- Home

- »

- Beauty & Personal Care

- »

-

Global Aloe Vera Extract Market Size Report, 2019-2025GVR Report cover

![Aloe Vera Extract Market Size, Share & Trends Report]()

Aloe Vera Extract Market Size, Share & Trends Analysis Report By Application (Food, Pharmaceutical, Cosmetic), By Distribution Channel (Offline, Online), By Product (Gels, Capsule, Powder, Liquid), And Segment Forecasts, 2019 - 2025

- Report ID: GVR-2-68038-883-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2015 - 2017

- Forecast Period: 2019 - 2025

- Industry: Consumer Goods

Report Overview

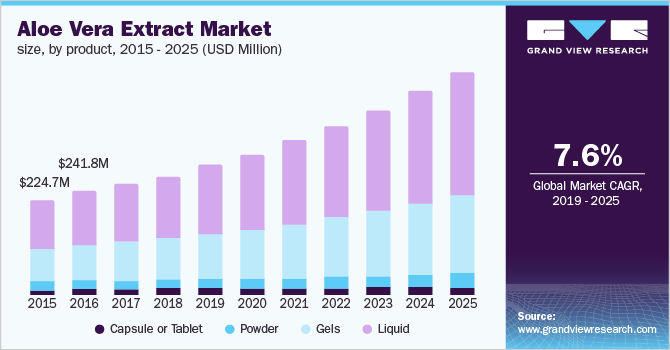

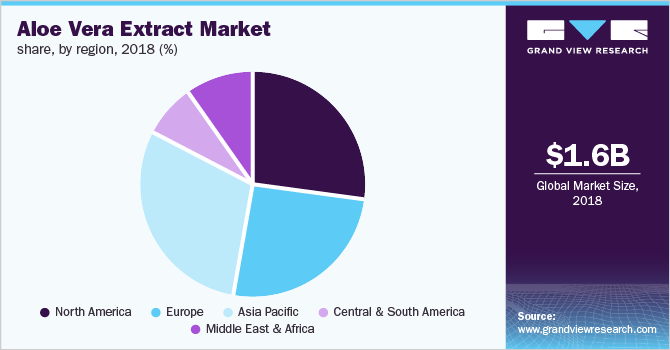

The global aloe Vera extract market size was valued at USD 1.60 billion in 2018 and is anticipated to expand at a CAGR of 7.6% during the forecast period. Growing awareness regarding the medicinal importance of aloe Vera in the treatment of diabetes, skin diseases, etc. has increased the demand for natural and organic cosmetics, including aloe Vera extracts.

Most of the companies are investing in R&D and are launching innovative products to gain a competitive advantage over others and to expand their global presence. Currently, one of the major trends seen in the market is the increasing use of aloe Vera extracts in sugar-free drinks, which is expected to increase the application scope for the product. Countries like India, China, and the U.S. are the major markets for manufacturers owing to rising consumer awareness about following a healthy lifestyle.

Aloe Vera extracts are widely used in the treatment of many health issues, such as skin problems, hair loss, gum diseases, and cancer. Increased pollution coupled with a hectic lifestyle has resulted in an increased prevalence of such health issues, which is supporting the market growth. Increasing cases of diabetes are also expected to open new avenues for the industry, as a lot of diabetic patients are increasingly using herbal extracts for the disease treatment.

Furthermore, aloe Vera gel or leaves is used as an instant relief from different burn problems like burns from a fire, chemical injuries, and sun exposure. Moreover, increasing penetration of aloe Vera items in hospitals is also another factor anticipated for the growth of the global market in the upcoming years. Furthermore, Aloe Vera is used in various cosmetic products like skin tanning cream, lipsticks, stretch marks cream, moisturizer, soap, etc. may be another factor expected to have rapid growth in the market.

Aloe Vera Extract Market Trends

The increasing demand for products made from aloevera extract is another significant driver leading the market growth. Aloe vera products are known for providing remedies to various health conditions diabetes, skin, and hair diseases. Specifically, organic or herbal extracts are used nowadays, to treat a large number of diabetic populations.

The usage of aloe vera extract is widely used as an ingredient in food, cosmetics, pharmaceuticals, zero sugar drinks, and others. Therefore, it has widened the scope of application, strengthening the market growth over the forecast period. Therefore, an increase in consumer awareness and increased economic growth are the factors expected to boost the market growth over the forecast years. Thus, aloe vera extract obtained from the aloe plant leaf has an array of applications, which led to increased investment by the companies.

Initial high costs and low returns on investments from the farming of aloe vera plants on small land areas are expected to hinder the market growth. Lack of access to the advanced technology for maintenance of the aloe vera extract plants at the commercial stage is also expected to curtail growth. Price fluctuations of aloe vera-based products and complex manufacturing procedures are anticipated to hamper the growth of the market.

The emerging trend of consuming aloe vera supplements and other products to improve the well-being of all age groups is expected to create growth opportunities for the market. The increasing investment by the manufacturers to reduce sugar content is also expected to direct the demand for products. Therefore, the rising consumer inclination toward organic products represents a vital opportunity for market growth.

Product Insights

Liquid product form was the largest segment in 2018 and accounted for 63.82% share of the overall market. It is expected to remain a prominent segment over the forecast period. The gels segment is expected to register a CAGR of 7.6% from 2019 to 2025. Increasing awareness about skin health has led to an increased usage of herbal extracts. This may contribute to segment development. Furthermore, sunburns or burn injuries can be cured by applying aloe Vera gel, which is further expected to augment the demand for gel products. Moreover, the growing demand for ammonia, sulfur-, and parabens-free products is likely to fuel the segment growth in the coming years.

