- Home

- »

- Medical Devices

- »

-

Anesthesia Devices Market Size, Industry Report, 2033GVR Report cover

![Anesthesia Devices Market Size, Share & Trends Report]()

Anesthesia Devices Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Anesthesia Ventilators, Anesthesia Workstation), By End Use (Hospitals, Ambulatory Centers), By Region (North America, Europe, Asia Pacific, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68040-841-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Anesthesia Devices Market Summary

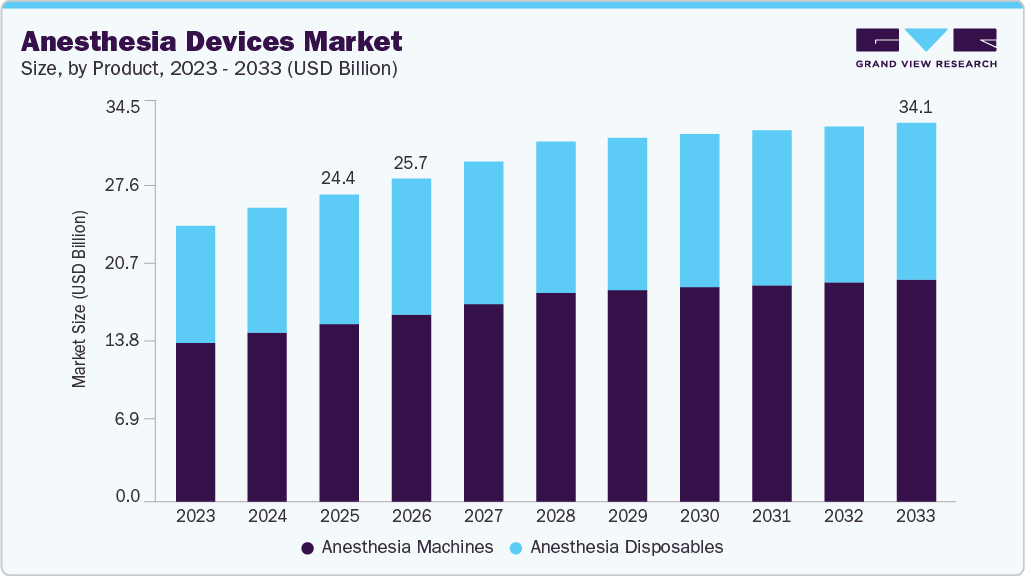

The global anesthesia devices market size was estimated at USD 24.4 billion in 2025 and is projected to reach USD 34.1 billion by 2033, growing at a CAGR of 4.13% from 2026 to 2033. The market growth is driven by the increasing number of surgical procedures worldwide, the prevalence of chronic diseases, and technological advancements in anesthesia workstations and monitors

