programs supported hospital-level monitoring in home settings, reduced the number of in-person clinical visits, and lowered operational burden, while maintaining or improving wound-healing outcomes. The findings highlight the role of digital platforms in enabling decentralized care models without compromising clinical results.

AI-assisted and remote monitoring technologies are also advancing, enabling automated wound assessment and predictive analytics to support clinical decision-making, as highlighted in recent consensus discussions on AI’s role in wound assessment and tailored care. Emerging innovation such as continuous monitoring sensors, smart dressings, and portable NPWT devices further extends care into outpatient and home settings. These technologies enable clinicians to intervene earlier, standardize documentation, and reduce costly complications, thereby directly increasing the utilization of advanced wound care products across various care settings.

Market Concentration & Characteristics

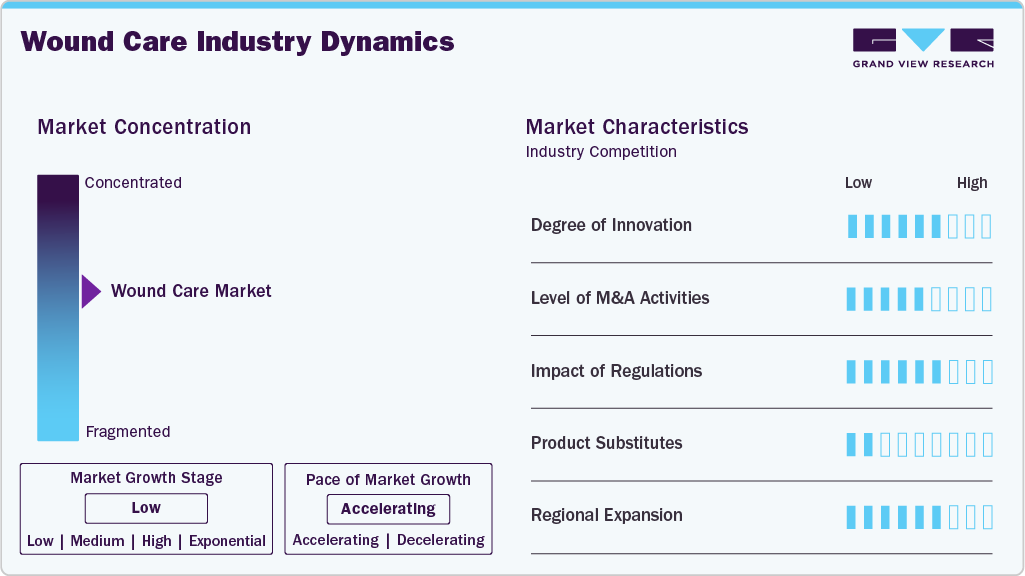

The market growth stage is low, and the pace of the growth is accelerating. The wound care market is characterized by growth due to the rising number of surgical procedures and accidental injuries, as well as the increasing prevalence of chronic wounds.

The wound care industry exhibits a high degree of innovation, supported by sustained investment and the development of new products. In March 2025, Convatec received regulatory approval for ConvaNiox, a nitric-oxide-generating dressing for diabetic foot ulcers, introducing a new multimodal treatment approach. Such developments highlight continuous innovation focused on clinical outcomes, materials advancement, and scalable wound care solutions.

Regulations have a significant impact on the global market for advanced dressings, surgical wound care, traditional products, and wound therapy devices. Products used for chronic and acute wounds are regulated as medical devices, with safety, biocompatibility, and performance requirements set by authorities such as the U.S. Food and Drug Administration. In the U.S., reimbursement and utilization are governed by the Centers for Medicare & Medicaid Services, which sets coverage and documentation criteria for advanced wound therapies.

The wound care market has experienced moderate to high levels of M&A activity, primarily focused on expanding advanced therapy portfolios and regenerative solutions. In 2025, Solventum announced the acquisition of Acera Surgical, strengthening its position in synthetic tissue matrices for complex wounds. Such transactions reflect strategic moves toward biologics, matrices, and differentiated therapies supported by clinical evidence.

