- Home

- »

- Medical Devices

- »

-

Angioplasty Balloons Market Size, Industry Report, 2030GVR Report cover

![Angioplasty Balloons Market Size, Share & Trends Report]()

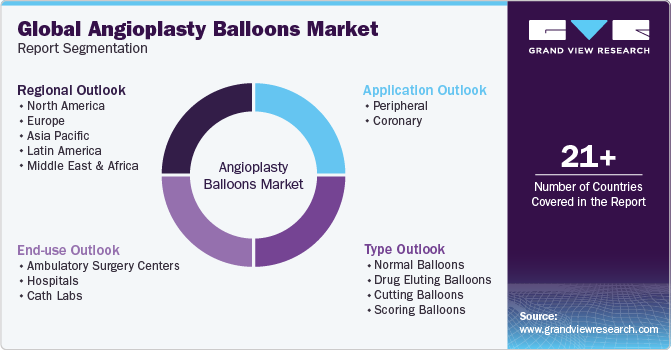

Angioplasty Balloons Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Normal Balloons, Drug Coated Balloons), By Application (Coronary, Peripheral), By End Use (Ambulatory Surgical Centers, Hospitals, Cath Labs), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-356-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Angioplasty Balloons Market Summary

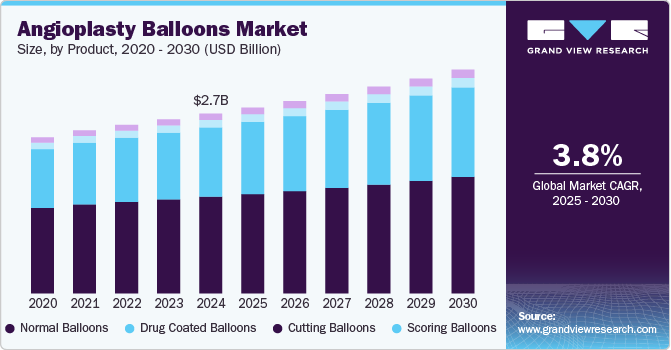

The global angioplasty balloons market size was estimated at USD 2,714.7 million in 2024 and is projected to reach USD 3,379.1 million by 2030, growing at a CAGR of 3.8% from 2025 to 2030. The market is driven by the rising global incidence of cardiovascular diseases, particularly coronary artery disease, and an aging population.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, normal balloons accounted for a revenue of USD 1,500.4 million in 2024.

- Scoring Balloons is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 2,714.7 Million

- 2030 Projected Market Size: USD 3,379.1 Million

- CAGR (2025-2030): 3.8%

- North America: Largest market in 2024

In October 2024, the CDC reported that approximately 5% of adults aged 20 and older have coronary artery disease (CAD), which translates to about 1 in 20 individuals. Advancements in balloon technology, such as drug-eluting balloons and improved materials, enhance performance and patient outcomes. The growing preference for minimally invasive procedures, with shorter recovery times and reduced complications, further boosts market demand.

The increasing global incidence of cardiovascular diseases, particularly coronary artery disease, is one of the primary drivers of the angioplasty balloons market. As the global population ages, the number of individuals suffering from heart-related conditions grows, fueling the demand for minimally invasive procedures like angioplasty. This trend has led to a higher adoption of angioplasty balloons in hospitals and clinics. In October 2024, heart disease is identified as the primary cause of death in the U.S., impacting individuals of all genders and various racial and ethnic backgrounds. Alarmingly, a person dies from cardiovascular disease every 33 seconds.

Significant advancements in angioplasty balloon technology, such as the development of drug-eluting balloons and advanced materials, are driving market growth. These innovations offer improved performance, better patient outcomes, and reduced restenosis rates. Newer balloon designs that provide better flexibility and enhanced delivery capabilities are appealing to healthcare providers, further increasing their use. In November 2024, the DCB-BIF trial, presented at TCT 2024, compared drug-coated balloons (DCB) to non-compliant balloons (NCB) for treating side branches after provisional stenting in coronary bifurcation lesions. DCB led to a 44% reduction in major adverse cardiac events (MACE), driven by fewer spontaneous myocardial infarctions. This study supports DCB use in simple true bifurcation lesions but highlights the need for further research, particularly on intravascular imaging guidance.