Key Market Trends & Insights

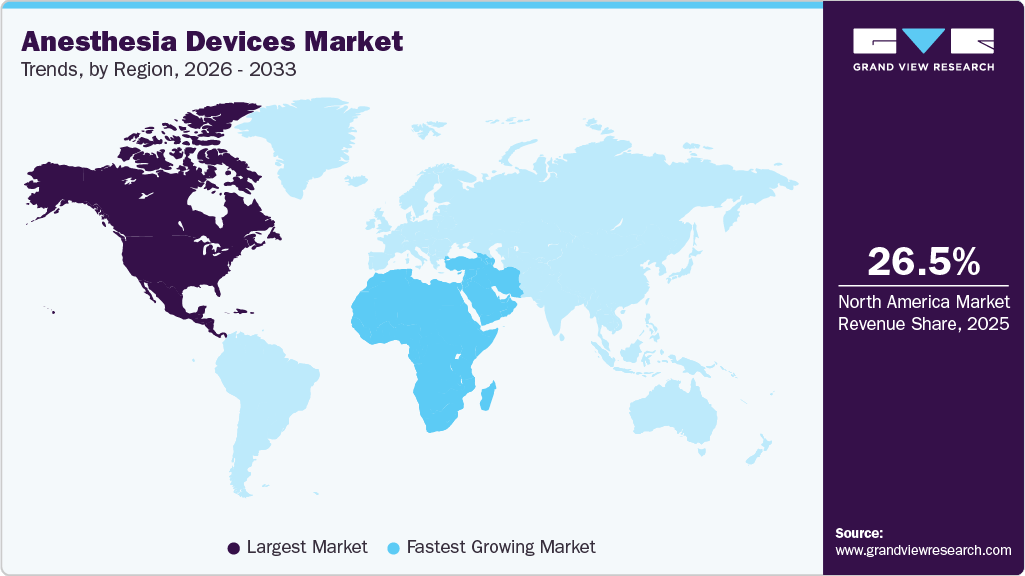

- North America dominated the anesthesia devices market with a share of 26.5% in 2025.

- Middle East and Africa is estimated to grow at the fastest CAGR from 2026 to 2033.

- By product, anesthesia machines held the largest market share of 57.7% in 2025.

- By end use, the hospitals segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 24.4 Billion

- 2033 Projected Market Size: USD 34.1 Billion

- CAGR (2026-2033): 4.13%

- North America: Largest market in 2025

- Middle East and Africa: Fastest growing market

Increasing frequency of new and upgraded product launches by leading manufacturers is accelerating technology adoption and replacement demand across hospitals and surgical centers, contributing to the growth of the anesthesia machines industry. Major players are continuously introducing next-generation anesthesia workstations with enhanced safety features, advanced ventilation modes, improved ergonomics, digital integration, and sustainability-focused designs, addressing evolving clinical requirements across adult, pediatric, and neonatal care. For instance:- In October 2025, GE HealthCare launched the Carestation 850 anesthesia delivery system at ANESTHESIOLOGY 2025, featuring ergonomic design, customizable apps, advanced vaporization, sustainability tools, and intuitive UI to enhance precision and efficiency for diverse patients from neonates to adults.

“In the dynamic operating environment, anesthesia professionals are focused on safety while managing increasingly complex cases and changing patient needs. As anesthesia care teams face new challenges, technology can help ease the burden and support safer and more effective care delivery.”

-John Beard, MD, anesthesiologist and Chief Medical Officer of Patient Care Solutions at GE HealthCare.

- In September 2025, Medisys launched the Made-in-India COSMOS anesthesia workstation, featuring a 15-inch advanced interface, integrated patient monitoring, and neonatal technology such as LED Phototherapy, at Medicall Delhi. This launch prioritized patient safety, clinician usability, and eco-friendly efficiency.

Such continuous innovation expands the clinical applicability of anesthesia machines, supports compliance with stricter safety and efficiency standards, and encourages healthcare providers to upgrade legacy systems, thereby strongly driving overall market growth and long-term demand for advanced anesthesia workstations.

A significant emerging trend in the anesthesia devices market is the integration of artificial intelligence (AI) and smart software, which is transforming the delivery of anesthesia care. AI-enabled algorithms support intelligent ventilation management, optimize anesthetic gas delivery using real-time patient data, enable predictive alarms to anticipate adverse events, and reduce clinician cognitive burden through automation and decision support.

These capabilities also improve workflow efficiency, standardize care across adult, pediatric, and neonatal populations, and enhance interoperability with perioperative IT systems. For instance, in January 2026, GE HealthCare collaborated with NXP Semiconductors to develop edge AI solutions for acute care, including voice-activated anesthesia delivery systems to reduce clinician cognitive load and real-time neonatal monitoring for NICUs, showcased at CES 2026; the partnership leverages NXP’s secure edge processors and GE HealthCare’s medical technology expertise to deliver low-latency, privacy-focused AI in operating rooms and other high-acuity settings. Thus, the growing integration of AI is making anesthesia devices smarter, safer, and more efficient, thereby accelerating the adoption of advanced anesthesia systems across modern healthcare facilities.

