- Home

- »

- Animal Health

- »

-

Animal Pregnancy Test Kit Market Size & Share Report, 2030GVR Report cover

![Animal Pregnancy Test Kit Market Size, Share & Trends Report]()

Animal Pregnancy Test Kit Market Size, Share & Trends Analysis Report By Product (Strips, Cassettes), By Animal Type (Companion, Livestock), By Distribution Channel, By End-use, By Sample Type, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-179-4

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Animal Pregnancy Test Kit Market Trends

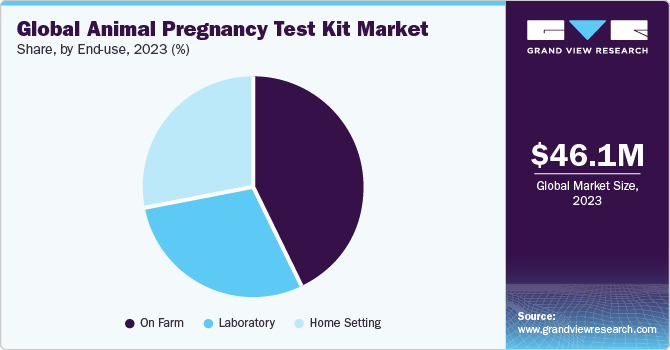

The global animal pregnancy test kit market size was estimated at USD 46.15 million in 2023 and is most likely to grow at a compound annual growth rate (CAGR) of 4.68% from 2024 to 2030. The market growth is driven by rising expenditure on animal care along with increasing animal population, technological advancements, and high demand for point-of-care diagnostics pregnancy testing in farm animals. Companies are spending on R&D to develop point-of-care diagnostic kits, including pregnancy testing kits. For instance, in November 2023, Ring Biotechnology Co. Ltd. introduced early pregnancy diagnosis for cows that can identify pregnancy as early as 28-30 days and does not require the expertise of an operator or equipment.

In addition, the expansion of livestock farming operations and increasing number of livestock farms are contributing to market growth. Growing awareness among farmers, veterinarians, and animal owners about the importance of monitoring and managing the reproductive health of animals drives demand for animal pregnancy test kits. Furthermore, efforts from governments, animal health organizations, and private entities to boost the adoption of artificial insemination for enhancing cattle reproduction and demand for tools to verify pregnancy outcomes are significant factors driving the market growth. For example, in August 2022, the Indian Ministry of Fisheries, Animal Husbandry and Dairying initiated phase IV of its Nationwide Artificial Insemination Program (NAIP).

This phase provided coverage through AI to around 33 million bovines across the country’s 604 districts having less than 50% AI coverage. The Ministry further reported the production of 2.78 million doses of sex-sorted semen in 2022 under the Rashtriya Gokul Mission. In addition, growing emphasis is placed on ensuring the welfare of animals, including proper breeding practices. Pet owners and breeders are increasingly opting for pregnancy testing to monitor the health of pregnant animals and plan for safe, healthy delivery. As a result, demand for animal pregnancy test kits is expected to grow rapidly from 2024 to 2030.

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The animal pregnancy test kit market is characterized by a high degree of innovation owing to rapid technological advancements in veterinary point-of-care diagnostic testing and the availability of a wide range of animal pregnancy testing kits for different animal species. In addition, ever-increasing investment in research and development aimed to enhance the technology behind animal pregnancy test kits is expected to boost market growth. Developing innovative and more efficient testing methods allows companies to stay competitive and meet the evolving needs of veterinarians and pet owners.

The market is also characterized by a high level of merger and acquisition (M&A) activity by some of the leading players. Acquiring companies often share access to innovative technologies developed by involved companies. This includes progressions in biochemical assays, point-of-care testing devices, or other diagnostic technologies that enhance the accuracy and efficiency of animal pregnancy testing.

Established companies engage in strategic partnerships or acquire smaller firms with the strategic aim of expanding their product portfolios, accessing new technologies, and strengthening their market presence. This trend results in creating synergies, streamlining operations, and capitalizing on harmonizing strength. For instance, in August 2023 Synlab— a German diagnostics company specializing in both human and animal health, agreed to sell its animal health diagnostics business to Mars Inc. This would enable Synlab to focus on its core competencies while SYNLAB VET is expected to thrive as part of Mars.

The market features a range of diagnostic modalities and tools, that offer multiple options for pregnancy testing to veterinarians and pet owners For example, traditional methods, such as physical examinations and abdominal ultrasound, may serve as substitutes for more advanced biochemical-based animal pregnancy testing. Biochemical-based animal pregnancy test kits allow for rapid on-site testing, reducing the need to send samples to centralized laboratories.

