- Home

- »

- Plastics, Polymers & Resins

- »

-

Americas Plastic Compounding Market Size, Report, 2030GVR Report cover

![Americas Plastic Compounding Market Size, Share & Trends Report]()

Americas Plastic Compounding Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (PE, PP, TPV, TPO, PVC, PS, PET, PBT, PA, PC, ABS), By Application (Automotive, Construction, Electrical & Electronics, Packaging), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-182-5

- Number of Report Pages: 135

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

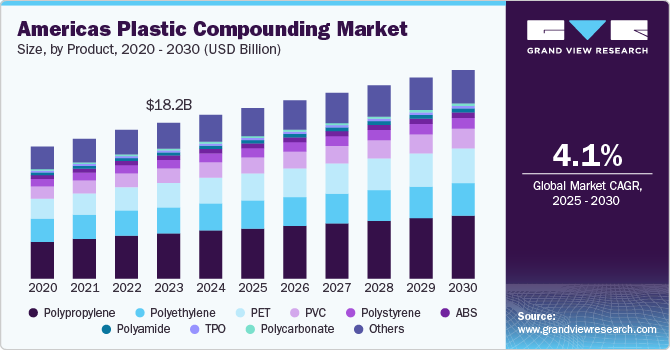

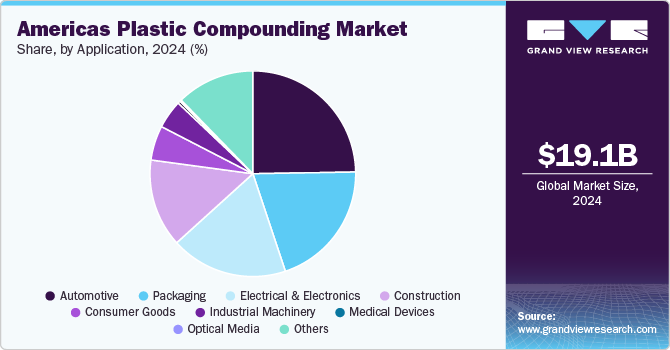

The Americas plastic compounding market size was estimated at USD 19,111.71 million in 2024 and is expected to expand at a CAGR of 4.11% from 2025 to 2030. Growing demand for lightweight materials from automotive & construction industries coupled with increasing concerns regarding depletion of conventional materials, such as wood and rubber, is expected to drive market growth over the forecast period.

Plastic compounding is a process whereby additives and fillers are incorporated into polymers in a molten state to attain uniformity in end products. The three basic constituents or raw materials, namely polymers, fillers, and additives are extensively used in the manufacturing process.

In the Americas, there is a strong shift towards the use of sustainable and environmentally friendly plastic compounding solutions. This trend is driven by the growing awareness of environmental impacts associated with plastics, particularly in North America. Companies are increasingly investing in bio-based polymers, recycled compounds, and biodegradable materials to meet stringent regulations and consumer demand for eco-friendly products. This shift is reshaping the market, with major players focusing on research and development (R&D) to create sustainable alternatives without compromising material performance.

Drivers, Opportunities & Restraints

The automotive industry in the Americas is a major driver for the plastic compounding market. As manufacturers increasingly look for lightweight materials to improve fuel efficiency and reduce emissions, compounded plastics have become vital. These materials offer enhanced properties such as durability, strength, and thermal stability, making them ideal for automotive applications, including under-the-hood components and interior parts. The U.S. and Mexico, as automotive manufacturing hubs, are experiencing growing demand for advanced plastic compounds, further propelling the market's growth in the region.

The rise of 3D printing in various industries across the Americas presents a significant opportunity for the plastic compounding market. As 3D printing technology becomes more sophisticated, the demand for specialized plastic compounds that provide strength, flexibility, and precision has increased. Sectors such as aerospace, healthcare, and manufacturing are adopting 3D printing for prototyping and production, creating a new market for compounding companies to develop customized materials. This opens a lucrative avenue for growth, particularly in the U.S. where innovation in 3D printing is rapidly advancing.