The growing preference for minimally invasive procedures is another key factor propelling the angioplasty balloons market. These procedures offer shorter recovery times, reduced hospital stays, and lower risk of complications compared to traditional surgeries. Additionally, the cost-effectiveness of angioplasty, especially in resource-limited settings, has made it a widely accepted treatment option, driving market demand. In December 2024, the article "Eclipse on Orbital Atherectomy: Balloon Angioplasty Still Shines in Calcified Lesions" explores how balloon angioplasty continues to be a vital treatment for calcified lesions despite the rise of orbital atherectomy. The article emphasizes that balloon angioplasty remains favored for its accessibility, effectiveness, and cost-efficiency in managing complex cardiovascular conditions.

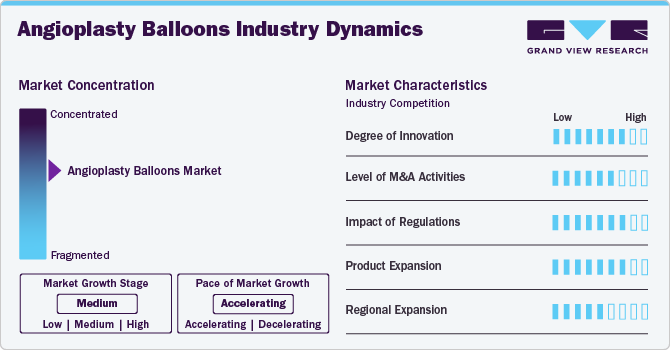

Market Concentration & Characteristics

The degree of innovation in the angioplasty balloons industry is high, driven by the need for better patient outcomes and the increasing demand for minimally invasive procedures. Advancements focus on improving balloon materials, coating technologies, and drug-eluting balloons. Manufacturers explore bioresorbable technologies and balloon designs that can better adapt to complex vessel anatomies. The pressure to enhance balloon performance, reduce complications, and minimize recovery times continues to stimulate innovation.

The angioplasty balloons market has a moderate level of mergers and acquisitions. Larger medical device companies are acquiring smaller firms specializing in innovative balloon technologies or those with unique drug-eluting balloon offerings. These acquisitions allow firms to diversify their portfolios and strengthen their capabilities in the cardiovascular sector. The goal is often to integrate cutting-edge technology or expand into new markets

The impact of regulations on the angioplasty balloons industry is high. Regulatory bodies like the FDA and the European Medicines Agency (EMA) impose stringent standards for product approval and safety testing. This drives manufacturers to comply with rigorous clinical trial requirements and quality control processes, which can lengthen time-to-market and increase costs. However, strong regulatory oversight also ensures the safety and efficacy of devices, which is crucial for patient trust.

Product expansion in the angioplasty balloons industry is high, as companies seek to broaden their product lines to cater to various cardiovascular conditions. This includes expanding into drug-eluting balloons, which offer targeted drug delivery to reduce restenosis, and bioresorbable balloons, eliminating the need for permanent implants. Manufacturers are also exploring specialized balloons for complex lesions, smaller vessels, and different types of coronary and peripheral artery diseases.

Regional expansion in the angioplasty balloons industry is moderate, with significant growth in emerging markets such as Asia-Pacific and Latin America. These regions are witnessing increased demand for advanced cardiovascular treatments due to aging populations and rising incidences of cardiovascular diseases. In developed regions like North America and Europe, market expansion is driven by technological advancements and growing healthcare infrastructure.

Product Insights

The normal balloons segment held the largest market share of 53.8% in 2024 due to the low price of these devices, supportive government regulations, streamlined approval processes, and favorable reimbursement policies, Drug-Eluting Balloons (DEBs) are expected to experience substantial demand growth. The positive reimbursement policies contributed to higher sales of DEBs in 2024, which is projected to continue throughout the forecast period. In September 2024, in the Journal of the American College of Cardiology, a study highlights that balloon angioplasty significantly reduced major adverse cardiac events (MACE) in coronary artery disease patients. This approach offers potential advantages over traditional methods, suggesting a shift toward better clinical outcomes. The findings could influence future treatment strategies for coronary interventions.