Companies often use regional expansion strategies to improve their market presence. This involves entering new geographic markets to tap into emerging opportunities, and reach a larger customer base while addressing the specific needs of diverse regions. Adapting products and strategies to suit regional preferences, regulatory environments, and specific healthcare needs is crucial for successful regional expansion. This may involve customizing pregnancy testing kits to meet the unique requirements and characteristics of different markets.

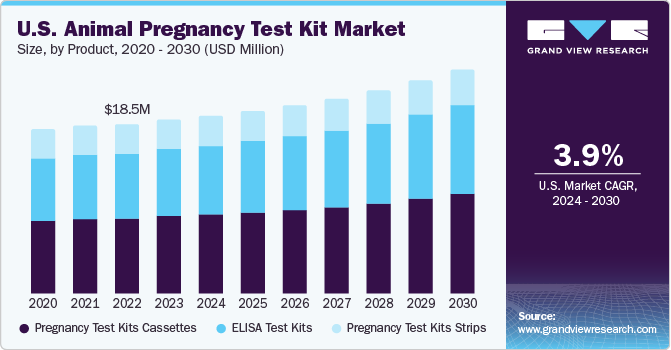

Product Insights

The pregnancy test kit cassettes product segment dominated the market with a share of 44.36% in 2023. In agricultural settings and animal husbandry, managing reproductive cycles is crucial for efficient breeding programs. Pregnancy test kit cassettes enable farmers and breeders to identify pregnant animals and plan their breeding strategies effectively. These test kits provide accurate results and the tests can be conducted by non-veterinary professionals as well. This user-friendly characteristic makes them a popular choice in the market.

The ELISA test kits segment is anticipated to grow at the fastest CAGR of 4.85% from 2024 to 2030. ELISA-based pregnancy tests are versatile and can be developed for different animal species. This adaptability makes ELISA a preferred choice among veterinary professionals working with different types of animals. Moreover, ELISA assays are known for their high sensitivity and specificity in detecting specific animal pregnancy-associated biomarkers. This accuracy is crucial for reliable and trustworthy results, contributing to their increasing adoption.

Sample Type Insights

The whole blood, plasma, and serum sample type segment accounted for the largest revenue share of 50.02% in 2023 and is expected to register the fastest CAGR from 2024 to 2030. Whole blood, plasma, and serum samples are frequently utilized in animal pregnancy testing, especially in ruminants like cattle, sheep, and goats. This method relies on detecting pregnancy-associated glycoproteins (PAGs) produced by placental cells, which are present in the blood and milk of pregnant ruminants.

This method boasts a high sensitivity of 99.3% in serum samples, offering an effective and reliable approach for early pregnancy detection in ruminant species. Furthermore, urine samples are not recommended for pet pregnancy testing due to low hormone concentrations, with serum samples being common practice for hormonal measurement. Owing to the above-mentioned factors, it is expected to witness significant demand from 2024 to 2030.

Animal Type Insights

By animal type, the livestock animals segment held the highest share in 2023. The availability of various pregnancy test kits specifically designed for different livestock animals, such as cows, swine, and sheep, supports the use of these kits in the livestock industry. The ability to accurately and efficiently determine the pregnancy status of livestock animals is crucial for reproductive management and planning. This directly impacts the productivity and profitability of livestock operations. As a result, the product demand and utilization are high in the livestock sector. The companion animal segment is expected to register the fastest CAGR of 5.27% from 2024 to 2030.

Growing pet population, expenditure on pets, pet humanization, medicalization rate, and increasing R&D activities are expected to propel segment growth. For example, as the per 2021-2022 National Pet Owners Survey by the American Pet Products Association (APPA), it was found that approximately, 70% of households in the U.S. had a pet, totalling 90.5 million homes. This figure included 45.3 million households with cats and 69 million with dogs. Growing pet population fosters a shift toward preventive healthcare practices. Pet owners are inclined to take proactive measures to detect and address health issues early on. Pregnancy test kits serve as preventive measures, allowing pet owners to identify pregnancies early, leading to better care for pregnant animals.

Distribution Channel Insights

The e-commerce distribution channel segment held the highest share of 46.67% in 2023 and is estimated to grow at the fastest CAGR from 2024 to 2030. The dominance of the e-commerce segment is attributed to factors, such as convenience, product variety, competitive pricing, information availability, and overall shift in consumer behavior toward online shopping. Furthermore, E-commerce platforms often provide a broader selection of animal pregnancy test kits than brick-and-mortar stores. This extensive range allows pet owners to choose products that suit their preferences and requirements.

