- Home

- »

- Biotechnology

- »

-

Analytical Chemistry Sample Preparation Market Report, 2030GVR Report cover

![Analytical Chemistry Sample Preparation Market Size, Share & Trends Report]()

Analytical Chemistry Sample Preparation Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Kits & Reagents, Consumables), By Technique (Extraction, Filtration), By Application (HPLC, LC-MS, GC-MS), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-523-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Analytical Chemistry Sample Preparation Market Summary

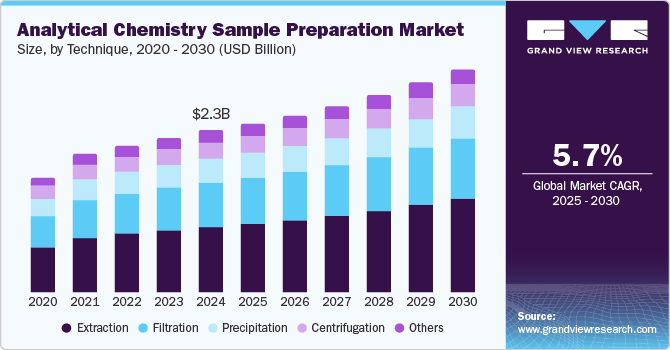

The global analytical chemistry sample preparation market size was estimated at USD 2,328.8 million in 2024 and is projected to reach USD 3,206.1 million by 2030, growing at a CAGR of 5.7% from 2025 to 2030. The analytical chemistry sample preparation industry is expanding rapidly due to increasing demand for precise testing in pharmaceuticals, food safety, environmental monitoring, and research.

Key Market Trends & Insights

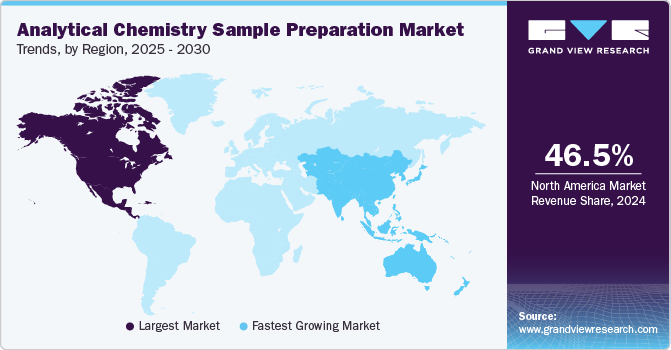

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, consumables accounted for a revenue of USD 980.5 million in 2024.

- Instruments & Software is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 2,328.8 Million

- 2030 Projected Market Size: USD 3,206.1 Million

- CAGR (2025-2030): 5.7%

- North America: Largest market in 2024

Advances in automation, regulatory compliance, and high-throughput techniques are driving growth. Laboratories are adopting innovative methods to enhance efficiency, accuracy, and reliability. Rising investments in R&D and technological innovations, such as microextraction and solid-phase extraction, further boost market demand.

The COVID-19 pandemic has emphasized the need for efficient and adaptable sample preparation in analytical chemistry. Increased testing in pharmaceuticals, diagnostics, and environmental monitoring drove demand for rapid, reliable techniques. Laboratories adopted automation and advanced technologies to handle high-throughput analysis while ensuring accuracy. The crisis highlighted the importance of streamlined workflows and regulatory compliance, accelerating innovation in sample preparation methods. As a result, the market continues to evolve, supporting faster and more efficient analytical processes across various industries.

In addition, the increasing demand for precise testing in pharmaceuticals, food safety, environmental monitoring, and research is driving market growth. This is attributed to stricter regulatory requirements, advancements in analytical technologies, and the need for high-quality, reliable data. Industries are investing in innovative sample preparation techniques to improve accuracy, efficiency, and reproducibility. As testing standards evolve, laboratories seek automated and high-throughput solutions to meet growing analytical demands across various sectors.

