- Home

- »

- Animal Health

- »

-

Animal Ultrasound Market Size, Share, Industry Report 2033GVR Report cover

![Animal Ultrasound Market Size, Share & Trends Report]()

Animal Ultrasound Market (2026 - 2033) Size, Share & Trends Analysis Report By Solution (Equipment, Accessories/Consumables, PACS), By Animal (Small, Large), By Type, By Technology, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-545-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Animal Ultrasound Market Summary

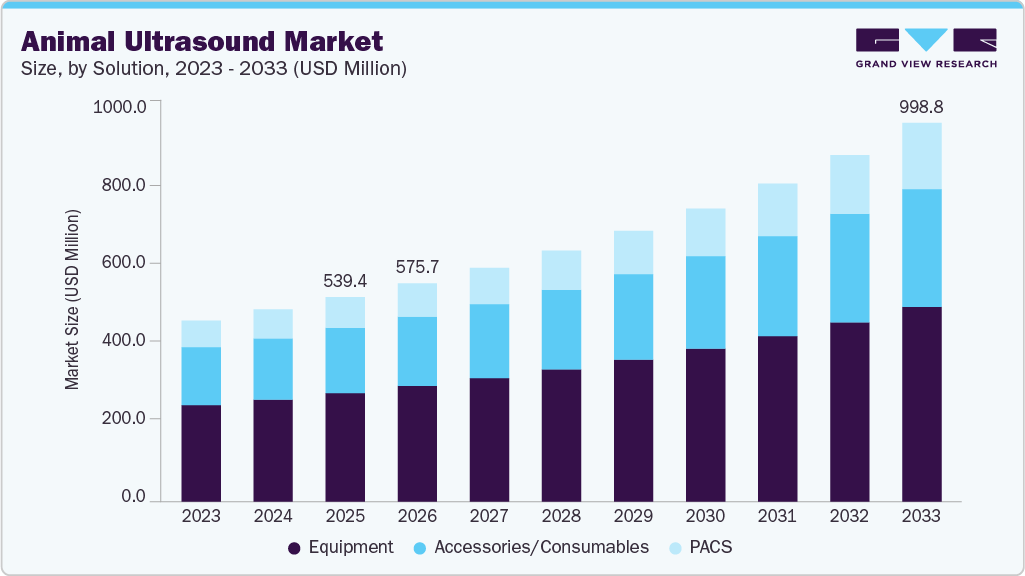

The global animal ultrasound market size was estimated at USD 539.39 million in 2025 and is projected to reach USD 998.76 million by 2033, growing at a CAGR of 8.19% from 2026 to 2033. Some of the key factors driving market growth are growing research initiatives & breakthroughs, expanding applications of ultrasound in the veterinary sector, rising adoption of pet insurance, and increasing critical collaboration in the industry.

Key Market Trends & Insights

- North America animal ultrasound market held the largest revenue share of 37.29% in 2025.

- The U.S. dominated the North America region with the largest revenue share in 2025.

- By animal, small animals held the largest share of 61.49% of the market in 2025.

- By solution, the equipment segment held the largest share in 2025.

- Based on type, the 2-D ultrasound imaging segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 539.39 Million

