- Home

- »

- Advanced Interior Materials

- »

-

Aluminum Wire Market Size, Share, Industry Report, 2033GVR Report cover

![Aluminum Wire Market Size, Share & Trends Report]()

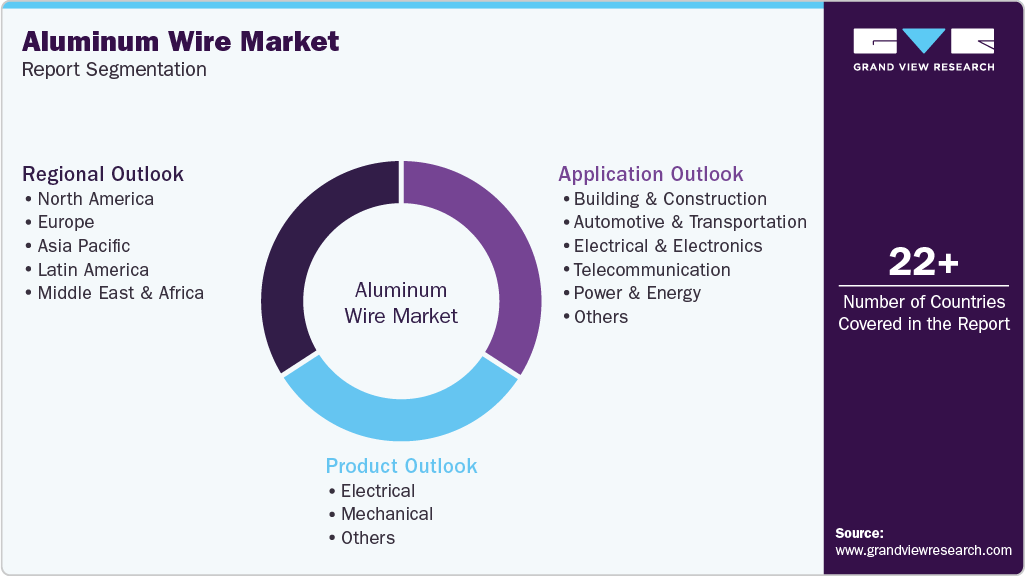

Aluminum Wire Market (2026 - 2033) Size, Share & Trends Analysis Report By Grade (Electrical, Mechanical), By Application (Building & Construction, Power & Energy, Telecommunication, Automotive & Transportation, Electrical & Electronics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-051-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aluminum Wire Market Summary

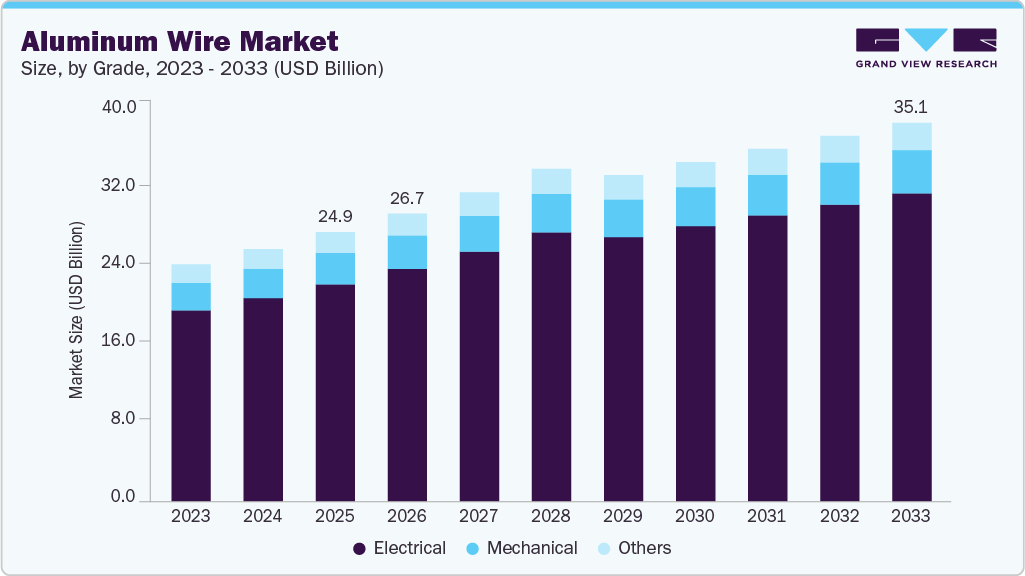

The global aluminum wire market size was estimated at USD 24.96 billion in 2025 and is projected to reach USD 35.10 billion by 2033, growing at a CAGR of 4.0% from 2026 to 2033. This growth is driven by the expansion of power transmission and distribution networks, the rise of renewable energy installations, and an increasing preference for lightweight, cost-effective alternatives to copper in electrical applications.

