- Home

- »

- Animal Health

- »

-

Animal Sedative Market Size & Share, Industry Report, 2033GVR Report cover

![Animal Sedative Market Size, Share & Trends Report]()

Animal Sedative Market (2025 - 2033) Size, Share & Trends Analysis Report By Application, By Animal Type, By Route Of Administration (Parenteral, Oral), By Drug Class, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-179-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Animal Sedative Market Summary

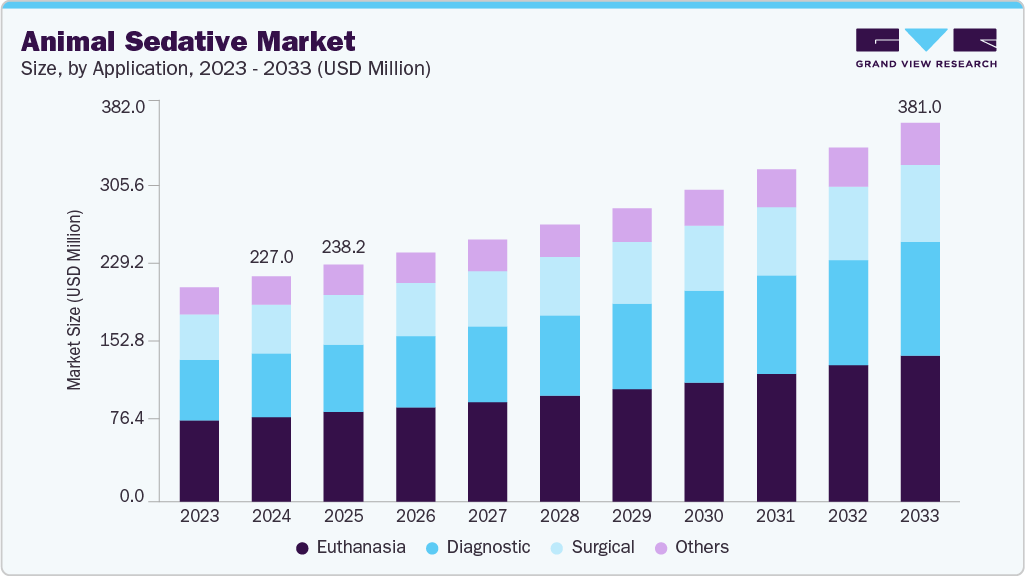

The global animal sedative market size was estimated at USD 227.0 million in 2024 and is projected to reach USD 381.0 million by 2033, growing at a CAGR of 6.04% from 2025 to 2033. The market is progressing, driven by growth in the livestock industry and meat production, expansion of veterinary surgical and diagnostic procedures, and advances in veterinary pharmacology and drug development.

Key Market Trends & Insights

- North America animal sedative market held the largest revenue share of 37.70% in 2024.

- The animal sedative industry in Mexico is expected to grow at the fastest CAGR from 2025 to 2033.

- By application, the euthanasia segment held the largest market share of 37.78% in 2024.

- By animal, the dogs segment held the highest market share of about 40.0% in 2024.

- By route of administration, the parenteral segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 227.0 Million

