- Home

- »

- Medical Devices

- »

-

Ambulatory Services Market Size And Share Report, 2030GVR Report cover

![Ambulatory Services Market Size, Share & Trends Report]()

Ambulatory Services Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Primary Care Offices, Outpatient Departments, Emergency Departments, Surgical Specialty, Medical Specialty), By Region, And Segment Forecast

- Report ID: 978-1-68038-731-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ambulatory Services Market Summary

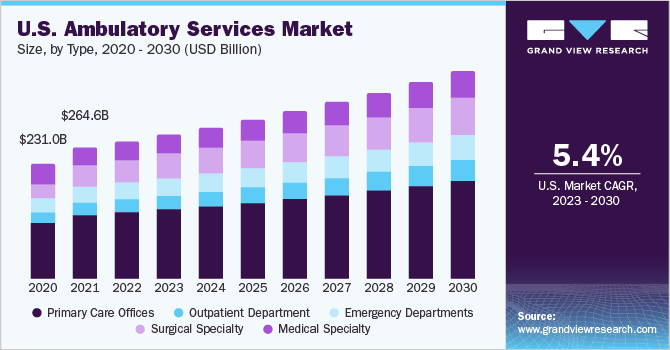

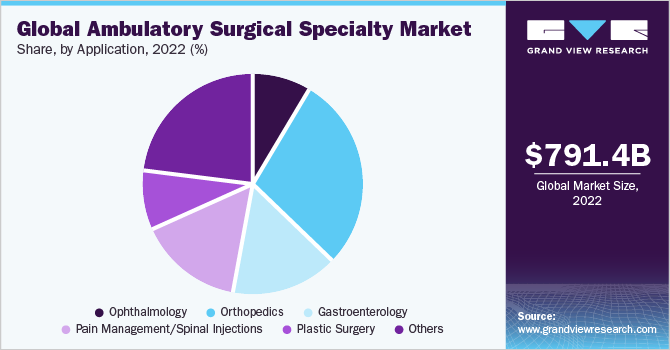

The global ambulatory services market size was valued at USD 791.4 billion in 2022 and is expected to reach USD 1.2 trillion by 2030, growing at a compound annual growth rate (CAGR) of 5.29% from 2023 to 2030. The growth of the market is attributed to factors such as the rising burden of chronic conditions requiring surgeries, growing demand for minimally invasive surgical procedures, and growing technological advancement.

Key Market Trends & Insights

- North America held a significant market share of around 38.78% in 2022.

- Asia Pacific is expected to register the fastest growth over the coming years.

- By type, the primary care offices segment accounted for a maximum share of 48.6% of the overall revenue in 2022.

Market Size & Forecast

- 2022 Market Size: USD 791.4 Billion

- 2030 Projected Market Size: USD 1.2 Trillion

- CAGR (2023-2030): 5.29%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Further, a growing preference for ambulatory care, as it is cost-effective and doesn't require hospitalization, is the key factor driving the market. The increasing prevalence of chronic conditions has driven market growth. According to WHO, around 41 million people died due to Noncommunicable Diseases (NCDs) globally, which is equivalent to 74% of overall deaths that occurs worldwide. In addition, according to the same source, cardiovascular diseases are responsible for the highest number of non-communicable disease (NCD) fatalities, with approximately 17.9 million people affected each year. This is followed by cancer, which accounts for 9.3 million individuals annually. Chronic respiratory diseases account for 4.1 million deaths, while diabetes, including kidney disease resulting from diabetes, causes 2.0 million fatalities yearly.

Moreover, the COVID-19 pandemic has substantially had an impact on global healthcare provision. Face-to-face appointments in primary and secondary areas due to interruptions in the facility of healthcare services were limited. According to data from digital Hospital Episode Statistics (HES) from December 2018 to October 2020, general, appointments dropped by 58% during the pandemic, follow-ups fell by 51%, first attendances fell by 43 %, and day cases fell by 37% in England.

On the other hand, the pandemic has led to a surge in interest among physicians and medical technology companies to invest in or enter the ambulatory care sector. This has led to increased emphasis on the expansion of ambulatory care solutions and technologies, as well as a growing focus by health systems on providing comprehensive care. For instance, in July 2020, Stryker launched its ambulatory surgical center business.

Additionally, new developments and government initiatives are anticipated to drive the market. For instance, in 2020 CMS added 11 services to the ambulatory surgical center (ASC), which covers hip replacement procedures. Additional 267 musculoskeletal-related services are eligible for Medicare coverage if carried out in an ASC. These changes are expected to support patients’ health expenditure and the development of less invasive technologies that allows for safety standards.

Type Insights

The primary care offices segment dominated the global market in 2022 and accounted for a maximum share of 48.6% of the overall revenue. The growth is attributed to improved quality of care and application of advanced technologies, and increased high-quality primary care services. Based on the type, the market is segmented into outpatient departments, emergency departments, primary care offices, medical specialty, and surgical specialty.

The acceptance of innovative technologies such as automated prescribing systems and EHR has resulted in enhanced primary and follow-up care, leading to a reduction in manual errors. The implementation of EHRs in rural areas, along with improved drug procurement processes, has further contributed to these advancements. Additionally, collaborations between government and private organizations to offer affordable access to diverse treatments are anticipated to drive growth in the ambulatory services segment.

