- Home

- »

- Medical Devices

- »

-

Ambulatory Blood Pressure Monitoring Devices Market Report 2030GVR Report cover

![Ambulatory Blood Pressure Monitoring Devices Market Size, Share & Trends Report]()

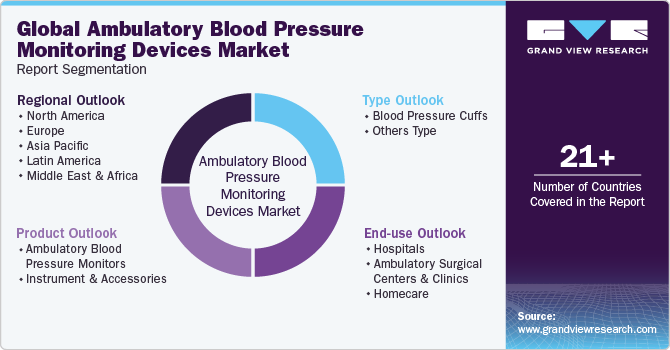

Ambulatory Blood Pressure Monitoring Devices Market Size, Share & Trends Analysis Report By Product (Ambulatory Blood Pressure Monitors, Instrument & Accessories), By Type (Blood Pressure Cuffs, Others), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-206-0

- Number of Report Pages: 60

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

ABPM Devices Market Size & Trends

The global ambulatory blood pressure monitoring devices market size was valued at USD 1.25 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.6% from 2024 to 2030. The driving factors for this market include the increasing geriatric population, the prevalence of chronic disorders such as hypertension, and technological advancement worldwide. According to statistics published by the WHO, around 1.13 billion people are likely to suffer from hypertension causing 7.6 million deaths annually.

Moreover, high blood pressure has been a crucial risk factor for hemorrhagic stroke and coronary heart disease in this decade. For instance, as per WHO, an estimated 1.28 billion adults who are aged between 30-79 years globally suffer from hypertension, whereas 42.0% of the adults having hypertension are not aware that they have the condition. The WHO states that hypertension is more prevalent in low- and middle-income countries, for instance, the African region has the highest prevalence of hypertension (27%), and North America has the lowest (18%). Hypertension, besides being most prevalent, is also the leading cause of cardiovascular disease, premature mortality, and disability, posing a significant economic burden.

The prevalence of geriatric population impacts the demand for ambulatory blood pressure monitoring (ABPM) devices. As per the recent WHO statistical data published in October 2022, 1 in 6 people would be over 60 years of age worldwide by 2030 and this number would be doubled by 2050. Moreover, cardiovascular diseases are highly prevalent in the older age population. As per the review published by the National Health Institute, around 70-75 % population over the age of 60-79 and 70-86 % of the population over the age of 80 are likely to suffer from cardiovascular disease (CVD) coupled with hypertension, chronic heart disease (CHD), Heart failure (HF), and stroke. This escalated dominance of cardiac conditions can be attributed to the market growth over the forecast period.

Furthermore, technological advancement in ABPM devices is likely to boost the market growth over the forecast period. Manufacturing of digital technology-based and mobile blood pressure devices fueling the demand of consumers. Key companies in the ABPM devices market consistently focus on the development of cost-friendly, innovative, and easy-to-use devices is likely to strengthen the market.

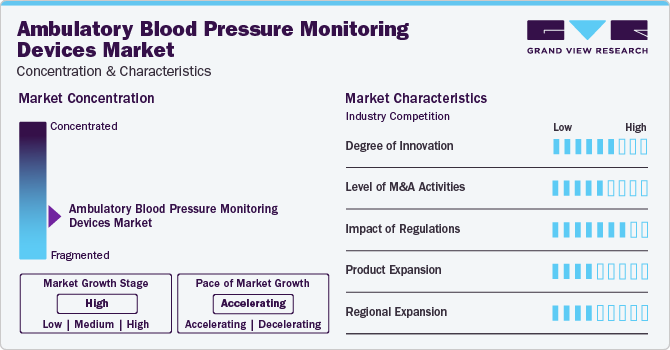

Market Concentration & Characteristics

The market growth stage is high, and the pace of market growth is accelerating. The market for ambulatory blood pressure monitoring is fragmented. This is due to different strategic initiatives, mergers & acquisitions, a high degree of innovation, and the impact of regulatory bodies.

