- Home

- »

- Clothing, Footwear & Accessories

- »

-

Watches Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Watches Market Size, Share & Trends Report]()

Watches Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Analog, Digital), By Price Range (Economy, Premium, Mid-range, Luxury), By End User (Men, Women), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-947-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Watches Market Summary

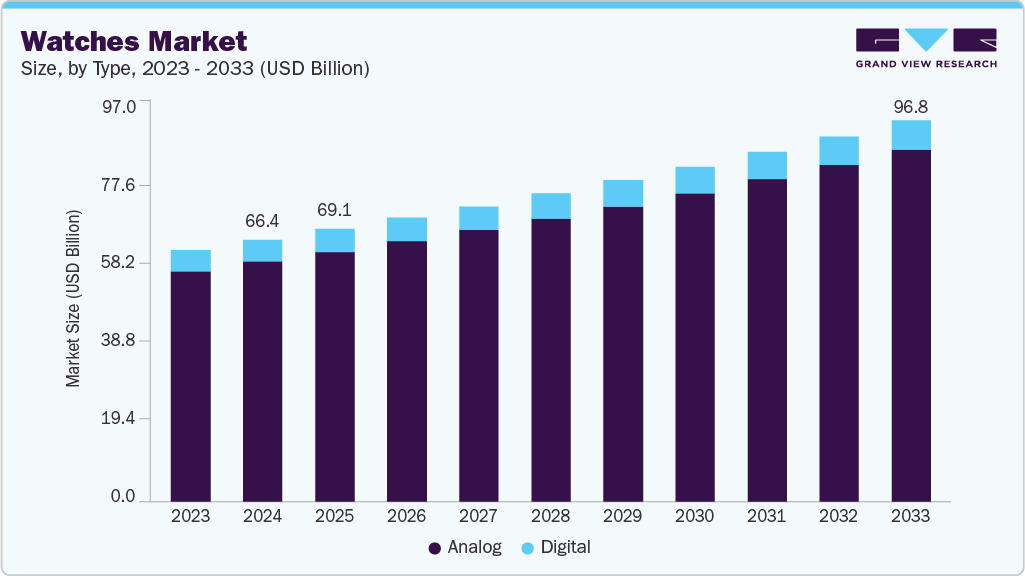

The global watches market size was estimated at USD 66.38 billion in 2024 and is projected to reach USD 96.81 billion by 2033, growing at a CAGR of 4.3% from 2025 to 2033. This growth can be attributed to the rising demand for premium and mid-range quartz and mechanical watches, driven by consumers seeking precision, craftsmanship, and stylish everyday timepieces.