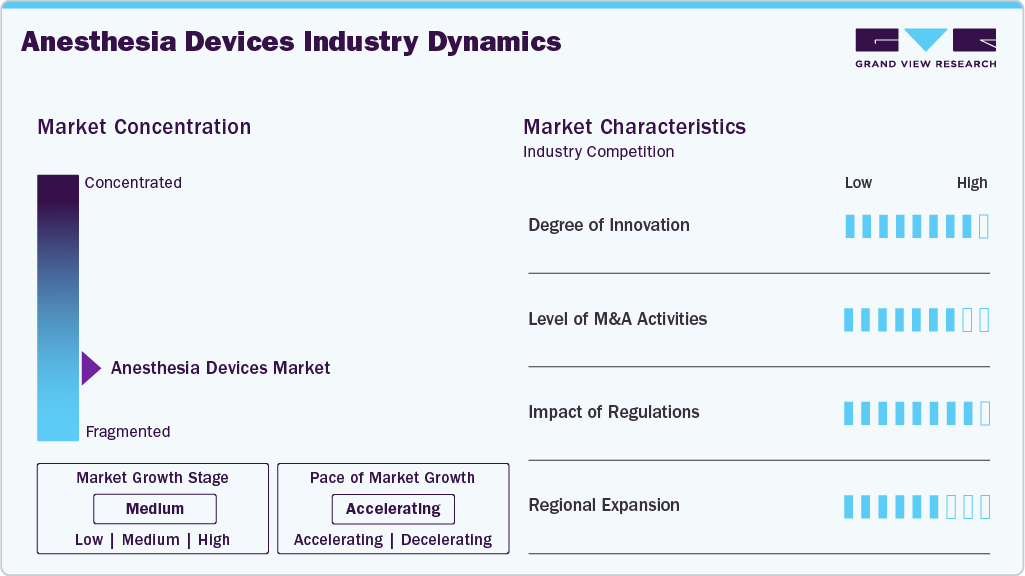

Market Concentration & Characteristics

The degree of innovation in the anesthesia devices market is high, supported by rapid advances in smart anesthesia workstations, precision ventilation, and AI-enabled control systems that enhance patient safety and clinical efficiency. Manufacturers are increasingly integrating artificial intelligence to enable real-time adjustment of ventilation parameters, low-flow anesthesia delivery, and automated decision support, helping clinicians deliver lung-protective and patient-specific anesthesia across diverse populations. For instance, Shanghai Huifeng Medical Instrument Co., Ltd. offers AI-integrated anesthesia machines that utilize artificial intelligence to automatically adjust ventilation parameters in real time, optimizing gas exchange and reducing the risk of anesthesia-related lung injury.

Mergers and acquisitions activity in the anesthesia devices industry is moderate, as established players with strong in-house R&D and well-established product portfolios dominate the market. Companies primarily focus on organic growth through product innovation and upgrades, using selective partnerships or small acquisitions mainly to enhance technology capabilities or regional presence, rather than pursuing large-scale consolidation.

The impact of regulations on the market is moderate to high, as these devices are classified as critical, life-supporting systems used during surgical procedures. Regulatory authorities such as the U.S. FDA, along with European and other national regulators, enforce stringent requirements related to device safety, performance, software validation, and manufacturing quality. With the increasing integration of digital technologies and AI into anesthesia machines, the complexity of compliance has further increased. Failure to meet regulatory standards can lead to product recalls, manufacturing halts, delayed approvals, or market withdrawal, making regulatory compliance a key determinant of market entry, continuity, and growth for manufacturers.

A key strategic focus in the anesthesia devices market is for manufacturers to tap into high-growth regions, such as the Asia-Pacific, Latin America, the Middle East, and Africa. Leading players are expanding their presence through local manufacturing, distribution partnerships, regulatory approvals, and region-specific product launches to address rising surgical volumes, improve healthcare infrastructure, and increase access to anesthesia care.

Product Insights

The anesthesia machines segment led the anesthesia devices market, accounting for the largest share of 57.7% in 2025, driven by the increasing number of surgical procedures, both elective and emergency. This rise has increased demand for advanced anesthesia workstations and delivery systems in hospitals and ambulatory surgical centers. In addition, the prevalence of chronic diseases such as cardiovascular disorders, cancer, and orthopedic conditions, particularly among the aging population, is contributing to a greater volume of surgeries, which in turn boosts the adoption of anesthesia devices.

