Anthrax Vaccine Market Size & Trends

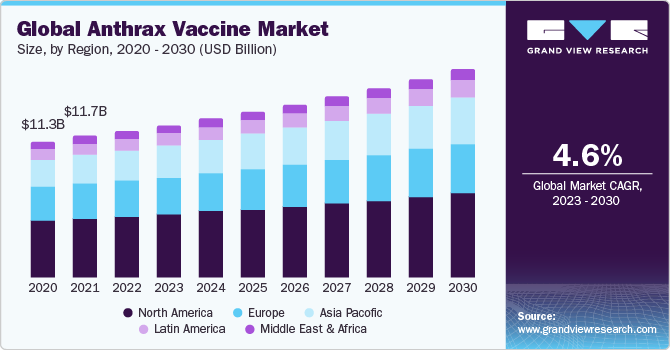

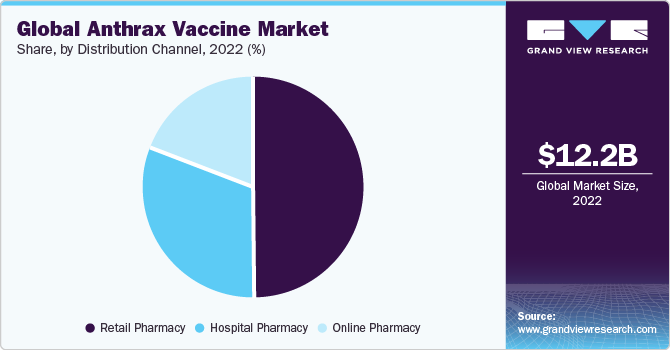

The global anthrax vaccine market size was valued at USD 12.17 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.59% from 2023 to 2030. The main factors driving the anthrax vaccine market are eating undercooked and raw meat from infected animals and the rising prevalence of anthrax. Bacillus anthracis is the bacteria that causes the deadly infectious illness anthrax. There are several types of anthrax, such as inhalation, cutaneous (skin), and gastrointestinal anthrax, and it may infect both humans and animals.

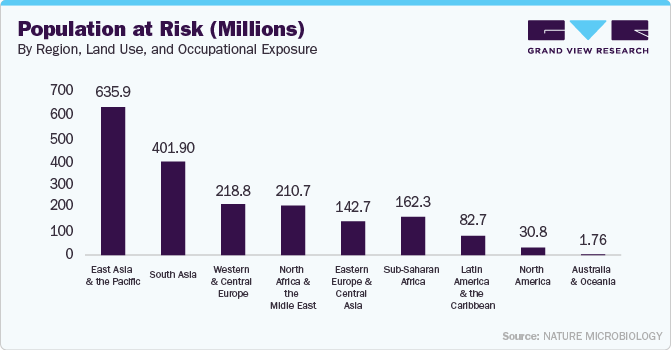

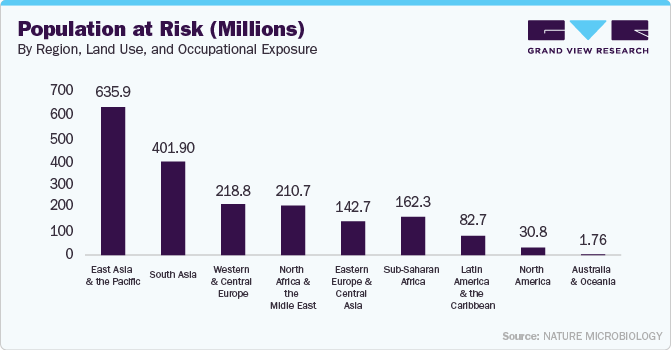

Sheep, cattle, and goats are examples of herbivores in the Bacillus anthracis' habitat. As a result, those in professions like farming, veterinary care, and wool sorting are more susceptible to anthrax infections. Furthermore, people who consume undercooked meat infected with spores and those who reside in rural and agricultural regions are also at high risk of contracting anthrax infection. Approximately 95% of anthrax infections are cutaneous, 5% are pulmonary, and 1% are gastrointestinal origins. Here, anthrax vaccination plays an important role in preventing the spread of infection. For instance, as per the study published in NCBI in 2023, vaccination campaigns against anthrax in humans and animals have made the disease rare in developed countries. Conducting such campaigns in developing countries is anticipated to open avenues in the market.

The development of new anthrax vaccines has engaged a number of pharmaceutical companies and academic institutes. BioThrax (Anthrax Vaccine Adsorbed), developed by Emergent BioSolutions, is a unique and well-known anthrax vaccine in the U.S. as of 2021. Furthermore, the biodefense industry and the anthrax vaccine market are closely related. In order to safeguard their citizens in the case of an anthrax assault, governments invest in anthrax vaccinations as part of their bioterrorism preparation measures. Thus, more research and vaccination initiatives have been made globally to boost the R&D of new anthrax vaccines, which is anticipated to boost research and development in the field of anthrax vaccine in the coming years.