- 2033 Projected Market Size: USD 998.76 Million

- CAGR (2026-2033): 8.19%

- North America region: Largest market in 2025

- Asia Pacific region: Fastest growing market

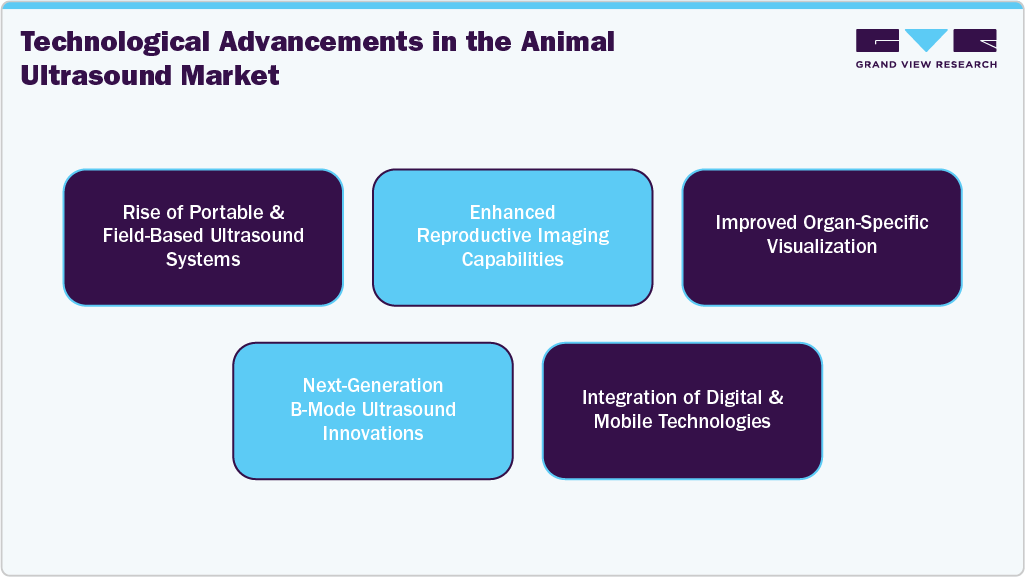

Growing research initiatives and technological breakthroughs are significantly accelerating the market by enhancing diagnostic precision, expanding therapeutic applications, and supporting wider clinical adoption. Increasing R&D investment by universities, veterinary institutes, and animal health companies is leading to innovations that make ultrasound systems more accurate, portable, and cost-efficient. A major advancement is the rapid adoption of focused ultrasound (FUS), which extends ultrasound use beyond diagnostics into noninvasive therapeutic procedures. FUS shows strong potential in oncology, pain management, soft-tissue repair, neuromodulation, and metabolic diseases, driving demand for advanced systems capable of high-energy, image-guided interventions. As research transitions into routine practice, veterinary hospitals increasingly invest in upgraded ultrasound platforms, training, and workflow integration.

In addition, the expanding use of ultrasound across all tiers of veterinary practice is a major growth catalyst, signaling its transition from a specialized tool to a standard diagnostic modality. More than half of clinics now own ultrasound systems, and routine use for abdominal pain, respiratory issues, reproductive monitoring, and emergency triage is rising steadily. This shift drives recurring demand for upgraded hardware, software enhancements, and practitioner training. Clinical applications are diversifying beyond abdominal and thoracic imaging into cardiology, oncology, musculoskeletal injuries, and point-of-care emergency diagnostics. As ultrasound becomes integral to general practice and specialty care workflows, it boosts recurring revenue from device purchases, service contracts, consumables, and education programs, expanding long-term market adoption.

Moreover, rising pet insurance adoption is reducing the financial barriers associated with advanced diagnostics, significantly increasing the utilization of ultrasound in veterinary practices. For instance, the North American Pet Health Insurance Association, Inc. reported in April 2025 that an estimated 7.03 million pets in North America were insured in 2024, demonstrating strong growth in policy enrollment and reflecting a broader willingness among owners to financially safeguard their animals’ health. Some of the providers such as Embrace and Wagmo routinely cover medically necessary imaging, enabling earlier diagnosis of chronic and acute conditions. This trend supports preventative care, improves treatment decision-making, and expands demand for high-quality ultrasound systems across general practices, specialty centers, and emergency hospitals.

Furthermore, growing collaboration among veterinary hospitals, research institutions, and imaging technology manufacturers is strengthening innovation and accelerating clinical adoption within the veterinary ultrasound market. For instance, in August 2025, Probo Veterinary collaborated with Improve Veterinary Education and Mindray Animal Medical to support veterinarians seeking advanced ultrasound training by providing Mindray Vetus Ultrasound Systems for Improve Veterinary Education’s renowned imaging courses. Similarly, in August 2025, Esaote North America and Epica International partnered to collaboratively broaden their imaging portfolios in both human and veterinary healthcare, spanning MRI, ultrasound, and CT technologies. These collaborations support joint product development, accelerate technology dissemination, and reinforce market competitiveness, ultimately increasing demand for sophisticated imaging platforms and strengthening overall ultrasound adoption across veterinary settings.

