- Home

- »

- Beauty & Personal Care

- »

-

Anti-Aging Products Market Size, Industry Report, 2030GVR Report cover

![Anti-Aging Products Market Size, Share & Trends Report]()

Anti-Aging Products Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Facial Serum, Eye Care Products, Sunscreen & Sun Protection), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Beauty Stores), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-385-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Anti-Aging Products Market Summary

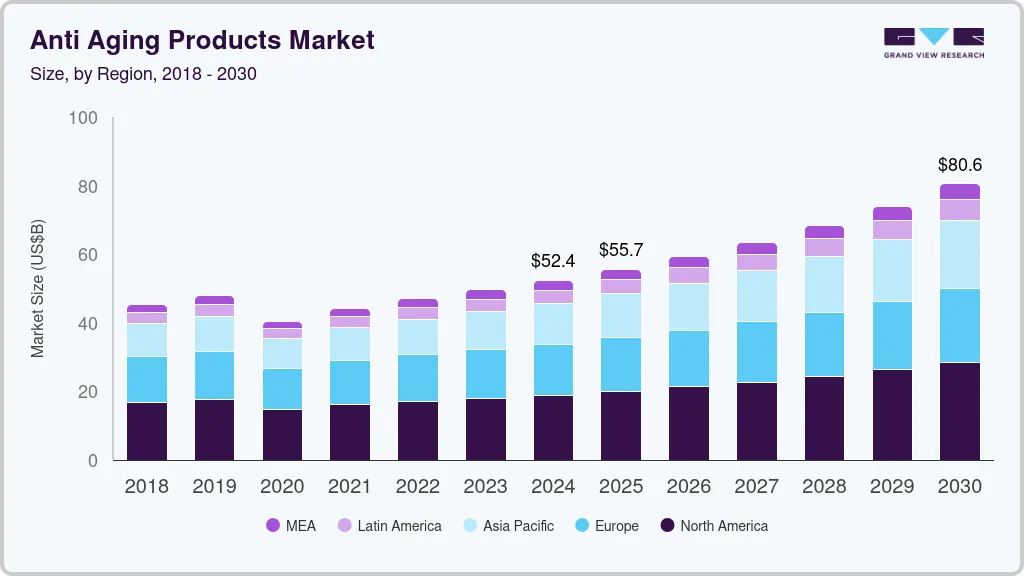

The global anti-aging products market size was estimated at USD 52.44 billion in 2024 and is projected to reach USD 80.61 billion by 2030, growing at a CAGR of 7.7% from 2025 to 2030. This growth is primarily driven by rising consumer awareness of skincare and longevity, and the growing demand for premium and personalized anti-aging solutions.

Key Market Trends & Insights

- The anti-aging products market in North America accounted for 30.4% of the global market revenue in 2024.

- The anti-aging products industry in the U.S. is set to grow at a CAGR of 6.8% from 2025 to 2030.

- Based on type, moisturizers, creams, & lotions segment accounted for a revenue share of 39.6% in the overall anti-aging products industry in 2024.

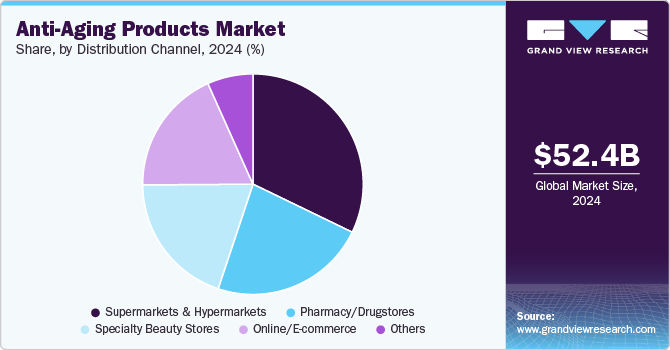

- Based on distribution channel, anti-aging products sales through hypermarkets & supermarkets segment accounted for a revenue share of 32.2% in the overall anti-aging products industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 52.44 Billion

- 2030 Projected Market Size: USD 80.61 Billion

- CAGR (2025-2030): 7.7%

- North America: Largest market in 2024

Advancements in dermatological research, the widespread adoption of retinol, peptides, and hyaluronic acid-based formulations, and the influence of social media and beauty influencers are further accelerating market expansion. A foundational driver of anti-aging cosmetic consumption is the global demographic transition characterized by increased life expectancy and a growing proportion of the elderly population. According to the United Nations Department of Economic and Social Affairs, individuals aged 60 years or above are projected to constitute over 21% of the global population by 2050, up from 13% in 2020. This expansion of the aging population is particularly pronounced in regions such as Europe, North America, Japan, and South Korea, where the median age has reached historically high levels. With longer life expectancy comes a heightened consumer focus on maintaining physical vitality and youthful appearance well into the later stages of life. The cosmetic industry is responding by expanding product portfolios specifically designed to address age-related skin concerns-namely, fine lines, hyperpigmentation, loss of elasticity, and dryness.

