- Home

- »

- Clinical Diagnostics

- »

-

Allergy Diagnostics Market Size, Industry Report, 2030GVR Report cover

![Allergy Diagnostics Market Size, Share & Trends Report]()

Allergy Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Products And Services (Instruments, Consumables), By Allergen (Food, Inhaled, Drugs), By Test Type (In Vivo Test, In Vitro Test), By End Use (Hospital & Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-600-0

- Number of Report Pages: 320

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Allergy Diagnostics Market Summary

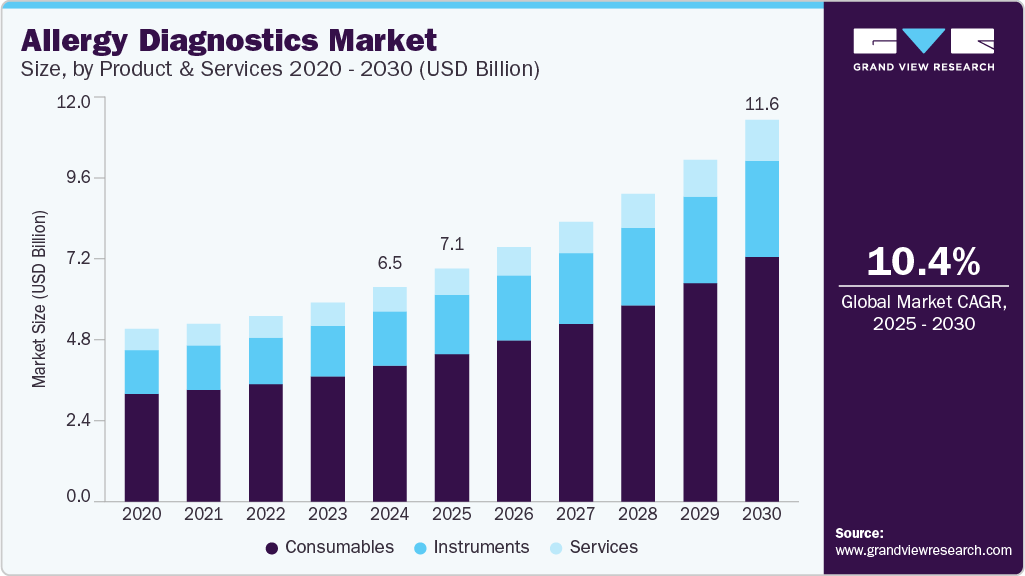

The global allergy diagnostics market size was estimated at USD 6.54 billion in 2024 and is projected to reach USD 11.63 billion by 2030, growing at a CAGR of 10.39% from 2025 to 2030. The market is driven by the rising incidence of conditions such as allergic rhinitis, asthma, atopic dermatitis, and food allergies, which are becoming more common due to environmental pollution, urbanization, and lifestyle changes.