The anesthesia disposables segment is expected to grow at a significant CAGR over the forecast period, owing to rising preference for single-use products to reduce hospital-acquired infections, increasing surgical volumes, stringent infection control regulations, and growing adoption of disposable breathing circuits, masks, and airway devices across hospitals and ambulatory surgical centers.

End Use Insights

The hospitals segment held a significant market share in 2025, driven by the high volume of surgical procedures, critical care admissions, and emergency interventions conducted in hospitals. The availability of advanced operating room infrastructure, higher adoption of technologically advanced anesthesia machines, presence of trained anesthesiology professionals, and greater capital spending capacity compared to other care settings further supported the large segment share.

The ambulatory surgical centers (ASCs) segment represents a significant and growing portion of the anesthesia machines market, driven by the increasing preference for outpatient procedures, the rising number of minimally invasive surgeries, cost-effectiveness compared to hospital settings, and the demand for compact, portable, and easy-to-use anesthesia devices that support efficient patient turnover and shorter recovery times.

Regional Insights

The North America anesthesia devices industry accounted for the largest revenue share of 26.5% in 2025. The increasing geriatric population in the U.S. is driving a rise in surgeries, which is boosting market growth. According to the World Health Organization's projection, the geriatric population in the U.S. is expected to grow from 12% in 2015 to 22% by 2050. In addition, well-established healthcare infrastructure, high adoption of advanced anesthesia devices, strong government healthcare spending, and increasing prevalence of chronic diseases requiring surgical interventions contribute to the growth of the market in the region.

U.S. Anesthesia Devices Market Trends

The U.S. accounted for a major share of the anesthesia devices industry in 2025, driven by the growing demand for elective and emergency surgical procedures, the expansion of outpatient and minimally invasive surgeries, and the increasing focus on patient safety and perioperative care. High penetration of technologically advanced anesthesia machines, rising investments in hospital modernization, and supportive reimbursement policies for surgical procedures

Europe Anesthesia Devices Market Trends

The Europe anesthesia devices industry is projected to experience significant growth during the forecast period. The region's robust healthcare infrastructure and commitment to innovation drive the adoption of advanced anesthesia machines. Additionally, the aging population is contributing to a rise in surgical procedures and perioperative care needs, thereby further increasing demand for anesthesia devices. For instance, Eurostat projects that by 2050, Europe will have nearly half a million centenarians, with the median age expected to rise by 4.5 years to 48.2 years.

The growth of the anesthesia devices market in the UK is driven by ongoing efforts within the National Health Service (NHS) to upgrade surgical and perioperative facilities, as well as the increasing adoption of smart, connected anesthesia machines in both public and private hospitals. Government initiatives are promoting digital health integration, along with a growing focus on enhancing patient outcomes in elective and day-case surgeries.

The France anesthesia devices market is expected to grow, driven by increasing investments in hospital modernization and expansion of outpatient surgical centers. Adoption of connected and AI-enabled anesthesia machines, along with government initiatives to improve surgical safety and perioperative outcomes, is further fueling the market growth.

Asia Pacific Anesthesia Devices Market Trends

The Asia Pacific anesthesia devices industry is expected to witness strong growth over the forecast period, driven by rapid expansion of healthcare infrastructure, rising number of hospitals and surgical centers, and increasing investments in modern perioperative care. In addition, the growing awareness of advanced anesthesia technologies, rising medical tourism in countries such as India, Thailand, and Singapore, and supportive government initiatives to improve surgical safety and accessibility are further contributing to the adoption of anesthesia devices across the region.

The anesthesia devices market in Japan is projected to grow steadily during the forecast period, supported by an increasingly aging population and the corresponding rise in age-related surgeries. For instance, according to the 2023 National Clinical Database (NCD) Annual Report by the Japan Surgical Society, around 2.63 million cases were registered in the NCD in fiscal year 2023, highlighting the substantial volume of surgical procedures, thereby contributing to the market growth.