Key Market Trends & Insights

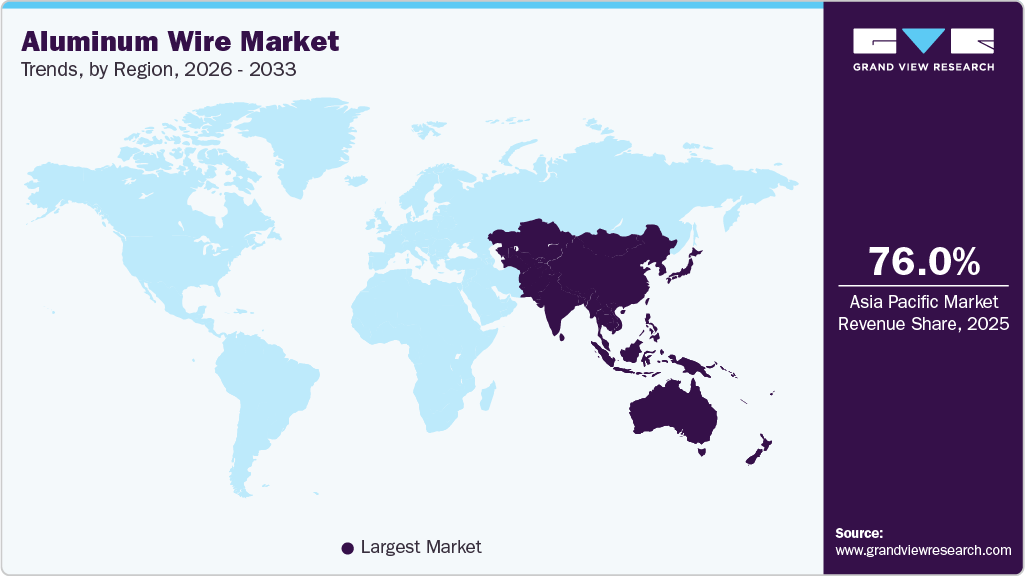

- Asia Pacific dominated the aluminum wire market with a revenue share of over 76.0% in 2025.

- The Asia Pacific aluminum wire industry is expected to grow at a substantial CAGR of 4.3% from 2026 to 2033.

- By grade, the electrical segment dominated the market with a revenue share of over 80.0% in 2025.

- By application, the power & energy segment is expected to grow at a substantial CAGR of 4.4% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 24.96 Billion

- 2033 Projected Market Size: USD 35.10 Billion

- CAGR (2026-2033): 4.0%

- Asia Pacific: Largest Market in 2025

Strong investments in grid modernization, urban infrastructure, and rural electrification, particularly in the Asia Pacific and emerging economies, are further supporting demand. The aluminum wire industry is strongly positioned around sustainability, recyclability, energy efficiency, and lightweight conductors, making it a preferred material in modern electrical infrastructure. Aluminum offers high recyclability, low embodied energy, and reduced lifecycle carbon emissions, as it can be recycled with nearly 95% lower energy consumption compared to primary aluminum production. In power transmission and distribution (T&D) networks, aluminum wires enable long-span overhead lines, lower tower loading, and reduced material intensity, collectively minimizing environmental impact during both installation and operation. Moreover, the growing deployment of aluminum conductors in renewable energy integration, smart grids, rural electrification, and grid expansion projects supports global decarbonization and net-zero targets.