The ABPM devices market is characterized by a high degree of innovation owing to advancements in technology, and the introduction of remote facilities for blood pressure monitoring devices, which helps to ease the process. For instance, In June 2021, Biobeat launched a cuffless continuous ambulatory blood pressure monitor. This unique cuffless device can capture data about a patient's cardiac health throughout the day. This also can be used at home without the need for healthcare support.

Ambulatory blood pressure monitoring companies undertake strategies such as collaborations, partnerships, and acquisitions, to promote the reach of their offerings and increase their product capabilities globally. For instance, in February 2021, Philips announced the acquisition of U.S.-Based BioTelemetry Company. This acquisition will help to strengthen Philip’s cardiac service portfolio and improve healthcare service delivery. Moreover, through this acquisition, Philips is likely to have an advanced and safe cloud-based HealthSuite digital platform.

The operating players in ambulatory blood pressure monitoring are receiving approvals from several regulatory authorities to boost their product expansion, thereby increasing market growth. For instance, in 2021, the EU approved a wrist-worn cuffless BP monitoring system developed by Aktiia SA. Such patent grants and approvals are indicative of a supportive regulatory environment, which is likely to boost production and market entry of novel as well as innovative products in the region.

Type Insights

Based on the type, the blood pressure cuff segment dominated the market with a revenue share of 56.3% in 2023. Blood pressure cuffs provide accuracy, reliability of data collection, and flexibility in usage, engaging more consumers and thereby accelerating the growth of this segment. Moreover, these devices are convenient and available in different sizes, according to the patient type. Two types of cuffs, disposable and reusable, are available in the market.

The other segment is projected to witness growth with a faster CAGR from 2024 to 2030. This segment mainly includes bladders, valves, and bulbs. The growth is significantly driven by the increasing usage of blood pressure monitors. Bladders are available in various sizes and are most sold with blood pressure kits. Moreover, the presence of affordable bulbs with metal valves, which are wear-resistant, of high quality, ergonomic, of high strength, and enable proper air flow control is anticipated to contribute to segment growth.

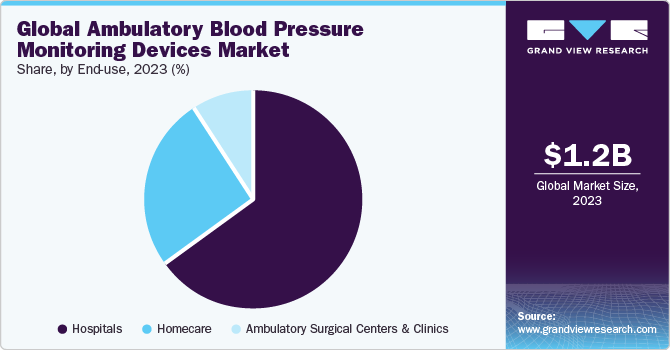

End-use Insights

Based on the end-use, hospitals accounted for largest share of 64.8% of the ambulatory blood pressure monitoring devices market in 2023. This growth can be attributed to clinical accuracy and precision, improved patient outcomes, technological advancements, and regulatory compliances.Hospitals are under strict regulatory requirements to maintain high standards of care and patient safety. Moreover, hospitals require highly accurate and precise monitoring devices to ensure the proper diagnosis and treatment of patients with hypertension or other cardiovascular conditions. Ambulatory blood pressure monitoring devices devices offer continuous monitoring over a 24-hour period, providing a more comprehensive picture of a patient’s blood pressure patterns compared to traditional in-office measurements.

The homecare segment is anticipated to register a faster CAGR from 2024 to 2030 .and this trend is expected to continue during the forecast period. This can largely be attributed to the rise in demand for home-based monitoring devices due to ease of use & probability of devices and the need to reduce healthcare expenditure. Moreover, reimbursement or coverage policies served by government bodies of countries such as U.S. and UK likely to drive the growth in the forecast period. According to the CDC, 6 in 10 adults in the U.S. live with at least one chronic disease, and 4 in 10 adults live with comorbidities. Therefore, homecare and remote patient monitoring are expected to be the next standard of care treatment processes in countries like the U.S. and the UK.

