- Home

- »

- Animal Health

- »

-

Animal Identification Market Size, Industry Report, 2030GVR Report cover

![Animal Identification Market Size, Share & Trends Report]()

Animal Identification Market (2025 - 2030) Size, Share & Trends Analysis Report By Animal Type (Companion Animals, Livestock Animals), By Solution (Hardware, Software), By Usage (Permanent, Non Permanent), By Procedure, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-085-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Animal Identification Market Summary

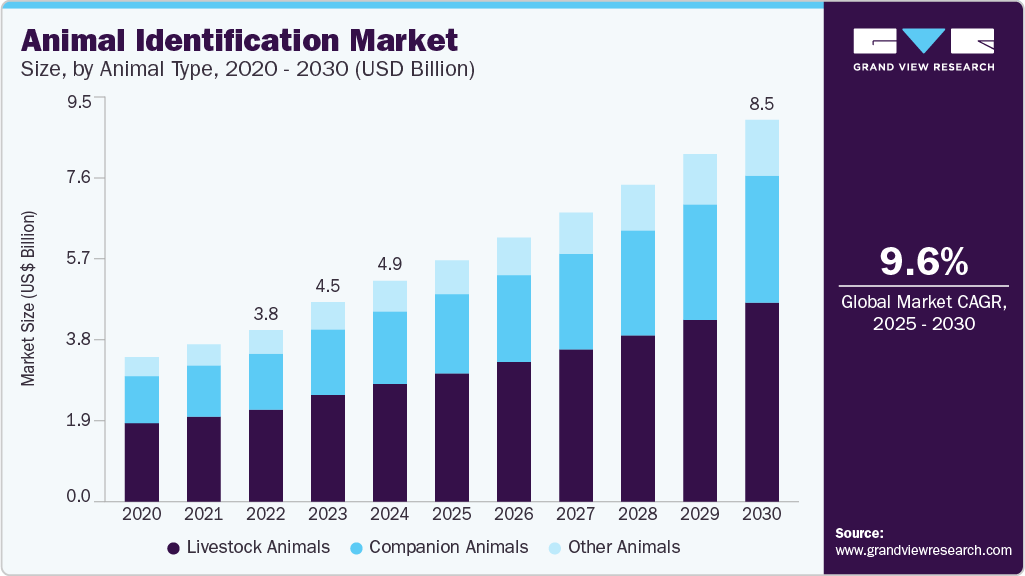

The global animal identification market size was estimated at USD 4.94 billion in 2024 and is projected to reach USD 8.55 billion by 2030, growing at a CAGR of 9.61% from 2025 to 2030. Key Market growth drivers include increasing the Usage of livestock animal tag/ID systems to enhance animal health surveillance & disease eradication measures, easy tracking of animal mortality rate, vaccination status, import & export regulations, and production rates, among others.