Furthermore, advances in automation are anticipated to propel market growth. This is expected to be driven by the need for higher efficiency, reduced human error, and faster sample processing in laboratories. Automated solutions enhance reproducibility, streamline workflows, and improve data accuracy, making them essential for high-throughput pharmaceutical applications, food safety, and environmental testing applications. As demand for precise and reliable analytical results increases, the adoption of automated sample preparation technologies continues to rise, supporting market expansion.

Artificial Intelligence Integration Transforms Sample Preparation

The integration of artificial intelligence (AI) is transforming sample preparation into analytical chemistry, enhancing efficiency, accuracy, and automation. AI-powered systems optimize workflows by reducing manual errors, predicting optimal sample conditions, and streamlining data analysis. Machine learning algorithms enable real-time adjustments, improving reproducibility and precision in complex sample matrices. AI-driven automation accelerates high-throughput testing while ensuring regulatory compliance in pharmaceuticals, food safety, and environmental monitoring industries. As laboratories adopt AI-enhanced sample preparation techniques, they benefit from faster processing, reduced costs, and improved analytical outcomes, driving innovation and growth in the market.

Sample Preparation: A Key Driver in Chromatographic Analysis

The analytical chemistry sample preparation industry is experiencing steady growth as industries prioritize efficiency, accuracy, and automation in laboratory workflows. Advancements in instruments, consumables, and reagents are reducing processing time and improving the reliability of analytical techniques. Increased demand for high-throughput extraction and filtration methods drives adoption across pharmaceuticals, biotechnology, and research sectors. As laboratories focus on streamlining sample preparation for chromatography and mass spectrometry applications, businesses offering innovative and automated solutions are positioned for strong market expansion.

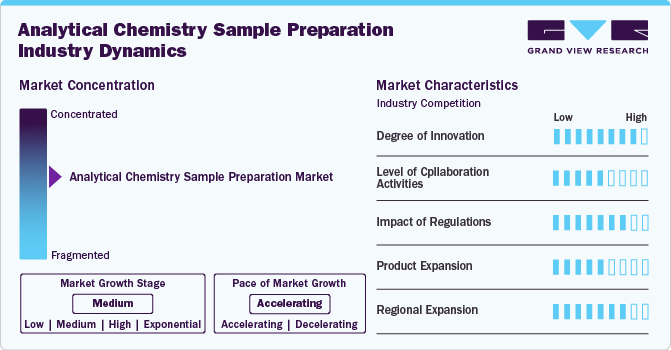

Market Concentration & Characteristics

The analytical chemistry sample preparation industry is set for strong growth, driven by increasing demand for accurate testing, automation, and AI integration. Rising applications in pharmaceuticals, food safety, and environmental testing are boosting market expansion. Innovations in technology and efficiency improvements are further fueling adoption.

The market is growing steadily, with moderate collaboration among industry players. Key drivers include increasing demand for accurate pharmaceutical testing, food safety, and environmental monitoring. Advances in automation, regulatory compliance, and high-throughput techniques enhance efficiency and reliability. Companies are investing in innovative technologies to streamline workflows and improve analytical precision. As industries prioritize quality control and data accuracy, the market continues to expand, supported by ongoing technological advancements and strategic partnerships. In January 2025, Agilent Technologies and ABB collaborated to automate sample preparation and analytical workflows, enhancing efficiency, accuracy, and scalability in pharmaceuticals, biotech, environmental testing, and food safety. This integration streamlines sample handling and data processing, accelerating R&D and reducing time-to-market.

Regulations have moderately influenced the market by ensuring standardization, improving data accuracy, and driving demand for compliant technologies. Stricter guidelines in pharmaceuticals, food safety, and environmental testing have increased the adoption of advanced preparation techniques. However, regulatory complexities and compliance costs pose challenges for smaller players.

The market has seen significant growth in product expansion, driven by advancements in automation, increasing demand for high-quality analysis, and the integration of AI-driven solutions. Growing applications in pharmaceuticals, food safety, and environmental testing have also contributed to developing innovative sample preparation techniques. For instance, in January 2025, Nicoya introduced the Alto Automation Suite for its Alto Digital SPR system, making it the first SPR platform fully compatible with standard lab automation. This innovation enables high-throughput analysis of thousands of samples per week without human intervention, enhancing efficiency in biomolecular research.