Key Market Trends & Insights

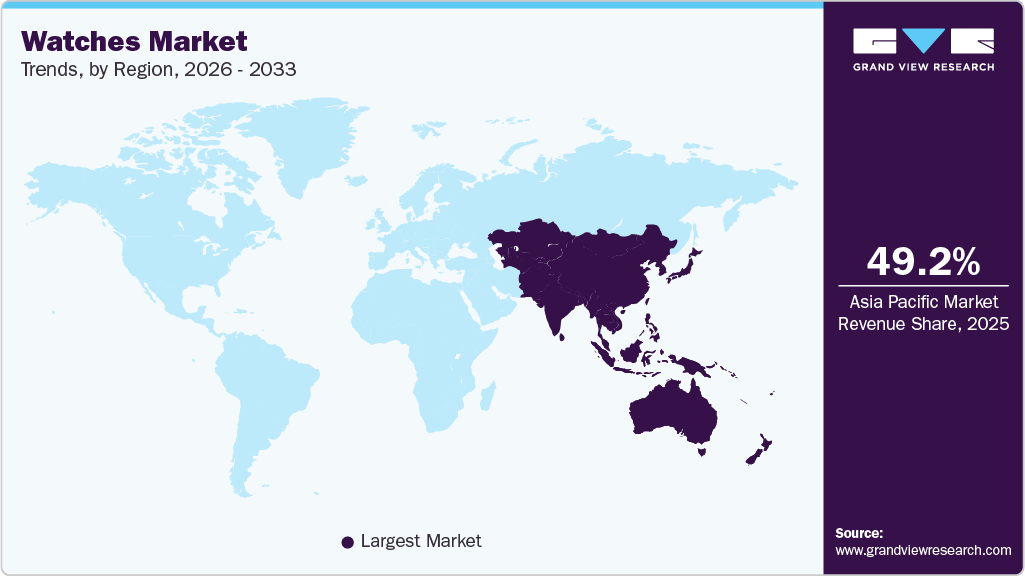

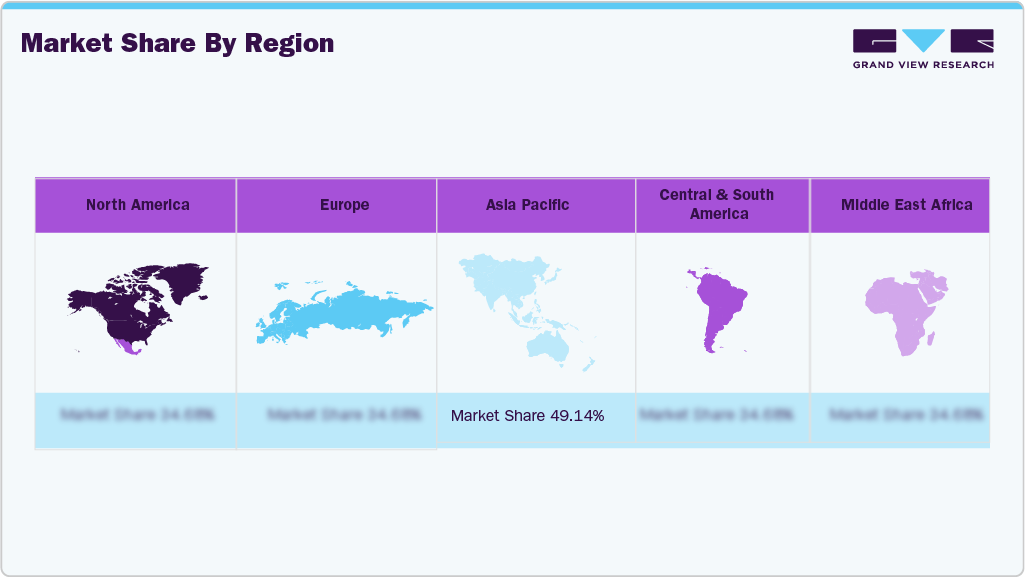

- By region, Asia Pacific held a market share of 49.14% in 2024.

- The U.S. watch market is expected to see a CAGR of 4.2% from 2025 to 2033.

