- Home

- »

- Advanced Interior Materials

- »

-

Americas Pipe Insulation Market Size & Share Report, 2030GVR Report cover

![Americas Pipe Insulation Market Size, Share & Trends Report]()

Americas Pipe Insulation Market (2022 - 2030) Size, Share & Trends Analysis Report By Material (Cellular Glass, Polyurethane & Polyisocyanurate Foam, Fiberglass), By Application (Industrial, Building & Construction), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-961-2

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The Americas pipe insulation market size was estimated at USD 2.48 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2022 to 2030. This growth is expected to be driven by the rising awareness regarding energy conservation among the growing population. The acoustic performance of insulation in large-scale factories helps curb high-frequency noises made by machines on the job floor. Furthermore, it protects all industrial appliances from fire, prevents the condensation of moisture on the equipment, and protects the equipment at extremely low or high temperatures leading to reduced accidental risks.

Various metropolitan areas within the U.S., including San Francisco, New York, Milwaukee, Denver, and Seattle, among others, extensively use district heating systems to serve the space heating and water requirements of both residential and commercial buildings within their distribution network. As a result, the sector is generating an incremental demand for pipe insulation materials to prevent heat loss during the transportation phase and increase the energy efficiency of the overall system.

The market is highly fragmented owing to the presence of numerous established industry participants. Market players are highly focused on providing eco-friendly and diversified product portfolios to their customers. Furthermore, maintaining competitive pricing is another strategy adopted by companies to gain a competitive edge over other players in the market.

Insulation system provides long-term, as well as immediate benefits to the industry, including protection of equipment, personnel, system, and budget. In addition, insulation is responsible for enhancing the efficiency of machinery and process performance in the system, which results in the reduction of manufacturing and energy costs.

Furthermore, insulation products improve product performance by making manufacturing processes more efficient and providing exposed equipment and piping a finished and durable appearance. Industrial insulation offers frost protection for pipes at low ambient temperatures. Insulation is one of the economical and secure techniques of energy conservation.

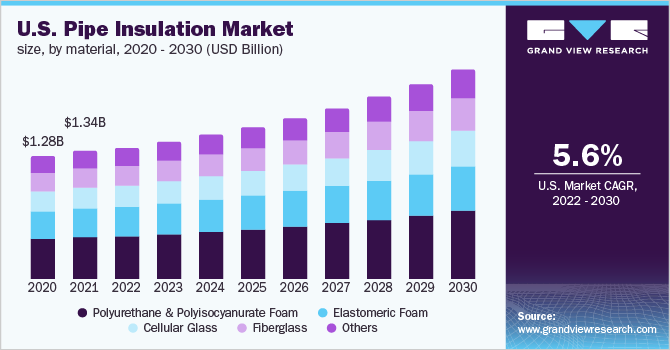

Material Insights

The polyurethane & polyisocyanurate foams material segment accounted for the largest revenue share of 29.6% in 2021. The foam is typically used in pipe insulation applications as it can restrict the absorption of air, water, and gas. The demand for rigid PU foam is projected to increase in the coming years owing to various features offered by the material, such as enhanced durability and stability during the lifetime of the product.

Cellular glass is used in various applications such as in heat transfer fluid systems, chemical processing systems, ductwork & commercial pipework, storage tanks, and many other application areas. Few advantages offered by the material are consistent insulating efficiency, low vapor permeability, fire protection, and high compressive strength.

Fiberglass is commonly known as glass fiber, which is produced from very thin glass wires melted from molds. The material is widely used in insulation systems due to its lower cost and easy installation. The material is widely used to insulate copper, iron, and PVC pipes in industrial, commercial, and institutional buildings.

Aerogel insulation is used in various insulation applications including transportation, industrial, and piping. Aerogel-based pipe insulation has a very low thermal conductivity and can be manufactured in blanket form. Aerogel is more expensive to produce but because very less material is consumed in the piping application, it offsets the difference in cost.

Application Insights

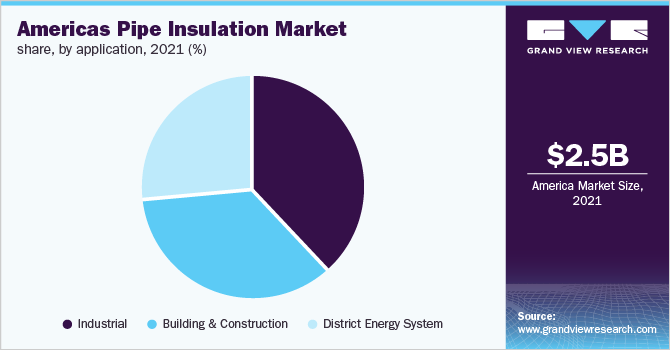

The industrial applications segment led the Americas pipe insulation market with a revenue share of 38.5% in 2021. The escalating demand for piping systems in various industries such as petrochemical, oil & gas, power generation, chemical, and wastewater treatment is estimated to augment segment growth.

The building and construction application segment accounted for 35.1% revenue share in 2021. The growing number of single-family houses in developing economies and the increasing disposable incomes of consumers are a few factors anticipated to drive the growth of the building & construction segment.

District energy systems use pre-insulated pipes for the distribution of produced streams. These systems supply steam or hot water for cooling building spaces. The hot water is distributed through insulated pipes installed underground. Insulated piping systems are the major components of district energy systems.