- 2033 Projected Market Size: USD 381.0 Million

- CAGR (2025-2033): 6.04%

- North America: Largest market in 2024

- Asia Pacific: Fastest Growing Market

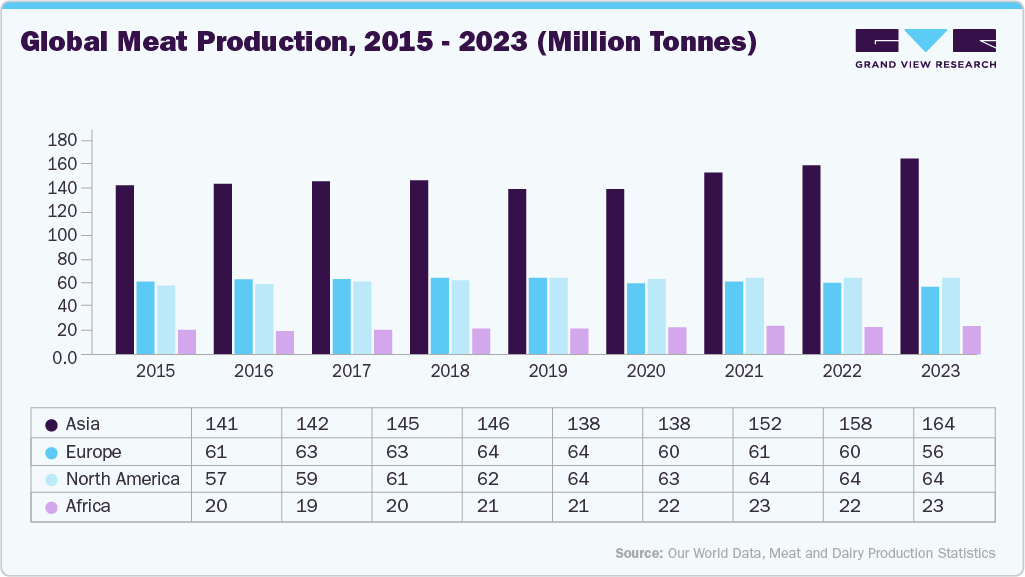

The livestock sector represents another strong market growth driver. Along with increasing global demand for meat, dairy, and poultry products, sedatives are widely used to manage stress, facilitate transportation, and improve handling safety in large animals like cattle, horses, and pigs.

Sedation reduces stress-related weight loss, improves reproduction management, and enhances overall productivity in livestock operations. Additionally, government initiatives for animal welfare and regulations around humane handling are encouraging the responsible use of sedatives. As livestock farming intensifies to meet global food needs, the demand for effective and safe sedative solutions is expected to rise steadily.

The increasing number of complex surgical, dental, and diagnostic procedures in animals is significantly boosting demand for sedatives. From routine spaying and neutering to advanced orthopedic surgeries and diagnostic imaging like MRI or CT scans, sedatives are essential to ensure both animal safety and veterinarian efficiency. Modern veterinary clinics are also adopting minimally invasive techniques, which require precision and animal immobility. As pet owners seek advanced healthcare services, veterinarians rely heavily on sedatives to reduce stress, manage pain, and minimize risks during procedures, directly supporting the growth of the animal sedative market globally.

Innovation in veterinary pharmacology is transforming the market by introducing safer, fast-acting, and more species-specific products. Companies are developing sedatives with fewer side effects, improved recovery times, and tailored dosage options for different animal types, from small pets to large livestock. Combination drugs that provide both sedation and analgesia are gaining traction, streamlining procedures, and enhancing patient care. Moreover, increasing research investments and partnerships between animal health companies and research institutions are driving product pipeline expansion. These advancements not only improve animal safety but also boost veterinarian confidence, fuelling wider adoption of modern sedative products.