End-use Insights

The on-farm end-use segment accounted for the highest share of 43.30% of the overall revenue in 2023. The use of on-farm animal pregnancy test kits is more convenient and cost-effective for farmers, as it eliminates the need for veterinary visits and reduces the time and cost. These factors are expected to drive segment growth. Moreover, accurate and efficient pregnancy testing is crucial for livestock producers to optimize productivity and profitability.

On-farm animal pregnancy test kits can help improve reproductive management by providing accurate results. The home-setting end-use segment is expected to register the fastest growth rate of 5.64% from 2024 to 2030. With a larger number of pets, there is increased concern among pet owners regarding the reproductive health of their animals. Thus, animal pregnancy test kits become essential tools for managing and monitoring the breeding process at home, helping pet owners plan and ensure the well-being of both mother and offspring.

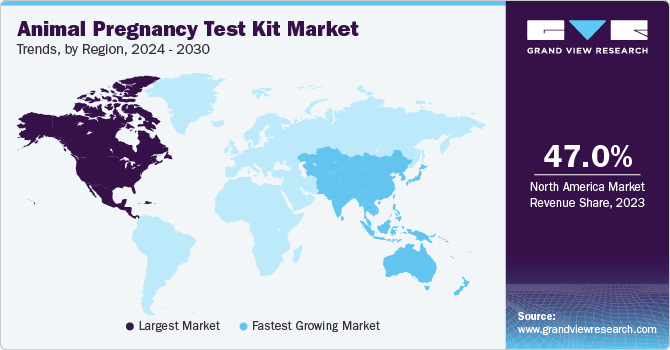

Regional Insights

North America Animal Pregnancy Test Kits Market Trends

North America dominated the market with a share of 47.01% in 2023 due to the wide-scale use of artificial insemination techniques and the resultant need for pregnancy testing tools. In September 2021, the American Veterinary Medical Association reported that over 90% of veterinary hospitals across the U.S. were providing insemination services. This surge in insemination services is anticipated to drive product sales over the forecast period.

U.S. Animal Pregnancy Test Kits Market Trends

Pet owners and livestock breeders are becoming increasingly aware of the significance of early detection of pregnancy in animals. This rising awareness is expected to drive the demand for reliable and convenient pregnancy test kits in the U.S.

Europe Animal Pregnancy Test Kits Market Trends

The market in Europe held the second-largest revenue share in 2023. Europe has seen a rise in pet ownership, leading to a higher demand for veterinary services and products, including rapid pregnancy test kits. As more households keep companion animals, there is a greater need for accurate and timely reproductive management in veterinary practices.

Germany Animal Pregnancy Test Kits Market Trends

Cattle production, including milk and dairy farming, is an important contributor to the German economy. Efficient reproduction management, facilitated by accurate pregnancy testing, directly impacts the economic viability of cattle operations. By maximizing reproductive efficiency, breeders can optimize herd productivity and profitability, underscoring the importance of advanced pregnancy testing solutions. The significance of cattle production in Germany, with its long history of business, highly organized industry, and wealth of breeding experience, greatly influences the market in the country.

UK Animal Pregnancy Test Kits Market Trends

The UK is at the forefront of technological innovation in veterinary medicine. This includes the development of advanced veterinary diagnostics, such as rapid pregnancy test kits, which offer quick and accurate results. The availability of cutting-edge technologies enhances the appeal of these kits to veterinarians and livestock farmers.

Asia Pacific Animal Pregnancy Test Kits Market Trends

Asia Pacific is anticipated to witness significant growth in the market. Rising awareness among pet owners about the importance of animal pregnancy testing is contributing to the market's growth. Furthermore, efforts from governments, animal health organizations, and private entities to boost the adoption of artificial insemination for enhancing cattle reproduction and the growing demand for rapid bovine pregnancy testing kits to verify pregnancies are significant factors driving the market growth.

India Animal Pregnancy Test Kits Market Trends

The market in India is expected to grow steadily over the coming years due to the development of advanced animal pregnancy test kits by government organizations. These developments are positively influencing the market in India by addressing the specific needs of the agricultural sector, promoting technological advancements, and contributing to overall improvements in livestock management practices. For example, the development of Pregmare, a serum-based sandwich ELISA kit for pregnancy diagnosis in horse mares by the Indian Council of Agricultural Research (ICAR) Krishi Bhavan, is a significant advancement in equine reproductive management.