The China anesthesia devices market is expected to grow, driven by a rising geriatric population, increasing prevalence of chronic diseases, andgrowth in elective and minimally invasive surgeries. The presence of local anesthesia machine providers such as Shenzhen Northern Meditec Limited, Shanghai Huifeng Medical Instrument Co., Ltd., and Shenzhen Comen Medical Instruments Co., Ltd. further contributes to the growth of the region.

Latin America Anesthesia Devices Market Trends

The growth of the anesthesia devices industry in Latin America is driven by increasing surgical and trauma care needs, expanding public-private healthcare collaborations, and strengthening regional hospital capabilities. In addition, the rapidly aging population is contributing to higher surgical volumes; for instance, according to “Ageing in Latin America and the Caribbean: Inclusion and Rights of Older Persons,” the older population is projected to reach 193 million by 2050 (25.1% of the total population), more than double the 2022 level, supporting sustained demand for anesthesia devices.

Middle East and Africa Anesthesia Devices Market Trends

The growth of the Middle East & Africa anesthesia devices industry is driven by rising investments in advanced, multispecialty care hospitals, an increasing focus on expanding surgical capacity, and the growing adoption of modern operating room technologies in Gulf countries. In addition, improving access to surgical care in African nations through healthcare reforms, medical outreach programs, and infrastructure development initiatives is supporting the gradual adoption of anesthesia devices across the region.

Key Anesthesia Devices Company Insights

The market is fragmented, competitive, and is characterized by the presence of various small, medium, and large companies. The market players are involved in the deployment of strategic initiatives, such as regional expansion, product advancements, distribution partnerships, collaborations, and mergers and acquisitions, to gain greater market share.

Key Anesthesia Devices Companies:

The following are the leading companies in the anesthesia devices market. These companies collectively hold the largest Market share and dictate industry trends.

- GE Healthcare

- Drägerwerk AG & Co. KGaA

- Mindray Bio-Medical Electronics Co., Ltd.

- Medtronic

- Koninklijke Philips N.V.

- Beijing Aeonmed Co., Ltd.

- Spacelabs Healthcare acquired by OSI Systems, Inc.

- Getinge AB

- Penlon

- Heal Force Bio-Meditech Holdings Limited

- Shenzhen Northern Meditec Limited

- Shanghai Huifeng Medical Instrument Co., Ltd.

- Shenzhen Comen Medical Instruments Co., Ltd.

- BPL Medical Technologies

- aXcent medical

Recent Developments

-

In August 2025, Dräger announced that its Atlan A350/A350 XL anesthesia workstations received Authority to Operate (ATO) certification under the DoD's Risk Management Framework (RMF) eMASS #4060, effective July 14, 2025-2028, ensuring top-tier cybersecurity for patient data protection.

“Cyberattacks continue to be a serious threat to hospitals both clinically and financially, to help hospitals meet this challenge, Dräger embeds the latest cybersecurity technology deeply into our development processes. Our new Atlan anesthesia workstations now carry ATO certification, which is the highest level of security a medical device can hold.”

-President and CEO for Draeger, Inc., Lothar Thielen

-

In April 2025, Dräger launched the Atlan A100 anesthesia workstation in India, featuring advanced lung-protective ventilation, low-flow anesthesia, infection prevention, and seamless integration with monitoring systems for optimized perioperative care across adults, pediatrics, and neonates.

-

In April 2024, the FDA issued a Class I recall alert for GE HealthCare's Carestation 600/700 series anesthesia workstations due to potential unexpected shutdowns during AC power loss, failing to switch to battery mode, and disrupting ventilation/agent delivery, posing life-threatening risks, though no injuries were reported.

-

In September 2023, Dräger launched the Atlan anesthesia workstation family in the US, offering scalable configurations for precise ventilation from neonates to adults, low/minimal-flow anesthesia optimization, and integrated safety features to reduce tidal volumes and support error prevention across ORs.