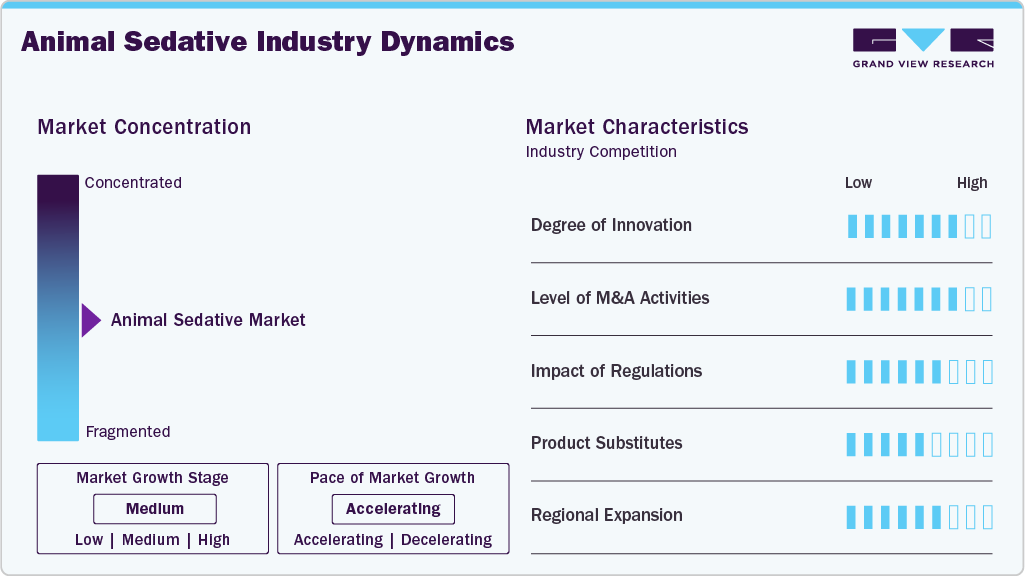

Market Concentration & Characteristics

The animal sedative market exhibits a moderate concentration in the market, and the pace of the growth is accelerating. The market is dominated by global players such as Zoetis, Virbac, Ouro Fino Saude Animal Group and Dechra. These companies leverage strong R&D, broad portfolios, and global distribution networks to maintain competitiveness.

Animal Sedative Market Industry Characteristics

The animal sedative industry is experiencing steady innovation, with advancements in drug formulations aimed at improving safety, reducing side effects, and offering faster recovery times. Companies are developing species-specific sedatives and combination therapies that integrate sedation with analgesia. In October 2024, Panav Biotech launched Maropitine Injection, a breakthrough veterinary solution for dogs and cats, effectively treating nausea, vomiting, motion sickness, chemotherapy-related illness, and post-anesthesia recovery, advancing companion animal healthcare.

Mergers and acquisitions play a crucial role in shaping the animal sedative market, with global animal health companies acquiring niche players to expand portfolios and geographic reach. For instance, in April 2024, the University of Helsinki and Vetcare have strengthened their collaboration, advancing animal welfare through joint research, drug development, project funding, and academic support in veterinary medicine. Such consolidations accelerate market competitiveness, streamline distribution channels, and enhance overall growth potential in companion and livestock segments.

Regulatory frameworks significantly impact the animal sedative industry, governing product safety, quality standards, and approval timelines. Stringent veterinary drug regulations ensure efficacy and reduce risks of misuse, especially in food-producing animals. For example, in February 2025, the AVMA-backed Combating Illicit Xylazine Act, reintroduced in Congress, seeks to schedule xylazine as Schedule III, curb illicit misuse, and protect essential veterinary access for livestock, wildlife, and research species. Regional differences in drug approval and usage policies further shape market accessibility, influencing global players’ strategies to meet animal welfare and consumer safety expectations.

Alternative approaches, such as natural calming supplements, behavioral therapy, and pheromone-based products, act as substitutes for chemical sedatives. While these substitutes appeal to pet owners seeking non-pharmaceutical solutions, they often lack the efficacy required for surgical or diagnostic procedures. Nevertheless, rising awareness of holistic and integrative veterinary care may moderate sedative use in certain cases, influencing long-term demand patterns within companion animal markets.

Regional expansion is a key growth strategy in the animal sedative market, with companies targeting emerging economies where veterinary care is rapidly developing. Expanding distribution networks in Asia-Pacific, Latin America, and the Middle East enables access to underserved markets with growing livestock and companion animal populations. Multinational players are also investing in localized manufacturing, training, and partnerships to strengthen their presence and meet region-specific veterinary needs.