The anti-aging category is being revolutionized by dermaceutical innovation, with continuous breakthroughs in both active ingredient development and transdermal delivery mechanisms. High-efficacy compounds-such as encapsulated retinoids, growth factors, stem cell extracts, ceramides, and stabilized forms of Vitamin C-are now being incorporated into formulations that ensure deep penetration and minimal irritation. Advanced delivery technologies, such as liposome encapsulation, nanoemulsions, and time-release systems,s allow for targeted action and sustained efficacy, thereby enhancing both product performance and user compliance.

A significant driving factor for the anti-aging products market is the rising penetration of men's grooming products. This trend can be attributed to the increasing rejection of traditional gender distinctions among Generation Z consumers. This generation is embracing a more inclusive approach to personal care, leading to a rise in men's interest in skincare products as a way to practice self-care. New brands entering the market can benefit from this trend by featuring more male models in their promotional photoshoots for unisex anti-aging products.

The rise of social media platforms, particularly Instagram and TikTok, has played a major role in normalizing skincare for men. Influencers, celebrities, and skincare experts (many of them male) are openly sharing their grooming and skincare routines, helping to break down taboos and making skincare more accessible and desirable to a male audience. TikTok has been a key driver in the beauty trend of male grooming. The hashtag “#mensskincare” has approximately 1.7 million views on TikTok, and the search volume for “men's skincare routine” has increased by 857% in the past five years.

The ubiquity of high-resolution digital media and the rise of visual-first platforms such as Instagram, TikTok, and YouTube have had a transformative impact on consumer expectations around beauty. Public figures, influencers, and even peers frequently present images of flawless, youthful skin, thereby establishing new aesthetic benchmarks. The result is a heightened psychological pressure on individuals across age groups to invest in their appearance. Furthermore, in the professional environment, where ageism remains a concern, maintaining a youthful appearance is often perceived as a means of enhancing employability and confidence, particularly among women in corporate or client-facing roles.

Historically underserved, the male grooming segment is witnessing a marked evolution, with increasing male participation in skincare regimens that include anti-aging products. This trend is particularly visible in urbanized markets and among professionals aged 30-50 who seek to preserve a competitive edge in both personal and professional spheres. Men are seeking products that can help them achieve healthy, youthful-looking skin. According to the Voyant Beauty study conducted in March 2022, 44% of men follow a skincare and cosmetics routine to look young. Thus, manufacturers are launching unisex anti-aging products that can be used for both men and women, with rising awareness about skincare and surging popularity of anti-aging products among the male population. For instance, in August 2024, Purple Pompa announced the launch of its skincare line dedicated to “Age Balance” for both men and women.

Consumer Survey & Insights

Early Adoption of Anti-Aging Products Among Younger Generations: A notable trend in the anti-aging products market is the growing adoption of these products by younger consumers. While previous generations typically started using anti-aging skincare in their mid-30s or early 40s, Gen Z and millennials are now adopting such products in their early 20s. For example, the TBC research indicates that many Gen Z consumers begin incorporating anti-aging products into their routine around the age of 25, whereas millennials generally start around age 35. This trend is driven by greater awareness of preventive skincare, the influence of social media, and a desire to maintain youthful skin before signs of aging appear.

