- Home

- »

- Clinical Diagnostics

- »

-

Alzheimer’s Disease Diagnostics Market Size Report, 2030GVR Report cover

![Alzheimer’s Disease Diagnostics Market Size, Share & Trends Report]()

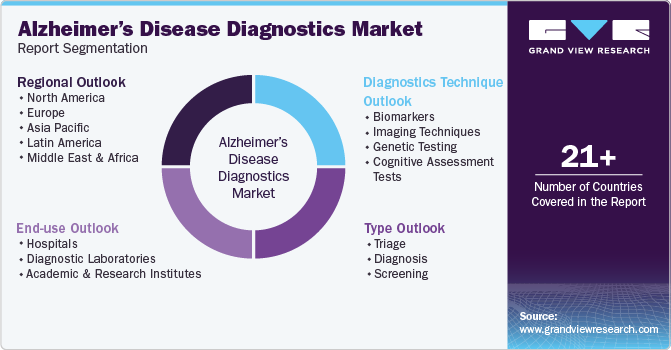

Alzheimer’s Disease Diagnostics Market Size, Share & Trends Analysis Report By Diagnostics Technique (Biomarkers, Imaging Techniques), By Type (Triage, Diagnosis), By End-use (Hospitals, Diagnostic Laboratories), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-323-7

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

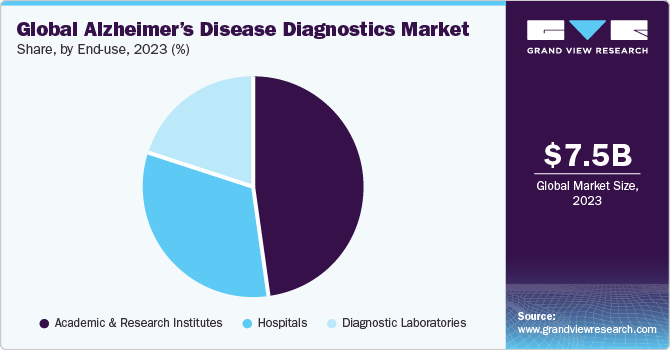

The global alzheimer’s disease diagnostics market size was estimated at USD 7.54 billion in 2023 and is expected to grow at a CAGR of 11.4% from 2024 to 2030. The increasing prevalence of Alzheimer’s Disease (AD), growing use of biomarkers in disease diagnostics, growing adoption of personalized products, and increasing technological advancements in medical imaging are expected to drive the demand for Alzheimer’s diagnostics. Increasing government investments and R&D studies is further propelling growth.

In recent years, there has been a surge in the development of novel therapeutic drugs globally that target the root causes of Alzheimer’s disease. Recently, in January 2023, the U.S. FDA granted accelerated approval to lecanemab (generic name), a jointly developed treatment for Alzheimer’s disease by Eisai Co., Ltd. and Biogen Inc. In addition, Eisai Co., Ltd. filed an application for the manufacturing and marketing approval of lecanemab in Japan, and the drug received priority review designation from the Japanese Ministry of Health, Labour and Welfare (MHLW) in the same month. The appropriate use and dissemination of these drugs require technology to identify the accumulation of Aβ in the brain. However, conventional testing methods such as CSF testing and amyloid PET testing have drawbacks in terms of their invasiveness and cost. Therefore, there is an increasing need for less invasive, simpler, and straightforward testing approaches for the effective clinical implementation of these therapeutic drugs.

The global disease burden carries a higher need for early detection and precise diagnosis. Advances in technologies such as genomics, proteomics, and metabolomics have expanded the scope and use of biomarkers in disease diagnostics. Several biomarkers have been identified and are being increasingly utilized in diagnostic procedures for Alzheimer’s disease. One of the most studied biomarkers is for detection of amyloid-beta and tau proteins in cerebrospinal fluid via positron emission tomography (PET) imaging. In addition, several market players are introducing novel biomarker tests to support ongoing clinical trials. For instance, in March 2024, Labcorp announced the launch of a blood biomarker test called pTau217, aimed at accelerating the diagnosis of Alzheimer’s and further supporting clinical trials. The test is further expected to improve the accuracy and efficiency of Alzheimer’s diagnosis, which is critical for timely treatment and management of the disease.