Application Insights

Euthanasia represented the largest segment with a revenue share of 37.78% in 2024, driven by the rising need for humane end-of-life solutions for companion and livestock animals. Increasing awareness among pet owners regarding ethical euthanasia practices, coupled with stringent animal welfare regulations, has significantly boosted demand. Veterinary clinics and animal shelters are adopting safe and effective sedative formulations to ensure painless procedures. Moreover, advancements in sedative combinations have improved efficacy, safety, and reliability. The growing global pet population and expanding veterinary infrastructure further reinforce euthanasia’s dominance in the animal sedatives market.

Diagnostic is the fastest-growing segment in the animal sedatives industry, driven by the rising need for accurate imaging, advanced surgical planning, and minimally invasive procedures in veterinary care. Sedatives play a vital role in facilitating diagnostics such as X-rays, MRIs, CT scans, and ultrasounds by reducing animal stress and ensuring precision. Increasing pet ownership, demand for early disease detection, and the rise in specialized veterinary facilities are further fueling growth. Continuous advancements in sedative formulations tailored for diagnostics enhance safety and efficacy, solidifying this segment’s rapid expansion.

Animal Insights

The dogs segment led the animal sedatives market with the largest share of about 40.0% in 2024, driven by their high population, widespread ownership, and frequent need for sedation in veterinary care. Sedatives are commonly used in dogs for diagnostic imaging, surgical procedures, grooming, and behavioral management. For instance, in January 2025, Parnell introduced PropofolVet Multidose, the first generic propofol injectable emulsion for dogs, offering veterinarians a versatile, efficient anesthetic option for induction and maintenance of anaesthesia while ensuring consistent results and streamlined clinical operations. Rising cases of anxiety, aggression, and travel-related stress in pets further increase demand. With growing awareness of animal welfare, veterinarians are increasingly adopting safe and effective sedative options. The expanding pet healthcare sector, along with rising expenditure on companion animals, strongly supports the dominance of the canine segment in this market.

The other animal’s segment has been witnessing the fastest growth in the animal sedatives industry, driven by increasing attention to sedation needs beyond traditional pets like dogs, cats, and horses. This category includes animals such as exotic pets, wildlife, zoo animals, and livestock requiring specialized sedatives for medical procedures, transport, or handling. Rising awareness of animal welfare, veterinary innovations, and the development of safer, species-specific sedatives are fuelling adoption. Expanding veterinary services, conservation programs, and exotic pet ownership in North America, Europe, and Asia Pacific further contribute to the segment’s rapid market growth.

Route of Administration Insights

The parenteral segment held the largest share of the animal sedative market in 2024, primarily due to its rapid onset, precise dosing, and reliable efficacy across various animal species. Injectable sedatives are widely preferred by veterinarians for surgical procedures, diagnostic interventions, and emergency treatments in pets, livestock, and exotic animals. Their ability to deliver controlled sedation with predictable effects makes them indispensable in clinical and field settings. Growing veterinary infrastructure, increased adoption of surgical and diagnostic procedures, and rising awareness of animal welfare further reinforce the dominance of the parenteral segment globally.

The oral segment has been emerging as the fastest-growing category, driven by its convenience, non-invasive administration, and stress-free approach for both pets and owners. Oral sedatives, available as tablets, chews, or flavored treats, are increasingly preferred for routine veterinary procedures, travel, and behavioral management. Rising pet ownership, especially of cats and small dogs, along with growing awareness of animal welfare and stress reduction, is fueling adoption. Innovative formulations and palatable options are expanding usage, particularly in North America, Europe, and Asia-Pacific, accelerating the segment’s market growth.

Drug Class Insights

Alpha-2 Adrenergic Receptor Agonists has emerged as both the largest and fastest-growing segment in the market, driven by their multifaceted pharmacological benefits. In July 2022, Dechra and Vetcare Oy launched Zenalpha, an alpha2 adrenergic agonist combining medetomidine and vatinoxan, offering effective sedation and analgesia while reducing cardiovascular side effects during exams and minor procedures. These sedatives provide potent sedation, analgesia, and muscle relaxation, making them highly effective for surgical procedures, diagnostic interventions, and routine handling across companion animals, livestock, and exotic species. Their predictable onset and controllable duration of action allow veterinarians to deliver safer and more efficient care, reducing stress for both animals and handlers.