Key Market Trends & Insights

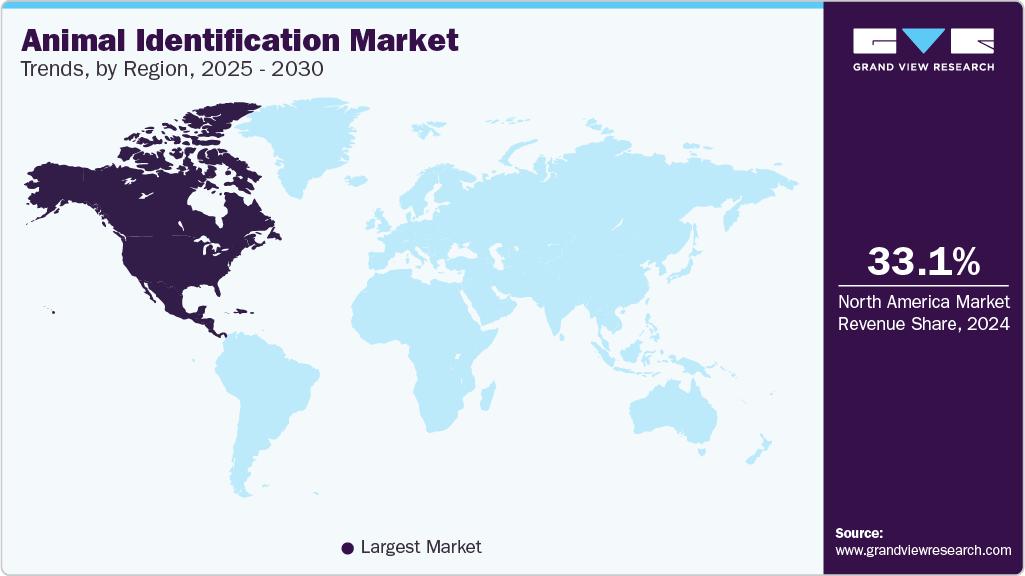

- The North America animal identification market held a 33.08% share of the global market in 2024.

- The animal identification market in the U.S. is expected to grow significantly over the forecast period due to an increasing focus on disease prevention, food safety, and livestock traceability.

- Based on animal type, the livestock animals segment generated the largest revenue share of 53.31% in 2024.

- In terms of solution, the hardware segment dominated the market with the highest revenue share of 49.49% in 2024.

- On the basis of usage, The non-permanent segment held the dominant revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.94 billion

- 2030 Projected Market Size: USD 8.55 billion

- CAGR (2025-2030): 9.61%

- North America: Largest market in 2024

Rapid identification of disease outbreaks and regional compartmentalization can limit disease spread and minimize the respective economic impacts. In addition, technological advancements in animal healthcare have enabled farmers and other animal owners to use real-time tracking systems that simplify the monitoring processes with early emergency detection.

Several ranchers and farmers prefer keeping track of individual livestock to exploit & identify desirable production characteristics such as “hormone-free,” “grass-fed,” and “organic” to command premium prices in retail markets. To support this, a verification program called ‘Agricultural Marketing Service’ has been launched by USDA to provide “Process Verified” labels to such livestock suppliers. This voluntary, fee-for-service program enables farmers to have claims, such as breed labels, thereby increasing their domestic marketing opportunities. Furthermore, animal identification systems can contain the spread of foodborne illnesses by tracking the product back to the production unit and helping authorities prevent the stem of future incidents.

Associated benefits of tagging livestock, companion, wild, and laboratory animals include helping owners maintain the record of animals, enabling easy choice for replacement stock before breeding seasons, tracking behavior & movement, establishing ownership, mandatory requirement for insurance claims, and managing or studying laboratory animals in case of research purposes. Moreover, in situations of natural disasters, animal ID systems could be significantly used to locate, track, and rescue at-risk animal populations. As animal tracking devices & integrated ID systems are entirely automated, individual or manual attention is eliminated. Increasing awareness among pet owners to use IoT-enabled devices or wearable collars that track the location of pets has benefited owners by notifying immediate alerts on their smartphones or watches. Therefore, several vital advantages of animal ID systems contribute to their increased adoption and substantial market growth.

Animal Type Insights

The livestock animals segment generated the largest revenue share of 53.31% in 2024. The governments of various countries around the globe have mandated official ID systems for livestock animals before moving them inter-state or across the state lines for public sale or any other events. For instance, in May 2024, The USDA’s Animal and Plant Health Inspection Service (APHIS) mandated electronic identification (EID) tags for certain cattle and bison in interstate movement, effective 180 days after the publication of a new rule. This regulation enhances traceability, enabling rapid response to disease outbreaks and minimizing impacts on farms and markets. States and tribal nations will oversee intrastate traceability efforts.