The analytical chemistry sample preparation industry is expanding gradually across regions, driven by increasing regulatory standards, growing demand for accurate testing in pharmaceuticals and food safety, and advancements in automation and AI integration. Emerging markets also contribute to growth through increased research activities and industrial applications.

Product Insights

In 2024, the consumables segment dominated the market with a 42.10% share, driven by increasing laboratory testing, stringent regulatory requirements, and the growing need for high-quality sample processing materials. Frequent use and repeat purchases of filters, cartridges, and reagents in pharmaceuticals, food safety, and environmental testing contributed to its strong market position. The rising adoption of automated workflows also boosted demand for reliable consumables, ensuring accuracy and efficiency in sample preparation processes across various industries.

The instrument & software segment in the analytical chemistry sample preparation industry is expected to grow at the highest CAGR of 6.59% from 2025 to 2030. This growth is driven by increasing automation, AI integration, and the demand for high-precision analysis. Advanced software solutions for data management, compliance, and innovations in sample preparation instruments are boosting adoption. Rising applications in pharmaceuticals, food safety, and environmental testing further contribute to market expansion.

Technique Insights

In 2024, the extraction segment led the market, holding a 40.66% share, and is expected to grow at the fastest rate of 6.32% CAGR in the coming years. This growth is driven by the increasing need for efficient sample purification, rising demand in pharmaceuticals and environmental testing, and advancements in automated extraction techniques. Adopting innovative methods like solid-phase and liquid-liquid extraction further boosts efficiency, accuracy, and compliance with stringent industry regulations.

The filtration segment is also set for strong growth, driven by increasing demand for high-purity samples in pharmaceuticals, food safety, and environmental testing. Advances in membrane and microfiltration technologies enhance efficiency, while stricter regulatory standards boost adoption. The rise of automated filtration systems further supports market expansion, ensuring faster and more accurate sample preparation.

Application Insights

In 2024, the LC-MS segment dominated the analytical chemistry sample preparation industry with a 24.05% share and is projected to grow at the highest CAGR in the coming years. This growth is driven by its high precision, sensitivity, and ability to detect complex compounds in pharmaceuticals, food safety, and environmental analysis. Increasing regulatory standards, advancements in instrumentation, and the rising demand for accurate analytical techniques further boost adoption. Additionally, the integration of automation and AI enhances efficiency, making LC-MS essential for laboratories seeking reliable and high-throughput sample analysis.

The ICP-MS segment is expected to grow strongly in the market, driven by its superior sensitivity, precision, and ability to detect trace metals in pharmaceuticals, food safety, and environmental testing. Increasing regulatory requirements, technological advancements, and rising demand for high-accuracy elemental analysis further boost adoption. Additionally, automation and AI integration enhance efficiency, making ICP-MS a preferred choice for laboratories and research institutions.

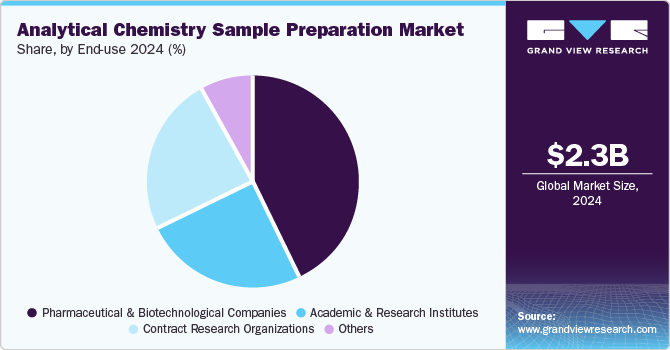

End Use Insights

In 2024, pharmaceutical & biotechnology companies held the largest market share of 43.01%, driven by their increasing demand for high-precision analytical testing in drug development, quality control, and regulatory compliance. Stringent guidelines from regulatory bodies require accurate sample preparation for drug safety and efficacy testing. Advancements in automation, AI-driven workflows, and high-throughput screening further enhance efficiency. Additionally, the growing focus on biologics and personalized medicine boosts the need for advanced sample preparation techniques, fueling market expansion.