Key Market Trends & Insights

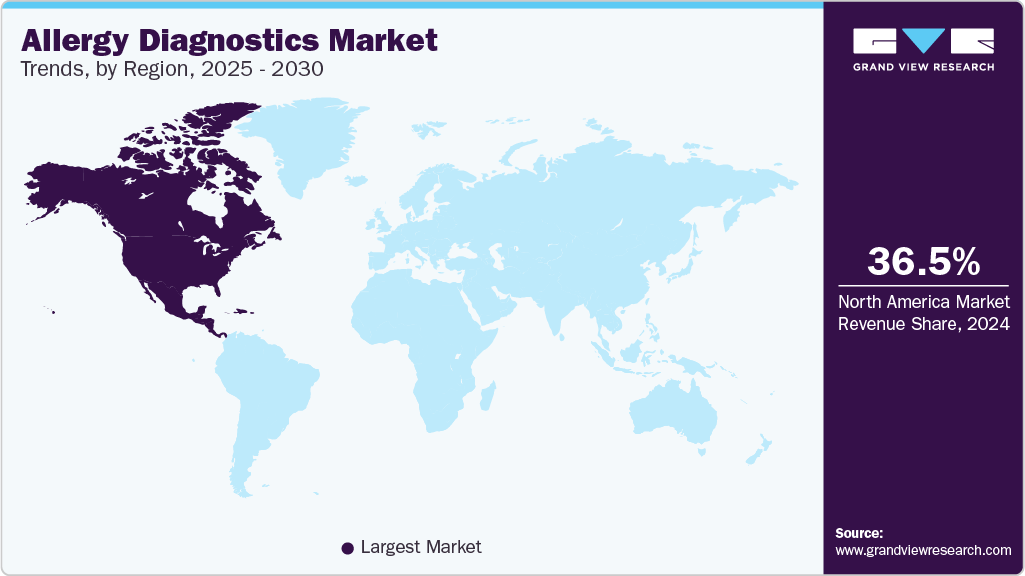

- North America allergy diagnostics market dominated the allergy diagnostics market and accounted for a 36.53% share in 2024.

- The U.S. allergy diagnostics market leads the North America market

- By products and services, consumables held the largest revenue share of 63.14% of the allergy diagnostics market in 2024.

- By allergen, inhaled allergen type accounted for the largest revenue share of the allergy diagnostics market in 2024

- By test type, the in vitro test segment dominated the allergy diagnostics market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.54 Billion

- 2030 Projected Market Size: USD 11.63 Billion

- CAGR (2025-2030): 10.39%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

For instance, allergic rhinitis affects about 400 million individuals worldwide annually, impacting around 25% of children and 40% of adults. Furthermore, unhealthy habits, such as smoking, and urbanization are some of the key factors contributing to the increasing incidence of allergic conditions. Increasing incidence of allergies is one of the key factors contributing to the allergy therapeutics market growth. Rising exposure to outdoor and indoor air pollutants and occupational exposure are among high-risk factors causing chronic respiratory diseases. The prevalence of allergies is much higher in the urban population compared to rural areas due to rising exposure to environmental pollutants from industrial activities and urbanization.

