- Home

- »

- Animal Feed and Feed Additives

- »

-

Animal Antimicrobials And Antibiotics Market Report, 2030GVR Report cover

![Animal Antimicrobial And Antibiotics Market Size, Share & Trends Report]()

Animal Antimicrobial And Antibiotics Market Size, Share & Trends Analysis Report By Type (Antimicrobial, Antibiotics), By Livestock (Cattle, Poultry, Aquaculture), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-054-6

- Number of Report Pages: 200

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

Market Size & Trends

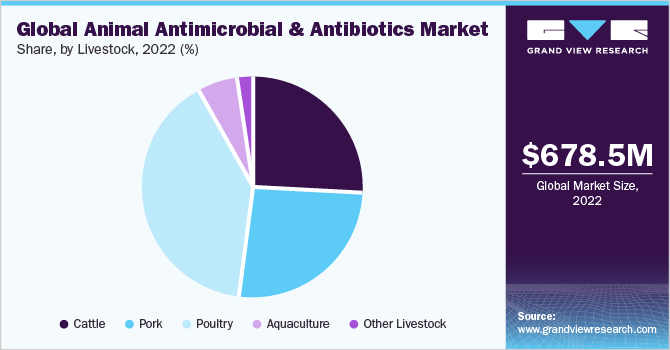

The global animal antimicrobial and antibiotics market size was valued at USD 678.48 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.5% from 2023 to 2030. The increase in meat consumption is driving the market in several ways. In meat production, animals are often kept in confined spaces with many other animals, which can lead to the spread of disease. To prevent and treat these diseases, farmers use antibiotics and other antimicrobials to keep their animals healthy. Therefore, there is a growing demand for these products in the animal agriculture industry.

Further, the use of antibiotics and other antimicrobials in animal agriculture has been linked to the development of antibiotic-resistant bacteria, a serious public health concern. This has created a need for new and more effective antibiotics to combat these resistant bacteria. Additionally, with the growing demand for meat as the global population continues to grow, there is a need for more efficient and sustainable meat production practices.

In the U.S., the meat industry still uses medically significant antibiotics on chickens, fish, pigs, and cattle that are raised in crowded and unclean conditions in order to promote their growth and reduce the occurrence and transmission of diseases. The majority of scientific experts agree that this practice contributes to the development of antibiotic resistance in bacteria, which poses a risk to human health.

The market is expected to grow in the coming years due to factors such as increasing demand for animal-based food products, the rising prevalence of diseases, and the need to increase the productivity of livestock. There has been a trend toward reducing the use of antibiotics in North America over the past several years. This is due to concerns about antibiotic resistance, which can occur when bacteria are exposed to antibiotics and evolve to become resistant to them. Overuse of antibiotics in animal agriculture can contribute to the development of antibiotic-resistant bacteria, which can be a threat to public health.

Stringent government regulations have a significant impact on market growth. While regulations are necessary to ensure the safety of animals, they can also restrict the market growth in several ways, such as extensive testing and approval processes for new antibiotics and antimicrobials can increase costs for manufacturers, making it difficult to introduce new products to the market and discourage investment in research and development.

Type Insights

Antimicrobial type segment dominated the market with a revenue share of more than 44.9% in 2022. Animal antimicrobials, also known as veterinary antimicrobials, are drugs used in the treatment and prevention of infectious diseases in animals. These drugs can be used for a variety of animals such as livestock, poultry, and pets. Additionally, animal antimicrobials work by either killing or inhibiting the growth of bacteria, viruses, fungi, and other microorganisms in animals. They can be administered orally, topically, or by injection depending on the specific medication and the condition to be treated in animals.

Antimicrobials are commonly used in animal farms to prevent and treat infectious diseases, promote animal growth, and improve feed efficiency. However, the overuse and misuse of antimicrobials can lead to the emergence and spread of antimicrobial-resistant bacteria, which can pose a threat to animal and human health.

Animal antibiotics are types of medication that are used to prevent or treat bacterial infection in animals, including livestock, pets, and wildlife. They are similar to the antibiotics used to treat bacterial infections in humans. However, these antibiotics are formulated specifically for use in animals. These antibiotics may be administered orally, injected, or applied topically, depending on the specific medication and the type of infection in animals that is to be treated.