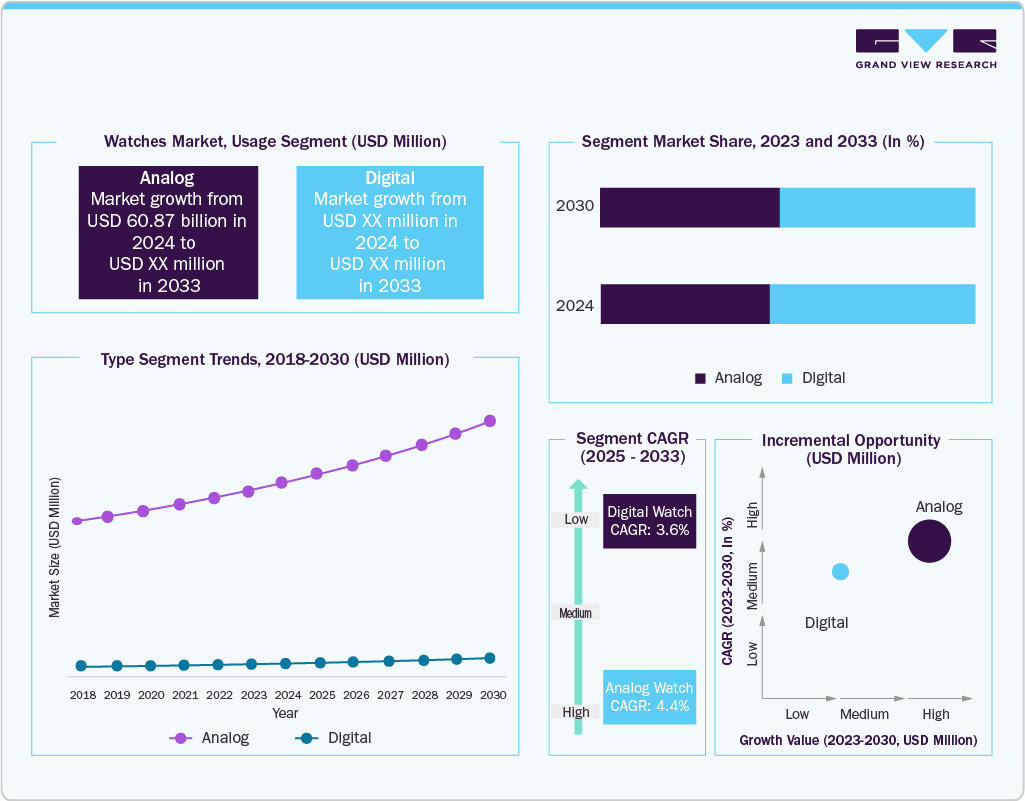

- By type, analog watches led the market with a revenue share of 91.69% in 2024.

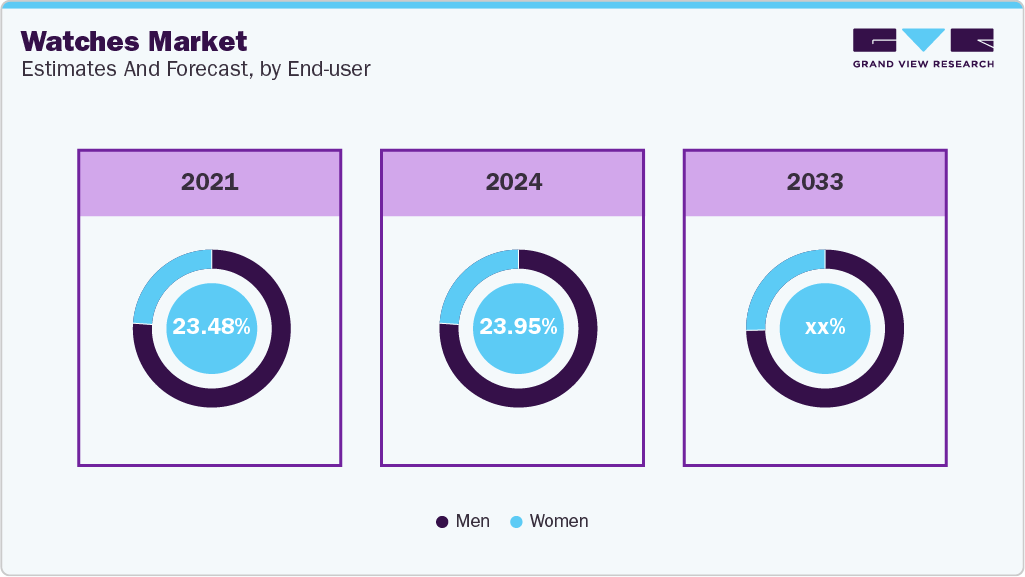

- By end user, men led the market with the largest revenue share of 76.05% in 2024.