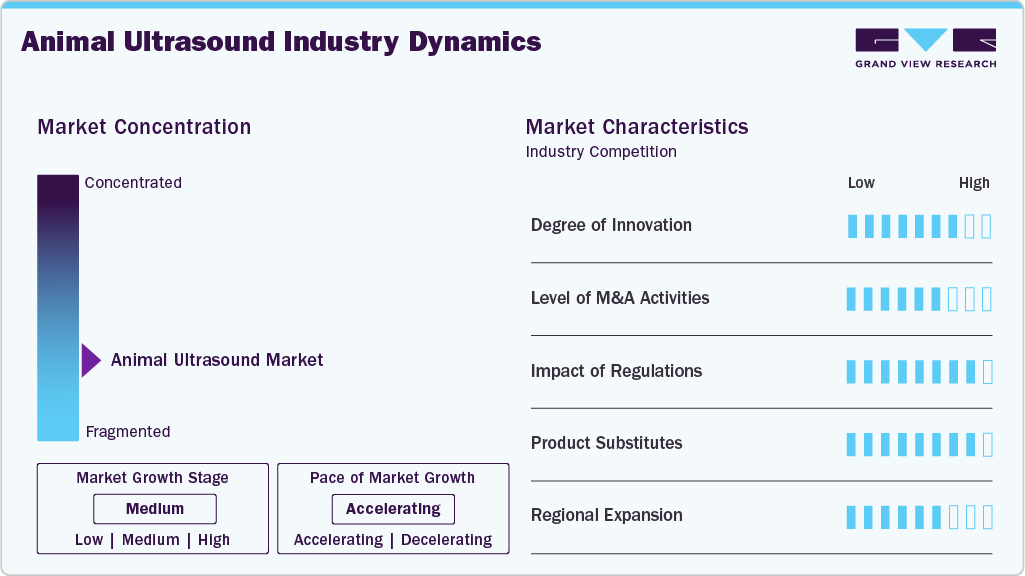

Market Concentration & Characteristics

The industry is at a moderate growth stage, and the pace is accelerating. The market is dominated by established players such as Fujifilm American Holdings Corporation, Mindray, Esaote, and IMV Imaging. These companies control advanced technology, global distribution, and training networks. However, rising demand for portable and affordable systems is enabling new entrants to gain traction, gradually increasing competitive diversity.

The market is driven by rapid innovation, particularly in portable, wireless, and AI-enhanced imaging technologies. Some of the advancements such as high-resolution probes, 3D/4D imaging, focused ultrasound therapeutics, and cloud-based diagnostics are transforming veterinary workflows. For instance, in October 2025, Butterfly launched the next-generation iQ3 Vet, built on P4.3 Ultrasound-on-Chip technology with faster data transfer, enhanced imaging, and ergonomic design, expanding advanced POCUS capabilities in the U.S. and Canada.

The market is experiencing moderate but steadily increasing mergers and acquisitions as leading imaging companies seek to expand their veterinary portfolios. Acquisitions and strategic partnerships such as collaborations between ultrasound manufacturers, veterinary hospital groups, and training institutions help accelerate technology integration, expand product lines, and strengthen regional presence. For instance, in March 2024, Mars completed acquiring Cerba HealthCare’s stakes in Cerba Vet and ANTAGENE, strengthening its Science & Diagnostics division with expanded veterinary diagnostic and genetic testing capabilities across the French market.

Regulations impact the veterinary ultrasound industry primarily through device safety standards, veterinary practice guidelines, and import/export controls. Compliance with FDA, CE, and regional veterinary regulations ensures product quality and clinical reliability.

Product substitutes in the market include X-ray, CT, and MRI serve as diagnostic alternatives but ultrasound remains uniquely positioned due to its noninvasive nature, affordability, portability, and real-time imaging capabilities. Substitution risk is low in routine diagnostics and reproductive care but moderate in advanced orthopedic or neurological cases where CT/MRI may be preferred.

Regional expansion is accelerating as rising pet ownership, livestock health investments, and improving veterinary infrastructure boost demand for diagnostic imaging. North America and Europe remain mature markets, while Asia Pacific, Latin America, and the Middle East show significant growth potential.

Solution Insights

On the basis of solution, the equipment segment dominated the market with the largest revenue share of 53.05% in 2025. Console/cart-based ultrasound and portable/handheld ultrasound solutions are included in this segment. The segment is driven by its universal use across companion animals, livestock, and exotic species. Its noninvasive, cost-effective, and versatile capabilities enable real-time imaging for abdominal, cardiac, reproductive, and emergency diagnostics, making it standard in clinics, hospitals, and field settings. Continuous use in small-animal practices and livestock breeding further sustains demand. Some of the technological advancements also support growth. For instance, in December 2024, Allambie Vet introduced an advanced ultrasound system offering clearer imaging and faster diagnostics, whereas in May 2024, Esaote North America launched the MyLab FOX, featuring next-generation probes and enhanced connectivity to improve productivity across varied veterinary environments.