One of the key restraints for the plastic compounding market in the Americas is the volatility of raw material prices. The market heavily relies on petrochemical derivatives, which are subject to fluctuations in crude oil prices. Price instability not only affects production costs but also disrupts supply chains, impacting the profit margins of plastic compounders. Additionally, geopolitical tensions and trade policies can further complicate raw material sourcing, adding pressure to manufacturers in managing cost structures effectively. This poses a challenge, particularly for smaller players in the market.

Product Insights

The polypropylene (PP) segment led the market and accounted for more than 29.20% share of the global market revenue in 2024. PP compounds are widely utilized across various automotive applications that include exterior components, interior trims, seating components, boot liners, lamp housing, electrical housing, and other injection molded parts. The product demand is expected to witness strong growth owing to a positive automotive industry outlook in the U.S. and Mexico.

Polyethylene terephthalate (PET) is the fastest-growing product owing to its consumption in the food packaging industry. Rising demand for sustainable & recyclable plastics with superior barrier properties & excellent clarity has led to its consumption in the expanding processed food sector of emerging economies such as Brazil, Mexico, and Argentina.

Polyethylene (PE) finds extensive application scope in diverse end use industries such as automotive & aerospace. The product is an integral solution for packaging applications as well. Outstanding product characteristics such as its high chemical & environmental stress crack resistance are expected to drive its application in several industries.

Application Insights

The automotive segment accounted for more than 24.74% of the overall market revenue in 2024. They are being increasingly utilized in the automotive industry on account of the regulatory intervention promoting fuel efficiency in various automobiles and vehicles Economic recovery from the recession of 2009 - 10 in the U.S. has led to a revitalization in the automotive industry, which in turn has fostered passenger car sales as well.

The electrical & electronics industry is expected to grow at a steady growth rate owing to rapid technological advancements coupled with evolving customer requirements. Miniaturization of electrical appliances along with rising demand for polymers is a key factor driving plastic compound consumption in the application sector.

Increasing construction spending in emerging nations along with infrastructure development activities in Mexico, Brazil, Argentina, and Peru are major driving factors for the application growth in the future. PVC is a major plastic constituent in various building materials & construction activities. The plastic is modified accordingly to meet structural requirements and application specifications.

Regional Insights

North America dominated the Americas plastic compounding market and accounted for largest revenue share of 70.12% in 2024, driven by the growing demand for advanced packaging solutions, which is a key driver of the plastic compounding market. Companies across industries, from food and beverages to pharmaceuticals, are seeking high-performance packaging materials that offer superior strength, flexibility, and barrier properties to extend product shelf life.

U.S. Americas Plastic Compounding Market Trends

The U.S. dominated the North American market in 2024 favored by economic environment and emergence of plastic manufacturers. The rebound of the automotive industry coupled with increasing construction spending in the country is anticipated to drive demand over the forecast period. Wide application scope has led to a significant increase in consumption in end use industries such as medical devices, industrial machinery, and consumer goods.

Latin America Plastic Compounding Market Trends

In Latin America, the plastic compounding market is driven by the increasing investment in construction and infrastructure development. Countries like Brazil, Mexico, and Colombia are witnessing a surge in residential and commercial construction projects, which is boosting the demand for durable, cost-effective, and versatile building materials. Compounded plastics, such as PVC and polypropylene, are being used in pipes, fittings, insulation, and other construction components due to their lightweight nature, corrosion resistance, and ease of installation.

The Mexico market is expected to be driven by strong manufacturing sector growth along with the shift of major automotive companies to the country due to the availability of low-cost raw material and cheap labor. Escalating investments coupled with a favorable business environment is further anticipated to contribute towards expanding the industrial sector coupled with the growth of consumer goods in the region.

Key Americas Plastic Compounding Market Company Insights

The companies in the market are competing on product quality offered and innovations in the production of plastics. Major players are adopting new technologies for product formulation. Established players are investing in research & development activities to formulate new and advanced plastics compounds, which gives them a competitive edge over the other players. Key players include BASF SE,LyondellBasell Industries Holdings B.V. , and Dow, which dominate through strategic investments and long-term contracts.