Product Insights

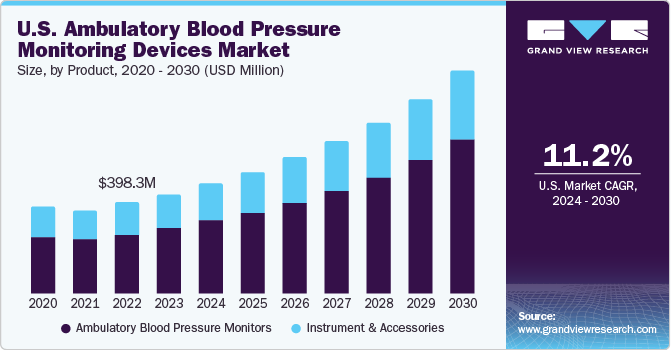

Based on the product, ambulatory blood pressure monitors dominated the market and accounted for 65.5% of global revenue in 2023 and are expected to grow at a fastest CAGR over the forecast period. This growth can be attributed to the increasing demand and adoption of ABPM devices, introduction of digital innovative ABPM devices, and the higher prevalence of geriatric population is estimated to accelerate segment growth during the forecast period. For instance, in January 2021, Biospectal Company with the Swiss Centre for Electronics and Microtechnology (CSEM) launched OptiBP which is a cuffless blood measurement algorithm application. This app will empower people for blood pressure monitoring using their smartphones.

The instrument & accessories segment held a significant share in the ambulatory blood pressure monitoring devices market in 2023. Constant technological advancements such as improvements in wearable technology, apps, & mobiles, their accessibility, and simplicity in usage, are likely to fuel the growth of ambulatory blood pressure monitoring devices in the market. For instance, in January 2024, the National Institute of Aging (NIA)-funded researchers manufactured a cost-effective, unique smartphone clip to monitor BP virtually. This device can be accessible anywhere and anytime using a custom smartphone application.

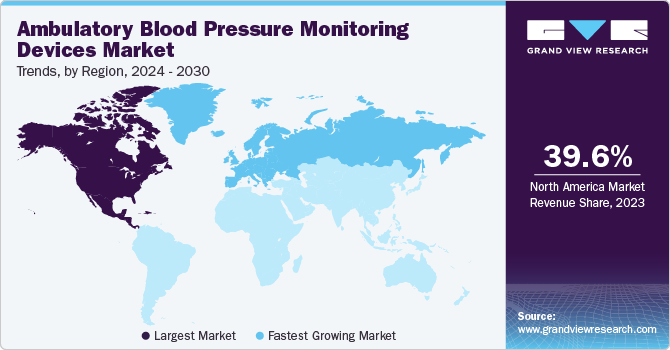

Regional Insights

North America dominated the global ABPM devices market with a revenue share of 39.6% in 2023. Growth in the region is driven by an increase in product launches by key companies, rising overall healthcare expenditure, and an increase in several regulatory approvals. Moreover, the region has a high number of health-conscious consumers which is likely to expand the growth in the market.

U.S. Ambulatory Blood Pressure Monitoring Devices Market Trends

The ambulatory blood pressure monitoring devices market in the U.S. dominated the market with a share of 87.4% in 2023. The high prevalence of heart diseases is the major driving force accelerating the market growth. As per CDC statistics, heart disease is the leading cause of death amongst the U.S. population. Furthermore, around 50% of adults in the United States have high blood pressure. This ongoing hypertension epidemic is a major cause of cardiovascular events like heart attacks and stroke and leads to more than half a million unnecessary deaths every year in the US alone. Considering the prevalence, key companies are actively manufacturing blood pressure monitoring devices to provide reliable cardiac care. For instance, in January 2022, Aktiia, the global leader in continuous blood pressure monitoring, today announced that it is bringing its 24/7 Blood Pressure Monitor to the United States1, delivering the next generation of clinical wearables specifically designed to meet the needs of both patients and physicians. Such initiatives are growing the demand for ABPM devices in the market.

Europe Ambulatory Blood Pressure Monitoring Devices Market Trends

Europe ambulatory blood pressure monitoring devices market is the second largest market for ambulatory blood pressure monitoring. This growth can be attributed to the rising geriatric population who are more likely to develop hypertension, which will further propel the demand in the forecast years. Growing awareness about the advantages of 24-hour blood pressure monitoring as compared to spot readings taken in clinics is expected to boost the adoption of ambulatory blood pressure monitors across European countries.

The ambulatory blood pressure monitoring devices market in the UK is anticipated to grow at the significant CAGR from 2024 to 2030. This can be attributed to the growing population and increasing number of people suffering from several chronic disorders. For instance, as per the Office for National Statistics, the UK population is estimated to grow by 2.1 million by 2030, representing 69.2 million, which is an increase of around 3.2%. Furthermore, the launch of several products by market players may increase the awareness and demand for blood pressure monitoring devices. For instance, in March 2021, OMRON Healthcare introduced OMRON Hypertension Plus, a remote patient monitoring platform for hypertension. OMRON Hypertension Plus is designed to help NHS clinicians remotely manage a patient’s medication plan.