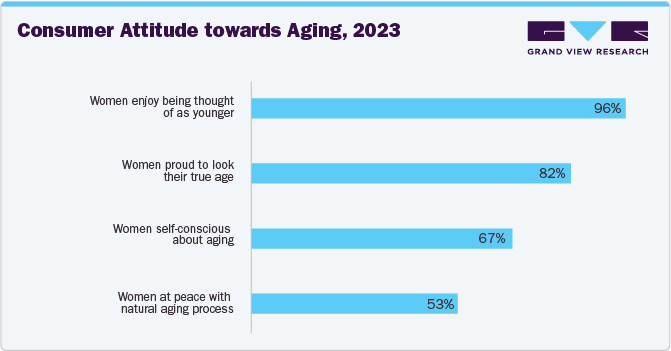

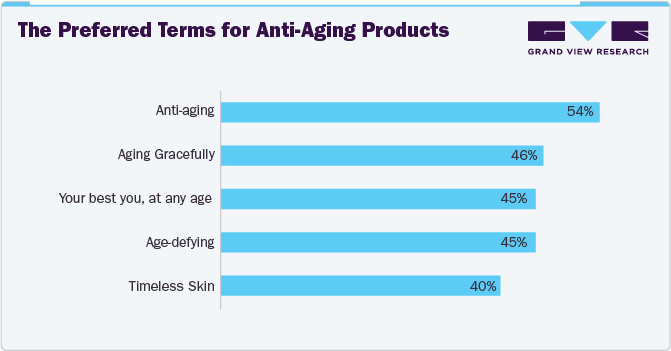

The TBC Consumer Study (2023) highlights the preferred terminology for anti-aging products, with 54% of surveyed women favoring the term "anti-aging" over alternatives like "aging gracefully" (46%) and "age-defying" (45%). This indicates that despite the evolving language around aging, consumers still resonate with the more traditional term, associating it with effective skincare solutions. This preference underscores the importance of clear, targeted marketing language in the anti-aging products market, as brands that use relatable and widely accepted terms are more likely to capture consumer interest and trust.

Type Insights

Moisturizers, creams, & lotions accounted for a revenue share of 39.6% in the overall anti-aging products industry in 2024, owing to their essential role in daily skincare routines, widespread consumer preference for hydration and skin barrier protection, and strong demand for multi-functional formulations that combine anti-aging benefits with hydration, SPF, and skin repair. For instance, in August 2024, Neutrogena introduced its Visible Repair range in India to address early signs of skin aging among women. The line includes a serum, regenerating cream, and under-eye cream, all formulated with fast-acting retinol and other potent anti-aging ingredients to enhance collagen production and improve skin elasticity.

Demand for facial serum is expected to grow at a CAGR of 9.1% from 2025 to 2030. Facial serums are highly concentrated formulations that deliver potent active ingredients deep into the skin, making them more effective in addressing specific concerns such as fine lines, wrinkles, dullness, and dehydration. Compared to traditional creams and lotions, serums offer faster and more visible results, which appeals to modern consumers looking for high-performance skincare. For instance, in March 2025, The Ordinary introduced a new anti-aging serum, GF 15% Solution, which is designed to target common signs of aging such as fine lines, wrinkles, and loss of skin elasticity. The serum combines advanced skincare technologies to promote a smoother, firmer, and more radiant complexion.

Distribution Channel Insights

Anti-aging products sales through hypermarkets & supermarkets accounted for a revenue share of 32.2% in the overall anti-aging products industry in 2024, primarily driven by high consumer footfall, easy accessibility, and the availability of diverse product ranges at competitive prices. These retail formats offer one-stop shopping convenience, enabling consumers to explore and compare various anti-aging brands, from mass-market to premium options. Frequent discounts, in-store promotions, and bundling strategies further attract price-conscious buyers.

The online/e-commerce channel is expected to grow at a CAGR of 9.4% from 2025 to 2030. The growing preference for convenience among consumers contributes to the increasing demand for online/e-commerce channels. With the rise of digitalization, customers now prefer to browse, compare, and purchase products from the comfort of their homes rather than visiting physical stores. E-commerce platforms provide a seamless shopping experience by offering a wide range of anti-aging products, detailed descriptions, customer reviews, and competitive pricing, making them a popular choice for consumers seeking skincare solutions.

Regional Insights

The anti-aging products market in North America accounted for 30.4% of the global market revenue in 2024, due to a high concentration of premium skincare brands, strong demand for clinically tested and dermatologist-recommended formulations, and a well-established beauty and wellness industry. The U.S. dominates regional sales, driven by high consumer spending on skincare, a growing emphasis on preventative aging treatments among Millennials and Gen Z, and the influence of celebrity-endorsed beauty trends.

U.S. Anti-Aging Products Market Trends

The anti-aging products industry in the U.S. is set to grow at a CAGR of 6.8% from 2025 to 2030. Consumers in the U.S. have higher purchasing power, enabling them to invest in premium skincare products and treatments. This financial capability allows individuals to seek high-quality, clinically tested anti-aging solutions, including luxury skincare brands and professional dermatological services. Additionally, a well-established beauty industry, with a large presence of global and local skincare brands, contributes to the accessibility and variety of anti-aging products in the market.

Europe Anti-Aging Products Market Trends

The anti-aging products industry in Europe accounted for a revenue share of 28.3% of the global market revenue in 2024. Consumer spending on anti-wrinkle products in Europe has witnessed a significant surge. Individuals are more willing to invest in premium skincare products that deliver visible improvements rather than relying solely on traditional or generic moisturizers. The rise of luxury skincare brands and medical-grade skincare treatments has fueled the trend of high-end anti-aging solutions.

