- Home

- »

- Agrochemicals

- »

-

Animal Feed Organic Trace Minerals Market Report, 2030GVR Report cover

![Animal Feed Organic Trace Minerals Market Size, Share & Trends Report]()

Animal Feed Organic Trace Minerals Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Zinc, Iron, Copper, Selenium), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-065-1

- Number of Report Pages: 104

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global animal feed organic trace minerals market size was estimated at USD 749.4 million in 2023 and is projected to reach USD 1,244.6 million by 2030, growing at a CAGR of 7.8% from 2024 to 2030. The growth of the market is fueled by the rising popularity of water-soluble natural feed additives, the expanding animal feed industry, and the increasing demand for meat & dairy products worldwide.

The market size and penetration of animal feed organic trace minerals in poultry are anticipated to remain high over the forecast period with the growing demand for protein from animal sources. The growing Asia Pacific market mainly drives this demand, including countries such as India and China. Organic trace minerals witnessed the second-largest penetration in the pig segment. Pork is widely consumed in the Asia Pacific and European countries as it is also considered an essential source of protein. Furthermore, the growing demand for dairy products has also resulted in an increasing market for cattle feed, consequently driving the demand for organic trace minerals over the forecast period.

Drivers, Opportunities & Restraints

The Organization for Economic Cooperation and Development (OECD) forecasts a 14% rise in the global consumption of meat proteins by 2030 compared to the average of 2018-2020, primarily due to a surge in income and an increase in population worldwide. The availability of proteins from beef, pork, poultry, and sheep is expected to increase by 5.9%, 13.1%, 17.8%, and 15.7%, respectively, by 2030. However, in wealthy countries, a shift in consumer preferences, along with a continuously aging population and slowly increasing population, is anticipated to lead to the stabilization of meat consumption per capita, with the prevalence of the trend for purchasing high-quality meat cuts.

The increasing incidence of animal diseases is posing a significant hindrance to the growth of the animal feed organic trace minerals market. Outbreaks of diseases, such as African swine fever (ASF), avian influenza (AI), and foot-and-mouth disease (FMD), can lead to substantial losses in livestock populations. For instance, according to a report published by the European Food Safety Authority (EFSA), in 2023, domestic pigs saw the largest number of African Swine Fever (ASF) outbreaks since 2014. Moreover, 1 out of every 5 farm animals are lost to disease every year, according to the World Organization for Animal Health (OIE). The Government of Australia has estimated that an outbreak of foot-and-mouth disease would cost farmers AUD 80.00 billion (USD 52.37 billion) in direct costs over 10 years.

Industry Dynamics

The animal feed organic trace minerals market is moderately consolidated with intense competition among the tier-1 and tier-2 players.

The impact of regulations on the animal feed organic trace minerals market is notable, influencing supply chains and product development. Regulatory agencies across the globe, such as the European Food Safety Authority (EFSA) and the U.S. Food and Drug Administration (FDA), have implemented stringent guidelines to ensure feed safety and quality. These regulations mandate rigorous testing and certification for feed additives, including organic trace minerals, to ensure their safety for animal consumption and efficacy in promoting animal health. For example, the EU's Regulation (EC) No. 1831/2003 outlines specific procedures for authorizing feed additives, including organic trace minerals, emphasizing the need for detailed scientific evidence supporting their benefits.

Companies adopt mergers and acquisitions to quickly gain market share, access new technologies, or enter new markets by leveraging the established capabilities of other firms. These strategies can lead to cost efficiencies through enhanced competitive positioning and provide strategic advantages such as increased resources.

Product Categories Insights

“Zinc segment is expected to witness growth at 8.3% CAGR”

The zinc segment of the market was valued at USD 246.1 million in 2023 and is projected to reach USD 422.6 million by 2030. Zinc is an essential trace mineral in the animal feed industry. It improves the immunity and metabolism of animals. However, if used in excess, this mineral can be dangerous. Excess consumption results in zinc excretion through feces, which pollutes the environment. Thus, stringent regulations are being implemented globally to ensure minimum consumption of this mineral in animal feed. Growing awareness about its importance in animal feed is expected to be one of the primary drivers of the market over the forecast period.