Furthermore, according to Ambulatory Surgery Center Association and ASCA Foundation, ASCs perform estimated 22.5 million procedures annually with more than 5,900 Medicare-certified facilities across 50 states of the U.S. country. Also, in ASC, Medicare assists to save more than USD 4.2 billion annually in cases where procedures are performed. Similarly, these services in centers are structured most efficiently, reducing wait times, and creating more personalized care. This is expected to boost the growth of the segment during the forecast period.

Regional Insights

North America held a significant market share of around 38.78% in 2022. This can be attributed to the adoption of advanced healthcare infrastructure. The increasing government initiatives and M&A operations are expected to drive the regional market. For instance, in April 2022, the U.S. Department of Agriculture mentioned that in Pennsylvania, Greater Pittston Ambulance Association will utilize a USD 226,900 grant to purchase more than 200 medical equipments for ambulatory & emergency services.

Moreover, regional growth is driven by factors such as a growing number of surgical procedures, an increased number of ASC, and a growing preference for minimally invasive surgeries. In addition, the demand for ASC service across the region has led hospitals to establish outpatient facilities to serve healthcare needs. For instance, according to Definitive Healthcare’s SurgeryView product, there are 11,815 ASCs currently active across the U.S.

Asia Pacific is expected to register the fastest growth over the coming years. Increasing healthcare expenditure owing to the rising prevalence of chronic diseases and cases of rehospitalization in hospitals has led to the expansion of outpatient centers. Similarly, the emerging number of road traffic accidents and the rising requirement for emergency medical response has accelerated the market in this region. For instance, according to the Government of India Ministry of Road Transport & Highways in 2021, 4,12,432 total road accidents were reported in India, claiming 1,53,972 lives & causing injuries to 3,84,448 persons.

Key Companies & Market Share Insights

The market is competitive owing to the presence of ambulatory services providers. The market players are adopting various strategies, such as new service launches, partnerships & collaborations, and regional expansion to gain higher shares. For instance, in January 2023, McLeod Health announced its partnership with Wesmark Ambulatory Surgery Center to expand its reach of hospital systems & offer multi-specialty services of ambulatory surgery for the Sumter community. Additionally, in November 2021, Tenet Healthcare Corporation's subsidiary, United Surgical Partners International (USPI), announced its agreement to acquire SurgCenter Development (SCD). This acquisition entails the purchase of SCD's 92 ambulatory surgical centers (ASCs) along with their associated ambulatory support services. Some of the prominent players in the ambulatory services market include:

-

Envision Healthcare Corporation

-

Surgery Partners

-

NueHealth (Nueterra Healthcare)

-

Terveystalo Healthcare

-

Hospital Corporation of America (HCA) Management Services, L.P

-

Aspen Healthcare

-

Healthway Medical Group

-

Medical Facilities Corporation

-

AQuity Solutions

Ambulatory Services Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 828.1 billion

The revenue forecast in 2030

USD 1.2 trillion

Growth Rate

CAGR of 5.29% from 2023 to 2030

The base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Norway; Denmark; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Envision Healthcare Corporation; Surgery Partners; NueHealth (Nueterra Healthcare); Terveystalo Healthcare; Hospital Corporation of America (HCA) Management Services; L.P; Aspen Healthcare; Healthway Medical Group; Medical Facilities Corporation; AQuity Solutions

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

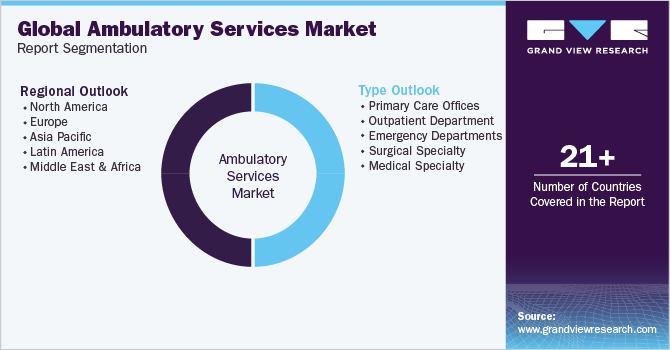

Global Ambulatory Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global ambulatory services market report based on type and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Primary Care Offices

-

Outpatient Department

-

Emergency Departments

-

Surgical Specialty

-

Ophthalmology

-

Orthopedics

-

Gastroenterology

-

Pain Management/Spinal Injections

-

Plastic Surgery

-

Others

-

-

Medical Specialty

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ambulatory services market size was estimated at USD 791.4 billion in 2022 and is expected to reach USD 828.5 billion in 2023.

b. The global ambulatory services market is expected to grow at a compound annual growth rate of 5.29% from 2023 to 2030 to reach USD 1.2 trillion by 2030.

b. Europe dominated the ambulatory services market with a share of around 41.5% in 2022. This can be attributed to the quick adoption of technologically advanced products.

b. Some key players operating in the ambulatory services market include Envision Healthcare Corporation, Surgery Partners, NueHealth (Nueterra Healthcare), Terveystalo Healthcare, Hospital Corporation of America (HCA) Management Services, L.P, Aspen Healthcare, Healthway Medical Group, Medical Facilities Corporation, AQuity Solutions

b. Key factors that are driving the market growth include increasing preference for outpatient care, as it is cost-effective and does not require a hospital stay.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.