Germany ambulatory blood pressure monitoring devices market is expected to grow at a CAGR of 10.7% from 2024 to 2030 owing to ongoing advancements in technology coupled with improving healthcare infrastructure. Germany is the largest market for medical devices in Europe. It is four times larger than the UK medical devices market; hence, serves as a major contributor to Europe.

The ambulatory blood pressure monitoring devices market in France held the second-largest position in 2023. The presence of a growing geriatric population is expected to have a positive impact on the blood pressure monitoring devices market. According to Cable News Network, France is projected to have a super-aged society by 2030, with nearly 23.2% of its population above 65 years of age. The growing geriatric population is anticipated to boost the demand for healthcare services, especially home- and long-term care services, positively impacting the demand for home-based BP monitors

APAC Ambulatory Blood Pressure Monitoring Devices Market Trends

Asia Pacific’s ambulatory blood pressure monitoring devices market is anticipated to witness significant growth with a CAGR of 13.4% during the forecast period. Major factors boosting growth are favorable government initiatives supporting the adoption of advanced medical devices, the growing geriatric population, and increasing healthcare expenditure. The demand for devices is expected to increase owing to the growing need to reduce healthcare costs.

The ambulatory blood pressure monitoring devices market in China is estimated to grow at the fastest CAGR from 2024 to 2030. China is a major manufacturer of low-cost electronic chips and products, which is expected to attract investors in the country as well as other Asian countries. Moreover, low manufacturing costs and easy availability of labor further accelerate the market.

India ambulatory blood pressure monitoring devices market is projected to expand with a CAGR of 12.1% over the forecast years. COVID-19 has significantly impacted the health of people, resulting in higher incidences of hypertension post-COVID recovery and thereby increasing the usage of blood pressure monitoring devices. Moreover, an increase in the prevalence of stroke in India may propel the market growth. For instance, the experts of the All-India Institute of Medical Sciences (AIIMS) India revealed that India reports about 1, 85,000 cases of stroke incidences every year.

The ambulatory blood pressure monitoring devices market in Japan is expected to grow at a significant CAGR from 2024 to 2030 due to the higher prevalence of people with hypertension. In Japan, all residents are covered under the country’s universal health insurance policy. The plan covers ambulatory, extended care, prescription drugs, most dental care, and hospital care. For medical devices, the reimbursement plan is based on categories of medical devices. The presence of market leaders, such as Omron Healthcare and Nihon Kohden, in the country is anticipated to drive market growth

Latin America Ambulatory Blood Pressure Monitoring Devices Market Trends

The Latin American ambulatory blood pressure monitoring devices market is estimated to grow over the coming years owing to the rising number of people living with chronic diseases and cardiac disorders. Furthermore, the proportion of the aging population is growing in Latin America, due to an increase in the average life expectancy and demographic changes. The aging population in Latin America is expected to reach 18.5% by 2050. This is expected to increase the prevalence of age-associated diseases, driving demand for BP monitoring devices.

The ambulatory blood pressure monitoring devices market in Mexico is expected to grow at a significant growth rate. Healthcare reforms, rising demand for home care, and increasing burden of conditions, such as diabetes & cardiovascular disorders. According to a recent report by the Organization for Economic Co-operation and Development (OECD), Mexico is focused on strengthening its primary care and monitoring services, to reduce hospital admissions. These factors are anticipated to contribute to the adoption of digital BP monitoring products, especially home-based

Brazil ambulatory blood pressure monitoring devices market is projected to witness growth with a CAGR of 9.2% over the forecast years. The driving factors for this growth include the growing presence of manufacturers within the country, reduced cost of devices, and technologically updated devices.

Key Ambulatory Blood Pressure Monitoring Devices Company Insights

The key companies operating in the global ambulatory blood pressure monitoring devices market include Baxter International Inc., Bosch Sohn GmbH Co KG, BPL Ltd, Contec Medical Systems Co., Ltd, GE Healthcare, Halma Plc, Omron Corporation, OSI Systems Inc. (Spacelabs Healthcare Inc.), Schiller AG, and Vaso Corporation.