Product substitutes include systemic antibiotics and medical management, surgical interventions such as debridement or skin grafting, preventive measures like offloading footwear and compression therapy, home remedies in low-resource settings, and clinical observation for minor wounds. These alternatives may reduce short-term use of wound care products but often provide limited control over healing outcomes compared with dedicated wound care solutions.

Regional expansion is increasingly driven by investments in localized manufacturing and regulatory approvals that strengthen supply resilience and market access. In November 2025, Mölnlycke established its first wound care manufacturing site in China, marking a strategic expansion of its global production footprint. The new facility in Changshu spans 10,000 m² and aims to begin production of wound care products by late 2026 or early 2027, enhancing supply chain resilience and proximity to key customers. This investment strengthens Mölnlycke’s position in Asia’s wound care market aligns with growing regional demand for locally manufactured healthcare solutions.

Product Insights

The advanced wound dressing segment held the largest share of 35.09% in 2025 and is projected to record the fastest CAGR over the forecast period. Advanced wound dressings are primarily used in the management of chronic and non-healing wounds, including diabetic foot ulcers. As a result, the increasing incidence of chronic wounds is directly supporting demand for advanced wound care products.

Published in March 2024 by Bonvadis, an analysis on the global status of diabetic foot ulcers reports that approximately 6.3% of people with diabetes worldwide experience DFUs, with higher prevalence observed in regions such as North America. DFUs are associated with elevated infection risk and account for a significant proportion of non-traumatic lower-limb amputations. These findings highlight the growing chronic wound burden and support continued utilization of advanced wound dressings as diabetes prevalence increases globally.

The surgical wound care segment is expected to grow at a considerable pace during the forecast period, driven by the rising surgical volumes across hospitals and ambulatory care settings. Growth is linked to increasing prevalence of chronic diseases, aging populations, and higher incidence of trauma and emergency procedures, which drive demand for sutures, staples, tissue adhesives, sealants, and anti-infective dressings. According to the World Health Organization, more than 300 million surgical procedures are performed each year globally, a volume that continues to rise as access to surgical care expands, reinforcing sustained demand for surgical wound care products.

Application Insights

The chronic wounds segment led the wound care industry, accounting for the largest revenue share of 59.81% in 2025, driven by the growing geriatric population and the rising prevalence of long-term conditions such as diabetic foot ulcers, venous pressure ulcers, and other non-healing wounds. This trend is reflected in an epidemiological study. Published in September 2024 in Cureus, the cross-sectional study “Epidemiological Profile of Chronic Wounds in an Indian Population” evaluated 10,003 individuals in Uttar Pradesh, India, and reported an overall chronic wound prevalence of 1.89 per 1,000 people, with higher prevalence in rural areas (2.64 per 1,000) compared with urban areas (1.57 per 1,000). Notably, 36.8% of identified chronic wounds were diabetic foot ulcers, while another 36.8% were trauma-related, underscoring the substantial and persistent burden of chronic wounds. These findings reinforce why chronic wounds continue to dominate overall wound care demand and drive sustained utilization of advanced and long-term wound management solutions.

The acute wound segment is expected to grow at a significant CAGR during the forecast period, driven by rising volumes of surgical procedures, trauma cases, and burn injuries across hospital and ambulatory care settings. Increasing access to surgical care, higher rates of emergency interventions, and greater emphasis on timely wound closure and infection prevention are supporting demand for acute wound management products, including surgical dressings, sutures, staples, and anti-infective solutions.

End Use Insights

The hospital segment held the largest share of 36.41% in 2025. The growth of this segment can be attributed to a global rise in surgical procedures resulting from an inactive lifestyle and an increase in bariatric surgeries, which require the use of wound care products to prevent surgical site infections. Furthermore, surgical wound care dressings and NPWT are especially suitable for hospital use and are not feasible for home care. Additionally, hospital institutions are considered significant buyers of wound care, often holding long-term contracts with suppliers. Hence, owing to the aforementioned factors, the segment is anticipated to propel during the forecast period.

The home healthcare segment is anticipated to grow at a significant CAGR during the forecast period, driven by the increasing shift of wound management from hospitals to home settings. Factors such as the rising prevalence of chronic wounds, an aging population, shorter hospital stays, and increased adoption of home health services are driving demand for wound care products that enable safe and effective treatment outside acute care facilities.