The rise of personalized medicine has highlighted the importance of biomarkers in categorizing patients, selecting treatments, and monitoring therapeutic outcomes. For instance, in February 2023, Biomedicines published a review in Journal of Alzheimer's Disease, which highlighted the role of precision medicine in Alzheimer’s disease, emphasizing the importance of genetic, environmental, and lifestyle factors in disease development and progression. Another study, in October 2021, suggested an oral diuretic pill, bumetanide, as a viable treatment for Alzheimer’s disease. The research funded by the National Institute on Aging (NIA), analyzed data from brain tissue samples and FDA-approved drugs to identify potential candidates for drug repurposing. The findings further supported the use of precision medicine approaches to identify existing FDA-approved drugs that can be repurposed to treat Alzheimer’s disease based on their genetic makeup.

Advanced image analysis and quantification techniques, such as volumetric analysis and machine learning algorithms, have improved the accuracy and reliability of Alzheimer’s diagnosis through imaging. Ongoing advances in diagnostic approaches range from traditional cognitive assessments to cutting-edge neuroimaging techniques and Cerebrospinal Fluid (CSF) assays enabling early identification crucial for effective treatment. For instance, in June 2023, Roche received FDA clearance for its cerebrospinal fluid (CSF), which is likely to support timely diagnosis and treatment decision-making in Alzheimer’s disease. The assay measures beta-amyloid and tau proteins, two biomarkers of Alzheimer's disease pathology in adults aged 55 and older.

With further advancements in diagnostic technologies and ongoing research, companies are expanding their product offerings by launching new tests and products. Additionally, strategic collaborations, mergers and acquisitions, and new investments in other companies are expected to contribute to the growth of the market over the forecast period. In February 2024, an article by Med Page Study discussed the diagnostic utility of blood biomarkers in Alzheimer’s diagnosis in research and clinical settings. Key manufacturers are introducing such blood biomarkers to their global clientele and putting a step ahead in the market. For instance, in August 2023, C2N Diagnostics, a pioneer in advanced brain health diagnostics, introduced the PrecivityAD2 blood test, a clinical care assay that meets the standard of care set by existing PET scans and cerebrospinal fluid tests. This blood test aims to evaluate patients with symptoms of Alzheimer’s and other cognitive decline.

Market Concentration & Characteristics

The Alzheimer’s disease diagnostics market is characterized by a high degree of innovation, driven by advancements in diagnostic technologies such as biomarkers and neuroimaging techniques. These innovations enable more accurate and early diagnosis of Alzheimer’s disease, allowing for prompt intervention and individualized treatment. Key innovations include the use of blood-based and cerebrospinal fluid biomarkers combined with neuroimaging for improved diagnostic accuracy. For instance, in April 2024, Quest Diagnostics announced its portfolio expansion by adding a new blood biomarker test for phosphorylated tau 217 (p-tau217). Companies further have innovations in various blood-based biomarkers, cerebrospinal fluid tests, and genetic tests to provide a comprehensive offering in brain health. Such initiatives is expected to keep degree of innovation high in the market over the forecast period.

The market is characterized by the leading players with moderate levels of technology launches and merger and acquisition (M&A) activity. Market players like Quest and others are involved in new product launches and merger and acquisition activities. For instance, in February 2023, Lantheus announced the acquisition of Cerveau Technologies, a company focused on developing imaging agents for Alzheimer's Disease research and clinical trials. This acquisition aligns with Lantheus' growth strategy and provides the potential to utilize MK-6240 (an F-18 labeled PET imaging agent that targets tau tangles in Alzheimer's Disease) as a key clinical tool supporting patient care as more Alzheimer's treatments.

Regulation has a significant impact on the market. The increasing number of regulatory criteria and approvals changes for Alzheimer's diagnostics products underscores the need for reliable tests and contributes to market growth. For instance, in July 2024, an article by Alzheimer’s Association highlighted discussions around the revised diagnostic criteria for Alzheimer’s disease and its staging. The criteria were developed by the Alzheimer's Association and the National Institute on Aging (NIA) and aim to improve the diagnosis and characterization of Alzheimer’s disease. The revised criteria refine and broaden previous guidelines issued in 2011 and 2018. They incorporate new scientific insights and technological advances to improve current diagnoses and establish a research agenda for future progress.