The PACS segment is projected to grow at the fastest CAGR from 2026 to 2033. The market’s growth is boosted as veterinary practices shift to fully digital imaging workflows. PACS software allows seamless storage, retrieval, and sharing of ultrasound images across devices, enabling instant access, comparison with past scans, and efficient collaboration through teleradiology. In addition, demand is rising as modern systems such as Butterfly iQ3 Vet, Clarius HD3 Vet, and Esaote MyLab FOX generate large, high-resolution files that require secure, centralized storage. Furthermore, cloud-based PACS lets veterinarians upload images directly from devices and review them anywhere. IMV Imaging further supports this shift by integrating specialized PACS with its equine and companion-animal ultrasound platforms for streamlined image management.

Animal Insights

On the basis of animal, small animals dominated with the largest revenue share in 2025 and are expected to grow at the fastest rate over the forecast period. The market is advancing due to rising pet ownership, growing insurance uptake, and increased veterinary spending. For instance, according to the American Pet Products Association's 2024-2025 National Pet Owners Survey, 66% of American homes, or about 94 million families, own a pet. Small-animal ultrasound has become a daily diagnostic tool, with a 2024 survey of 1,216 veterinarians showing 84% have an ultrasound unit and most use it several times weekly. Besides this, common applications such as cystocentesis, pregnancy checks, and abdominal or thoracic scans are considered essential in general and emergency care. In addition, clinics are widely adopting devices from handheld Butterfly iQ+ Vet to advanced GE Logiq S8 systems, fueling the segment’s leading market share.

The large animals segment is expected to show significant growth during the forecast period, driven by rising demand for advanced, portable imaging in equine sports medicine and livestock fertility management. In addition, performance horses rely on high-resolution musculoskeletal ultrasound for tendon and ligament assessment, supported by technologies like Samsung’s MV-Flow and S-Shearwave Imaging. Moreover, livestock growth and herd-health pressures are boosting the adoption of ultrasound for early disease detection and reproductive monitoring. Innovation is accelerating this shift; for example, IMV Technologies’ BovIntel software, launched in 2024, automates bovine reproductive imaging and improves fertility precision, expanding usage of systems like Easi-Scan: Go and strengthening technology-driven herd management.

Type Insights

On the basis of type, 2-D ultrasound imaging accounted for the largest revenue share in 2025, as it provides clear, real-time grayscale imaging for pregnancy checks, abdominal and thoracic evaluations, cardiac exams, biopsies, and musculoskeletal assessments across companion animals, livestock, and equine patients. Its affordability, reliability, and universal applicability make it the default tool in clinics and field settings. The market is witnessing continuous improvements in imaging, such as higher spatial resolution, harmonic imaging, speckle reduction, and AI-based optimization that further enhance diagnostic quality, keeping systems simple to use. Most leading platforms, from GE Logiq consoles to Butterfly iQ3 Vet and IMV Easi-Scan, are built around advanced 2-D capabilities, reinforcing its dominant market position.

3-D/4-D ultrasound imaging is projected to grow at the fastest CAGR during the forecast period. These systems use high-density volumetric transducers, far more expensive than standard probes, making them suitable mainly for academic or research settings. Current veterinary use focuses on specialized applications such as fetal morphology assessment, viability evaluation, and structural characterization. Although studies like Hildebrandt et al. (2009) show potential benefits, 3-D imaging requires several seconds of motion-free acquisition, often unrealistic without sedation. Moreover, high cost, longer scan times, and workflow constraints continue to limit widespread adoption in everyday veterinary practice.

Technology Insights

On the basis of technology, digital imaging dominated with the largest revenue share in 2025, as it offers superior resolution, faster processing, and seamless data management compared to analog systems. Fully digital platforms provide enhanced clarity through harmonic imaging, speckle reduction, and automated optimization, improving diagnostic accuracy in cardiology, abdominal scans, reproduction, and musculoskeletal assessments. These systems also support advanced features such as color doppler, elastography, and 3-D/4-D imaging, making them essential across small-animal, equine, and livestock care. Furthermore, modern systems such as GE LOGIQ V2 Vet and Mindray Vetus series use digital beamforming to deliver sharper visualization of fine structures. Innovation continues to fuel adoption, for instance, Butterfly Network’s iQ3 Vet, launched in October 2025, delivers cart-level digital imaging in a handheld probe, reinforcing the shift toward portable, chip-based ultrasound solutions.