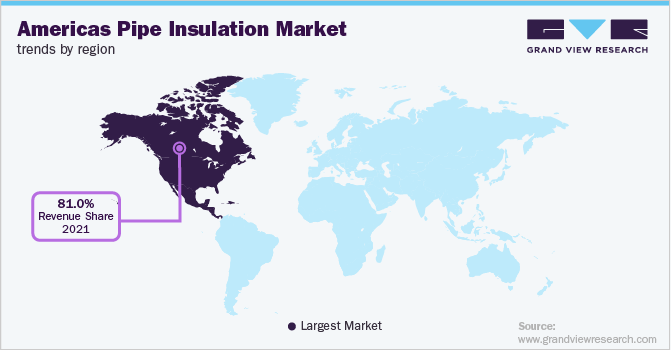

Regional Insights

North America led the pipe insulation market in the Americas accounting for over 81% of the total revenue share in 2021. The rising adoption of district heating systems was one of the primary factors driving the product demand in the region. Growing investments in the development and expansion of chemical processing capacities as well as in LNG gasification plants are expected to drive the regional growth over the forecast period.

The North American region, especially the U.S. and Canada, witnesses extremely cold weather during the winter months. The majority of the commercial buildings in the region are equipped with central heating systems to maintain optimum temperatures inside the building structure. As a result, building contractors tend to insulate heating system pipes to prevent heat loss and help improve the energy efficiency of buildings.

The majority of the Canadian population lives in the temperate parts of the country. The country witnesses freezing temperatures during the winter seasons. As a result, a significant amount of energy is consumed in building heating systems.

District heating operators are gradually expanding their network in major metropolitan areas such as Vancouver, Ontario, Toronto, and Edmonton owing to high energy costs and growing awareness about the positive environmental attributes of centralized district heating systems. Thus, the demand for pipe insulation is expected to witness positive growth over the forecast period.

Key Companies & Market Share Insights

The market comprises various established brands such as Owens Corning, Kingspan Group, Saint-Gobain, Huntsman Corporation, and Johns Manville. These players in the industry have a wide sales and distribution network and presence in multiple applications. Companies attempt to diversify their businesses through consistent quality and better customer service. The majority of the industry players have a diverse product portfolio, which has increased industry rivalry. As a result of intense competition, the entrance threat of new players is low in the industry.Some prominent players in the Americas pipe insulation market include:

-

Armacell International

-

Lydall, Inc.

-

Kingspan Group

-

Owens Corning

-

Huntsman International LLC

-

Saint-Gobain Group

-

Rockwool International A/S

-

Johns Manville

-

Knauf Insulation

-

BASF SE

-

Covestro AG

-

WINCELL INSULATION CO., LTD

-

Gilsulate International, Inc.

-

Sekisui Foam Australia

Americas Pipe Insulation Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 2.56 billion

Revenue forecast in 2030

USD 3.91 billion

Growth rate

CAGR of 5.2% from 2022 to 2030

Base year for estimation

2021

Actual estimates/Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America; Central & South America

Country scope

U.S.; Canada; Mexico; Brazil; Argentina

Key companies profiled

Armacell International; Lydall, Inc.; Kingspan Group; Owens Corning; Huntsman International LLC; Saint-Gobain Group; Rockwool International A/S; Johns Manville; Knauf Insulation; BASF SE; Covestro AG; WINCELL INSULATION CO., LTD; Gilsulate International, Inc.; Sekisui Foam Australia

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Americas Pipe Insulation Market Segmentation

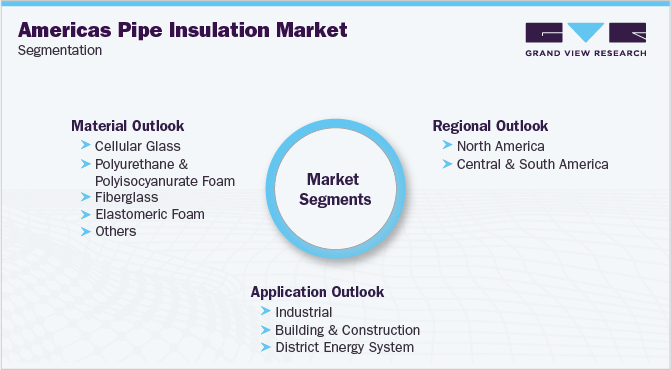

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2030. For this study, Grand View Research has segmented the Americas pipe insulation market report based on material, application, and region:

-

Material Outlook (Revenue, USD Million; 2017 - 2030)

-

Cellular Glass

-

Polyurethane & Polyisocyanurate Foam

-

Fiberglass

-

Elastomeric Foam

-

Others

-

-

Application Outlook (Revenue, USD Million; 2017 - 2030)

-

Industrial

-

Building & Construction

-

District Energy System

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The Americas pipe insulation market size was estimated at USD 2.48 billion in 2021 and is expected to reach USD 2.56 billion in 2022.

b. The Americas pipe insulation market is expected to grow at a compound annual growth rate of 5.2% from 2021 to 2030 to reach USD 3.91 billion by 2030.

b. The industrial application segment dominated the Americas pipe insulation market with a share of 38.5% in 2021. This is attributed to the escalating demand for piping systems in various industries such as petrochemical, oil & gas, power generation, chemical, and wastewater treatment.

b. Some of the key players operating in the Americas pipe insulation market include Armacell International, Lydall, Inc., Kingspan Group, Owens Corning, Huntsman International LLC, Saint-Gobain Group, Rockwool International A/S, Johns Manville, Knauf Insualtion, BASF SE, Covestro AG, WINCELL INSULATION CO., LTD, Gilsulate International, Inc., Sekisui Foam Australia

b. The key factors that are driving the pipe insulation market include rapidly growing awareness regarding energy conservation and the growth of the chemical processing industry in the Americas region. The growing trend of green building is also expected to boost the market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.