Copper regulates blood cell functions and maintains healthy nerve fibers in animals. It also strengthens animal bones. Thus, the product is witnessing demand due to increasing awareness regarding its beneficial properties. However, the overconsumption of copper results in toxicity. This factor has led to the establishment of specific guidelines among governing bodies to restrict the use of copper in animal feed.

Application Insights

“Poultry segment is expected to witness growth at 8.1% CAGR”

The poultry application segment accounted for the largest revenue share of 43.6% of the market in 2023 owing to the growing demand for animal protein sources from the U.S., China, etc. Poultry is the most consumed meat in the world. Chicken, eggs, and turkeys are this segment's most common meat sources. Growing demand for animal protein sources has driven the market for poultry over the years. The outbreak of avian influenza in the U.S., which resulted in the deaths of millions of chickens and turkeys, had a significant impact on the poultry market. However, the industry has recovered since, due to technological developments and better animal vaccinations. Growing poultry markets in China and the U.S. have played key roles in this revival. This has driven the demand for animal feed and organic trace minerals.

Pork is the second highest-consumed meat in the world after poultry. It is considered a rich source of protein. Growing demand for high-quality pork and the overall growth in pork consumption have been major drivers of pork feed. Outbreaks of diseases in this sector are common, making manufacturers and pork processors equally aware of the importance of high-quality feed incorporated with trace minerals and other nutrients. Growing demand from countries such as China and the U.S. has played key roles in the market growth in this segment.

Regional Insights

The North America market is expected to grow during the forecast period. This growth is attributed to rising demand for products from consumers in the region. The growing food industry is also expected to be one of the major drivers of this market in the country.

U.S. Animal Feed Organic Trace Minerals Market Trends

The U.S. is known as one of the major milk and milk products manufacturers in the world. The country's dairy industry is characterized by state-of-the-art manufacturing and storage facilities. In addition, the growing demand for pork from the rapidly growing food industry here is expected to play a major role in the growth of this segment.

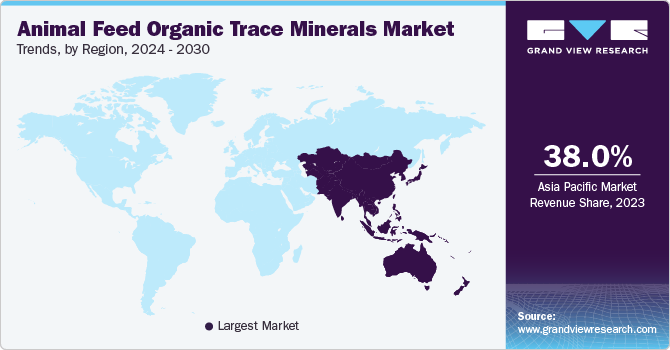

Asia Pacific Animal Feed Organic Trace Minerals Market Trends

“Asia Pacific. is expected to witness a market growth of CAGR 8.1%”

Asia Pacific is a prominent consumer of products in the world with revenue share of 38.0% in 2023. This growth is attributed to the presence of stringent regulations in the region to improve animal health and productivity, along with a robust demand for high-quality meat and dairy products

China Animal Feed Organic Trace Minerals Market Trends

China is one of the most rapidly developing countries in Asia, with growing animal feed, agriculture, pharmaceuticals, construction, chemicals, and automobile sectors. Favorable demographics, economic landscape, manufacturing sector incentives, and a subsidized tax regime for manufacturing are expected to drive this country's animal feed organic trace minerals market. The growing food industry is also expected to be one of the major drivers of this market in this country.

