- Home

- »

- Medical Devices

- »

-

Ambulance Stretchers Market Size, Industry Report, 2030GVR Report cover

![Ambulance Stretchers Market Size, Share & Trends Report]()

Ambulance Stretchers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Emergency, Transport), By Technology (Manual, Electric Powered, Pneumatic), By Equipment, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-025-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ambulance Stretchers Market Summary

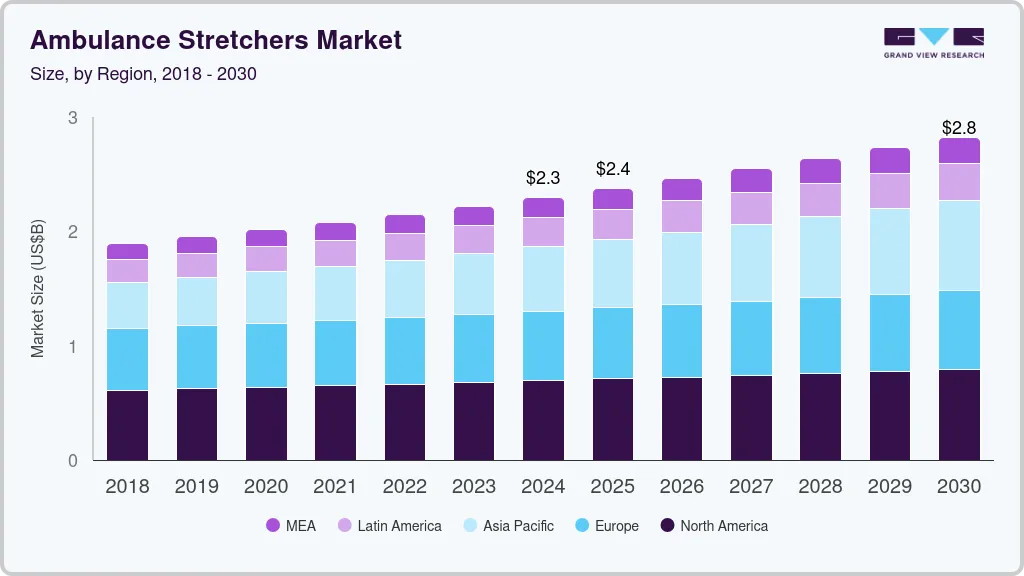

The global ambulance stretchers market size was estimated at USD 2.30 billion in 2024 and is projected to reach USD 2.82 billion by 2030, growing at a CAGR of 3.5% from 2025 to 2030. The rising geriatric population, coupled with the increasing prevalence of chronic diseases, necessitates more frequent emergency medical services.

Key Market Trends & Insights

- North America ambulance stretchers market dominated the global market in 2023 with a revenue share of 30.5%.

- U.S. ambulance stretchers market dominated the North America market with a share of 78.7% in 2023.

- By product, transport stretchers segment dominated the market and accounted for a share of 55.0% in 2023.

- By technology, manual stretchers segment accounted for the largest market revenue share of 45.4% in 2023.

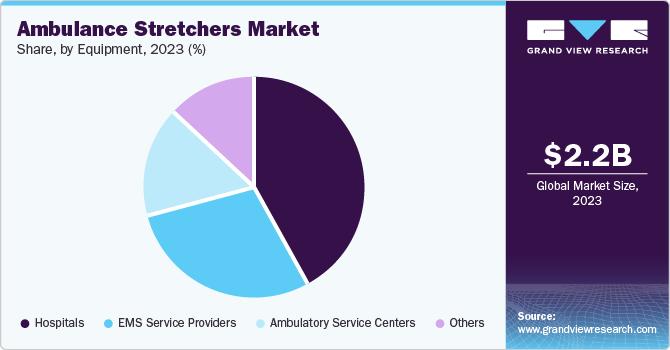

- By equipment, hospitals segment dominated the market and accounted for a share of 41.9% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 2.30 Billion

- 2030 Projected Market Size: USD 2.82 Billion

- CAGR (2025-2030): 3.5%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

This demographic shift is a significant driver of demand for ambulance stretchers, as older adults often require urgent medical attention. The growing number of road accidents necessitates the need for effective ambulance stretchers that can provide timely and efficient patient transport, underscoring the importance of innovation in stretcher design and functionality. The integration of telemedicine capabilities and development of electric-powered and lightweight models enhance the efficiency and safety of patient transport, catering to the need for improved patient care during emergencies.