Livestock Insights

Poultry livestock segment dominated the market with a revenue share of over 40.0% in 2022. Antimicrobials and antibiotics are commonly used in poultry feed to prevent and treat infections in chickens, ducks, etc. They can be added to the feed or water to maintain the health and well-being of the birds and improve their growth rate. Antimicrobials are compounds that can kill or inhibit the growth of microorganisms such as bacteria, viruses, and fungi in poultry. They are commonly used in poultry feed to prevent and treat bacterial infections that can be transmitted through feed, water, or air. These compounds can be added directly to the feed or water, or they can be administered through injections or other methods to poultry.

The use of antimicrobials and antibiotics in pig feed has been a common practice in swine farms to promote growth, prevent diseases, and improve feed efficiency. However, there are concerns about the development of antibiotic-resistant bacteria in animals that can be transferred to humans through food or the environment.

Animal antimicrobials are added to cattle feed for different purposes such as improving health and growth, preventing and controlling diseases, and reducing the risk of bacterial contamination in animal products. Animal antibiotics, for instance, promote growth and improve feed efficiency by encouraging the growth of beneficial gut bacteria in animals. This leads to increased weight gain and reduced feed costs. Ionophores are a type of antimicrobial used to control coccidiosis, a parasitic disease that can cause health problems in cattle.

Some common antimicrobials and antibiotics used in aquaculture feed are quinolones and sulfonamides. They are often added to fish feed at low doses, either continuously or intermittently, to prevent bacterial infections or to treat infected fish, solid boards, especially in North America and Europe, is projected to drive the demand for the product in OSB over the forecast period.

Additionally, some feed additives can inhibit the growth of Salmonella and other bacteria in the gut of cattle, reducing the risk of contamination in meat and dairy products. However, the use of antimicrobials and antibiotics in animal feed has been contentious owing to concerns about the development of antimicrobial resistance, in both animals and humans. Therefore, a number of countries across the world have implemented regulations and guidelines to limit or prohibit the use of certain antimicrobials and antibiotics in animal feed.

Regional Insights

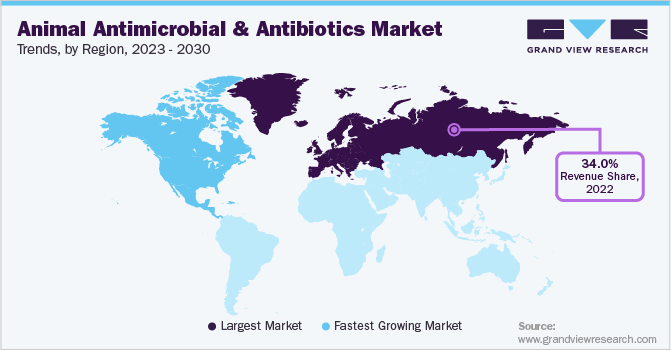

Europe region dominated the market with a revenue share of more than 34.0% in 2022. Europe is home to some of the world's most advanced animal husbandry practices, which include advanced breeding techniques, sophisticated housing systems, and advanced feeding practices. These practices lead to healthier animals that are less susceptible to disease, reducing the need for antibiotics and other antimicrobials.

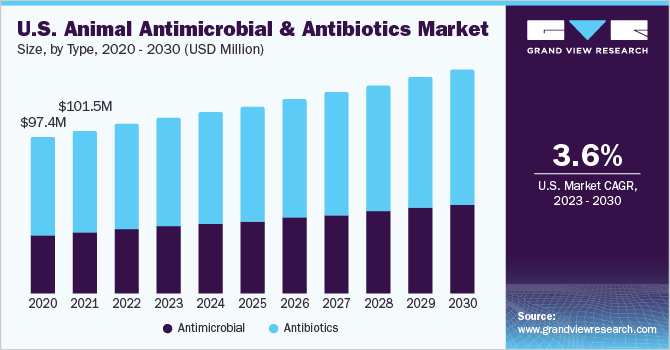

The market in North America is a significant segment of the animal healthcare industry. The market is expected to grow in the coming years due to factors such as increasing demand for animal-based food products, rising prevalence of animal diseases, and the need to increase the productivity of livestock. There has been a trend toward reducing the use of antibiotics in animals in North America over the past several years. This is due to concerns about antibiotic resistance, which can occur when bacteria are exposed to antibiotics and evolve to become resistant to them. Overuse of antibiotics in animal agriculture can contribute to the development of antibiotic-resistant bacteria, which can be a threat to public health.