These key companies aim to focus on business expansion by undertaking strategic initiatives, M&A activities, and new product launches to strengthen their position in the market. Innovation and technological advancement seem to be one of their top strategies to uphold in the market space.

Key Ambulatory Blood Pressure Monitoring Devices Companies:

The following are the leading companies in the ambulatory blood pressure monitoring devices market. These companies collectively hold the largest market share and dictate industry trends.

- Omron Healthcare Welch Allyn, Inc.

- A&D Medical Inc.

- American Diagnostics Corp.

- Withings; Briggs Health

- GE Healthcare; Kaz Inc.

- Microlife AG

- Rossmax International Ltd.

- GF Health Products Inc.

- Philips Healthcare;

- Hill-Rom Servicee Inc.

- Spacelabs Healthcare Inc,

- Bosch & Sohn GmbH & Co. KG,

- SunTech Medical, Schiller AG,

- Welch Allyn Inc,

- DAIFUKU CO. LTD,

- GE Company,

- Microlife Corporation,

- Omron Healthcare Company,

- Biobeat

Recent Developments

-

In September 2023, North West London Integrated Care System initiated a digital program of remote blood monitoring using the Viso Hypertension Plus App. This application includes of remote patient management services from OMRON Healthcare. This service helped people to monitor their blood pressure at home without the necessity of a GP appointment.

-

In September 2022, researchers from the University of Pittsburgh received a grant of USD 580k from the National Institute of Health (NIH) to manufacture a cuffless blood pressure monitor. The gecko feet concept was used to improve the adhesion of cuff-less 24-hour ambulatory blood pressure monitoring. This device would be beneficial to track variation in BP and detect hypertension.

-

In July 2022, Biotech company, CardiAI introduced BPAro, a new 24-hour ambulatory blood pressure monitoring (ABPM) system in the worldwide blood pressure device market. BRAro is a compact, portable, self-monitoring device consisting of Bluetooth for wireless connection. This device constantly monitors human blood pressure and automatically records patient blood pressure at regular intervals for up to 30 hours.

Ambulatory Blood Pressure Monitoring Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.36 billion

Revenue forecast in 2030

USD 2.63 billion

Growth rate

CAGR of 11.6% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million, number of patients treated in thousands, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; Netherlands; Belgium; Nordics; Japan; China; India; South Korea; Australia; Thailand, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Omron Healthcare Welch Allyn, Inc.; A&D Medical Inc.; American; Diagnostics Corp.; Withings; Briggs Healthcare;GE Healthcare;Rossmax International Ltd.; GF Health Products Inc.; Philips Healthcare; Hill-Rom Servicee Inc.;Biobeat;Spacelabs Healthcare Inc, Bosch & Sohn GmbH & Co. KG, SunTech Medical, Schiller AG, Welch Allyn Inc, DAIFUKU CO. LTD, GE Company, Daray Medical, Microlife Corporation, Omron Healthcare Company, Biobeat

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ambulatory Blood Pressure Monitoring Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ambulatory blood pressure monitoring devices market report based on product, end-use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ambulatory Blood Pressure Monitors

-

Instrument & Accessories

-

Blood Pressure Cuffs

-

Others Type

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers & Clinics

-

Homecare

-

-

Regional Outlook (Revenue, USD Million, Number of Patients Treated in Thousands, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ambulatory blood pressure monitoring devices market size was estimated at USD 1.08 billion in 2023 and is expected to reach USD 1.15 billion in 2024.

b. The global ambulatory blood pressure monitoring devices market is expected to grow at a compound annual growth rate of 8.5% from 2024 to 2030 to reach USD 1.87 billion by 2030.

b. Based on the product, instruments & accessories dominated the market and accounted for 67.5 % of global revenue in 2023. Constant technological advancements such as improvements in wearable technology, apps, & mobiles, their accessibility, and simplicity in usage, are likely to fuel the growth of ambulatory blood pressure monitoring in the market

b. The key companies operating in the global ambulatory blood pressure monitoring devices market include Baxter International Inc., Bosch Sohn GmbH Co KG, BPL Ltd, Contec Medical Systems Co., Ltd, GE Healthcare, Halma Plc, Omron Corporation, OSI Systems Inc. (Spacelabs Healthcare Inc.), Schiller AG, and Vaso Corporation.

b. The driving factors accelerating the growth of this market include the increasing geriatric population, the prevalence of chronic disorders such as hypertension, and technological advancement worldwide

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."