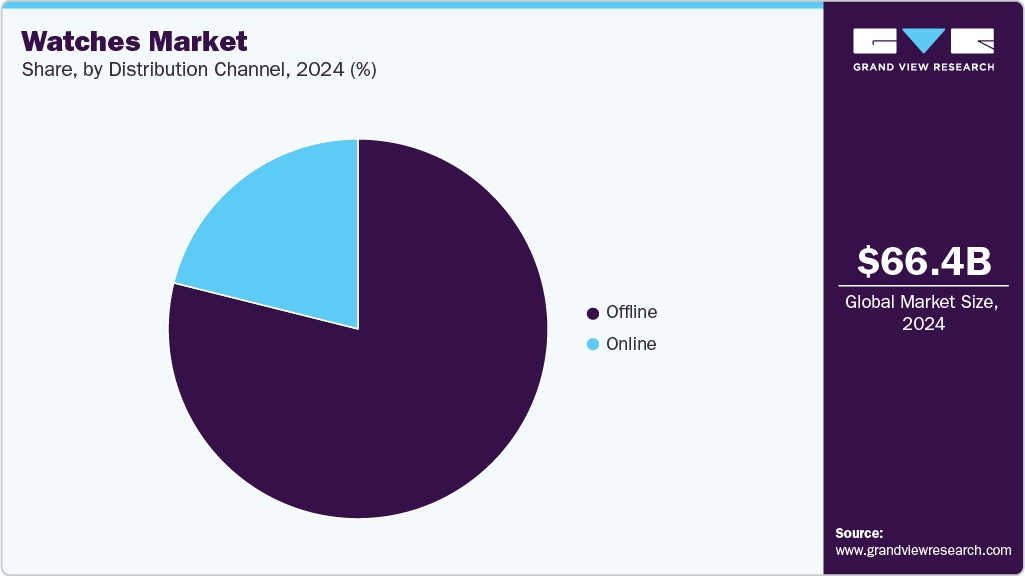

- By distribution channel, the offline sales held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 66.38 Billion

- 2033 Projected Market Size: USD 96.81 Billion

- CAGR (2025-2033): 4.3%

- Asia Pacific: Largest market in 2024

A key trend in the global traditional watches industry is the rising popularity of compact, minimalist quartz watches that combine precision with everyday wear. Across regions, from Europe’s stylish cities to Asia’s urban millennials, consumers are increasingly choosing slimmer, versatile designs over bulky or purely mechanical models. This shows a global shift toward functional yet trendy timepieces.A sustained consumer preference for classic craftsmanship and long-term value continues to drive growth in the traditional watch market. According to an article by Luxury Tribune, published in October 2025, 26% of consumers still wear traditional watches. Furthermore, purchasing intentions remain robust, with 54% of respondents planning to buy a mechanical or quartz watch within the next year. This strong purchase intent reflects the enduring appeal of traditional timepieces as symbols of personal identity, heritage, and status. Many consumers view these watches not only as functional accessories but also as collectible assets that retain emotional and resale value over time, which continues to support steady demand across both mid-range and luxury price segments.

Beyond affordability, functionality, and product quality have become decisive purchase drivers in the traditional watches market, particularly in value-focused regions. According to a 2025 analysis by Clootrack based on 10,691 consumer surveys in India, daily usability emerged as the top factor influencing adoption, indicating that consumers prefer watches suitable for regular wear rather than purely fashion-led accessories. Warranty expectations ranked second, with buyers demanding a minimum of 1-2 years of coverage as a measure of long-term reliability. The study also highlighted that competitive pricing within the affordable-to-mid range, design that reflects personal style, and durability features such as strap strength and water resistance significantly influence brand preference. This suggests that consumers now evaluate watches as a balance of practicality, aesthetics, and value rather than price alone.

Emerging markets are becoming a key demand driver for the traditional watch industry as rising disposable incomes fuel aspirational purchasing. According to an article by Luxury Tribune published in October 2025, India’s watch imports grew nearly 7% between January and August 2025 and approximately 30% over the past two years, reflecting sustained consumer appetite for international brands.

JCK Online reported in October 2025 that 62% of consumers in Mexico are considering the purchase of a traditional watch, positioning Latin America as another growth market. At the same time, global trade policies are reshaping pricing and supply strategies; JCK Online noted that a 39% tariff on Swiss watch imports into the U.S. took effect in August 2025, prompting brands such as Rolex and Patek Philippe to implement price increases, which has introduced pricing uncertainty and moderated near-term demand in the U.S. watches market.