Australia Animal Pregnancy Test Kits Market Trends

In Australia, bovine artificial insemination (AI) techniques are becoming a common breeding practice. The abundance of cattle AI service providers nationwide is a major factor driving the market growth. One of the top providers of bovine genetics is Genus Plc. Similarly, Holbrook Breeders Australia and the Indonesia-Australia Commercial Cattle Breeding Program (IACCBP) are providing numerous services to support artificial insemination technology in the nation's bovine farms. According to a FutureBeef blog post, the nation reported that about 1.5 million cows are artificially inseminated annually. The market is expected to grow profitably with the growing use of AI and fast pregnancy kits.

Mexico Animal Pregnancy Test Kits Market Trends

Mexico has a significant livestock industry, including cattle, pigs, goats, and sheep. The need for efficient reproduction management in these sectors drives the demand for animal pregnancy test kits. Animal pregnancy test kits help ensure timely breeding and reproductive management, contributing to increased production efficiency.

Key Animal Pregnancy Test Kit Company Insights

EMLAB GENETICS LLC., Megacor Diagnostik Gmbh, and BIOTRACKING, INC. are some of the emerging market participants in the market.

Key players frequently employ different methods to enhance their brand recognition in the competitive market. Companies are enhancing their product portfolios to cater to a wider range of species and testing needs. This includes the development of test kits tailored for specific animals, such as cattle, horses, sheep, goats, and companion animals, like dogs and cats.

Key Animal Pregnancy Test Kit Companies:

The following are the leading companies in the animal pregnancy test kit market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these animal pregnancy test kit companies are analyzed to map the supply network.

- Zoetis Services LLC

- IDEXX Laboratories, Inc.

- Ring Biotechnology Co Ltd.

- Hangzhou Testsea Biotechnology Co. LTD.

- Novis Animal Solutions

- Secure Diagnostics Pvt. Ltd

- J&G Biotech Ltd

- EMLAB GENETICS LLC.

- megacor diagnostik gmbh

- BIOTRACKING, INC.

Recent Developments

-

In November 2023, Ring Biotechnology Co. Ltd. introduced a new early pregnancy rapid test for cows. This test can detect pregnancy as early as 28-30 days and does not require skilled personnel or special equipment

-

In September 2022, Ring Biotechnology Co. Ltd. released its first generation of bovine pregnancy rapid test kit, a 10-15 min lateral flow immunoassay to find cow pregnancy status in blood serum samples. This kit uses high-affinity monoclonal antibodies against ruminant pregnancy-associated glycoproteins, a class of marker protein for these animals during pregnancy, which can easily check if the cow is pregnant or not

Animal Pregnancy Test Kit Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 47.40 million

Revenue forecast in 2030

USD 62.36 million

Growth rate

CAGR of 4.68% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal type, sample type, distribution channel, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; Saudi Arabia; UAE; Kuwait; South Africa.

Key companies profiled

Zoetis Services LLC; IDEXX Laboratories, Inc.; Ring Biotechnology Co Ltd.; Hangzhou Testsea Biotechnology Co Ltd.; Novis Animal Solutions; Secure Diagnostics Pvt. Ltd.; J&G Biotech Ltd.; EMLAB GENETICS LLC.; Megacor Diagnostik GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Pregnancy Test Kit Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global animal pregnancy test kit market report based on product, animal type, sample type, distribution channel, End-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Pregnancy Test Kits Cassettes

-

Pregnancy Test Kits Strips

-

ELISA Test Kits

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animal

-

Canine

-

Feline

-

Equine

-

Others

-

-

Livestock Animal

-

Bovine

-

Swine

-

Caprine/Ovine

-

Others

-

-

-

Sample Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Urine

-

Whole Blood, Plasma, Serum

-

Others (Milk)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals and Clinics

-

Retail Stores

-

E-commerce

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

On Farm

-

Laboratory

-

Home Setting

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global animal pregnancy test kit market size was estimated at USD 46.15 million in 2023 and is expected to reach USD 47.40 million in 2024.

b. The global animal pregnancy test kit market is expected to grow at a compound annual growth rate of 4.68% from 2024 to 2030 to reach USD 62.36 million by 2030.

b. North America dominated the animal pregnancy test kit market with a share of 47.01% in 2023. This is attributable to wide-scale use of artificial insemination techniques and increasing need for pregnancy testing tools.

b. Some key players operating in the animal pregnancy test kit market include Zoetis Services LLC, IDEXX Laboratories, Inc., Ring Biotechnology Co Ltd., Hangzhou Testsea Biotechnology Co Ltd., Novis Animal Solutions, Secure Diagnostics Pvt. Ltd, J&G Biotech Ltd, EMLAB GENETICS LLC., megacor diagnostik gmbh.

b. The market is primarily driven by increased animal expenditures, increased pet as well as livestock population, technological advancements, and high demand for point-of-care diagnostics for pregnancy testing in farm animals.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."