Mode of Purchase Insights

The prescribed segment dominated the wound care market and is projected to grow at the fastest CAGR over the forecast period. The prescribed wound care products depend on the type of product and the severity of the wound. For mild to moderate wounds, over-the-counter wound care products, such as bandages, gauze, and antiseptic creams, can be purchased at pharmacies, drugstores, or online retailers. For more severe wounds, prescription wound care products such as wound dressings, wound cleansers, and topical antibiotics may be required. These products can only be obtained with a prescription from a healthcare provider and are available for purchase at a pharmacy.

The non-prescribed (OTC) segment is expected to witness considerable growth over the forecast period, due to increasing numbers of acute wounds and injuries. Moreover, industry players are also launching non-prescribed wound care products. For instance, in April 2024, Vomaris made available a bioelectric bandage, PowerHeal, which was cleared by the FDA for over-the-counter use in wound management. Such approvals and launches for non-prescribed wound care products are anticipated to support the segment's growth.

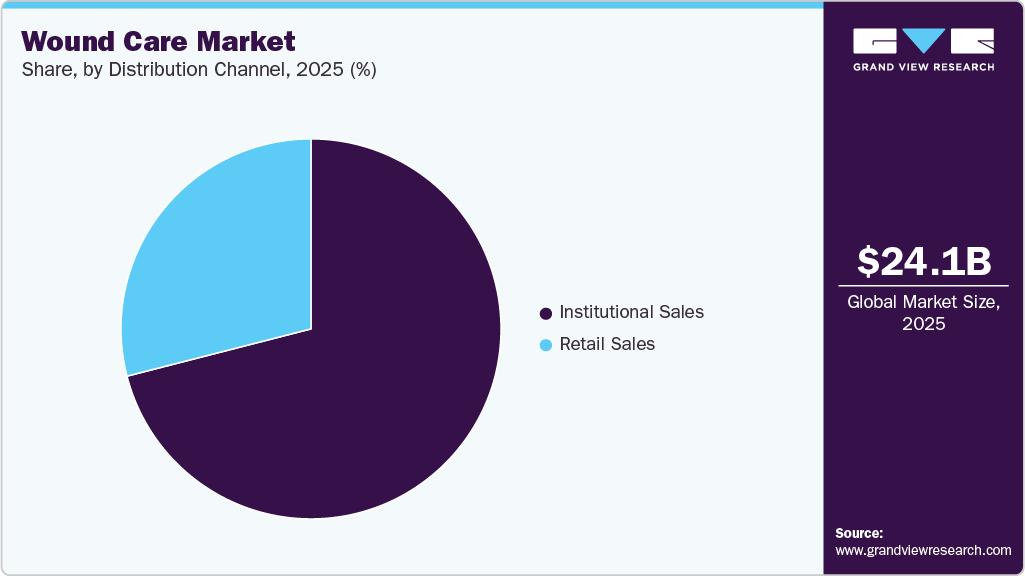

Distribution Channel Insights

The institutional sales segment dominated the wound care industry in 2025. Manufacturers usually sell products directly to healthcare providers, such as hospitals and clinics, or to patients through direct-to-consumer marketing. This strategy provides manufacturers with greater control over distribution and helps foster stronger customer relationships. Institutional sales primarily involve direct distributors and manufacturers, with hospitals, wound care centers, clinics, nursing homes, long-term care facilities, diagnostic labs, and birth centers typically having long-term contracts with distributors and manufacturers. Key players are using these long-term agreements as a strategy to expand their market reach and strengthen their position.

The retail sales segment is expected to experience the fastest growth during the forecast period. The segment encompasses retail pharmacies, e-commerce platforms, and other outlets. Pharmacies offer numerous benefits to customers, such as a wide range of delivery options and excellent service. Customers typically purchase both prescription and over-the-counter wound care products, including dressings, ointments, and bandages, from retail pharmacies and specialty stores, which may also provide wound care advice. The e-commerce demand is anticipated to grow due to the convenience, affordability, and accessibility of online stores and mail-order services. The growing availability of wound care products through e-commerce, including the rise of eHealth services, is expected to further boost segment growth.