The contrast imaging segment is expanding rapidly as veterinary professionals adopt contrast-enhanced ultrasound (CEUS) for early, accurate diagnosis of complex conditions in small animals. CEUS uses microbubble agents to improve visualization of tissue perfusion and vascularity, allowing detection of lesions that are often missed on standard B-mode or Doppler scans. In addition, CEUS helps differentiate benign and malignant masses without requiring CT or MRI, reducing cost and anesthesia risks. Its growing use in abdominal imaging, cardiology, oncology, and emergency care, along with improved CEUS-enabled systems and contrast agents, is accelerating clinical adoption and market growth.

Application Insights

On the basis of application, the abdominal segment held the largest share of the market in 2025, because abdominal diseases are among the most frequent and clinically significant issues in pets. Conditions such as vomiting, diarrhea, urinary problems, and weight loss commonly require abdominal imaging to identify causes like GI obstructions, liver and kidney disease, pancreatitis, or bladder stones. Since many abnormalities cannot be detected through exams or X-rays alone, ultrasound provides essential real-time clarity. Its broad utility across species and age groups, detecting tumors, blockages, congenital issues, and organ dysfunction, strengthens its dominance. Veterinary clinics, such as Crystal Creek Animal Hospital, rely on abdominal ultrasound daily to assess key organs, underscoring its importance in routine diagnostics.

The oncology segment is growing steadily due to the rising incidence of cancer in companion animals and the essential role of ultrasound in early detection. Cancer is affecting millions of pets annually, one in four dogs and one in five cats. Veterinarians rely on ultrasound to identify internal tumors, cysts, metastases, and organ abnormalities. It provides a noninvasive, real-time view of the liver, spleen, kidneys, lymph nodes, and abdominal cavity, where many cancers originate or spread. Ultrasound is often the first tool to detect conditions such as splenic hemangiosarcoma or unexplained weight loss and vomiting, helping guide biopsies, staging, and treatment decisions. Its accuracy and accessibility make it indispensable in veterinary oncology.

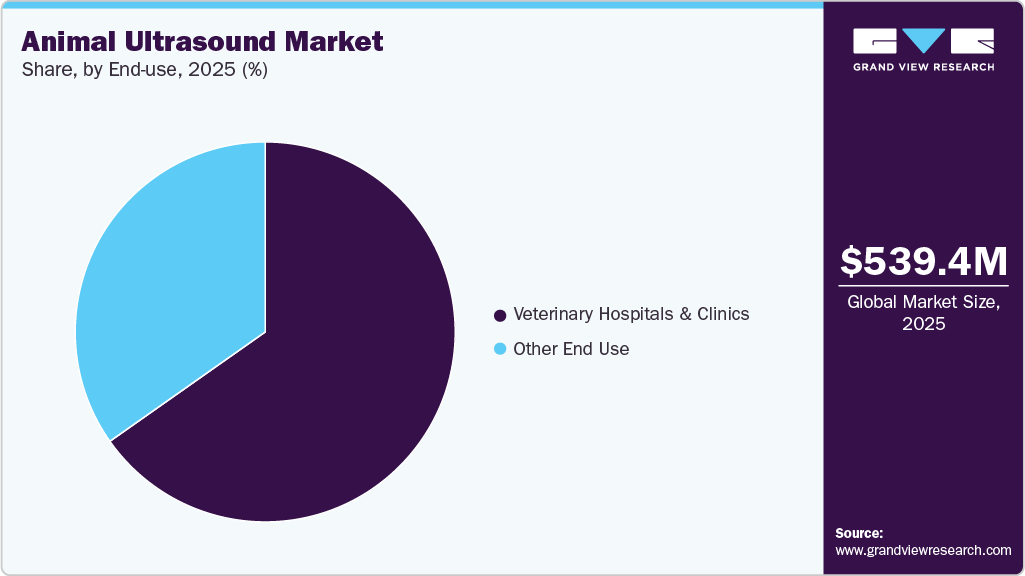

End Use Insights

On the basis of end use, veterinary clinics & hospitals segment held the largest share of the market in 2025 driven primarily by its capacity to deliver rapid diagnostics and immediate treatment to patients. These facilities typically invest in advanced ultrasound equipment because they handle a higher caseload and more complex cases, allowing them to maximize system utilization and clinical value. For instance, a study from the University of North Carolina conducted in 2018, showed that over 50% of veterinary practices now use some form of ultrasound equipment, and about 45% conduct five or more ultrasound examinations each week in U.S. Thus, the increasing caseloads in clinics and hospitals, fueled by rising pet ownership and greater willingness to spend on preventive diagnostics are contributing to usage intensity. Moreover, technological innovations, especially portable handheld ultrasound machines and cloud-based image management systems have made it increasingly cost-effective for clinics to adopt ultrasound for point-of-care use.