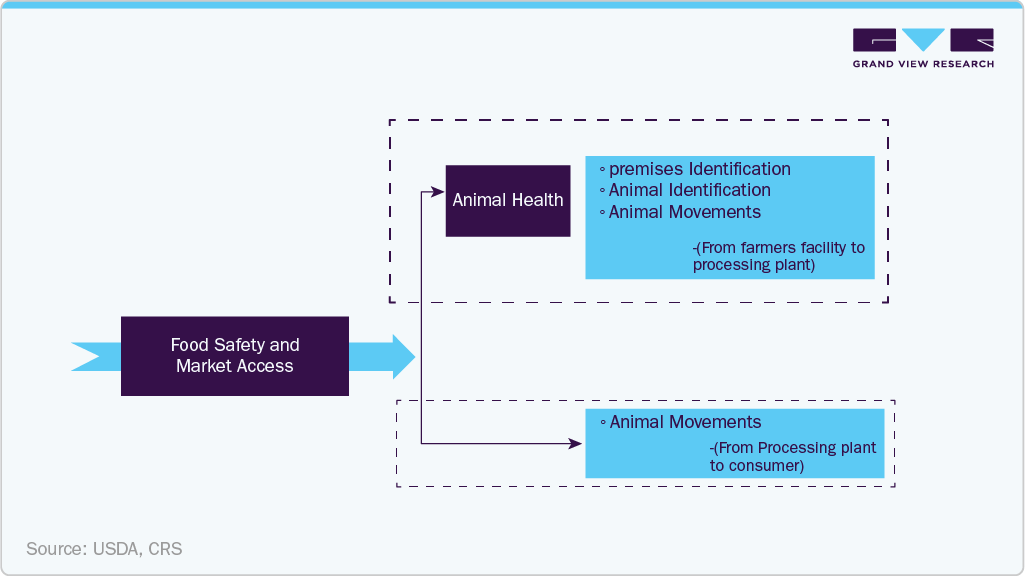

According to USDA and Congressional Research Service, animal ID goals expand with the level of traceability as per the following figure:

Similarly, every cattle in the U.S. must have official and registered ear tags to identify & record each animal. This legal requirement was implemented to control and prevent disease outbreaks. The French government has made it compulsory for sheep and goats to be double Ear tagged with RFID systems since 2010. These factors support the largest revenue generated by the livestock animal segment. On the other side, the other animal segment is anticipated to grow at the fastest CAGR of 10.63% during the projected timeline. This is owing to the large implementation of wildlife policies with necessary identification systems. For instance, the Australian Department for Environment & Water reported that the Wildlife Ethics Committee of the country recommends specific microchip implant sites and methods of administration for wild species to track their activities & records.

Solution Insights

The hardware segment dominated the market with the highest revenue share of 49.49% in 2024. This segment further comprises electronic hardware, visual hardware, and applicators or consumables used in animal identification processes. Growing government intervention in mandating electronic or RFID tags to manage livestock movement within or across state lines, increasing adoption of GPS-based identification collars for pet animals, and growing implementation of the microchipping process for wild animals contribute to the largest share of the electronic hardware segment.

The United States Department of Agriculture, USDA, recommends that livestock producers use government-certified RFID tags that are commercialized in two forms (button tags or full tags), each with a readable registered ID number. In the U.S., since January 2023, RFID tags have been approved as the only official identification device for moving cattle species. These factors further support the market share of the hardware segment. On the other side, the software segment is anticipated to grow at the fastest CAGR of about 10.5% during the forecast period, owing to the growing availability of cloud-based software for remote monitoring, record maintenance, and alert notifying features within smartphones or smartwatches.

Usage Insights

The non-permanent segment held the dominant revenue share in 2024. This segment comprises the largely adopted ID systems such as RFID ear or body tags, GPS-based wearables, visual tags, paints, and temporary branding, among others. These non-permanent solutions are considered reliable, reusable, and flexible solutions for tagging animals such as livestock. For instance, RFID tags provide an easy & simple way to track each animal's breeding history and medical records, including poaching.

The non-permanent segment is also expected to grow at the fastest CAGR of 9.89% over the forecast period, owing to the increasing technological advancements and government regulations in RFID tag systems. The permanent usage segment is also notably growing, with a significant share in 2024 attributed to the rising adoption of microchips for companion and wild animals. For example, every European Union member country requires pet microchip implantation compulsorily before shipping or traveling, owing to its tremendous importance. Similarly, the Indian government states that obtaining an ISO-compatible microchip is recommended before relocating or transporting companion animals within the country.