Regional Insights

The North America wound care market held the largest revenue share, exceeding 46.88% in 2025. The key drivers of growth in the region include a large population base and an increasing patient pool, particularly in the U.S. Additionally, the growing geriatric population, which is more susceptible to wounds, will further drive demand for wound care products. According to Statistics Canada, the proportion of individuals aged 65 and older in the total population is projected to grow from 18.9% in 2023 to between 21.9% (slow-aging scenario) and 32.3% (fast-aging scenario) by 2073.

U.S. Wound Care Market Trends

The U.S. wound care industry dominates North America, supported by the strong presence of established manufacturers and continued product innovation. For instance, in July 2025, Convatec secured regulatory clearance in the U.S., the UK, the European Union, and Australia for Aquacel ConvaFiber, a next-generation Hydrofiber wound dressing indicated for venous leg ulcers, diabetic foot ulcers, pressure injuries, surgical wounds, and partial-thickness burns. The product enhances Convatec’s Hydrofiber technology through improved absorbency and wound contact and is planned for market availability from 2026, reinforcing the U.S. market’s leadership in advanced wound care adoption.

Europe Wound Care Market Trends

The Europe wound care industry is projected to grow steadily during the forecast period, supported by increasing surgical procedure volumes, greater awareness of structured wound management, and stronger industry-policy collaboration. Ongoing investment continues to support innovation and the adoption of advanced wound care therapies. In December 2025, Mölnlycke was elected to a leadership role within the MedTech Europe Wound Care Sector Working Group, with a mandate to raise awareness of chronic wound challenges, engage policymakers, and promote aligned care pathways and education across European healthcare systems. Collectively, rising clinical demand and coordinated policy engagement are reinforcing the market’s growth outlook across Europe.

The UK wound care market is expected to grow at a moderate pace over the forecast period, driven by an aging population, the rising prevalence of chronic conditions such as diabetes, and the continued adoption of advanced wound care technologies. Increased healthcare spending, national focus on improving wound outcomes, and greater awareness of evidence-based treatments are contributing to steady demand for innovative solutions. Reflecting this trend, in September 2025, AVITA Medical received CE Mark approval under the EU Medical Device Regulation for its RECELL GO system, enabling commercialization in the UK and other European markets. The point-of-care technology uses a small sample of a patient’s own skin to generate Spray-On Skin Cells for use in burns and traumatic or surgical wounds, expanding access to advanced acute wound treatments within the UK healthcare system.

The wound care market in France is projected to grow during the forecast period, driven by the increasing prevalence of chronic conditions, the introduction of innovative products, and significant healthcare spending. For instance, in January 2022, Accel-Heal, a wearable electrical stimulation device for wound management, was launched in France. This single-use, easy-to-use device helps reduce pain and accelerate the healing of chronic wounds.

The Germany wound care market is witnessing steady growth due to various factors, such as the increasing prevalence of chronic diseases, an aging population, and advancements in wound care technologies. Rising healthcare spending and the demand for advanced wound care solutions further support market growth.

Asia Pacific Wound Care Market Trends

Asia Pacific is expected to register the fastest CAGR during the forecast period, driven by significant growth in the wound care industry. Key factors include the rising demand for wound care products in Southeast Asian countries such as Indonesia, Malaysia, and Singapore. Additionally, the region's increasing healthcare expenditure is expected to further drive market growth. Moreover, the large patient population in countries such as India, China, and Japan can further propel the market growth over the forecast period.

China's wound care market is expected to grow steadily throughout the forecast period, driven by increasing demand for solutions to address the rising incidence of chronic wounds, such as diabetic foot ulcers. According to the study published by the Frontiers in August 2024, the incidence of DFUs ranges from 17.03% to 42.84% (19-22) in China, which is significantly higher than in other nations. Furthermore, the same study also reported a high incidence of amputation among Chinese individuals with DFUs. Thus, the high incidence of DFUs and amputations is anticipated to drive the demand for wound management products.

The wound care market in Japan is expected to experience substantial growth during the forecast period, driven by several key factors. These include a rising number of surgical procedures across the country, which increases the demand for effective wound care solutions. In addition, Japan's rapidly aging population is a significant driver, as elderly individuals are more prone to chronic wounds, pressure ulcers, and surgical complications.