Technological advancements in the aluminum wire market are focused on optimizing alloys, developing high-performance conductors, enhancing thermal stability, and improving mechanical strength. The development of advanced Al-Mg-Si alloys, All-Aluminum Alloy Conductors (AAAC), Aluminum Conductor Steel Reinforced (ACSR), and High-Temperature Low-Sag (HTLS) conductors has significantly improved current-carrying capacity, sag resistance, and tensile strength, enabling aluminum wires to perform in high-load and high-temperature environments. Innovations in conductor stranding, surface treatment, corrosion-resistant coatings, and cross-linked polyethylene (XLPE) insulation have enhanced durability and reliability across diverse climatic conditions. In parallel, automation in wire drawing, continuous casting and rolling (CCR), annealing, and quality control systems improve dimensional consistency, electrical conductivity, and cost competitiveness, positioning aluminum wire as a technologically advanced solution for grid modernization, EV infrastructure, and next-generation power networks.

Drivers, Opportunities & Restraints

The market is experiencing a sharp increase in power transmission and grid expansion projects associated with the integration of renewable energy sources. In February 2025, China’s State Grid significantly increased procurement volumes for aluminum wire and cable to support ultra-high-voltage (UHV) transmission lines and long-distance power evacuation projects. These projects are designed to transmit electricity from renewable-rich regions to demand centers, directly increasing demand for aluminum conductors due to their lightweight nature, cost efficiency, and suitability for overhead transmission. Similar grid-strengthening initiatives announced across Asia and North America during 2024-2025 continue to underpin sustained market demand.

A shift toward low-carbon and environmentally friendly aluminum production is gaining momentum across the entire value chain. In December 2025, India-based AM Green and Japan’s Mitsui & Co announced a strategic collaboration to explore the production and global supply of green aluminum manufactured using renewable energy. This development creates downstream opportunities for aluminum wire manufacturers to supply low-carbon conductors to utilities, renewable energy developers, and infrastructure projects that increasingly prioritize sustainability credentials. As governments and utilities strengthen procurement norms regarding carbon footprint disclosure from 2024 to 2026, demand for green aluminum wire is expected to accelerate.

The aluminum wire market continues to face restraints from raw material price volatility and rising energy costs. During 2024 and early 2025, global aluminum prices experienced fluctuations driven by power shortages, smelter curtailments, and geopolitical disruptions affecting energy supply. These factors increased input costs for wire manufacturers and created uncertainty in long-term pricing contracts with utilities and EPC companies. Additionally, stricter emission regulations on energy-intensive aluminum smelting, implemented across Europe and parts of Asia in 2024-2025, have increased compliance costs. Meanwhile, copper’s higher conductivity still limits the adoption of aluminum wire in applications that require compact designs and high electrical efficiency.

Grade Insights

Electrical-grade aluminum wire holds the largest share of the aluminum wire industry, due to its extensive use in power transmission and distribution, renewable energy integration, and electrical infrastructure projects. Its high electrical conductivity, lightweight nature, corrosion resistance, and cost advantage over copper make it the preferred choice for overhead lines, substations, and grid expansion projects. Growing investments in grid modernization, rural electrification, and renewable power evacuation networks across Asia Pacific, North America, and the Middle East continue to reinforce the dominance of electrical-grade aluminum wire.

Electrical-grade aluminum wire is also expected to register the fastest growth rate over the forecast period, supported by rising electricity demand, large-scale renewable energy deployments, and expansion of smart grid infrastructure. The increasing adoption of advanced conductor technologies, such as AAAC, ACSR, and HTLS, is enabling higher current capacity and improved thermal performance, thereby further accelerating demand. As utilities prioritize cost-efficient and high-performance conductors to upgrade existing networks, electrical-grade aluminum wire is set to remain the key growth driver of the overall market.

Mechanical-grade aluminum wire and other specialty grades are primarily used in automotive components, industrial fastening, cable armoring, and structural applications, where mechanical strength, formability, and durability are critical. Demand for these grades is driven by lightweight trends in the automotive and transportation sectors, as well as their applications in industrial manufacturing and equipment assembly. Although these segments hold a comparatively smaller market share, steady growth is expected due to increasing adoption of aluminum in industrial machinery, specialty cables, and customized applications, supported by ongoing alloy development and improved processing technologies.