Rising awareness of animal welfare, coupled with increasing veterinary procedures and clinical interventions, is significantly boosting adoption. Additionally, ongoing research and development have led to innovative formulations and species-specific applications, further strengthening their market presence. North America and Europe remain key growth regions due to advanced veterinary infrastructure, while emerging markets in Asia Pacific show rapidly increasing demand. Collectively, these factors underscore the dominance and accelerated growth of alpha-2 adrenergic receptor agonists in the animal sedatives market.

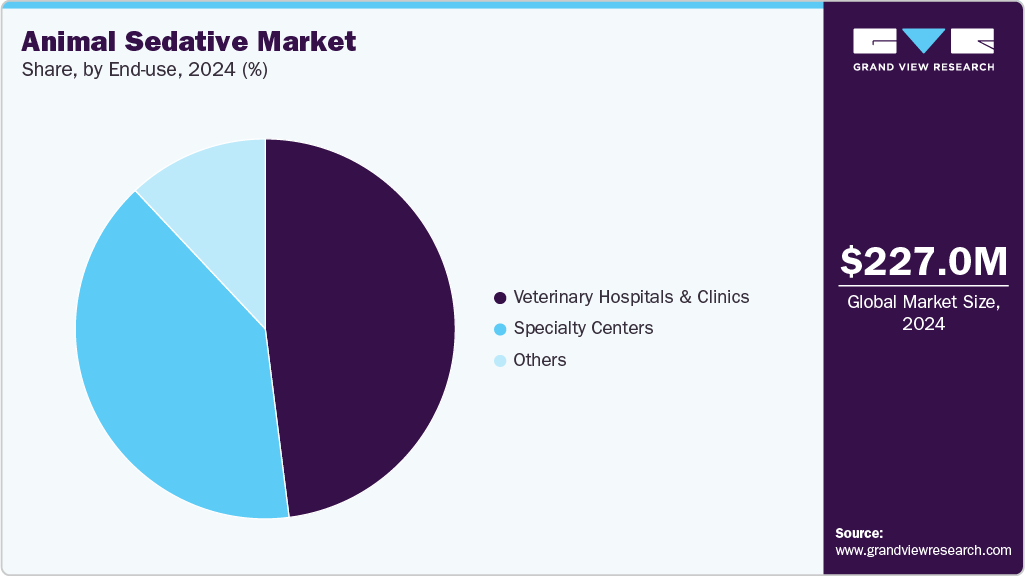

End Use Insights

Veterinary hospitals and clinics represent the largest segment in the animal sedatives market, owing to their critical role in administering sedatives for surgical procedures, diagnostics, and routine animal care. These facilities manage a wide range of animals, including pets, livestock, and exotic species, requiring reliable and effective sedation solutions. The segment benefits from growing veterinary infrastructure, increasing clinical interventions, and rising awareness of animal welfare, which drives demand for safer, efficient, and species-specific sedatives.

The specialty centers segment is expected to grow at the fastest CAGR from 2025 to 2033, driven by their focus on advanced veterinary care, complex procedures, and specialized animal treatments. These centers cater to companion animals, exotic pets, and high-value livestock, requiring precise and effective sedation solutions for surgeries, diagnostics, and behavioral management. Rising pet ownership, increasing demand for specialized veterinary services, and heightened awareness of animal welfare are fueling adoption. Innovative sedative formulations, non-invasive delivery methods, and the expansion of specialty centers across North America, Europe, and Asia-Pacific are accelerating growth in this high-potential market segment.