Middle East and Africa Wound Care Market Trends

he Middle East and Africa wound care industry is expected to witness significant growth in the coming years, driven by rising awareness about wound management, the increasing prevalence of chronic diseases, and growing healthcare expenditure. For instance, the UAE Government reserves a substantial share of the federal budget for the healthcare sector every year. According to federal budget data published in June 2024, approximately USD 1.33 billion was allocated for 2023, increasing to USD 1.36 billion in 2024.

The wound care market in Saudi Arabia is anticipated to grow over the forecast period. The country's market is driven by the rising prevalence of chronic conditions, such as diabetes, an aging population, and growing healthcare investments. Government initiatives to improve healthcare infrastructure, along with increasing awareness of advanced wound care technologies, are further supporting market growth.

The Kuwait wound care market is expected to grow over the forecast period due to the increasing incidence of chronic diseases, particularly diabetes, which leads to a rise in diabetic ulcers and other wound-related conditions. Moreover, growing healthcare expenditure propels the country's market growth.

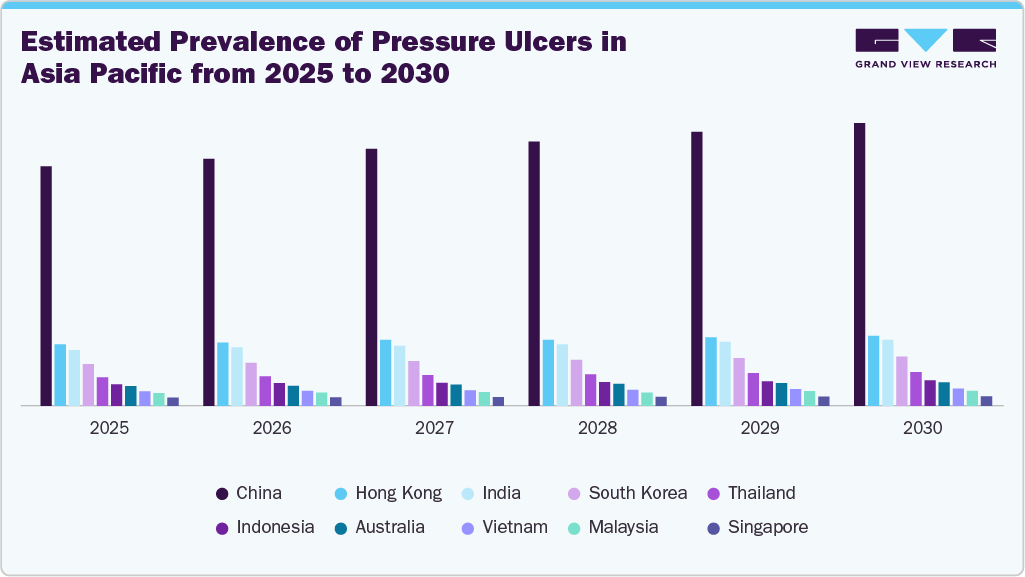

The increasing prevalence of chronic wounds such as pressure ulcers is anticipated to drive the demand for wound care products. The prevalence of pressure ulcers in China is estimated to increase by around 22.95% from 2024 to 2030. Wound management products, such as superabsorbent dressings and antibacterial dressings containing silver, are used to treat pressure ulcers. Several major industry players, such as Convatec Group Plc and Mölnlycke Health Care AB, offer dressings for treating pressure ulcers under various brands, such as ConvaMax and Mepilex. Thus, the increasing prevalence of pressure ulcers in numerous countries such as China, India, and South Korea, among others, is anticipated to support the market growth over the forecast period.

Growing Demand for Negative Pressure Wound Therapy (NPWT) Systems

The demand for NPWT is anticipated to increase significantly in the coming years due to the rising incidence of chronic and acute wounds and the increasing launches of NPWT systems. Several major companies operating in the wound care industry have witnessed growth in their revenue due to increasing demand for NPWT systems.