Scoring balloons segment is anticipated to grow at the fastest CAGR over the forecast period owing to the increasing prevalence of peripheral artery disease (PAD) and coronary artery disease (CAD), which require effective and minimally invasive treatment options. Better plaque modification, lower risk of vessel dissection and recoil, and improved stent delivery and expansion are also the key drivers. In September 2024, a study found that cutting balloon (CB) and scoring balloon (SB) treatments for calcified in-stent restenosis were equivalent in angiographic outcomes. While CB showed a higher rate of residual stenosis, factors such as severe calcified ISR implantation negatively affected results, with no significant differences in major adverse cardiovascular events.

End Use Insights

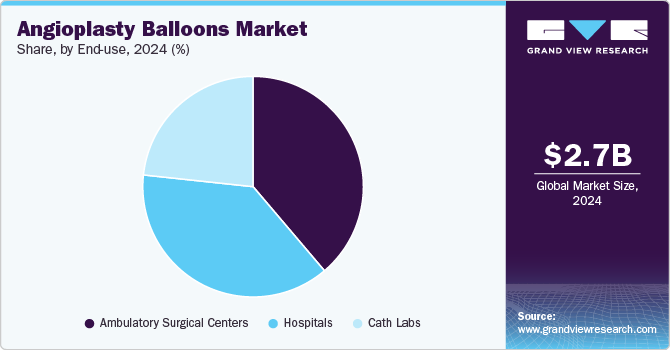

The ambulatory surgery centers segment dominated the market with a share of 38.8% in 2024. The angioplasty balloons market can be categorized by end use into ambulatory surgery centers, hospitals, and cath labs. Ambulatory Surgery Centers (ASCs) dominated the angioplasty balloon market due to their ability to offer cost-effective, efficient, and minimally invasive procedures. ASCs are increasingly preferred for non-emergency, elective surgeries like angioplasty because they provide a high level of care in a more convenient, lower-cost environment compared to hospitals. With advancements in medical technology, including angioplasty balloon procedures, these centers can perform complex cardiovascular treatments in an outpatient setting.

The cath labs segment is expected to grow at the fastest CAGR during the forecast period due to their essential role in diagnosing and treating cardiovascular diseases. Cath labs are specialized facilities equipped with advanced imaging technology and catheter-based tools that allow for precise and minimally invasive procedures, such as balloon angioplasty. In March 2023, it was stated that drug-coated balloons (DCB) could streamline procedures in situations where stents aren't necessary. This approach would eliminate the requirement for a foreign object in the artery and simplify post-procedure medication, according to a director of a cardiac catheterization lab and interventional cardiology center in Italy.

Application Insights

In 2024, coronary vascular diseases segment held the largest market share of 53.4%. The angioplasty balloon market is divided into two main segments: coronary and peripheral vascular diseases. The coronary vascular diseases (CVD) segment leads the market, primarily due to the widespread occurrence of coronary artery disease (CAD), which is the foremost cause of cardiovascular-related complications and deaths worldwide. In June 2024, the FDA approved the use of drug-coated balloon (DCB) stents for angioplasty procedures, now available at OhioHealth. This procedure, which uses paclitaxel-coated balloons, is designed to reduce the risk of restenosis in patients with coronary artery disease. The DCB offers an alternative to traditional stents, improving treatment options for patients and potentially enhancing recovery outcomes.

The peripheral vascular diseases (PVD) segment is expected to witness the fastest growth rate during the forecast period, fueled by rising risk factors like diabetes, obesity, smoking, and hypertension that contribute to atherosclerosis in peripheral arteries. In January 2024, Summa Therapeutics, LLC announced the first human use of its Finesse Injectable balloon catheter platform for injectable angioplasty in patients with below-the-knee peripheral artery disease (PAD), targeting those at risk of limb loss.

Regional Insights

North America angioplasty balloons market held a significant position in the global market in 2024, with a share of 39.1%. North America has been a dominant region in the angioplasty balloons market, driven by advanced healthcare infrastructure, high healthcare spending, and a growing elderly population. The U.S. and Canada are major contributors to market growth, with widespread adoption of minimally invasive procedures and cutting-edge medical technologies. In October 2024, the UPMC Heart and Vascular Institute in Central Pa. treated its first patient with a new FDA-approved drug-coated balloon therapy for in-stent restenosis (ISR). This innovative treatment delivers a drug via balloon catheter to prevent the recurrence of ISR and offers a promising solution for patients suffering from related chest pain and cardiac events.