Regional Insights

The North America animal sedatives market held the largest revenue share of 37.70% in 2024, led by key players such as Zoetis, Dechra, and Virbac. Rising pet ownership, advanced veterinary procedures, and increasing awareness of animal welfare drive growth. Innovations in alpha-2 agonists, combination therapies, and non-invasive sedatives, along with expanding veterinary infrastructure, are fueling market advancement across the region.

U.S. Animal Sedative Market Trends

The U.S. animal sedatives industry is experiencing robust growth, driven by factors such as increasing pet ownership, a rising number of veterinary procedures, and advancements in veterinary medicine. For instance, in April 2024, Zoetis launched Bonqat, the first FDA-approved pregabalin oral solution for alleviating acute anxiety and fear in cats during transportation and veterinary visits. This advancement underscores the industry's commitment to enhancing animal welfare and expanding therapeutic options.

Europe Animal Sedative Market Trends

Europe’s animal sedatives industry is highly competitive, supported by strict animal welfare regulations and the growing demand for safe and effective veterinary solutions. Some of the players, such as Zoetis, Boehringer Ingelheim, Dechra, Elanco, and Orion, are actively expanding their presence through innovative formulations and combination therapies. Advancements in alpha-2 agonists, non-invasive delivery systems, and improved safety profiles are further shaping the market’s evolution. In January 2022, the University of Helsinki team and Vetcare developed a canine sedative combining medetomidine and vatinoxan, improving cardiovascular safety.

The UK animal sedatives market is moderately concentrated, driven by rising pet ownership, technological advancements, and evolving regulations. In April 2023, Zenalpha introduced a new canine sedative combining medetomidine with vatinoxan, reducing cardiovascular side effects while preserving sedation. This innovation enhances safety, minimizing the routine need for atipamezole reversal. Ongoing regulatory scrutiny into veterinary pricing and consolidation, the UK CMA is investigating to promote competition, and transparency adds dynamic pressure for innovation and fair access.

Asia Pacific Animal Sedative Market Trends

The Asia Pacific animal sedatives industry is among the fastest-growing regions, with its growth fueled by rising pet ownership, expanding veterinary infrastructure, and investments in animal vaccines. Some of the companies, including Zoetis, Dechra, Virbac, Merck, and local firms like vetcare.fi, are driving innovation with advanced formulations and safer sedatives like the medetomidine-vatinoxan combo. Rapid urbanization and increasing demand across China, India, Japan, and Australia are accelerating market expansion.

India's animal sedatives market is expanding, driven by rising pet ownership, growing veterinary infrastructure, and strong livestock health needs supported by government programs like NADCP. Some of the companies include Zoetis, Elanco, Boehringer Ingelheim, Virbac, and local firms such as SeQuent Scientific. Advances involve innovative sedative formulations and increased access through expanding veterinary clinics nationwide.

Latin America Animal Sedative Market Trends

The Latin America animal sedatives market is expanding, driven by rising pet ownership, expanding veterinary services, and evolving livestock health practices. Brazil leads the region with key players including Zoetis, Boehringer Ingelheim, Bayer, Ceva, and local firms such as Ouro Fino. Advances focus on safer, faster-acting formulations tailored to species and recovery needs.

Brazil’s animal sedatives market is gaining momentum, propelled by growing pet ownership, robust livestock production, and increasing veterinary infrastructure. Prominent players such as Zoetis, Ceva, Merck, Elanco, Virbac, and local leader Ourofino Saúde Animal drive innovation. Key advancements include telemedicine, digital monitoring, AI-assisted care, safer sedative formulations, enhancing access, and animal welfare across diverse regions.

Middle East & Africa Animal Sedative Market Trends

The Middle East animal sedative industry is emerging, fueled by increasing pet ownership, livestock health demands, and expanding veterinary infrastructure. Key players like Zoetis, Elanco, Boehringer Ingelheim, Merck Animal Health, Ceva, and Virbac are actively driving growth. Recent advancements focus on safer sedatives and improved diagnostic access through investment in clinics and veterinary services.