Meanwhile, the contract research organizations (CROs) segment is expected to grow the fastest in the coming years, driven by pharmaceutical and biotechnology companies' increasing outsourcing of analytical testing. The demand for cost-effective, high-quality sample preparation services is rising, along with stricter regulatory requirements. Advancements in automation and AI-driven workflows further enhance efficiency, making CROs preferred for drug development, clinical trials, and quality control processes.

Regional Insights

In 2024, North America led the analytical chemistry sample preparation market with a 46.45% share, driven by strong investments in pharmaceutical research, stringent regulatory standards, and advanced laboratory infrastructure. The presence of major pharmaceutical and biotechnology companies, along with increasing demand for high-precision analytical testing, further supports market dominance. Rising adoption of automation, AI-driven workflows, and innovative sample preparation technologies enhance efficiency and accuracy. Additionally, growing applications in food safety, environmental analysis, and forensic testing contribute to market expansion.

U.S. Analytical Chemistry Sample Preparation Market Trends

The U.S. analytical chemistry sample preparation market is growing rapidly due to increasing pharmaceutical research, stringent regulations, and advanced laboratory technologies.

Europe Analytical Chemistry Sample Preparation Market Trends

Europe is a key analytical chemistry sample preparation market, driven by stringent regulatory standards, rising pharmaceutical research, and growing environmental testing needs. Advancements in automation and AI-driven workflows further boost market adoption across industries.

The UK analytical chemistry sample preparation market is expanding due to increasing pharmaceutical and biotechnology research investments. Strict regulatory requirements drive the demand for high-precision testing and advanced sample preparation techniques. Growing applications in food safety, environmental monitoring, and forensic analysis further support market growth. Additionally, automation and AI integration advancements enhance laboratory efficiency and accuracy.

The Germany analytical chemistry sample preparation market is growing rapidly due to strong pharmaceutical research, strict regulations, and advanced laboratory technologies.

Asia Pacific Analytical Chemistry Sample Preparation Market Trends

The Asia Pacific analytical chemistry sample preparation market is expected to grow the fastest, 6.47% CAGR from 2025-2030, driven by rising pharmaceutical and biotechnology research. Increasing regulatory standards and growing demand for food safety and environmental testing further boost market expansion. Advances in automation and AI-driven workflows enhance efficiency and accuracy in laboratories. Additionally, rapid industrialization and increased investments in healthcare infrastructure support the region’s strong growth.

The China analytical chemistry sample preparation market is set for rapid growth, driven by expanding pharmaceutical and biotechnology research. Increasing regulatory standards and a strong focus on food safety and environmental testing fuel demand. Advances in automation and AI-driven technologies enhance laboratory efficiency and accuracy. Additionally, government investments in healthcare and industrial innovation further support market expansion.

The Japan analytical chemistry sample preparation market held a strong share in 2024, driven by advanced pharmaceutical research and stringent regulatory standards. Growing demand for high-precision testing in food safety and environmental monitoring further supported market growth. Adoption of automation and AI-driven technologies improved laboratory efficiency and accuracy. Strong government support for scientific innovation and healthcare advancements also contributed to market expansion.

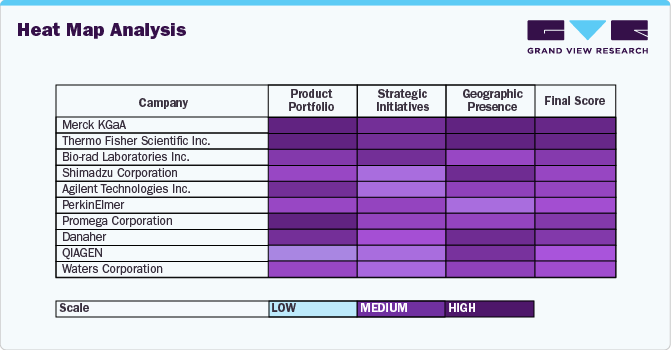

Key Analytical Chemistry Sample Preparation Company Insights

Key players operating in the analytical chemistry sample preparation industry are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling market growth.