U.S. Angioplasty Balloons Market Trends

The U.S. accounted for the largest market share in North America angioplasty balloons industry in 2024. The U.S. market growth is attributed to its advanced healthcare system, high demand for cardiovascular procedures, and the growing prevalence of coronary artery disease (CAD) and peripheral vascular diseases (PVD). The adoption of minimally invasive surgeries, the availability of advanced medical technologies, and the presence of key industry players in the country have accelerated market growth. In September 2024, UHealth—University of Miami Health System became the first academic medical center in Florida to successfully treat a patient with the new AGENT Drug-Coated Balloon (DCB) technology, aimed at preventing re-narrowing of coronary arteries in patients with stents.

Europe Angioplasty Balloons Market Trends

Europe angioplasty balloons market is anticipated to grow significantly over the forecast period. Europe is a significant region in the angioplasty balloon market, driven by increasing incidences of cardiovascular diseases, an aging population, and well-established healthcare infrastructure. Countries such as Germany, France, and the UK lead the market due to their advanced medical technologies and high adoption rates of interventional cardiology procedures. In September 2024, the European Society of Cardiology (ESC) released a statement from the European Association of Percutaneous Cardiovascular Interventions (EAPCI) on the use of drug-coated balloons (DCBs) in interventions. The statement outlines the growing role of DCBs in coronary and peripheral artery procedures, highlighting their benefits in reducing restenosis and improving outcomes. Ongoing research and clinical guidelines are also discussed to optimize DCB use in practice.

The UK angioplasty balloons market is expected to grow over the forecast period. In the UK, market benefits from a strong healthcare system, with the National Health Service (NHS) providing broad access to advanced interventional cardiology treatments. The rising prevalence of coronary artery disease and peripheral vascular diseases, combined with the growing trend toward minimally invasive surgeries, supports the demand for angioplasty balloons.

The angioplasty balloons market in Germany is expected to grow over the forecast period. Germany is one of the largest markets for angioplasty balloons in Europe, due to its advanced healthcare system, high standard of medical research, and a large aging population. The country’s well-established network of hospitals and catheterization labs, combined with the growing demand for interventional cardiology procedures, particularly in coronary and peripheral artery diseases, has spurred the use of angioplasty balloons. In March 2024, JAMA published an article on "The AGENT IDE Randomized Clinical Trial," demonstrating that drug-coated balloons, tested in Germany, effectively reduce neointimal growth and restenosis compared to standard balloon angioplasty. The ISAR-DESIRE 3 trial also indicated that these balloons significantly lowered the need for repeat revascularization over 10 years compared to uncoated balloons.

France the angioplasty balloons market is expected to grow over the forecast period. In France market is growing steadily, supported by a robust healthcare system, high healthcare expenditure, and an aging population with a high prevalence of cardiovascular diseases. The French healthcare system provides wide access to medical treatments, and hospitals and catheterization labs are key centers for performing balloon angioplasty. A September 2023 article in the Annals of Biomedical Engineering examined drug-coated balloons for treating stenotic arteries, revealing challenges with coating transfer. An in silico study identified how factors like balloon geometry and vessel stiffness affect contact pressure (CP) during inflation, influencing drug-coating effectiveness and highlighting the need for improved balloon-tissue interaction.

Asia Pacific Angioplasty Balloons Market Trends

The Asia Pacific angioplasty balloons market is expected to experience rapid growth, with a projected CAGR of 4.6% from 2025 to 2030. Asia-Pacific is experiencing significant growth in the angioplasty balloon market, driven by a rapidly aging population, rising incidences of cardiovascular diseases, and improving healthcare infrastructure. The market is expanding due to greater access to advanced medical treatments, increasing healthcare investments, and rising awareness about the benefits of minimally invasive procedures. In September 2023, a study in the Journal of Clinical Medicine evaluated scoring balloon angioplasty's effectiveness in enhancing drug-coated balloon (DCB) treatment for coronary artery disease. The retrospective analysis of 259 patients showed that using a scoring balloon resulted in significantly better angiographic outcomes, including reduced severe dissection and higher rates of optimal results compared to non-scoring balloons.