Moreover, Anthrax vaccination may be a component of public health programs in some countries, especially for those with greater exposure risks, such as laboratory personnel and veterinarians who work with possibly contaminated materials. Thus, an increasing number of these personnel is projected to fuel demand for anthrax vaccine during the forecast period.

Product Type Insights

On the basis of the product type, the market is segmented into cell-free PA vaccines and live cells. The cell-free PA vaccines segment held the largest market share in 2022. This can be attributed to the increasing prevalence of anthrax infection. Anthrax vaccines, such as cell-free PA vaccines, are available, and certain EEA/EU nations have authorized them to control the spread of infection.

In areas with a high risk of exposure, guidelines recommend immunization for those who work in abattoirs, with animal skins or fur, in research facilities, with veterinarians, or in the armed services. Thus, an increasing number of people with this work background is anticipated to drive segment growth.

Application Insights

Based on the application, the anthrax vaccine market is segmented into animal use and human use. The animal use segment held the largest market share in 2022. Animals receive a large majority of anthrax immunizations due to high demand in developing countries. As per the NCBI study 2022, animal anthrax cases have been reported often in Bangladesh in recent years, particularly in the districts of Sirajganj and Pabna. The disease's shift in pattern from sporadic to endemic in Bangladesh is shown by the outbreak. Anthrax infection has been reported in Bangladesh's people, goats, cattle, buffaloes, and elephants.

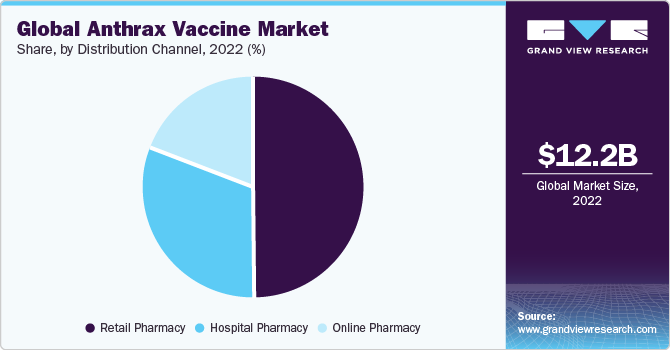

Distribution Channel Insights

Based on the distribution channel, the anthrax vaccine market is segmented into hospital pharmacy, online pharmacy, and retail pharmacy. The retail pharmacy segment held the largest market share in 2022. The widespread availability of anthrax immunizations in retail pharmacies is one of the reasons for the largest market share.

Additionally, the increasing number of animals with anthrax infection worldwide, the high incidence of anthrax infection in humans, and recommendations for anthrax vaccinations are some of the major factors driving segment growth.

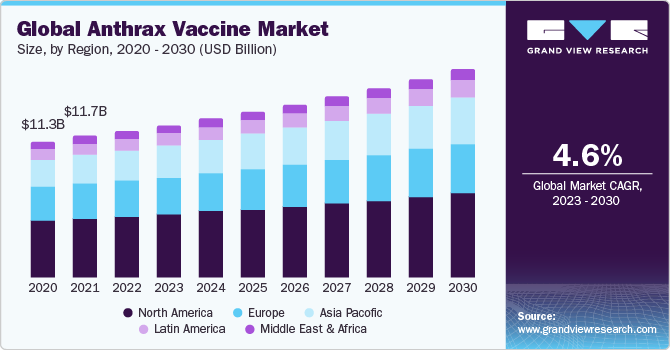

Regional Insights

North America dominated the market in 2022. The growing awareness of livestock animal caretakers regarding their immunization against anthrax is expected to positively impact regional growth over the forecast period. In May 2022, the South Dakota Animal Industry Board and Veterinarians from SDSU Extension urged South Dakota, cattle farmers to incorporate the anthrax vaccine into their immunization schedule when their cattle are let out to summer pastures in the spring. According to estimates, these activities will decrease the spread of germs to people and increase the effectiveness of the anthrax vaccination in protecting animals from deadly infections. Asia-Pacific is expected to witness the fastest CAGR over the forecast period. This can be attributed to increasing raw or undercooked meat consumption and a high anthrax load in the area in developing countries of Asia.

Key Companies & Market Share Insights

Key players operating in the market are Colondo Serum Company, Merck Co, Inc., Emergent BioSolutions Inc., and Proton Biopharma Ltd. The market participants are persistently working towards new product launches, collaborations, M&A activities, and other strategic alliances to gain new market avenues.

The following are some instances of strategic initiatives:

-

In July 2023, the U.S. FDA approved CYFENDUS, developed by Emergent BioSolutions Inc., for post-exposure prophylaxis of disease in people between 18 years to 65 years identified with Bacillus anthracis infection. This vaccine is given in association with mandated antiviral drugs.

-

In August 2023, the Federal Government supported the Lagos State Government with 50,000 vials of anthrax vaccines. Such initiatives are expected to drive the anthrax vaccine market growth.