Consumer Insights

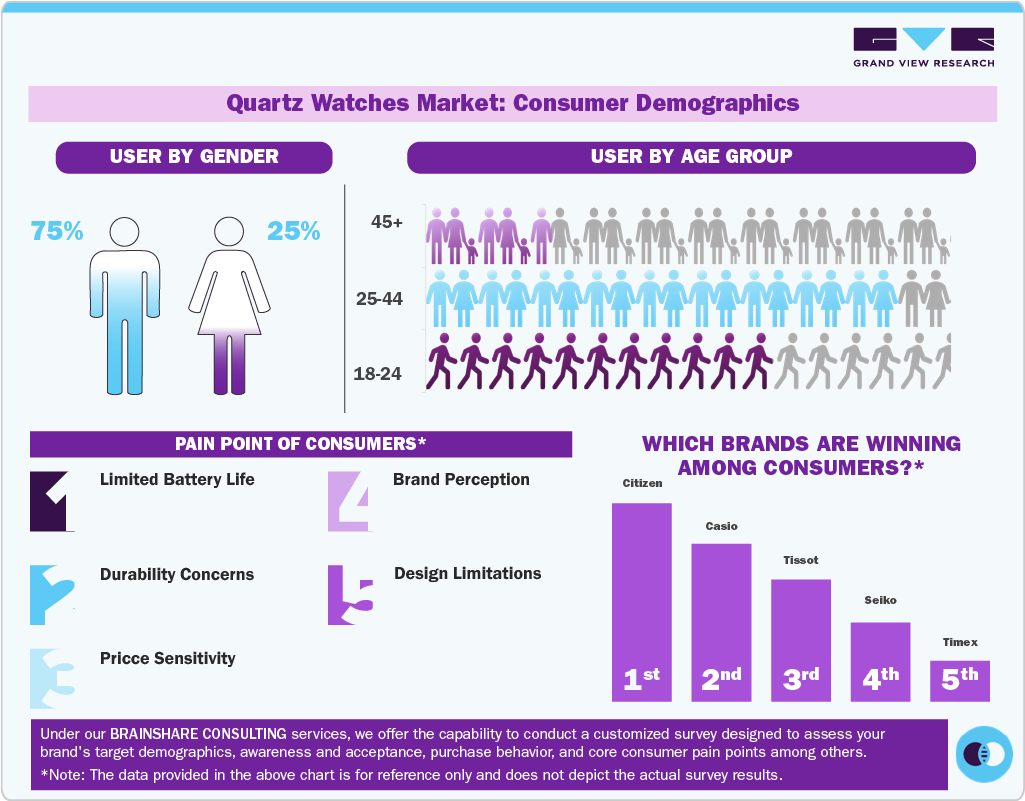

The global traditional watch market is mainly made up of male users, who represent about 75% of consumers, while women make up 25%. This imbalance comes from the long-standing belief that watches are masculine status symbols and collectible items, especially in the mechanical and luxury categories. Men see watches not only as practical accessories but also as ways to express personal identity, appreciate craftsmanship, and invest. Although female participation is smaller, it is slowly increasing as fashion and premium lifestyle brands expand their women-specific collections in mid and affordable luxury ranges.

In terms of age distribution, consumers aged 25 to 44 make up the largest group at 48%. This age range includes working professionals with increasing buying power who purchase watches for professional style, luxury goals, and personal milestones. The 45 and older group accounts for 38%, made up of loyal mechanical watch buyers and collectors who value heritage brands and long-term ownership. Meanwhile, younger buyers aged 18 to 24 represent 14% of the market. Although they have a smaller share, this group is influencing future demand, particularly for affordable automatic and quartz watches from brands like Seiko, Tissot, and Citizen.

Even with steady demand, consumers face significant challenges that affect their buying decisions. High prices are the biggest barrier, especially in Europe and Asia, where import duties raise costs. Service delays and limited warranty coverage frustrate buyers in both entry-level and luxury segments due to high maintenance times and costs. The issue of counterfeit products is serious in markets like India, Southeast Asia, and the Middle East, especially for popular Swiss and Japanese brands. Import taxes raise final retail prices in many growing markets, making it hard for middle-income buyers to access products. These challenges are driving demand toward local distributors and certified pre-owned sellers.

Among brands, Rolex continues to lead in global consumer preference due to its unmatched brand strength, resale value, and prestige. Seiko and Citizen are prominent in the mid-range category, viewed as reliable daily-use brands with strong movements. Tissot is favored by first-time luxury buyers, especially in Europe and Asia, due to its accessible Swiss quality. Omega has a strong appeal due to its sports heritage and design credibility. These brands succeed by balancing durability, heritage value, and wide product availability, ensuring relevance across income levels and regions.

Type Insights

Analog watches led the watch industry with a revenue share of 91.69% in 2024, as they remain the preferred choice for consumers seeking timeless design, mechanical craftsmanship, and precision. Their dominance is reinforced by heritage brands and classic collections that appeal to both collectors and everyday users, making analog timepieces the cornerstone of the traditional watches market.