The China angioplasty balloons market is anticipated to grow over the forecast period. China is one of the fastest-growing markets for angioplasty balloons in the Asia-Pacific region. The increasing burden of cardiovascular diseases, particularly coronary artery disease and peripheral vascular diseases, is driving the demand for interventional procedures. In September 2024, the REC-CAGEFREE-I trial was presented, comparing drug-coated balloon (DCB) angioplasty rescue stenting with intended stenting for coronary artery lesions. This multicenter non-inferiority trial explores whether DCBs can effectively treat coronary lesions while potentially avoiding routine stent placement. The results are crucial for refining treatment strategies and improving patient outcomes in coronary interventions.

The Japan angioplasty balloons market is expected to grow rapidly over the forecast period. Japan has a well-established and advanced healthcare system, making it a key market for angioplasty balloons in the Asia-Pacific region. With one of the highest rates of cardiovascular diseases in the world, the demand for balloon angioplasty procedures is high. In October 2024, a study in JACC: Cardiovascular Interventions found that targeting a pressure ratio of 0.7 in functional assessment-guided pulmonary artery dilation improved outcomes for patients with chronic thromboembolic pulmonary hypertension (CTEPH) undergoing balloon pulmonary angioplasty, enhancing lung perfusion and reducing complications.

The angioplasty balloons market in India is anticipated to grow rapidly over the forecast period. India is experiencing a growing demand for angioplasty balloons, driven by rising incidences of cardiovascular diseases, particularly in urban areas. In March 2023, an article from the Indian Journal of Cardiovascular Disease in Women highlighted that coronary artery disease (CAD) is the leading cause of death among women, responsible for one in three female fatalities each year, or about one woman every minute. Additionally, 90% of women with CAD have at least one parental risk factor.

Latin America Angioplasty Balloons Market Trends

In Latin America, the angioplasty balloons market is witnessing a significant trend. Latin America market is expanding due to increasing rates of cardiovascular diseases and the growing adoption of minimally invasive procedures. Countries such as Brazil, Mexico, and Argentina are seeing higher demand for angioplasty balloons, driven by improving healthcare infrastructure and rising cardiovascular health awareness. In March 2024, the FDA approval of a drug-coated balloon (DCB) for in-stent restenosis could significantly impact Latin America. The technology offers an advanced treatment option for patients with coronary artery disease, particularly in regions where access to cutting-edge medical interventions is growing.

The angioplasty balloons market in Brazil is expected to grow over the forecast period. Brazil is the largest market for angioplasty balloons in Latin America, driven by the rising prevalence of cardiovascular diseases and an expanding healthcare sector. The Brazilian government’s focus on improving access to medical treatments and the increasing adoption of modern medical technologies has spurred the demand for angioplasty procedures. The growing number of catheterization labs and the trend toward minimally invasive surgeries have further fueled the adoption of angioplasty balloons in Brazil.

Middle East & Africa Angioplasty Balloons Market Trends

The angioplasty balloons market in the Middle East and Africais poised to grow in the near future. The Middle East and Africa (MEA) region is witnessing steady growth in the angioplasty balloon market, driven by increasing cardiovascular disease prevalence, improving healthcare infrastructure, and growing awareness about the benefits of interventional cardiology procedures. Countries like Saudi Arabia, the UAE, and South Africa are leading the market, with investments in advanced medical technologies and healthcare facilities. Additionally, the rising demand for minimally invasive treatments and the expansion of specialized heart centers in the region are contributing to the market’s growth.

The angioplasty balloons market in Saudi Arabia is expected to grow over the forecast period. Saudi Arabia is a key market in the MEA region for angioplasty balloons, driven by high rates of cardiovascular diseases, especially coronary artery disease. The country has been investing heavily in its healthcare system, with a focus on upgrading hospitals and catheterization labs to provide advanced treatment options. In September 2022, an article in Frontiers in Cardiovascular Medicine reported that the estimated prevalence of coronary artery disease (CAD) in the Kingdom of Saudi Arabia (KSA) was 5.5%. The rates were found to be slightly higher in urban regions compared to rural ones, with figures of 6% and 4.2%, respectively.