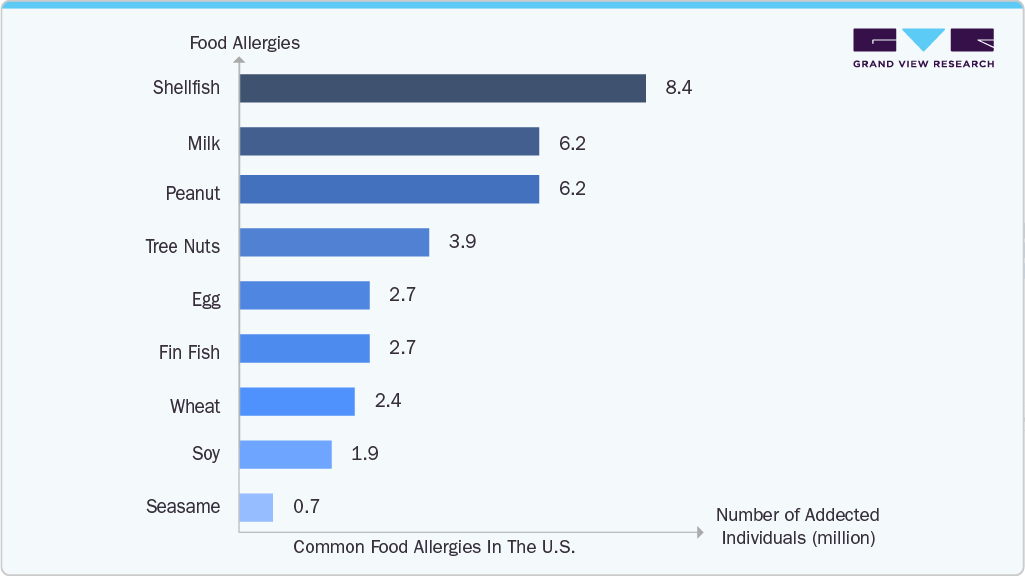

According to statistics published by the World Health Organization (WHO) in January 2023, around 1 in 4 children and 1 in 3 adults have a seasonal allergy in the U.S. Nearly 6% of children and adults in the U.S. suffer from a food allergy with the rate being highest among black, Asian, and Hispanic individuals. Similarly, as per data from the Asthma and Allergy Foundation of America, in 2021, in the U.S., about 81 million people were diagnosed with seasonal allergic rhinitis, representing around 26% affected adults and 19% of affected children.

Technological innovations are significantly enhancing the allergy diagnostics landscape. Advancements such as component-resolved diagnostics (CRD), multiplex assays, and the integration of artificial intelligence (AI) are enabling more precise allergen identification and personalized treatment plans. The IVD tests offer increased accuracy, reduced invasiveness, and improved patient comfort, making them a preferred choice over traditional skin prick tests. Additionally, the development of at-home and point-of-care testing kits is expanding access to allergy diagnostics, particularly in remote and underserved areas.

The market's expansion is also supported by increased healthcare spending and strategic initiatives by key players. Global healthcare spending is projected to reach USD 10.2 trillion by 2025, with a significant portion allocated to treating chronic diseases like allergies. Companies are investing in research and development to create innovative diagnostic products, such as AI-powered testing solutions, to address unmet medical needs.

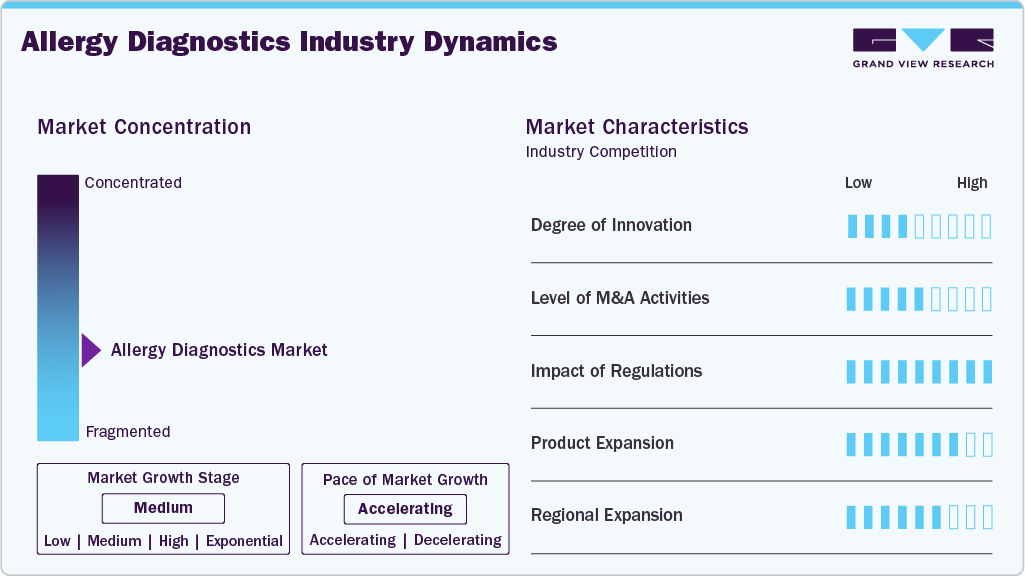

Market Concentration & Characteristics

The allergy diagnostics market demonstrates a high degree of innovation, driven by the rapid development of molecular diagnostics, multiplex assays, and the integration of digital health technologies such as artificial intelligence (AI). For example, in February 2025, Swiss biotech startup ATANIS Biotech secured a USD 2 million grant from FARE (Food Allergy Research & Education) after winning Phase 2 of its Innovation Award Diagnostic Challenge. The funding will support the commercialization of ATANIS's FAST-PASE allergy test, an innovative ex vivo mast cell activation assay designed to safely and accurately diagnose food allergies without the risks associated with traditional oral food challenges. Clinical studies have demonstrated over 95% accuracy for peanut allergy detection. ATANIS is collaborating with leading institutions, including Mount Sinai and SickKids Toronto, to advance the test's development across multiple allergy indications.