The South Africa’s animal sedatives market is evolving, propelled by growing wildlife healthcare needs, expanding veterinary infrastructure, and regulatory modernization. Local specialists like Wildlife Pharmaceuticals offer tailored sedatives and antidotes for conservation medicine. Multinationals such as Bimeda, via its acquisition of Afrivet, are deepening their African footprint, strengthening distribution and product access. Regulatory developments, including the SAHPRA-led reassessment of Yohimbine, a sedative, underscore the dynamic interplay between innovation and oversight in the region.

Key Animal Sedative Company Insights

Leading players such as Zoetis, Ouro Fino Saúde Animal Group, Dechra, and Bimeda Inc. hold substantial market share, supported by extensive product portfolios, global reach, and strong regulatory compliance. Their competitive strength is reinforced through innovations in advanced therapies, entry into emerging markets, and strategic mergers and acquisitions. However, regulatory challenges, high R&D costs, and stricter antibiotic regulations shape the competitive landscape, while regional firms increasingly capture market attention with affordable, locally tailored solutions.

Key Animal Sedative Companies:

The following are the leading companies in the animal sedative market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis Services, LLC

- Virbac

- Ouro Fino Saude Animal Group

- Dechra

- Merck & Co., Inc.

- Bimeda Inc.

- vetcare. fi.

- Chanelle Pharma (Exponent)

- Randlab Australia Pty Ltd

- Troy Laboratories Pty Ltd

Recent Developments

-

In July 2025, Cronus Pharma introduced Butorphic (Butorphanol Tartrate) Injection in the U.S., approved for equine colic and postpartum pain

-

In November 2024,Fidelis Animal Health received FDA indexing for Ethiqa XR in rodents and rabbits, expanding use of its extended-release buprenorphine technology.

-

In May 2024, Parnell launched Dexmedetomidine Hydrochloride Injection and CONTRASED, expanding its pet care sedation portfolio.

Animal Sedative Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 238.2 million

Revenue forecast in 2033

USD 381.0 million

Growth rate

CAGR of 6.04% from 2025 to 2033

Historical period

2021 - 2023

Actual data

2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, animal, route of administration, drug class, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Qatar; Oman

Key companies profiled

Zoetis Services LLC.; Virbac; Ouro Fino Saude Animal Group; Dechra; Merck & Co., Inc.; Bimeda Inc.; vetcare. fi.; Chanelle Pharma (Exponent); Randlab Australia Pty Ltd; Troy Laboratories Pty Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Sedative Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the animal sedative market report based on application, animal, route of administration, drug class, end use, and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Surgical

-

Diagnostic

-

Euthanasia

-

Others

-

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Dogs

-

Cats

-

Horses

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2021 - 2033)

-

Parenteral

-

Oral

-

-

Drug Class Outlook (Revenue, USD Million, 2021 - 2033)

-

Phenothiazines

-

Benzodiazepines

-

Alpha-2 Adrenergic Receptor Agonists

-

Butyrophenones

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Hospitals & Clinics

-

Specialty Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global animal sedative market size was estimated at USD 227.0 million in 2024 and is expected to reach USD 238.2 million in 2025

b. The global animal sedative market is expected to grow at a compound annual growth rate of 6.04% from 2025 to 2033 to reach USD 381.0 million by 2033.

b. North America dominated the animal sedative market with a share of 37.70% in 2024. The market is propelled by the existence of well-established competitors and the rising demand for services from veterinarians.

b. Some key players operating in the animal sedative market include Zoetis Services LLC., Virbac, Ouro Fino Saude Animal Group, Dechra, Merck & Co., Inc., Bimeda Inc., vetcare. fi., Chanelle Pharma (Exponent), Randlab Australia Pty Ltd, Troy Laboratories Pty Ltd

b. Key factors that are driving the market growth include growth in livestock industry and meat production, expansion of veterinary surgical and diagnostic procedures and advances in veterinary pharmacology and drug development.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.