The angioplasty balloons market in Kuwait is anticipated to grow over the forecast period. Kuwait is witnessing steady growth in the angioplasty balloon market, primarily due to the rising prevalence of cardiovascular diseases and an increasingly health-conscious population. The country’s well-established healthcare system, combined with significant investments in advanced medical technologies, has led to the adoption of minimally invasive interventional procedures, including balloon angioplasty.

Key Angioplasty Balloons Company Insights

Some of the key market players operating in the angioplasty balloons market include Medtronic, Boston Scientific Corporation, Johnson & Johnson Services, Inc., Abbott. These companies are making significant infrastructure investments, which enable them to develop, manufacture, and commercialize a high volume of devices worldwide. In addition, to increase their presence globally, companies engage in several strategic partnerships with distributors and other companies.

Key Angioplasty Balloons Companies:

The following are the leading companies in the angioplasty balloons market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Boston Scientific Corporation

- Johnson & Johnson Services, Inc.

- Abbott

- C. R. Bard, Inc.

- Spectranetics

- Terumo Medical Corporation

- Cardinal Health

- BIOTRONIK

- Cook Medical

- ENDOCOR GmbH

- B. Braun SE

Recent Developments

-

In July 2024, Teleflex Incorporated received FDA clearance for its Ringer Perfusion Balloon Catheter (PBC), the first of its kind for percutaneous transluminal coronary angioplasty (PTCA). This innovative catheter features a helical balloon design that maintains coronary blood flow during balloon inflation, enabling improved myocardial perfusion and facilitating the delivery of additional devices during procedures.

-

In March 2024, Boston Scientific Corporation disclosed that it has obtained FDA approval for its AGENT Drug-Coated Balloon (DCB). This device is designed to treat coronary in-stent restenosis (ISR) in individuals suffering from coronary artery disease. ISR occurs when a previously stented artery experiences narrowing or blockage due to the buildup of plaque or scar tissue. This new approval aims to enhance treatment options for patients facing this complication.

-

In March 2024, a BIDMC-led trial resulted in the FDA's approval of coronary drug-coated balloons (DCBs), marking a breakthrough in the treatment of coronary artery disease. The trial demonstrated the effectiveness of DCBs in reducing restenosis and improving patient outcomes. This approval paves the way for broader clinical applications of DCBs, offering a promising option for patients undergoing coronary interventions.

Angioplasty Balloons Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.8 billion

Revenue forecast in 2030

USD 3.4 billion

Growth rate

CAGR of 3.8% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Medtronic; Boston Scientific Corporation; Johnson & Johnson Services, Inc.; Abbott; C. R. Bard, Inc.; Spectranetics; Terumo Medical Corporation; Cardinal Health; BIOTRONIK; Cook Medical; ENDOCOR GmbH; B. Braun SE

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Angioplasty Balloons Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global angioplasty balloons market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Normal Balloons

-

Drug Coated Balloons

-

Cutting Balloons

-

Scoring Balloons

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Peripheral Vascular Disease

-

Coronary Vascular Disease

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Ambulatory Surgical Centers

-

Hospitals

-

Cath Labs

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global angioplasty balloons market size was estimated at USD 2.71 billion in 2024 and is expected to reach USD 2.8 billion in 2025.

b. The global angioplasty balloons market is expected to grow at a compound annual growth rate of 3.8% from 2025 to 2030 to reach USD 3.4 billion by 2030.

b. The normal balloons segment led the market in 2024 with a 53.7% share due to the low cost of these devices, supportive government regulations and submission processes for approval, and favorable reimbursement policies. Drug-Eluting Balloons (DEBs) are anticipated to be the fastest-growing type segment.

b. Some of the key companies in the global market are Boston Scientific Corporation; Medtronic PLC; Spectranetics Corp.; Becton, Dickinson and Company (C. R. Bard, Inc.); Abbott Laboratories; Cook Medical, Inc.; Cardinal Health (Cordis); ENDOCOR GmbH; and Johnson & Johnson.

b. Key factors that are driving the market growth include technological advancements and rising angioplasty procedures being performed due to the minimally invasive nature of the surgery

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.