The allergy diagnostics market experiences a high level of mergers and acquisitions (M&A), as major players seek to broaden their technological capabilities, enhance their product portfolios, and enter new regional markets. Several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies. Key players engaged in this growth strategy. For instance, in 2023, Thermo Fisher Scientific acquired The Binding Site Group, a leader in specialty diagnostics, including allergy testing, to enhance its immunodiagnostics segment and strengthen its global footprint. These activities highlight how M&A is a core strategy for companies to diversify offerings, integrate innovative platforms, and capture greater market share in the evolving allergy diagnostics landscape.

Regulatory frameworks play a pivotal role in shaping the allergy diagnostics market by ensuring patient safety, efficacy, and accuracy of diagnostic products. The U.S. FDA, European CE marking, and local regulatory bodies have set stringent standards for allergy testing kits, particularly molecular and at-home diagnostics. In 2024, the European Union updated its In Vitro Diagnostic Regulation (IVDR), intensifying compliance requirements for allergy diagnostic products, thereby pushing companies to invest in rigorous clinical validation and post-market surveillance. These regulatory pressures are driving innovation while simultaneously raising entry barriers for new players, ensuring that only high-quality, reliable diagnostic tools enter the market.

Product expansion is at a high level in the allergy diagnostics market, with companies diversifying their offerings to cover a broader range of allergens, including food, inhalants, and drug allergies. For instance, in October 2024, ALK, a Denmark-based pharmaceutical company specializing in allergy prevention and treatment, received U.S. FDA approval for its AccuTest line of allergy skin testing devices and allergen trays.

The AccuTest-1 is a single-prick device, while the AccuTest-8 and AccuTest-10 are multi-head applicators with eight and ten heads, respectively. These devices feature smaller tine lengths and diameters to enhance precision and minimize patient discomfort. Additionally, the AccuTest 48-well and 60-well allergen trays are designed with air-tight locking mechanisms and non-slip rubber bottoms to prevent contamination and ensure stability during testing procedures. This aggressive product expansion strategy is helping companies cater to the growing demand for personalized and precise allergy management.

The allergy diagnostics market is witnessing a medium to high level of regional expansion as companies aim to tap into growth opportunities in emerging markets while solidifying their presence in established regions. Asia-Pacific, Latin America, and the Middle East are becoming key targets. In 2023, Thermo Fisher Scientific expanded its allergy testing portfolio in China and India, recognizing the large, underserved population suffering from allergic diseases. Similarly, EUROIMMUN (a PerkinElmer company) launched new regional collaborations in Brazil and the Gulf Cooperation Council (GCC) countries, aiming to penetrate emerging markets with high growth potential. This strategic regional expansion is enabling companies to capitalize on the growing demand for allergy diagnostics in developing economies, while consolidating their position in established markets.

Products And Services Insights

Consumables held the largest revenue share of 63.14% of the allergy diagnostics market in 2024. This segment comprises critical components such as allergen extracts, assay kits, and reagents that are indispensable for both in vitro and in vivo testing. The continuous, repeatable nature of allergy testing in clinical settings drives steady demand for consumables. Moreover, the expanding allergy testing menu and inclusion of new allergens further augment the demand.

Instruments are expected to grow at a substantial CAGR over the forecast period, supported by the adoption of automated diagnostic platforms that improve laboratory efficiency, throughput, and diagnostic accuracy. Automation is increasingly being integrated into allergy diagnostics to support high-volume testing and standardized results, which is especially crucial in large diagnostic networks. A key development in this space is the April 2024 launch of Beckman Coulter Life Sciences' Basophil Activation Test (BAT), which provides laboratories with a novel, highly sensitive method for identifying IgE-mediated allergic reactions using flow cytometry, further modernizing allergy diagnostics workflows.