According to React report, India is the world’s 5th largest producer of meat. Chicken is the most consumed meat in India. Increase in the usage of antimicrobials and antibiotics in chicken is expected to drive market growth in the region. Additionally, the Asia Pacific region is home to a large population of livestock, including cattle, swine, poultry, and aquaculture, which provides ample opportunities for the animal antimicrobial and antibiotics market.

Key Companies & Market Share Insights

The global market is fragmented with the presence of numerous global and regional players. These global players face intense competition from each other as well as from the regional players who have strong distribution networks and good knowledge about suppliers & regulations, along with merger and acquisition. For instance, Elanco and Colorado State University’s agnext had announced a strategic alliance to improve livestock sustainability. In addition, companies in the market compete on the basis of quality offered and the technology used for the manufacturing of the product. Some prominent players in the global animal antimicrobial and antibiotics market include:

-

Ashish Life Science

-

Ayurvet

-

C.H. Boehringer Sohn AG & Co. KG.

-

Ceva

-

Elanco

-

Endovac Animal Health.

-

HIPRA, S.A.

-

HUVEPHARMA

-

Kyoritsuseiyaku Corporation

-

Neogen Corporation

-

Phibro Animal Health Corporation

-

UCBVET Animal Health and Welfare

-

Vetoquinol

-

Virbac

-

Zoetis

Animal Antimicrobial And Antibiotics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 702.08 million

Revenue forecast in 2030

USD 893.93 million

Growth rate

CAGR of 3.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, volume in kilotons and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, livestock, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Mexico; Germany; Spain; Russia; Turkey; China; India; Japan; Brazil; South Africa; Saudi Arabia

Key companies profiled

Ashish Life Science; Ayurvet; C.H. Boehringer Sohn AG & Co. KG.; Ceva; Elanco; Endovac Animal Health.; HIPRA, S.A.; HUVEPHARMA; Kyoritsuseiyaku Corporation; Neogen Corporation; Phibro Animal Health Corporation; UCBVET Animal Health and Welfare; Vetoquinol; Virbac; Zoetis

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Antimicrobial And Antibiotics Market Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global animal antimicrobial and antibiotics market report based on type, livestock, and region:

-

Type Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Antimicrobial

-

Antibiotics

-

-

Livestock Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Cattle

-

Pork

-

Poultry

-

Aquaculture

-

Other Livestock

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Mexico

-

-

Europe

-

Germany

-

Spain

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global animal antimicrobial and antibiotics market size was valued at USD 678.48 million in 2022 and is expected to reach USD 702.08 million in 2023.

b. The global animal antimicrobial and antibiotics market is projected to grow at a compound annual growth rate (CAGR) of 3.5% from 2023 to 2030 and reach USD 893.93 million by 2030.

b. Europe dominated the market with a revenue share of more than 34.0% in 2022. Europe is home to some of the world's most advanced animal husbandry practices, which include advanced breeding techniques, sophisticated housing systems, and advanced feeding practices. These practices lead to healthier animals that are less susceptible to disease, reducing the need for antibiotics and other antimicrobials.

b. Some key players in the global animal antimicrobial and antibiotics market include Ashish Life Science, Ayurvet, C.H. Boehringer Sohn AG & Co. KG., Ceva, Elanco, Endovac Animal Health., HIPRA, S.A., HUVEPHARMA, Kyoritsuseiyaku Corporation, Neogen Corporation, Phibro Animal Health Corporation, UCBVET Animal Health and Welfare, Vetoquinol, Virbac, Zoetis.

b. The rise in zoonotic diseases, which are diseases that can be transmitted from animals to humans, has been a driving force behind the growth of the animal antimicrobial and antibiotics market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."