Digital watch is anticipated to witness a CAGR of 3.6% from 2025 to 2033, driven by affordable pricing, durability, and functional features such as alarms, timers, and chronographs. They appeal to consumers seeking practical, easy-to-read timepieces for everyday use, sports, and casual wear, maintaining steady demand alongside analog watches.

Price Range Insights

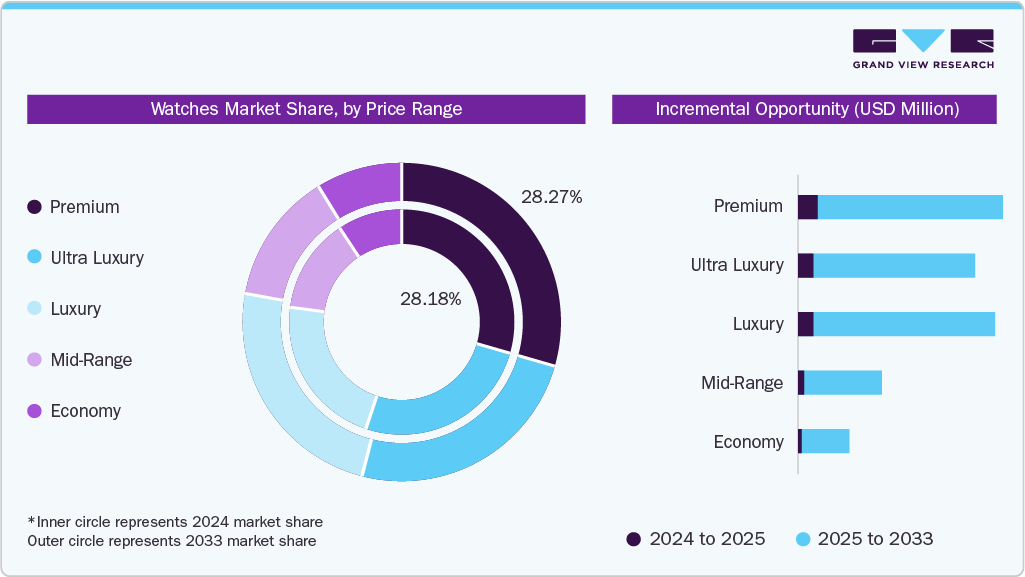

Premium watches accounted for 28.18% of global watch revenue in 2024, driven by their role as luxury status symbols, investment assets, and heirloom pieces with prices far above mass-market alternatives. The segment benefits from strong brand equity and heritage craftsmanship, with Swiss makers like Rolex, Patek Philippe, and Audemars Piguet achieving unit prices ranging from thousands to hundreds of thousands of dollars. According to an article by JCK published in October 2025, the premium segment shows resilience through value retention, with 16% of consumers considering resale value when buying new and 17% of secondhand buyers viewing purchases as investments. Although premium watches make up fewer units, their much higher prices generate a disproportionately large share of market revenue.

Luxury watches are anticipated to grow at a CAGR of 4.8% from 2025 to 2033, driven by rising demand in emerging markets, investment appeal, and evolving consumer demographics. Increasing disposable incomes across Asia-Pacific markets such as China, India, Japan, and Singapore are expanding the high-net-worth consumer base seeking luxury timepieces as status symbols.

According to an article by Finshots, published in September 2024, 78% of Indian consumers plan to buy a watch for themselves within the next year, while the Knight Frank Luxury Investment Index reports that luxury watches have appreciated 138% over the past decade, surpassing art as a top investment choice for affluent Indians.

End User Insights

Watches for men accounted for 76.05% of the watches market in 2024, primarily due to the long-standing perception of watches as a male accessory and status symbol, especially in mechanical and luxury segments. Men are more likely to purchase watches as personal style statements, professional accessories, and collectibles. The dominance of mid-range and luxury mechanical watches, which historically target male buyers, further reinforces this skew, with brands like Rolex, Omega, and Seiko designing collections that emphasize masculine aesthetics, larger case sizes, and technical features appealing to male consumers.