Application Insights

The power & energy segment accounts for the highest share of aluminum wire consumption, driven by its widespread use in overhead transmission lines, distribution networks, and renewable energy projects. Aluminum wire is favored in this segment due to its lightweight characteristics, suitability for long-distance transmission, and lower installation costs, particularly in high-voltage and extra-high-voltage networks. Ongoing investments in grid expansion, cross-border interconnections, and renewable energy evacuation infrastructure continue to sustain strong demand from this segment.

Power & energy is also projected to record the highest CAGR during the forecast period, supported by accelerating energy transition initiatives, electrification of transport and industry, and increasing renewable capacity additions. The rapid development of solar and wind power plants, along with the need to upgrade aging transmission infrastructure, is driving increased consumption of aluminum wire. Additionally, the adoption of high-capacity and low-sag conductor technologies is enabling utilities to enhance transmission efficiency without expanding rights-of-way, further boosting growth in this application segment.

Other applications, including building & construction, automotive & transportation, electrical & electronics, and telecommunication, collectively contribute a significant share to the aluminum wire market. In the building and construction industry, aluminum wire is increasingly being adopted for internal wiring and calculating due to its cost efficiency and ease of installation. The automotive and transportation sector benefits from aluminum wire’s role in vehicle lightweighting and EV wiring systems, while electrical & electronics and telecommunication segments rely on aluminum conductors for cables, connectors, and network infrastructure. Although individually smaller than power & energy, these applications are expected to grow steadily, supported by urbanization, digitalization, EV adoption, and infrastructure modernization.

Regional Insights

Asia Pacific represents the largest and fastest-growing regional market for aluminum wire, led by extensive electrification, urbanization, and power capacity additions. Countries such as China, India, and Southeast Asian nations are investing heavily in transmission and distribution expansion, renewable energy integration, and rural electrification, making aluminum wire the preferred choice due to its lower cost and ease of deployment. The region also benefits from strong domestic aluminum production capacity and large-scale infrastructure development, including ultra-high-voltage transmission corridors, which significantly boost demand for aluminum conductors.

North America Aluminum Wire Market Trends

The growth of the North America aluminum wire industry is driven by grid modernization, renewable energy integration, and the replacement of aging transmission infrastructure. Utilities across the region are increasingly adopting aluminum conductors for overhead transmission and distribution due to their lightweight characteristics, cost advantages over copper, and suitability for long-span applications. Rising investments in solar and wind power evacuation networks, along with growing demand from data centers and EV charging infrastructure, are supporting steady market growth. The technological adoption of high-temperature, low-sag (HTLS) and alloy-based conductors is gaining traction as utilities seek to increase capacity without extensive right-of-way expansion.

U.S. Aluminum Wire Market Trends

Federal infrastructure spending, grid resilience programs, and the expansion of renewable energy sources primarily drive the growth of the U.S. aluminum wire industry. Large-scale transmission projects aimed at improving reliability and connecting renewable energy zones are driving demand for ACSR, AAAC, and advanced aluminum alloy conductors. The U.S. market also benefits from rising investment in EV infrastructure and utility-scale battery storage, where aluminum wiring supports cost-effective power distribution. Additionally, stricter efficiency and safety standards are encouraging utilities to replace legacy copper systems with modern aluminum-based solutions in overhead networks.

Europe Aluminum Wire Market Trends

Energy transition policies, grid decarbonization targets, and stringent environmental regulations shape the Europe market. Utilities across the region are focusing on upgrading transmission networks to accommodate offshore wind, interconnectors, and distributed renewable energy sources, driving demand for high-performance aluminum conductors. Europe is also witnessing an increased adoption of low-carbon and recycled aluminum wire, supported by regulatory emphasis on lifecycle emissions and the use of sustainable materials. However, market growth is moderated by high energy costs and strict compliance requirements, which continue to influence production economics and sourcing strategies.

Key Aluminum Wire Company Insights

Some of the key players operating in the market include Ashapura Minechem Limited, Sibelco Group, and Golcha Minerals Pvt. Ltd.

-

Ashapura Minechem Limited, established in 1960, is an India-based multinational industrial minerals company with integrated operations spanning mining, beneficiation, processing, and global distribution. The company has a strong presence in aluminum wire and other industrial minerals used in ceramics, refractories, glass, and construction materials. Ashapura focuses on customized, application-specific products, operational scale, and sustainable mining practices, serving customers across Asia, Europe, and North America through a well-developed export network.