Anesthesia Devices Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 25.7 billion

Revenue forecast in 2033

USD 34.1 billion

Growth rate

CAGR of 4.13% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE Healthcare; Drägerwerk AG & Co. KGaA; Mindray Bio-Medical Electronics Co., Ltd.; Medtronic, Koninklijke Philips N.V.; Beijing Aeonmed Co., Ltd.; Spacelabs Healthcare (acquired by OSI Systems, Inc.); Getinge AB; Penlon; Heal Force Bio-Meditech Holdings Limited; Shenzhen Northern Meditec Limited; Shanghai Huifeng Medical Instrument Co., Ltd.; Shenzhen Comen Medical Instruments Co., Ltd.; BPL Medical Technologies; aXcent medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

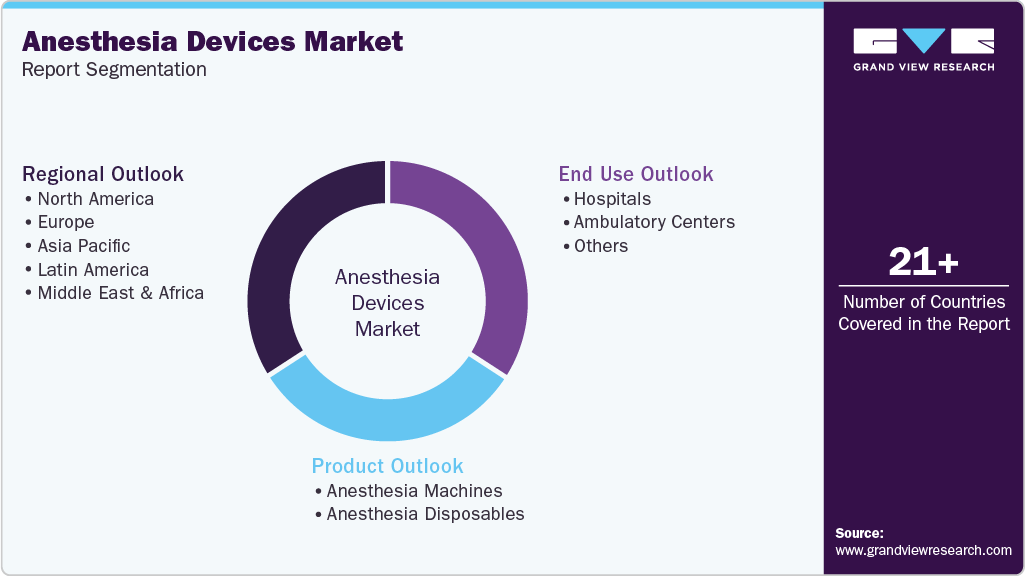

Global Anesthesia Devices Market Report Segmentation

This report forecasts revenue growth and provides at the global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global anesthesia devices market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Anesthesia Machines

-

Anesthesia Workstation

-

Anesthesia delivery machines

-

Portable

-

Standalone

-

-

Anesthesia Ventilators

-

Anesthesia Monitors

-

-

Anesthesia Disposables

-

Anesthesia Masks

-

Anesthesia Accessories

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global anesthesia devices market size was estimated at USD 24.4 billion in 2025 and is expected to reach USD 25.7 billion in 2026.

b. The global anesthesia devices market is expected to grow at a compound annual growth rate of 4.13% from 2026 to 2033 to reach USD 34.1 billion by 2033.

b. North America dominated the anesthesia devices market with a share of 26.5% in 2025. This is attributable to rising healthcare awareness coupled with cloud-based technologies acceptance and constant research and development initiatives.

b. Some key players operating in the anesthesia devices market include GE Healthcare; Drägerwerk AG & Co. KGaA; Mindray Bio-Medical Electronics Co., Ltd.; Medtronic, Koninklijke Philips N.V.; Beijing Aeonmed Co., Ltd.; Spacelabs Healthcare (acquired by OSI Systems, Inc.); Getinge AB; Penlon; Heal Force Bio-Meditech Holdings Limited; Shenzhen Northern Meditec Limited; Shanghai Huifeng Medical Instrument Co., Ltd.; Shenzhen Comen Medical Instruments Co., Ltd.; BPL Medical Technologies; aXcent medical

b. Key factors that are driving the market growth include increasing number of surgical procedures worldwide, the prevalence of chronic diseases, and technological advancements in anesthesia workstations and monitors

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.