Allergen Insights

Inhaled allergen type accounted for the largest revenue share of the allergy diagnostics market in 2024, driven by the high prevalence of conditions such as asthma, allergic rhinitis, and allergic conjunctivitis caused by allergens like pollen, dust mites, and mold spores. Urbanization, rising pollution levels, and climate change are intensifying the burden of inhaled allergens globally. Recently, on July 29, 2024, AliveDx received the IVDR CE mark for its microarray immunoassay, marking its inaugural entry into allergy diagnostics. This assay, designed to detect specific IgE antibodies targeting protein allergens in human serum, operates on AliveDx’s proprietary MosaiQ platform. The multiplex immunoassay microarray enables the simultaneous detection of over 30 allergens, encompassing both inhalant and food allergens, thereby streamlining laboratory workflows and reducing diagnostic time.

Food allergens are expected to grow at a substantial rate over the forecast period. Growing pediatric populations and increased food allergy prevalence in both developed and emerging countries are contributing to this trend. A significant regulatory milestone in this area includes Thermo Fisher Scientific's 2022 FDA approval for its ImmunoCAP tests for wheat and sesame allergens, providing clinicians with reliable tools to differentiate between true wheat allergy and cross-reactivity with grass pollen, thereby avoiding unnecessary dietary restrictions. Companies such as 3M offer Allergen Protein Rapid Test Kits: These lateral flow assays provide quick, qualitative detection of specific food allergens such as almond, peanut, pecan, walnut, and gluten. They are suitable for monitoring allergens in raw ingredients, finished products, and environmental samples, delivering results in approximately 10-12 minutes.

Test Type Insights

The in vitro test segment dominated the allergy diagnostics market in 2024. The segment's growth is propelled by its convenience, reproducibility, and safety, particularly in patients where skin tests may pose risks. The growing preference for blood-based assays such as specific IgE tests, component-resolved diagnostics (CRD), and basophil activation tests reflects the market’s move toward minimally invasive, standardized diagnostics.

In vivo test segment is anticipated to grow at the fastest rate over the forecast period. This segment comprises of encompassing skin prick tests (SPT), intradermal tests, and patch tests, is poised for accelerated adoption, especially in outpatient clinics where immediate reactions can be visually assessed. Technological refinements in test devices, combined with clinical protocols integrating both in vitro and in vivo tests, are enhancing diagnostic precision and patient experience. Growth is further attributed to increasing adoption of several in vivo tests having convenient, cost-effective, safe & reliable properties than that of others. Growing demand for rapid, simple, and efficient testing has fueled the growth of in vivo diagnostic tests. These tests look at the susceptibility and reactivity of dermal mast cells, which can indicate allergic sensitivity. To ensure reliability, these procedures include skin exams with standardized allergenic extracts.