Furthermore, the post-pandemic focus on healthcare has emphasized the importance of well-equipped ambulances capable of safely transporting patients, particularly those with infectious diseases. This has led to a growing trend towards eco-friendly stretcher designs that aim to reduce waste and carbon footprints, reflecting a broader commitment within the healthcare sector to sustainability. As healthcare systems continue to evolve, the demand for advanced ambulance stretchers that meet the needs of both patients and healthcare providers is expected to rise.

Government regulations and standards play a critical role in shaping the market, as regulatory bodies set specifications for stretcher design, safety, and performance. Manufacturers must comply with these guidelines to ensure that their products meet the required standards, ensuring high-quality care during transportation. By understanding these drivers, manufacturers can develop products that meet the evolving needs of the healthcare sector, ultimately driving market growth further.

Product Insights

Transport stretchers dominated the market and accounted for a share of 55.0% in 2023. Transport stretchers are designed for non-emergency patient transfers within healthcare facilities, prioritizing comfort, convenience, and mobility. These stretchers often feature collapsible frames, locking mechanisms, and ergonomic designs, simplifying movement and reducing the burden on healthcare professionals.

Emergency stretchers is expected to register the fastest CAGR of 3.7% during the forecast period. Emergency stretchers are engineered to provide swift and secure support to patients in critical situations, including accidents, trauma incidents, or medical emergencies. Equipped with adjustable height, side rails, and durable materials, these stretchers ensure patient safety and ease of handling in high-stress environments.

Technology Insights

Manual stretchers accounted for the largest market revenue share of 45.4% in 2023, the extensive product offerings from leading manufacturers and their lightweight, portable design, making them suitable for use in remote locations. These stretchers have been a cornerstone in ambulance transportation, providing reliable and user-friendly operation.

Electric powered stretchers is expected to register the fastest CAGR of 3.8% during the forecast period. Industry leaders are driving innovation by introducing cutting-edge products. Prominent manufacturers are developing electric-powered stretchers with advanced motorized systems. These innovative solutions enable effortless patient handling and positioning, reducing the physical burden on healthcare professionals and enhancing patient comfort during transport.

Equipment Insights

Hospitals dominated the market and accounted for a share of 41.9% in 2023. The need for efficient patient transport within hospitals and between healthcare facilities is driving the adoption of advanced ambulance stretchers. Key features such as adjustable height and patient monitoring capabilities are in high demand, driven by the growing prevalence of heart-related issues and the increasing patient population, including those with obesity-related conditions.

EMS service providers is projected to grow at the fastest CAGR of 4.1% over the forecast period. Ambulance stretchers are critical for secure and comfortable patient transport during emergencies. New entrants are leveraging innovative strategies to gain a competitive edge. Capsule, a Kenyan startup, has introduced “Flare”, an app that enables patients to schedule ambulances remotely. Integrating geolocation services and real-time traffic updates, Flare is expected to drive growth in ambulance stretcher usage, revolutionizing the industry.

Regional Insights

North America ambulance stretchers market dominated the global market in 2023 with a revenue share of 30.5% due to established healthcare systems, technological advancements, and high healthcare spending. Moreover, the increasing occurrence of accidents and chronic illnesses in the area also enhances the need for ambulance stretchers.

U.S. Ambulance Stretchers Market Trends

U.S. ambulance stretchers market dominated the North America market with a share of 78.7% in 2023. The U.S. boasts a comprehensive healthcare infrastructure, including hospitals and ambulance services, generating a substantial demand for advanced ambulance stretchers. The aging population requires comfortable and safe transportation solutions, aligning with current stretcher technology capabilities, making the country a lucrative market.

