Anorexiants Market Size & Trends

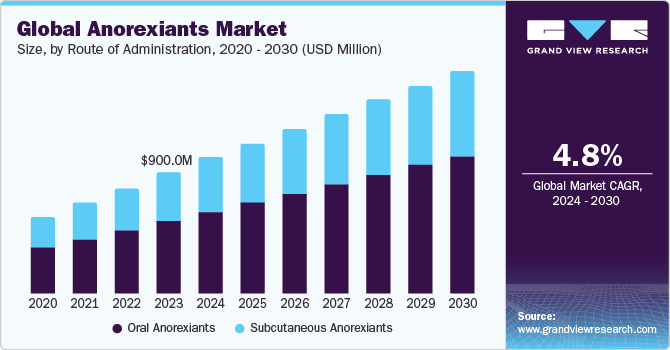

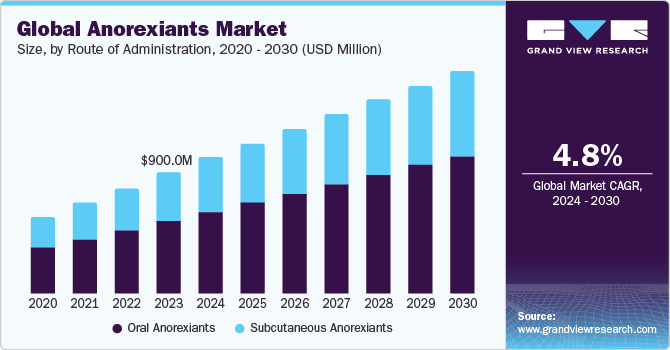

The global anorexiants market size was valued around USD 900 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.77% from 2024 to 2030. Anorexiants, also known as appetite suppressants or weight loss medications, are drugs or pharmaceutical compounds specifically designed to help individuals manage their weight by reducing appetite and promoting a feeling of fullness. The market is witnessing growth primarily due to the increasing prevalence of sedentary lifestyles, physical inactivity, and unhealthy dietary habits leading to weight gain. Furthermore, there is a significant increase in global healthcare expenditure aimed at addressing other health issues and diseases associated with obesity, which is expected to lead to market growth.

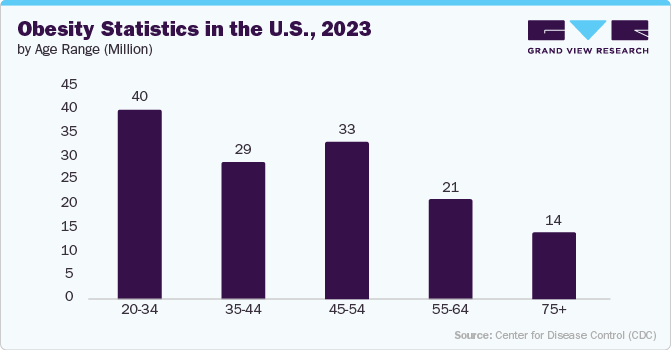

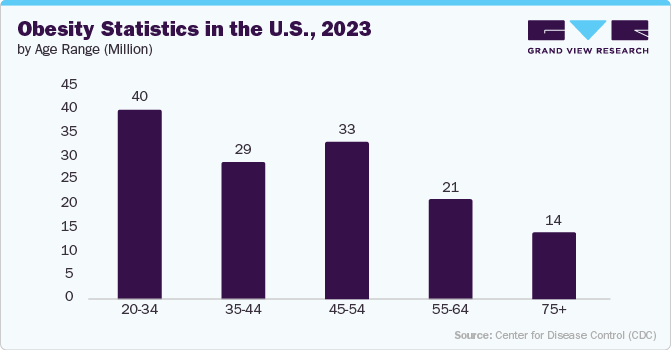

The increasing prevalence of obesity and its associated health conditions, including cardiovascular diseases (CVDs), diabetes, and hypertension, is anticipated to boost the demand for these products. According to the World Health Organization's June 2021 estimates, around 2.8 million individuals succumb to overweight or obesity-related issues each year. Furthermore, in 2021, the WHO reported that roughly 115 million individuals in developing countries are grappling with health problems linked to obesity. Therefore, the increasing reliance on anorexiant’s to manage and achieve a healthy body weight is anticipated to drive market growth.

According to a study conducted by MDPI in September 2020, examining changes in body weight during the initial months of the pandemic, it was found that 18% of respondents experienced a decrease in their body weight, while 34% reported an increase in body weightConsumers are increasingly recognizing the advantages of using these supplements, which positively impacts product demand and consumption. For instance, the U.S. population is becoming healthier and actively embracing a physically active lifestyle.

Route Of Administration Insights

On the basis of route of administration, the market is segmented into subcutaneous anorexiants, and oral anorexiants. The oral anorexiants segment dominated the market in 2023 and is projected to maintain this position throughout the forecast period. The increasing demand for these products can be attributed to patients' growing preference for non-invasive treatments. Furthermore, the segment is expected to experience growth due to the increased availability of products in tablet and capsule forms and the increased awareness efforts by key industry players.

Distribution Channel Insights

Based on distribution channels, the anorexiants market is segmented into online pharmacy, retail pharmacy, and hospital pharmacy. The online pharmacy dominated the market in 2023. The online pharmacy offers customers attractive discounts on product prices, effectively boosting sales through digital channels.

Additionally, online platforms are implementing and executing various strategies to maintain their competitiveness against their brick-and-mortar counterparts. The convenience provided by online distribution channels is one of the crucial factors driving the segment growth.

Regional Insights

North America dominated the market in 2023. North America emerged as the key market for anorexiants due to the increasing prevalence of obesity-related complications in the region. Based on data from the 2017–2020 NHANES study, the prevalence of obesity is also on the rise among children and adolescents, with approximately 20% of youngsters aged 2 to 19 in the United States being classified as obese. Furthermore, on a national scale, in 2023, 41.9% of adults are dealing with obesity. Additionally, the presence of major industry players and a substantial target population with disposable income in the U.S. are expected to fuel market growth in the coming years.

Competitive Insights

Key players operating in the market are Novo Nordisk Inc., Lannett Co, Inc., F. Hoffmann-La Roche AG, Pfizer Inc., Bausch Health, Sun Pharmaceutical Industries Ltd, Novartis AG, Teva Pharmaceutical Industries Ltd, Roche, Abbott, Johnson & Johnson, and Currax Pharmaceuticals LLC. The market participants are constantly working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

-

In July 2022, IVUS LLC announced that the U.S. FDA granted approval for the use of QSYMIA CIV in treating obesity among adolescents aged 12 to 17 with an initial body mass index (BMI) in the 95th percentile or higher, adjusted for age and gender.

-

In September 2019, Currax Pharmaceuticals LLC. completed the acquisition of Nalpropion Pharmaceuticals, a firm specializing in the production of CONTRAVE, an anorexiant medication employed in obesity treatment. This strategic acquisition enabled the company to broaden its presence within the U.S. anorexiants market.