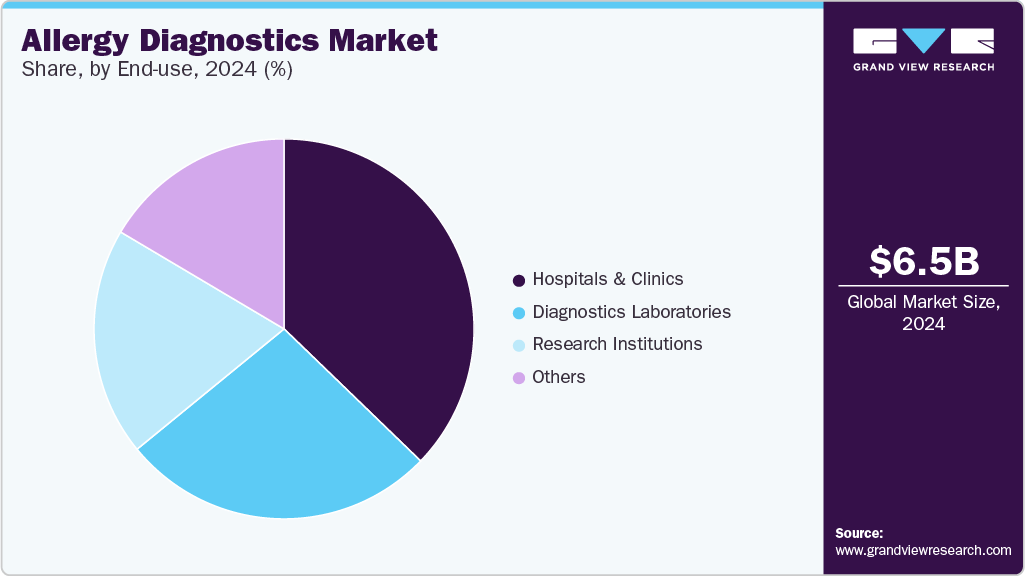

End Use Insights

Hospitals & clinics accounted for the largest revenue share of the allergy diagnostics market in 2024. These settings are central to allergy diagnosis, management, and treatment planning, offering both diagnostic services and immunotherapy interventions under one roof. The rising prevalence of allergic diseases, combined with the availability of advanced diagnostic modalities, supports the sustained growth of this segment.

Research institutions segment is expected to grow at the highest CAGR during the forecast period. Academic and research centers are increasingly conducting translational research in allergy diagnostics, focusing on novel biomarkers, molecular allergens, and personalized diagnostic approaches. Notable partnerships between diagnostic companies and research entities, such as Allergy Partners' 2022 collaboration with Aimmune Therapeutics to expand access to PALFORZIA through its network of clinics, are fostering innovation at the interface of diagnostics, therapeutics, and clinical research. This synergy is accelerating the development of next-generation allergy diagnostic tools and expanding the understanding of allergy pathophysiology.

Regional Insights

North America allergy diagnostics market dominated the allergy diagnostics market and accounted for a 36.53% share in 2024. The increasing prevalence of food allergies, coupled with high awareness among patients and clinicians, drives demand for innovative diagnostic solutions. The region also witnesses strong collaborations between diagnostic companies and academic institutions, fostering continual advancements in testing methods.

U.S. Allergy Diagnostics Market Trends

The U.S. allergy diagnostics market leads the North America market, propelled by the rising prevalence of allergies, advanced biotechnology infrastructure, strong government support, and significant private investments. Government-backed initiatives aimed at allergy awareness, along with a rise in self-reported allergic conditions, are further supporting the uptake of both in vitro and point-of-care allergy tests. In the United States, over 50 million people experience allergies annually, making it the sixth most common cause of chronic illness. This includes seasonal allergies (affecting 25.7% of adults and 18.9% of children), eczema (7.3% of adults), and food allergies (6.2% of adults and 5.8% of children), according to the CDC.

Specifically, seasonal allergic rhinitis, also known as hay fever, affects 67 million adults and 14 million children annually. Recently, in May 2022, Thermo Fisher Scientific announced the U.S. availability of its Phadia 2500+ series of instruments, expanding its application to include autoimmune testing alongside allergy diagnostics. These high-capacity, automated systems are designed to enhance laboratory efficiency by enabling the simultaneous processing of EliA autoimmune and ImmunoCAP allergy tests on a single platform.

Europe Allergy Diagnostics Market Trends

The Europe allergy diagnostics market is rapidly evolving, driven by the increasing clinical emphasis on accurate identification of environmental and food-related allergens. The region benefits from the support of harmonized regulatory policies that encourage the adoption of advanced diagnostic assays, while lifestyle shifts and pollution are contributing to the growing allergy burden.