There is no direct substitute for existing disease diagnostic products and treatments, as various diagnostic tests and tools serve complementary roles in assessing risk, aiding diagnosis, and monitoring disease progression. However, there are alternatives that can provide valuable information, such as cognitive assessments, neurological exams, genetic testing, spinal fluid analysis, and neuropsychological tests. These alternatives are often used in conjunction with biomarker tests to provide a comprehensive understanding of an individual's cognitive health.

The market mostly comprises end users as hospital and clinicians allowing hospitals and clinics to purchase the necessary equipment and drugs needed to treat patients with Alzheimer’s disease. This concentration of end users in institutional settings drives the demand for reliable and accurate diagnostic tests, which in turn fuels the growth of the market.

Diagnostics Technique Insights

The imaging techniques accounted for the largest revenue share of 41.37% in 2023. This high share is attributable to the urgent need for early and accurate detection of the disease. Advancements in imaging technologies such as Computed Tomography (CT), Positron Emission Tomography (PET), functional MRI (fMRI) have emerged as crucial tools for diagnosing and monitoring the disease. These techniques can identify alterations associated with Alzheimer’s disease, such as amyloid plaques and brain atrophy.

Manufacturers are involved in gaining market approval for novel medical imaging technology. For instance, in November 2023, Pixyl, a French medtech company, received FDA 510(k) clearance for its AI-powered brain MRI software, Pixyl.Neuro. This software uses generative AI technology to analyze brain MRI images and support rapid detection, early diagnosis, and objective monitoring of neurological disorders. Such developments are poised to keep segment share high in the market over the forecast period.

Biomarkers segment is anticipated to witness the fastest growth over the forecast period, owing to increasing demand for biomarkers to diagnose and monitor the condition. The segment is further divided into CSF biomarkers and blood-based biomarkers. CSF Biomarkers, such as amyloid-beta (Aβ), tau, and neurofilament light chain (NfL), are used in clinical practice to help diagnose Alzheimer’s and other types of dementia. Blood-based biomarkers are being explored for their potential to predict Alzheimer’s from blood samples. Furthermore, blood biomarker is anticipated to witness the fastest segment growth.

As, recent advances in blood-based biomarkers have shown great potential for the early detection, diagnosis, and monitoring of various neurological disorders, particularly Alzheimer’s disease. For instance, in July 2023, ALZpath, a U.S. based pioneer in the diagnostic solutions for Alzheimer’s, secured funding from the Alzheimer's Drug Discovery Foundation's (ADDF) for Accelerating the clinical launch of ALZpathDx, a laboratory-developed test that utilizes a novel, blood-based biomarker to detect Alzheimer’s disease with unprecedented accuracy. This significant investment will enable Allopath to accelerate the commercialization of its groundbreaking technology, ultimately empowering healthcare professionals to make more accurate diagnoses and improve patient outcomes. Moreover, in February 2024, an article by MedPage today highlights, blood biomarkers clinical usage discussion to be presented at the 2024 Alzheimer's Association International Conference in July, with new guidelines and a systematic review expected to be published by the end of 2024. This highlights the forthcoming developments in the segment.

End-use Insights

The academic and research institutes segment dominated the market with the largest share of 47.85% in 2023. This is attributable to the increase in the research studies and clinical trials for neurological disorders over the last decade. Academic and research institutes are at the forefront of advanced research, clinical trials, and the development of innovative diagnostic techniques. Academic and research institutes often receive substantial funding and grants from government agencies, private foundations, and industry partners. Fsor instance, The NIA funds Alzheimer's Disease Research Centers (ADRCs) at major medical institutions across the U.S. Institutions conduct numerous clinical trials and studies to evaluate the efficacy and safety of new diagnostic tools. For instance, the Alzheimer's Disease Research Center at the Icahn School of Medicine at Mount Sinai is using blood-based biomarkers to diagnose Alzheimer’s disease. In another study, the AHEAD 3-45 trial of lecanemab (Leqembi) and the TRAILBLAZER-ALZ study of investigational donanemab uses blood markers to identify patients for treatment.