Watches for women are anticipated to witness a CAGR of 5.0% from 2025 to 2033, driven by increasing fashion-consciousness, rising disposable incomes, and expanding availability of female-focused collections. Brands are introducing designs that combine style, functionality, and luxury appeal, attracting both first-time buyers and collectors. Additionally, growth in emerging markets and the rising popularity of affordable luxury and mid-range watches for women are supporting steady demand in this segment.

Distribution Channel Insights

The sale of watches through offline channels accounted for 75.92% of the watch industry. Physical retail remains dominant in the watches industry, driven by consumers’ preference for hands-on experiences and personal interaction. According October 2025 article by JCK, 60% of consumers prefer buying luxury watches in brick-and-mortar stores, citing the ability to try and test products (51%), personal interaction with sales staff (44%), and convenience or proximity (39%) as key motivators.

The sale of watches through the online channels is expected to grow at a CAGR of 5.6% from 2025 to 2033, driven by 24/7 convenience, easy price comparison, and wider product selection. Growth is particularly strong in emerging markets and mid-range segments, as consumers increasingly embrace digital platforms for research and purchase, complementing traditional brick-and-mortar experiences.

Regional Insights

The Asia Pacific watches market accounted for a global revenue share of 49.14 % in 2024, driven by rapidly growing disposable incomes, rising brand awareness, and a strong appetite for luxury and mid-range watches. Countries like China, India, Japan, and Singapore are key contributors, with consumers increasingly purchasing watches as status symbols, fashion accessories, and investment items. The region’s large population, expanding middle class, and growing presence of international and regional brands continue to make APAC the largest revenue contributor globally.

In December 2024, Seiko launched the Asia Pacific-exclusive Grand Seiko SBGJ283, limited to 150 pieces. The watch features a Washi-inspired off-white dial with a red Kozo GMT hand, a 40 mm Ever-Brilliant Steel 44GS case with Zaratsu finishing, and dual-curved sapphire. Powered by the hi-beat Caliber 9S86 with quick-set GMT, it offers 10 bar water resistance. It comes with a steel bracelet plus a brown crocodile strap, available only at Grand Seiko boutiques and authorized retailers in Asia Pacific.

North America Watches Market Trends

The North America watch market is projected to grow at a CAGR of 4.4% from 2025 to 2033, supported by a mature consumer base that values heritage, mechanical craftsmanship, and brand prestige. Strong demand in the luxury segment, particularly for Swiss watches, sustains growth, while mid-range watches gain traction through multi-brand retailers. Online sales are gradually rising, but brick-and-mortar stores remain dominant, reflecting the preference for in-person shopping and expert guidance.

U.S. Watches Market Trends

The U.S. watch market is expected to see a CAGR of 4.2% from 2025 to 2033, shaped by premium and aspirational consumer segments, where buyers prioritize brand heritage, quality, and investment potential. Offline retail dominates, particularly for high-value purchases, with consumers emphasizing tactile experience, personal interaction, and after-sales service. The growth of mid-range watches and the support market expansion among younger, value-conscious buyers.