The European Academy of Allergy and Clinical Immunology (EAACI) estimates that over 150 million Europeans suffer from chronic allergic diseases. By 2025, more than 50% of all Europeans will suffer from at least one type of allergy, with no age, social, or geographical distinction. Regulatory frameworks, such as IVDR, support the introduction of innovative diagnostic assays across the region. Key players, including Thermo Fisher Scientific, EUROIMMUN (PerkinElmer), and Stallergenes Greer, are actively expanding their offerings through partnerships, product launches, and digital integration, focusing on high-throughput and multiplex testing to meet the growing demand for precision diagnostics.

The UK allergy diagnostics market is experiencing significant growth. The market is driven by a growing need for accurate allergy detection tools, particularly among pediatric populations affected by food and respiratory allergies. The NHS’s integration of allergy services in primary care and hospitals has further strengthened the demand for reliable and accessible testing platforms. Approximately 44% of the UK's adult population and up to 40% of children experience at least one allergy, driving demand for accurate testing solutions. The market is led by companies such as Omega Diagnostics and Lincoln Diagnostics, with a focus on improving point-of-care testing and home-based allergy testing services.

Germany allergy diagnostics market is growing, influenced by the high demand for precision testing in both private and public healthcare settings. The availability of comprehensive allergy panels and molecular-level diagnostic technologies is fostering the growth of personalized allergy management practices across the country. Companies such as Siemens Healthineers, HOB Biotech, and AESKU.GROUP is a key contributor to the market, leveraging automation, molecular panels, and component-resolved diagnostics to expand their clinical utility and reach both private and public health settings.

Asia Pacific Allergy Diagnostics Market Trends

The Asia Pacific allergy diagnostics market is anticipated to witness significant growth, driven by rising urbanization, lifestyle changes, and environmental pollution. Increased focus on preventive healthcare and growing awareness regarding food and respiratory allergies have created fertile ground for companies to introduce technologically advanced yet affordable diagnostic solutions.

China allergy diagnostics market held a substantial revenue share in 2024. The market is advancing steadily due to a combination of rising allergy prevalence, especially among children, and government-led public health programs emphasizing early diagnosis. The market also benefits from domestic investments in local manufacturing and distribution networks to improve accessibility.

Japan allergy diagnostics marketis progressing steadily, reflecting a preference for high-precision diagnostic solutions, with an emphasis on in vitro testing. The country’s aging population, coupled with an increase in allergic conditions like asthma and atopic dermatitis, is propelling the demand for sophisticated allergy detection tools.

Latin America Allergy Diagnostics Market Trends

The Latin American market for allergy diagnostics is witnessing increasing attention due to collaborative efforts and government initiatives. Increasing environmental pollution and evolving dietary patterns have contributed to a rise in allergy incidence across the region.

Brazil allergy diagnostics market is witnessing substantial growth, fueled by expanding healthcare services and improved patient awareness. The country is witnessing greater acceptance of laboratory-based allergy tests in both urban and semi-urban areas, supporting market expansion.

Middle East & Africa Allergy Diagnostics Market Trends

The Middle East and Africa (MEA) allergy diagnostics market is poised for growth. The rising demand for specialized allergy services is encouraging both local and international players to invest in improving testing infrastructure.

Saudi Arabia allergy diagnostics market is experiencing robust growth, marked by increasing public and private sector investments in healthcare infrastructure. The growing burden of food and respiratory allergies, particularly among younger populations, has intensified the demand for accessible and accurate allergy diagnostics.

Key Allergy Diagnostics Company Insights

The allergy diagnostics market is driven by a cohort of specialized diagnostics and biotechnology companies that are advancing the field through continuous innovation, technological advancements, strategic partnerships, and portfolio expansion across in vitro and in vivo allergy testing. Key players include Thermo Fisher Scientific, Inc., HYCOR Biomedical, EUROIMMUN Medizinische Labordiagnostika AG (PerkinElmer, Inc.), Omega Diagnostics Group PLC, Lincoln Diagnostics, Inc., AESKU.GROUP GmbH, Minaris Medical America, Inc., HOB Biotech Group Corp., Ltd., DASIT Group SPA, and R-Biopharm AG.