The hospitals segment is also anticipated to grow at a faster pace. This is attributable to growing recognition of the importance of early detection and diagnosis of Alzheimer’s disease, and hospitals are the primary settings where patients often seek treatment and care. Hospitals are equipped with state-of-the-art diagnostic equipment and technologies, such as neuroimaging techniques MRI, PET, and biomarker tests. These advanced tools are crucial for accurate and early diagnosis of Alzheimer’s disease, enabling timely intervention and management. In addition, hospitals are working to integrate blood-based biomarkers into their diagnostic protocols to improve patient care.

Type Insights

The diagnosis segment dominated the market and accounted for the largest share of 53.06% in 2023. The global market is expanding as the aging population rises, with more individuals at risk of developing Alzheimer's disease. This has heightened the demand for early and accurate diagnostic tools, driving the market forward. One prominent example of technological advancement in this field is LMI and SOFIE's Neuraceq PET imaging agent. Innovations like this, along with the development of cerebrospinal fluid (CSF) biomarkers and blood-based tests, are enhancing the accuracy and accessibility of diagnoses. These advancements are crucial for early intervention and improving patient outcomes.

Moreover, awareness campaigns and initiatives play a significant role in market growth. Organizations such as the Alzheimer's Association and the World Health Organization (WHO) are increasing public and professional awareness about the importance of early diagnosis and intervention. These efforts are supported by educational programs, public service announcements, and community outreach, which encourage individuals to seek diagnostic evaluations at the earliest signs of cognitive decline.

Additionally, government initiatives will further offer lucrative opportunities in the review period. For instance, in October 2023, U.S. health officials lifted restrictions on the reimbursement of amyloid PET scans, a non-invasive imaging test used to diagnose Alzheimer's disease. This change eliminates the previous once-per-lifetime limitation, allowing for broader use of the test to determine eligibility for new treatments. These treatments include Eisai and Biogen's Leqembi, as well as Eli Lilly's experimental drug, donanemab, which targets and removes beta amyloid protein from the brain. The expanded access to amyloid PET scans is expected to facilitate earlier and more accurate diagnoses of Alzheimer's, which is crucial for determining eligibility for these FDA-approved treatments. Amyloid confirmation is necessary for U.S. government reimbursement of Leqembi and similar therapies through a national data collection registry managed by the Centers for Medicare & Medicaid Services (CMS).

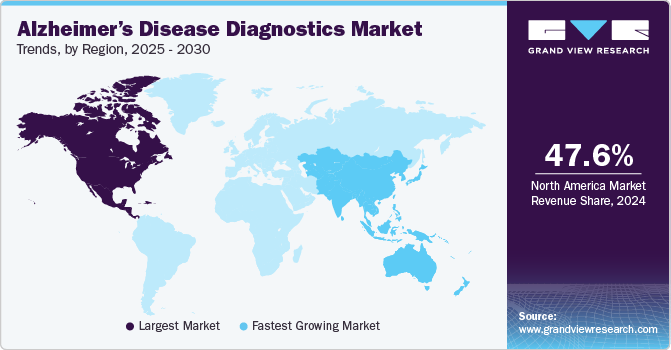

Regional Insights

North America dominated the market and accounted for 47.74% share in 2023. This high share is attributable to presence of key players in the market, such as LabCorp, Quanterix, Sysmex, and other players. Moreover, the growth of market can majorly be attributed to the increasing prevalence of Alzheimer’s disease in the region. For instance, approximately 6.7 million Americans aged 65 and older are living with Alzheimer's dementia. This number is projected to rise to 13.8 million by 2060 unless medical breakthroughs occur to prevent, slow, or cure Alzheimer’s disease. Furthermore, North America is at the forefront of research into Alzheimer’s disease biomarkers, including cerebrospinal fluid analysis and blood-based biomarkers. These advancements are driving the development of more accurate and minimally invasive diagnostic tests, which are expected to contribute significantly to market growth.