-

Sibelco Group, founded in 1872, is a Belgium-headquartered global material solutions provider specializing in industrial minerals, including aluminum wire for ceramics and refractory applications. The company operates a fully integrated model covering resource extraction, advanced processing, and technical support, with a strong emphasis on quality consistency and regulatory compliance. Sibelco serves a diversified customer base across construction materials, industrial manufacturing, and specialty ceramics, positioning itself as a technology- and application-driven supplier.

-

Golcha Minerals Pvt. Ltd., established in 1979, is a leading Indian producer of industrial minerals with a notable portfolio that includes aluminum wire for ceramics, refractories, and filler applications. The company operates captive mines and in-house processing facilities, enabling tight control over purity, particle size, and product performance. Golcha Minerals emphasizes export-oriented growth, long-term customer partnerships, and continuous process optimization, supplying to major ceramic and industrial clusters in India and international markets.

Key Aluminum Wire Companies:

The following are the leading companies in the aluminum wire market. These companies collectively hold the largest market share and dictate industry trends.

- Alcoa

- Ducab

- Henan Chalco Aluminium

- Kaiser Aluminum

- LS Cable & System Ltd.

- Nexans S.A.

- Norsk Hydro ASA

- Prysmian Group

- Southwire Company, LLC

- Sumitomo Electric Industries Ltd.

Recent Developments

-

In July 2024, Ashapura Minechem Limited announced the commissioning of product beneficiation and micronization lines at its Rajasthan minerals complex to enhance the output of high-purity aluminum wire products. The development is aimed at meeting rising demand from ceramic tiles and refractory manufacturers seeking consistent particle size distribution and improved thermal performance in kiln-fired applications.

-

In October 2024, several ceramic raw material processors in Gujarat, India, reported increased procurement of processed aluminum wire following capacity expansions in the regional ceramic tile cluster. This development reflects a shift toward optimized alumino-silicate blends in tile bodies to improve firing stability and reduce energy consumption amid higher fuel costs.

-

In February 2025, European specialty ceramics manufacturers highlighted increased use of refined aluminum wire in technical ceramic and kiln furniture formulations during industry forums, citing its role in enhancing dimensional stability and service life under high-temperature conditions. This trend highlights the increasing adoption of application-engineered aluminum wire products in performance-critical industrial ceramics.

Aluminum Wire Market Report Scope

Report Attribute

Details

Market definition

Market size represents apparent consumption of aluminum wire building & construction, automotive & transportation, electrical & electronics, telecommunication, and power & energy applications.

Market size value in 2026

USD 26.71 billion

Revenue forecast in 2033

USD 35.10 billion

Growth rate

CAGR of 4.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Grade, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Indonesia; Brazil; Argentina; GCC

Key companies profiled

Alcoa; Ducab; Henan Chalco Aluminium; Kaiser Aluminum; LS Cable & System Ltd.; Nexans S.A.; Norsk Hydro ASA; Prysmian Group; Southwire Company, LLC; Sumitomo Electric Industries Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aluminum Wire Market Report Segmentation

This report forecasts global, country, and regional revenue & volume growth and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global aluminum wire market report by grade, application, and region:

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Electrical

-

Mechanical

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Building & Construction

-

Automotive & Transportation

-

Electrical & Electronics

-

Telecommunication

-

Power & Energy

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC

-

-

Frequently Asked Questions About This Report

b. The global aluminum wire market size was estimated at USD 24.96 billion in 2025 and is expected to reach USD 26.71 billion in 2026.

b. The global aluminum wire market is projected to grow at a compound annual growth rate (CAGR) of 4.0% from 2026 to 2033, reaching USD 35.10 billion by 2033.

b. By grades, the electrical segment dominated the market with a revenue share of over 80.0% in 2025.

b. Some of the key vendors of the global aluminum wire market are Alcoa, Ducab, Henan Chalco Aluminium, Kaiser Aluminum, LS Cable & System Ltd., Nexans S.A., Norsk Hydro ASA, Prysmian Group, Southwire Company, LLC, Sumitomo Electric Industries Ltd., among others.

b. The key factor driving the growth of the global aluminum wire market is the rising copper prices and infrastructural upgrades for electricity distribution across nations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.