The other end use segment, including veterinary diagnostic laboratories, academic institutions, and research centers, is projected to grow at the fastest CAGR from 2025 to 2033 due to rising adoption of ultrasound for advanced, non-clinical applications. Diagnostic laboratories use high-resolution ultrasound and PACS to support smaller clinics that lack in-house imaging capabilities, creating scalable demand. In addition, academic and research institutes also rely on ultrasound for studies in physiology, reproduction, and disease modeling, and drive the uptake of portable and high-precision systems. Furthermore, growth is further supported by rising pet insurance coverage, which boosts diagnostic testing volumes. In 2024, North America recorded 7.03 million insured pets, up 12.2% from 2023, reflecting expanding use of diagnostic imaging across veterinary facilities.

Regional Insights

North America animal ultrasound market dominated with the largest revenue share of 37.29% in 2025. The market is driven by rising pet healthcare spending, growing demand for advanced diagnostic imaging, and increased adoption of portable, point-of-care systems in veterinary clinics. Ultrasound is widely used for cardiac, abdominal, and reproductive assessments in companion animals, whereas durable handheld devices enable on-site diagnostics for livestock and equine patients. In addition, continuous technological advancements and new product launches are further driving adoption across general and specialty practices.

Besides this, strategic initiatives, such as partnerships and expanded distribution agreements, are enhancing access to advanced imaging. For instance, in May 2024, Esaote North America’s collaboration with Epica International and the launch of the portable MyLab Omega eXP VET with AI-enhanced imaging are accelerating market penetration, improving workflow efficiency, and raising diagnostic standards across North American veterinary facilities.

U.S. Animal Ultrasound Market Trends

The animal ultrasound market in the U.S. accounted for the highest sharein the North American region, owing to rising pet healthcare spending, demand for early diagnostics, and adoption of portable imaging systems in veterinary clinics. Small-animal practices utilize ultrasound for cardiology, abdominal scans, and emergencies, while large-animal veterinarians rely on handheld devices for equine and livestock care. Market growth is driven by innovation, AI-enhanced systems, and expanding product portfolios. Some of the key players, such as Esaote, IDEXX, and Butterfly Network, compete by offering advanced imaging, versatile probes, and workflow-optimizing technologies.

Canada animal ultrasound market is expected to grow at a significant CAGR during the forecast period. The region is transforming due to increasing adoption of veterinary ultrasonography, hands-on training, and educational programs such as miEducation’s Veterinary Ultrasound Bootcamp. Innovations like MRI-guided High-Intensity Focused Ultrasound (HIFU) for canine osteosarcoma expand ultrasound use into therapeutic applications. In addition, companies such as Animages provide teleradiology, mobile ultrasound, and multimodal imaging services, enhancing access and expertise. These initiatives and technological advancements are driving broader adoption of high-performance ultrasound systems across veterinary hospitals, specialty clinics, and research centers in Canada.

Europe Animal Ultrasound Market Trends

The animal ultrasound market in Europe is expanding rapidly, supported by regional initiatives promoting standardized, safe veterinary imaging. Some of the organizations such as the Animal Ultrasound Association (AU) provide structured guidelines, enhancing diagnostic accuracy and encouraging adoption across companion animal, mixed-practice, and livestock clinics. In addition, collaborations between manufacturers and education providers, such as Probo Veterinary, Improve Veterinary Education, and Mindray Animal Medical, equip courses with advanced Vetus systems, improving clinician skills and confidence. As hands-on training expands and adherence to guidelines rises, ultrasound is becoming an essential diagnostic tool, boosting equipment adoption, service utilization, and overall market growth across small-animal, equine, and production-animal segments in Europe.

The UK animal ultrasound market is expected to grow significantly over the forecast period. The market is expanding rapidly, driven by growing adoption of advanced imaging technologies and AI-enabled systems that enhance diagnostic precision in companion animals. In addition, strategic partnerships, such as Vetology with VetIT and Probo Veterinary with AltinVet, are expanding access to portable, AI-assisted, and cloud-compatible ultrasound solutions, improving workflow and diagnostic confidence. For instance, in June 2025, Vetology entered into a partnership with UK-based VetIT to expand access to AI-powered diagnostic imaging and teleradiology across the UK and Europe, enabling veterinary clinics to integrate advanced, cloud-compatible radiology tools with local support and streamlined workflows.