The market has witnessed mergers & acquisitions, and capacity expansion in the market in the past few years. Strategic partnerships and new product developments are popular strategies adopted by a majority of the players operating in the U.S. plastic compounding industry.

Key Americas Plastic Compounding Companies:

- BASF SE

- LyondellBasell Industries Holdings B.V.

- Dow, Inc.

- DuPont de Nemours, Inc.

- SABIC

- RTP Company

- Aurora Material Solutions, LLC

- Asahi Kasei Corporation

- Covestro AG

- Washington Penn

- Ascend Performance Materials

- KURARAY CO., LTD.

- Teijin Limited

- Evonik Industries AG

- 3M

Recent Developments

-

In September 2024, Braskem America introduced WENEW, a bio-circular PP designed to enhance sustainability in the food industry. This innovative material is made by repurposing used cooking oil (UCO), which helps reduce dependence on fossil fuels and supports environmental goals.

-

In May 2024, Premix launched a new manufacturing plant in the U.S., specifically near Charlotte, North Carolina. The company received a significant investment of USD 79.90 million from the U.S. government to support this initiative. This facility focuses on producing electrically conductive polymers, which are increasingly important in various industries, especially as demand grows for advanced materials in electronics and other applications.

Americas Plastic Compounding Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19,889.18 million

Revenue forecast in 2030

USD 24.33 billion

Growth rate

CAGR of 4.11% from 2025 to 2030

Actual data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD Million, Volume in Kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, Application, Region

Regional scope

North America; Latin America

Country Scope

U.S.; Canada; Mexico; Brazil

Key companies profiled

BASF SE; LyondellBasell Industries Holdings B.V.; Dow, Inc.; DuPont de Nemours, Inc.; SABIC; RTP Company; Aurora Material Solutions, LLC; Asahi Kasei Corporation; Covestro AG; Washington Penn; Ascend Performance Materials; KURARAY CO., LTD.; Teijin Limited; Evonik Industries AG; 3M

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Americas Plastic Compounding Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented Americas plastic compounding market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2030)

-

Polypropylene

-

Thermoplastic Vulcanizates (TPV)

-

Thermoplastic Olefins

-

Polyvinyl Chloride (PVC)

-

Polystyrene

-

Polyethylene Terephthalate (PET)

-

Polybutylene Terephthalate (PBT)

-

Polyamide 6

-

Polyamide 6,6

-

-

Polyamide

-

Polycarbonate

-

Acrylonitrile Butadiene Styrene (ABS)

-

Others

-

-

Application Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2030)

-

Automotive

-

Automotive interior parts

-

Automotive exterior parts

-

Under the hood components

-

Power train

-

-

Construction

-

Electrical & Electronics

-

Packaging

-

Consumer Goods

-

Industrial Machinery

-

Medical Devices

-

Optical Media

-

Others

-

-

Regional Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Latin America

-

Mexico

-

Brazil

-

-

Frequently Asked Questions About This Report

b. The global Americas plastic compounding market size was estimated at USD 19,111.71 million in 2024 and is expected to reach USD 19,889.18 million in 2025.

b. The global Americas plastic compounding market is expected to grow at a compound annual growth rate of 4.1% from 2023 to 2030 to reach USD 24.33 billion by 2030.

b. Polypropylene segment dominated the Americas plastic compounding market with a share of 29.2% in 2024. This is attributed to the rising demand from automotive applications such as exterior components, interior trims, electrical housings, and others.

b. Some key players operating in the Americas plastic compounding market include RTP Company, SABIC, BASF SE, Kraton Polymers, Kuraray, Asahi Kasei, A. Schulman, LyondellBasell Industries N.V., DuPont, and Bayer Material Science (Covestro).

b. Key factors that are driving the market growth include growing demand for lightweight materials from automotive & construction industry and increasing concerns regarding depletion of conventional materials, such as wood and rubber.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.