Europe Ambulance Stretchers Market Trends

Europe ambulance stretchers market was identified as a lucrative region in 2023 due to a strong healthcare system and positive government actions backing up emergency medical services. The market in this region is experiencing growth due to the involvement of major players and continuous research and development efforts.

The ambulance stretchers market in the UK is expected to grow rapidly in the coming years. Manufacturers are developing more ergonomic and comfortable stretchers to enhance patient care. These reduce physical strain on medical personnel and improve patient handling efficiency. Stretchers equipped with patient monitoring capabilities provide real-time data for better care.

Asia Pacific Ambulance Stretchers Market Trends

Asia Pacific ambulance stretchers market is anticipated to witness the fastest CAGR of 5.8% over the forecast period. The demand for ambulance stretchers is being fueled by rapid urbanization, rising disposable income, and enhanced healthcare services. Nations such as China, India, and Japan are experiencing notable market expansion due to their sizeable populations and increasing healthcare funding.

Ambulance stretchers market in China held a substantial market share in 2023. China is gradually aging and this trend will persist in the next decades, meaning a shift of demography. Due to the rising incidences of old people requiring medical care and possibly reliance on ambulances, the market is advancing with more and better designs of stretchers targeting the more vulnerable patient; the elderly. This demographic transition focuses on the advancement and usage of stretchers for the elderly and the incorporation of these are the primary ambulance stretchers market.

Key Ambulance Stretchers Company Insights

Some key companies in ambulance stretchers market include Stryker; Baxter; Medline Industries, LP.; Narang Medical Limited; FU SHUN HSING TECHNOLOGY CO., LTD; and others. The market players are dedicating significant resources to research and development, driving the introduction of innovative features and technologies that enhance patient safety and comfort during transportation.

-

FU SHUN HSING TECHNOLOGY CO., LTD is a manufacturer of innovative medical equipment, including 40 medical transport stretchers and hospital beds. The company’s product range encompasses transfer trolleys, stretchers, lights, and beds for various medical settings, including specialized products for pediatric care. They also offer customizable solutions through OEM and ODM services.

-

Ferno-Washington, Inc. is a manufacturer of emergency, mortuary, and healthcare solutions. The company’s comprehensive product range includes ambulance cots, stair chairs, restraints, mattresses, and stretcher accessories, catering to the needs of various healthcare professionals.

Key Ambulance Stretchers Companies:

The following are the leading companies in the ambulance stretchers market. These companies collectively hold the largest market share and dictate industry trends.

- Stryker

- Baxter

- Medline Industries, LP.

- Narang Medical Limited

- FU SHUN HSING TECHNOLOGY CO., LTD

- Ferno-Washington, Inc.

- Zhangjiagang New Fellow Med Co.,Ltd.

- ROYAX

- MAC Medical, Inc.

- Advanced Instrumentations

Recent Developments

-

In June 2024, Zhangjiagang New Fellow Med Co., Ltd. launched the vacuum negative pressure splint stretcher, an innovative device that utilizes a vacuum to create a rigid mold, offering a compact, lightweight, and portable solution for protection.

-

In May 2024, RMA and Royax announced a strategic cooperation to promote innovation and enhance customer options in the Ambulance & Emergency Medical Services industry, leveraging their combined expertise.

-

In September 2023, Stryker introduced Prime Connect, an intelligent hospital stretcher, at the Emergency Nursing 2023 event in San Diego, California, designed to support facility-wide fall prevention protocols.

Ambulance Stretchers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.38 billion

Revenue forecast in 2030

USD 2.82 billion

Growth rate

CAGR of 3.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, equipment, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Stryker; Baxter; Medline Industries, LP.; Narang Medical Limited; FU SHUN HSING TECHNOLOGY CO., LTD; Ferno-Washington, Inc.; Zhangjiagang New Fellow Med Co.,Ltd.; ROYAX; MAC Medical, Inc.; Advanced Instrumentations

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ambulance Stretchers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ambulance stretchers market report based on product, technology, equipment, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Emergency Stretchers

-

Transport Stretchers

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual Stretchers

-

Electric Powered Stretchers

-

Pneumatic Stretchers

-

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

EMS Service Providers

-

Ambulatory Service Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.