Asia Pacific Anti-Aging Products Market Trends

The anti-aging products industry in the Asia Pacific is expected to grow at a CAGR of 9.2% from 2025 to 2030. Many Asian countries, including China and India, have seen significant economic growth in recent years, allowing consumers to spend more on personal care and beauty products. This financial ability has made premium and high-end skincare brands more accessible to a larger segment of the population. Furthermore, the rise of K-beauty (Korean beauty) and J-beauty (Japanese beauty) has also contributed significantly to the growing obsession with flawless, youthful skin. For instance, in January 2025, Shiseido, a Japanese beauty brand, reformulated its ULTIMUNE Power Infusing Serum, leveraging over 30 years of research. The new version features Power Fermented Camellia+, a proprietary technology designed to slow skin aging and enhance regeneration.

Key Anti-Aging Products Company Insights

The anti-aging products market is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some prominent companies in this market are Unilever PLC, L'Oréal S.A., Beiersdorf AG, The Procter & Gamble Company, The Estée Lauder Companies Inc., and others.

-

The Procter & Gamble Company (P&G) is a multinational consumer goods corporation known for its diverse range of personal care, beauty, health, and household products. Founded in 1837, P&G owns several well-known brands, including Olay, and SK-II, which cater to the anti-aging skincare market. Its anti-aging offerings focus on reducing wrinkles, improving skin firmness, and enhancing hydration.

-

Beiersdorf AG is a global skincare company based in Germany that is recognized for its expertise in dermatological and personal care products. Established in 1882, the company owns well-known brands such as Nivea, Eucerin, and La Prairie, catering to a wide range of skincare needs, including anti-aging solutions. Beiersdorf offers products designed to reduce wrinkles, boost skin elasticity, and promote hydration.

Key Anti-Aging Products Companies:

The following are the leading companies in the anti-aging products market. These companies collectively hold the largest market share and dictate industry trends.

- Unilever PLC

- L'Oréal S.A.

- Beiersdorf AG

- The Procter & Gamble Company

- The Estée Lauder Companies Inc.

- Shiseido Company, Limited

- Avon Products, Inc.

- Oriflame Holding AG

- Revlon, Inc.

- PMD Beauty (Age Sciences Inc.)

Recent Developments

-

In February 2025, Estée Lauder Companies (ELC) collaborated with Serpin Pharma to develop innovative skincare ingredients focused on longevity. Serpin Pharma specializes in anti-inflammatory research, particularly a group of proteins called Serine Protease Inhibitors, which help the body repair inflamed cells.

-

In February 2025, NIVEA MEN introduced the Age Defense skincare line, designed to address common signs of aging such as wrinkles, dryness, rough texture, dullness, and loss of firmness. The range features key ingredients like Thiamidol and Hyaluronic Acid to deliver effective results while maintaining a simple routine. It includes an advanced serum to reduce dark spots and fine lines, a hydrating face serum with Pro-Retinol for long-lasting moisture, an eye cream to combat puffiness and dark circles, and a daily moisturizer with SPF 30 for sun protection and hydration.

Anti-Aging Products Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 55.66 billion

Revenue forecast in 2030

USD 80.61 billion

Growth Rate (Revenue)

CAGR of 7.7% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; Argentina; South Africa; UAE

Key companies profiled

Unilever PLC; L'Oréal S.A.; Beiersdorf AG; The Procter & Gamble Company; The Estée Lauder Companies Inc.; Shiseido Company, Limited; Avon Products, Inc.; Oriflame Holding AG; Revlon, Inc.; PMD Beauty (Age Sciences Inc.)

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-Aging Products Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anti-aging products market based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Facial Serum

-

Moisturizer, Creams, & Lotions

-

Eye Care Products

-

Facial Cleanser & Exfoliators

-

Facial Masks & Peels

-

Sunscreen & Sun Protection

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Pharmacy/Drugstores

-

Specialty Beauty Stores

-

Online/E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global anti-aging products market was estimated at USD 52.44 billion in 2024 and is expected to reach USD 55.66 billion in 2025.

b. The global anti-aging products market is expected to grow at a compound annual growth rate of 7.7% from 2025 to 2030, reaching USD 80.61 billion by 2030.

b. North America dominated the anti-aging products market, with a share of 30.4% in 2024. The regional growth is driven by the high concentration of premium skincare brands, strong demand for clinically tested and dermatologist-recommended formulations, and a well-established beauty and wellness industry.

b. Some of the key players operating in the anti-aging products market include Unilever PLC; L'Oréal S.A.; Beiersdorf AG; The Procter & Gamble Company; The Estée Lauder Companies Inc.; Shiseido Company, Limited; Avon Products, Inc.; Oriflame Holding AG; Revlon, Inc.; and PMD Beauty (Age Sciences Inc.).

b. The growth of the global anti-aging products market is mainly driven by rising consumer awareness of skincare and longevity, and the growing demand for premium and personalized anti-aging solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.