Application Insights

Food, pharmaceutical, and cosmetics are the major application segments. The cosmetics segment led the market in 2018 and accounted for 41.9% of the global market share. Increasing use of herbal extracts in cosmetics, such as skin, hair, and body care products, is driving the segment growth. Moreover, consumer preference for herbal and organic products is fueling the demand in this segment. Rising geriatric population base and cases of skin problems are several other factors driving these segment growth.

The pharmaceutical segment is expected to register a CAGR of 7.5% from 2019 to 2025. Increasing use of herbal products for the treatment of various health issues, such as diabetes, is propelling the product demand in the segment. Moreover, rising awareness about healthy lifestyle practices is expected to boost the product demand in the pharma sector, as aloe Vera juice is widely used for weight loss and to strengthen immunity and improve digestion.

Distribution Channel Insights

The offline segment accounted for the largest market share of 91.2% in 2018. The online segment is expected to exhibit the fastest growth at a CAGR of 9.1% over the forecast period. With the increasing internet penetration in various countries, online sales channels are experiencing significant growth. Moreover, online retailers including Amazon and Flipkart are adding this packaging category as the main focus area.

Regional Insights

Asia Pacific is a prominent region and accounted for 30.6% share of the global market in 2018. It is expected to remain the dominant regional market throughout the forecast period. China and India are the major revenue-generators in APAC. Growing pharmaceutical and cosmetic industries is the key factor driving the market growth in this region. Increasing per capita income levels coupled with a growing population is expected to fuel the demand for skincare and cosmetic products. India is the fastest-growing cosmetics market in the world. Moreover, increasing concentration of herbal product manufacturers, such as Patanjali, Dabur, and Himalaya Drug Company, in rural areas is fueling the product demand in the region.

Followed by Asia Pacific, North America was the largest market in 2018. The region is expected to register a CAGR of 8.7% over the forecast period due to the presence of a large number of major product manufacturers, especially in the U.S. Increasing product usage for the treatment of cancer, diabetes, etc. is driving the regional market. Europe is also one of the promising markets and is expected to witness significant growth over the forecast period. Rising awareness about the potential health benefits of aloe Vera products is expected to fuel the demand. Moreover, consumer preference for natural and herbal cosmetics will open new avenues for the market.

Key Companies & Market Share Insights

The aloe vera extract market has attained a significant level of competitiveness owing to multiple applications, and a wide variety of benefits. The strategies adopted by the companies included mergers, acquisitions, product launches, and expansion to ensure a competitive edge in the industry. On Sep 1, 2021, Desert Harvest, a producer of nutritional supplements with a high concentration of aloe vera extract, has obtained approval from FDA to utilize their superior medicine, aloe vera capsules for treating interstitial cystitis (IC), which is a chronic bladder health condition nearly impacting 12 million people. The capsules are organically grown, which tends to provide relief to the patient from the pain. Furthermore, the capsules are also used to treat patients with symptoms including pelvic pain, urination problems such as burning, and other problems amongst patients. Some of the key players in this market include:

-

Aloe Farms, Inc.

-

Lily of the Desert Organic

-

Terry Laboratories, Inc.

-

Pharmachem Laboratories, Inc.

-

Natural Aloe Costa Rica S.A.

-

Foodchem International Corporation

-

Aloe Laboratories, Inc.

-

Aloecorp, Inc.

Aloe Vera Extract Report Scope

Report Attribute

Details

Revenue forecast in 2025

USD 2.67 billion

Growth rate

CAGR of 7.6% from 2019 to 2025

Base year for estimation

2018

Historical data

2015 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD billion and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, Region

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country scope

U.S., Germany, U.K., China, India, Japan, and Brazil

Key companies profiled

Aloe Farms, Inc.; Lily of the Desert Organic Terry Laboratories, Inc.; Aloeceuticals; Pharmachem Laboratories, Inc.; Natural Aloe Costa Rica S.A.; Foodchem International Corporation; Aloe Laboratories, Inc.; and Aloecorp, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

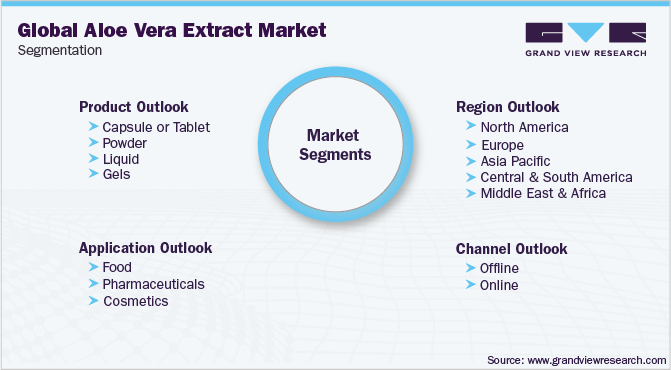

Aloe Vera Extract Market SegmentationThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2025. For the purpose of this study, Grand View Research has segmented the global aloe Vera extract market report on the basis of product, application, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2015 - 2025)

-

Capsule or Tablet

-

Powder

-

Liquid

-

Gels

-

-

Application Outlook (Revenue, USD Million, 2015 - 2025)

-

Food

-

Pharmaceuticals

-

Cosmetics

-

-

Distribution Channel Outlook (Revenue, USD Million, 2015 - 2025)

-

Offline

-

Online

-

-

Region Outlook (Revenue, USD Million, 2015 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."