-

For instance, Smith+Nephew reported a growth of 17.0% in the revenue of its Advanced Wound Devices segment in 2023. This growth was driven by both the RENASYS NPWT System and the single-use PICO NPWT System

-

Furthermore, the company also reported continuous demand for its NPWT portfolio in the second quarter (Q2) of 2024. As per the Second Quarter and First Half 2024 Results published by Smith+Nephew, Advanced Wound Devices revenue increased by 8.0% (6.6% reported) due to the robust growth from the single-use PICO NPWT System, VERSAJET Hydrosurgery System, and LEAF Patient Monitoring System

“We are pleased with our 2023 performance, led by our Negative Pressure Wound Therapy portfolio where we focused on accelerating growth, delivering on the 12-Point Plan.”Rohit Kashyap,President Advanced Wound Management & Global Commercial Operations Smith+Nephew.

Key Wound Care Company Insights

The major players in the wound care market are expanding their portfolios of wound care devices, such as NPWT, to gain a competitive advantage in the coming years. The industry players are also launching antimicrobial wound dressings incorporating silver to meet the growing demand for silver dressings.

Key Wound Care Companies:

The following are the leading companies in the wound care market. These companies collectively hold the largest Market share and dictate industry trends.

- Smith+Nephew

- Convatec Group PLC

- Mölnlycke Health Care AB

- Baxter

- DeRoyal Industries, Inc.

- Coloplast Corp

- Medtronic

- 3M

- INTEGRA LIFESCIENCES

- Medline Industries, LP

- Johnson & Johnson Services, Inc.

- B. Braun SE

- MIMEDX Group, Inc.

- Cardinal Health

- Organogenesis Inc.

Recent Developments

-

In November 2025, the Department of Atomic Energy (DAE) of India, in collaboration with Cologenesis Healthcare Pvt. Ltd., launched ColoNoX, India’s first nitric oxide-releasing wound dressing for diabetic foot ulcers (DFU). Developed by scientists at the Bhabha Atomic Research Centre, the product received regulatory approval from the Central Drugs Standard Control Organisation (CDSCO) after Phase II and III clinical trials. ColoNoX uses controlled nitric oxide delivery with collagen hydrogel to improve blood flow, reduce infection, and support healing in DFUs, addressing a major clinical need in the country’s diabetic population.

-

In October 2025, Convatec announced plans to invest more than USD 1 billion over the next decade to expand its global R&D footprint, reinforcing its innovation strategy in chronic care. The commitment includes USD 600 million for the expansion of R&D facilities in Boston, U.S., increasing capacity by about 50 % by the end of 2025, and £500 million (≈USD 650 million) for a new R&D hub in Manchester, UK, expected to open in 2027.

-

In September 2025, Mölnlycke broke ground on a USD 135 million expansion of its wound care manufacturing facility in Brunswick, Maine, USA, aimed at significantly increasing U.S. production capacity for wound dressings and related products. The project will add new production lines, warehousing, and operations, create jobs (increasing the local workforce by about 10%), and support localized supply to meet rising demand from U.S. healthcare providers. Completion is expected by late 2026 or early 2027.

-

In May 2025, Mölnlycke agreed to acquire P.G.F. Industry Solutions GmbH, the Austrian manufacturer of Granudacyn wound cleansing and moisturizing solutions. The acquisition expands Mölnlycke’s wound care portfolio with wound cleansing products used for both acute and chronic wounds, which are distributed in over 50 countries. This move is intended to strengthen Mölnlycke’s global position in wound care and improve access to cleansing solutions that support wound healing.

-

In May 2025, Mölnlycke announced support for the Wound Care Collaborative Community (WCCC) initiative to develop a standardised pre-clinical testing framework for wound dressings. The collaboration brings together clinicians, procurement teams, regulators, and industry experts to enhance consistency and clinical relevance in dressing evaluations, enabling clinicians to make more informed decisions and guiding product design toward real-world needs. By addressing gaps in current testing standards, the initiative aims to drive innovation and elevate wound dressing performance across the care continuum.

-

In March 2025, Convatec showcased its strongest wound-care innovation pipeline to date at EWMA 2025 in Barcelona. The company highlighted advanced solutions designed to improve healing outcomes, reduce clinical burden, and enhance patient quality of life. Key presentations included next-generation ConvaFoam™ dressings, new clinical evidence supporting silver-based therapies for hard-to-heal wounds, and reinforcement of its Wound Hygiene protocol. Convatec also hosted innovation forums and competitions, underlining its commitment to advancing evidence-based wound care globally.