Europe Animal Feed Organic Trace Minerals Market Trends

The product market is expected to grow in Europe during the forecast period. This growth is attributed to countries such as Spain is the largest producer of compound animal feed in Europe. As of 2021, it has produced over 25.56 million tons of compound feed. Integration between feed manufacturers and slaughter companies, an uncomplicated supply chain, and strong exports are some of the key factors driving the market in Spain. As this country relies on imports of raw feed materials, the local supply crisis has not had a drastic effect on the industry here, as compared to other markets such as the UK or Germany, which depend on local raw material suppliers.

Germany Animal Feed Organic Trace Minerals Market Trends

The animal feed organic trace minerals market in Germany is characterized by state-of-the-art manufacturing facilities. Iron is essential in increasing the hemoglobin levels in animals' blood. This, in turn, helps regulate the reproduction cycle in animals and also improves their immunity.

Central & South America Animal Feed Organic Trace Minerals Market Trends

Central & South America is projected to be an emerging market that is expected to grow continuously during the forecast period. Countries such as Brazil and Argentina are promoting the development are increasingly their food industry in the region in order to meet rising consumer demand in the region.

Brazil Animal Feed Organic Trace Minerals Market Trends

Brazil is the largest economy in Central & South America and has been witnessing steady growth in the agriculture and animal feed sectors. Although the industrial output has registered a slowdown recently, favorable economic indicators are expected to stabilize growth in this country. The Brazilian Animal Protein Association regulates the animal feed industry in this country.

Middle East & Africa Animal Feed Organic Trace Minerals Market Trends

The Middle East is the potential market over the forecast period. The increase in demand for the processes meat and increasing demand for animal feed products to meet the consumer demands will drive the middle east & Africa market.

South Africa Animal Feed Organic Trace Minerals Market Trends

In South Africa, the animal feed market is increasingly adopting organic trace minerals to improve livestock health and productivity amid growing agricultural demands. For instance, the Animal Feed Manufacturers Association (AFMA) regulates and oversees the animal feed industry in Africa. The Animal Feed Manufacturers Association (AFMA) plays a pivotal role in regulating and overseeing the animal feed industry in Africa, promoting not just quality and safety standards, but also sustainable and responsible feeding practices.

Key Animal Feed Organic Trace Minerals Company Insights

Some of the key players operating in the market include Novus International, Tanke, and Pancosma SA, Ltd. among others.

-

The company stands at the forefront of China's production of animal feed additives and nutritional products and is certified by the government as a high-tech entity. The company is committed to answering the call for secure feed options internationally, focusing on providing organic trace minerals. In 2019, Tanke expanded its manufacturing capabilities with a new facility in Qingyuan City. Its product portfolio is comprehensive, including items like mineral amino acid chelates, premixes of the same, enhancements for feed flavor and sweetness, as well as antioxidants, acidifiers, and additives for aquatic feeds, among other specialized products.

-

The company stands at the forefront of the animal agriculture sector, providing cutting-edge health and nutrition solutions. Leveraging global research and integrating local knowledge, the company offers innovative technology to enhance the productivity of protein producers. The company operates under the ownership of Mitsui & Co., Ltd. and Nippon Soda Co., Ltd. The company's extensive product portfolio includes notable brands like ACTIVATE, AVIMATRIX, ALIMET, CIBENZA, MINTREX, NEXT ENHANCE, PROVENIA, ZORIEN, MFP, and MHA. Beyond products, it delivers a comprehensive suite of services, including the AIMS Automated Supply Chain Management System, the C.O.W.S Program, NOVUS Analytical Services, Online Order Entry, Premium Services, the REDUCE and REPLACE App, SOWS Service, VERIFY Profit Tools, and the Xpert Link Network.

DSM, Mercer Milling Company, Inc., and Cargill Incorporated, among others, are some of the emerging market participants in the animal feed organic trace minerals market.