The animal ultrasound market in Germany held a significant share in 2025. The market is expanding rapidly, supported by strong demand from small-animal clinics, equine specialists, and livestock operations. Veterinarians rely on portable, battery-powered units for fieldwork and high-resolution consoles in referral centers for cardiology, reproductive, musculoskeletal, and abdominal imaging. Professional development programs by organizations such as the German Veterinary Medical Society enhance clinician proficiency, supporting the adoption of AI-assisted imaging, cloud teleradiology, and advanced measurement tools.

Asia Pacific Animal Ultrasound Market Trends

The animal ultrasound market in Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The region's market is expanding due to growing pet ownership, modernization of livestock management, and rising demand for advanced veterinary diagnostics. In addition, increased awareness of preventive care and early disease detection is boosting the adoption of portable, high-resolution ultrasound systems in countries such as China, India, Japan, and Australia for cardiac, abdominal, musculoskeletal, and reproductive assessments. Innovative applications in wildlife conservation are emerging. For instance, EC Technologies in May 2024 utilized ultrasound to non-invasively monitor reproductive health and detect complications in endangered species, supporting conservation efforts and expanding the clinical and ecological role of veterinary ultrasound across the region.

Japan animal ultrasound market held a significant revenue shareandis witnessing new growth opportunities due to increasing demand for advanced diagnostic care. Early detection and preventive care are fueling the adoption of high-resolution ultrasound systems for cardiac, renal, and musculoskeletal evaluations for more than 15 million companion animals. Besides this, clinics are upgrading to technologically advanced platforms, such as the Vetus 8 Premium, enhancing imaging precision and workflow. Modernized veterinary facilities integrating these systems are raising diagnostic standards, improving client trust, and supporting proactive, high-quality care.

The market for animal ultrasound in India is emerging, supported by a vast livestock population and a focus on reproductive efficiency. Some of the programs, such as the Rashtriya Gokul Mission and ABIP, promote pregnancy detection, IVF, and embryo transfer using portable ultrasound systems, supported by subsidies and regulatory clarity. In addition, technological advancements and institutional upgrades, such as GADVASU’s new diagnostic unit, further accelerate adoption.

Latin America Animal Ultrasound Market Trends

The animal ultrasound market in Latin America is poised by rising pet ownership and increased spending on preventive veterinary care. Clinics in Brazil and Argentina are adopting portable, digital, and AI-integrated ultrasound systems for rapid, non-invasive diagnostics in abdominal, cardiac, and reproductive applications. Furthermore, technological innovations from companies like Mindray, Esaote, and Canon Medical enhance workflow and accuracy, while partnerships with local distributors expand market reach.

Brazil animal ultrasound market is gaining momentum, due to its large livestock and cattle industry, with a 2025 calf crop of 47.8 million head. Farmers use portable, field-ready ultrasound systems for reproductive monitoring, disease detection, and calf health assessment to optimize breeding outcomes. In addition, beef and dairy production demands, along with international export standards, further boost adoption. Some of the technological advancements, including AI-assisted and high-resolution portable devices, enable real-time, non-invasive imaging, enhancing herd health management, productivity, and preventive care.

Middle East & Africa Animal Ultrasound Market Trends

The animal ultrasound market in the Middle East & Africa is driven by the growing adoption of advanced reproductive technologies in livestock, rising demand for improved herd productivity, and government-backed initiatives to modernize veterinary practices. For instance, in March 2025, Rwanda is deploying veterinary ultrasound technology through the RwanNovIA project to improve artificial insemination (AI) success rates in cattle. Early trials increased AI conception from 33% to up to 95% in some districts, enabling early pregnancy detection, reproductive health monitoring, and better herd management, with support from IMV Technologies, JS AFRICA, and the French government. Projects like Rwanda’s RwanNovIA demonstrate the impact of ultrasound in enhancing AI success, early pregnancy detection, and reproductive health management in cattle.

South Africa animal ultrasound market held the largest regional revenue share and is fueled by rising demand for advanced diagnostics in companion animals, livestock, and wildlife. Portable, high-resolution systems like BXL enable pregnancy detection, cardiac and organ assessments, musculoskeletal imaging, and wildlife care, enhancing veterinary efficiency and animal welfare. Innovations such as underwater ultrasound for marine species, exemplified by the first thorntail ray embryo scan at uShaka Marine World in 2024, highlighted non-invasive monitoring.

The animal ultrasound market in Kuwait is growing due to increased adoption of advanced imaging technologies in companion animal and livestock care. The market is driven by rising pet-owner awareness of preventive healthcare drives clinics to use portable, high-resolution, and 3D/Doppler-enabled ultrasound systems for diagnostics, reproductive monitoring, and cardiac assessments. Simultaneously, modernization in livestock management, supported by government animal health initiatives, encourages ultrasound use for reproductive efficiency in cattle and camels.