Key Analytical Chemistry Sample Preparation Companies:

The following are the leading companies in the analytical chemistry sample preparation market. These companies collectively hold the largest market share and dictate industry trends.

- Merck KGaA

- Thermo Fisher Scientific Inc.

- Bio-rad Laboratories Inc.

- Shimadzu Corporation

- Agilent Technologies Inc.

- PerkinElmer

- Promega Corporation

- Danaher

- QIAGEN

- Waters Corporation

Recent Developments

-

In February 2025, Volta Labs announced the adoption of its Callisto Sample Prep System by UMC Utrecht, one of the Netherlands' largest public healthcare institutions. This collaboration aims to streamline Whole Genome Sequencing workflows, improving efficiency and scalability to meet the growing demand for genetic testing.

-

In January 2025, Curiox Biosystems introduced the C-Free Pluto ALPHA, the latest addition to its Pluto product line. Designed to enhance cell washing automation, this compact and user-friendly device offers labs of all sizes a reliable and affordable solution for accurate and reproducible cell analysis.

-

In November 2024, Advanced Automation Technologies (AAT) announced an agreement to acquire GERSTEL, strengthening its expertise in automated sample preparation. GERSTEL will join AAT’s portfolio of brands, including Skalar Analytical, LCTech, PromoChrom, EST Analytical, and tsHR. The acquisition enhances AAT’s product offerings, service capabilities, and global reach in the analytical instrumentation industry.

Analytical Chemistry Sample Preparation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.43 billion

Revenue forecast in 2030

USD 3.21 billion

Growth rate

CAGR of 5.67% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technique, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Merck KGaA; Thermo Fisher Scientific Inc.; Bio-rad Laboratories Inc.; Shimadzu Corporation; Agilent Technologies Inc.; PerkinElmer; Promega Corporation; Danaher; QIAGEN; Waters Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Analytical Chemistry Sample Preparation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global analytical chemistry sample preparation market report based on product, technique, application, end use, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Kits & Reagents

-

Consumables

-

Instruments & Software

-

-

Technique Outlook (Revenue, USD Million; 2018 - 2030)

-

Extraction

-

Filtration

-

Precipitation

-

Centrifugation

-

Others

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

HPLC

-

LC-MS

-

GC-MS

-

MALDI-ToF-MS

-

ICP-MS

-

NMR

-

Others

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Pharmaceutical & Biotechnological Companies

-

Academic & Research Institutes

-

Contract Research Organizations

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global analytical chemistry sample preparation market size was estimated at USD 2.33 billion in 2024 and is expected to reach USD 2.43 billion in 2025.

b. The global analytical chemistry sample preparation market is expected to grow at a compound annual growth rate of 5.67% from 2025 to 2030 to reach USD 3.21 billion by 2030.

b. North America dominated the analytical chemistry sample preparation market with a share of 46.45% in 2024. This is driven by its advanced research infrastructure, strong R&D investments, and technological innovations in laboratory techniques. The region's leadership is attributed to the presence of key industry players, increasing demand for high-throughput analytical solutions, and stringent regulatory requirements that necessitate precise sample preparation methods.

b. Some key players operating in the analytical chemistry sample preparation market include Merck KGaA; Thermo Fisher Scientific Inc.; Bio-rad Laboratories Inc.; Shimadzu Corporation; Agilent Technologies Inc.; PerkinElmer; Promega Corporation; Danaher; QIAGEN; and Waters Corporation

b. Key factors driving the growth of the analytical chemistry sample preparation market include technological advancements in chromatography and mass spectrometry, increasing automation in laboratories, and rising investments in R&D across pharmaceuticals, biotechnology, and environmental testing. Additionally, stringent regulatory requirements for quality and accuracy in sample analysis, coupled with the growing demand for high-throughput analytical solutions, are further propelling market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.