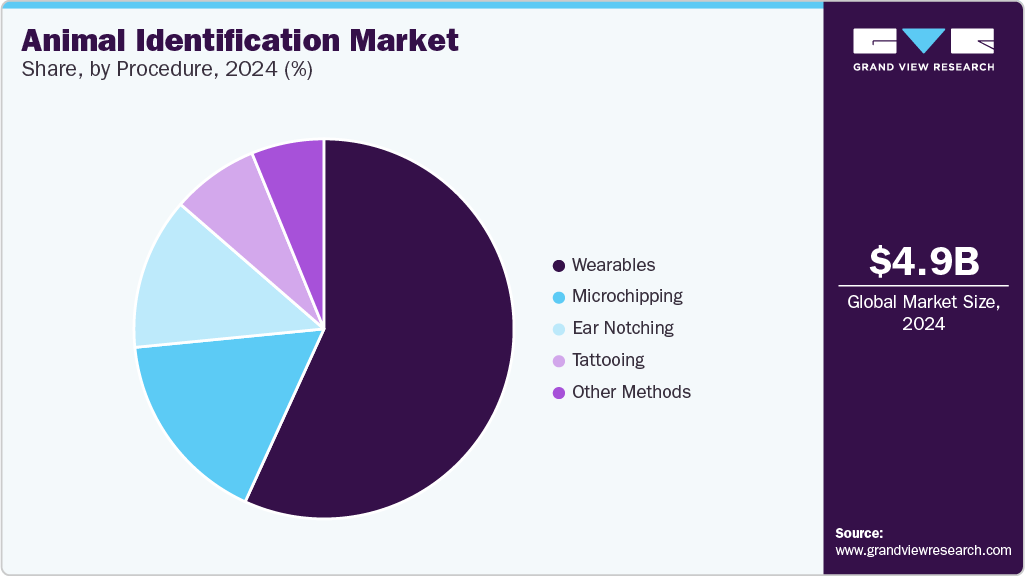

Procedure Insights

The wearable segment dominated the market with a revenue share of 56.81% in 2024. Recent advancements in wearable technologies have customized identification devices to meet the specific requirements of individual animals, such as livestock, pets, wild, or lab species. The tags that are GPS or RFID-enabled allow animal owners to track or record animal activities & locations remotely through IoT (Internet of Things) capabilities. In addition, wearable sensor-based collars are gaining traction in the companion animal space owing to their growing needs and awareness of the benefits among pet parents.The conjunction of these wearable devices with mobile applications has further eased the process of remote animal identification.

On the other side, the microchip procedure segment is anticipated to grow at the fastest CAGR of 10.62% over the forecast period. This growth is attributed to the growing microchip technology used to mark the animals permanently for lifetime identification requirements. A registered microchip ID system provides the owners with up-to-date contact information in the recovery database of implanted animals. Other procedures, such as notching, branding, and tattooing, are still prevalent in developing countries, such as India, China, and Brazil, to mark their animals temporarily or permanently.

Regional Insights

The North America animal identification market held a 33.08% share of the global market in 2024. The significant share can be attributed to the strong presence of key players, growing animal population coupled with respective disease monitoring & traceability measures, improved infrastructure & technological advancements in animal tag production, increased pet & animal care expenditure, and revised regulatory norms for livestock & wild animal identification processes, among others. Moreover, the growing wildlife conservation measures in the region have enabled essential tagging systems for endangered species to maintain routine records of animals.

U.S. Animal Identification Market Trends

The animal identification market in the U.S. is expected to grow significantly over the forecast period due to an increasing focus on disease prevention, food safety, and livestock traceability. The adoption of electronic identification (EID) technologies like RFID tags is expanding, driven by USDA regulations and consumer demand for transparency. For instance, dairy farms often integrate RFID tags into herd management systems to monitor health and productivity efficiently. Advances in IoT and blockchain further enhance traceability, bolstering market growth.