U.S. Alzheimer’s Disease Diagnostics Market Trends

The market in the U.S. is expected to grow substantially over the forecast period. Substantial investments in R&D by government agencies and non-profit organizations, such as the Alzheimer's Drug Discovery Foundation (ADDF), are contributing to the market's expansion. The emergence of digital biomarkers and advancements in diagnostic technologies are also expected to propel market growth. Academic institutions, pharmaceutical companies, and government agencies in the U.S. are actively collaborating on research initiatives to develop and validate new diagnostic tools and biomarkers for Alzheimer’s disease. For instance, in July 2023, Quest Diagnostics introduced the AD-Detect Test, a groundbreaking blood-based biomarker test that can be purchased by consumers in the U.S. This innovative test empowers individuals to assess their likelihood of developing Alzheimer’s by analyzing levels of beta-amyloid protein, a critical marker of the condition.

Europe Alzheimer’s Disease Diagnostics Market Trends

Europe is identified as a lucrative region in this industry. Increasing awareness about Alzheimer’s among healthcare professionals and patients is driving the growth of the market. The European market is highly competitive, with multiple players such as Eli Lilly and Company, Bio-Rad Laboratories, Quest Diagnostics, and others offering different types of tests and biomarkers. Key players are further focusing on developing more accurate and reliable tests, as well as expanding their geographic reach.

UK Alzheimer’s disease diagnostics market is expected to grow over the forecast period due to the increased government focus and substantial investments to develop new clinical tools for dementia and neurodegeneration. For instance, in March 2024, the UK Research and Innovation published that Innovate UK awarded funding of USD 6.24 million to develop new technologies via the Small Business Research Initiative (SBRI), which can be used for improved Alzheimer’s disease diagnostics services.

Germany Alzheimer’s disease diagnostics market is expected to grow over the forecast period. With the increase in the elderly population, the demand for Alzheimer’s diagnostics is expected to rise, particularly among older adults who are more likely to develop neurological conditions such as dementia or Alzheimer’s disease. For instance, German demographic highlights by 2040, nearly 21.4 million people are expected to constitute this age group, which is crucial for understanding the prevalence of Alzheimer’s disease and other neurological conditions.

Asia Pacific Alzheimer’s Disease Diagnostics Market Trends

Asia Pacific market is anticipated to witness the fastest growth of 13.1% CAGR over the forecast period. This is due to rising public awareness and increased research efforts to create new medications to treat Alzheimer’s disease. Many countries in the Asia-Pacific region, including China, Japan, and India, are experiencing a rapid demographic shift towards an aging population. These increasing elderly population is more susceptible to age-related diseases like Alzheimer's, driving the demand for accurate and early diagnostic services. Moreover, there is a growing emphasis on innovation of new testing technologies and growing investments for product development. Such activities are expected to offer favorable opportunities for market growth in Asia Pacific.

China Alzheimer’s disease diagnostics market is expected to grow over the forecast period due to the country being actively engaged in Alzheimer’s research, including the development and validation of new diagnostic methods. Increased Clinical trials for investigational diagnostic tools and biomarkers are also driving market growth in the region.

Japan Alzheimer’s disease diagnostics market is expected to grow over the forecast period. This is attributable to the increasing number of patients with dementia in Japan, predicted to reach 6-7 million by 2025. This raises the need for early diagnosis and treatment of Alzheimer’s, which is the most common form of dementia, accounting for approximately 60%-70% of all cases. Manufacturers in the region are involved in the development of new assay kits that address the fundamental pathology of Alzheimer’s disease. For instance, in June 2023, Sysmex Corporation announced the launch of the HISCL β-Amyloid 1-42 and 1-40 Assay Kit in Japan. These kits are designed to measure amyloid beta (Aβ) levels in the blood, which is a characteristic of Alzheimer’s disease. The kits are intended to assist in identifying Aβ accumulation in the brain by measuring Aβ levels in the blood.

Latin America Alzheimer’s Disease Diagnostics Market Trends

Latin America market is anticipated to grow at a substantial growth rate over the forecast period. Latin America has an aging population, with a high percentage of people above 65 years, which is a high-risk group for Alzheimer’s disease. Growing demand for personalized medicine and precision diagnostics. Collaboration between pharmaceutical companies and diagnostic companies to develop minimally invasive diagnostics in countries such as Brazil and Argentina.