Key Animal Ultrasound Company Insights

Key players operating in the animal ultrasound market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Animal Ultrasound Companies:

The following are the leading companies in the animal ultrasound market. These companies collectively hold the largest market share and dictate industry trends.

- IDEXX

- Esaote SpA

- Mars Inc. (Sound & Heska)

- FUJIFILM Holdings America Corporation

- Shenzhen Mindray Bio-Medical Electronics

- Siemens Healthcare Limited (PLH Medical Ltd.)

- Samsung Healthcare

- ASUSTeK Computer Inc.

- IMV Imaging

- CHISON Medical Technologies Co., Ltd.

- BenQ Medical Technology Corp.

- Avante Animal Health

- Contec Medical Systems Co. Ltd.

- Wuhan Zoncare Bio-medical Electronics Co., Ltd

- Butterfly Network, Inc.

Recent Developments

-

In September 2025, Mindray launched Project 2030, expanding ultrasound education, global outreach, and academic partnerships to enhance imaging accessibility, training, and clinical competence in veterinary and human healthcare settings.

-

In August 2025, Siemens Healthineers signed an eight-year partnership to replace 29 ultrasound units in Germany, modernizing systems and enhancing imaging reliability with direct benefits extending to veterinary workflows.

-

In June 2025, Fujifilm VisualSonics launched the Vevo F2 LAZR-X20, a multimodal photoacoustic imaging platform offering high-powered laser technology, advanced tissue characterization, and expanded research capabilities for preclinical animal oncology, cardiovascular, neurobiology and molecular biology applications.

Animal Ultrasound Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 575.69 million

Revenue forecast in 2033

USD 998.76 million

Growth rate

CAGR of 8.19% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, solution, type, technology, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

IDEXX; Esaote SpA; Mars Inc. (Sound & Heska); FUJIFILM Holdings America Corporation; Shenzhen Mindray Bio-Medical Electronics; Siemens Healthcare Limited (PLH Medical Ltd.); Samsung Healthcare; ASUSTeK Computer Inc.; IMV Imaging; CHISON Medical Technologies Co., Ltd.; BenQ Medical Technology Corp.; Avante Animal Health; Contec Medical Systems Co. Ltd.; Wuhan Zoncare Bio-medical Electronics Co., Ltd; Butterfly Network, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Ultrasound Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global animal ultrasound market report based on animal, solution, type, technology, application, end use, and region:

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Small Animals

-

Large Animals

-

-

Solution Outlook (Revenue, USD Million, 2021 - 2033)

-

Equipment

-

Console/Cart-Based Ultrasound

-

Portable/Handheld Ultrasound

-

-

Accessories/Consumables

-

PACS

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

2-D Ultrasound Imaging

-

3-D/4-D Ultrasound Imaging

-

Doppler Imaging

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Digital Imaging

-

Contrast Imaging

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Orthopedics

-

Cardiology

-

Oncology

-

Abdominal

-

Other Applications

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Hospitals & Clinics

-

Other End-Use

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global veterinary ultrasound market size was estimated at USD 539.39 million in 2025 and is expected to reach USD 575.69 million in 2026.

b. The global veterinary ultrasound market is expected to grow at a compound annual growth rate (CAGR) of 8.19% from 2026 to 2033 to reach USD 998.76 million by 2033.

b. North America veterinary ultrasound market held the largest share of 37.29% of the global market in 2025. The region is expected to grow owing to the business activities like product launch, research initiatives, etc. by the industry participants in the region.

b. Some key players operating in the global veterinary ultrasound market include IDEXX, Esaote SpA, Mars Inc. (Sound & Heska), FUJIFILM Holdings America Corporation, Shenzhen Mindray Bio-Medical Electronics, Siemens Healthcare Limited (PLH Medical Ltd.), Samsung Healthcare, ASUSTeK Computer Inc., IMV Imaging, CHISON Medical Technologies Co., Ltd. , BenQ Medical Technology Corp., Avante Animal Health, Contec Medical Systems Co. Ltd., Wuhan Zoncare Bio-medical Electronics Co., Ltd, and Butterfly Network, Inc.

b. Some of the key factors driving market growth are growing research initiatives & breakthroughs, expanding applications of ultrasound in the veterinary sector, rising adoption of pet insurance and increasing critical collaboration in the industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.