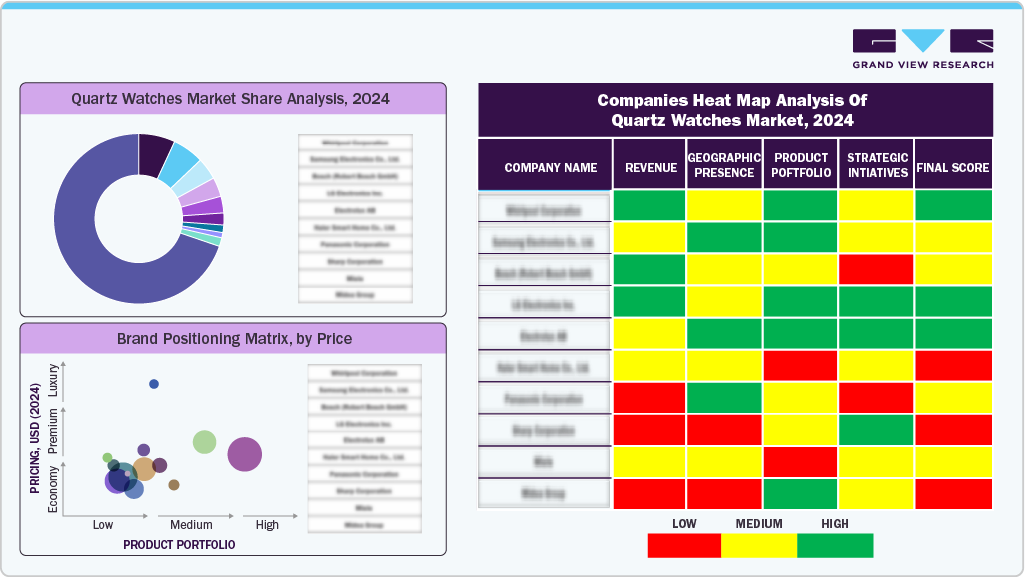

Key Watch Company Insights

The global watch market is shaped by a mix of heritage brands, premium luxury houses, and rising regional players, each catering to different consumer segments.

Iconic Swiss and Japanese brands like Rolex, Omega, Grand Seiko, and Citizen lead the premium and mid-range segments, leveraging craftsmanship, precision, and brand prestige to appeal to collectors and enthusiasts.

Luxury-focused labels such as Patek Philippe and Audemars Piguet target affluent buyers seeking investment-grade timepieces and status symbols.

At the same time, regional players like Titan in India and Seiko in select Asian markets focus on affordable mechanical and quartz models, capturing value-conscious consumers and broadening market reach in emerging economies, reinforcing the overall global footprint of traditional watches.

Key Watches Companies:

The following are the leading companies in the watch market. These companies collectively hold the largest market share and dictate industry trends.

- Rolex

- Omega

- Seiko

- Citizen

- Tissot

- Casio

- Patek Philippe

- Audemars Piguet

- Longines

- Timex

Recent Developments

-

In September 2025, Citizen announced that it will be launching three new quartz-powered Eco-Drive Promaster Skyhawk watches in October 2025, featuring the Caliber U830 movement. Housed in 43mm stainless steel cases with sapphire glass, they are priced between USD 795 and USD 850.

-

In November 2024, Tissot added a new 25 mm quartz model to its PRX collection. This watch combines the brand’s 1970s integrated-bracelet design with a modern touch. The watch includes a Swiss quartz movement with an End-of-Life indicator and is water-resistant up to 100 m. Available in several finishes, including carnation-gold PVD, it appeals to those looking for an elegant, vintage-inspired timepiece that is also compact and durable.

-

In May 2024, Audemars Piguet introduced a set of three compact Royal Oak models powered by quartz, each featuring a petite 23mm diameter.

Watches Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 69.10 billion

Revenue forecast in 2033

USD 96.81 billion

Growth rate

CAGR of 4.3% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/ billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, price range, end user, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; Australia & New Zealand ; South Korea; Thailand; Singapore; Brazil; South Africa

Key companies profiled

Rolex; Omega; Seiko; Citizen; Tissot; Casio; Patek Philippe; Audemars Piguet; Longines; Timex

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Watches Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global watches market report based on type, price range, end user, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Analog

-

Mechanical

-

Quartz

-

Digital

-

-

Price Range Outlook (Revenue, USD Million, 2021 - 2033)

-

Economy

-

Mid-range

-

Premium

-

Luxury

-

Ultra Luxury

-

-

End User Outlook (Revenue, USD Million, 2021 - 2033)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

Singapore

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global watches market size was estimated at USD 66.38 billion in 2024 and is expected to reach USD 69.10 billion in 2025.

b. The global watches market is expected to grow at a compound annual growth rate of 4.3% from 2025 to 2033 to reach USD 96.81 billion by 2033.

b. Asia Pacific dominated the watches market with a share of 49.14% in 2024, driven by rapidly growing disposable incomes, rising brand awareness, and a strong appetite for luxury and mid-range watches. Countries like China, India, Japan, and Singapore are key contributors, with consumers increasingly purchasing watches as status symbols, fashion accessories, and investment items.

b. Some key players operating in the watches market include Rolex; Omega; Seiko; Citizen; Tissot; Casio; Patek Philippe; Audemars Piguet; Longines; and Timex

b. Key factors that are driving the market growth include rising demand for premium and mid-range quartz and mechanical watches, driven by consumers seeking precision, craftsmanship, and stylish everyday timepieces.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.