The Alzheimer’s disease diagnostics market in Brazil is expected to grow over the forecast period. The Brazilian government has been keen in launching initiatives to improve healthcare infrastructure and increase access to diagnostic services, particularly in rural areas. Furthermore, there is the presence of global and local players. The market still faces challenges such as the need for more accurate and reliable diagnostic tests, the high cost of treatment, and the lack of access to healthcare services in some regions.

The Alzheimer’s disease diagnostics market in Saudi Arabia is expected to grow over the forecast period. The Saudi government has been investing heavily in modernizing the country's healthcare infrastructure, including the establishment of advanced diagnostic facilities and specialized centers for neurological disorders. This expansion is creating opportunities for the adoption of advanced Alzheimer’s diagnostic tools, including blood biomarkers.

Key Alzheimer’s Disease Diagnostics Company Insights

Some of the key players operating in the market include Quest Diagnostics Incorporated, Abbott, F. Hoffmann-La Roche Ltd., Eli Lily, Bio-Rad Laboratories, Inc, Eisai Co Ltd and others. The market is highly competitive, with a large number of manufacturers accounting for a majority of the share. New source developments, mergers and acquisitions, and collaborations are some of the major strategies adopted by these players to counter the stiff competition.

Key Alzheimer’s Disease Diagnostics Companies:

The following are the leading companies in the alzheimer’s disease diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Quest Diagnostics

- Labcorb

- C2N diagnostics

- FujireBio

- Bristol Myers Squibb

- Hoffmann-La Roche

- Quanterix

- Sysmex

- Lantheus

- Siemens Healthineers

Recent Developments

-

In October 2023, Quanterix introduced a novel blood-based biomarker test, LucentAD p-Tau 217, for the accurate diagnosis of Alzheimer’s disease. The test has achieved an exceptional accuracy rate of over 90%, surpassing the stringent criteria set by the Alzheimer's Association.

-

In October 2023, Diadem SpA announced a significant partnership with Quest Diagnostics. The two companies have entered into an exclusive licensing agreement in the U.S for Diadem's AlzoSure-R Predict, a pioneering technology that can predict the development of Alzheimer’s disease. This collaboration aims to bring this groundbreaking technology to the U.S. market, potentially revolutionizing the early detection and diagnosis of Alzheimer's disease.

-

In May 4, 2022, Fujirebio, a subsidiary of H.U. Group Holdings, Inc. announced that it had received FDA approval of its product Lumipulse G β-Amyloid Ratio (1-42/1-40) in vitro diagnostic test for FDA marketing authorization for the assessment of Alzheimer’s in the U.S.

Alzheimer’s Disease Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.32 billion

Revenue forecast in 2030

USD 15.92 billion

Growth Rate

CAGR of 11.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Diagnostics technique, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Quest Diagnostics; Labcorp; C2N Diagnostics; Fujirebio; Bristol Myers Squibb; Hoffmann-La Roche; Quanterix; Sysmex; Lantheus; Siemens Healthineers

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alzheimer’s Disease Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Alzheimer’s disease diagnostics market report based on diagnostics technique, type, end use, and region.

-

Diagnostics Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Biomarkers

-

CSF Biomarkers

-

Blood-Based Biomarkers

-

-

Imaging Techniques

-

Genetic Testing

-

Cognitive Assessment Tests

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Triage

-

Diagnosis

-

Screening

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Laboratories

-

Academic and Research Institutes

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global Alzheimer’s disease diagnostics market size was estimated at USD 7.54 billion in 2023 and is expected to reach USD 8.32 billion in 2024.

b. The global Alzheimer’s disease diagnostics market is expected to grow at a compound annual growth rate of 11.4% from 2024 to 2030 to reach USD 15.92 billion by 2030.

b. North America dominated the Alzheimer’s disease diagnostics market with a share of 47.74% in 2023. This is attributable to increasing prevalence of alzheimer’s in the region

b. Some key players operating in theAlzheimer’s disease diagnostics market include Quest Diagnostics, Labcorp, C2N Diagnostics, Fujirebio, Bristol Myers Squibb, Hoffmann-La Roche, Quanterix, Sysmex, Lantheus, Siemens Healthineers

b. Key factors that are driving the market growth are increasing prevalence of Alzheimer’s disease (AD), growing use of biomarkers in disease diagnostics, growing adoption of personalized products, and increasing technological advancements in medical imaging

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."