-

The company is engaged in various sectors, such as the trading and distribution of agricultural products, livestock farming, the creation of food ingredients, and the management of a significant financial services division. The company provides an extensive array of products, including those related to agriculture, animal nutrition, the bio-industrial sector, cosmetics, the food & beverage industry, meat & poultry, pharmaceuticals, and nutritional supplements. It also provides transportation, risk management, and data assets management services. Furthermore, the company delivers comprehensive solutions in animal nutrition, digital technologies, biosecurity, and farm management to producers working with a broad range of animals and aquaculture species through its brands and programs like Diamond V, Nutrena, EWOS, Delacon, Provimi, Purina, and Loyall Life. With operations in 70 countries and product sales in 125 markets, the company boasts more than 5,000 brands. It employs over 1,500 research, development, applications and technical services, and intellectual property specialists spread across 200 research & development locations.

-

The company produces a wide range of private-label premixes, vitamin blends, and over 400 unique items for a diverse clientele, from quaint farm shops to the most extensive feed mills nationwide. Additionally, the company provides a comprehensive lineup of products, including buffers, rumen-protected amino acids, fat supplements, additives for feed, agents to enhance flow/mycotoxin control, ingredients for major minerals, blends of minerals with medication, ingredients for trace minerals, replacements for milk, products containing salt, specialty items/micronutrients, trace mineral components, and a variety of vitamins.

Key Animal Feed Organic Trace Minerals Companies:

The following are the leading companies in the animal feed organic trace minerals market. These companies collectively hold the largest market share and dictate industry trends.

- Alltech

- ADM

- Biochem

- Tanke

- Cargill, Incorporated

- Kemin Industries

- Mercer Milling Company, Inc.

- Novus International, Inc.

- Nutreco

- Pancosma

- DSM

- Zinpro

Recent Developments

-

In April 2024, Starting May 1, 2024, Alltech has become the distributor and importer of Agolin products in the U.S. and Canada. The company’s high-quality essential oil blends are scientifically proven to improve feed intake and performance, resulting in enhanced milk and meat production in ruminants and non-ruminants.

-

In 2024, Vitafort, a joint venture with ADM, launched a cutting-edge feed mill in Hungary, which reached total production capacity by January 2024. This development underscores ADM’s dedication to modernizing regional production infrastructure. The facility further produced animal feed for ruminants, swine, and poultry and, became the largest feed mill in Hungary upon reaching total capacity. It also met increased production demands and supported local farmers using their raw materials.

Animal Feed Organic Trace Minerals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 794.7 million

Revenue forecast in 2030

USD 1,244.6 million

Growth rate

CAGR of 7.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa.

Country scope

U.S.; Canada; Mexico; Germany; Spain; UK; France; Italy; China; Japan; India; Australia; Vietnam; Indonesia; Brazil; and South Africa.

Key companies profiled

Alltech; ADM; Biochem; Tanke; Cargill Incorporated; Kemin Industries; Mercer Milling Company Inc.; Novus International Inc.; Nutreco Pancosma; DSM; Zinpro.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Feed Organic Trace Minerals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global animal feed organic trace minerals market report based on product, application, and region

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Zinc

-

Iron

-

Copper

-

Selenium

-

Other Products

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Dairy Cattle

-

Poultry

-

Horses

-

Pigs

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Spain

-

UK

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Vietnam

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global animal feed organic trace minerals market size was estimated at USD 749.4 million in 2023 and is expected to reach USD 794.7 million in 2024.

b. The global animal feed organic trace minerals market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 1,244.6 million in 2030

b. The zinc segment of the market was valued at USD 246.1 million in 2023 and is projected to reach USD 422.6 million by 2030

b. Some prominent players in the animal feed organic trace minerals market include: • Alltech Inc. • Archer Daniels Midland Co. • Biochem • Tanke International Group • Cargill Inc.

b. Key factors that are driving the market growth include increasing awareness regarding the harmful effects of consuming inorganic trace minerals containing heavy metal contaminants.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.