Europe Animal Identification Market Trends

The Europe animal identification market is influenced by factors such as stringent regulatory frameworks, animal disease prevention, and trade requirements. Initiatives like DAERA's introduction of 'XI' prefix livestock tags in June 2024 highlight the shift towards standardized systems to ensure traceability and compliance with export regulations. From 24 June 2024, new livestock tags with the 'XI' prefix will replace 'UK' tags, which will no longer be available for purchase. Existing 'UK' tags can be used until the final switchover in January 2025. DAERA advises using 'XI' tags for newborn animals, especially those intended for export, to avoid re-identification. Additionally, technological advancements like RFID tags and blockchain enhance efficiency and transparency in tracking livestock movement, further driving market adoption.

The animal identification market in the UK held the largest share of the European market in 2024. The market is driven by stringent government regulations and advancements in traceability technologies. Initiatives like mandatory livestock tagging for disease control, welfare monitoring, and meeting international trade requirements fuel market growth, while innovations in RFID and DNA-based identification methods enhance accuracy and efficiency in animal management.

Asia Pacific Animal Identification Market Trends

The Asia Pacific animal identification market is anticipated to grow at the fastest CAGR of 10.86% over the projected period. Significantly improving measures for animal healthcare with disease traceability/eradication programs in developing countries, such as India and Australia, contribute to the growth. For instance, the Australian government announced in September 2022 that the country will mandate that every sheep and goat have electronic identification tags starting from January 1, 2025. Similar commitments are being routinely implemented by various Asian countries as a national approach to enhancing livestock traceability systems.

The animal identification market in India is experiencing significant growth due to increasing focus on livestock management, disease control, and regulatory compliance. For instance, in October 2024, Ahmedabad Municipal Corporation (AMC) proposed mandatory RFID microchip implants and visual ear tags for the city's estimated 2 lakh pet and stray dogs, aiming to improve identification, sterilization, and vaccination tracking under the Prevention of Cruelty to Animals Act and ABC Rules. Such initiatives showcase the rising adoption of modern identification methods. Additionally, government programs for cattle tagging under schemes like the National Animal Disease Control Programme (NADCP) emphasize traceability and health monitoring, driving market expansion.

Similarly, in December 2024, India achieved a historic milestone with the first-ever satellite tagging of the Ganges River Dolphin in Assam, marking a significant advancement in wildlife conservation. This initiative, part of Project Dolphin, aims to enhance understanding of the species' migratory patterns and habitat needs. The tagging underscores India's growing focus on animal identification and conservation technologies, which contribute to wildlife research and ecosystem management.

Latin America Animal Identification Market Trends

The Latin America animal identification market is witnessing growth driven by increasing regulatory requirements and technological advancements in livestock traceability. Initiatives like Brazil's mandatory traceability for cattle and buffalo and rising demand for exportable meat products are boosting the adoption of electronic identification solutions. This trend enhances animal health monitoring, improves disease management, and meets international market standards.

The animal identification market in Brazil is set for significant growth as the government mandates traceability for cattle and buffalo by 2032. Starting in 2027, individual identification using electronic ear or flag tags will be implemented. This will enhance animal health, improve disease outbreak management, and meet international sanitary standards, potentially unlocking new export opportunities, including markets like Japan and South Korea.

Middle East & Africa Animal Identification Market Trends

The Middle East & Africa animal identification market is growing due to increasing livestock management needs and government initiatives to track animal movements for health and safety. Technological advancements, such as RFID tagging, are enhancing the efficiency of animal monitoring, particularly in countries like Saudi Arabia and South Africa, where agriculture and livestock farming are vital.

The animal identification market in South Africa is experiencing significant growth due to growing demand for livestock traceability to meet export standards and improve disease management. Technologies like RFID tagging and digital traceability systems are increasingly adopted, reflecting global trade and biosecurity priorities. For instance, in January 2025, Kenya's government plans to launch "Anitrack," a digital livestock identification and traceability system, to register and monitor livestock, enhancing product safety and combating cattle rustling. In South Africa, the red meat industry is adopting a phased approach to livestock traceability, recognizing its importance for disease management and economic benefits. These initiatives reflect a broader regional commitment to improving livestock management and market access through advanced identification systems.