These companies are at the forefront of developing advanced allergy diagnostic solutions such as immunoassays, molecular allergy diagnostics, skin prick testing devices, and point-of-care testing platforms, addressing both respiratory and food allergies. For instance, in April 2025, Beckman Coulter Life Sciences announced the launch of its next-generation Basophil Activation Test (BAT), designed to enhance food allergy research by providing a safer and more efficient alternative to traditional testing methods. Similarly, HYCOR Biomedical continues to innovate with its NOVEOS System, focusing on automation and improved sensitivity in allergy testing. These ongoing innovations, coupled with strategic collaborations and regulatory approvals, are expected to drive significant advancements in the allergy diagnostics market, enabling earlier detection, better differentiation of allergens, and improved patient outcomes.

Key Allergy Diagnostics Companies:

The following are the leading companies in the allergy diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- HYCOR Biomedical

- EUROIMMUN Medizinische Labordiagnostika AG (PerkinElmer, Inc.)

- Omega Diagnostics Group PLC

- Lincoln Diagnostics, Inc.

- AESKU.GROUP GmbH

- Minaris Medical America, Inc.

- HOB Biotech Group Corp., Ltd.

- DASIT Group SPA

- R-Biopharm AG

- bioMérieux

- Siemens Healthcare GmbH

Recent Developments

-

In April 2025, Beckman Coulter Life Sciences announced the launch of its next-generation Basophil Activation Test (BAT), a significant advancement in allergy research. This new assay offers a safer and more efficient alternative to traditional oral food challenges (OFCs), which often carry risks of severe allergic reactions.

-

In February 2025, Swiss biotech startup ATANIS Biotech secured a USD 2 million grant from FARE (Food Allergy Research & Education) after winning Phase 2 of its Innovation Award Diagnostic Challenge. The funding will support the commercialization of ATANIS's FAST-PASE allergy test, an innovative ex vivo mast cell activation assay designed to safely and accurately diagnose food allergies without the risks associated with traditional oral food challenges.

-

In October 2024, ALK, a Denmark-based pharmaceutical company specializing in allergy prevention and treatment, received U.S. FDA approval for its AccuTest line of allergy skin testing devices and allergen trays. The AccuTest-1 is a single-prick device, while the AccuTest-8 and AccuTest-10 are multi-head applicators with eight and ten heads, respectively.

Allergy Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.09 billion

Revenue forecast in 2030

USD 11.63 billion

Growth rate

CAGR of 10.39% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Products and services, allergen, test type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK, Germany; France; Spain; Italy; Sweden; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; HYCOR Biomedical; EUROIMMUN Medizinische Labordiagnostika AG (PerkinElmer, Inc.); Omega Diagnostics Group PLC; Lincoln Diagnostics, Inc.; AESKU.GROUP GmbH; Minaris Medical America, Inc.; HOB Biotech Group Corp., Ltd.; DASIT Group SPA; R-Biopharm AG; bioMérieux; Siemens Healthcare GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Allergy Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global allergy diagnostics market report based on products and services, allergen, test type, end use, and region.

-

Products and Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Consumables

-

Services

-

-

Allergen Outlook (Revenue, USD Million, 2018 - 2030)

-

Food

-

Dairy Products

-

Poultry Product

-

Tree Nuts

-

Peanuts

-

Shellfish

-

Wheat

-

Soys

-

Other Food Allergens

-

-

Inhaled

-

Drug

-

Other Allergens

-

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

In Vivo Test

-

Skin Prick Test

-

Intradermal Test

-

Patch Test

-

-

In vitro Test

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Diagnostics Laboratories

-

Research Institutions

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.