-

In September 2024, Solventum launched a new product called the V.A.C. Peel and Place Dressing, which combines both dressing and drape into one integrated solution. This all-in-one dressing can be used for up to seven days and can be applied in under two minutes. Additionally, it features a built-in, non-adherent, perforated layer that minimizes tissue ingrowth, making the removal process less painful.

-

In April 2024, Mölnlycke AB agreed to acquire the Austrian manufacturer of Granudacyn wound cleansing and moisturizing solutions, P.G.F. Industry Solutions GmbH. This acquisition will help the company to strengthen its wound cleansing and moisturizing portfolio.

-

In April 2024, Smith+Nephew, a major company operating in the wound care industry, introduced a lightweight and compact NPWT system named the RENASYS EDGE Negative Pressure Wound Therapy (NPWT) System. This system was launched in the U.S. market for treating chronic wounds.

Wound Care Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 25.07 billion

Revenue forecast in 2033

USD 33.62 billion

Growth rate

CAGR of 4.28% from 2026 to 2033

Base year for estimation

2025

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, mode of purchase, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Smith+Nephew; Convatec Group PLC; Mölnlycke Health Care AB; Baxter; DeRoyal Industries, Inc.; Coloplast Corp; Medtronic; 3M; INTEGRA LIFESCIENCES; MIMEDX Group, Inc.; Medline Industries, LP; Johnson & Johnson Services, Inc.; B. Braun SE; Cardinal Health; Organogenesis Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wound Care Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global wound care market report based on product, application, end use, mode of purchase, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Advanced Wound Dressing

-

Foam Dressings

-

Hydrocolloid Dressings

-

Film Dressings

-

Alginate Dressings

-

Hydrogel Dressings

-

Collagen Dressings

-

Other Advanced Dressings

-

-

Surgical Wound Care

-

Sutures & staples

-

Tissue adhesive and sealants

-

Anti-infective dressing

-

-

Traditional Wound Care

-

Medical Tapes

-

Cotton

-

Bandages

-

Gauzes

-

Sponges

-

Cleansing Agents

-

-

Wound Therapy Devices

-

Negative pressure wound therapy

-

Oxygen and hyperbaric oxygen equipment

-

Electric stimulation devices

-

Pressure relief devices

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Chronic Wounds

-

Diabetic foot ulcers

-

Pressure ulcers

-

Venous leg ulcers

-

Other chronic wounds

-

-

Acute Wounds

-

Surgical & traumatic wounds

-

Burns

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Physician’s Office

-

Nursing Homes

-

Others

-

-

Mode of Purchase Outlook (Revenue, USD Million, 2021 - 2033)

-

Prescribed

-

Non-prescribed (OTC)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Institutional Sales

-

Retail Sales

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Thailand

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global wound care market size was estimated at USD 24.08 billion in 2025 and is expected to reach USD 25.07 billion in 2026.

b. The global wound care market is expected to grow at a compound annual growth rate of 4.28% from 2026 to 2033 to reach USD 33.62 billion by 2033.

b. Advanced wound dressing dominated the wound care market in 2025 with a market share of 35.09% and is expected to witness the fastest growth over the forecast period due to an increase in technological advancement, rising cases of chronic diseases, and an increase in sports-related injuries.

b. Some key players operating in the wound care market include Smith+Nephew, Convatec Group PLC, Mölnlycke Health Care AB, Baxter, DeRoyal Industries, Inc, Coloplast Corp, Medtronic, 3M, INTEGRA LIFESCIENCES, MIMEDX Group, Inc., Medline Industries, LP, Johnson & Johnson Services, Inc., B. Braun SE, Cardinal Health, URGO MEDICAL, and Organogenesis Inc

b. An aging population drives the wound care market, increasing the incidence of chronic diseases such as diabetes, the prevalence of pressure ulcers and venous leg ulcers, and the demand for advanced wound care products and therapies. Technological advancements in wound care products, awareness about wound care management, and favorable reimbursement policies contribute to market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.