Key Animal Identification Company Insights

The major players in the animal identification indutsry, such as Merck Animal Health, Avid Identification Systems, Inc., Datamars, and Shearwell Data Limited, are constantly implementing strategic measures such as geographical expansion, acquisitions, mergers, collaborations, partnerships, and product or service launches.

Key Animal Identification Companies:

The following are the leading companies in the animal identification market. These companies collectively hold the largest market share and dictate industry trends.

- Merck & Co., Inc.

- Avid Identification Systems, Inc.

- Datamars

- HID Global Corporation, part of ASSA ABLOY

- Shearwell Data Limited

- AEG Identification Systems

- AVERY DENNISON CORPORATION

- GAO RFID

- Fitbark

- RFID, INC.

Recent Developments

-

In January 2025, HID signed an agreement to acquire 3millID and Third Millennium, expanding its portfolio of access control solutions, including animal identification technologies. This acquisition enhances HID’s global presence and product offerings, particularly in North America and Europe, to serve enterprise and government clients more effectively.

-

In July 2024, Somark introduced the world’s smallest RFID fish tag, Digifish™, designed to enhance identification in both laboratory and environmental research. At just 6mm in length, the bioinert tag ensures animal welfare and improves data accuracy in biomedical studies. With its use already expanding in preclinical research, it offers a significant advancement in tracking small fish species like zebrafish and salmonids.

-

In February 2024, ID Tech, an Indian company specializing in RFID animal identification, received ICAR certification for its RFID injectable transponders, marking a significant achievement in livestock technology. These subcutaneously injected transponders, designed for minimal animal discomfort, ensure global uniqueness and reliability, supporting enhanced animal welfare, breeding, and livestock management. This certification underscores ID Tech's commitment to international standards and innovation in agricultural and animal husbandry technologies.

Animal Identification Market Report Scope

Report Attribute

Details

The market size value in 2025

USD 5.40 billion

The revenue forecast in 2030

USD 8.55 billion

Growth rate

CAGR of 9.61% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion & CAGR in % from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Animal type, solution, usage, procedure

Regions covered

North America; Europe; Asia Pacific, Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain;Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Merck & Co., Inc.; Avid Identification Systems, Inc.; Datamars; HID Global Corporation, part of ASSA ABLOY; Shearwell Data Limited; AEG Identification Systems; AVERY DENNISON CORPORATION; GAO RFID; Fitbark; RFID, INC.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Identification Market Report Segmentation

This report forecasts revenue growth at the global, regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global animal identification market report based on the animal type, solution, usage, procedure, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animals

-

Livestock Animals

-

Other Animals

-

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Electronics

-

Visual

-

Applicators & Consumables

-

-

Software

-

Services

-

-

Usage Outlook (Revenue, USD Million, 2018 - 2030)

-

Permanent

-

Non-Permanent

-

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Wearables

-

Microchipping

-

Ear Notching

-

Tattooing

-

Other Methods

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global animal identification market size was estimated at USD 4.94 billion in 2024 and is expected to reach USD 5.40 billion in 2025.

b. The global animal identification market is expected to grow at a compound annual growth rate (CAGR) of 9.61% from 2025 to 2030 to reach USD 8.55 billion by 2030.

b. North American region held over 33% revenue share of the animal identification market in 2024, owing to the large presence of key players, growing animal population coupled with respective disease monitoring & traceability measures, improved infrastructure & technological advancements in animal tag production, and increased pet & animal care expenditure.

b. Some key players operating in the global animal identification market include Merck & Co., Inc.; Avid Identification Systems, Inc.; Datamars; HID Global Corporation, part of ASSA ABLOY; Shearwell Data Limited; AEG Identification Systems; AVERY DENNISON CORPORATION; GAO RFID; Fitbark; and RFID, INC., among others.

b. Some of the key factors driving the animal identification market growth include growing government initiatives to prevent or eradicate disease outbreaks among livestock species, increasing mandatory adoption of electronic or RFID identification systems for moving animals, rising requirement for registered animal tagging to claim insurance coverages, and ample availability of automated record maintenance platforms for remote animal monitoring.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.